Automated Guided Vehicle Market Outlook:

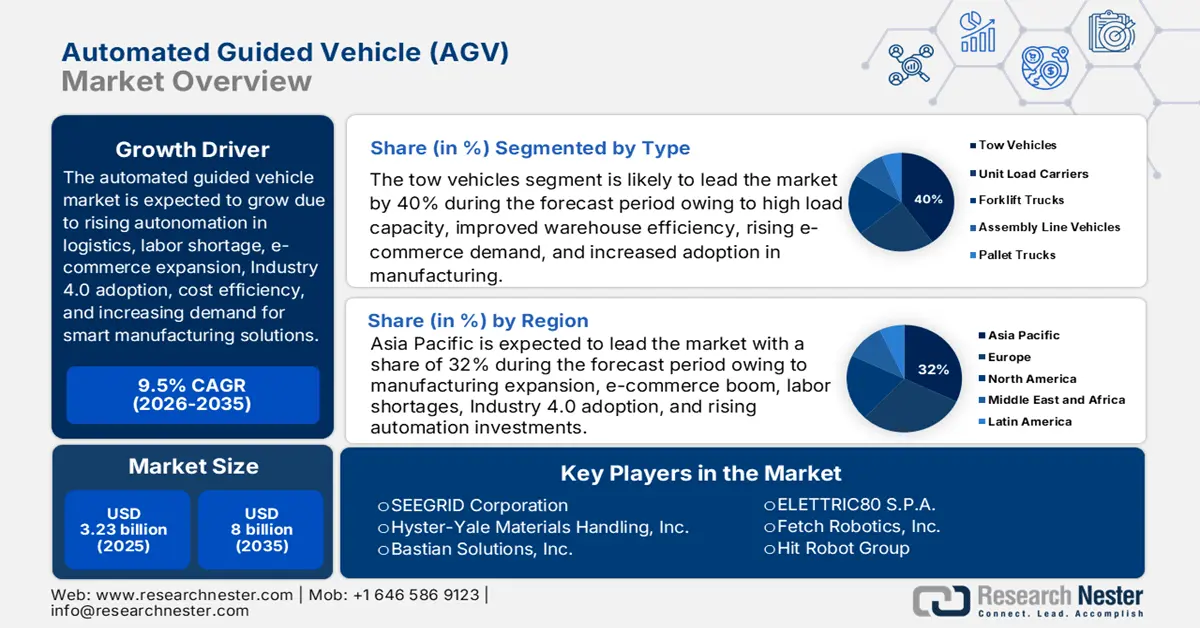

Automated Guided Vehicle Market size was over USD 3.23 billion in 2025 and is projected to reach USD 8 billion by 2035, witnessing around 9.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automated guided vehicle is evaluated at USD 3.51 billion.

The increased incidence of injuries and accidents within production and storage facilities is expected to drive growth in the automated guided vehicle market. According to the International Labour Organization, the annual mortality due to work-related accidents and diseases around the globe crossed 3 million in 2023. Over 63% of the total global fatal occupational injuries, 200,000, originated from Agriculture, construction, forestry, fishing, and manufacturing industries. In addition, work accidents caused 2.6 million deaths in the same year. On the other hand, AGVs can reduce fatalities and increase industrial output by improving worker safety and plant security, signifying a continuous surge in this sector.

The increasing popularity of industrial automation is also contributing to the expansion of the automated guided vehicle market. Being a crucial asset for enterprises in enhancing productivity and reducing workforce costs, these tools have become an essential part of this Industry 4 transformation. On this note, the International Federation of Robotics published the World Robotics 2024 Report, which revealed that over 4.2 million robots were operating in factories worldwide, representing a 10% increase from 2023. It also mentioned the annual robotic system installation to surpass 0.5 million in the same year. This showcases the inflation in the adoption rate in this sector

Key Automated Guided Vehicle Market Insights Summary:

Regional Highlights:

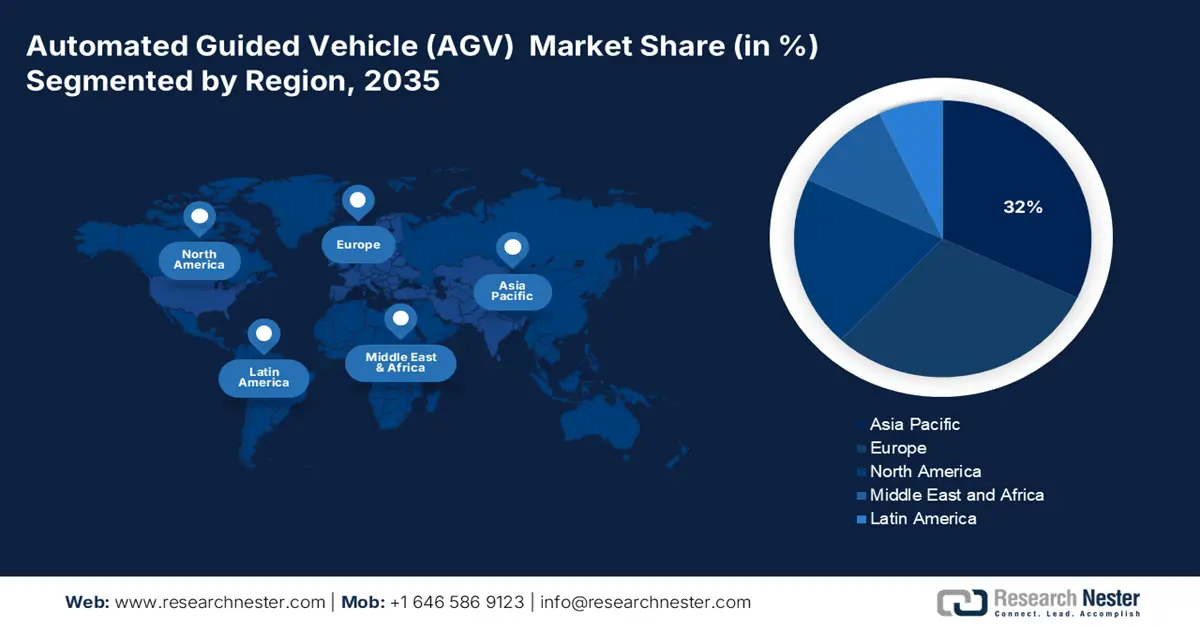

- Asia Pacific automated guided vehicle market will hold around 32% share, expected to expand by 2035, driven by rising e-commerce and manufacturing activities increasing workplace automation needs.

- North America market will register remarkable CAGR during 2026-2035, driven by industrial automation backed by tech innovation and safety needs in logistics.

Segment Insights:

- The tow vehicles segment in the automated guided vehicle market is forecasted to achieve a 40% share by 2035, driven by widespread towing operations in heavy industries like automotive, emphasizing high load capacity and operational efficacy.

- The logistics & warehousing segment in the automated guided vehicle market is projected to hold a 35% share by 2035, driven by rising demand for smart warehousing and efficient order fulfillment.

Key Growth Trends:

- Industrial integration of data-driven solutions

- Rapid expansion in online business

Major Challenges:

- Exorbitant cost of AGV installation and upkeep

Key Players: Swisslog Holding AG, SEEGRID Corporation, Hyster-Yale Materials Handling, Inc., Bastian Solutions, Inc., ELETTRIC80 S.P.A., Fetch Robotics, Inc., Hit Robot Group, EK Robotics, Seegrid Corporation, KUKA AG, Murata Machinery Ltd.

Global Automated Guided Vehicle Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.23 billion

- 2026 Market Size: USD 3.51 billion

- Projected Market Size: USD 8 billion by 2035

- Growth Forecasts: 9.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 9 September, 2025

Automated Guided Vehicle Market Growth Drivers and Challenges:

Growth Drivers

- Industrial integration of data-driven solutions: Technology developments such as AI and machine learning (ML) have showcased the ability to enhance financial output and efficiency in past years. Thus, it is evident that more manufacturers are willing to invest in the automated guided vehicle market. Testifying this fact, the German Electrical and Electronic Manufacturers’ Association reported that the global expenditure on cognitive and AI-powered systems obtained USD 77.6 billion in 2022. AI & ML showed the potential to create an additional value of USD 2 trillion in manufacturing and supply chain planning in 2020. It also predicted the economic contribution of this technology to the manufacturing industry to reach USD 27.0 billion by 2027.

- Rapid expansion in online business: As the roadmap of digitalizing business processes consists of e-commerce platforms, the demand for efficient fulfillment centers and smart warehouses is rising. For instance, in 2021, the value of global e-commerce sales accounted for USD 25 trillion across 43 developed and developing countries, which reached USD 27.0 trillion in 2022 (United Nations). Thus, the boom in this industry in recent years is pushing companies to seek solutions to streamline their inventory management and order picking, magnifying investments in the automated guided vehicle market.

Challenges

- Exorbitant cost of AGV installation and upkeep: Increasing concern about notable initial investments is one of the main reasons that may hinder growth in the automated guided vehicle market. The upfront costs for associated hardware, software, and integration are significantly high, which often deters the overall production or warehousing budget of small and medium-sized enterprises (SMEs). In addition, the complex and time-consuming layouts of the AGV ecosystem require skilled operators, causing additional expenses. Moreover, these factors accumulatively create an economic barrier to wide adoption and implementation.

Automated Guided Vehicle Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.5% |

|

Base Year Market Size (2025) |

USD 3.23 billion |

|

Forecast Year Market Size (2035) |

USD 8 billion |

|

Regional Scope |

|

Automated Guided Vehicle Market Segmentation:

Type Segment Analysis

The tow vehicles segment is poised to hold an automated guided vehicle market share of over 40% by the end of 2035. Towing operations are widely implemented across different production lines of heavy industries, such as automotive, highlighting the significance of this segment in revenue generation. In addition, these commodities are becoming indispensable for material transport due to their high load capacity, flexibility, and operational efficacy while being an affordable option. For instance, in June 2023, Dematic introduced a third-generation freezer-rated AVD model. This transport system is equipped with cutting-edge sensors and navigation technology to offer unmatched occupational safety, particularly in cold storage facilities.

Application Segment Analysis

The logistics & warehousing segment is expected to garner a significant share of around 35% in the automated guided vehicle market over the discussed timeframe. The increasing demand for smart warehousing around the world is escalating this segment’s captivity in this sector. With the intensification of online shopping worldwide, the requirement for efficient order fulfillment is rising. According to a study released by IEEE Xplore, in 2023, the 3 per 4 employees in a warehouse had a workload over 100%. AGVs are specifically designed to automate crucial roles, such as picking, packing, and storing, faster and more accurately to reduce this burden. Thus, the paramount speed and high-volume orders, coupled with the deep penetration of AI and robotics in storage facilities, are also a few of the major drivers in this category.

Our in-depth analysis of the global AGV market includes the following segments:

|

Type |

|

|

Battery Type |

|

|

Application |

|

|

Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automated Guided Vehicle Market Regional Analysis:

APAC Market Insights

The Asia Pacific automated guided vehicle market is anticipated to hold 32% of the revenue share throughout the assessed period. In developing countries such as Japan, China, and India, the regional e-commerce and manufacturing industries are gaining momentum. Thus, a large workforce is required to manage factory operations more efficiently, heightening the frequency of occupational accidents. As per the International Labour Organization, 60% of global work-related mortalities originated from Asia Pacific in 2023. As a result, this scenario is creating new business opportunities for domestic and global pioneers in this sector. On this note, in January 2024, Sumitomo Heavy Industries launched a new compact drive for space-saving in smartris, including AGVs.

North America Market Insights

The AGV market in North America is poised to follow a remarkable pace of growth by 2035. The region is pledged with the strong presence of global pioneers in this field and uplifting industrial output through automation. It can be testified by the region’s contribution, over 61%, in the USD 75.5 billion worth of rise in the global AI industry in 2023 (German Electrical and Electronic Manufacturers’ Association). Thus, the North America landscape is inspiring leaders in this merchandise to bring innovation to this landscape. For instance, in February 2024, Mitsubishi Logisnext Americas group unveiled its Jungheinrich warehouse products and Rocrich AGV Solutions at MODEX 2024. These commodities are specifically engineered for material handling operations.

According to the Bureau of Labor Statistics, the number of fatal work injuries registered in the U.S. was 5283 in 2023, where the transportation and warehousing segment had the 2nd highest rate of fatalities. This demography signifies the need for greater investments in industrial automation, representing a progressive future for the AGV market. The country’s leadership in technology integration, such as smart warehousing and AI management modules, in the primary workflow is also fueling its propagation in this sector. Currently, several domestic and global tech leaders are focusing on improving the quality and durability of AGVs. For instance, in January 2024, EnerSys introduced a wireless AGV charger, NexSys, to automate charging and eliminate the need for frequent maintenance.

Automated Guided Vehicle Market Players:

- Swisslog Holding AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SEEGRID Corporation

- Hyster-Yale Materials Handling, Inc.

- Bastian Solutions, Inc.

- ELETTRIC80 S.P.A.

- Fetch Robotics, Inc.

- Hit Robot Group

- EK Robotics

- Seegrid Corporation

- KUKA AG

- Murata Machinery Ltd.

- Stellantis

- Scott Technology

Key players in the automated guided vehicle (AGV) market are currently targeting large production and storage houses to generate maximum revenue. They are forming strategic alliances with customer entities to maintain a long-term business flow. In this regard, in January 2024, XSQUARE Technologies, in partnership with Coca-Cola, introduced five new autonomous forklifts at Coca-Cola's regional beverage concentrate plant in Singapore. As a part of Coca-Cola’s digital transformation roadmap, both partners collaboratively worked to embrace Industry 4 capabilities, promoting the advantages of AGVs and solidifying XSQUARE’s leadership in the Asia Pacific landscape. Such key players are:

Recent Developments

- In March 2025, Scott Technology launched a next-generation automated guided vehicle (AGV), NexBot, at ProMat 2025 to make automation more accessible, cost-effective, and easier to deploy. The modular approach of this vehicle is designed for warehousing, manufacturing, logistics, and e-commerce.

- In February 2025, Stellantis announced its plans to produce 1,000 automated guided vehicles (AGV) annually at its Kenitra plant in Morocco. The plant has the capacity to assemble 1 AGV every 3 hours, solidifying the company’s position as one of the biggest manufacturers in this field.

- Report ID: 3704

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automated Guided Vehicle Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.