Automated Biochemical Analyzers Market Outlook:

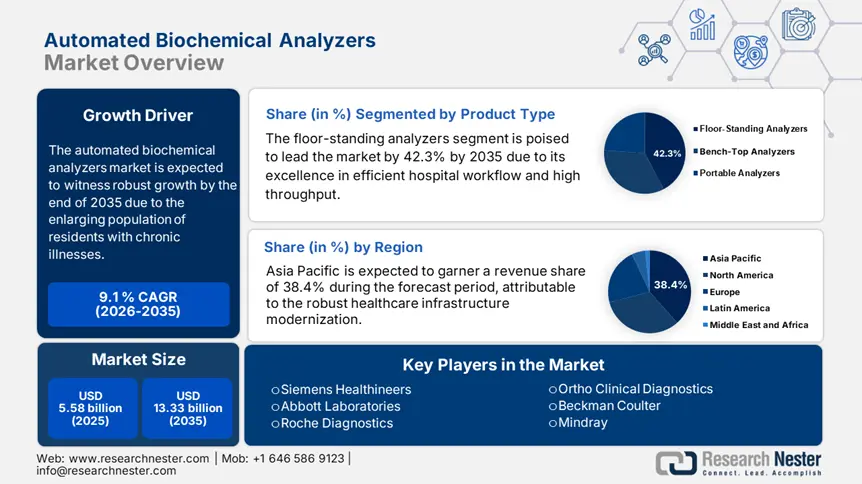

Automated Biochemical Analyzers Market size was valued at USD 5.58 billion in 2025 and is likely to cross USD 13.33 billion by 2035, registering more than 9.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automated biochemical analyzers is assessed at USD 6.04 billion.

Being a crucial part of pathological assessments, accommodating essential components for biochemical analysis has become a pivotal diagnostic practice. In addition, the rising volume of patient population with chronic illnesses, such as metabolic disorders, liver ailments, renal issues, cardiovascular disease (CVD), and even cancer, is creating a surge in next-generation and large-scale laboratory solutions. In this regard, the WHO reported that the worldwide counts of hypertension and diabetes-afflicted patients crossed 1.2 billion and 422.3 million in 2024. Similarly, in 2025, Germany alone consisted of 8.3 million people with chronic kidney disease (CKD), requiring these detection services. As a result, this is fueling demand in the market.

Budget overflow during production in the automated biochemical analyzers market is becoming more frequent than ever on account of the increasing costs and supply chain delays of raw materials. This has subsequently resulted in significant payers' pricing pressure on both diagnostic service providers and patients. Displaying the same, in 2024, the Bureau of Labor Statistics (BLS) revealed that the producer price index (PPI) in the U.S. witnessed a 4.3% year-over-year (YoY) rise for medical device manufacturing. The upstream flow also affected the other economic indicator, the consumer price index (CPI), for diagnostic services, which grew by a 3.9% increase in 2023. Such consistency in inflation requires standardization of pricing structures and sufficient distribution channels for semiconductor and precision components.

Key Automated Biochemical Analyzers Market Insights Summary:

Regional Highlights:

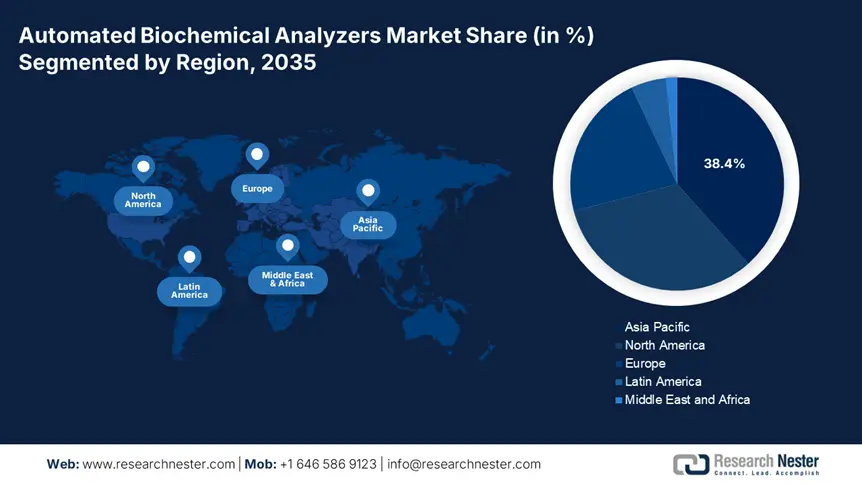

- Asia Pacific dominates the Automated Biochemical Analyzers Market with a 38.4% share, fueled by healthcare initiatives and demand for scalable diagnostic solutions, driving strong growth through 2026–2035.

- North America's automated biochemical analyzers market is dominating in growth by 2035, attributed to a growing chronic illness patient pool and strong healthcare infrastructure.

Segment Insights:

- The Diagnostic Laboratories segment is projected to hold a 38.3% share by 2035, fueled by the growth of independent labs and their cost-efficiency in developing economies.

- Floor-Standing Analyzers segment are projected to achieve a 42.3% share by 2035, fueled by high-volume testing demand in centralized healthcare diagnostics.

Key Growth Trends:

- Continuous funding from authorized investors

- Growing AI acceptance in the diagnostic industry

Major Challenges:

- Resistance toward novel technologies

Key Players: Roche Diagnostics, Siemens Healthineers, Abbott Laboratories, Beckman Coulter, Mindray, Ortho Clinical Diagnostics.

Global Automated Biochemical Analyzers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.58 billion

- 2026 Market Size: USD 6.04 billion

- Projected Market Size: USD 13.33 billion by 2035

- Growth Forecasts: 9.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Automated Biochemical Analyzers Market Growth Drivers and Challenges:

Growth Drivers

- Continuous funding from authorized investors: The dramatic growth in the patient pool pushed governing bodies in various regions to procure maximum resources from the automated biochemical analyzers market. In addition, it is influencing them to invest more in deploying next-generation technologies to streamline and fasten the workflow. For instance, in 2024, Europe sanctioned USD 913.9 million in funds to advance lab automation and point-of-care diagnostics under the region-wide Horizon Europe program. Simultaneously, Germany drafted an outlay of USD 571.2 million as per the guidelines of its Digital Healthcare Act to accommodate automated laboratories in hospitals across the nation.

- Growing AI acceptance in the diagnostic industry: Based on the efficacy of AI in streamlining and fastening the workflow of diagnostic laboratories, more dedicated authorities and institutions are showing interest in deploying commodities from the automated biochemical analyzers market. This surge in next-generation technologies is further influencing regulatory frameworks to make these solutions a mainstream practice by accelerating approvals. For instance, in 2023, based on the 30.2% reduction in processing time, the FDA cleared Roche's AI-powered cobas pro system. Moreover, the advanced features, including auto-calibration and predictive maintenance, are attracting payers to invest more in this field.

Challenges

- Resistance toward novel technologies: The increased incidences of data breaches are creating hesitation among legacy healthcare settings and professionals from integrating AI into their mainstream practices, restricting wide adoption in the automated biochemical analyzers market. Particularly, the absence of skilled operators and adequate infrastructure in underserved regions often imposes a hurdle in gaining optimum results from such advanced technologies, creating reimbursement barriers. For instance, in 2024, Beckman Coulter was forced to invest additionally in demonstrating sessions and alliance formation with UnitedHealthcare to ensure the enlistment of its DxA 5000 system insurer in the national insurance coverage.

Automated Biochemical Analyzers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.1% |

|

Base Year Market Size (2025) |

USD 5.58 billion |

|

Forecast Year Market Size (2035) |

USD 13.33 billion |

|

Regional Scope |

|

Automated Biochemical Analyzers Market Segmentation:

Product Type(Floor-Standing Analyzers, Bench-Top Analyzers, Portable Analyzers)

In terms of product type, the floor-standing analyzers segment is expected to dominate the automated biochemical analyzers market with a share of 42.3% by the end of 2035. Its wide use in large healthcare facilities to cope with high-volume testing demands is the primary factor behind the leadership of this segment. For instance, in 2023, the utilization of this subtype was observed among more than 70.2% of the hospitals in the U.S. to serve accurate and timely diagnosis in a scalable and efficient way. Additionally, the trend of centralizing advanced pathological assessment services under single point-of-care premises to comply with the basic criteria of establishing modern healthcare systems is also escalating demand in this segment.

Application (Hospitals, Diagnostic Laboratories, Research Institutes)

Based on applications, the diagnostic laboratories segment is poised to secure the highest revenue share of 38.3% in the automated biochemical analyzers market throughout the assessed timeframe. This dominance is followed by the emergence of independent laboratory service providers in developing economies, such as China and India. On the other hand, the cost-efficiency of these institutions in offering quality experiences and patient convenience makes them a superior option for both companies and consumers to invest in. As evidence, in 2023, the WHO revealed that individual diagnostic laboratory has the potential to save up to 25.4%, outperforming the amount of savings in automating traditional hospital-based laboratories.

Our in-depth analysis of the global automated biochemical analyzers market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automated Biochemical Analyzers Market Regional Analysis:

APAC Market Statistics

Asia Pacific is anticipated to lead the global automated biochemical analyzers market by capturing the highest share of 38.4% over the discussed period. The region is home to a large population of older citizens, CVD-afflicted patients, and increasing cancer mortality. This represents a large consumer base for this sector, attracting both domestic and international MedTech leaders to invest and participate in this landscape. On the other hand, the substantial healthcare initiatives taken by the governments of emerging economies, such as China and India, to prevent epidemics of related ailments are also fueling demand for scalable diagnostic solutions, including automated biochemical analyzers.

China has become the global hub of AI integration and medical device manufacturing, which indicates the country's predominant control over the regional automated biochemical analyzers market. Considering the massive population, the nation's efforts are concentrated on centralizing and modernizing medical systems to make advanced detection and intervention more accessible to its citizens. To fulfill the same goal, in 2023, Guangdong made a substantial provincial-level investment of USD 500.4 million to expand the reach of local diagnostic capabilities across China. Moreover, the combination of strong government support and private spending on MedTech R&D is solidifying the country's position in this sector.

India is augmenting the automated biochemical analyzers market with an ambitious government goal of achieving minimal reliance on foreign medical supplies. With an aim to increase clinical connectivity up to underserved areas of the country, the government is enabling subsidized deployment and localized production. In this regard, the scheme implemented by the Ayushman Bharat facilitated 5,0010 analyzer installations in rural hospitals in India. The reflection of the success of such initiatives is further displayed by the 50.4% increase in the number of diagnosed patients from 2015 to 2023. This demography is creating a favorable trading atmosphere for both domestic and foreign investors.

North America Market Analysis

North America is predicted to maintain a significant dominance over the pace of growth of the global automated biochemical analyzers market. The continuously enlarging patient pool of chronic illnesses, such as diabetes and obesity, is the major factor of revenue escalation in this landscape. Testifying this, the National Institute of Health (NIH) underscored the 32.5% rise in diabetes occurrence from 2018 to 2023. Simultaneously, a report from the Centers for Disease Control and Prevention (CDC) mentioned that over 40.4% of the adult population in the U.S. required annual biochemistry panels in 2024. This demography reflects the presence of a sustainable demand in this region in the upcoming years.

The U.S. is augmenting its regional leadership in the automated biochemical analyzers market with robust healthcare infrastructure, Federal initiatives, and MedTech excellence. As evidence, in 2024, the NIH dedicated USD 1.3 billion to incorporate advancements in the nation's diagnostic capabilities. Further, as a strategy to serve the purpose, the country imported USD 1.5 billion worth of analyzers and their parts in the same year. In support of enhancing public access, the regulatory body of the U.S. is also levitating the speed of approvals for newly developed commodities in this sector. For instance, in 2024 alone, the U.S. FDA gave clearance to 12 AI-powered analyzers. Furthermore, the expansion of Medicare & Medicaid coverage is making products more affordable and acceptable for patients.

Canada is also following the region's propagation toward global leadership in the automated biochemical analyzers market with a strong provincial investment culture and dramatic patient pool expansion. Particularly, the increasing volume of senior citizens, which is expected to captivate 25.3% of the net population by 2030, is pushing governments to assign prompt medical response systems for better and faster healthcare delivery. In this regard, in 2023, the government of Alberta accomplished a 30.4% reduction in diagnostic delays by strengthening AI pilot programs. Additionally, in 2024, the country's universal healthcare system invested USD 4.2 billion to make laboratory services more accessible.

Key Automated Biochemical Analyzers Market Players:

- Roche Diagnostics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens Healthineers

- Abbott Laboratories

- Beckman Coulter

- Mindray

- Ortho Clinical Diagnostics

- Becton Dickinson

- Thermo Fisher Scientific

- Transasia Bio-Medicals

- Samsung Healthcare

- Snibe Diagnostic

- Randox Laboratories

- ELITechGroup

- Biosystems S.A.

- Caretium Medical

- Microlab

The automated biochemical analyzers market represents intense competency among established diagnostics giants and agile regional players, where Roche, Siemens, and Abbott collectively maintain dominance. Ongoing innovation in AI automation and strategic acquisitions are their primary asset of outstretched expansion across the world. On the other hand, manufacturers in countries of APAC, such as Mindray in China and Transasia in India, are focusing on upgrading their cost-competitiveness. Moreover, their commercial success proves that the industrial transformation in this sector is delivered through competing approaches and players' value-focused developments.

Top contenders of such key players are:

Recent Developments

- In June 2024, Abbott Laboratories strengthened its position in the automated biochemical analyzers market with the launch of its AI-driven Alinity ci-Series upgrade. The enhanced system features real-time predictive maintenance capabilities and improved error reduction technology.

- In March 2024, Roche significantly advanced laboratory diagnostics with the introduction of the Cobas Pro Integrated Solutions, combining immunoassay and biochemistry analysis in a single platform. It enhanced lab efficiency, delivering a 20.1% faster turnaround time for combined tests according to hospital reports.

- Report ID: 7740

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.