Veterinary Hematology Analyzers Market Outlook:

Veterinary Hematology Analyzers Market size was over USD 1.6 billion in 2025 and is estimated to reach USD 3.8 billion by the end of 2035, expanding at a CAGR of 10.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of veterinary hematology analyzers is evaluated at USD 1.7 billion.

The fundamental growth factor behind the robust expansion of the veterinary hematology analyzers market is the increase in the companion animal population and livestock production. Evidencing the same, a 2025 report from the U.S. Department of Agriculture (USDA) unveiled that the amount of exported beef and chicken meat worldwide grew from 12.0 million MT to 13.0 million MT and from 13.5 million MT to 14.0 million MT between 2023 and 2025, respectively. Besides, the Global Animal Health Association reported that, till 2022, more than 50% of the global households had a pet at home. This describes the growing need for the availability of complete diagnostic and treatment solutions, hence fueling this sector.

The cohort of primary payers in the market includes institutional diagnostic cores, veterinary pathology labs, and university-based service providers. On the other hand, the current dynamics of payers’ pricing for related services is strongly influenced by automated vs manual differentials, sample volume, and species type. This economic trend can be exemplified by the 2024‑2025 fee schedule of the Veterinary Pathology Diagnostic Services department in Iowa State University. The prices of CBC with automated differential for small animals, CBC without differential, and CBC with manual differential in this setup were USD 14.0, USD 12.0, and USD 21.0, respectively. This reflects the tendency to standardize the pricing structure for end users in this sector.

Key Veterinary Hematology Analyzers Market Insights Summary:

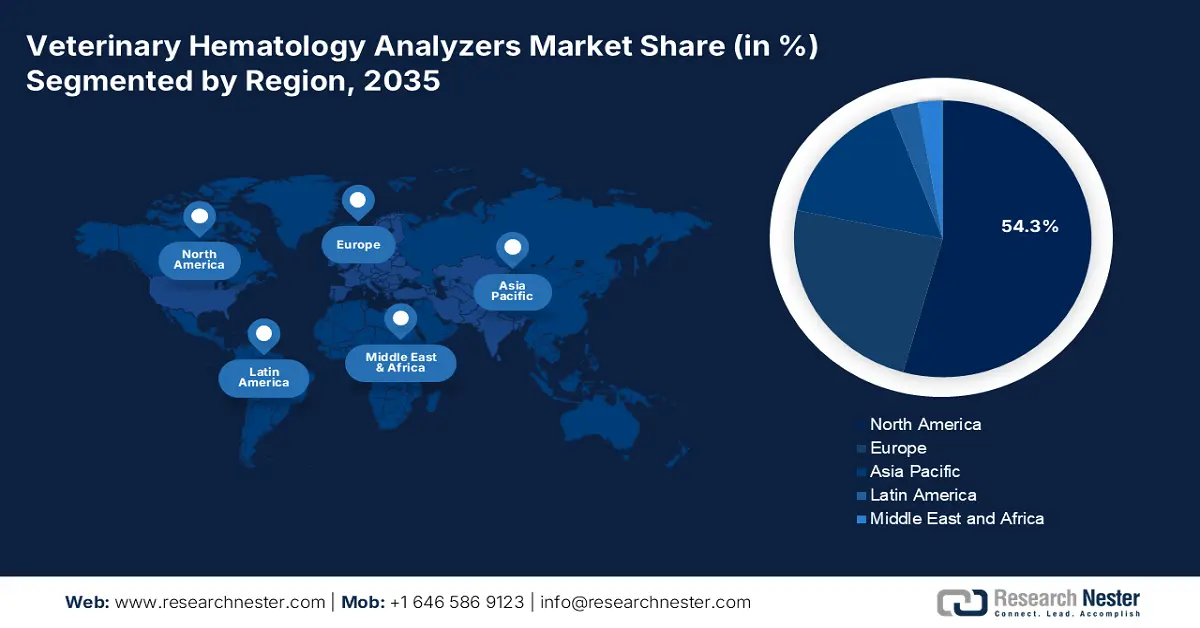

Regional Insights:

- North America is projected to hold a 54.3% revenue share in the Veterinary Hematology Analyzers Market by 2035, owing to its robust pet ownership rates, mature diagnostics infrastructure, and heightened expenditure on animal healthcare.

- Asia Pacific is set to witness the fastest expansion through 2026–2035, propelled by surging pet populations, rising disposable incomes, and reinforced veterinary healthcare systems.

Segment Insights:

- The companion animals segment is anticipated to capture a commanding 65.4% share by 2035 in the Veterinary Hematology Analyzers Market, propelled by the surge in pet ownership and the growing humanization of pets.

- Point-of-care (POC) analyzers segment is expected to dominate the market over 2026–2035, driven by their portability, ease of use, and the accelerating shift toward real-time veterinary diagnostics.

Key Growth Trends:

- Increased spending on veterinary diagnostics

- Rising worldwide burden of zoonotic diseases

Major Challenges:

- Lack of adequate financial support

- Competition from rental business models

Key Players: IDEXX Laboratories, Inc., Zoetis Inc., Sysmex Corporation, Mindray Medical International Ltd., Heska Corporation (Part of Antech), Horiba, Ltd., Boule Diagnostics AB, Virbac, Abaxis, Inc. (Part of Zoetis), Diatron MI PLC, HORIBA Medical, Siemens Healthineers, Scil Animal Care Company GmbH, Drew Scientific Inc. (Erba Group), Rayto Life and Analytical Sciences Co., Pixcell Medical, Clindiag Systems Co., Ltd., Norma Diagnostics, Crony Instruments, Woodley Equipment Company Ltd.

Global Veterinary Hematology Analyzers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.6 billion

- 2026 Market Size: USD 1.7 billion

- Projected Market Size: USD 3.8 billion by 2035

- Growth Forecasts: 10.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (54.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Australia, Mexico

Last updated on : 1 October, 2025

Veterinary Hematology Analyzers Market - Growth Drivers and Challenges

Growth Drivers

- Increased spending on veterinary diagnostics: The growing awareness of animal welfare is empowering the foundation of the veterinary hematology analyzers market. To support this cohort, the number of veterinary hospitals, diagnostic labs, and point-of-care clinics is growing, which supports consistent growth in this sector. This has created a trend among newly established clinics to upgrade their offerings by incorporating advanced tools into the infrastructure. Ultimately, such physical expansion of facilities boosts analyzer sales and installation by fostering a persistent cycle of procurement among dedicated medical settings.

- Rising worldwide burden of zoonotic diseases: The rising incidence of leptospirosis, rabies, tick-borne, and other illnesses is increasingly becoming a global concern, necessitating early hematological screening to control outbreaks. Testifying to this, in a 2025 report, the Centers for Disease Control and Prevention (CDC) unveiled that 6 out of 10 known and 3 out of 4 new or emerging infectious diseases found in humans potentially spread from animals. Particularly, for companion animals, healthcare authorities are mandating guidelines recommending regular check-ups to prevent transmission of these diseases to people, amplifying the surge in this sector.

- Integration of AI and data analytics in pathology: The market is securing a progressive future by developing next-generation pathological tools. The ability of these advanced systems to automatically flag abnormal results, identify disease patterns, and suggest follow-up tests improves diagnostic confidence, reduces manual errors, and improves workflow efficiency. This attracts more clinics and hospitals to adopt such equipment that can enhance the overall performance and cost-optimization. As evidence, a peer-reviewed study published by PLOS in 2025 unveiled that automated hematology analyzers (HAs) can analyze 23 parameters from multi-species blood samples within just one minute for each test.

Overview of the Financial Landscape of the Target Demography in the Veterinary Hematology Analyzers Market

Category-wise Trade Values for the Global Livestock Industry (2023)

|

Livestock Category |

Global Trade Value (in USD) |

Change in Value (2022-2023) |

|

Animal Products |

439 billion |

-3.9% |

|

Bovine |

10.9 billion |

+14.4% |

|

Live Animals |

28.3 billion |

+13.1% |

|

Sheep and Goats |

2.9 billion |

+33.1% |

|

Poultry Meat |

34.3 billion |

-3.4% |

|

Cattle: Live |

9.0 billion |

+18.3% |

|

Horses |

3.7 billion |

-9.9% |

Source: OEC

Challenges

- Lack of adequate financial support: In contrast to human healthcare, medical attention and availability are relatively limited. As government animal health agencies and public payer programs have restrictive budgets, investments in the veterinary hematology analyzers market often become rare, particularly in low- and middle-income countries (LMICs). Hence, advanced HA testing is mostly not covered under government beneficiaries, placing the full cost burden on private veterinarians, livestock producers, or pet owners, creating economic barriers in this sector.

- Competition from rental business models: Due to the high upfront cost of deploying a new HA system, service providers are increasingly opting for contractual procurement for a bounded timeline. This tendency is even observed among several established veterinary clinics that choose reagent-rental models over complete purchases. This severely damages the consistency of the cash inflow in the market. As a result, new entrants without a largely trusted portfolio and massive capital reserves find it extremely difficult to compete with this cost-conscious behavior.

Veterinary Hematology Analyzers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.3% |

|

Base Year Market Size (2025) |

USD 1.6 billion |

|

Forecast Year Market Size (2035) |

USD 3.8 billion |

|

Regional Scope |

|

Veterinary Hematology Analyzers Market Segmentation:

Animal Type Segment Analysis

Companion animals are poised to remain the largest source of revenue generation for the veterinary hematology analyzers market by securing a share of 65.4% by the end of 2035. The segment’s dominance is primarily attributed to the substantial rise in pet ownership rates and the increasing trend of humanization of pets. Testifying to the same, results from a survey conducted by the Employees Retirement System (ERS) of Texas, released in 2025, revealed that more than 77% of Americans show a willingness to pay out-of-pocket for unexpected medical expenses on their pets, even if it taps into their savings or emergency fund. Moreover, the inclined preference of owners to opt for detailed diagnostic tests for preventive health and illness management serves as a growth engine for this segment.

Product Segment Analysis

Point-of-care (POC) analyzers are anticipated to represent dominance in the market over the analyzed period. The ease of use and portability of these HAs are the foundational factors behind the segment’s strong presence in this field. The compact design of these tools allows professionals to deliver on-site pathological services with unmatched precision that facilitates rapid veterinary testing, particularly in emergencies. Besides, the ongoing shift of the animal health industry towards real-time diagnostics in mainstream practices, combined with the ongoing trend of miniaturization, continues to enable widespread adoption in this category.

End user Segment Analysis

Veterinary hospitals & clinics are estimated to remain the dominant contributor to the trading value increase in the veterinary hematology analyzers market during the assessed timeline, while acquiring a 58.7% share. With a central role in conducting the majority of in-house testing, these facilities have become the core of capital involvement for this equipment. In addition, the high patient volume of these facilities amplifies the financial priority of investing in reliable and high-throughput HAs to manage the rising workload efficiently. Currently, increasing support from public institutions is emphasizing the role of veterinarians in a One Health approach to combat zoonotic diseases and antimicrobial resistance, reinforcing the segment’s leadership in this field.

Our in-depth analysis of the market includes the following segments:

|

Segments |

Subsegments |

|

Product |

|

|

Analysis Parameters |

|

|

Technology |

|

|

Price Range |

|

|

Animal Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Veterinary Hematology Analyzers Market - Regional Analysis

North America Market Insights

Detailed estimates position North America as the leading region in the market throughout the discussed timeframe, capturing a 54.3% revenue share. Heightening rates of pet ownership, a well-established animal therapeutics and diagnostics industry, and increasing expenditure on pet care are collectively fueling the region’s dominance in this sector. On the other hand, robust utilization and innovation in point-of-care analyzers are seen across North America for both companion animals and livestock, which reflects the significance of the landscape in this category.

Favorable animal welfare guidelines and high awareness of zoonotic disease-related health risks are positioning the U.S. at the top of the regional veterinary hematology analyzers market. The persistent increase in pet ownership also solidifies the country’s proprietorship in this sector. For instance, the proportion of households in the U.S. owning a pet rose from 68% to 70% from 2016 to 2021, where the net population of companion dogs and cats reached 150 million in 2022, as reported by the Global Animal Health Association. Besides, the import of beef and veal also increased by 5% in the country in 2025, portraying the rising demand for livestock that ultimately fuels this sector.

The scale of the Canada market is relatively small compared to the U.S., but shows strong growth potential. The consistent drop in cattle production, showing a notable decrease of 157,000 heads between 2022 and 2025, is translating to a nationwide livestock shortage, where diseases are one of the major reasons. This underscores the urgent need to enable adequate preventive measures, creating new opportunities for the merchandise and redirecting heavy capital influx from public authorities to this field. As evidence, in April 2022, the governments of Canada, in alliance with Manitoba, invested USD 2.2 million to modernize the provincial Animal Health Laboratory Information Management System (LIMS) to safeguard the national food supply and health of both humans and animals.

APAC Market Insights

Asia Pacific is predicted to grow at the fastest pace in the market by the end of 2035. The substantial increase in pet population, disposable incomes, and veterinary healthcare reinforcement over the past years established a lucrative landscape with a promising growth potential in this region for the merchandise. In addition, the heightening rate of urbanization in emerging economies is resulting in a higher volume of companion animals, amplifying demand for HA systems. On the other hand, the urge to maintain a solid position in producing and supplying livestock assets at a large scale also pushes APAC countries to invest in animal disease preparedness, contributing notably to the region’s accelerated progress in this sector.

China is one of the fastest-growing national landscapes in the APAC veterinary hematology analyzers market, owing to the rising pet ownership in urban areas and government efforts to enable disease monitoring in livestock. From companion animal clinics seeking fast and reliable blood‑tests to the nationwide poultry operations requiring herd health surveillance, the country is marking its significance as a large consumer base for both categories. Particularly, the tightening of zoonotic disease control and food safety protocols, in response to the 50,000 metric ton decrease in beef and veal production between 2024 and 2025, is creating a necessity for maximum HA deployment among various veterinary settings.

The India market is also expected to present lucrative opportunities for global pioneers due to the rising awareness of lifestyle-related conditions in pets. As a result, the nation’s veterinary diagnostic and clinical infrastructure is evolving rapidly, creating demand for HAs tailored to both local rural and semi-urban use. Specifically, the advanced features, including multi-species capability, low reagent use, and ease of maintenance, offered by next-generation laboratory tools available in this sector are captivating a large proportion of the cost-sensitive consumer base in India.

Country-wise Demography of Pets (2022)

|

Country |

Number of Dogs (in Million) |

Number of Cats (in Million) |

|

China |

74.0 |

67.0 |

|

Thailand |

8.9 |

3.3 |

|

Australia |

6.3 |

4.9 |

|

Japan |

8.5 |

9.6 |

|

India |

10.0 |

10.0 |

Source: Global Animal Health Association

Europe Market Insights

Europe is expected to display a steady position in the market during the timeline between 2026 and 2035. Key growth drivers in this landscape include an increasing awareness of animal healthcare and welfare, an enlarging pet population, strong regulatory oversight on zoonotic/livestock disease control, and greater investment in veterinary diagnostic infrastructure. Major contributors to the consistent surge in this field are economically developed countries, such as the UK, Germany, France, Italy, and Spain. Moreover, remarkable progress in animal-related clinical research and the development of its preventive animal health ecosystem are consolidating the position of Europe in this sector.

The veterinary hematology analyzers market in the UK is exhibiting a remarkable pace of progress, in support of the nationwide outbreak control measure implementation. Particularly, in urban areas, the network of veterinary clinics and referral centres is expanding at a considerable pace to support equitable healthcare access to the massive pet population in the country. The UK also shows strong uptake of point-of-care diagnostics within veterinary practice in the companion animal segment, influenced by the growing demand for user-friendly solutions to enable faster decision-making.

The rising awareness of animal-borne diseases, coupled with high health standards in livestock, is making Germany an attractive scope for revenue generation in the market. Key contributors to the food supply chain are being continuously pressured by the country’s stringent disease monitoring regulatory frameworks, which further translates to a surge in scalable and liable laboratory ecosystems. Exemplifying the same, in January 2022, the Sino-German Cooperation Project on Sustainable Animal Husbandry and Breeding entered its third phase, which underscored the scope of investments in animal welfare.

Country-wise Demography of Pets (2022)

|

Country |

Number of Dogs (in Million) |

Number of Cats (in Million) |

|

Germany |

10.7 |

15.7 |

|

Spain |

6.7 |

3.7 |

|

France |

7.6 |

14.2 |

|

Russia |

17.1 |

22.7 |

|

UK |

13.0 |

12.0 |

|

Italy |

7.0 |

7.3 |

|

Netherlands |

1.9 |

3.1 |

Source: Global Animal Health Association

Key Veterinary Hematology Analyzers Market Players:

- IDEXX Laboratories, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Zoetis Inc.

- Sysmex Corporation

- Mindray Medical International Ltd.

- Heska Corporation (Part of Antech)

- Horiba, Ltd.

- Boule Diagnostics AB

- Virbac

- Abaxis, Inc. (Part of Zoetis)

- Diatron MI PLC

- HORIBA Medical

- Siemens Healthineers

- Scil Animal Care Company GmbH

- Drew Scientific Inc. (Erba Group)

- Rayto Life and Analytical Sciences Co.

- Pixcell Medical

- Clindiag Systems Co., Ltd.

- Norma Diagnostics

- Crony Instruments

- Woodley Equipment Company Ltd.

The commercial dynamics of the veterinary hematology analyzers market are currently evolving with the ongoing tech-based innovations. Key players in this sector support the trending wave of automation by incorporating AI and cloud-based features in next-generation HA systems. They are also developing suitable solutions to capitalize on the emerging cost-sensitive consumer base in developing nations, portraying the active participation and engagement in potentially large regional landscapes. The future roadmap of expansion in the merchandise is further shaped by public-private partnerships and collaborative R&D initiatives.

Here is a list of key players operating in the market:

Recent Developments

- In December 2024, Zoetis shared its plans to launch its new screenless point-of-care hematology analyzer, Vetscan OptiCell, in the global market at the Veterinary Meeting & Expo (VMX) in Orlando. This AI-powered tool is designed to provide a complete blood count (CBC) analysis for accurate insights in minutes for veterinary diagnosis.

- In June 2024, Horiba expanded its compact hematology instrument range, Yumizen H550, by launching new models with Erythrocyte Sedimentation Rate (ESR) on board. The new Yumizen H550E (autoloader), H500E CT (closed tube), and Yumizen H500E OT (open tube) can deliver results from whole blood in just 60 seconds.

- Report ID: 8156

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.