Automated Radiosynthesis Module Market Outlook:

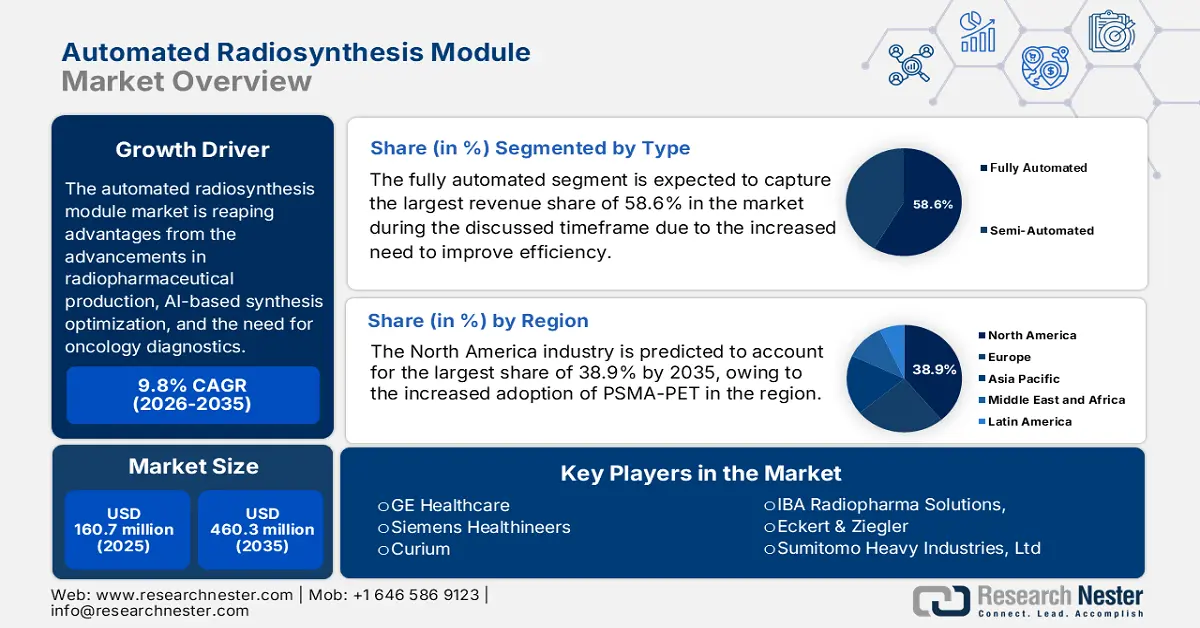

Automated Radiosynthesis Module Market size was valued at USD 160.7 million in 2025 and is projected to reach USD 460.3 million by the end of 2035, rising at a CAGR of 9.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of automated radiosynthesis module is assessed at USD 177.5 million.

The automated radiosynthesis module market is reaping advantages from the advancements in radiopharmaceutical production, AI-based synthesis optimization, and the need for oncology diagnostics. Meanwhile, the increasing burden of cancer and neurological disorders among the worldwide population is providing an encouraging opportunity for this landscape. In this regard, the WHO in February 2025 reported that cancer led to nearly 10 million deaths in a year, wherein low- and lower-middle-income countries, infections like HPV and hepatitis contribute to about 30% of cancer cases, further compelling PET-based therapeutics and diagnostics.

Furthermore, the global market is enhancing on account of proactive applications of radiopharmaceuticals beyond oncology into neurology and cardiology, which contribute to broader adoption. Testifying to this ACR in November 2024, CMS reported that starting in 2025, CMS will implement changes to reimbursement for high-cost diagnostic radiopharmaceuticals by unbundling their costs from the overall imaging exam under the hospital outpatient prospective payment system. Therefore, the new policy sets a cost threshold to separately reimburse radiopharmaceuticals that exceed this level, initially at USD 630, with plans for annual adjustments associated with pharmaceutical price indices.

Key Automated Radiosynthesis Module Market Insights Summary:

Regional Insights:

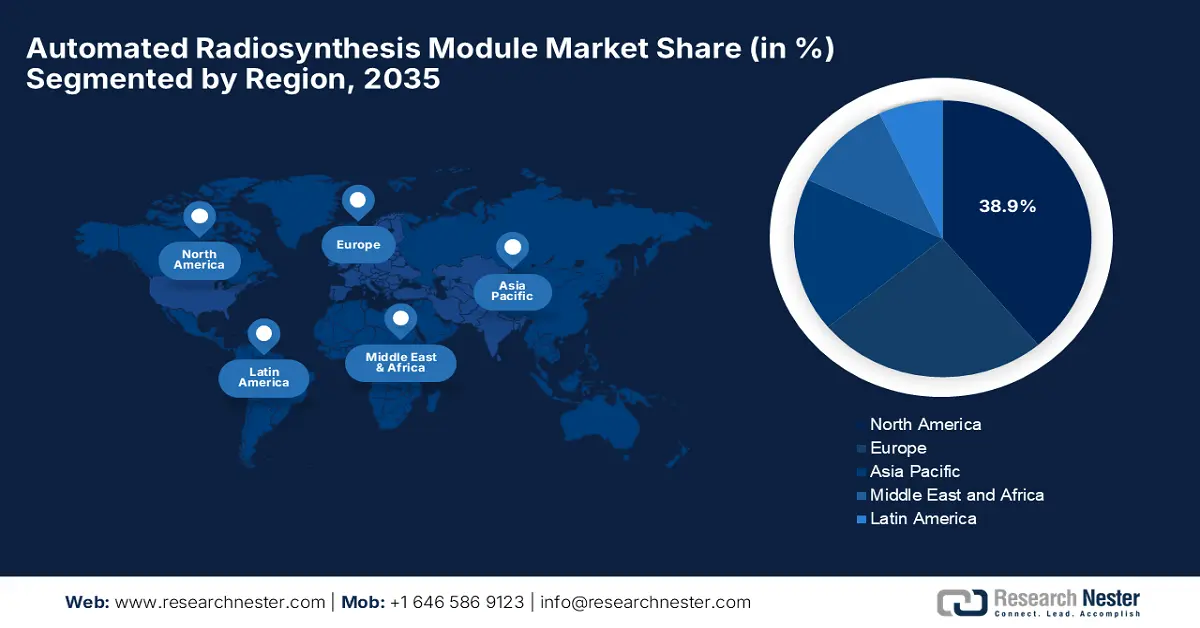

- North America is expected to dominate with a 38.9% share by 2035, fueled by collaborations between major firms and widespread adoption of PSMA-PET.

- Asia Pacific is recognized as the fastest-growing region, impelled by expanding investments in nuclear medicine infrastructure and improving healthcare access.

Segment Insights:

- The fully automated segment is projected to account for 58.6% share by 2035, owing to increased production efficiency and reduced human error in radiopharmaceutical manufacturing.

- The oncology segment is anticipated to hold a 40.4% share by 2035, driven by the growing cancer burden and the critical role of PET imaging in early cancer detection and treatment monitoring.

Key Growth Trends:

- Advancements in PET & SPECT imaging

- Decentralization of radiotracer production

Major Challenges:

- Radioisotope availability

- Technical complications

Key Players: GE Healthcare, Siemens Healthineers, Curium, IBA Radiopharma Solutions, Eckert & Ziegler, Sumitomo Heavy Industries, Ltd., Raytest, Trasis, SCINTOMICS, Comecer, ACSIRaylab, CellPoint, NorthStar Medical Radioisotopes, JFE Engineering Corporation, NuPET LLC, Telix Pharmaceuticals, BARC (Bhabha Atomic Research Centre), MOLECUBES, KIRAMS, ANSTO.

Global Automated Radiosynthesis Module Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 160.7 million

- 2026 Market Size: USD 177.5 million

- Projected Market Size: USD 460.3 million by 2035

- Growth Forecasts: 9.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, Japan, Canada

- Emerging Countries: China, India, South Korea, Brazil, Australia

Last updated on : 6 October, 2025

Automated Radiosynthesis Module Market - Growth Drivers and Challenges

Growth Drivers

- Advancements in PET & SPECT imaging: This is one of the primary drivers in the market, as the growing adoption of PET and SPECT imaging systems enhances the need for high-quality radiotracers. As evidence in June 2025, the Royal Infirmary of Edinburgh reported that Scotland’s first total-body PET scanner is operational at the Royal Infirmary of Edinburgh, which offers scans up to 40 times more sensitive and 10 times faster than existing machines, thereby using less radiation, enhancing diagnosis and treatment of cancer, cardiovascular disease, stroke, and others.

- Decentralization of radiotracer production: The upgradations in terms of the regulatory guidelines are encouraging the decentralization of radiotracer production, which allows on-site synthesis in hospitals and clinics as well. Seminars in Nuclear Medicine in May 2022 reported that there have been considerable advancements in radiotracer production, wherein radiotracer synthesis necessitates rapid, automated processes within GMP-compliant, shielded environments. Innovations such as compact cyclotrons and microfluidic chemistry hold promise for future production efficiencies, whereas these advancements enable the widespread clinical use of PET.

- Population demographics: The rapidly escalating aging global population is more susceptible to chronic diseases, increasing the demand for diagnostic and therapeutic imaging services, wherein these modules cater to the need by providing efficient solutions. According to the article published by the World Health Organization in October 2024, 1 out of 6 people will be aged more than 60 by the end of 2030, whereas by 2050, the aging demographics will surpass 2.1 billion. Therefore, this enables the widespread clinical use of advanced diagnostic capabilities and personalized medicine.

Global Cancer Incidence and Mortality Statistics (2020)

|

Category |

Statistics |

|

Global Cancer Deaths |

Nearly 10 million deaths |

|

Most Common New Cases |

|

|

Breast |

2.26 million cases |

|

Lung |

2.21 million cases |

|

Colon and Rectum |

1.93 million cases |

|

Prostate |

1.41 million cases |

|

Skin (non-melanoma) |

1.20 million cases |

|

Stomach |

1.09 million cases |

Sources: WHO

Challenges

- Radioisotope availability: This has created a major barrier for the expansion of the automated radiosynthesis module market since the supply chain concerns create shortages in the production capabilities. Also, most of the radiotracers rely on isotopes with very short half-lives, such as ^11C, ^15O, and ^13N; therefore, delays in isotope delivery or interruptions in supply can disrupt production. Hence, the logistics of transporting isotopes, precursors, and reagents under certain required conditions make it both complex and expensive, limiting adoption.

- Technical complications: This, along with the flexibility changes, also poses a major obstacle for the market to capture the desired success. Different sorts of radiotracers require different synthesis chemistry, target types, reaction conditions, and purification steps, which makes it challenging for small-scale manufacturers to leverage them. Therefore, ensuring consistency is highly essential when a module or process is being adapted for new tracers.

Automated Radiosynthesis Module Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 160.7 million |

|

Forecast Year Market Size (2035) |

USD 460.3 million |

|

Regional Scope |

|

Automated Radiosynthesis Module Market Segmentation:

Type Segment Analysis

The fully automated segment is expected to capture the largest revenue share of 58.6% in the automated radiosynthesis module market during the discussed timeframe. The dominance of the segment is effectively attributable to the increased need to improve production efficiency and reduce human error in radiopharmaceutical manufacturing. Besides, these fully automated systems support higher throughput and better compliance with good manufacturing practices, which is highly essential for clinical applications.

Application Segment Analysis

The oncology segment is predicted to garner a significant share of 40.4% in the market by the end of 2035. The growing cancer burden and the crucial role of PET imaging in early cancer detection, staging, and treatment monitoring are the key factors behind this leadership. An NIH article published in February 2025 stated that PET scanning, which uses radioactive tracers such as 18F-fluorodeoxyglucose to visualize metabolic activity in the body, assists in the diagnosis, staging, and monitoring of cancers by highlighting areas of increased glucose uptake, hence a wider segment scope.

End user Segment Analysis

Based on end user hospitals segment, it is projected to attain a share of 38.5% in the automated radiosynthesis module market during the discussed timeframe. The growth in the segment is highly subject to their extensive diagnostic imaging departments and the need for on-site radiopharmaceutical production. In June 2022, Karkinos Healthcare reported that it had established India’s first-ever oncology laboratory, the Advanced Center for Cancer Diagnostics and Research, to address the country’s severe cancer care gaps, including late diagnoses. This healthcare facility will offer advanced diagnostics such as histopathology, molecular testing, and gene sequencing, supporting precision medicine and personalized therapies.

Our in-depth analysis of the automated radiosynthesis module market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

|

End user |

|

|

Technology |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automated Radiosynthesis Module Market - Regional Analysis

North America Market Insights

North America’s market is anticipated to dominate with the largest revenue share of 38.9% during the assessed timeframe. The market is driven by factors such as collaborations between major firms and the tremendous adoption of PSMA-PET in the region. For instance, in January 2025, Lantheus Holdings announced an agreement to acquire Life Molecular Imaging for USD 350 million upfront, thereby aiming to expand its leadership in radiopharmaceuticals, especially in the growing Alzheimer’s disease diagnostics. The acquisition also includes Neuraceq, which is an FDA-approved F-18 PET imaging agent used to detect beta-amyloid plaques in patients with cognitive impairment.

The U.S. market is poised for growth with immense exposure towards research and development and suitable reimbursement policies. As of the NIH November 2023 article, CMS coverage for diagnostic services is structured across different parts of the program, wherein Medicare Part A typically covers diagnostic tests provided during an inpatient hospital stay, while Part B covers these services in outpatient settings, such as imaging centers and physician offices. Beneficiaries also have the option to enroll in Medicare Part C, which is known as Medicare Advantage, through which private health plans approved by CMS provide all Part A and Part B benefits.

The Canada market is undergoing exceptional expansion, due to both federal and provincial healthcare investments and cross-border collaborations. In January 2025, International Isotopes, a key provider of medical isotopes and nuclear medicine solutions, formed an exclusive partnership with SCINTOMICS Molecular Applied Theranostics Technologies, which is a global leader in radiopharmaceutical synthesis technology. Through this collaboration, International Isotopes will distribute, install, and service ATT’s automated synthesis modules across the U.S. and Canada, along with supplying consumables and ongoing support.

Key Developments in Radiopharmaceuticals Impacting the Automated Radiosynthesis Module Market

|

Year |

Development |

Company |

Radiopharmaceuticals |

Market Impact |

|

2024 |

Acquisition of global rights to Life Molecular’s RM2 theranostic pair targeting GRPR |

Lantheus |

177Lu-DOTA-RM2 & 68Ga-DOTA-RM2 |

Broadens pipeline beyond PSMA, creating new demand for automated synthesis of novel radiotheranostics for prostate and breast cancers |

|

2022 |

Collaboration with Novartis to include PYLARIFY in Pluvicto clinical trials |

Lantheus & Novartis |

PYLARIFY (piflufolastat F18), Pluvicto (lutetium Lu 177 vipivotide tetraxetan) |

Expands PSMA-targeted PET imaging use; increases demand for synthesis modules to produce PYLARIFY for clinical trials and patient selection |

Source: Company Official Press Releases

APAC Market Insights

Asia Pacific is recognized as the fastest-growing region in the market during the discussed timeline. The rapid upliftment in the region is effectively propelled by the amplifying investments in nuclear medicine infrastructure and expanding healthcare access. On the other hand, countries across the region are increasingly adopting the advanced synthesis technologies to improve the production of radiopharmaceuticals, which are essential for diagnostic and therapeutic applications, hence denoting a positive market outlook.

China is augmenting its dominance over the regional automated radiosynthesis module market, extensively supported by the government's focus on improving healthcare infrastructure and promoting advanced medical technologies. IBA in August 2022 reported that it entered into a partnership with CNRT to install the Cyclone IKON cyclotron in China, thereby enhancing the domestic production of crucial medical isotopes such as Germanium-68 and Iodine-123. Also, this collaboration supports advanced theranostics and targeted therapies by enabling a stable, high-capacity supply of radiopharmaceuticals.

India is also gaining enhanced traction in the market, owing to the increased awareness about the benefits of radiopharmaceuticals in cancer and neurological disorders, along with government initiatives to improve cancer care in the country. In February 2025, MoHFW reported that the country is strengthening its cancer care through exclusive policies that are focused on prevention, early detection, treatment, and research, supported by initiatives like Day Care Cancer Centres and financial assistance schemes, hence suitable for market progression.

Europe Market Insights

The Europe market is poised to hold a significant share by the end of the assessed timeframe. The growth is being facilitated with isotope funding and novel product introduction activities in the region. In May 2025, IBA announced the launch of CASSY, which is a compact and scalable radiochemistry module designed to improve the efficiency of radiopharmaceutical production, especially radiometals. The firm also stated that its small size allows up to six units to be stacked in one hot cell, saving space while boosting output, making it ideal for current and future radiotheranostics needs.

Germany is the key contributor to expansion in Europe’s automated radiosynthesis module market, highly attributed to the presence of vigorous radiopharmaceutical strategies and enhanced demand for theranostics. In October 2024, GE HealthCare unveiled Aurora at EANM24, which is a dual-head SPECT/CT system powered by advanced AI to enhance image quality, reduce scan times, and improve workflow efficiency across cardiac, cancer, and neurological imaging, hence benefiting overall market growth.

The market in the U.K. is undergoing significant transformations deliberately, propelled by suitable reimbursement policies and a robust research ecosystem. Besides the advancements in radiopharmaceutical production and the increasing adoption of PET imaging, this landscape is fostering a profitable business environment. Furthermore, the integration of automated systems in the healthcare settings remarkably enhances the efficiency and reliability of radiopharmaceutical synthesis, thus denoting a positive market outlook.

Key Automated Radiosynthesis Module Market Players:

- GE Healthcare

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens Healthineers

- Curium

- IBA Radiopharma Solutions

- Eckert & Ziegler

- Sumitomo Heavy Industries, Ltd.

- Raytest

- Trasis

- SCINTOMICS

- Comecer

- ACSIRaylab

- CellPoint

- NorthStar Medical Radioisotopes

- JFE Engineering Corporation

- NuPET LLC

- Telix Pharmaceuticals

- BARC (Bhabha Atomic Research Centre)

- MOLECUBES

- KIRAMS

- ANSTO

The key organizations involved in the market are readily implementing strategies such as modular system designs, GMP compliance, and AI-integrated optimization to strengthen their global market positions. The merchandise is collectively dominated by the presence of leading firms such as GE Healthcare, Siemens, Curium, and IBA, which captured the maximum market share. Besides, the emerging players are leveraging microfluidics and closed-loop automation to compete in the highly consolidated landscape. Furthermore, the development relies on partnerships with pharma firms and academia, which are critical for market expansion.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In June 2025, Siemens Healthineers announced that it had partnered with Massachusetts General Hospital to launch a focus on advancing theranostics, which is an approach combining diagnostics and targeted radiopharmaceutical therapy.

- In May 2024, Novartis reported that it entered into a strategic alliance to acquire Mariana Oncology, a firm specializing in novel radioligand therapies for hard-to-treat cancers, enhancing its RLT pipeline and clinical supply capabilities.

- Report ID: 7732

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.