Automated Suturing Devices Market Outlook:

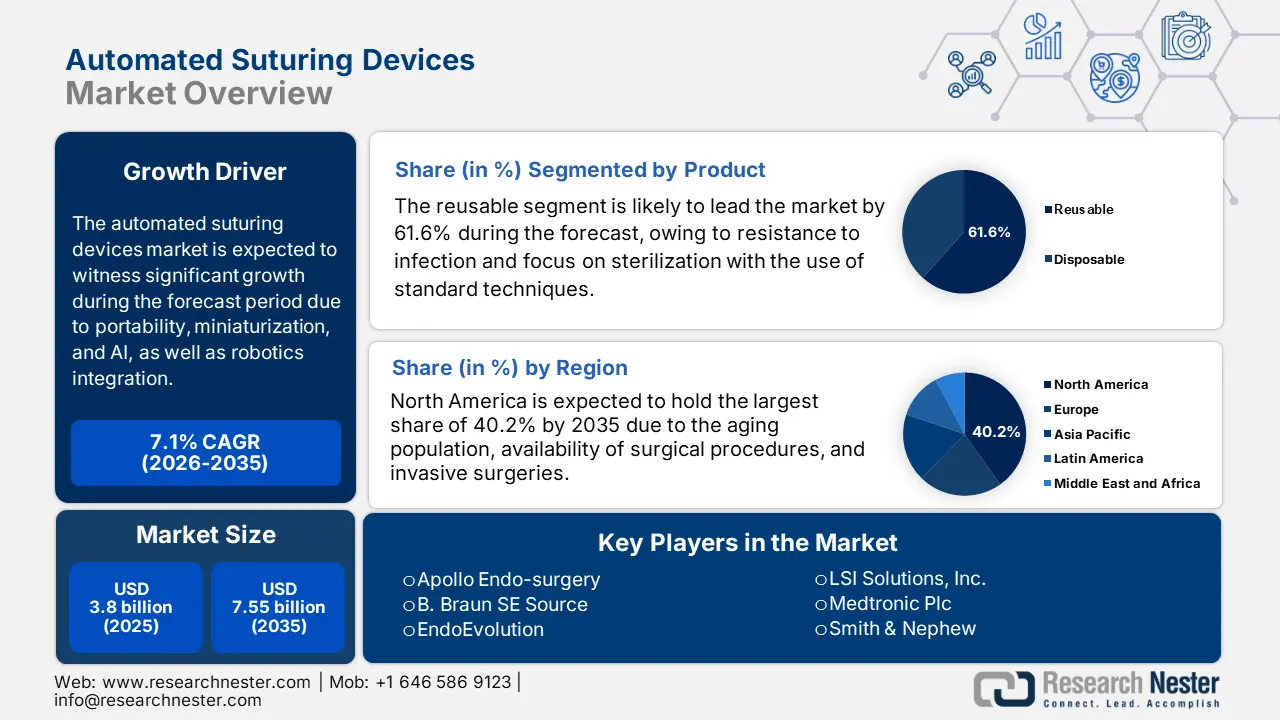

Automated Suturing Devices Market size was valued at USD 3.8 billion in 2025 and is set to exceed USD 7.55 billion by 2035, expanding at over 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automated suturing devices is estimated at USD 4.04 billion.

Automated suturing devices have achieved huge popularity because they possess the capability to enhance accessibility, efficiency, and precision in surgical procedures, especially in minimally invasive surgeries. According to a clinical study published by NLM in June 2024, these devices have been readily utilized to conduct mitral and aortic valve replacement surgeries. The study comprised 66 patients who underwent surgery by implementing the RAM device, with a 3.5 size device applied to 16.7% of patients and a 5.0 size to the remaining 83.3%. The study proved to be successful, denoting the absence of leakage and complications, thereby driving the demand for the automated suturing devices market globally.

Moreover, the expansion of the market depends upon the continuous trading of instruments that are highly essential in the manufacturing process. According to the 2023 OEC report, Bhutan is the biggest importer of tubular metal needles for sutures, with a valuation of USD 44,300. India is the top origin at worth USD 38,100, followed by Japan at USD 5,580 and China at USD 561, thereby ensuring market upliftment. Besides, built-in scissor is yet another instrument of automated suturing devices, and as stated in the April 2025 OEC report, the global trade value of scissors is USD 853 million. Its product complexity is 0.7, and it is the 288th most complex product, thus bolstering the market evolution.

Nationwide Scissors Export/Import

|

Countries |

Export |

Import |

|

China |

USD 575 million |

- |

|

Germany |

USD 44.5 million |

USD 57.8 million |

|

Taipei |

USD 29.7 million |

- |

|

United States |

- |

USD 151 million |

|

Japan |

- |

USD 41.4 million |

Source: OEC, April 2025

Key Automated Suturing Devices Market Insights Summary:

Regional Highlights:

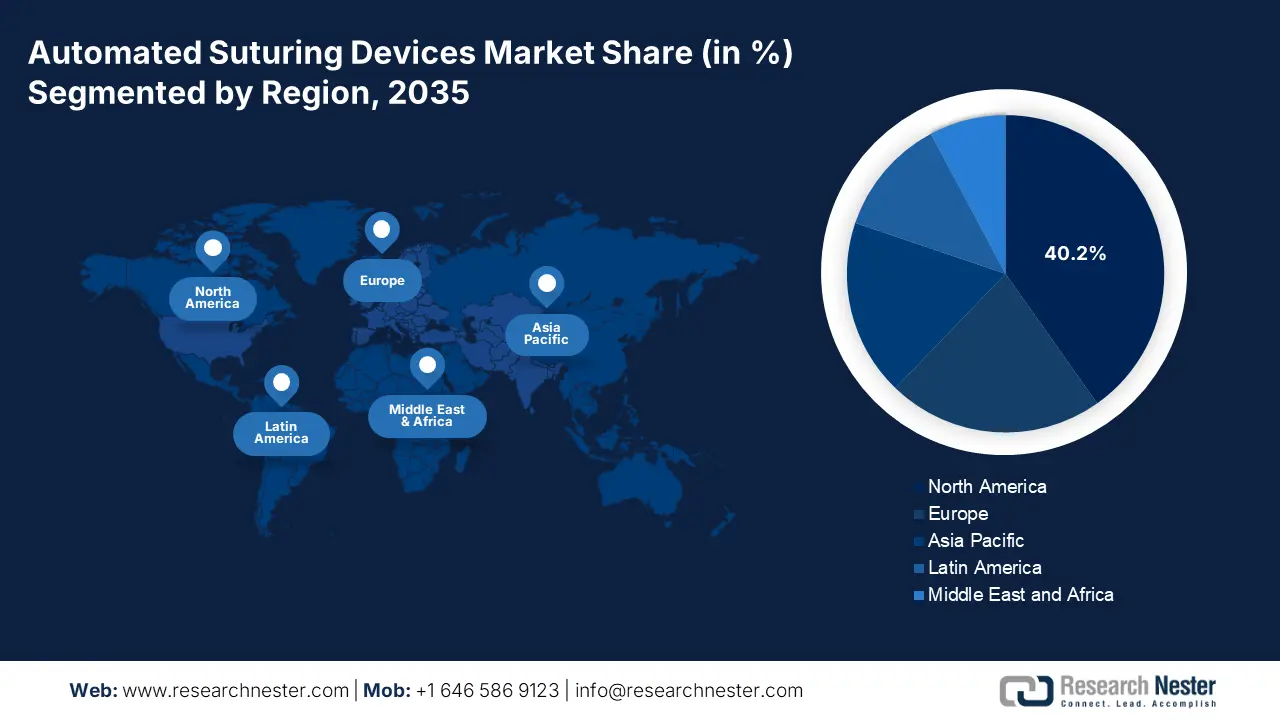

- North America leads the Automated Suturing Devices Market with a 40.2% share, driven by rising demand for surgical procedures and ongoing technological innovation, ensuring market dominance through 2026–2035.

- Asia Pacific’s automated suturing devices market is anticipated to grow rapidly by 2035, driven by increasing rare diseases and demand for minimally invasive surgeries.

Segment Insights:

- The Cardiac segment is expected to achieve 33.4% market share by 2035, fueled by the increasing prevalence of cardiovascular disorders.

- The reusable segment is expected to achieve a 61.6% share by 2035, fueled by the affordability and easy availability of these devices through effective sanitization techniques.

Key Growth Trends:

- Innovation in surgical technology

- The rise in surgical procedures

Major Challenges:

- Rise in initial cost

- Presence of administrative challenges

- Key Players: Boston Scientific, EndoEvolution, LSI Solutions, Inc., Medtronic Plc.

Global Automated Suturing Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.8 billion

- 2026 Market Size: USD 4.04 billion

- Projected Market Size: USD 7.55 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, Brazil, Mexico

Last updated on : 12 August, 2025

Automated Suturing Devices Market Growth Drivers and Challenges:

Growth Drivers

- Innovation in surgical technology: The growth of the automated suturing devices market is fueled by ground-breaking advancements that are undertaken in surgical techniques. For instance, in March 2025, SS Innovations International achieved the regulatory approvals for its SSi Mantra 3 Surgical Robotic System in both Ukraine and the Philippines. In addition to this approval, the organization also declared the efficacious issuance of the Certificate of Conformity from the Ukraine Government through its partnership with Loran Group, which is based out of Kiev, Ukraine.

- The rise in surgical procedures: With the increase in non-communicable diseases worldwide, there is a huge demand for surgical volumes, which is another growth factor for the market internationally. As per a cross-sectional study published by the Annals of Medicine and Surgery in March 2021, the volume of orthopedic surgery increased by 38.04% with a moderate case difference of 64. Also, ambulatory surgery increased by 19.24% with 37 cases. Besides, health insurance deductibles rose from USD 1,476 to USD 1,655, thereby driving the market expansion globally.

Challenges

- Rise in initial cost: The biggest hindrance in the evolution of the market is the expensive cost at the initial stage. Owing to this aspect, medical infrastructures and hospitals are hesitant enough to implement these technologies due to monetary apprehensions, especially in resource-constrained surroundings. Therefore, this ultimately results in delayed treatment and diagnosis of patients owing to the unavailability of medical devices.

- Presence of administrative challenges: The presence of strict regulations and policies initiated by governments and administrative bodies is yet another challenge in the expansion of the market across nations. This inevitably and negatively affects market players, with the main hurdle being to manufacture, produce, and commercialize automated devices. In addition, the accomplishment of compliance in accordance with numerous regulators is time-consuming which creates a barrier in the market entry.

Automated Suturing Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 3.8 billion |

|

Forecast Year Market Size (2035) |

USD 7.55 billion |

|

Regional Scope |

|

Automated Suturing Devices Market Segmentation:

Product (Reusable, Disposable)

Based on product, the reusable segment is expected to garner the largest share of 61.6% in the automated suturing devices market by the end of 2035. The segment’s growth is fueled by the affordability and easy availability of these devices since these devices are sanitized by utilizing appropriate techniques. According to an article published by Helion in January 2024, the success rate of reusable medical device cleaning is determined by the use of adenosine triphosphate (ATP) bioluminescence detection, which ranges between 80.1% to 94.6%. Therefore, following standard cleaning procedures ensures the quality of reusable medical devices, thereby driving the segment’s growth.

Application (Cardiac, Gynecological, Orthopedic, Ophthalmic)

Based on the application, the cardiac segment is estimated to hold a share of 33.4% in the automated suturing devices market by the end of the forecast period. The increase in the prevalence of cardiovascular disorders is the main reason behind the segment’s upliftment. As stated in the October 2024 CDC report, heart failure is one of the leading causes of death for both men and women, and every 33 seconds, a person faces death due to this condition. Besides, in 2022, approximately 702,880 people suffered from cardiac conditions, which is equivalent to 1 in every 5 deaths, thereby driving the demand of the market.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Application |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automated Suturing Devices Market Regional Analysis:

North America Market Analysis

The North America automated suturing devices market is anticipated to account for the largest share of 40.2% by the end of the forecast timeline. This growth is attributed to the rising demand for surgical procedures, especially catering to the elderly population. In addition to this factor, the need for robot-based non-invasive treatment solutions and ongoing technological innovation through continuous research and developmental activities are also bolstering the market demand in the region.

The market in the U.S. is expected to grow due to the presence of administrative bodies to approve and ensure the availability of suitable devices. For instance, in February 2024, the U.S. FDA has accepted the implementation of defibrillators and pacemakers to improve the lives of millions of people in the country suffering from rigid heart conditions. The organization undertakes the responsibility of minutely evaluating such devices for effectiveness and safety before their commercialization in the present market arena. Therefore, this positively impacts the market upliftment in the region with the presence of available automated devices.

The involvement of the government in initiating strategies is a huge turnaround for the market in Canada. According to the January 2024 Ontario Canada report, the government invested USD 25 million through a local medical technology organization, FluidAI Medical. The company has established an AI-powered monitor device that identifies post-operative gastrointestinal leaks and prevents errors. Through the funding, there will be research product improvements and the development of an automated assembly line to ensure international demand for job opportunities.

APAC Market Statistics

Asia Pacific is projected to be the fastest-growing region in the automated suturing devices market in the forecast period. The market in this region is experiencing development owing to a surge in the occurrence of rare diseases that include cancer, diabetes, and cardiovascular conditions. In addition, there is a huge demand for minimally invasive surgical procedures that provide benefits such as reduced complications and a low recovery time span that also effectively contributes towards the market evolution in the region.

The market in India is on the route to evolution since international organizations are effectively making contributions to make devices readily available. For instance, in November 2024, Abbott declared the inauguration of the AVEIR VR single-chamber ventricular unleaded pacemaker for the handling of patients in the country with measured heart rhythms. This device has been accepted by the Central Drugs Standard Control Organization (CDSCO) as well as the U.S. FDA to ensure advancement for patient care, thus positively thriving the market growth in the country.

The market in China is gaining increased popularity owing to the rise in incidences of chronic disorders and aging population. As stated in the 2025 WHO report, people more than 60 years of age in the country will increase to 28%, that is 402 million people by 2040, since there has been a reduction in fertility rates and an enhancement of life expectancy. Therefore, with this geriatric population increase in the country, there will be a surge in disease causation that requires a huge demand for automated devices during diagnosis and therapy processes, which will deliberately boost the market.

Key Automated Suturing Devices Market Players:

- Abbott

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Apollo Endo-surgery

- B. Braun SE Source

- Boston Scientific

- EndoEvolution

- LSI Solutions, Inc.

- Medtronic Plc

- Smith & Nephew

- Sutrue

- Suturion

- SS Innovations International

- Corza Medical

- BIOTRONIK

- Royal Philips

- MMI

The automated suturing devices market is fueled by the presence of a diversified landscape of well-known multinational establishments and evolving corporations, each seeking to modernize and expand market share through pioneering technologies and strategic partnerships. For instance, in October 2024, Corza Medical the introduction of its advanced new line of Onatec ophthalmic microsurgical sutures, unveiled at the American Academy of Ophthalmology (AAO) conference. The purpose is to deliver high-quality and tailored solutions to address the evolving requirements of the global market.

Here's the list of some key players:

Recent Developments

- In February 2025, BIOTRONIK proclaimed a strategic shift to strengthen its leadership in active implantable devices and digital healthcare to leverage future technologies that include artificial intelligence, healthcare platforms, and remote monitoring devices.

- In June 2024, Royal Philips its next-generation AI-enabled cardiovascular ultrasound platform to ensure speed up cardiac ultrasound analysis with verified AI technology and diminish the burden on echocardiography labs.

- Report ID: 7582

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automated Suturing Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.