- Introduction

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- Industry Overview (1/3)

- Market Overview

- Market Segmentation

- Country Synopsis

- Industry Supply Chain Analysis

- Current & Future Market Share by End-User Segment: Hospitals, Diagnostic Labs, Clinics

- End-User Landscape in Hematology Analyzers

- Country-Wise Sales Analysis of Major Hematology Analyzer Series

- Company Wise Hematology Analyzer Sales Data: US & Japan

- US Equipment vs. Reagent Sales (2025E)

- OEM Product Development Base Assessment – Japan vs. Global

- Comparative Analysis of Hematology Analyzer Types

- Semi-Automated vs. Fully Automated Hematology Analyzers

- Application Landscape in Hematology Analyzers: CBC & Reticulocyte Testing

- Remote Software & Maintenance Ecosystem in Hematology Analyzers

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Trends

- Regulatory Framework

- Competitive Landscape

- Abbott

- Backman Coulter, Inc.

- Bio-Rad Laboratories, Inc.

- Boule

- Erba Group

- HORIBA Group

- NIHON KOHDEN CORPORATION

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Siemens Healthcare Private Limited

- Sysmex

- U.S. Hematology Analyzer Market – Strategic

- Comparison

- Modality Focus in Hematology Analyzers: Benchtop vs. Floor-standing

- Technological Advancements

- Patents Outlook

- Pricing Benchmarking

- Recent Developments

- SWOT Analysis

- Root Cause Analysis (RCA) For The Market

- Porter’s Five Forces

- Industry Risk Assessment

- U.S. Outlook and Projections

- Overview

- Market Value (USD Million), Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2020-2036, By

- Product Type, Value (USD Million)

- 3-Part Differential Hematology Analyzers

- 5-Part Differential Hematology Analyzers

- 6-Part and Above/High-End Analyzers

- Point-of-Care Hematology Analyzers

- Hematology Reagents & Consumables

- Modality, Value (USD Million)

- Benchtop

- Floor-Standing

- Application, Value (USD Million)

- Complete Blood Count (CBC)

- Reticulocyte Testing

- Others

- Automation Level, Value (USD Million)

- Fully Automated Hematology Analyzers

- Semi-Automated Hematology Analyzers

- End Use, Value (USD Million)

- Hospitals

- Diagnostic Laboratories

- Clinics/Outpatient Centers

- Others

- Product Type, Value (USD Million)

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

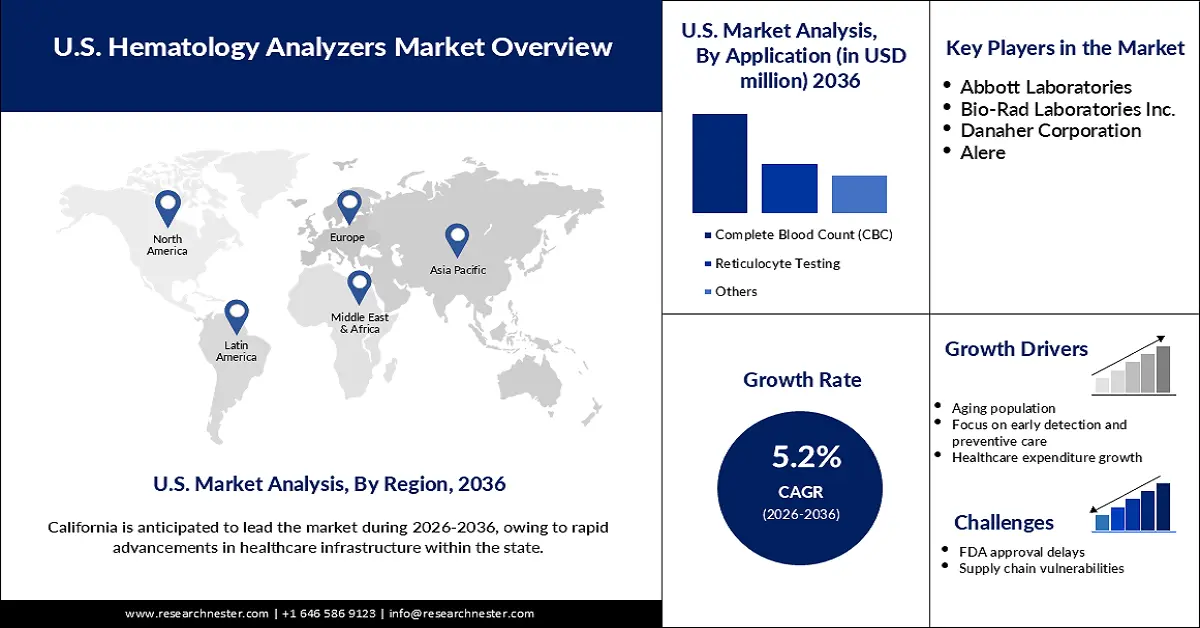

U.S. Hematology Analyzers Market Outlook:

U.S. Hematology Analyzers Market was valued at USD 16.24 billion in 2025 and is forecasted to reach a valuation of USD 28.41 billion by the end of 2036, rising at a CAGR of 5.2% during the forecast period, i.e., 2026-2036. In 2026, the industry size of U.S. hematology analyzer is estimated at USD 16.87 billion.

The growing prevalence of different blood disorders in the U.S. hematology analyzers market growth. As reported by the National Library of Medicine (NLM) in October 2024, the common types of blood disorders in the U.S. include platelet disorders, bleeding problems, excessive clotting, anemia, blood cancers, such as leukemia and myeloma, and eosinophilic disorders. Similarly, the Office of Disease Prevention and Health Promotion (ODPHP) disclosed that millions of people in the U.S. carry genes capable of causing blood disorders, such as hemophilia and sickle cell disease. Around 100,000 individuals were affected by the sickle cell disorders, mostly men. This type of scenario of outbreak of blood disorders creates a strong demand for hematology analyzers for diagnostic and monitoring purposes.

The association of numerous companies in the development of hematology analyzers is fueling the market growth. These companies are not only foreign businesses supplying hematology analyzers, but also headquartered in the U.S., contributing significantly to the production of the automated medical device. For instance, in August 2023, Abbott Laboratories received approval for the newly developed hematology analyzer, Alinity h-series hematology system, from the U.S. Food and Drug Administration. The new technology of the business is enabled with an automated hematology analyzer, Alinity hq, which can leverage Multi-Angle Polarized Scatter Separation (MAPSS) technology and distinguish cellular features and detect blood cells in improved ways by using light scattering.

Key United States Hematology Analyzers Market Insights Summary:

Regional Insights

- California is predicted to hold a significant share by 2036, owing to rapid advancements in healthcare infrastructure within the state.

- Minnesota is expected to witness substantial growth during the forecast period, driven by the rising prevalence of chronic diseases.

Segment Insights:

- The 3-part differential hematology analyzer segment is projected to account for a 34.6% share by 2036, impelled by its cost-effectiveness and reliability in performing routine diagnostics.

- The complete blood count segment is expected to hold an 86.7% share during the forecast period, owing to the rising prevalence of hematological disorders.

Key Growth Trends:

- Rising aging population

- Focus on early detection and preventive care

Major Challenges:

- FDA approval delays

- Supply chain vulnerabilities

Key Players: Abbott Laboratories (Illinois), Bio-Rad Laboratories Inc. (California), Danaher Corporation (Washington, D.C.), Alere (Massachusetts).

Global United States Hematology Analyzers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.24 billion

- 2026 Market Size: USD 16.87 billion

- Projected Market Size: USD 28.41 billion by 2036

- Growth Forecasts: 5.2% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: California (significant share by 2036)

- Fastest Growing Region: Minnesota

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Canada

Last updated on : 6 November, 2025

U.S. Hematology Analyzers Market - Growth Drivers and Challenges

Growth Drivers

- Rising aging population: The U.S. is witnessing an issue with an aging population, which is expected to increase the prevalence of hematological disorders. As disclosed by the National Library of Medicine in July 2025, total water in the human body reduces with aging, which leads to less fluid in the bloodstream and a decrease in the blood volume. This causes depletion in the speed at which the blood cells are produced to respond to stress or diseases. As a result, the responses to blood loss limits and the risk of anemia increase. A report by the Population Reference Bureau, published in January 2024, also reveals that the median age of the national population surged to 30.0 to 38.9. Based on all these facts, it can be assumed that there is a strong demand for hematology analyzers in the U.S.

- Focus on early detection and preventive care: The government of the U.S. is highly focused on taking suitable public healthcare measures that can lead to early detection and prevention of different diseases, including hematological disorders. The Office of Disease Prevention and Health Promotion (ODPHP) reveals that the government launched the Healthy People 2030 initiative, aimed at increasing preventive care for people regardless of their ages. Similarly, in April 2025, the American Medical Association disclosed that the implementation of the Affordable Care Act is ensuring the provision of coverage of the first-dollar preventive care to patients, saving lives and decreasing healthcare costs. The focus of the government on early detection and preventive care creates a strong demand for automated and advanced diagnostic technologies, which can dramatically foster the adoption of hematology analyzers.

- Healthcare expenditure growth: Public and private organizations, government-sponsored programs, charities, and the general population are driving high healthcare expenditure in the U.S. In December 2024, the Centers for Medicare & Medicaid Services revealed that health spending in 2023 rose by 7.5%, reaching USD 4.9 trillion or USD 14,570 per patient. Similarly, according to the Centers for Disease Control and Prevention in August 2025, 90% of the United States’ annual healthcare expenditures of USD 4.9 trillion are attributed to the treatment of chronic diseases and mental health disorders. All these facts indicate that healthcare organizations and the general population have access to adequate funding to afford hematology analyzers, which is expected to lead to widespread consumption of the automated medical machine.

Challenges

- FDA approval delays: Even after a priority review by the U.S. Food and Drug Administration, additional evaluations under the Breakthrough Devices Program are conducted when approving innovative medical devices. Failure to meet the required criteria can result in delays or even rejection of approval. Consequently, without access to comprehensive pre-market data, the launch of advanced hematology analyzers can be challenging for manufacturers, potentially limiting market growth.

- Supply chain vulnerabilities: A combination of durable plastics and steel is required to manufacture hematology analyzers. The incorporation of these materials ensures longevity and resistance to the chemical agents utilized in blood sample processing. Through precision engineering, sensors and other crucial components are produced to be incorporated in hematology analyzers so they can deliver appropriate cell counting and detection. Shortage of any of the mentioned raw materials can disrupt the production of the hematology analyzers and deteriorate the industry condition.

U.S. Hematology Analyzers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2036 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 16.24 billion |

|

Forecast Year Market Size (2036) |

USD 28.41 billion |

|

Country Scope |

U.S. (Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, and Wyoming) |

U.S. Hematology Analyzers Market Segmentation:

Product Type Segment Analysis

The 3-part differential hematology analyzer segment is expected to account for a market share of 34.6% by the end of 2036, owing to its cost-effectiveness and the reliability in performing routine diagnostics. This type of hematology analyzer features a simplified design, resulting in a lower purchase price. Additionally, its operating costs are considerably lower compared to 5-part differential, 6-part and above, or other high-end analyzers. Many leading companies in the U.S. market focus on developing 3-part differential hematology analyzers, enhancing product accessibility through increased manufacturing. For instance, in March 2025, Sysmex America expanded its 3-part differential automated hematology analyzer line with the launch of the XQ-320, a system capable of performing accurate and reliable complete blood count (CBC) testing efficiently.

Application Segment Analysis

The complete blood count is projected to acquire a market share of 86.7% during the forecast period, attributed to the rising prevalence of hematological disorders. As reported by the Mayo Clinic in January 2036, complete blood count (CBC) tests using hematology analyzers are widely conducted to monitor health and detect a variety of conditions, including leukemia, anemia, and infections. Additionally, a December 2025 report by Europe PMC highlights the development of mobile blood analyzers capable of automatically reporting full WBC differential counts, mean corpuscular hemoglobin (MCH), and RBC counts. The introduction of these mobile analyzers is enhancing the convenience of performing CBC tests, thereby supporting the segment’s continued dominance in the coming years.

End use Segment Analysis

The hospitals segment is estimated to hold a market share of 61.7% by 2036, due to rising demand for diagnostic services in hospitals, driven by the growing prevalence of hematological disorders. This is likely to increase the demand for hematology analyzers to perform different blood cell testing processes in automated and efficient ways. The government support to enhance healthcare infrastructure development can also accelerate the adoption of hematology analyzers in hospitals. A March 2024 report by the Centers for Disease Control and Prevention (CDC) revealed that USD 4.8 trillion was allocated under the Public Health Infrastructure Grant to support local health departments in promoting and safeguarding community health.

Our in-depth analysis of the U.S. hematology analyzers market includes the following segments:

|

Segments |

Subsegments |

|

Product Type |

|

|

Modality |

|

|

Application |

|

|

Automation level |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

U.S. Hematology Analyzers Market - Regional Analysis

California Market Insights

The California hematology analyzer market is anticipated to experience a steady CAGR throughout the projection timeline, owing to rapid advancements in healthcare infrastructure within the state. As revealed by the California Association of Public Hospitals & Health Systems, around 17 healthcare systems exist across California, covering northern and southern geographic portions of the state. The healthcare systems of the state account for only 6% of hospitals; however, they serve over 3.7 million patients on a year-on-year basis, and operate in a total of 15 counties that are home to more than 80% of the population.

Similarly, healthcare organizations operating in California are also working to make healthcare increasingly accessible for people with low-income status. Based on all the facts, one can adapt to the fact that the likelihood of growing adoption of the hematology analyzers to provide healthcare cost-effectiveness and in more accessible ways is high. The aging population within the state is another factor, indicating a high demand for the complex automated medical device for health monitoring and diagnostic purposes.

Minnesota Market Insights

Minnesota is set to emerge as an expanding hematology analyzer market, on account of the growing prevalence of chronic diseases. As reported by the Minnesota Department of Health in August 2025, hypertension, cardiovascular disorders, diabetes, high cholesterol, and asthma are common among people in Minnesota. In August 2025, the Centers for Disease Control and Prevention also revealed that cancer, heart attacks, stroke, chronic lower respiratory diseases, diabetes, hypertension, and chronic liver diseases were the major causes of death in Minnesota. This indicates a strong demand for hematology analyzers to assess blood cell parameters so that proper diagnosis and monitoring of the mentioned chronic diseases can be ensured.

Adequate government support for the healthcare settings within the state is also available, which can lead to rising adoption of the automated medical device. The Minnesota Department of Health also reported in October 2025 that the Minnesota Public Health Infrastructure Fund initiated a 3rd round of funding distribution to support 10 novel local innovation projects that can be accomplished to find, test, and expand measures suitable to take to build capacity in foundational public health responsibilities.

Key U.S. Hematology Analyzers Market Players:

- Abbott Laboratories (Illinois)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Bio-Rad Laboratories Inc. (California)

- Danaher Corporation (Washington, D.C.)

- Alere (Massachusetts)

- Abbott is a global healthcare leader offering a wide range of diagnostic solutions, including hematology analyzers. Its portfolio encompasses automated systems for complete blood counts (CBC) and specialized testing, supporting hospitals, clinical laboratories, and point-of-care settings. Abbott focuses on innovation, integrating advanced software, AI, and connectivity solutions to enhance efficiency and accuracy in hematology testing.

- Bio-Rad Laboratories Inc. provides a comprehensive suite of hematology and life science diagnostic products, including blood testing instruments and quality control solutions. Its analyzers are designed for high throughput, accuracy, and reproducibility, serving clinical laboratories, hospitals, and research institutions. Bio-Rad emphasizes reliability, regulatory compliance, and continuous product improvement in the U.S. market.

- Danaher Corporation, through subsidiaries such as Beckman Coulter, offers a broad range of hematology analyzers that cater to clinical laboratories and hospitals. The company focuses on automation, precision, and workflow efficiency, enabling high-volume testing with consistent accuracy. Its innovations include integrated software platforms for data management and diagnostics.

- Alere, now part of Abbott, specializes in point-of-care diagnostics, including hematology and immunoassay analyzers. The company is recognized for rapid testing solutions that provide timely results for patient management. Alere’s instruments target hospitals, clinics, and decentralized testing environments, emphasizing ease of use, reliability, and quick turnaround times.

Below is the list of the most dominant key businesses in the U.S. hematology analyzers market:

The hematology analyzer market is highly competitive in the U.S. The domination of large key players operating in the U.S. and the emergence of new businesses involved in the development of the innovative hematology analyzers are expected to increase the intensity of competition in the years to come. However, the new entrants compete extensively with the large players, increasing the industry fragmentation over the years, and are expected to do so soon. All the key competitors in the market, regardless of their size, are focused on research and development to make medical machines more advanced.

Corporate Landscape of the U.S. Hematology Analyzers Market:

Recent Developments

- In July 2025, Scopio Labs introduced an AI-enabled solution, Complete Blood Morphology (CBM), capable of automating blood morphology.

- In April 2024, Mindray launched a revolutionary series of hematology analyzers, BC-700. The technology is incorporated with both complete blood count (CBC) and erythrocyte sedimentation rate (ESR) tests.

- Report ID: 8224

- Published Date: Nov 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

United States Hematology Analyzers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.