Anesthesia devices Market Outlook:

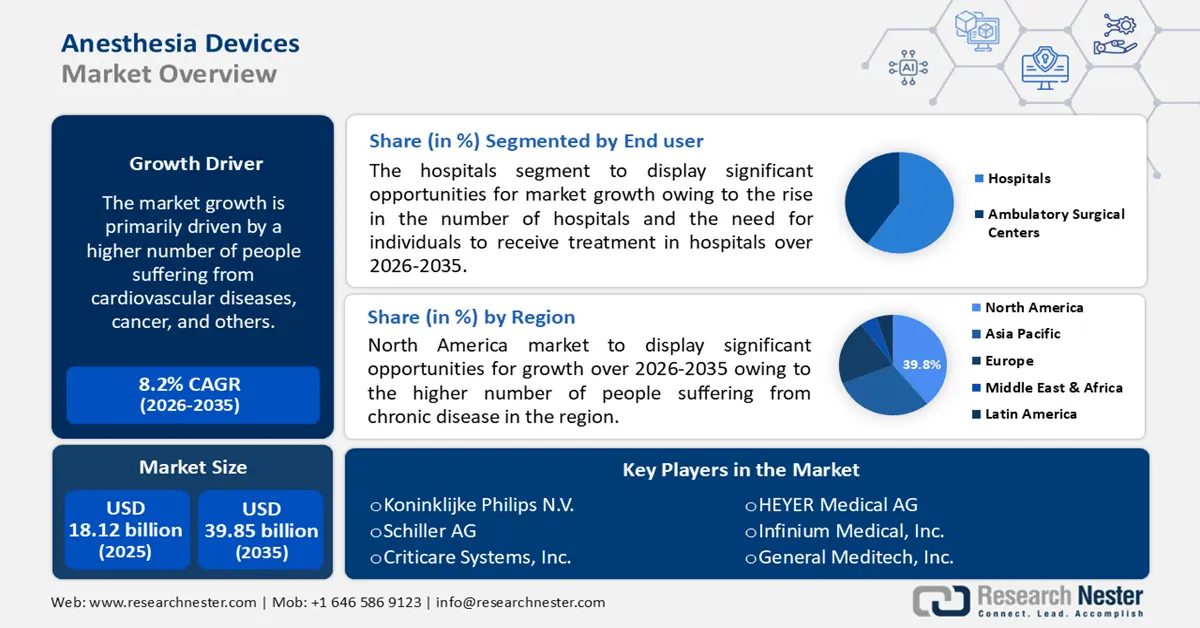

Anesthesia devices Market size was valued at USD 18.12 billion in 2025 and is set to exceed USD 39.85 billion by 2035, expanding at over 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of anesthesia devices is estimated at USD 19.46 billion.

The market growth is primarily driven by a higher number of people suffering from cardiovascular diseases, cancer, and others. Moreover, the increasing prevalence of chronic diseases such as cardiovascular disease, cancer, and others is leading to a higher demand for surgical procedures, which in turn is driving the demand for anesthesia devices. In the United States, cardiovascular disease claims one life every 34 seconds. Moreover, every 1 in 5 deaths in the United States in 2020 was caused by heart disease, which claimed about 7000,000 lives. Furthermore, in 2020, there were around 18,0oo billion new cancer cases reported worldwide. In 2020, the combined age-standardized rate for all malignancies, excluding non-melanoma skin cancer, was 190 per 100,000.

Additionally, the aging population and the increasing adoption of minimally invasive surgical procedures are also driving anesthesia devices market growth. Minimally invasive procedures, such as laparoscopic surgery, require the use of specialized anesthesia devices, which is contributing to the growth of the market. Besides this, the global anesthesia market growth is also attributed to a higher number of surgical procedures performed, which can be done for many causes, including cancer, organ transplantation, bypass surgery, and others. According to the estimates, around 129,681 organ transplants took place globally in 2020. The kidney, liver, and heart are the three organs that are transplanted the most globally. Furthermore, nearly 60% of cancer cases require surgical care, and around 17 million die every year globally from a lack of timely surgical care. In addition, nearly 90% of maternal deaths can be prevented by the intervention of obstetric surgery.

Key Anesthesia devices Market Insights Summary:

Regional Highlights:

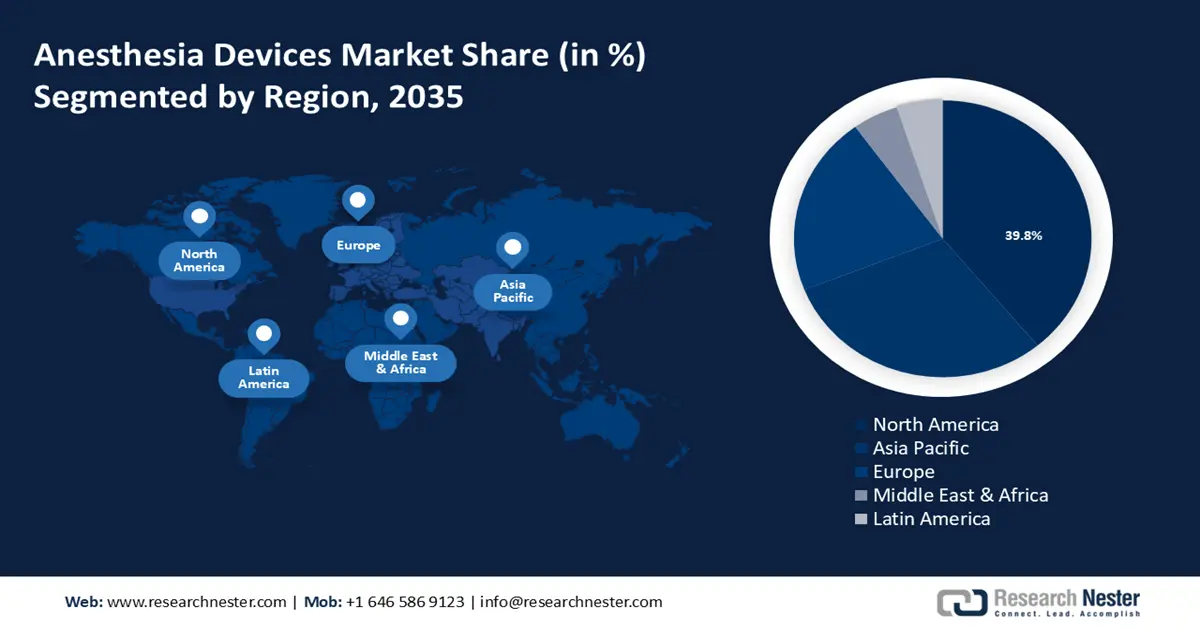

- North America anesthesia devices market will hold around 39.8% share by 2035, fueled by the rising chronic disease burden and increasing need for surgeries.

Segment Insights:

- The integrated anesthesia workstations segment in the anesthesia devices market is expected to achieve a substantial share by 2035, influenced by the growing number of surgical procedures globally.

- The hospital segment in the anesthesia devices market is set for remarkable share by 2035, driven by the increasing number of hospitals and demand for hospital-based treatments.

Key Growth Trends:

- Rising Prevalence of Chronic Diseases

- Surging Population of Old Adults

Major Challenges:

- Rising Prevalence of Chronic Diseases

- Surging Population of Old Adults

Key Players: Medtronic PLC, B.Braun Melsungen AG, Drägerwerk AG & Co. KGaA, General Electric Company, Koninklijke Philips N.V., Schiller AG, Criticare Systems, Inc., HEYER Medical AG, Infinium Medical, Inc., General Meditech, Inc.

Global Anesthesia devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 18.12 billion

- 2026 Market Size: USD 19.46 billion

- Projected Market Size: USD 39.85 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Anesthesia devices Market Growth Drivers and Challenges:

Growth Drivers

- Rising Prevalence of Chronic Diseases- Chronic disease involves diabetes, heart issues, cancer, and others. In many cases, patients with heart issues and cancer get to the stage of needing surgery. Therefore, anaesthesia device demand also increases. The World Health Organization estimates that cardiovascular diseases claim the lives of almost 18 million people worldwide each year.

- Surging Population of Old Adults- The global geriatric population is rising every year. One in six individuals on the planet will be 60 or older by 2030. Moreover, globally between 2020 and 2050, the number of people 80 or older is projected to triple, reaching 426 million as per the statistics of the World Health Organization.

- Requirement of Surgical Procedure is Increasing- The demand for anesthetic equipment rises, along with the number of surgeries conducted globally. More than 310 million surgical operations are performed every year throughout the world. Furthermore, surgery is needed to treat almost 11% of diseases worldwide.

- Growing Need for Anesthesia- Anesthesia is a medical aid that prevents patients from feeling the process of ongoing surgery. The rising cases of surgical care are boosting the demand for anesthesia. As of April 2020, it was projected that Japan had executed around 67% more general anesthetic cases than it had in 2015.

- Technological Advancement of Anesthesia Devices- A global leader in innovative healthcare technology, Mindray, launched the new anesthesia systems A9 and A8, in Europe. The new system has cutting-edge technologies that cater to physicians' needs during the whole perioperative phase, enabling them to give patients precise, stable, and safe anesthesia.

Challenges

- High Costs of Anesthesia Device Installation and Maintenance

- Illegal Sales of Anesthesia in the Market

- Side Effects Associated with Anesthesia Intake - Millions of people undergo medical operations each year while being anesthetized safely. Anesthesia does, however, come with some danger. Lung collapse, malignant hyperthermia, cognitive impairment, and nerve damage are possible side effects. These potential side effects are expected to impede the anesthesia devices market.

Anesthesia devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 18.12 billion |

|

Forecast Year Market Size (2035) |

USD 39.85 billion |

|

Regional Scope |

|

Anesthesia devices Market Segmentation:

End-user Segment Analysis

By 2035, hospital segment is expected to account for remarkable anesthesia devices market share. due to rise in the number of hospitals and the need for individuals to receive treatment in hospitals. Moreover, people are opting for hospitals in order to have surgical procedures with better medical facilities, and this is expected to surge the segment’s growth in the market. There were over 8,000 hospitals in Japan as of 2020. Korea, by contrast, had about 4,000 hospitals. In addition, there were more than 6000 hospitals in the US.

Product Type Segment Analysis

By 2035, integrated anesthesia workstations segment is poised to account for substantial anesthesia devices market share. Integrated anesthesia workstations are customized medical carts that contain a ventilator, an anesthetic machine, and monitoring tools. The use of these–in–solutions is expected to grow as surgical procedures grow in number globally, which can be owed to chronic diseases, road accidents, and other cases which require surgical medical attention. For instance, it is estimated that over 1.25 million people die every year owing to road accidents across the globe.

.Our in-depth analysis of the global anesthesia devices market includes the following segments:

|

By Product Type |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Anesthesia devices Market Regional Analysis:

North America Market Insights

North America region is anticipated to hold lucrative anesthesia devices market share of 39.8% by the end of 2035. The market growth is expected on the account of a higher number of people suffering from chronic disease and a higher number of people who need organ transplantation. Organ transplants are often required in lifesaving situations and surgeries when a disease or illness progresses to later stages. The burden of chronic diseases is increasing in the U.S. as a result of a sedentary lifestyle, rising disposable income, and a higher life expectancy. Such diseases have become a leading cause of mortality. As per the statistics of the Centers for Disease Control and Prevention, 6 out of 10 U.S. adults are living with a chronic illness and every 4 out of 10 people have at least 1 chronic condition. Moreover, there are currently close to 121,000 people in need of kidney transplants in the United States.

Furthermore, in the US, the prevalence of diseases, including cancer and cardiovascular conditions is rising quickly. Nearly half of Americans, including those with hypertension, coronary heart disease, etc., had some form of cardiovascular disease, according to data from the American Heart Association that was released in January 2019. These illnesses usually necessitate procedures such as angioplasty, bypass, and so on, which helps to fuel the market for anesthetic devices rising demand. Additionally, according to GLOBOCON 2020, there were 612,390 fatalities and 2,281,658 new cancer cases reported in the United States in 2020. The increasing incidence of cancer cases suggests the need for more cancer-related surgeries and cancer services which are estimated to raise the need for anesthetic equipment in the area. Hence, it is predicted to surge the market growth.

Anesthesia devices Market Players:

- Medtronic PLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- B.Braun Melsungen AG

- Drägerwerk AG & Co. KGaA

- General Electric Company

- Koninklijke Philips N.V.

- Schiller AG

- Criticare Systems, Inc.

- HEYER Medical AG

- Infinium Medical, Inc.

- General Meditech, Inc.

Recent Developments

-

Philips and B. Braun announced the FDA approval for Onvision. It is an innovative ultrasound guidance setup for keeping track of needle tips.

-

GE Healthcare received the FDA clearance for the breakthrough software that enables the automation of anesthesia delivery and the reduction of greenhouse gas emissions during surgery.

- Report ID: 3840

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Anesthesia devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.