Agreement Analytics Market Outlook:

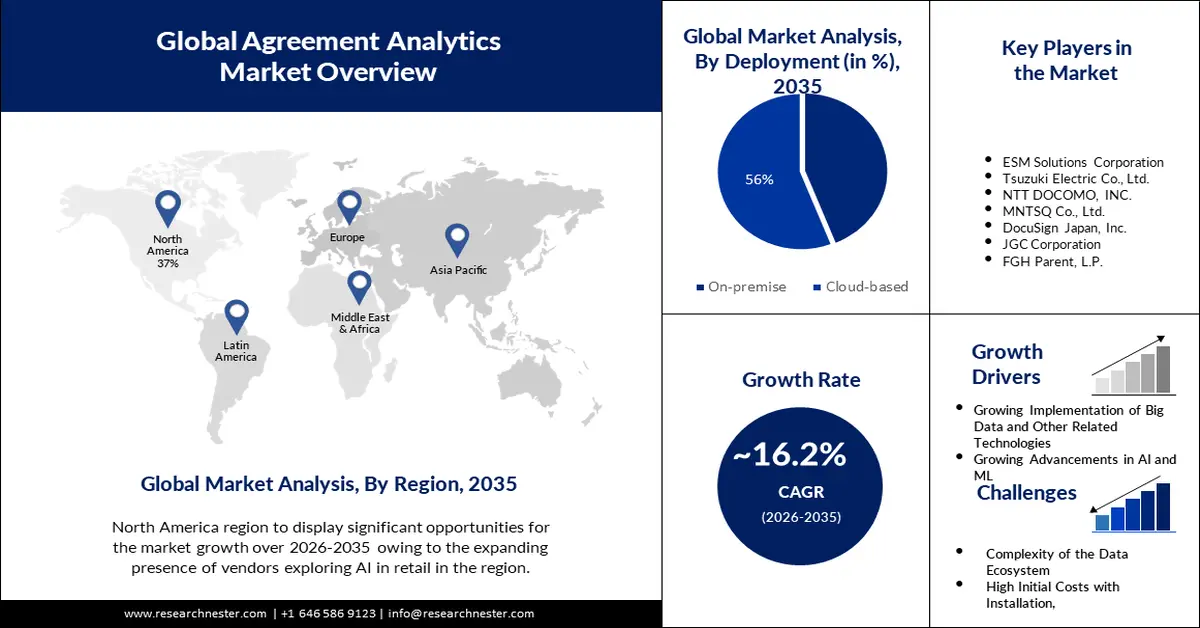

Agreement Analytics Market size was valued at USD 2.64 billion in 2025 and is expected to reach USD 11.85 billion by 2035, registering around 16.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of agreement analytics is assessed at USD 3.02 billion.

The production of vast volumes of IT operational data is responsible for the market's expansion. The market is becoming increasingly crowded with emerging technologies like big data, ML, and IoT, creating intense competition. As per a report, by 2021, services accounted for almost half of BDA (big data and business analytics) spending. Enterprises are trying hard to adopt these technologies and enhance their expertise to sustain their position in the market. Agreement analytics solutions provide organizations with a better understanding of procurement risks that might occur while operating in such a rigorous competitive environment.

The web's accessibility has significantly improved digital working environments in all fields. The proliferation of digital technology has led to the widespread adoption of automated solutions, such as software for managing contracts. Software for managing contracts has made it easier for sellers, customers, and partners to work together. The goals of legal and medical services are to provide high-quality care while keeping prices down. Owing to all this, the agreement analytics market is witnessing growth.

Key Agreement Analytics Market Insights Summary:

Regional Highlights:

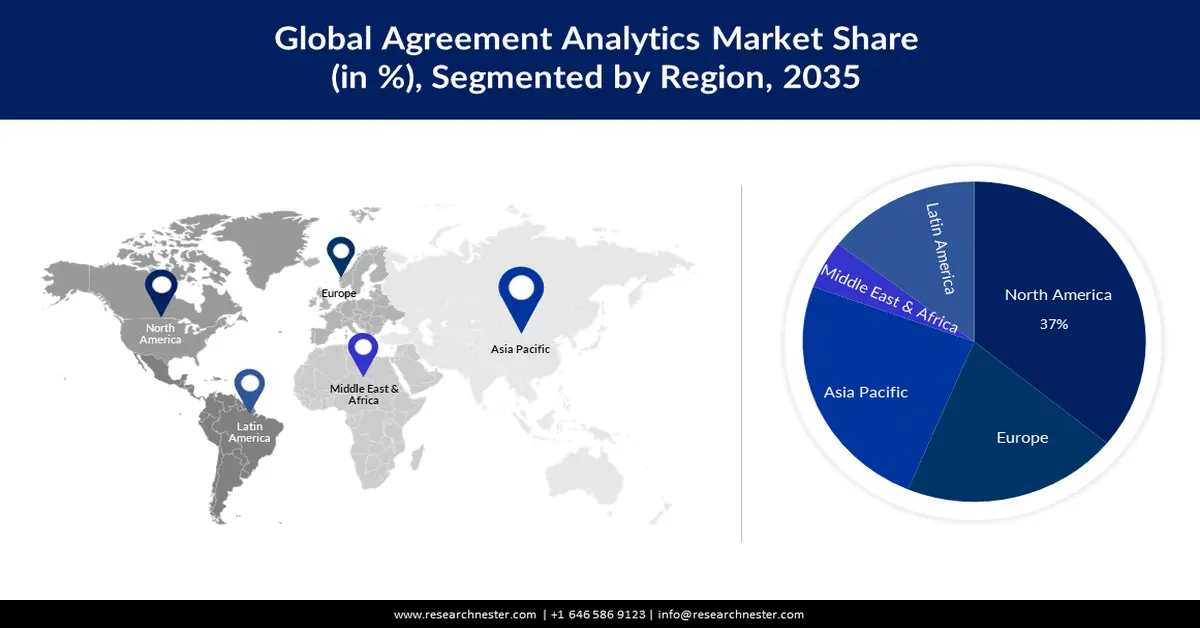

- North America is projected to command a 37% share by 2035 in the Agreement Analytics Market, propelled by the expanding presence of AI-focused vendors and a rising number of small and medium-sized enterprises.

- Asia Pacific is anticipated to capture a 25% share during 2026–2035, supported by the region’s rapid digitization and surging adoption of cloud-based applications.

Segment Insights:

- The cloud-based segment is expected to hold a 56% share over 2026–2035 in the Agreement Analytics Market, fueled by broader enterprise adoption of cloud infrastructure for enhanced remote data accessibility.

- The healthcare segment is set to secure a 24% share during the projected period, strengthened by growing requirements for real-time regulatory compliance at the clause level.

Key Growth Trends:

- Growing Implementation of Big Data and Other Related Technologies

- Growing Advancements in AI and ML Technologies

Major Challenges:

- Concerns Related to Data Privacy and Security

- High Initial Costs with Installation, Deployment, or Maintenance

Key Players: AT Internet, IBM, Oracle, FGH Parent, L.P., ESM Solutions Corporation, Tsuzuki Electric Co., Ltd., NTT DOCOMO, INC., MNTSQ Co., Ltd., DocuSign Japan, Inc., JGC Corporation.

Global Agreement Analytics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.64 billion

- 2026 Market Size: USD 3.02 billion

- Projected Market Size: USD 11.85 billion by 2035

- Growth Forecasts: 16.2%

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: India, South Korea, Singapore, Brazil, United Arab Emirates

Last updated on : 19 November, 2025

Agreement Analytics Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Implementation of Big Data and Other Related Technologies - Growth in the business ecosystem has been stimulated by the increasing use of modern technologies including cloud, IoT, big data & analytics, mobility, and social media. These technologies have led to innovation and transformation. This real-time data processing can be used by advanced analytics tools to deliver timely insights for preventive measures. The increasing utilization of big data and associated technologies fosters a favorable atmosphere. The rising market acceptance of advanced analytics is fuelled by these technologies, which help organizations leverage the power of data, extract relevant insights, and drive data-driven decision-making.

-

Growing Advancements in AI and ML Technologies - The capabilities of advanced analytics systems are constantly being improved by developments in AI and machine learning algorithms. Advancements in algorithms, automated model construction, and deep learning methodologies facilitate the extraction of more precise and practical insights from data, hence propelling the utilization of advanced analytics within enterprises. As AI and ML algorithms develop, more precise forecasts and insights from data are made possible. Furthermore, developments in AI and ML enable automated construction and optimization procedures. This helps enterprises save time and money by reducing the need for manual model development and tuning. Furthermore, developments in AI and ML enable customized experiences and recommendations to be provided by sophisticated analytics systems. Organizations are able to offer recommendations that are specifically personalized by analyzing past data, preferences, and use behavior.

-

Growing Joint Ventures Between Key Players - As the world becomes more interconnected, the need to manage projects and work together in joint ventures has made contracts more visible to the parties involved. As a result, several businesses have implemented agreement analytics programs. For instance, in 2022 Ooredoo Group selected Icertis as a contract intelligence provider. In order to guarantee that all of the data are appropriately preserved throughout the organization, Ooredoo intends to use the contract intelligence CLM platform to create massive amounts of papers in an organized and connected manner. Therefore, the development of cloud-based agreement analytics is one of the major factors propelling the market for contract management software.

Challenges

-

Concerns Related to Data Privacy and Security - Data losses and security breaches are more likely now that exabytes and petabytes of data are being managed inefficiently. In the current competitive industry, marketing teams need access to secure, up-to-date data in order to provide exceptional customer service. Businesses are using several touchpoints to collect data and measure it digitally. Public information about goods, services, and communication platforms is included in these data types. Thus, in order to keep customers' trust, vendors must guarantee the highest level of data security. Cybercriminals now have easy access to technologies that can be used to get passwords, secret questions, and passwords created using tokens. Strong hacks like this still make it difficult for advanced analytics to be widely used in data-intensive industrial sectors. Therefore, this factor is anticipated to hinder the market growth of agreement analytics.

-

Complexity of the Data Ecosystem Leading to Data Breaches and Security Issues May hinder the Market Growth

-

High Initial Costs with Installation, Deployment, or Maintenance May Hamper the Market Growth of the Agreement Analytics

Agreement Analytics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

16.2% |

|

Base Year Market Size (2025) |

USD 2.64 billion |

|

Forecast Year Market Size (2035) |

USD 11.85 billion |

|

Regional Scope |

|

Agreement Analytics Market Segmentation:

Deployment Segment Analysis

Agreement analytics market for the cloud-based segment is anticipated to hold a share of 56% during the forecast period. Over time, the market is expected to grow as more and more businesses embrace cloud infrastructure to enhance data accessibility from remote places. For instance, Amazon Web Services (AWS) held about 33 percent market share in the market for cloud infrastructure services in the first quarter of 2022. Cloud deployment makes it possible for data to be seamlessly synchronized from many sources, making data transmission and communication easier than with an on-premises architecture. Additionally, the advantages of cloud deployment including its pay-per-use model and ease of deployment are said to be some of the main drivers of its global expansion.

Application Segment Analysis

The healthcare segment in the agreement analytics market is poised to hold a share of 24% during the projected period. The market is growing because there is a growing need to achieve regulatory compliance throughout one's life by obtaining real-time visibility for business associate agreements at the clause level. Furthermore, the healthcare industry is under increasing scrutiny for complying with regulations like the Health Insurance Portability and Accountability Act (HIPAA), which highlights the necessity for clearly defined standard operating procedures. Additionally, the industry's growth has been aided by numerous other strict medical regulations, standards, and policies. Software for contract analytics helps healthcare firms create a stronger foundation for compliance management while lowering risks.

Our in-depth analysis of the global market includes the following segments:

|

Deployment |

|

|

Component |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Agreement Analytics Market - Regional Analysis

North American Market Forecast

North America industry is set to hold largest revenue share of 37% by 2035. The growth can be attributed to the expanding presence of vendors exploring AI in retail and natural processing techniques, and the increase in the number of small and medium-sized organizations in the region. For instance, in 2020, there were around 6.62 million small businesses in the US that employed people. Also, it is anticipated that data security and privacy regulations such as the Health Insurance Portability and Accountability Act (HIPAA) will increase the demand for agreement analytics. Therefore, all these factors are propelling the market growth in the region.

APAC Market Statistics

Asia Pacific agreement analytics market is projected to hold the second-largest share of 25% during the foreseen period. The growth can be accredited to the rapid shift towards digitization and increasing demand for cloud-based applications. The market for agreement analytics is expected to grow as a result of the growing requirement for software that ensures regulatory compliance in order to protect the organization from fines for non-compliance and to mitigate contract-related risks.

Agreement Analytics Market Players:

- AT Internet

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IBM

- Oracle

- FGH Parent, L.P.

- ESM Solutions Corporation

Recent Developments

- August 2023 - In order to provide policyholders and insurers with the best possible customer experience, IBM and FGH Parent, L.P. announced that they have signed a USD 450 million deal to transform Fortitude Re's life insurance policy servicing operations through the use of AI technology and other automation tools.

- September 2023 - Oracle presented new AI-powered features for Oracle Analytics Cloud. The new capabilities help analytics self-service customers conduct advanced analysis more quickly and effectively and make better business decisions without waiting for data scientists or IT teams, thanks to the Oracle Cloud Infrastructure (OCI) Generative AI service.

- Report ID: 3595

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Agreement Analytics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.