AI in Retail Market Outlook:

AI in Retail Market size is valued at USD 14.4 billion in 2025 and is projected to reach a valuation of USD 123.7 billion by the end of 2035, rising at a CAGR of 24% during the forecast period, i.e., 2026-2035. In 2026, the industry size of AI in retail is evaluated at USD 17.8 billion.

The market is shifting rapidly as retailers increasingly use artificial intelligence to automate supply chain optimization, merchandising, and personalized customer experiences. One of the drivers of this is the need for unified commerce, where AI bridges online and offline channels and produces smooth shopping experiences. In a key announcement, IBM rolled out new generative AI offerings at NRF in January 2024, intended to unify shopping experiences and maximize store-level product assortment optimization with improved supply chain transparency and tailored service. This is part of a wider industry trend toward using AI to bridge the gap between customer expectations and retail execution.

Government actions are also significantly influencing the market by offering incentives for AI adoption as well as regulatory structures for its use. For example, the U.S. government's National Artificial Intelligence Research and Development Strategic Plan in May 2023 laid out nine strategies for developing trustworthy AI, such as long-term investments in research and building public datasets. These regulations are speeding up the creation of AI technologies for the retail industry while creating essential guidelines on data governance and security.

Key AI in Retail Market Insights Summary:

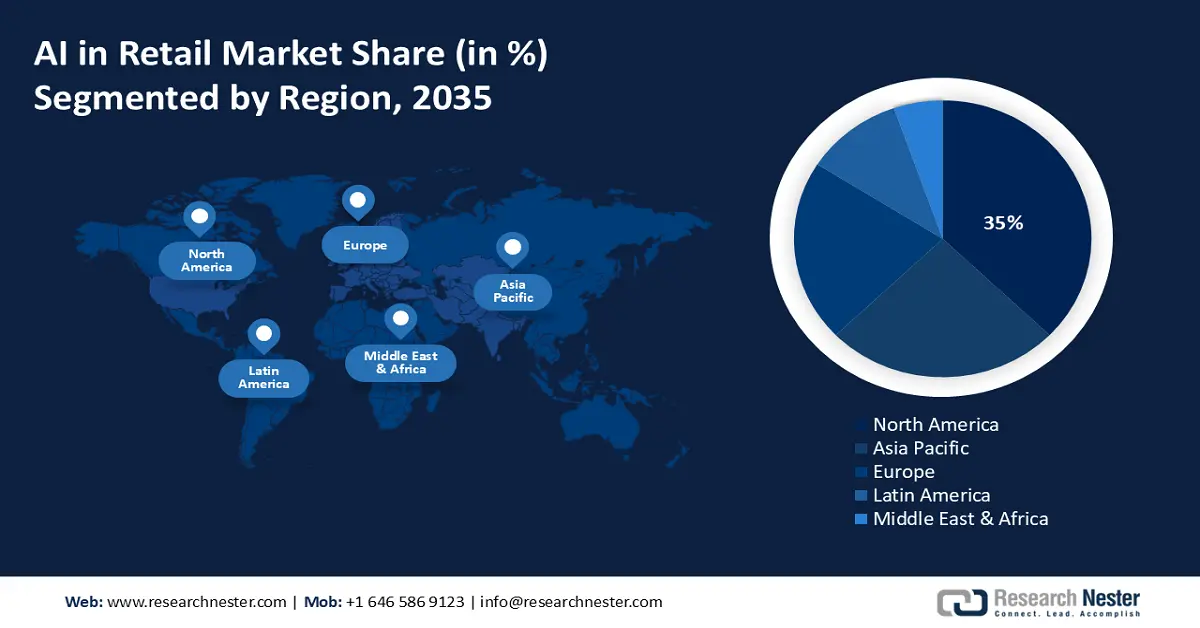

Regional Highlights:

- North America is expected to command a 35% share of the ai in retail market by 2035, sustained by its advanced retail infrastructure and strong policy support for ai innovation.

- Asia Pacific is projected to expand at a 22% cagr from 2026 to 2035 as accelerating urbanization, a growing digital consumer base, and rising investments in ai technologies reshape the regional retail ecosystem.

Segment Insights:

- The solution segment is expected to secure a 60% share of the ai in retail market during 2026–2035, strengthened by rising demand for unified ai systems that streamline merchandising, logistics, and customer experience functions.

- The machine learning category is projected to achieve a 40% share by 2035 as retailers increasingly rely on data-driven models to enhance forecasting accuracy and in-store operational efficiency.

Key Growth Trends:

- Improved supply chain and inventory optimization

- Customer personalization

Major Challenges:

- Regulatory scrutiny and compliance

- Integration with legacy systems

Key Players: Oracle Corporation, IBM Corporation, Google LLC (Alphabet Inc.), Amazon Web Services, Inc., Salesforce, Inc., NVIDIA Corporation, SAP SE, Intel Corporation, Shopify Inc., Tata Consultancy Services Limited, Samsung SDS Co. Ltd., NTT DATA Corporation, Fujitsu Limited, Hitachi, Ltd.

Global AI in Retail Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 24 September, 2025

AI in Retail Market - Growth Drivers and Challenges

Growth Drivers

- Improved supply chain and inventory optimization: Retailers are using AI more and more to develop more robust and effective supply chains, from demand planning to managing stocks. A vital element is the capability of AI to examine enormous sets of information and yield actionable insights that lower costs and avoid stockouts. For example, Accenture announced its acquisition of retail technology services company Logic in August 2024 to enhance its strength in driving AI-powered transformations in merchandising and supply chain responsiveness. This emphasis on AI-based operational effectiveness is aiding retailers in their ability to operate in a challenging and competitive environment.

- Customer personalization: AI is transforming the way retailers engage with their customers by facilitating highly personalized shopping experiences, from product suggestions to conversational service. Its capacity to deliver personalized content and support at scale is a significant growth driver. Salesforce introduced Einstein Copilot for Shoppers, a generative AI-based conversational assistant in February 2024 that comes integrated directly into its Commerce Cloud to offer personalized product recommendations and support. This reflects the sector's move toward leveraging AI to create richer, more meaningful customer relationships.

- Creation of popular AI platforms: The presence of nimble AI platforms and microservices is making it possible for retailers to construct individualized applications specific to their own demands. This is fueling innovation and enabling companies to create novel solutions for distinct challenges in such areas as demand forecasting, visual search, and customer service. NVIDIA expanded its retail AI platform in January 2025 with new microservices that allow retailers to create custom generative AI apps for inventory management, supply chain optimization, and virtual assistants. This shift towards scalable, customizable AI solutions is a key growth driver in the market.

Online Retail Sales as a Share of Total Retail (2023)

Online retail sales surged during the pandemic, reaching as high as 25 to 30% of total retail in China, the U.K., and Korea, while the U.S. stands at 15% and most other markets remain in the 5-10% band. This concentration of online activity is accelerating adoption of AI in retail, from demand forecasting to real-time personalization.

Source: UNCTAD

AI Adoption and Productivity in Retail and Related Sectors (2023)

|

Aspect |

Key Figures / Insights |

Impact on Retail |

|

AI Adoption vs. Productivity |

Among the 10% most productive firms in Belgium, Germany, Italy, and Korea, AI usage is nearly 2× higher than among the bottom 10% |

High-productivity retailers benefit most from AI for forecasting, personalization, and supply chain optimization |

|

Complementary Assets |

Productivity gains depend on ICT systems, digital infrastructure, management skills, and problem-solving abilities |

Retailers must pair AI with robust digital platforms and staff training to fully capture value |

|

Human Capital Needs |

Over 30% of U.S. online job postings from top AI employers mention management or leadership skills, beyond technical expertise |

Retail businesses adopting AI should invest in leadership, innovation, and analytics skills to align teams with AI-driven operations |

|

Sector Concentration |

28% of ICT firms in OECD countries used AI in 2023, compared with an 8% average across all firms |

While AI is still concentrated in ICT, retail adoption is expanding as omnichannel commerce and personalization gain importance |

|

Firm Size Dynamics |

Large firms are about 2× more likely to use AI than SMEs (<250 employees) |

Bigger retailers often lead in AI investment, but SMEs can leverage cloud AI tools to bridge the gap |

|

Firm Age Variation |

In France and Denmark, younger firms show higher AI use than older peers |

New retail entrants and startups may adopt AI faster, enabling innovation in customer experience and inventory systems |

Source: OECD

Challenges

- Regulatory scrutiny and compliance: The increased application of AI in retail has drawn greater regulatory attention, specifically regarding data privacy and consumer protection, resulting in a multifaceted compliance environment for companies. One of the main challenges is making sure AI-based tools, including those applied to pricing analytics and customer support, are utilized in an open and equitable fashion. In September 2024, the U.S. Federal Trade Commission (FTC) issued Operation AI Comply, a law enforcement sweep targeting deceptive AI assertions. This move serves notice that retailers need to be careful in the way they advertise and implement AI solutions to prevent legal and reputational consequences.

- Integration with legacy systems: Merging sophisticated AI solutions with legacy systems proves to be a significant operational barrier for most retailers, typically involving substantial investment and technical know-how. The intricacy of integrating separate systems can hinder the implementation of new AI technologies and restrict their functionality. One similar challenge is protecting data and interoperability between new and existing platforms. In July 2024, the UK and India initiated the UK-India Technology Security Initiative, whose goal is to standardize security protocols for technology, impacting SaaS providers that offer AI services for retail. This underscores the need to tackle integration and security issues to gain maximum benefits of AI in the retail market.

AI in Retail Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

24% |

|

Base Year Market Size (2025) |

USD 14.4 billion |

|

Forecast Year Market Size (2035) |

USD 123.7 billion |

|

Regional Scope |

|

AI in Retail Market Segmentation:

Component Segment Analysis

The solution segment is expected to hold a commanding 60% market share throughout the forecast period, stimulated by the intense requirement for end-to-end, comprehensive AI solutions focused on alleviating critical retail pain points. One of the main drivers is the necessity of holistic solutions that put AI-driven merchandising, logistics, and customer experience capabilities together on a single platform. A pertinent advancement is the increasing number of specialist AI assistants available to the retail industry. In April 2024, Amazon Web Services (AWS) released the general availability of new retail AI services, such as Amazon Q, a generative AI assistant that can handle sales data analysis and offer supply chain performance insights. This movement towards solutions that offer everything in one is driving the growth of this category as retailers want to streamline their technology stack and achieve high ROI.

Technology Segment Analysis

The machine learning category is predicted to account for a 40% share of the market by 2035 because it is the underlying technology behind most of the most significant AI uses in retail, from predictive analytics to personalization. The capacity of machine learning algorithms to process large data sets and determine patterns is key to optimizing everything from demand forecasting to customer segmentation. One of the major developments is leveraging machine learning to drive in-store operational effectiveness. In April 2024, Zebra Technologies introduced new AI-driven software for its mobile computers and scanners, utilizing machine learning to deliver real-time visibility to store associates on activities such as stocking shelves. As retailers continue to invest more in data-informed decision-making, the machine learning segment will continue to be a pillar of the AI in Retail market.

Sales Channel Segment Analysis

The omnichannel segment is projected to account for a 45% market share during the forecast period, as retailers increasingly emphasize delivering seamless, unified experiences across both digital and physical channels. AI is a key driver of this trend, enabling the integration of data and operations from e-commerce sites, mobile applications, and physical stores. One key driver is the application of AI to fuel integrated logistics and fulfillment networks. In August 2023, Shopify released a broadened partnership with Amazon, permitting its merchants to utilize the Buy with Prime service directly from their Shopify stores. This omnichannel integration, based on Amazon's AI-based logistics network, exhibits the increased significance of a singular solution to retail and also the central function that AI serves in making this possible.

Our in-depth analysis of the global AI in retail market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Technology |

|

|

Sales Channel |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

AI in Retail Market - Regional Analysis

North America Market Insights

North America is expected to hold a 35% market share throughout the forecast period, led by a highly advanced retail industry, robust technology ecosystem, and substantial investments in AI development and research. The region has been favored by large AI vendors and an early adopter culture, making it the forefront of the AI in Retail market. Government policy supporting AI innovation is also a decisive factor.

The U.S. is the prevailing market within North America, boasting a huge and competitive retail sector that is always looking for new means to innovate and improve its efficiency. A prime motivator is the requirement to maximize enormous and convoluted supply chains, something that is optimally suited to AI-based solutions. A pertinent government initiative is the heavy investment in AI infrastructure. In January 2025, a U.S. Executive Order was released to promote American leadership in AI infrastructure, calling on federal agencies to step up site and grid improvements appropriate for large data centers to facilitate the computational demands of the retail sector. Such a focus on creating a strong AI ecosystem is also driving the market forward.

Canada AI in Retail market is increasing steadily with the help of a robust research community and AI investment by the government. One of the major influences is the emphasis on building an educated labour force and creating innovation through national policy. A key government program is the Pan-Canadian Artificial Intelligence Strategy, overseen by research organization CIFAR, which has continued to support AI research chairs and national AI institutes in 2024. The long-term investment in core AI research is developing the next generation of machine learning and NLP methods that will be commercialized and used by Canada retail sector, building a strong talent pool and healthy innovation ecosystem.

APAC Market Insights

Asia Pacific AI in retail market is forecast to achieve a CAGR of 22% from 2026 to 2035, driven by urbanization, an increasing digital consumer base, and an e-commerce boom. The diverse and dynamic markets of the region are providing unparalleled opportunities for AI-driven solutions to adapt to various consumer values and tendencies. This expansion is also driven by growing investments in AI technologies and government support schemes encouraging digital transformation across businesses. The region is well placed to emerge as a global leader in AI adoption in the retail sector, defining new standards for innovation and customer experience.

China market is marked by a highly developed digital ecosystem and a high emphasis on mobile-first retailing. The main driver is the widespread uptake of emerging technologies by consumers and enterprises, so there is fertile soil for AI innovation. But a tight regulatory ecosystem, especially on data privacy, needs localization. In 2024, China continued its rigorous application of the Personal Information Protection Law (PIPL), which affects how international businesses can market to Chinese consumers and demands compliant processes for data management. This regulatory environment is influencing growth in the AI in Retail market in China, where demand is building for specialized, compliant solutions.

India market is growing steadily, led by a significant, young population that is quickly adopting digital technologies. One of the drivers is the government's emphasis on developing a skilled workforce to facilitate the nation's digital shift. One of the major government initiatives is the AI for India 2.0 initiative, a free online AI training initiative launched in July 2023 by the Ministry of Skill Development & Entrepreneurship. This initiative is intended to develop a skilled talent pool that will be able to drive the adoption of AI in major industries, including retail, which is increasingly depending on AI for everything from CRM to supply chain management. This emphasis on skill development is a key driver of the AI in Retail market growth in India.

Europe Market Insights

Europe is expected to experience stable growth in the AI in Retail market by 2035, fueled by robust concern about data privacy, a developed retail industry, and government initiatives to support digitalization. The General Data Protection Regulation (GDPR) has generated a special market dynamic, where there is high demand for AI solutions that are secure, transparent, and compliant. This focus on responsible AI development, combined with a very competitive retail environment, positions Europe as a primary location for innovative AI applications focused on customer trust and ethics. This trend will further establish Europe's role as a leader in secure and compliant AI retail solutions.

Germany market is dominated by a robust B2B retail industry and an emphasis on efficiency, quality, and data protection. A prime driver is the requirement for AI solutions able to streamline intricate supply chains and industrial processes. An applicable government initiative is the support of secure, federated data infrastructures. Germany's Digital Strategy in 2025 encouraged the creation of data spaces as part of the European Gaia-X initiative, which is intended to build an open data infrastructure that enables retailers to exchange data in order to train AI models without compromising their own proprietary information. This emphasis on data sovereignty and security is determining the uptake of AI in the German retail sector.

The UK economy is dynamic and proactive, with significant emphasis placed upon e-commerce and a thriving technology startup culture. One of the drivers is the government's proactive encouragement of AI take-up in most sectors, including retail. One of the crucial government initiatives is the AI Opportunities Action Plan, a 50-point action plan initiated in January 2025 that aims to encourage the take-up of AI by businesses. The initiative has included pilot project funding, for example, utilizing AI to minimize food waste from bakeries through precise sales forecasting, and the establishment of an "AI Knowledge Hub" to exchange best practices. This forward-looking government backing is giving rise to a ground conducive to AI innovation in the UK retail sector.

Key AI in Retail Market Players:

- Microsoft Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Oracle Corporation

- IBM Corporation

- Google LLC (Alphabet Inc.)

- Amazon Web Services, Inc.

- Salesforce, Inc.

- NVIDIA Corporation

- SAP SE

- Intel Corporation

- Shopify Inc.

- Tata Consultancy Services Limited

- Samsung SDS Co., Ltd.

- NTT DATA Corporation

- Fujitsu Limited

- Hitachi, Ltd.

The AI in retail market is extremely competitive, with a combination of large technology firms, domain-specific AI providers, and an increasing number of start-ups. Major vendors are Microsoft Corporation, Oracle Corporation, IBM Corporation, Google LLC, Amazon Web Services, Inc., Salesforce, Inc., NVIDIA Corporation, and SAP SE, who are all competing to offer end-to-end, complete AI solutions for the retail segment. The competitive environment is marked by fast-paced innovation, with firms continually launching new AI-enabled tools and features to respond to changing retailer needs. Strategic collaborations and acquisitions are also prevalent as firms seek to broaden their capability and market coverage.

This is propelling a race to provide the most complete and accessible AI-enabled suites. One of the emerging trends is the integration of generative AI into ERP systems for supply chain management and customer experience. In June 2024, SAP released new generative AI capabilities integrated into its S/4HANA Cloud platform, such as AI capabilities for smart demand forecasting and personal product recommendations. This action is a perfect illustration of the trend towards integrating AI as a fundamental part of business software, giving retailers smarter and more automated solutions to manage their businesses.

Here are some leading companies in the AI in retail market:

Recent Developments

- In September 2025, Tata Consultancy Services (TCS) announced a partnership with NVIDIA to embed its accelerated computing capabilities into TCS's AI-fueled retail solutions. This collaboration aims to help global retailers reduce costs, boost efficiency, and drive innovation with features like computer vision and digital twins.

- In June 2025, Amazon introduced "Wellspring mapping," a next-generation demand-forecasting model, along with robotics upgrades powered by natural language. These AI-backed enhancements were part of a larger $1.2 billion workforce upskilling investment and are designed to improve supply chain efficiency and reduce fulfillment costs.

- In April 2025, at the ReTechCon event, SymphonyAI showcased its CINDE Connected Retail platform with new autonomous AI agents. These agents are designed to handle tasks such as optimizing promotions, managing inventory, and orchestrating supply chains in real-time, helping retailers act faster on data-driven insights and automate repetitive tasks.

- Report ID: 3516

- Published Date: Sep 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

AI in Retail Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.