Business Analytics in Fintech Market Outlook:

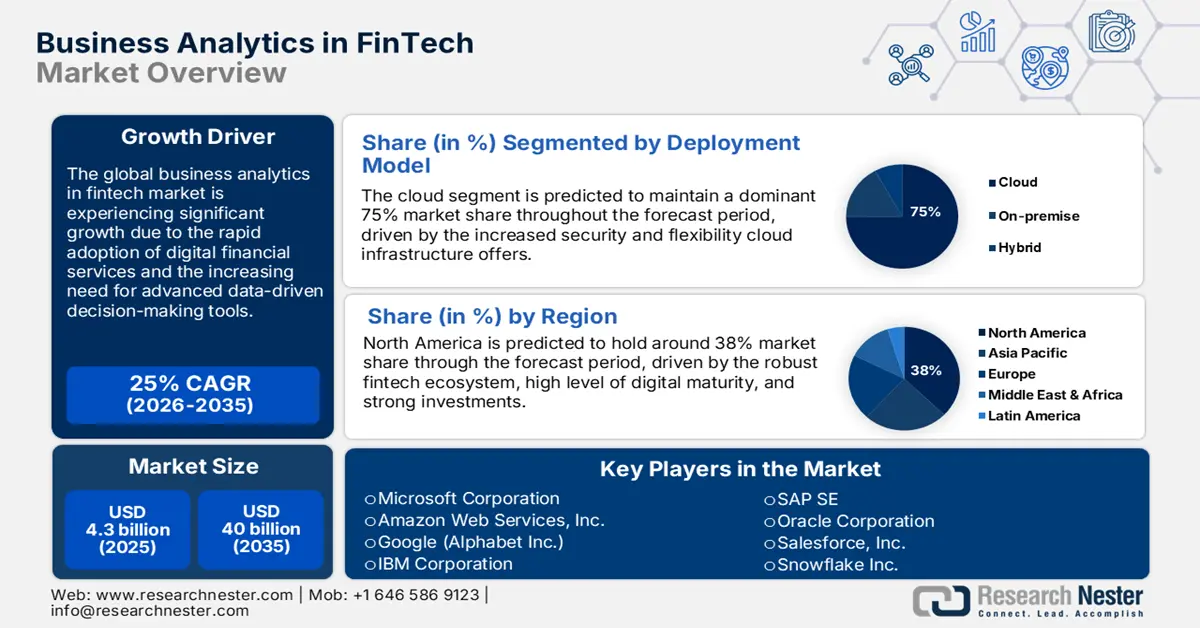

Business Analytics in Fintech Market size was valued at USD 4.3 billion in 2025 and is projected to reach a valuation of USD 40 billion by the end of 2035, rising at a CAGR of 25% during the forecast period, from, 2026-2035. In 2026, the industry size of business analytics in fintech is assessed at USD 5.3 billion.

The business analytics in fintech market is showcasing significant growth owing to increasing complexity in fraud detection systems, regulatory compliance, and the emerging demand for customized financial services requiring advanced data processing and predictive assistance. This is echoed by cutting-edge tech rollouts that mirror market creativity, e.g., when in May of 2025 Amazon Web Services launched a sample solution for building a generative AI-powered financial research assistant by integrating Amazon Q Business and Amazon QuickSight for the mixed structured/unstructured workflows of analysts, showcasing how to consume SEC filings and real-time market feeds, create risk and portfolio analysis, and produce charts via natural language that reduce days of analysis to minutes.

Regulatory environments across the globe are promoting environments to enable data-driven financial innovation, while establishing holistic frameworks for analytics governance, consumer protection, and system risk management in increasingly evolving fintech environments. The radical impact of state-led initiatives is seen in big economies, as seen in India's Reserve Bank promoting the Payments Vision 2025 with ambitious targets on digital payment analytics, aiming to triple digital payments, achieve a 50% CAGR for mobile transactions, and 150% growth in PPI transactions. This integrated program demonstrates how regulatory frameworks are building enabling infrastructure in place to promote analytics-driven fintech innovation while they propel financial inclusion and digitalization across emerging markets.

Key Business Analytics in Fintech Market Insights Summary:

Regional Insights:

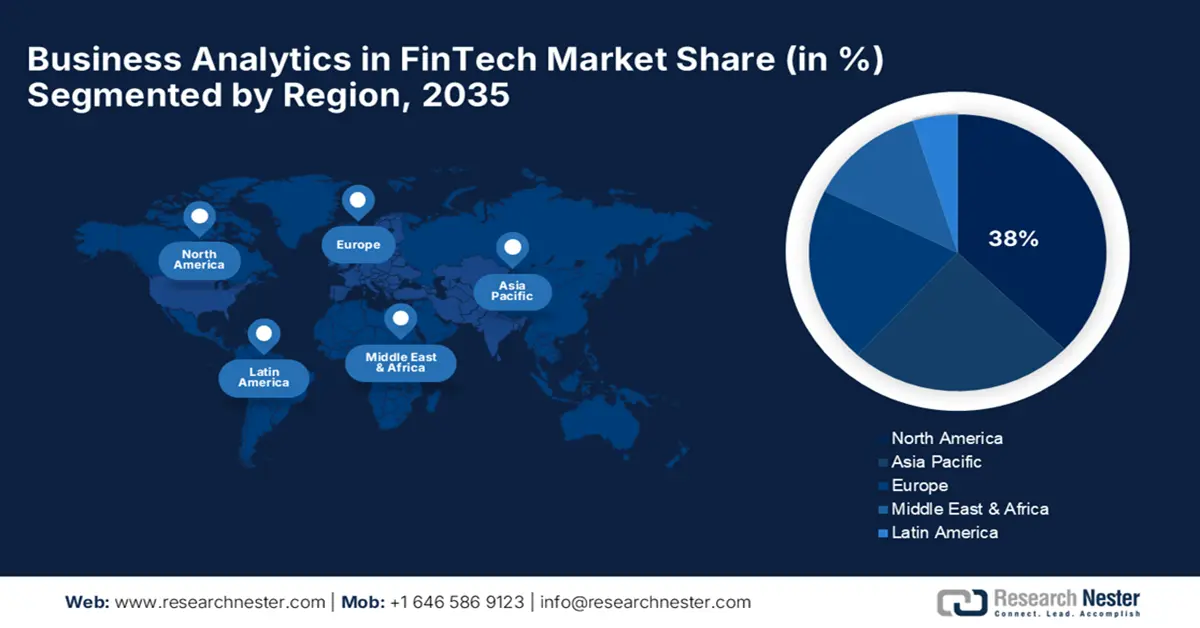

- North America is anticipated to hold a 38% share in the Business Analytics in Fintech Market during the forecast period, fueled by sophisticated technology infrastructure and high institutional adoption of analytics solutions.

- Europe is expected to maintain steady growth between 2026 and 2035, owing to regulatory harmonization, advanced data protection standards, and widespread adoption of business analytics technologies.

Segment Insights:

- The cloud segment is projected to account for 75% share in the Business Analytics in Fintech Market throughout the forecast period, propelled by cloud platforms' increased scalability, cost-effectiveness, and integration support.

- The risk management application segment is expected to hold around 45% share by 2035, owing to increasing regulatory requirements and the need for sophisticated analytical solutions to detect threats and monitor compliance.

Key Growth Trends:

- Real-time fraud detection and risk management systems

- Open banking data analytics and API-driven insights

Major Challenges:

- Regulatory complexity of compliance and data governance requirements

- AI governance and explainability requirements in regulated environments

Key Players:Microsoft Corporation, Amazon Web Services, Inc., Google (Alphabet Inc.), IBM Corporation, SAP SE, Oracle Corporation, Salesforce, Inc., Snowflake Inc., SAS Institute Inc., TCS (Tata Consultancy Services), Infosys Limited, Samsung SDS Co., Ltd., Telstra Corporation Limited.

Global Business Analytics in Fintech Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.3 billion

- 2026 Market Size: USD 5.3 billion

- Projected Market Size: USD 40 billion by 2035

- Growth Forecasts: 25% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share during the forecast period)

- Fastest Growing Region: Asia Pacific

- Dominating Countries – United States, United Kingdom, Germany, Canada, France

- Emerging Countries – China, India, Singapore, Brazil, United Arab Emirates

Last updated on : 5 September, 2025

Business Analytics in Fintech Market - Growth Drivers and Challenges

Growth Drivers

- Convergence of generative AI and conversational analytics adoption: The business analytics in FinTech market is experiencing revolutionary growth with cutting-edge generative AI integration that supports conversational analytics, automatic insights, and natural language processing capabilities that revolutionize the manner in which large data sets are accessible and interpretable to financial professionals. In July 2025, AWS highlighted its Moneythor on AWS architecture for FinTech personalization analytics through the reduction of acquisition costs with real-time enrichment, ML-based nudges, and dynamic loyalty programs utilizing a reference architecture that utilizes Amazon MSK for transaction ingestion, Amazon EKS for orchestration, RDS for secure storage, and Amazon Bedrock for generative capabilities.

- Real-time fraud detection and risk management systems: The business analytics in fintech market is experiencing swift expansion with leading real-time analytics platforms that employ machine learning algorithms, behavior analysis, and pattern recognition technologies to detect suspicious behavior and assess risk in advanced financial networks at record speed and precision. In November 2024, Chartis acknowledged SAS as a category leader in AML transaction monitoring, citing ML, DL, typology models, and link analysis as advanced analytics differentiators among payment service providers and banks based on recognition favoring SAS's holistic approach to combining machine learning, deep learning, and advanced analytics.

- Open banking data analytics and API-driven insights: Banks are gaining valuable competitive advantages through open banking data analytics platforms using standardized APIs, third-party data feeds, and connected financial ecosystems. In April 2023, the UK Joint Regulatory Oversight Committee introduced guidelines for the second stage of Open Banking, facilitating new value-added analytic services and improved user journey performance through frameworks to provide sustainable competitive advantages beyond initial government mandates. This regulatory development aims to deliver improved user experiences and establish Open Banking as a long-term framework that will foster future innovation in digital payments and mobile banking.

Leveraging Business Analytics to Optimize FinTech Market Entry & Product Strategy

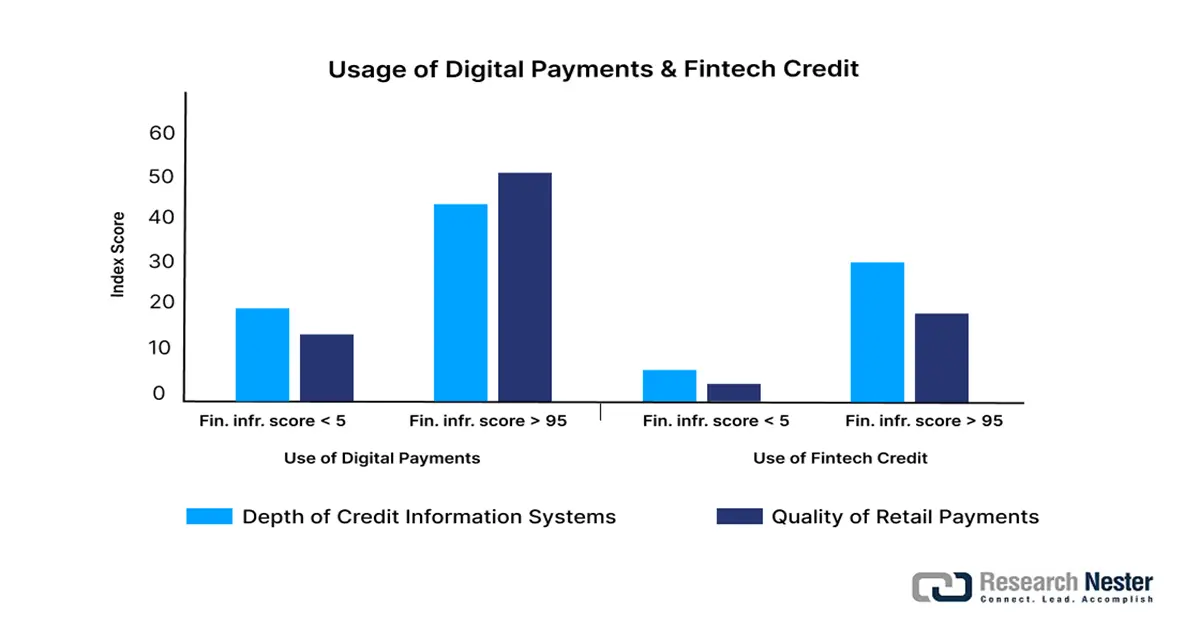

For markets with high infrastructure (score > 95), the more balanced adoption indicates competition is based on features and user experience, not just basic access. Analytics would focus on competitive analysis and differentiation.

Source: World Bank

Challenges

- Regulatory complexity of compliance and data governance requirements: The business analytics in FinTech market are being challenged with escalating pressures from complex regulatory environments that require sophisticated data governance models, audit trails, and compliance monitoring systems that inject operations sophistication and resource allocation complexity across various jurisdictions with varying requirements. This combined regulatory framework poses analytics platforms with new compliance demands while requiring enhanced levels of operational resilience that impact system design, operations processes, and risk management frameworks in European financial institutions.

- AI governance and explainability requirements in regulated environments: Fintech providers' business analytics encounter a major technical and regulatory challenge with regard to implementing AI governance models, offering algorithm explainability, and creating transparency in automated decision-making that affects customer outcomes, as well as the requirements of regulatory compliance. The extent of the complexity of AI governance needs is underscored by Microsoft's January 2023 placement in IDC's first MarketScape for AI Governance Platforms, applicable to banks that are putting analytics into production with controls for lineage, bias, and explainability. This recognition focuses on the AI regulation role as being at the center of compliant credit scoring, AML analysis, and personalization model deployment, and demonstrating the technical acumen required to meet regulatory demands for transparency and fairness in automatic finance decision-making systems.

Business Analytics in Fintech Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

25% |

|

Base Year Market Size (2025) |

USD 4.3 billion |

|

Forecast Year Market Size (2035) |

USD 40 billion |

|

Regional Scope |

|

Business Analytics in Fintech Market Segmentation:

Deployment Model Segment Analysis

The cloud segment is predicted to maintain a dominant 75% business analytics in fintech market share throughout the forecast period, driven by cloud platforms' increased scalability, cost-effectiveness, and integration support, enabling financial institutions to deploy analytics solutions with ease in a fast and timely manner without compromising on operational flexibility and regulatory requirements in different geographic regions. For example, Snowflake revealed platform enhancements in June 2024 to enhance the Data Cloud's performance, interoperability, and data collaboration capabilities that augment financial analytics workloads end-to-end by leveraging innovations that accelerate data processing speeds, automate operations, and facilitate more sophisticated analytical capabilities for financial services organizations seeking a competitive edge through advanced data analytics.

Application Segment Analysis

The risk management application segment is predicted to hold around 45% business analytics in fintech market share by 2035, driven by increasing regulatory requirements, sophisticated types of fraud schemes, and the increased sophistication of financial markets that demand sophisticated analytical solutions to detect threats, monitor compliance, and measure operational risk. The segment growth is supported by regulatory programs demanding sophisticated capabilities for managing risks. In June 2024, the European Central Bank's digital euro preparations were still in the preparatory stage, laying down data and operational standards that will influence analytics, risk, and privacy controls across EU FinTech by extensive frameworks specifying technical requirements for risk assessment, privacy protection, and operational resilience on digital currency platforms.

Industry Vertical Segment Analysis

The banking sector is anticipated to maintain a substantial 51% business analytics in fintech market share during the forecast period, with banks' significant customer bases, valuable data assets, and regulatory requirements putting tremendous pressure on sophisticated analytics platforms to provide diverse financial services operations. The segment leadership is attested by effective use cases of sophisticated analytics platforms. For instance, Salesforce launched AI-powered capabilities for banks in Financial Services Cloud in March 2025 to reduce transaction dispute handling time with prebuilt process templates and embedded analytics in Data Cloud through operational processes optimized by solutions that provide end-to-end analytical insights for customer service optimization and dispute resolution.

Our in-depth analysis of the business analytics in fintech market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Model |

|

|

Application |

|

|

Industry Vertical |

|

|

Business Function |

|

|

Organization Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Business Analytics in Fintech Market - Regional Analysis

North America Market Insights

North America is expected to command a significant 38% market share during the forecast period, driven by sophisticated technology infrastructure, top-class regulatory frameworks, and high institutional adoption of business analytics solutions in numerous fintech applications and market segments. The region is underpinned by highly developed data science environments, complete capital markets infrastructure, and ongoing investment in artificial intelligence and machine learning technology that positions North American companies as world leaders in creating and applying fintech analytics.

The U.S. business analytics in fintech market is demonstrating exceptional growth with extensive regulatory transformation, institutional adoption initiatives, and business analytics technologies innovating first in the industry, serving as a template for international regulatory and financial services technology innovation. In November 2024, the FDIC reported that in 2023, 96% of U.S. households were banked, demonstrating sustained demand for digital banking services utilizing analytics and inclusion strategies that inform FinTech analytics strategies to satisfy underserved markets, digital onboarding, and risk modeling.

Canada business analytics in FinTech market is driven by strategic government initiatives, strong regulatory frameworks, and innovative financial institutions innovation which generate competitive leads in data analytics and financial technology solution development. In June 2023, Payments Canada advanced real-time payment modernization initiatives that FinTechs use to adopt real-time analytics for fraud mitigation, liquidity management, and customer service enhancements through infrastructure investments that provide foundational capabilities for higher-end analytics applications as well as enable secure, efficient payment processing within the Canadian payments system.

Europe Market Insights

Europe is likely to sustain steady growth between 2026 and 2035, driven by widespread regulatory harmonization, leading-edge standards in data protection, and strong institutional adoption of business analytics technologies for both operational efficiency and regulatory compliance across different national markets and financial services use cases. The region is facilitated by sophisticated regulatory frameworks, including GDPR data privacy regulations and comprehensive financial services regulations, as well as transforming AI governance requirements, which offer standardized and secure platforms for fintech analytics growth and cross-border financial operations.

The UK economy is a considerable example of outstanding innovation through comprehensive regulatory development, purposeful industry collaboration, and continuous investment in fintech analytics capital. This creates competitive prospects for local and foreign financial services providers competing in evolved market environments. In August 2025, the UK Government published its National Payments Vision, offering guidelines for payment data interoperability and innovation-led analytics for account-to-account payments through end-to-end frameworks specifying technical standards for the exchange of data while promoting payment technology innovation.

Germany business analytics in the fintech market is characterized by engineering prowess, strategic technology development, and comprehensive regulatory compliance, which establish German institutions at the forefront of secure, trustworthy, and innovative financial analytics solutions in the business analytics in fintech market. In May 2024, the business finance platform Tide partnered with Adyen to offer business accounts using a banking-as-a-service (BaaS) solution, showcasing progress in open banking. The business analytics in fintech market is centered on precision engineering, operating security, and methodical regulatory compliance that lead to long-term competitive advantages and technological supremacy in data-driven financial services.

APAC Market Insights

Asia Pacific business analytics in FinTech market is predicted to record a CAGR of 27% from 2026 to 2035 as a result of tremendous digital transformation efforts, rapidly growing fintech ecosystems, and broad government support for financial tech innovation across different economic conditions and regulatory frameworks. The region has high adoption rates of technology, strong government backing of digital financial services, and shifting consumer demand for data-based money services that open unprecedented prospects for technology leadership and business expansion.

China business analytics in FinTech imarket continues to demonstrate technological dominance through its sophisticated digital infrastructure, abundant data analytics proficiency, and enlightened technology development initiatives that enable Chinese financial institutions and technology companies to become the global leaders in using fintech analytics and financial technology. This drive is supported by the People's Bank of China's 2022–2025 Fintech Development Plan that revealed eight priorities ranging from the enhancement of digital infrastructure, expanding comprehensive data application, and building robust governance for the sector. The strategy aims at maximally unleashing the power of data as a production force, enabling ordered sharing of data, and providing secure digital pipelines to allow smart, inclusive, and green development in fintech.

India business analytics in FinTech in market represents a strong growth opportunity driven by comprehensive government digital infrastructure initiatives, rapidly expanding fintech penetration, and strategic financial inclusion programs that unlock potential for cutting-edge analytics solutions and technology adoption across different economic segments. In January 2025, the government inaugurated Gandhinagar's GIFT City FinTech Park, a physical and virtual center with infrastructure tailored to analytics-based FinTech innovation supported by Digital India initiatives favoring analytics-based startups building open banking, invoice financing, and personalized financial services.

Key Business Analytics in Fintech Market Players:

- Microsoft Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amazon Web Services, Inc.

- Google (Alphabet Inc.)

- IBM Corporation

- SAP SE

- Oracle Corporation

- Salesforce, Inc.

- Snowflake Inc.

- SAS Institute Inc.

- TCS (Tata Consultancy Services)

- Infosys Limited

- Samsung SDS Co., Ltd.

- Telstra Corporation Limited

The competitive dynamics in the business analytics in fintech market are marked by intense competition among established technology players, niche specialists in analytics, and emerging fintech platforms that leverage their unique strengths to acquire market share and drive innovation across different industry segments and geographies. Market leaders such as Microsoft Corporation, Amazon Web Services, Google (Alphabet Inc.), IBM Corporation, and SAP SE dominate through full-stack cloud solutions, advanced AI capabilities, and expansive enterprise connections, competing against specialized providers such as Salesforce, Snowflake, and SAS Institute offering specialty analytics solutions and industry expertise.

Companies are investing heavily in next-gen AI technology, cloud infrastructure, and specialist financial services capabilities that set their offerings apart in increasingly competitive markets and build customer trust and institutional confidence. For example, NTT DATA Corporation became a validator node and tenant node provider within SWIAT's regulated digital assets network in February 2024 to facilitate banks' access to tokenization infrastructure with high availability and resilience through strategic positioning for institutional access to blockchain-based financial services.

Here are some leading companies in the business analytics in fintech market:

Recent Developments

- In May 2025, Google’s AI-First accelerator plan included future Europe/India/Brazil cohorts, which multiple ministries in India are echoing through Digital India analytics enablement for startups. The program’s measurement-first mentorship helps FinTechs operationalize analytics responsibly at scale. It complements Indian initiatives that amplify AI analytics capacity for startups across sectors. This strengthens the analytics ecosystem feeding financial inclusion goals.

- In March 2025, Microsoft’s Security/DART guidance connected incident response readiness with analytics telemetry integration, enabling banks to feed SIEM/SOAR and ML anomaly detection with higher fidelity. The patterns strengthen fraud and breach analytics by aligning DR, secure deployment, and telemetry strategy.

- In June 2025, Hitachi Vantara highlighted that VSP One’s new all‑QLC flash, scalable object storage, and cloud integration are designed for large‑scale data growth and AI/analytics workloads in hybrid environments. The platform’s ENERGY STAR recognition and efficiency guarantees align with banks’ sustainability reporting and cost controls for analytics clusters.

- In September 2024, Rakuten Group, Inc. launched “Rakuten Analytics,” a corporate analytics platform leveraging the Rakuten Ecosystem’s statistical data (CustomerDNA) across 4,000+ AI‑derived attributes to support data‑driven decisions. By linking a client’s data with Rakuten’s statistical assets under privacy measures, firms can derive personas, visualize online/offline behaviors, and feed ad delivery, CRM, LTV improvement, and product planning.

- Report ID: 8069

- Published Date: Sep 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.