Business Analytics Vendors Market Outlook:

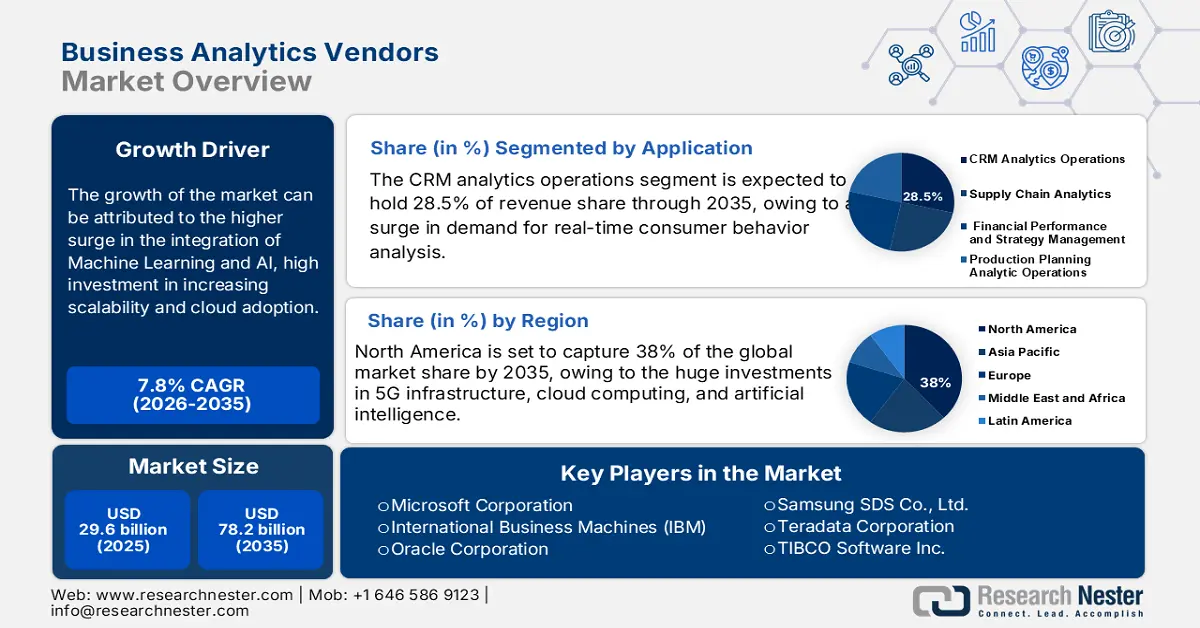

Business Analytics Vendors Market size was valued at USD 29.6 billion in 2025 and is projected to reach USD 78.2 billion by the end of 2035, rising at a CAGR of 7.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of business analytics vendors is evaluated at USD 32.1 billion.

The business analytics vendors market growth is driven by rising investments in technological advancements and a surge in demand for data-driven decision-making tools. According to data published by the U.S. Census Bureau in 2023, approximately 3.8% of businesses utilize Artificial Intelligence to produce services and goods, reflecting lucrative growth opportunities. The inclusion of business analytics tools in the supply chain operations is increasing performance and efficiency. For example, Langham Logistics adopted a BI platform and observed smarter and faster operations with efficient data analytics. Additionally, the worldwide landscape for the trade is also impacting the business analytics vendor market. Business analytics plays are crucial role in providing helpful solutions, helping businesses explore intricate trade atmosphere, identify opportunities, and manage risks for growth.

The marketplace is changing quickly using technologies like AI, machine learning, and generative AI, all of which are enhancing analytics, improving predictive and prescriptive insights, and enhancing ease of use through natural language interfaces. The pressure on vendors to provide self-service and no-code/low-code products continues with the hope of democratizing data across organizations. Cloud-native, cloud agnostic and hybrid architectures are becoming the norm rather than the exception. Real time and edge analytics are also being serious matured as organizations look for immediate, data driven decision points. At the same time all of the focus on data governance and privacy is informing an increase in the need for explainable AI as organizations aren't just concerned with regulation but also with ethical frameworks.

Key Business Analytics Vendors Market Insights Summary:

Regional Highlights:

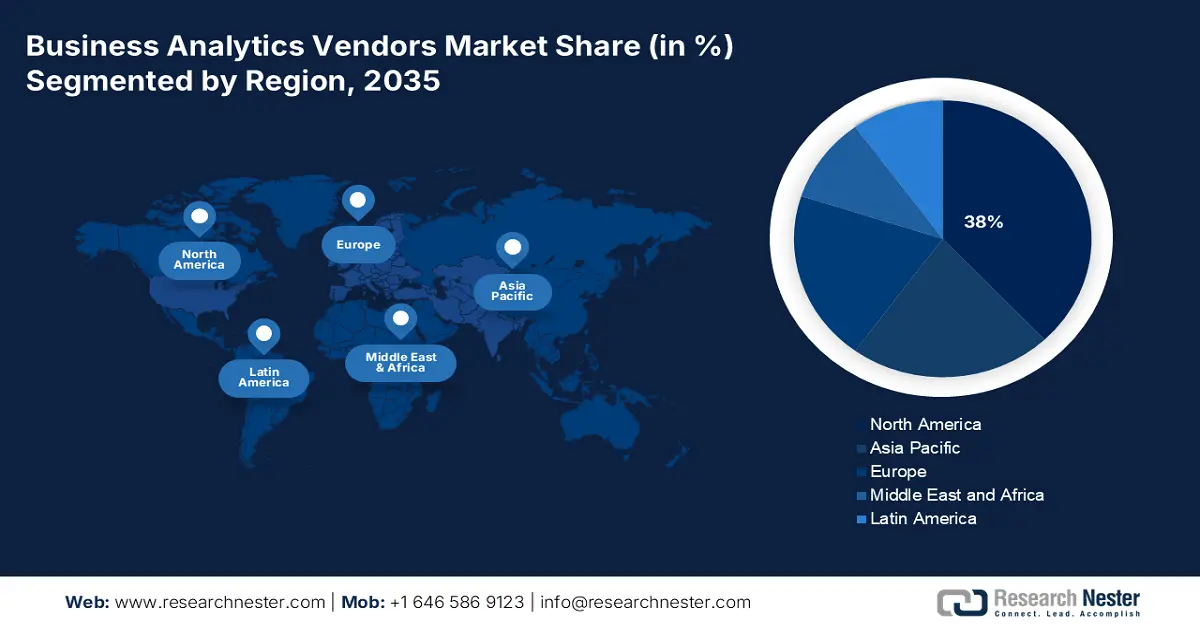

- North America is expected to register a 38% revenue share in the business analytics vendors market with a 7% cagr during 2026-2035, supported by significant investments in 5g infrastructure, cloud computing, and artificial intelligence.

- Asia-Pacific is projected to hold a 24.5% revenue share with a 15% cagr during 2026-2035, driven by rapid digital transformation, government investments in ict infrastructure, and increasing demand for cloud-based analytics solutions.

Segment Insights:

- In the operations segment, crm analytics is forecast to capture the highest share of 28.5%, propelled by the surge in real-time consumer behavior analysis and ai-driven predictive insights.

- Within the industry segment, bfsI is set to secure the largest share, driven by its reliance on business analytics for real-time risk management, fraud detection, and regulatory reporting.

Key Growth Trends:

- Surge in the integration of Machine Learning and AI

- High investment in increasing scalability and cloud adoption

Major Challenges:

- Data privacy and security concerns

- High cost of advanced analytics solutions

Key Players: International Business Machines (IBM), Oracle Corporation, SAP SE, Google LLC (Google Cloud Platform), Amazon Web Services, Inc. (AWS), Samsung SDS Co. Ltd., Teradata Corporation, TIBCO Software Inc., Infosys Limited, QlikTech International AB (Qlik), Fujitsu Limited, NEC Corporation.

Global Business Analytics Vendors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 1 October, 2025

Business Analytics Vendors Market - Growth Drivers and Challenges

Growth Drivers

- Surge in the integration of Machine Learning and AI: The inclusion of AI and ML into the business analytics platform enriches the infrastructure with predictive analytics and automates the data processing. The integration of the BA is also helping companies to make proactive and data-driven decisions. For instance, the business analytics software of Microsoft Power includes AI features that help financial institutions in forecasting stock performance and modelling market behavior. Various businesses are investing in BA tools integrated with AI to foster operational efficiency and decision-making capabilities.

- High investment in increasing scalability and cloud adoption: The inclination towards BA solutions based on cloud technology renders accessibility, cost efficiency, and scalability that are helpful for small and medium-sized enterprises (SMEs). Enterprises are also willing to reduce the infrastructure cost, and BA solutions are proving to be an effective tool to accomplish this goal. It is simpler to integrate, deploy faster, take on lower initial costs, and access on-demand higher-level offerings in areas such as AI and machine learning, as a result it is likely that cloud platforms address these needs. With businesses across industries wanting increased agility, scalability, and cost efficiency from their analytics offerings, those vendors who have invested in a cloud infrastructure and scalable architecture will be better positioned to meet the demand and capitalise on growth in the market.

- Explosion of data across industries: With organizations producing larger quantities of data from digital platforms, the internet of things (IoT), supply chains, and customer interactions, the ability to extract actionable insights has become even more important. Traditional tools are blowing up in scale, so organizations need to investing in more advanced business analytics platforms. These tools assist organizations in converting data into patterns, trends, and forecasts that can propagate smarter decision-making. Analytics and analytics products are being viewed as a core part of how organizations run and compete. This trend of digital transformation has been one of the largest drivers of growth for analytics vendors.

Cloud Computing Market Leaders & Segment Growth (2025)

|

Category |

Value |

|

AWS Market Share |

31% |

|

Microsoft Azure Share |

21% |

|

Google Cloud Share |

12% |

|

SaaS Spending |

$300 billion |

|

Infrastructure Growth |

25% increase |

|

Platform Services Growth |

22% increase |

|

Hybrid Cloud Market Size |

$128.01 billion |

|

Edge Computing Market |

$15.7 billion |

Source: Network.org

Cloud Computing Market Overview by Region (2025 Forecast)

|

Region |

Market Size / Growth |

|

North America |

$474.46 billion market size |

|

Asia-Pacific |

Fastest growth with 25% CAGR |

|

Europe |

$100 billion market size |

|

Middle East & Africa |

Projected 35% growth in cloud adoption |

|

Latin America |

Market expected to exceed $20 billion |

Source: Network.org

Share of Firms that Adopted AI by Industry

|

Industry |

Share of Firms (%) |

|

Information |

~18% |

|

Professional, Scientific, and Technical |

~12% |

|

Educational Services |

~9% |

|

Real Estate and Rental and Leasing |

~8% |

|

Finance and Insurance |

~7.5% |

|

Management of Companies and Enterprises |

~7% |

|

Retail Trade |

~6.5% |

|

Manufacturing |

~5.5% |

|

Wholesale Trade |

~5% |

|

Arts, Entertainment, and Recreation |

~5% |

|

Health Care and Social Assistance |

~5% |

|

Administrative Support and Waste Management |

~4.5% |

|

Transportation and Warehousing |

~3% |

|

Mining, Quarrying, and Oil and Gas |

~2.5% |

|

Construction |

~2.5% |

|

Agriculture, Forestry, Fishing, and Hunting |

~2% |

|

Other Services (except Public Admin) |

~2% |

|

Accommodation and Food Services |

~1.5% |

Source: Census BTOS

Challenges

- Data privacy and security concerns: With regulations increasing, such as GDPR and CCPA, vendors find themselves needing to ensure analytics platforms offer a higher level of data privacy and security. While it’s important to protect sensitive customer and company data from breaches, it is also often very costly and annoying to implement. Not effectively securing data accurately can create legal issues and harm the vendor’s reputation. Vendors also continuously struggle to guarantee security while also assuring a certain degree of accessibility to the user. Vendors also need to heavily invest in encryption, identity management, or compliance monitoring, which can affect product timelines, account for tech debt, and is an additional expense to the vendor.

- High cost of advanced analytics solutions: Often, sophisticated analytical tools that incorporate AI or machine learning are burdened with exorbitant expenses associated with licensing arrangements, technology infrastructure, and routine upkeep. This can inhibit investment from smaller or even mid-sized enterprises, which could stifle expansion potential in the market. Vendors need to consider weighing the cost of developing a fully featured product with a competitive price to stimulate usage. Pricing complexity and opaque pricing models may remain a barrier to entry after incurring those costs. Price is certainly a material barrier to entry, especially in emerging markets where budgets may even be tighter and it can inhibit or slow adoption.

Business Analytics Vendors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.8% |

|

Base Year Market Size (2025) |

USD 29.6 billion |

|

Forecast Year Market Size (2035) |

USD 78.2 billion |

|

Regional Scope |

|

Business Analytics Vendors Market Segmentation:

Application Segment Analysis

The CRM analytics operations is set to garner the highest share of 28.5%. The growth of the business analytics vendors market can be attributed to the surge in demand for real-time consumer behavior analysis. The surge in the utilization of customer engagement tools based on AI in various sectors such as retail, finance, and telecom services, is fostering the adoption. In addition, CRM platforms produce a wealth of customer data, providing a rich source for analytics. Vendors are investing significantly in adding AI and machine learning to CRM analytics to provide predictive insights and automation, thereby increasing the value of these tools. Every industry counts on strong relationships with customers to produce revenue, so CRM analytics will naturally dominate the market.

End user Segment Analysis

The BFSI sector is anticipated to be the largest share-acquiring segment due to its high reliance on BI for real-time risk analytics, regulatory reporting, and fraud detection. The BFSI sector has to manage vast amounts of sensitive and complex data on a daily basis. Business analytics provides organizations with the ability to efficiently organize, analyze, and extract value from this data. Analytics in the BFSI industry informs many important functions, including fraud detection, risk management, credit scoring, and customer segmentation. Given the increased regulatory scrutiny and the need for real time decisions, organizations in the BFSI sector are investing heavily in analytics to stay compliant and maintain a competitive edge.

Deployment Segment Analysis

It is expected that the cloud sector will have the largest share in the manufacturers of business analytics software market, because they offer many more benefits than on-premise solutions. They are much more scalable, flexible, and adaptable than conventional on-premise solutions. Cloud-based analytics platforms enable businesses to scale their resources appropriately, beyond fixed infrastructure, while requiring less capital investment for hardware in the long term. Cloud-based analytics platforms can also support businesses with faster implementations and easier integrations to the systems they are already using. The faster organizations can integrate their systems, the faster they will see results.

Our in-depth analysis of the global business analytics vendors market includes the following segments:

|

Segments |

Subsegments |

|

Component |

|

|

Deployment |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Business Analytics Vendors Market - Regional Analysis

North America Market Insights

The North America business analytics vendors market is set to register 38% of revenue share with 7% of CAGR during 2026-2035. The growth in the region is driven by huge investments in 5G infrastructure, cloud computing, and artificial intelligence. In the U.S., there is a presence of prominent market players such as IBM, Microsoft, Oracle, Salesforce, etc. These companies are global leaders in the deployment of an AI-integrated business analytics platform. The surge in need for real-time decision making and predictive analytics is set to bolster BI adoption across sectors such as retail, healthcare, and finance. Also, the growth in Canada is fostered by rising public-private collaborations.

The U.S. is a global leader in embracing technology adoption and digital innovation, which continues to generate strong demand for business analytics solutions. Its major industries -- such as finance, healthcare, retail, and technology -- are investing significant resources into analytics for improved insights around their customers, operational efficiencies, and compliance with regulations. The emergence of multiple AI and machine learning focused startups and heavy investment in R&D spending provide rapid advancements in analytics capabilities. The same is true of the growing acceptance of cloud computing; offering organizations scalable, data-driven strategies.

The growth of business analytics in Canada is largely driven by the substantial financial services, healthcare, and telecommunications sectors. The expansion of digital transformation initiatives and government investments into national data infrastructure will validate applicable analytics adoption. Canadian organizations are creating large, customer-centric strategies while promoting compliance with regulations (such as PIPEDA), and increasing operational efficiencies - all at the same time increasing the applicability of analytics tools. Canada's focus on privacy and data security pushes innovation toward advanced analytics compliance and security offerings.

Asia Pacific Market Insights

The Asia Pacific region is also set to witness staggering growth, with a 24.5% revenue share and 15% of CAGR. The market is experiencing expansion driven by rapid digital transformation, coupled with an increase in government investments into ICT infrastructure. The rise in cloud, in addition to mobile internet growth, is allowing companies of all sizes access to advanced analytics. Further, government investment into digital infrastructure and smart city initiatives is also generating demand for analytics solutions. Finally, a growing middle class and growing consumer expectations in the region are prompting companies to leverage analytics to deliver personalized advantages and improvements to the overall consumer experience. With these factors, rapid market growth in APAC continues to be favorable for the business analytics vendors.

India's business analytics sector is witnessing tremendous growth, largely due to the growing IT sector and digital economy. A lot of the analytics growth is driven by data generation from e-commerce, telecoms, and financial services companies. Government initiatives are also supporting data-driven decision-making across industries. Furthermore, the growth of cheap cloud-based analytics tools enables small and medium-sized businesses to introduce analytics solutions. A considerable supply of skilled analytics employees, combined with increased foreign investment for certain technology sectors, provides more legitimacy for growth within the country. As a result, the focus on innovation and technology-driven growth enhances India’s position in the business analytics market.

China's industrialization and digital transformation initiatives strongly influence the growth of its business analytics market. The massive consumer base generates quantities of data that businesses can utilize analytics to create tailored marketing and experiences for their customers. Government plans like "Made in China 2025" support smart manufacturing and the use of artificial intelligence and big data analytics. Investments in cloud infrastructure and AI research further enhance the growth initiative. Additional growth from expanded e-commerce and financial technologies is increasing the demand for real-time analytics to maintain a competitive advantage in a rapidly changing environment.

Europe Market Insights

The European business analytics vendors market for business analytics is projected to experience rapid growth due to the increasing digitalization across a wide range of sectors, including manufacturing, finance, health care and retail. European companies are actively trying to adopt data-driven strategies to enhance operational efficiencies and enhance the customer experience. The rise of Industry 4.0 and smart manufacturing initiatives are bringing attention to the need for advanced analytics technologies to enhance efficiency.

In France, there is a notable upward trajectory surrounding business analytics, as supported by a prominent manufacturing industry, a strong finance and healthcare industry, an emerging data ecosystem, and government emphasis on digital innovation and policies supporting this objective like the France AI Strategy. French organizations and corporations are increasingly concluding they need data analytics initiatives to improve their supply chains, adapt to comply with the GDPR, and provide improved customer experience. The adoption of cloud computing is gaining traction in France, positioning companies to deploy analytics in an agile way.

The rapid expansion of business analytics in Germany is due primarily to its leadership in the manufacturing sector, especially its advances in Industry 4.0. By integrating IoT, automation, and data analytics in factories, production is optimized, operational costs are reduced, and product quality is increased. While German firms leverage analytics to enhance production capabilities, they also have a heightened focus on data privacy, along with compliance with rigid EU laws, fueling demand for analytics solutions with a focus on data privacy. At the same time, Germany's strong engineering and technology sectors have committed significant investment in AI and machine learning solutions to enhance analytics capabilities, including products in this category.

Key Business Analytics Vendors Market Players:

- Microsoft Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- International Business Machines (IBM)

- Oracle Corporation

- SAP SE

- Google LLC (Google Cloud Platform)

- Amazon Web Services, Inc. (AWS)

- Samsung SDS Co., Ltd.

- Teradata Corporation

- TIBCO Software Inc.

- Infosys Limited

- QlikTech International AB (Qlik)

- Fujitsu Limited

- NEC Corporation

The competitive landscape of the business analytics vendors market is rapidly evolving as established key players, IT giants, and new entrants are investing in advanced technologies. Key players in the market are focused on developing products that cater to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their business analytics vendors market position.

Here is a list of key players operating in the global market:

Recent Developments

- In December 2024, Trend Micro integrated an "AI brain" into its security suite, enabling autonomous threat detection and response. This innovation aims to reduce manual intervention in cybersecurity operations, addressing the increasing volume of threats and alert fatigue among security teams.

- In April 2025, Palo Alto Networks launched Cortex XSIAM, an AI-driven platform designed for autonomous security operations. The platform enhances cyber threat detection and reduces response times, contributing to improved security postures for organizations.

- Report ID: 2335

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Business Analytics Vendors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.