Active Speaker Market Outlook:

Active Speaker Market size was over USD 13.8 billion in 2025 and is projected to reach USD 29.1 billion by 2035, witnessing a CAGR of 7.6% during the forecast period, i.e., between 2026-2035. In the year 2026, the industry size of the active speaker is evaluated at USD 14.8 billion.

The market growth of the active speaker market is prominently dependent on the robust supply chain. The production of these devices needs a highly reliable and consistent flow of pivotal components such as circuit boards, chips, amplifiers, etc. Any kind of disruption in the logistics or sourcing can hamper the manufacturing and increase the cost. This can further prevent the companies from adequately meeting burgeoning consumer demand, bolstered by ongoing trends such as wireless audio or high-fidelity sound. To increase the agility of the supply chain, countries are taking steps to diversify manufacturing hubs and implementing trade policies that lower the reliance on a single region.

Statistical Overview of Export Restrictions on Industrial Raw Materials (2009–2023)

|

Period |

Statistic / Data |

|

2009–2023 |

>5× increase in industrial raw material restrictions |

|

2021–2023 |

~14% of global trade in industrial raw materials impacted |

|

2021–2023 |

67% of global trade faced at least one restriction |

|

2021–2023 |

46% of global trade faced at least one restriction |

|

2009–2023 |

Trade affected nearly doubled from 2009–2011 to 2021–2023 |

|

2023 |

7 countries (China, Vietnam, Burundi, Russia, DRC, Zimbabwe, Laos) introduced 94% of new restrictions |

|

2019–2023 |

Export taxes, licensing, prohibitions, quotas, and quantitative restrictions increased sharply |

|

2023 |

500+ products affected by at least one restriction |

Source: OEC

These fluctuations have prompted companies as well as governments to develop more robust supply chains by broadening the sourcing and recycling the critical materials. Stakeholders are investing in enhancing the local manufacturing capacities, and such techniques are aiding in stabilizing market expansion. Moreover, the government has started giving incentives for the manufacturing of domestic products and encouraging large-scale investments in fostering innovations and stabilizing the pricing. These efforts also enable manufacturers to scale up production effectively and thereby augment the overall market growth as well as the competitiveness of the active speaker market.

Key Active Speaker Market Insights Summary:

Regional Highlights:

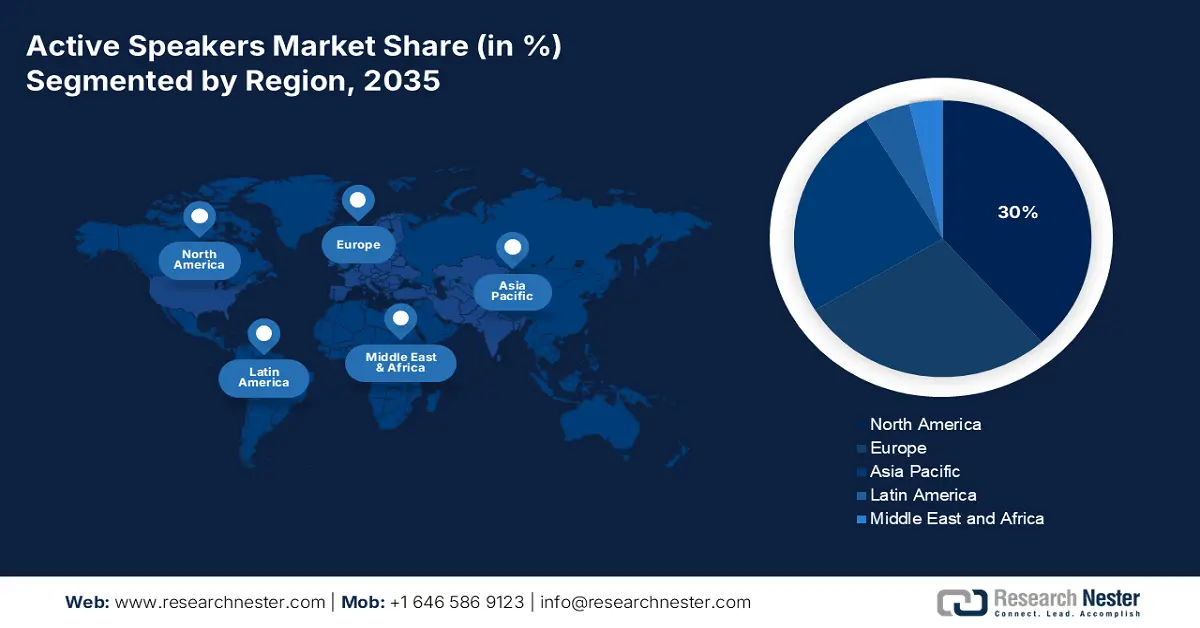

- By 2035, North America is projected to capture 30% share of the active speaker market, fostered by changing consumer preferences and technological advancements.

- By 2035, Asia Pacific is poised for robust expansion, underpinned by the presence of a large consumer base in the region.

Segment Insights:

- By 2035, the residential segment in the active speaker market is projected to secure a 40% share, propelled by mushrooming demand for spatial sound experiences in residential premises.

- By 2035, the consumer electronics sector is anticipated to command a dominant share, supported by the rise in penetration of smart TVs, tablets, and smartphones etc.

Key Growth Trends:

- Growth of the music streaming and podcasting industry

- Expansion of the e-commerce and digital retail channels

Major Challenges:

- Intense market competition and price pressure

- Cybersecurity and privacy concerns

Key Players: Sony Corporation (Japan), Bose Corporation (United States), Yamaha Corporation (Japan), Bang & Olufsen A/S (Denmark), LG Electronics Inc. (South Korea), Pioneer Corporation (Japan), Edifier International Limited (China), Klipsch Group, Inc. (United States), QSC Audio Products, LLC (United States).

Global Active Speaker Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13.8 billion

- 2026 Market Size: USD 14.8 billion

- Projected Market Size: USD 29.1 billion by 2035

- Growth Forecasts: 7.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Vietnam, Brazil, Indonesia

Last updated on : 5 November, 2025

Active Speaker Market - Growth Drivers and Challenges

Growth Drivers

- Growth of the music streaming and podcasting industry: In the past few years, there has been a staggering growth in the music streaming and podcasting industry. According to the India Brand Equity Foundation, the country has gained 105 million podcast listeners in 2024, and the country has now become the third-largest worldwide podcast market. The worldwide surge in podcast creators has also driven the interest in professional-grade audio equipment. This mushrooming adoption of the content creation has strengthened consumers to invest in better quality speakers for getting a dynamic listening experience.

- Expansion of the e-commerce and digital retail channels: The proliferation of e-commerce platforms such as Alibaba and Amazon has changed the way consumers purchase audio devices. With a diversified range of online availability of active speakers with customer feedback and competitive pricing, consumers are making informed purchase decisions. Furthermore, according to the International Trade Administration, by 2027, B2C e-commerce is predicted to surpass USD 5.5 trillion, with the leading share of consumer electronics followed by fashion. Also, the surge in online promotions and various seasonal discounts is driving impulse purchases from consumers and further augmenting the market expansion.

- Government initiatives and local manufacturing policies: The supportive government initiatives endeavor to encourage the electronics manufacturing ecosystem is prominently affecting the market. Various programs such as Make in India, Green Deal Industrial Plan in the EU, and the U.S. CHIPS and Science Act are promoting domestic production and innovation. Such types of initiatives are lowering the dependency on imported components and increasing the resilience of the supply chain. Also, these policies are attracting foreign investment and fostering regional players to scale their operations and offer lucrative opportunities.

Challenges

- Intense market competition and price pressure: The market is competitive with various players globally offering a similar type of product line. Avant-garde companies such as Bose and Harman International primarily dominate the sector, and budding manufacturers compete for the budget category. Additionally, the swift technological innovations are shortening the life cycle of the product, pushing companies to consistently innovate and launch new models.

- Cybersecurity and privacy concerns: As the active speakers are incorporating advanced features such as smart connectivity, voice recognition, etc. Due to this, privacy issues and cybersecurity have become a prominent concern as these speakers gather humongous data via voice commands and connectivity. Consumers are becoming more aware and cautious of data privacy.

Active Speaker Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.6% |

|

Base Year Market Size (2025) |

USD 13.8 billion |

|

Forecast Year Market Size (2035) |

USD 29.1 billion |

|

Regional Scope |

|

Active Speaker Market Segmentation:

End-user Segment Analysis

The residential segment is anticipated to hold 40% of the share by 2035. The growth of the segment can be attributed to the mushrooming demand for spatial sound experiences in residential premises. Consumers are looking for advanced quality sound systems that render connectivity as well as convenience, resulting in a rise in adoption of active speakers for home entertainment. Other than this, the popularity of platforms such as Amazon Prime Music and Spotify has raised the demand for deep resonant sound that upgrades the listening as well as viewing experiences. Active speakers such as Apple HomePod are setting a standard by amalgamating high-fidelity acoustic with AI-enabled voice interaction.

Application Segment Analysis

The consumer electronics sector is expected to witness a dominant share by 2035. The growth of the market can be attributed to the rise in penetration of smart TVs, tablets, and smartphones etc. This has increased the demand for wireless and portable audio solutions. Active speakers render superior sound quality and seamless connectivity through Bluetooth. According to the International Trade Center in 2021, USD 3.40 trillion of electronic products were exported. This shows the amplifying usage of consumer electronics products in making smart infrastructure on a wide scale and propelling the market growth.

Device Type Segment Analysis

The smart speaker is anticipated to garner significant market share by 2035 on the back of rising demand from customers. These smart speakers are amalgamating advanced acoustic engineering, incorporating voice assistant technologies such as Apple’s Siri and Google Assistant. These are integrating natural language processing to enable users to interact with the voice commands. Additionally, the proliferation of IoT home devices has propelled the adoption of smart speakers while also securing the communication protocols. The AI-enabled personalization is also positioning the smart speakers as a major revenue-generating device type.

Our in-depth analysis of the active speaker market includes the following segments:

|

Segment |

Subsegment |

|

Application |

|

|

End user |

|

|

Technology |

|

|

Device Type |

|

|

Frequency Band |

|

|

Material Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Active Speaker Market - Regional Analysis

North America Market Insight

The market in North America is projected to garner 30% of the market during the forecasted period. The growth of the market is propelled by changing consumer preferences and technological advancements. The region is witnessing vast integration of AI technologies and IoT into households, which has positioned the active speaker market as a revenue-generating avenue. There has been a burgeoning demand for high-fidelity audio experiences, and a staggering expansion in e-commerce platforms, which further contributed to the expansion of the market.

In the U.S., the market is flourishing with the rising inclusion of the smart home and a surge in demand for streaming services. Also, the growth can be attributed to the rapid inclusion of advancements in speaker electronics. The amalgamation of the voice assistants, such as Google Assistant and Alexa, has revolutionized active speakers into integrated smart home controllers. Additionally, the expansion of the gaming setups is further propelling the demand for active speakers to enhance the user experience.

The market in Canada is propelled by the rising adoption of wireless and high-fidelity audio systems in smart homes. Also, there is a surge in popularity of on-demand entertainment platforms, and consumers in the country are preferring feature-rich speakers. There has been a significant investment in home entertainment spending, coupled with a shift in urban lifestyles. Other than this, the market is also benefiting from the presence of e-commerce distribution networks. Also, the burgeoning demand from commercial as well as professional sectors is supporting the expansion of the market.

Asia Pacific Market Insights

The market in the Asia Pacific is driven by the presence of a large consumer base in the region. Also, growth is driven by rising disposable income and rapid urbanization across the region. The surge in commercial applications, such as in hospitality and corporate spaces, further aids the expansion of the market. Additionally, the rapid expansion of live events and corporate seminars is boosting the demand for professional studios with the deployment of active speakers. The market in India is thriving with rising event management programs and a surge in digital streaming programs. Initiatives for local manufacturing under the Make in India program and convenient access to cost-efficient electronics have further augmented the market expansion.

In China, the rising occurrence of livestreaming e-commerce on platforms such as Taobao Live has resulted in the higher utilization of active speakers. This trend in the country has become a prominent driver for professional as well as consumer-grade active speakers. Also, the booming entertainment industry in China, including esports arenas and performance venues, is generating robust demand for active speakers across the country. Moreover, the urban consumers in the country are inclined towards purchasing compact and minimalist active speakers that complement the modern interiors, compelling manufacturers to innovate in product form and functionality.

Europe Market Insights

The market in Europe is set to register staggering growth driven by high adoption of smart home technologies in the region. Consumers are showing a strong preference for the multi-room audio systems, aided by the burgeoning penetration of smart assistants as well as connected devices. There is a surge in the number of subscribers on music streaming channels across Europe, which is also propelling the market growth. The market in the UK is also growing steadily, augmented by a rapidly expanding digital entertainment ecosystem. Additionally, the flourishing e-commerce landscape of the country and the presence of leading audio brands are making impeccable audio products that are more accessible to the wider consumer base.

Germany's active speaker market is rapidly expanding, aided by consumer preferences for superior sound quality and modern smart-home connectivity. Consumers in Germany are embracing multi-room active speakers, which can render energy efficiency with high performance. The country has a vibrant culture for live entertainment and concerts in the corporate sector, fostering sales for active speaker systems. Moreover, sustainability-focused efforts and eco-friendly product manufacturing align with Germany’s environmental goals, further enhancing market appeal.

Key Active Speaker Market Players:

- Sony Corporation (Japan)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bose Corporation (United States)

- Yamaha Corporation (Japan)

- Bang & Olufsen A/S (Denmark)

- LG Electronics Inc. (South Korea)

- Pioneer Corporation (Japan)

- Edifier International Limited (China)

- Klipsch Group, Inc. (United States)

- QSC Audio Products, LLC (United States)

Below is the list of the key players operating in the global market:

The key players in the global active speaker market are operating in a highly competitive landscape. Competition is expected to intensify in the coming years due to the entry of numerous small and regional manufacturers offering innovative and cost-effective solutions. While the majority of the market share is held by established global brands, which makes the industry moderately concentrated, smaller players continue to have a strong presence in regional markets, catering to local preferences and niche segments. Key players are increasingly focusing on research and development, strategic collaborations, and technological innovation—such as smart connectivity, wireless solutions, and AI-enabled features—to strengthen their market position and drive product differentiation.

Recent Developments

- In April 2025, Sony introduced its ULT POWER SOUND series in a collaboration with Post Malone. The series emphasizes party speaker capabilities (360° party sound, built-in wheels/handle, long battery life) as well as portability and strong bass.

- In May 2025, Harman International Industries, Inc. announced the planned acquisition of the audio business of Masimo Corporation for USD 350 million, positioning itself to strengthen its consumer‑audio speaker ecosystem.

- Report ID: 8220

- Published Date: Nov 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Active Speaker Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.