Active Optical Cable Market Outlook:

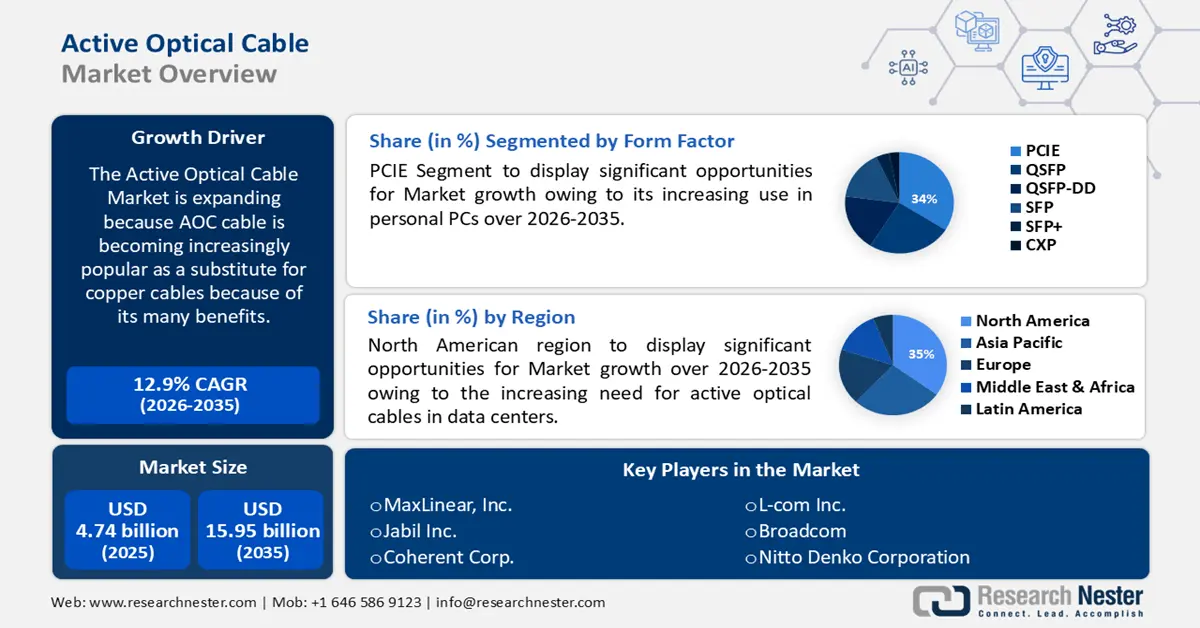

Active Optical Cable Market size was over USD 4.74 billion in 2025 and is projected to reach USD 15.95 billion by 2035, witnessing around 12.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of active optical cable is evaluated at USD 5.29 billion.

AOC cable is becoming increasingly popular as a substitute for copper cables because of its many benefits, including its tiny bend radius for simple installation, low power consumption, and lightweight nature.

The more recent and sophisticated kind of DAC cables are called Active Optical Cables (AOC). In essence, they are fiber optic cables with electrical components inserted to increase signal strength and range. AOC cables, as opposed to DAC cables, may accommodate greater distances—up to 300 meters—without sacrificing speed. The brand Dell Networking is well-known for its AOC cables. With the inclusion of numerous protocols, these cables' applications have grown beyond high-performance computers to include networking and storage.

In addition, the active optical cable market is projected to be propelled by the growing adoption of cutting-edge technologies such as network-function virtualization (NFV) and software-defined networking (SDN). Software-defined networking (SDN) and network function virtualization (NFV) have shown to be two potential technologies for controlling future networks in the direction of achieving such a technological paradigm change.

The use of these technologies is accelerating due to their many advantages, which include lower operating costs, improved resource use, and simpler management requirements. The implementation and maintenance of AOCs are made considerably simpler by SDN and NFV. Additionally, as the need for high-bandwidth networks grows, data centers expect to see a spike in the market for active optical cables.

Key Active Optical Cable Market Insights Summary:

Regional Highlights:

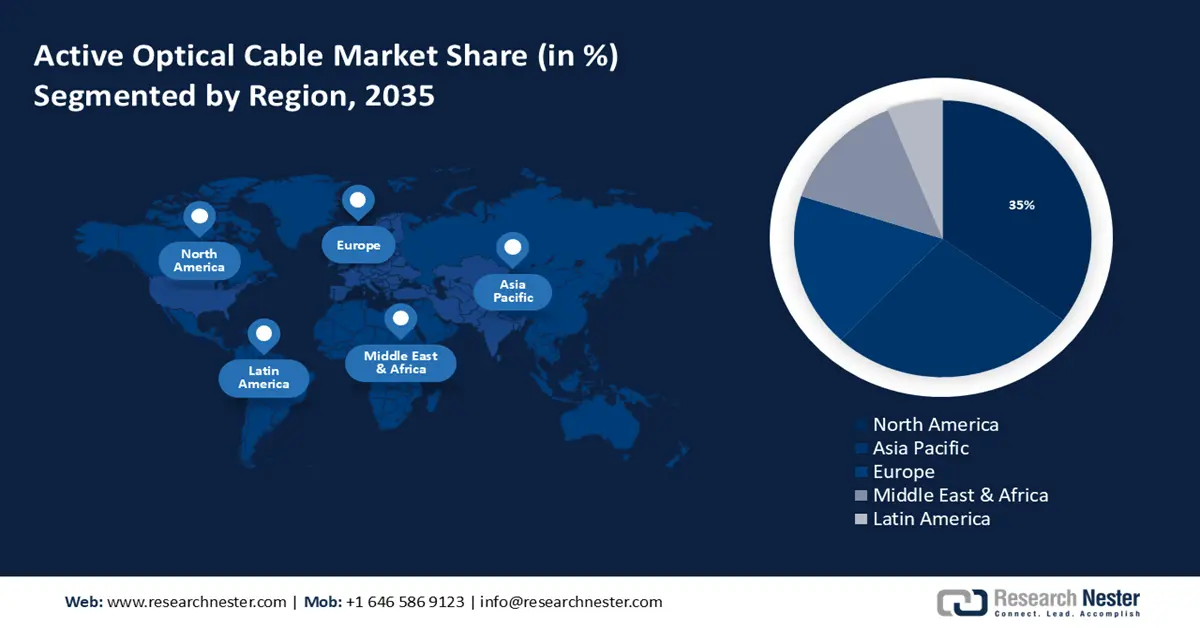

- North America active optical cable market will hold more than 35% share by 2035, attributed to the increasing need for active optical cables in data centers.

- Asia Pacific market will capture a 27% share by 2035, fueled by the quick development of data centers and cloud computing facilities.

Segment Insights:

- Pcie segment in the active optical cable market is expected to achieve 34% growth by the forecast year 2035, driven by growing adoption in PCs, data centers, and AI-driven high-speed computing.

- The infiniband segment in the active optical cable market is expected to hold a 30% share by 2035, fueled by its use in AI supercomputers, data centers, and high-performance computing systems.

Key Growth Trends:

- Growing adoption of 4K and 8K video technologies

- Surge in the implementation of digitalization and 5g network rollouts

Major Challenges:

- Higher power consumption may hamper the growth of the market

Key Players: MaxLinear, Inc., Jabil Inc., Coherent Corp., L-com Inc., Broadcom, Nitto Denko Corporation, LS Cable & System CO., Ltd., Hanwha Corporation, Nexans SA, Fujitsu Ltd.

Global Active Optical Cable Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.74 billion

- 2026 Market Size: USD 5.29 billion

- Projected Market Size: USD 15.95 billion by 2035

- Growth Forecasts: 12.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Mexico

Last updated on : 16 September, 2025

Active Optical Cable Market Growth Drivers and Challenges:

Growth Drivers

- Growing adoption of 4K and 8K video technologies - In a variety of sectors, including digital signs, gaming, broadcasting, and medical imaging, 4K and 8K video technologies are now widely used. As a result, there is now a noticeable need for long transmission lengths and high data speeds. AOC and extenders have become vital options to meet these needs.

These cutting-edge optical interconnects ensure that the integrity and quality of the video material are maintained while enabling the smooth and dependable transmission of high-resolution video signals over extended distances. Furthermore, the integration of 8K and 4K video technology necessitates complex home theatre configurations with components spread across multiple sectors. Because optical fiber technology is immune to electromagnetic interference and signal degradation, there is no chance of pixelation, artifacts, or disturbances that could reduce the reliability of the complex network of devices. - Surge in the implementation of digitalization and 5g network rollouts - Modern technologies are being adopted by several countries to increase data connectivity. It is forecasted that significant investments in data centers and other infrastructures would increase total data transmission speeds.

In order to handle the greater data speeds and reduced latency requirements of the 5G network rollout, sophisticated interconnect technologies are needed. 5G base stations and other network elements can have better connectivity due to active optical links and extenders. The need for AOCs and extenders in this industry is foreseen to increase as 5G networks spread throughout the world. Up to 100 times higher speeds than 4G are promised by 5G. This entails smooth video streaming and quick downloads of entire HD movies. - Cost-effectiveness of active optical cables - Active optical cables are the most economical product in the data center when compared to optical modules. Less optical components can be used in the production process since it fixes the optical fibers inside the module.

Rather, the optical modules are typically linked to a fiber optic patch cable, which comes at a hefty price. Furthermore, active optical cables have very dependable optical ports that are not exposed to the elements. As a result, dust and other impurities cannot harm them, saving money on cleaning and maintenance.

Challenges

- Higher power consumption may hamper the growth of the market - AOCs usually have a power usage of one to two watts, whereas DAC active cables have a power consumption of less than one watts. Because of their effective thermal design, passive DAC cables typically have an even lower power usage of less than 0.15 watts.

Optoelectronic components, like photodetectors and laser diodes, are included in AOC connections to transform electrical signals into optical signals that may be transmitted across optical fibers.

To function and aid in the signal conversion process, these parts need power. When several AOCs are implemented in data centers, power consumption can become an issue. Therefore, this factor may hamper the growth of active optical cables. - Lack of skilled IT personnel may hinder the active optical cable market growth. The growing countries need more skilled IT professionals to advance the active optical cable industry.

- Replacement of AOCs with Copper Cables

Active Optical Cable Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.9% |

|

Base Year Market Size (2025) |

USD 4.74 billion |

|

Forecast Year Market Size (2035) |

USD 15.95 billion |

|

Regional Scope |

|

Active Optical Cable Market Segmentation:

Form Factor Segment Analysis

The active optical cable market for the PCIE segment is set to hold a share of 34% during the foreseen period on account of its increasing use in personal PCs. The central processor unit (CPU) and peripherals (graphics cards, memory/disk drives, and external IO cards) can be connected at fast speeds using the PCI Express (PCIe) interface. PCIe is used by AOCs to connect switches, servers, and storage components. Cloud computing, the Internet of Things (IoT), fifth-generation mobile networks (5G), and artificial intelligence (AI) all gained traction in the industry in 2019.

GarterTM launched the AI-powered productivity revolution in 2022. PCIe 5.0 represents more than 10% of the PCIe 4.0 market. By minimizing or doing away with the quantity of protocol converter chips, they can reduce the total cost of the system. They are utilized in data centers, HPC, and consumer electronics and interface with PCIe. PCIe 1.0, 2.0, 3.0, 4.0, and 5.0 are the most widely used versions of PCIe, and they all offer faster transfer rates. The data rate per lane is indicated by the version number; the most recent PCIe 5.0 supports 32 GT/s (Giga transfers per second) per lane.

Protocol Segment Analysis

InfiniBand segment in the active optical cable market is poised to hold a share of 30% by the end of 2035. One of the main factors driving the growth of the InfiniBand segment is the increasing acceptance of this cutting-edge product in extremely efficient computing machines. In the upcoming years, the necessity for various organizations to develop data centers has grown, which has created an opportunity for the segment.

Almost all of the major operating systems, including Windows, Linux, Mac OS, AIX, HPUX, VMWare, VxWorks, and BSD, have support for InfiniBand. Furthermore, server-related technology is projected to be invented more frequently in the upcoming years, leading to the InfiniBand segment rising gradually between 2024 and 2035. For instance, when paired with NVIDIA HGX, InfiniBand—which is thought to be essential for achieving the scale and performance required for training LLMs—forms the fundamental architecture of AI supercomputers and data center infrastructures.

Our in-depth analysis of the global active optical cable market includes the following segments:

|

Protocol |

|

|

Form Factor |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Active Optical Cable Market Regional Analysis:

North American Market Insights

The active optical cable market in North America is projected to hold the largest share of 35% by 2035. The growth can be attributed to the increasing need for active optical cables in data centers. Fibre optics is the broadband technology with the fastest rate of growth in North America. The interconnect is becoming a more vital component of modern data centers as it provides the necessary communications connectivity across several servers, memory, and computational resources.

'Plain old telephone service' (POTS) is made possible by telecom service providers in the area via active optical connections that connect their nationwide networks, and they convey data over vast distances via active optical connections. The region's concentration of large corporations, academic institutions, governmental organizations, and banks encourages the usage of active optic cables.

APAC Market Insights

Asia Pacific active optical cable market is poised to hold the second-largest share of 27% during the foreseen period. Due to the quick development of data centers and cloud computing facilities, the active optical cable and extender market in Asia Pacific has experienced significant growth. From 1.08 million cabinets in 2015 to 2.39 million cabinets in 2020, China's data center cabinet count has grown significantly. A significant rise in power usage is correlated with the number of data center cabinets. The use of AOCs and extenders has been accelerated by this rise in demand for high-speed, dependable, and efficient connectivity options. The increasing dependence of businesses and customers on online services has made the need for seamless data transmission and low latency critical in the region.

Active Optical Cable Market Players:

- MaxLinear, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Jabil Inc.

- Coherent Corp.

- L-com Inc.

- Broadcom

- Nitto Denko Corporation

- LS Cable & System CO., Ltd.

- Hanwha Corporation

- Nexans SA

- Fujitsu Ltd.

Recent Developments

- MaxLinear, Inc., a leading supplier of high-speed interconnect integrated circuits (ICs) for data center, metro, and wireless transport networks announced today the addition of a new Keystone 5nm PAM4 DSP family member (KeystoneMM – MxL93684). For AOCs and multimode links, the recently released KeystoneMM model offers best-in-class power consumption, excellent performance, and lower costs by monolithically integrating VCSEL drivers with the DSP.

- Jabil Inc.'s creation of a new Active Optical Cable (AOC) family is the result of the photonics business unit's expansion of its design, manufacturing, and testing capabilities. Because of this, Jabil is in a unique position to serve the ongoing explosion of artificial intelligence (AI), cloud, high-performance computing (HPC), and machine learning (ML) applications, as well as the quick pace of improvements in optics-enabled network and data center designs. Jabil's cutting-edge photonics solutions will be on display at OFC’23 in San Diego (Booth #3425).

- Report ID: 5559

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Active Optical Cable Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.