Software-Defined Networking Market Outlook:

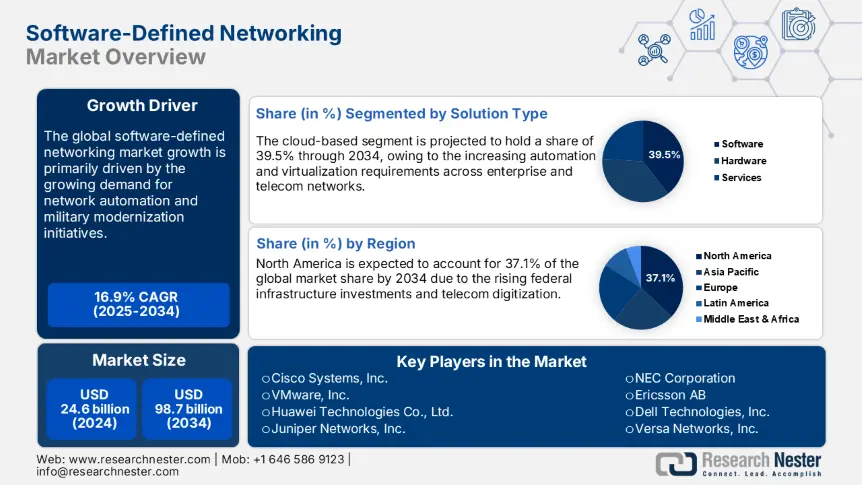

Software-Defined Networking Market size was valued at USD 24.6 billion in 2024 and is projected to reach USD 98.7 billion by the end of 2034, rising at a CAGR of 16.9% during the forecast period, from, 2025 to 2034. In 2025, the industry size of software-defined networking is estimated at USD 28.7 billion.

The software-defined networking trade is characterized by the multifaceted supply chain of semiconductor components and telecom hardware integration. The production of efficient software-defined networking solutions is dependent on advanced network processors, application-specific integrated circuits, and programmable switches. The supply of specialized raw materials and components is led by East Asian economies, owing to the strong presence of manufacturing hubs. The SDN market reports the import trade of raw materials from east to west, and the final product sales vice versa.

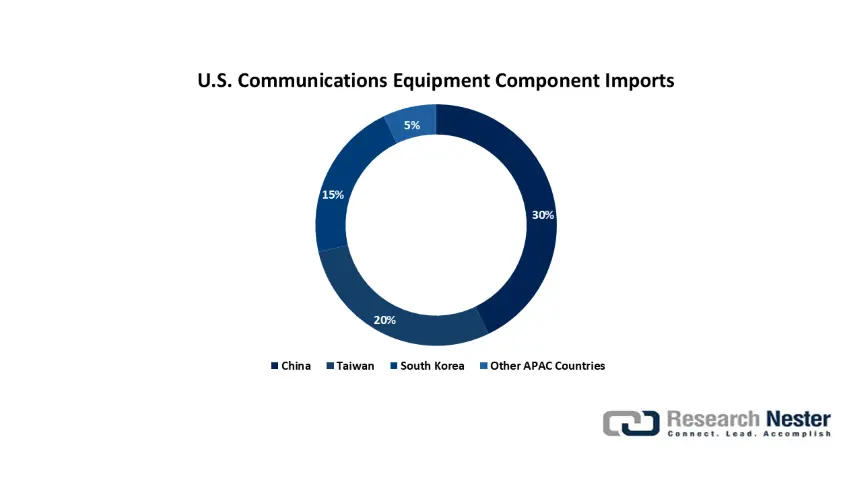

Source: International Trade Commission (ITC)

According to the International Trade Commission (ITC), the U.S. imports around 70% of its communications equipment components from Asia, with China, Taiwan, and South Korea. In 2023, U.S. communications equipment component imports grew by 6.3% YoY, reflecting high demand for programmable networking infrastructure. Domestic integration centers and OEMs are vital for incorporating SDN controllers into cloud and enterprise network systems. The Department of Commerce states that global semiconductor lead times fell to an average of 15 weeks in the fourth quarter of 2024, from over 22 weeks in 2022, enhancing hardware availability across SDN value chains. Such recommendations are poised to fuel the adoption of software-defined networking in the years ahead.

Software-Defined Networking Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for network automation: The shift toward cloud-native and virtualized environments is expected to accelerate the demand for automated network configuration and management. Software-defined networking is vital for enabling automation through programmable network control. As per NIST’s Automation and Control Systems framework analysis, the automation mitigates configuration time by over 30.5% and improves network availability. Moreover, the technological advancements coupled with the automation trend are likely to double the revenues of SDN manufacturers in the years ahead.

- Military modernization initiatives: The military upgradation needs are set to promote the adoption of advanced SDN solutions in the coming years. Defense networks increasingly demand secure, agile communication layers, and software-defined networking addresses this need with programmable segmentation and threat isolation. According to the NIST’s Cyber Resilient Systems report, SDN solutions are essential for resilient command-and-control networks. NATO and EU defense modernization efforts are also focusing on SDN-based architectures.

Technological Innovations in the Software-Defined Networking Market

The integration of AI/ML, 5G, and edge computing is expected to boost the efficiency of software-defined networking solutions. The digital shift in the telecom, finance, healthcare, and manufacturing sectors is estimated to propel the demand for software-defined networking systems. The continuous investments in technological innovations are further set to open high ROI opportunities for key players. The table below reveals the current technological trends and their outcomes.

|

Trend |

Industry Sector |

Company/Agency |

Adoption/Impact (2024) |

|

Virtualization & NFV |

Telecom |

Cisco |

68.5% of global telecom operators deployed SDN in core networks |

|

AI-Enabled Network Automation |

Telecom/Enterprise |

Verizon |

29.3% YoY fall in downtime through AI-integrated SDN fault detection |

|

SDN for Edge & 5G Core |

Telecom |

SK Telecom |

23.6% improvement in performance efficiency via SDN-based dynamic 5G traffic routing |

Sustainability Trends in the Market

The regulatory pressure and green strategies are set to boost the adoption of software-defined networking solutions in the coming years. The renewable energy sourcing and circular economy principles are pushing the trade of advanced software-defined networking technologies. The sustainability trend in both the public and private sectors is also accelerating the sales of software-defined networking solutions. The table below reveals the current sustainability strategies and their business impacts.

|

Company |

Sustainability Initiatives |

Goals & Vision |

Impact on Business |

|

Juniper Networks |

Reduced Scope 1 & 2 GHG emissions by 29.4% (2023) |

Net-zero across global ops by 2040 |

12.5% rise in brand value |

|

Cisco Systems |

86.5% global electricity from renewables (2023) |

100% renewable electricity use by 2030 |

Enhanced investor ESG ratings |

|

Hewlett-Packard Ent. |

Cut industrial waste by 38.6% through a recycling program |

Zero waste to landfill from production by 2030 |

Operational savings and reduced compliance costs |

Challenges

- Infrastructure inefficiencies and legacy system compatibility: The inaccessibility to proper infrastructure is poised to hinder the installation of software-defined networking solutions in developing economies. For instance, Latin America and Southeast Asia suffer from legacy hardware dependence that is incompatible with SDN systems. Moreover, the International Trade Union states that around 42.2% of enterprise routers in emerging markets are more than 6 years old, limiting their SDN controller compatibility. The cost and downtime associated with retrofitting or replacing legacy infrastructure also lower the sales of SDN technologies.

- Lack of skilled workforce for programmable networking: The unavailability of a skilled workforce is expected to hamper the sales of software-defined networking solutions to some extent. Software-defined networking installation requires specialized technicians with skills such as managing software-driven infrastructure and network scripting. But this is difficult to find in many parts of the world, owing to the unavailability of technological institutions to upgrade the latest skills related to ICT solutions. Less than 35.3% of network engineers globally are proficient in SDN technologies, per the OECD ICT Skills Outlook 2023. This gap slows down implementation and increases the cost of integration services.

Software-Defined Networking Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

16.9% |

|

Base Year Market Size (2024) |

USD 24.6 billion |

|

Forecast Year Market Size (2034) |

USD 98.7 billion |

|

Regional Scope |

|

Software-Defined Networking Market Segmentation:

Solution Type Segment Analysis

The software segment is projected to capture 39.5% of the global SDN market share through 2034. The SDN controllers are most sought-after due to increasing automation and virtualization requirements across enterprise and telecom networks. The public-oriented initiatives in the form of incentives and funding are expected to boost the sales of software solutions. the National Science Foundation's (NSF) USD 85.5 million investment in programmable networking is leading to the development of innovative SDN software ecosystems.

End user Segment Analysis

The telecom service providers are estimated to account for 37.9% of the global software-defined networking market share throughout the forecast period. Massive 5G rollouts, edge computing, and Open RAN initiatives are amplifying the adoption of SDN in the telecom sector. The International Trade Union’s 2024 Network Infrastructure Outlook reveals that SDN is vital to dynamic spectrum allocation and traffic rerouting in real-time 5G core systems. This is expected to directly boost the sales of software-defined networking solutions.

Our in-depth analysis of the global software-defined networking market includes the following segments:

|

Segment |

Subsegment |

|

Solution Type |

|

|

Deployment Mode |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

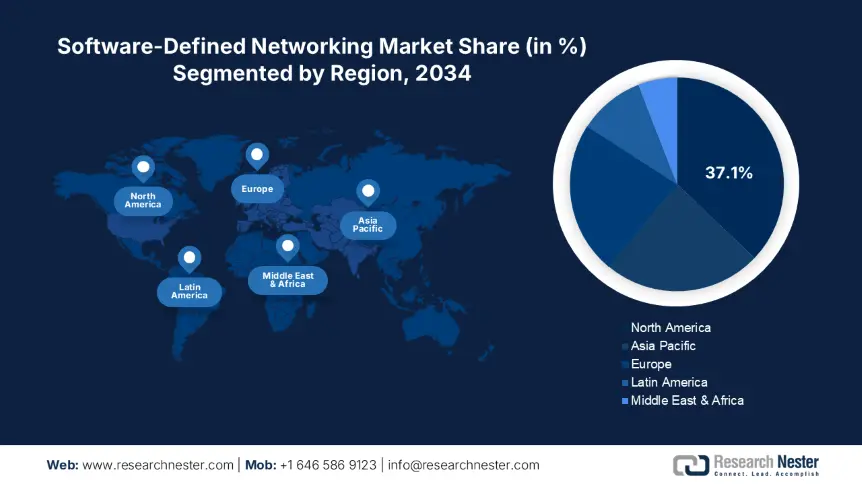

Software-Defined Networking Market - Regional Analysis

North America Market Insights

The North America SDN market is anticipated to hold 37.1% of the global revenue share through 2034. The rising federal infrastructure investments and telecom digitization are propelling the sales of software-defined networking solutions. The widespread enterprise cloud adoption in both public and private infrastructure is boosting the sales of software-defined networking technologies. The U.S. government allocated more than USD 90.5 billion between 2023 and 2024 to broadband infrastructure and digital transformation programs. In addition, the hefty public spending initiatives are set to double the revenues of key players in the coming years.

The software-defined networking adoption in the U.S. is expected to be fueled by rising demand for secure, programmable networks across the public sector and telecom domains. Cloud-native architectures driven by Amazon Web Services and Microsoft Azure have integrated SDN for real-time orchestration and segmentation. Moreover, the supportive government policies and funding are poised to encourage market players to expand their operations. The government’s Zero Trust Architecture push is expected to accelerate SDN adoption in defense and public agency networks.

Europe Market Insights

The Europe software-defined networking market is poised to capture 21.5% of the global revenue share throughout the study period. The EU-funded innovation initiatives and increasing demand for cloud-native infrastructure are expected to propel the deployment of SDN solutions. The European Commission’s Digital Europe Programme has reserved €7.6 billion in funding through 2027, with nearly €1.7 billion allocated to advanced digital infrastructure, including SDN. Moreover, the strategic public-private investment partnership is further set to drive the sales of software-defined networking technologies in the coming years.

The sales of software-defined networking systems in Germany are estimated to be driven by high public sector investments and robust enterprise digitalization programs. The strong industrial demand for programmable networks is creating lucrative earning opportunities for key players. The BMDV’s Digital Strategy allocated more than €6.5 billion to critical IT infrastructure from 2021 to 2025, with SDN positioned as a core technology for building flexible, secure, and scalable networks. In addition to this, the expansion of 5G infrastructure and cloud data centers is set to accelerate the trade of SDN solutions in the coming years.

Country-Specific Insights

|

Country |

Government/Program |

Investment Amount (2021-2024) |

Purpose / Focus Area |

|

United Kingdom |

Digital Infrastructure Investment Fund (DSIT) |

£375.5 million |

SDN-enabling infrastructure for cloud and telecom networks |

|

France |

France Numérique / ARCEP / Numeum |

€1.5 billion |

Telecom orchestration, enterprise networks, smart cities |

|

Italy |

National Recovery and Resilience Plan (PNRR) – ICT allocation |

€920.2 million |

5G/SDN deployment in public services and SMEs |

|

Spain |

Plan de Digitalización de las Administraciones Públicas |

€642.6 million |

Public cloud-SDN integration, smart city backbone networks |

|

Sweden |

Post- och telestyrelsen (PTS) Innovation Support |

SEK 4.4 billion (~€370.4 million) |

SDN trials in rural connectivity and green data centers |

|

Netherlands |

Digital Economy Strategy (EZK Ministry) |

€580.6 million |

SDN in enterprise WANs, broadband virtualization |

|

Finland |

National Cyber Security Centre – SDN for public infra |

€340.1 million |

Secure SDN backbone for critical services |

|

Denmark |

Ministry of Climate and Digitalization Initiatives |

€210.8 million |

Sustainable SDN infrastructure in municipal networks |

APAC Market Insights

The Asia Pacific software-defined networking market is foreseen to increase at a CAGR of 13.5% between 2025 and 2034, owing to aggressive digital transformation programs and public sector investment in programmable networks. The telecom, cloud infrastructure, and healthcare IT sectors are boosting the demand for advanced SDN solutions. China, Japan, India, and South Korea are high-earning marketplaces for SDN manufacturers. India’s MeitY confirmed a 19.9% CAGR in SDN investment from 2015 to 2023, with 2.9 million SMEs integrating SDN in cloud connectivity.

China is projected to lead the sales of SDN solutions owing to the massive government spending and industrial integration of programmable networks. The Ministry of Industry and Information Technology (MIIT) reveals that the public-sector investment in SDN-centric digital infrastructure crossed ¥48.5 billion between 2020 and 2024. This investment supported SDN expansion in 5G backhaul, edge computing, and smart manufacturing hubs. The China Academy of Information and Communications Technology (CAICT) further reveals that more than 3.2 million enterprises have deployed SDN in 2023, with financial services, energy, and logistics as leading sectors. The country’s 14th Five-Year Plan for Digital Economy is also contributing to the increasing trade of software-defined networking solutions.

Country-Specific Insights

|

Country |

2023-2024 SDN Funding |

Notable Stats |

|

Japan |

¥205B (~$1.7B) |

2024 budget up 23.9% from 2022 |

|

Malaysia |

RM2.4B (~$510M) |

SDN adoption doubled (2013–2023), 78.4% funding increase |

|

South Korea |

₩1.86T (~$1.5B) |

70.1% of public cloud systems on SDN by 2023 |

|

Indonesia |

IDR 7.2T (~$485M) |

Focus on SDN for digital health and cloud infrastructure |

|

Australia |

AUD 831M |

Used in federal data exchange & eHealth |

Key Software-Defined Networking Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global market is mostly dominated by gigantic companies, with the top 3 players holding more than 40.0% of the total share. The leading companies are focused on technological innovations to attract a wider consumer base. They are also forming strategic partnerships with other players to expand the market reach and product offerings. Furthermore, mergers & acquisitions, and regional expansion are poised to double the revenues of key players in the coming years. Also, industry giants are prioritizing open-source SDN controllers, AI-based traffic optimization, and hybrid cloud orchestration as part of their growth strategies in a highly software-centric ICT environment.

Here is a list of key players operating in the global market:

|

Company Name |

Country of Origin |

Revenue Share 2024 |

|

Cisco Systems, Inc. |

United States |

19.7% |

|

VMware, Inc. |

United States |

12.5% |

|

Huawei Technologies Co., Ltd. |

China |

10.2% |

|

Juniper Networks, Inc. |

United States |

8.8% |

|

Nokia Corporation |

Finland (Europe) |

7.5% |

|

Hewlett Packard Enterprise (HPE) |

United States |

xx% |

|

Arista Networks, Inc. |

United States |

xx% |

|

NEC Corporation |

Japan |

xx% |

|

Ericsson AB |

Sweden (Europe) |

xx% |

|

Dell Technologies, Inc. |

United States |

xx% |

|

Versa Networks, Inc. |

United States |

xx% |

|

Extreme Networks, Inc. |

United States |

xx% |

|

Tata Communications Ltd. |

India |

xx% |

|

Axiata Group Berhad |

Malaysia |

xx% |

|

Telstra Corporation Ltd. |

Australia |

xx% |

|

Cisco Systems, Inc. |

United States |

xx% |

|

VMware, Inc. |

United States |

xx% |

|

Huawei Technologies Co., Ltd. |

China |

xx% |

|

Juniper Networks, Inc. |

United States |

xx% |

|

Nokia Corporation |

Finland (Europe) |

xx% |

Below are the areas covered for each company in the software-defined networking market:

Recent Developments

- In May 2024, VMware launched NSX+, its upgraded SDN platform with embedded Zero Trust micro-segmentation. The company states that the enterprise adoption of NSX+ rose by 21.5% in the first two months post-launch.

- In March 2024, Cisco Systems announced the launch of its Cloud Application Control Engine (CACE). This is an AI-integrated SDN controller designed for multi-cloud orchestration.

- In February 2024, Huawei Technologies Co., Ltd. introduced CloudFabric 3.0, an SDN hardware-software convergence for hyperscale data centers. The company reports that this platform leads to a 42.5% enhancement in network throughput and 20.6% lower power consumption.

- Report ID: 4980

- Published Date: Jul 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Software-Defined Networking Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert