Software-Defined Perimeter Market Outlook:

Software-Defined Perimeter Market size was valued at USD 7.2 billion in 2025 and is projected to reach USD 1,460.8 billion by the end of 2035, rising at a CAGR of 34.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of software-defined perimeter (SDP) is estimated at USD 12.9 billion.

The market is portraying immense growth owing to the increasing need for enhanced cybersecurity solutions, coupled with increased adoption among organizations to secure their networks. As evidence, CSIS reported that in September 2022, hackers launched a cyberattack on the Mexican Defense Ministry by breaching its systems and accessing six terabytes of sensitive data. It further stated that the stolen information included internal communications, criminal records, and details revealing Mexico’s surveillance of Ken Salazar, the U.S. Ambassador to Mexico, raising considerable concerns about privacy and national security.

Furthermore, the data from PNNL in December 2021 revealed that the implementation of software-defined networking in energy delivery systems causes both initial and ongoing costs that must be carefully considered by the manufacturers making investments in this field. It also stated that the initial expenses include the procurement of SDN-compatible hardware such as switches and controllers, along with potential costs for software licenses, especially if commercial solutions are chosen over open-source alternatives. Moreover, network design, traffic engineering, and the configuration of flow rules also necessitate considerable investments in this sector.

Key Software-Defined Perimeter Market Insights Summary:

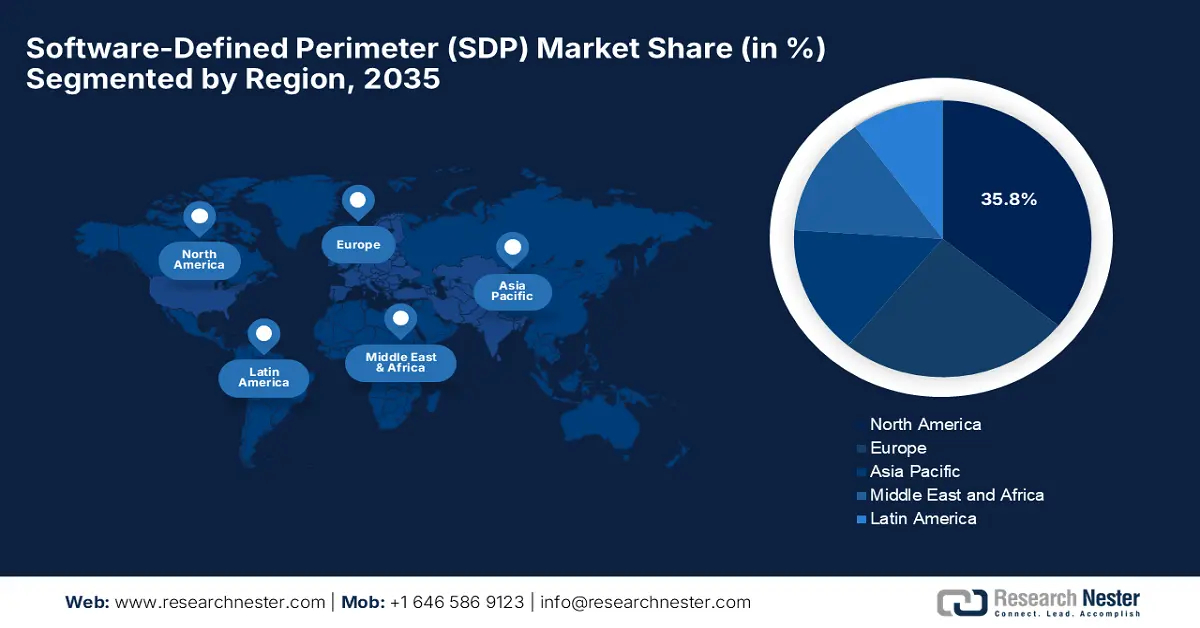

Regional Highlights:

- North America is anticipated to dominate the Software-Defined Perimeter (SDP) Market with a 35.8% revenue share by 2035, owing to a robust cybersecurity ecosystem and strong adoption of zero-trust frameworks.

- Asia Pacific is poised to exhibit the fastest growth during 2026–2035, impelled by rapid digital transformation, cloud expansion, and government-led cybersecurity initiatives.

Segment Insights:

- The cloud-based segment of the Software-Defined Perimeter (SDP) Market is projected to hold a dominant 60.7% revenue share during 2026–2035, propelled by the accelerating cloud migration trend and increasing adoption of cloud-based SDP solutions.

- The organization size large enterprises segment is anticipated to account for 55.5% share by 2035, driven by escalating cybersecurity challenges and the need to safeguard complex IT infrastructures.

Key Growth Trends:

- Adoption of cloud computing & remote work

- Strong emphasis on zero trust security models

Major Challenges:

- Complex integration with legacy systems

- Limited awareness and adoption

Key Players: Cisco Systems, Inc., Palo Alto Networks, Inc., Akamai Technologies, Inc., Check Point Software Technologies Ltd., Fortinet, Inc., Zscaler, Inc., VMware, Inc. (Broadcom), Juniper Networks, Inc., Ericsson, Nokia Corporation, NEC Corporation, Versa Networks, Inc., Cato Networks Ltd., Appgate, Perimeter 81 Ltd., Tata Communications Ltd., Telstra Corporation Limited, Lumen Technologies, Inc., DataLink, Samsung SDS.

Global Software-Defined Perimeter Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.2 billion

- 2026 Market Size: USD 12.9 billion

- Projected Market Size: USD 1460.8 billion by 2035

- Growth Forecasts: 34.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, Japan

- Emerging Countries: India, China, Singapore, South Korea, Australia

Last updated on : 10 October, 2025

Software-Defined Perimeter Market - Growth Drivers and Challenges

Growth Drivers

- Adoption of cloud computing & remote work: This aspect fosters a favourable business environment in this sector since there has been a remarkable shift towards cloud-based services, and widespread adoption of remote work has fundamentally changed how organizations manage their IT environments. BLS in October 2024 reported that COVID-19 resulted in a rise in remote work, with the average increase across industries being 14.9 percentage points in a span of three years. Further, the shift was associated with a 1.2 percentage-point increase in total factor productivity during the same period.

- Strong emphasis on zero trust security models: This has gained enhanced traction in recent years since the zero-trust security framework operates under the principle of never trust, always verify, encouraging more firms to opt for remote employment. In January 2023, WEF reported that the number of digital jobs across all nations that can be performed remotely is expected to grow by approximately 25%, reaching around 92 million roles by the end of 2030. Also, this shift offers considerable benefits for workers, employers, and nations.

- Cutting-edge technological breakthroughs: The amplifying innovations in terms of artificial intelligence and machine learning are rearranging the growth dynamics in the market. For instance, in June 2022, Johnson Controls reported that it acquired Tempered Networks to enhance cybersecurity for connected buildings by integrating Tempered’s zero-trust-based Airwall technology. Besides, Airwall uses software-defined perimeters to create encrypted, authenticated communication tunnels, enabling extremely secure, micro-segmented network access across devices, edge gateways, and cloud platforms.

Global Cyber Operations: Espionage, Disruption, and Data Thefts

|

Year |

Perpetrator |

Target |

Type of Incident |

|

May 2025 |

China |

Czech Foreign Ministry |

Cyber Espionage |

|

May 2025 |

Russia |

Entities in Tajikistan |

Cyber Espionage |

|

May 2025 |

Turkey |

Kurdish Military (Iraq) |

Cyber Espionage |

|

April 2025 |

Algeria-linked |

Morocco's Social Security Fund |

Data Breach |

|

April 2025 |

Unattributed |

U.S. Bank Regulators (OCC) |

Cyber Espionage |

|

February 2025 |

North Korea |

ByBit Cryptocurrency Exchange |

USD 1.5 Billion Cryptocurrency Theft |

|

January 2025 |

Russia |

Ukrainian Critical Infrastructure |

Disruptive Attacks |

|

December 2024 |

China |

U.S. Treasury Department Vendor |

Data Breach |

|

November 2024 |

China |

Global Telecom Providers (Salt Typhoon) |

Large-scale Cyber Espionage |

|

October 2024 |

China |

Canadian Government Networks |

Cyber Espionage |

|

October 2024 |

China |

U.S. Presidential Campaigns |

Cyber Espionage |

|

July 2024 |

CrowdStrike (Faulty Update) |

Global IT Systems |

Major Service Outage |

|

June 2024 |

Unattributed |

Indonesia's National Data Center |

Ransomware Attack |

|

May 2024 |

China |

UK Ministry of Defence |

Data Breach |

|

March 2024 |

Russia |

German Military Officials |

Leak of Sensitive Conversation |

|

January 2024 |

Russia |

Microsoft Corporate Systems |

Corporate Espionage |

|

December 2023 |

Russia |

Ukraine's Kyivstar Telecom |

Major Disruptive Attack |

|

December 2023 |

Ukraine |

Russian Tax Service |

Disruptive Attack |

|

November 2023 |

Russia |

Danish Power Companies |

Cyber Espionage |

|

September 2023 |

Indian Hacktivists |

Canadian Government Websites |

DDoS Attacks |

Source: CSIS

Major AI and Security Solutions Released by Top Tech Firms

|

Company |

Announcement |

Details |

Year |

|

Cisco |

Secure Network Architecture for AI Workplaces |

Unified management platform, AI-optimized devices, quantum-resistant security |

2025 |

|

Fortinet |

FortiGate 200G Next-Gen Firewall |

High performance firewall with AI-powered security, supports Wi-Fi 7 |

2024 |

|

Zscaler |

Acquisition of Avalor |

Integration of AI-driven security data fabric for real-time insights |

2024 |

Source: Company Official Press Releases

Challenges

- Complex integration with legacy systems: This is one of the primary challenges in the SDP market since integrating these solutions with existing legacy IT infrastructure is extremely complex. Also, most of the organizations still rely on traditional network architectures, and security systems may not be completely compatible with modern SDP frameworks. Furthermore, this complexity increases both implementation time and costs, which can slow down adoption and limit scalability in this sector.

- Limited awareness and adoption: This aspect negatively influences the upliftment of the market since most of the organizations, especially small and medium entities, face problems with no proper awareness about these technologies and their benefits. Therefore, the existence of a gap in understanding leads to slower adoption rates, thereby creating hesitation among organizations to make investments in this field. Additionally, concerns about cost, complexity, and disruptions to existing workflows also hinder adoption.

Software-Defined Perimeter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

34.2% |

|

Base Year Market Size (2025) |

USD 7.2 billion |

|

Forecast Year Market Size (2035) |

USD 1,460.8 billion |

|

Regional Scope |

|

Software-Defined Perimeter Market Segmentation:

Deployment Segment Analysis

The cloud-based segment is expected to garner the largest revenue share of 60.7% during the forecast duration. The dominance of the segment is effectively attributable to the surge in cloud migration, which drives the adoption of cloud-based SDP solutions. In September 2021, Safe-T Group Ltd. announced a joint Zero Trust Network Access solution with Thales, integrating its ZoneZero SDP-based technology with Thales' SafeNet Trusted Access cloud service. This combined offering enhances secure remote access by enforcing identity-based policies and strong multi-factor authentication for users regardless of location or device, hence denoting a wider segment scope.

Organization Size Segment Analysis

In terms of organization size large enterprises segment is expected to capture a share of 55.5% by the end of 2035. The growth in the segment is highly subject to the cybersecurity challenges; wherein large enterprises have complex IT environments and extensive user bases. Besides, they also make heavy investments in SDP to secure critical assets, ensure compliance, and support remote workforces across different nations. Further, the high cost of breaches and regulatory requirements motivates higher SDP adoption in this segment.

Type Segment Analysis

Based on the type of software solutions segment is predicted to grab a share of 45.4% in the software-defined perimeter market during the analyzed tenure. Their flexibility, scalability, and easier integration with existing IT infrastructure are the key factors behind this leadership. In April 2021, Appgate notified that it has launched a new version of its software-defined perimeter solution, introducing clientless, browser-based zero trust network access for secure connections without agents or plug-ins. Besides, this update enables secure access for contractors, IoT devices, and unmanaged endpoints while improving policy administration and reducing help desk load.

Our in-depth analysis of the software-defined perimeter market includes the following segments:

|

Segment |

Subsegments |

|

Deployment |

|

|

Organization Size |

|

|

Type |

|

|

Vertical |

|

|

Security Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Software-Defined Perimeter Market - Regional Analysis

North America Market Insights

North America is expected to lead the software-defined perimeter market by capturing the largest revenue share of 35.8% by the end of 2035. The leadership of the region is effectively attributable to a mature cybersecurity system, increased adoption of zero-trust frameworks, and extensive cloud infrastructure. In January 2023, Perimeter 81 reported that it had enhanced its converged network security platform by adding malware protection to safeguard users against evolving internet-borne threats. It also stated that this defends against a wide range of threats, such as zero-day and polymorphic attacks, using a combination of signature-based detection and machine learning.

The U.S. has established strong dominance in the regional software-defined perimeter market owing to a combination of strong federal and state cybersecurity mandates, high awareness of advanced threats, and a robust base of technology vendors. This can be testified from the White House report published in January 2025, which stated that the country’s President has issued a new executive order to strengthen national cybersecurity by building on EO 14028 and the national cybersecurity strategy. Besides, it mandates stricter requirements for secure software development, supply chain transparency, and third-party software attestations to counter threats, particularly from adversarial states.

Canada has a huge opportunity to capitalize on the software-defined perimeter market productively led by sectors such as government, healthcare, and financial services, which emphasize data security and privacy for enhanced protection. In March 2025, Plurilock Security Inc. declared that it had secured a CAD$1.4 million (USD 1.08 million), three-year contract with the Treasury Board of Canada Secretariat to deliver secure IT solutions through its subsidiary, Integra Networks. Therefore, this move deliberately reinforces Plurilock’s position as a trusted cybersecurity provider for critical government infrastructure, thereby positively impacting market growth.

Percentage of Remote Workers by Industry for 2021 and 2022

|

Industry |

2021 (%) |

2022 (%) |

|

Computer systems design and related services |

62.5 |

57.8 |

|

Data processing, internet publishing, and other info. services |

60.0 |

49.9 |

|

Publishing industries, except the internet (includes software) |

53.8 |

51.1 |

|

Insurance carriers and related activities |

50.2 |

46.3 |

|

Securities, commodity contracts, & other fin. Invest. & related act. |

47.1 |

35.6 |

|

Funds, trusts, and other financial vehicles |

47.1 |

35.6 |

|

Miscellaneous professional, scientific, and technical services |

42.1 |

37.1 |

|

Management of companies and enterprises |

39.4 |

33.0 |

|

Federal reserve banks, credit intermediation, and related activities |

39.3 |

30.9 |

|

Motion picture and sound recording industries |

38.7 |

29.8 |

|

Broadcasting and telecommunications |

36.6 |

32.1 |

|

Performing arts, spectator sports, museums, and related activities |

35.1 |

30.8 |

|

Computer and electronic products |

30.5 |

23.9 |

|

Legal services |

29.9 |

23.4 |

|

Utilities |

24.2 |

16.5 |

|

Real estate |

23.2 |

22.7 |

|

Water transportation |

23.2 |

15.8 |

Source: BLS

APAC Market Insights

The Asia Pacific region is likely to showcase the fastest growth rate during the forecast period, primarily fueled by a rapid digital transformation across both private and public sectors, especially the expansion of cloud services, 5G infrastructure, and remote workforce enablement. Besides, enterprises are increasingly seeking security architectures that support zero trust, hybrid cloud environments, and strong identity-centric access controls. On the other hand, governments across most nations are pushing cybersecurity policies enabling huge adoption for SDP.

China is maintaining strong dominance in the regional software-defined perimeter market owing to the strong policy initiatives which are favoring digital sovereignty, secure cloud computing, and hybrid architectures combining both on‐premises and cloud resources. CISA in September 2025 reported that the country’s state-sponsored cyber actors, linked to several China-based tech firms, have been compromising global networks since at least 2021, targeting telecommunications, government, transportation, and lodging sectors, further strongly necessitating SDP solutions.

There has been an accelerated adoption of software software-defined perimeter market in India, backed by the rise of remote work, growing use of cloud infrastructure, frequent cyber threats driving demand for modern, identity and context-based access controls, and governmental push for digital sovereignty and regulation. For instance, in October 2025, the country’s government reported that the union budget allocated a total of USD 94.2 million for cybersecurity initiatives, hence making it suitable for standard market growth.

Europe Market Insights

Europe’s market of software-defined perimeters is expected to retain its strong position from 2026 to 2035, owing to the shift of enterprises towards zero-trust security frameworks. The region also benefits from increasing cloud adoption and regulatory focus on data protection. In June 2025, Microsoft reported that it had launched a new European security program to strengthen cybersecurity across the continent, focusing on AI-driven threat intelligence sharing, increased investments in cyber resilience, and expanded partnerships to disrupt cybercriminal networks, hence positively impacting market growth.

Germany has a strong potential in the software-defined perimeter market, readily facilitated by its strong industrial base, especially in manufacturing and engineering, wherein operational technology needs to be securely integrated with IT systems. Besides, the pioneers in this country are proactively making investments in this field to safeguard proprietary data, support secure digital transformation, and comply with evolving cybersecurity standards. Furthermore, the presence of large multinational enterprises is also creating a heightened demand for scalable and centrally managed access solutions.

The U.K. is en route towards lucrative business opportunities in the software defined perimeter market across numerous sectors such as finance, healthcare, and government sectors, where protection of sensitive data is paramount. Therefore, the country’s government in April 2024 revealed that cybersecurity breaches remain widespread in UK organisations, wherein phishing being the dominant attack vector. Besides, the medium and large businesses face significantly higher breach rates, with rising attention to risk management and governance, thus denoting a positive market outlook.

UK Cyber Security Breaches Survey 2024

|

Category |

Businesses |

Charities |

|

Breaches in the past 12 months |

50% overall, 74% large, 70% medium |

32% overall, 66% high-income |

|

Most common attack type |

Phishing (84%) |

Phishing (83%) |

|

Average cost of breach |

£1,205 (avg.), £10,830 (med/large) |

£460 |

|

Risk assessment conducted |

31% overall, 72% large |

26% overall |

|

Cyber insurance coverage |

43% overall |

34% overall |

|

Cybersecurity as a board priority |

75% overall, 98% large |

63% overall, 93% high-income |

|

Formal cyber strategy in place |

66% large, 58% medium |

47% high-income |

|

Awareness of Cyber Essentials |

12% overall, 59% large |

11% overall |

|

Experienced cyber crime |

22% overall, 58% large |

14% overall |

|

Most common cybercrime |

Phishing (90%) |

Phishing (94%) |

|

Experienced fraud via cybercrime |

3% overall, 7% large |

1% overall |

|

Formal incident response plan |

22% overall, 73% large |

19% overall, 50% high-income |

Source: GOV.UK

Key Software-Defined Perimeter Market Players:

- Cisco Systems, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Palo Alto Networks, Inc.

- Akamai Technologies, Inc.

- Check Point Software Technologies Ltd.

- Fortinet, Inc.

- Zscaler, Inc.

- VMware, Inc. (Broadcom)

- Juniper Networks, Inc.

- Ericsson

- Nokia Corporation

- NEC Corporation

- Versa Networks, Inc.

- Cato Networks Ltd.

- Appgate

- Perimeter 81 Ltd.

- Tata Communications Ltd.

- Telstra Corporation Limited

- Lumen Technologies, Inc.

- DataLink

- Samsung SDS

The global software-defined perimeter (SDP) market is extremely competitive and fragmented, wherein there is a strategic convergence with secure access service edge frameworks. The prominent players, including cloud native specialists such as Zscaler and Cato Networks, compete with legacy security vendors such as Cisco and Palo Alto Networks, who are integrating SDP into their ecosystems. Furthermore, the strategic initiatives are heavily focused on technological integration, embedding SDP within comprehensive SASE platforms, hence positively impacting market growth.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In February 2025, Invisinet Technologies announced that it is entering a strategic distribution partnership with immixGroup to deliver its advanced Zero Trust cybersecurity solutions to the public sector, including federal, state, and local government entities.

- In April 2025, Palo Alto Networks announced significant enhancements to its Prisma SASE platform, including the launch of Prisma Access Browser 2.0, the world’s only SASE-native secure browser designed for today’s perimeterless, cloud-first workplaces.

- Report ID: 8186

- Published Date: Oct 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Software-Defined Perimeter Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.