Software-Defined Data Center Market Outlook:

Software-Defined Data Center Market size was over USD 83.75 billion in 2025 and is anticipated to cross USD 509.98 billion by 2035, witnessing more than 19.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of software-defined data center is assessed at USD 98.67 billion.

The growth of the market can be attributed to the rise in the adoption of the Internet of Things (IoT) worldwide together with the rising need for software-defined networking (SDN) to control the network in a unified manner using rule-based management. As per findings, there were nearly 13 billion IoT-connected devices in 2022, and that number is expected to almost double to approximately 26 billion by 2030. Hence, with software-defined DCN envisioned to address the heterogeneity and application-specific requirements of IoT in the context of DCN, the market is anticipated to grow with the increasing number of IoT-connected devices worldwide.

In addition to these, factors that are believed to fuel the market growth of software-defined data centers include the increasing development of hybrid cloud applications together with the expansion of the software-defined storage portfolio by some of the market key players. For instance, IBM Corporation in October 2022, announced the addition of Red Hat storage product roadmaps and Red Hat associate teams to the IBM Storage business unit, to bring consistent application and data storage across on-premises infrastructure and cloud. Moreover, the increasing emphasis and importance of infrastructure consistency, application agility, IT management, and flexible consumption consistency are further anticipated to boost the growth of the SDDC market.

Key Software-Defined Data Center Market Insights Summary:

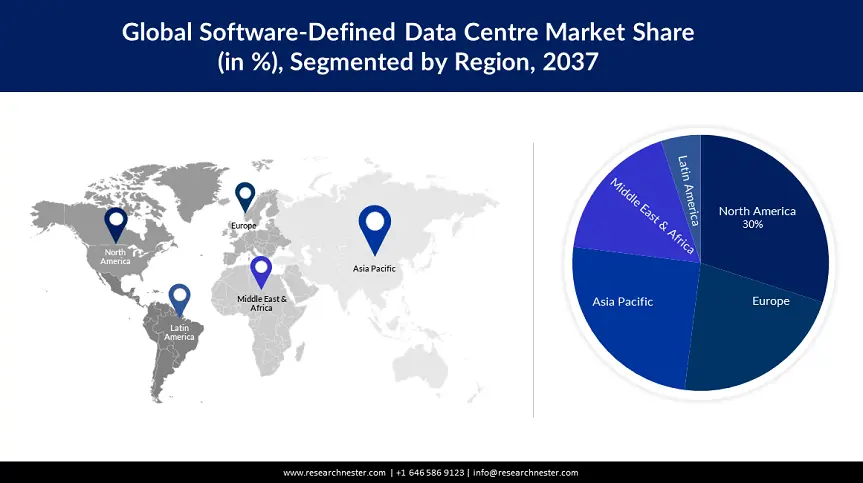

Regional Highlights:

- The North America software-defined data center market is projected to capture a 37% share by 2035, attributed to the presence of major software firms and investments in IT infrastructure.

- The Europe market is expected to secure a 23% share by 2035, attributed to the evolving IT landscape and adoption of virtualization and cloud services.

Segment Insights:

- The smes segment in the software-defined data center market is expected to hold a 64% share by 2035, driven by favorable government initiatives and global start-up trends.

- The it & telecom segment in the software-defined data center market is projected to capture a 40% share by 2035, influenced by rapid digitalization and adoption of technologies like 5G.

Key Growth Trends:

- Expanding Popularity of Data Centers

- Rising Adoption of Cloud Storage Architecture

Major Challenges:

- Lack of a universally accepted virtualization standard for networks

- Lack of strong IT infrastructure

Key Players: VMware, Inc,Microsoft Corporation, Dell Inc., Hewlett Packard Enterprise Development LP, Juniper Networks, Inc., Citrix Systems, Inc., Oracle Corporation, IBM Corporation, Cisco Systems, Inc., Huawei Technologies Co., Ltd., Fujitsu Limited.

Global Software-Defined Data Center Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 83.75 billion

- 2026 Market Size: USD 98.67 billion

- Projected Market Size: USD 509.98 billion by 2035

- Growth Forecasts: 19.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 11 September, 2025

Software-Defined Data Center Market Growth Drivers and Challenges:

Growth Drivers

-

Expanding Popularity of Data Centers – which is depicted by their increasing number. It was observed that in 2022, there were more than 8,000 data centers in the world. Moreover, as in a software-defined data center, all elements of the infrastructure viz, networking, storage, CPU, and security are virtualized and delivered as a service, these data centers are gaining more popularity over traditional data centers. Since the entire provisioning and operation of the infrastructure are driven by software, they provide cost efficiency and enhanced agility and productivity. All these factors are anticipated to propel the market growth over the forecast period.

-

Increasing Adoption of Cost-Effective Business Models - By pooling infrastructure resources, standardizing management tools across infrastructure layers, and enabling policy-driven provisioning, an SDDC enables IT groups to retain control over provisioning, reduce costs and establish a path to application modernization. It was observed that the operational expenditure (OPEX) of SDDC was almost 50% lower than that of traditional data centers whereas the IT productivity of companies using SDDC rose by 65%.

-

Rising Adoption of Cloud Storage Architecture – as per findings, by 2025, 60% of infrastructure and operations (I&O) leaders worldwide are anticipated to implement at least one of the hybrid cloud storage architectures, which is a significant rise from 20% in 2022. This approach is expected to unlock bi-directional application and data mobility based on a shared, secure, and cloud-scale software-defined storage foundation, indirectly leading the market growth.

-

Growing Valuation of SaaS Companies Worldwide – for instance, it was found that the median valuation for a public SaaS company is 15x forward revenue in 2023.

Challenges

-

Lack of a universally accepted virtualization standard for networks – is anticipated to hamper the market growth as to create software-defined environments, organizations will need to rethink universally accepted standards and adapt many IT processes accordingly. These may include automation, metering, billing, executing service delivery, service activation, and service assurance. Moreover, as all these factors depend on highly complex processes, issues like failing legacy applications in cases where they are just dropped in without accounting for parameters like latency, suitability to a distributed architecture, and fault tolerance at the application level can also become a deterrent.

-

Lack of strong IT infrastructure

-

Concern about data privacy

Software-Defined Data Center Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.8% |

|

Base Year Market Size (2025) |

USD 83.75 billion |

|

Forecast Year Market Size (2035) |

USD 509.98 billion |

|

Regional Scope |

|

Software-Defined Data Center Market Segmentation:

Enterprise size Segment Analysis

The global software-defined data center market is segmented and analyzed for demand and supply by enterprise size into large enterprises, and small & medium enterprises (SMEs). Out of the two enterprise sizes of the software-defined data centers, the SME segment is estimated to gain the largest market share of about 64% in the year 2035. The growth of the segment can be attributed to the surge in the number of SMEs globally owing to favorable government initiatives as well as the increasing trend of start-up businesses worldwide. For instance, it was found that there were around 330 million SMEs globally in 2020, a small increase from approximately 325 million in 2019.

Industry Segment Analysis

The global software-defined data center market is also segmented and analyzed for demand and supply by industry into IT and telecom, BFSI, government, energy & utilities, retail & e-commerce, manufacturing, healthcare, and others. Amongst these segments, the IT & telecom segment is expected to garner a significant share of around 40% in the year 2035. The growth of the segment can be attributed to the rapid development of the IT & telecom sector owing to rising digitalization worldwide together with the adoption of the various latest communication technologies such as 5G. For instance, as per estimations the investment in digital transformation worldwide is expected to almost double between the years 2022 to the year 2025 from nearly USD 1.8 trillion to around USD 2.8 trillion.

On the other hand, the BFSI segment is projected to witness a massive CAGR during the forecast period, owing to the rising adoption of cloud strategy to improve scalability, agility, and data security. This, as a result, is anticipated to create numerous opportunities for the growth of the segment in the coming years.

Our in-depth analysis of the global market includes the following segments:

|

By Component |

|

|

By Enterprise Size |

|

|

By Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Software-Defined Data Center Market Regional Analysis:

North American Market Insights

The market share of software-defined data centers in North America, amongst the market in all the other regions, is projected to be the largest with a share of about 37% by the end of 2035. The growth of the market can be attributed majorly to the presence of giant software companies as well the rising investment to develop the IT infrastructure together with rising investment in computers and software besides the growing development of software with automated storage with a tremendous focus on hardware cost reductions. As per recent data of 2023, as per predictions, the overall value for private investment in computers & software is anticipated to hit USD 1274 billion in the United States by the year-end.

Europe Market Insights

The European software-defined data center market is estimated to be the second largest, registering a share of about 23% by the end of 2035. The growth of the market can be attributed majorly to the radically evolving IT landscape in the region with the increasing number of organizations using software-defined data centers in order to increase IT agility besides reducing IT infrastructure complexity. Moreover, the growing investment by big software companies in the evolution of virtualization, container, and cloud services in the region is further anticipated to boost the market growth in the region.

APAC Market Insights

Asia Pacific region is expected to observe significant growth till 2035. The increasing number of data centers owing to various supporting economic conditions, such as tax benefits, favorable legislation for data centers, and good data privacy and protection rules in emerging economies such as China, India, and other developing nations of the region are boosting the growth of the software-defined data center market in the Asia Pacific region.

Software-Defined Data Center Market Players:

- VMware, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft Corporation

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- Juniper Networks, Inc.

- Citrix Systems, Inc.

- Oracle Corporation

- IBM Corporation

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Fujitsu Limited

Recent Developments

- VMware, Inc. announced new innovations across the VMware Cloud Provider Platform that will help cloud providers further expand their business opportunities in the new application economy. It is anticipated to enable cloud providers to deliver industrialized hybrid clouds to customers from any location including customer data centers, cloud provider data centers, VMware Cloud on AWS as a managed service, and hyperscale public clouds.

- Microsoft Corporation and London Stock Exchange Group (LSEG) entered into a long-term strategic partnership to architect LSEG’s data infrastructure using the Microsoft Cloud, and to jointly develop new products and services for data and analytics.

- Report ID: 4922

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Software-Defined Data Center Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.