Perimeter Security Market Outlook:

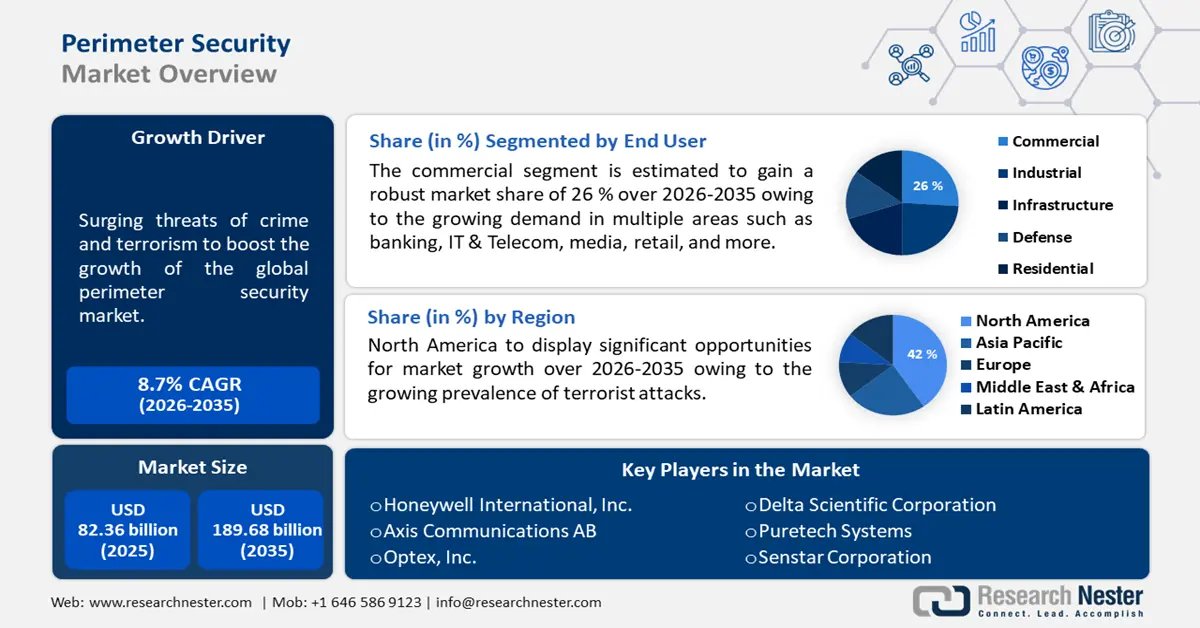

Perimeter Security Market size was valued at USD 82.36 billion in 2025 and is set to exceed USD 189.68 billion by 2035, expanding at over 8.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of perimeter security is evaluated at USD 88.81 billion.

The market growth is driven by increasing threat of crimes and terrorism. In the 2018 statistical report estimates, crime rate was registered to 2200 per 100,000 inhabitants. Henceforth, investments in security and surveillance have increased exponentially around the globe, propelling the market growth.

In addition, the market demand is impelled by increase in technological advancements in wireless technology, and an increase in adoption of various perimeter security systems such as video surveillance in workspaces, residences, movie theatres, and malls. The need to improve global safety and security along with the technological transition from analog to the IP network is also seen as a major growth factor for the global perimeter security market. For instance, Polaris Sensor Technologies in 2020, introduced Pyxis camera recently which uses infrared technology and polarization to build in thermal imaging. The United States military is currently putting the Pyxis Camera in its detection of camouflaged targets.

Key Perimeter Security Market Insights Summary:

Regional Highlights:

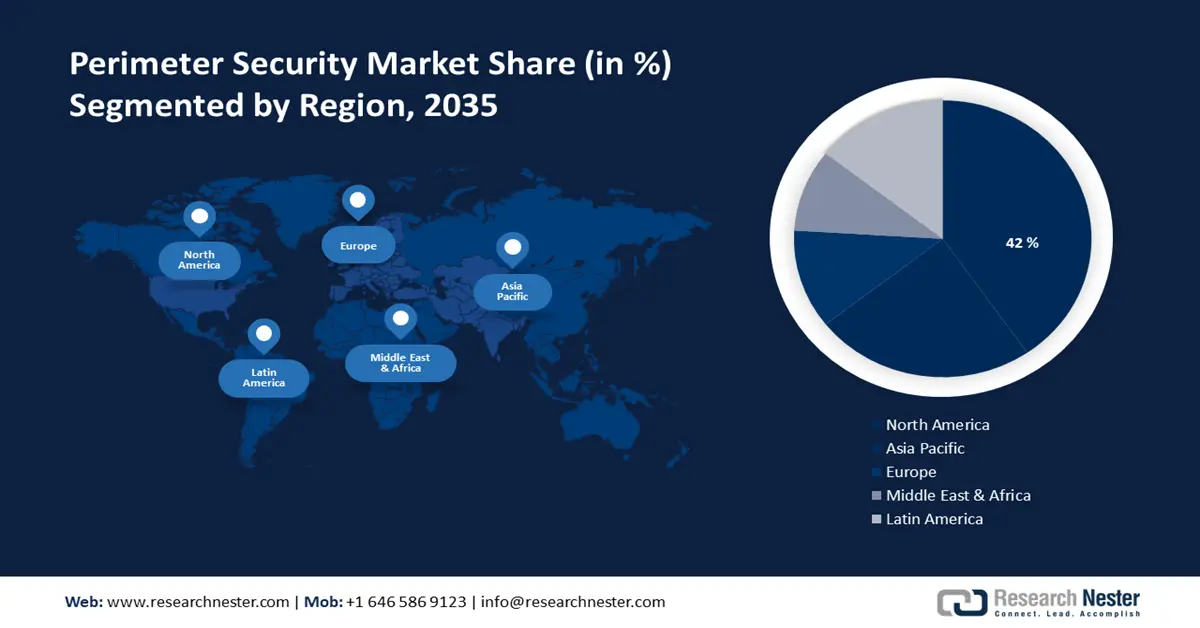

- North America perimeter security market will dominate over 42% share by 2035, driven by increasing frequency of terrorist attacks and presence of technology hubs investing in R&D.

- Asia Pacific market will capture a 28% share by 2035, driven by increasing infrastructure developments and strict government measures to counter rising crimes.

Segment Insights:

- The systems segment in the perimeter security market is expected to capture a 42% share by 2035, driven by rising concerns around public safety and increased adoption of video surveillance.

- The commercial segment in the perimeter security market is expected to experience a 26% share by 2035, driven by the increasing need for security systems in commercial spaces and government investments.

Key Growth Trends:

- Growing need for Automation of the workforce

- High prevalence of Cyberattacks, Terrorism and criminal activity

Major Challenges:

- Lack of expertise and need of Security

- False alarm triggers in the Perimeter Security Systems

Key Players: Axis Communications AB, Barrier1 Systems, Inc., Optex, Inc., Honeywell International, Inc., Tyco International Ltd., Puretech Systems, Senstar Corporation, Delta Scientific Corporation, RBtec Perimeter Security Systems, Panasonic Life Solutions India Pvt. Ltd., HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO. LTD.

Global Perimeter Security Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 82.36 billion

- 2026 Market Size: USD 88.81 billion

- Projected Market Size: USD 189.68 billion by 2035

- Growth Forecasts: 8.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 8 September, 2025

Perimeter Security Market Growth Drivers and Challenges:

Growth Drivers

- Growing need for Automation of the workforce – On account of the increasing prevalence of perimeter security systems, automation of the workforce will help expand the market more in the upcoming years. Automated operations can help reduce manual checkpoints and boost the market growth. According to an estimate, more than 50 percent of the companies use business process automation in order to automate their day-to-day repeatable tasks. It is also noted that AI considers the complexity of a threat much better than human capacity. machine intelligence and AI can compute excess data volume and cease any potential threats beyond human capability.

- High prevalence of Cyberattacks, Terrorism and criminal activity – An increase in terrorism and crime rate has led perimeter security systems be deployed in high-risk areas such as military installations. Since, terrorism poses a negative impact on economy, governments around the world focus on establishing high perimeter security rules and protect the infrastructure. For instance, on February 11th 2018, Defense Ministry of India sanctioned Rs 1487 crore to the Army to fortify the bases with highest perimeter security in the phase of hostility from neighboring countries. Moreover, there has been rise in the number of cyberattack cases around the globe, that needs cybersecurity, which in turn is anticipated to drive the growth of the market.

- Increasing developments in the Technology – Many of the organizations such as military, correctional facilities, workspaces, government, transportation, commercial are all demanding advanced perimeter security solutions to safeguard from very complex breaches. Traditional security systems are hence replaced by modern technology such as the AI, machine learning, computer vision, facial recognition. These technological advancements are another factor that boosts the Perimeter Security market. For instance, Axis Communications released an Edge-based Axis Perimeter Defender Intrusion Detector that supports AI based human and vehicle classifications that will reduce the false alarms and enhance Perimeter Security.

- Growing product launches, R&D Partnerships – It is expected that new product launches and greater investments in R&D by businesses could drive the market growth. U.S Marine Corps in 2020, announced a $16.1 million contract with FLIR Systems Inc for electro-optical sensors that can provide beyond-the-fence surveillance. Kifaru Rising Project is yet another Partnership of $3 Million between FLIR systems and WWF. Using the deep thermal imaging, rhino poaching in the area could be kept under surveillance.

- Increasing Focus on Smart City Projects –Security and surveillance are one of the primary sectors of smart city projects which involve a significant amount of investment. Several smart cities projects are going on across the globe, which addresses the need to install perimeter security solutions to enhance the security and surveillance of the area. For instance, the Government of India launched the smart city mission to modernize the existing tier 1 and tier 2 cities so that better utilization of the resources can be made. As a part of this project, India considered a plan to install smart technologies, where there would be a substantial deployment of security systems, such as perimeter intrusion detection systems and video surveillance systems. As per the Ministry of Housing and Urban Affairs, India's government has announced a smart city project in the country under which it targets to make 100 smart cities with the public and government investment of nearly US $27 billion. As a result, public safety and security would be paramount for city administrations, which in turn is anticipated to influence the global perimeter security market in the near future.

Challenges

- Lack of expertise and need of Security- general lack of understanding potential security risks could impede the growth of the global perimeter security market. As per the research reports, 66% of IT decision makers are insecure about the effectiveness of the Perimeter Security system owing to lack of technical expertise and training.

- False alarm triggers in the Perimeter Security Systems

- General concern for user Data Privacy

Perimeter Security Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.7% |

|

Base Year Market Size (2025) |

USD 82.36 billion |

|

Forecast Year Market Size (2035) |

USD 189.68 billion |

|

Regional Scope |

|

Perimeter Security Market Segmentation:

Component

The systems segment is estimated to account for 42% market share by 2035. The segment domination can be attributed to growing concerns regarding safety and security of the public, rise in criminal activities, terrorism along with growing adoption of IP cameras. The video surveillance system in the segmentation is expected to hold the largest market share throughout the forecast period. For instance, by the end of 2021, more than one billion surveillance camera has been estimated to installed around the world. Moreover, it was identified that the video surveillance security cameras demand is expected to grow as cameras are revolutionizing, and there has been newer technologies adoption.

End-user Vertical

The commercial segment is expected to garner around 26% share by 2035. Rising need and demand for perimeter security systems in retails, media, IT, telecom, banking, workspaces, are the major reason for the segment growth. On the other hand, the increasing demand of the security systems in industries, and the rising government investment for commercial purpose is another factor that is expected to contribute to the segment expansion. For instance, the German government invested EUR 350 million for the Smart City Project. This is to ensure an integrated safe system for the municipalities.

Our in-depth analysis of the global market includes the following segments:

|

By Components |

Systems

Services

|

|

By End User Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Perimeter Security Market Regional Analysis:

North American Market Insights

The North American perimeter security market is predicted to dominate 42% share by 2035, driven by increasing frequency terrorist attacks and to the presence of technology hubs investing in the R&D of the perimeter security field. It is also noted that the increased use of IoT in the region will contribute to the regional market growth. For instance, larceny theft accounted for more than 16 percent of all the theft in the United States, in the year 2019. Further, the presence of multiple technological hubs in the region, along with government supportive policies will contribute to the market growth in the region. In 2021, the US government allocated $19 Billion for cybersecurity and perimeter security systems of the country.

APAC Market Insights

The Asia Pacific perimeter security market is poised to hold share of over 28% during the forecast period. The market growth is impelled by increasing developments in infrastructure, along with strict government measures. The increasing incidences of crime such as personal crime, data theft, terrorist calls have all led to the need for perimeter security systems and thereby boosting the market growth. In addition, the regions expanding investment in the R&D of Perimeter Security systems will fuel the market revenue.

Europe Market Insights

Europe market is expected to register significant CAGR till 2035. The market growth is owing to increasing demand for perimeter security systems as a response to rising fire and other hazardous conditions. Additionally, the deployment of peripheral intrusion detection systems by the military in high-risk areas will boost the market revenue. For instance, the Germany Government has announced the formation of a cybersecurity agency to combat countries cyber–perimeter security threats. Further, the defense minister funded 350million Euros for the project.

Perimeter Security Market Players:

- Axis Communications AB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Barrier1 Systems, Inc.

- Optex, Inc.

- Honeywell International, Inc.

- Tyco International Ltd.

- Puretech Systems

- Senstar Corporation

- Delta Scientific Corporation

- RBtec Perimeter Security Systems

- Panasonic Life Solutions India Pvt. Ltd.

- HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO. LTD

Recent Developments

-

Axis Communications announced the World’s first Strobe Siren AXIS D4100-E, which can help dissuade intruders, pedestrians, ensure perimeter security and improve operational efficiency with the help of light and sound.

-

Hikvision (HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO. LTD) created Radar PTZ solution taking Perimeter Security perception to whole new level. A solid integration of video and Radar for multi-dimensional perception of Security is the main aim of the solution. Fast and automated detection of perimeter intrusion is a salient feature of the Radar PTZ solution.

- Report ID: 2684

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Perimeter Security Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.