Cybercrime and Security Market Outlook:

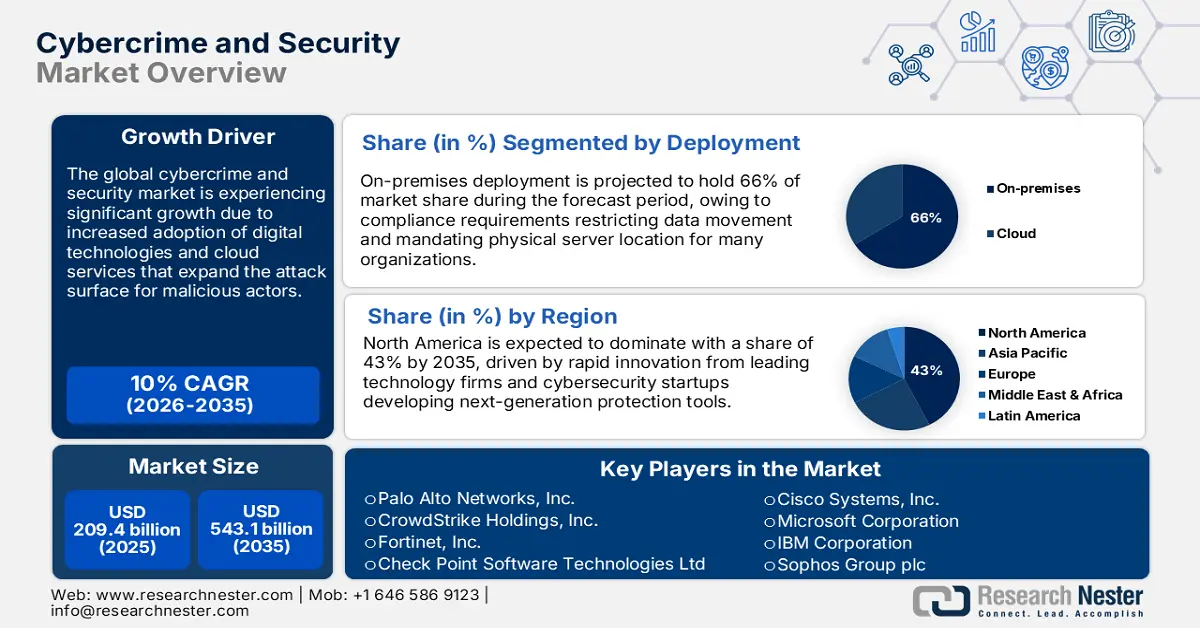

Cybercrime And Security Market size is valued at USD 209.4 billion in 2025 and is projected to reach a valuation of USD 543.1 billion by the end of 2035, rising at a CAGR of 10% during the forecast period, i.e., 2026-2035. In 2026, the industry size of cybercrime and security is evaluated at USD 230.3 billion.

The global cybercrime and security market is experiencing significant growth as companies face increasingly sophisticated cyberattacks on critical infrastructure, cloud environments, and digital assets. Leaders like Palo Alto Networks Inc., CrowdStrike Holdings Inc., Fortinet Inc., and Check Point Software Technologies Ltd. lead the way with AI-driven security products featuring threat protection, automated response, and all-risk management capabilities. In August 2025, CrowdStrike strengthened its Falcon platform with upgraded AI-powered threat detection and behavioral analytics to enhance defense on cloud and endpoint systems. Government initiatives worldwide drive business growth by enacting stringent cybersecurity regulations, facilitating the modernization of defense infrastructure through funding, and establishing public-private partnerships. This is done to combat emerging threats through end-to-end security measures like national defense programs, critical infrastructure protection programs, and international cooperation models.

The cybercrime and security market growth is fueled by technology convergence and strategic partnerships as companies develop converged security solutions based on artificial intelligence, machine learning, and automation to enhance threat detection and response capacities. Key leaders focus on developing integrated platforms that encompass endpoint security, network security, cloud defense, and identity management with real-time visibility and automated remediation across enterprise environments. In February 2025, Palo Alto Networks Inc. released Cortex Cloud as a next-generation cloud security platform that integrates Prisma Cloud's CNAPP capabilities with Cortex CDR for real-time cloud attack prevention. The platform unifies AI-driven prioritization, automated response, and simplicity with unified security operations that span code-to-cloud-to-SOC.

Key Cybercrime and Security Market Insights Summary:

Regional Insights:

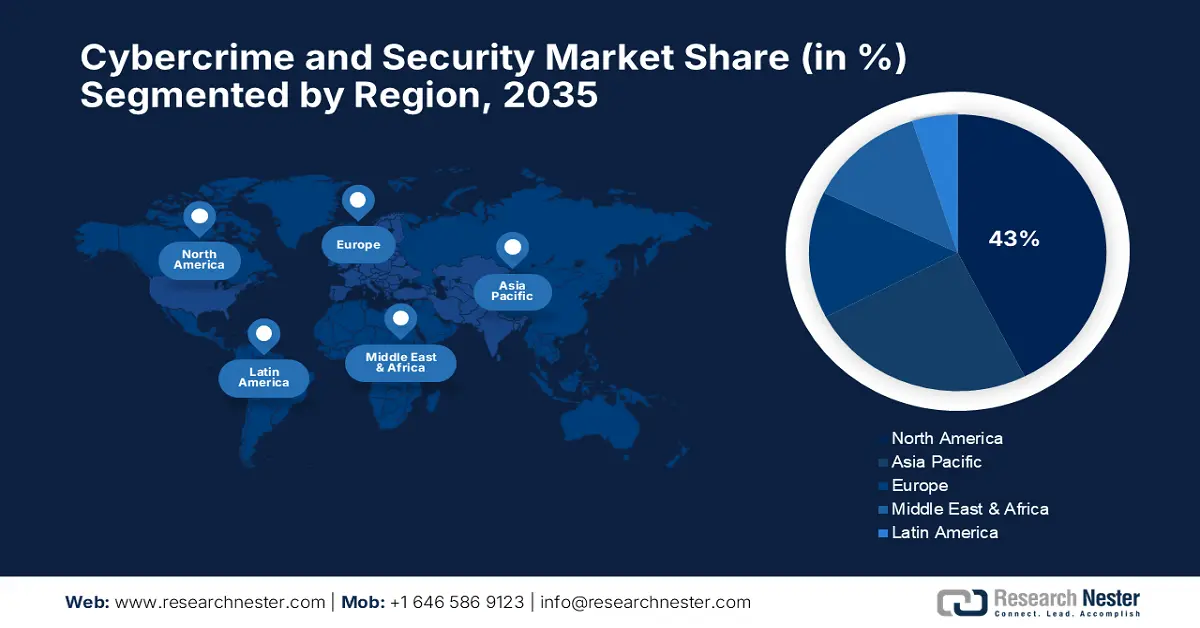

- North America Cybercrime and Security Market is projected to hold a 43% share by 2035, supported by advanced infrastructure, robust regulatory frameworks, and extensive venture capital funding enabling cybersecurity innovation.

- Asia Pacific region is expected to record a CAGR of 9.5% from 2026 to 2035, propelled by rapid digitalization, government-backed cybersecurity initiatives, and increasing threat sophistication.

Segment Insights:

- The on-premises deployment segment in the Cybercrime and Security Market is expected to capture a 66% share by 2035, driven by enterprises’ pursuit of full data control, enhanced protection, and regulatory compliance.

- Large enterprises are forecast to command a 76% share by 2035, fueled by complex operational requirements, high transaction volumes, and heavy investment in advanced cybersecurity systems.

Key Growth Trends:

- AI-powered threat detection and automated response systems

- Cloud security infrastructure expansion and hybrid protection models

Major Challenges:

- Skills shortage and cybersecurity workforce gap limitations

- Sophisticated threats and complicated attack vectors

Key Players: Palo Alto Networks, Inc., CrowdStrike Holdings, Inc., Fortinet, Inc., Check Point Software Technologies Ltd., Cisco Systems, Inc., Microsoft Corporation, IBM Corporation, Sophos Group plc, Zscaler, Inc., Samsung SDS Co., Ltd.

Global Cybercrime and Security Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 209.4 billion

- 2026 Market Size: USD 230.3 billion

- Projected Market Size: USD 543.1 billion by 2035

- Growth Forecasts: 10% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Australia, Brazil

Last updated on : 12 September, 2025

Cybercrime and Security Market - Growth Drivers and Challenges

Growth Drivers

- AI-powered threat detection and automated response systems: The deep embedding of sophisticated artificial intelligence enables cybersecurity products to identify sophisticated threats in real-time and automate response and remediation processes across diverse attack vectors. Security solutions driven by artificial intelligence scan massive volumes of data from different sources to identify unusual patterns, predict potential attacks, and impose automated countermeasures before the threats inflict damage. For example, in August 2025, Fortinet Inc. reconditioned FortiDLP with advanced AI-powered data loss prevention capabilities, including data lineage monitoring, behavior risk identification, and Shadow AI detection, to prevent the abuse of generative AI solutions. Companies in the industry are employing AI to identify high-risk behavior and to auto-correlate user activity for effective threat detection and prevention.

- Cloud security infrastructure expansion and hybrid protection models: Growing cloud utilization and digital transformation initiatives drive strong demand for end-to-end cloud security solutions that protect multi-cloud environments, hybrid infrastructures, and remote workforces. Advanced cloud security architectures support zero-trust security models, continuous monitoring, and automated threat response capabilities required to protect today's enterprise environments. In February 2025, Check Point Software Technologies Ltd. partnered with cloud security startup Wiz to offer enhanced cloud security capabilities combining Check Point's AI-driven cybersecurity solution and Wiz's cloud-native application security solution. The collaboration integrates technologies and creates a strategic business partnership enabling organizations to treat risks as priorities, gain deeper visibility into the cloud environment, and automatically prevent attacks. The partnership addresses business needs as they shift workloads and information to hybrid cloud environments.

- Government security mandates and compliance requirements to enhance cybersecurity rules and regulations: Strengthening cybersecurity rules and regulations in key sectors drives the widespread implementation of end-to-end security solutions that address data protection, privacy requirements, and critical infrastructure defense needs. Public and private sector market growth is being driven by government policies supporting improved cybersecurity through funding programs, procurement requirements, and strategic partnerships. In April 2025, Microsoft Corporation published its second Secure Future Initiative progress report, highlighting end-to-end cybersecurity improvements like Entra ID access token migration to hardware security modules, the addition of over 200 detection capabilities, and a partnership with the security research community and identify 180 vulnerabilities.

Cybercrime and Security Market Impact & Opportunity (2024 Data)

|

Metric |

Finding |

Implication for Cybercrime & Security Market |

|

Total Reported Losses |

$13.7 Billion |

Represents the massive financial impact of cybercrime, underscoring the critical need for and value of effective security solutions. |

|

Dominant Attack Vector |

Cyber-Enabled Fraud (83% of losses) |

The primary threat is not sophisticated hacking, but fraud. This drives demand for fraud detection, identity verification, and AI-powered transaction monitoring solutions. |

|

Report Volume |

333,981 Complaints |

Indicates a high volume of incidents, creating a large market for incident response, digital forensics, and recovery services. |

|

Proportional Impact |

38% of complaints cause 83% of losses |

Highlights that fraud attacks are highly targeted and effective. Security investments are shifting from pure prevention to rapid detection and response to minimize financial damage. |

Source: FBI ICR 2024

Cyber Crime Types by Complaint Count in 2024

Source: FBI ICR 2024

Phishing and spoofing dominate the cyber threat landscape, accounting for the overwhelming majority of reported incidents in 2024. This highlights a critical vulnerability in human-centric security, where social engineering remains the most effective tool for cybercriminals. The data underscores an urgent and continuous need for robust user awareness training alongside advanced email filtering and authentication technologies.

Challenges

- Skills shortage and cybersecurity workforce gap limitations: A critical shortage of skilled cybersecurity professionals presents significant challenges to organizations seeking to deploy and maintain enterprise-level security programs across increasingly complex digital environments. The technical expertise required for sophisticated cybersecurity products involves specialized skills in disciplines such as cloud security, artificial intelligence-based threat detection, and compliance models that are not typically available within most organizations. In July 2025, the National Institute of Standards and Technology (NIST) energized the mission of the National Initiative for Cybersecurity Education (NICE), which encouraged and coordinated a robust community working in collaboration to advance an integrated ecosystem of cybersecurity training, education, and workforce development. NICE addresses extreme cybersecurity skill shortages through coordinated initiatives by government, academia, and industry while developing cybersecurity education curricula and professional development guidelines.

- Sophisticated threats and complicated attack vectors: The increasing sophistication of threats and complexity of attack vectors pose extreme challenges to traditional security methods, as attackers utilize advanced techniques such as AI-based attacks, zero-day attacks, and supply chain attacks. Organizations are unable to combat multi-vector targeted attacks that incorporate social engineering tactics and advanced persistent threats, engineered to bypass established security controls. In July 2024, CrowdStrike Holdings Inc. experienced a worldwide incident when a Falcon sensor configuration update resulted in huge Windows system crashes that affected nearly 8.5 million Microsoft devices and incurred $5.4 billion losses to Fortune 500 companies. The incident justified the utmost importance of testing and gradual rollouts of security software updates.

Cybercrime and Security Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10% |

|

Base Year Market Size (2025) |

USD 209.4 billion |

|

Forecast Year Market Size (2035) |

USD 543.1 billion |

|

Regional Scope |

|

Cybercrime and Security Market Segmentation:

Deployment Type Segment Analysis

On-premises deployment is anticipated to retain 66% of cybercrime and security market share throughout the forecast period owing to enterprise demands for complete control of data, enhanced security, and support of strict regulatory frameworks. On-premises security products offer enterprises complete control over system setup, data management, and security features, with guarantees of compliance with industry-specific regulations and data sovereignty policies. Enterprise organizations and compliance-driven industries, such as finance, healthcare, and government institutions, often utilize on-premises installations to process sensitive information and maintain operational independence from third-party service providers. In October 2024, Sophos Group plc announced the acquisition of Secureworks for $859 million to establish a comprehensive cybersecurity portfolio through the union of Secureworks' extended detection and response solution with Sophos' managed detection and response platform. This convergence represents a sustained evolution in the marketplace, moving towards end-to-end on-premises security offerings.

Organization Size Segment Analysis

Large enterprises are anticipated to command 76% of cybercrime and security market share through 2035, reflecting complex operational requirements, high transaction volumes, and widespread security requirements across departments and geographies. These enterprises invest heavily in security solutions to enhance risk mitigation, reduce operational interruptions, and maintain a competitive advantage with an end-to-end security posture and regulatory compliance. For instance, Cisco Systems Inc. released comprehensive security technical updates in August 2025, including Cisco Security Cloud Control with an AI-embedded management solution, an enhanced Secure Firewall Migration Tool with improved support for Azure firewall migration, and Identity Services Engine version 3.4 with enhanced threat detection capabilities. The releases include new SAML application support, enhanced Multi-Factor Authentication, and powerful secure access capabilities to address the needs of enterprise-scale security in organizational complexity.

Application Segment Analysis

The government and defense sector is projected to garner around 41% cybercrime and security market share by 2035 because of the need for safeguarding critical infrastructure, national security objectives, and end-to-end cybersecurity requirements by public sector organizations. Sophisticated government security deployments involve safeguarding classified information, ensuring secure communication, and implementing comprehensive compliance programs that exceed commercial security practices. In May 2025, Japan Government enacted preemptive cyber defense legislation allowing the government to view basic information about online communications and proactively intervene to shut down malicious servers by means of the police and Self-Defense Forces. The legislation represents a bold shift from reactive to proactive action, requiring companies to report cyberattacks and encouraging cross-border collaboration to shape global cybersecurity standards. This showcases the leadership of the governmental sector in cybersecurity innovation and regulatory evolution.

Our in-depth analysis of the cybercrime and security market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Type |

|

|

Organization Size |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cybercrime and Security Market - Regional Analysis

North America Market Insights

North America industry is predicted to hold 43% cybercrime and security market share through 2035, positioning as a global leader in cybersecurity innovation, expansion in markets, and technology adoption across different industry sectors and application areas. Sophisticated technology infrastructure, massive venture capital investments, and comprehensive regulatory regimes that enable cybersecurity advancements, national security, protection of critical infrastructure, and economic competitiveness underpin the region. Compelling academic research facilities, government funding programs, and startup environments create appropriate conditions for the commercialization and innovation of cybersecurity and enable collaboration between technology vendors, system integrators, and end-user organizations in different deployment environments and threat scenarios.

The U.S. cybercrime and security market takes the lead in global cybersecurity development, thanks to widespread government support, substantial private sector investment, and visionary regulatory environments that promote innovation while preserving national security and defending critical infrastructure. US technology titans, such as Microsoft Corporation, IBM Corporation, and Cisco Systems Inc., drive platform innovation while enabling enterprise customers across various industries and geographies through integrated service offerings and partnerships. In June 2025, the White House released an Executive Order that maintains certain efforts to enhance the nation's cybersecurity, with a focus on protecting digital infrastructure and securing services through further steps. The order revises previous Executive Orders 13694 and 14144 and implements end-to-end cybersecurity measures that counter the mounting speed, scale, and sophistication of cyberattacks, such as nation-state attacks on critical infrastructure. This demonstrates the continued government leadership in cybersecurity policy and strategic coordination.

Canada cybercrime and security market reflects steady growth with government efforts supporting funding for technology research, innovation ecosystems development, and commercialization in key economic sectors like natural resources, manufacturing, healthcare, and telecommunications. In February 2025, the Government of Canada launched a new National Cyber Security Strategy with a long-term vision to partner with provinces, territories, Indigenous peoples, industry, and academia to ensure a secure digital future for Canada. The strategy reflects a societal responsibility approach, embracing adaptive action plans that counter significant challenges with timely action in a changing cyber environment through stakeholder participation, reflecting a comprehensive approach to national cybersecurity coordination and strategic planning initiatives.

APAC Market Insights

Asia Pacific cybercrime and security market is expected to achieve a CAGR of 9.5% throughout the forecast period, propelled by rapid economic growth, increasing digitalization, and growing sensitization of the strategic function of cybersecurity for business competitiveness in different regional economies. Regional governments have comprehensive cybersecurity policies that stimulate technology adoption in manufacturing, financial services, healthcare, and government sectors through funding programs, regulatory policies, and global cooperation schemes, thereby increasing technology transfer and fostering innovation ecosystem development. The region has massive digital transformation projects, growing e-commerce activities, and increasing sophistication of cyber threats, creating a significant demand for advanced cybersecurity solutions to support critical infrastructure protection, data privacy, and economic security.

China cybercrime and security market propels regional growth via strong government initiatives, mass domestic technology company investment, and strategic focus on digital transformation of state-owned and private sector businesses in multiple industry sectors. Government initiatives in China promote the adoption of cybersecurity, enabling the growth of the domestic technology industry and enhancing global competitiveness in key sectors such as telecommunications, manufacturing, financial services, and critical infrastructure. In June 2025, China's Ministry of Public Security announced its intention to maintain a robust counter to cybercrime and strengthen governance of cyberspace at a national conference held in Beijing. The act fosters synergy by leveraging advanced data and technology-assisted policing capabilities, integrating professional, operational, and large-scale data capabilities, and demonstrating the country's commitment to comprehensive cybersecurity regulation and law enforcement cooperation.

India cybercrime and security market demonstrates steady growth with government-sponsored digital transformation programs, global strategic alliances, and extensive support programs for technology uptake in all types of economic sectors and organizational sizes in both rural and urban India. The government encourages cybersecurity development through national digitization programs, startup schemes, and regulatory policies that promote innovation while considering data protection, cybersecurity, and operational security across various application domains. In July 2025, India Government strengthened cybersecurity in critical sectors with CERT-In conducting 9,708 security audits in FY 2024-25 across power, transport, and banking sectors. The government empaneled 200 cybersecurity agencies for a comprehensive audit, illustrating India's organized mechanism for safeguarding critical infrastructure and building cybersecurity capacity.

Europe Market Insights

Europe cybercrime and security market is poised for significant market growth between 2026 and 2035, driven by comprehensive regulatory frameworks, substantial research expenditures, and the prioritization of digital sovereignty, data protection, and the development of ethical technology among member states of the European Union. The continent focuses on responsible deployment of cybersecurity, comprehensive compliance standards, and people-centric security solutions, and drives innovation and economic competitiveness through programs for strategic digital transformation and global cooperation. These European companies invest heavily in cybersecurity R&D and collaborate with academic and government institutions to develop responsible technology solutions that comply with regulations such as the GDPR, NIS Directive, and industry standards for various areas of application and deployment environments.

The UK cybercrime and security market is experiencing robust growth due to the government's comprehensive support for technological innovation, strategic funding programs, and forward-looking regulatory approaches that balance innovation promotion with national security, data protection, and economic competition concerns. In June 2025, the UK Government introduced the Cyber Growth Action Plan to supercharge the UK's cyber sector with up to £16 million of fresh investment to boost jobs and innovation. The plan aims to grow the UK's £13.2 billion cyber sector, which is already supporting over 67,000 jobs as of 2024. Led by independent advisors at the University of Bristol and Imperial College London Centre for Sectoral Economic Performance, the Plan explores sector resilience and provides a roadmap for growth, demonstrating evidence-based government support for the growth of the cybercrime and security market.

Germany cybercrime and security market is underpinned by its high-tech manufacturing capabilities, a strong automotive industry presence, and widespread government support for the research and development of cybersecurity technology for industrial purposes and the protection of critical infrastructure. In July 2025, German federal government adopted the draft law for the "NIS-2 Implementation and Cybersecurity Strengthening Act (NIS2UmsuCG)," moving to expand and reinforce cybersecurity regulations for companies significantly. This necessitates urgent action, particularly in terms of reporting obligations, risk management, and compliance, with personal liability for executives, making proactive preparation legally advisable for all affected businesses.

Key Cybercrime and Security Market Players:

- Palo Alto Networks, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CrowdStrike Holdings, Inc.

- Fortinet, Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- Microsoft Corporation

- IBM Corporation

- Sophos Group plc

- Zscaler, Inc.

- Samsung SDS Co., Ltd.

The cybercrime and security market exhibits intense competition among established tech giants, such as Palo Alto Networks Inc., CrowdStrike Holdings Inc., Fortinet Inc., Check Point Software Technologies Ltd., and Microsoft Corporation, as well as specialty security providers and budding cybersecurity innovators across various application spaces and geographic regions. Companies compete through continuous platform innovation, strategic partnerships, bundled services, and in-your-face acquisitions that expand technological capabilities, market coverage, and customers in multiple industry verticals and geographic markets worldwide.

Latest market trends reflect a fierce drive for innovation and strategic partnerships aimed at enhancing cybersecurity. Industry leaders are constantly creating advanced products, forming strategic partnerships, and making strategic acquisitions to enhance technological capabilities and strengthen competitive positions in rapidly evolving cybercrime and security markets around the world. In December 2024, Trend Micro Incorporated announced that its Vision One, Email and Collaboration Security platform was named a Leader in the Gartner Magic Quadrant for Email Security Platforms. This recognition highlights the platform's role in providing centralized attack surface risk management (ASRM) capabilities.

Here are some leading companies in the cybercrime and security market:

Recent Developments

- In August 2025, CrowdStrike Holdings, Inc. acquired Madrid-based data observability startup Onum for $290 million to enhance Falcon Next-Gen SIEM platform with AI-native security capabilities. Onum specializes in real-time pipeline detection and anomaly identification in data flows, backed by Dawn Capital and Insight Partners.

- In April 2025, Cisco Systems, Inc. revolutionized cybersecurity at RSA Conference 2025 through comprehensive AI-driven security solutions including enhancements to Cisco XDR with Agentic AI capabilities, the launch of Foundation AI—the world's first open-source reasoning model designed specifically for cybersecurity, and deepened partnerships with Splunk.

- Report ID: 8086

- Published Date: Sep 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cybercrime and Security Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.