Network Traffic Analyzer Market Outlook:

Network Traffic Analyzer Market size was valued at USD 5.1 billion in 2025 and is projected to reach USD 9.5 billion by the end of 2035, rising at a CAGR of 6.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of network traffic analyzer is estimated at USD 5.4 billion.

The network traffic analyzer market is accelerating and is fueled by the rising number of severe cyber threats and operational shift towards cloud-centric infrastructure. The Cybersecurity and Infrastructure Security Agency has stated that cyber incidents are targeting large enterprises and have shown a rise in the volume and sophistication. As per the Federal Bureau of Investigation crime report in 2023, nearly 880,418 complaints were registered against internet cybercrime, highlighting the need for a strong network in detecting cyber threats. This threat environment is compelling firms to transform the network from a traditional perimeter to advanced network systems.

Investment in the research, development, and deployment of advanced network analysis tools is highly focused on cloud native architecture and artificial intelligence. The India cybersecurity domestic market report in 2023 depicts that the cybersecurity products market reached USD 3.76 billion in 2023, underpinning the demand for software tools. On the other hand, BFSI spending reached USD 1,738 million on cybersecurity in 2023. The National Institute of Standards and Technology highlights the need for an automated indicator sharing and analysis framework supporting R&D priorities. Furthermore, various governments are focusing on creating and analyzing processed data from diverse sources, which include virtual private clouds, software-defined wide area networks (SD-WAN), and containerized workloads, to provide a unified security posture.

Key Network Traffic Analyzer Market Insights Summary:

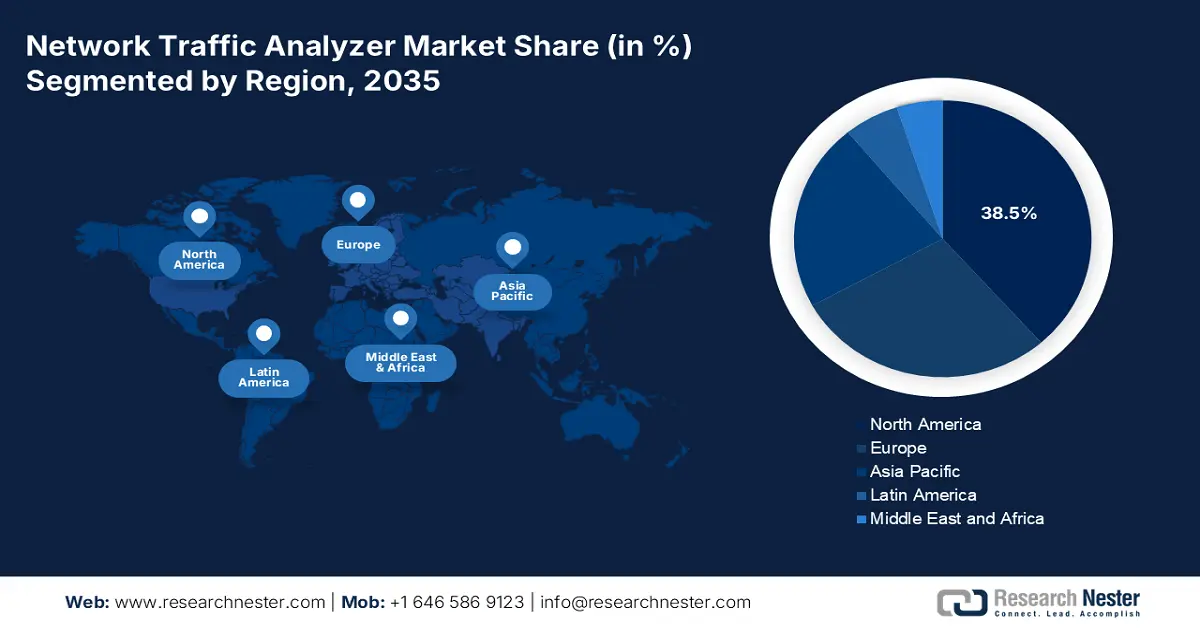

Regional Highlights:

- North America is projected to hold a 38.5% share of the network traffic analyzer market by 2035, driven by the high concentration of enterprise data centers, stringent regulatory compliance requirements, and increasing sophistication of cyber threats.

- Asia Pacific is anticipated to record a CAGR of 10.2% by 2035, propelled by rapid digitalization, heavy 5G investments, and the rising need for national cybersecurity enforcement.

Segment Insights:

- The large enterprises segment in the network traffic analyzer market is projected to hold a 65.5% share by 2035, driven by the need to secure complex network infrastructures and meet stringent regulatory compliance requirements.

- The software segment is anticipated to dominate by 2035, propelled by the rising demand for advanced analytics, AI, and ML-enabled network threat detection and behavioral analysis capabilities.

Key Growth Trends:

- Zero-trust security models

- Cloud migration and hybrid networks

Major Challenges:

- High implementation costs

- Limited market access in emerging regions

Key Players: Cisco Systems, Palo Alto Networks, VMware (Broadcom), SolarWinds, Fortinet, Juniper Networks, Kentik, ExtraHop, Darktrace, ManageEngine, IBM, Netscout, Progress Software, Paessler AG, Micro Focus, Nagios Enterprises, Splunk, Nokia, NIKSUN, InMon.

Global Network Traffic Analyzer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.1 billion

- 2026 Market Size: USD 5.4 billion

- Projected Market Size: USD 9.5 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, China

- Emerging Countries: India, South Korea, Japan, Singapore, Australia

Last updated on : 10 October, 2025

Network Traffic Analyzer Market - Growth Drivers and Challenges

Growth Drivers

- Zero-trust security models: The zero-trust framework is surging the demand for granular network telemetry. Companies are moving away from perimeter-based defenses and relying on the traffic analyzers to validate every connection. TLS 1.3 encryption and east-west traffic inspection are becoming standard features. Companies such as IBM and Broadcom are embedding encrypted traffic analytics to aid zero-trust architecture. This driver is mainly strong in regulated industries where compliance and internal threat detection are paramount.

- Cloud migration and hybrid networks: Many companies are moving towards hybrid and cloud infrastructures. Cloud-based deployments are dominating the market and according to the Advancing Cloud and Data Infrastructure Markets report in 2022, the global cloud market reached USD 600 billion. This data highlights that the cloud market growing at a fast pace and is expected to transfer, store, and analyze data more securely with the help of AI. This shift is driving demand for scalable, API-friendly solutions that offer centralized monitoring across fragmented networks.

- Rising cybersecurity threats: Nowadays, cyber-attacks are growing faster in advanced, demanding enterprises to an investment in real-time traffic analysis tools. Network analyzer helps to detect anomalies, encrypted threats, and lateral movement. Astra Security in September 2025 stated that the ransomware attacks are rising by 13% every year, and companies are actively integrating AI-based threat detection into their platforms. This trend is surging the demand for an analyzer, which provides deep inspection and behavioral analytics where data security is high.

Worldwide Gen AI Incidents Resulting in Cyber Attacks

|

Year |

Incident count |

|

2010 |

0 |

|

2011 |

0 |

|

2012 |

0 |

|

2013 |

0 |

|

2014 |

0 |

|

2015 |

0 |

|

2016 |

2 |

|

2017 |

4 |

|

2018 |

2 |

|

2019 |

5 |

|

2020 |

11 |

|

2021 |

6 |

|

2022 |

36 |

|

2023 |

107 |

|

2024 |

138 |

Source: Government of Canada, October 2024

Ransomware Incidents Registered from 2022-2023 in Canada

|

Sector |

Percentage |

|

Information Technology |

159 |

|

Finance |

157 |

|

Construction |

133 |

|

Transportation |

122 |

|

Professional Services |

112 |

|

Retail |

90 |

|

Healthcare |

75 |

|

Energy |

67 |

Source: Government of Canada, October 2024

Challenges

- High implementation costs: Network traffic analyzers tend to involve high costs in hardware, software, and trained resources, which is difficult for most organizations to adopt. Moreover, small and medium-sized businesses cannot afford the initial investment due to high cost. To overcome this, businesses are providing cheap alternatives, such as open-source systems or packaged services with easy deployment. This reduces the initial cost barriers, allowing for more widespread adoption by providing necessary monitoring, analytics, and visibility capabilities for advanced network infrastructures.

- Limited market access in emerging regions: Infrastructure limitations and low digital maturity has become the major issue in the developing regions. Constraints such as lack if skilled professionals, unreliable connectivity, and fragmented IT environments hinder deployment. To address this issue, many companies are actively focusing on the mobile friendly, lightweights, and cloud based analytical platforms which customizes for regions with digital ecosystems in emerging regions. This method supports remote monitoring, aids companies in various regions to get benefit from performance management and network visibility infrastructure constraints.

Network Traffic Analyzer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 5.1 billion |

|

Forecast Year Market Size (2035) |

USD 9.5 billion |

|

Regional Scope |

|

Network Traffic Analyzer Market Segmentation:

Organization Size Segment Analysis

Under the organization size segment, the large enterprises are dominating the segment and are expected to hold the share value of 65.5% by 2035. The segment is driven by their complex, sprawling network infrastructures, which present a larger attack surface and are subject to strict regulatory compliance mandates. Large organizations have the budget to invest in security solutions and install continuous network monitoring and vulnerability management controls to secure complex IT environments. This is the trend adopted by large enterprises, which is a constant practice with specialized security budgets and teams.

Component Segment Analysis

In the component segment, the software leads the segment due to the vital need for advanced analytics, AI, and ML capabilities, which cannot be addressed by hardware alone. Modern threats in network need software solutions to perform a deep inspection, automated detection of threats, and behavioral analysis. For example, Suricata is an open source network analysis and also a high-performance threat detection software used by private and public organizations. There are various other software which are essential to analyze vast data sets and secure the data against cyber threats.

Deployment Segment Analysis

The cloud sub-segment dominates the deployment segment due to the rapid remote and hybrid work models and migration of core infrastructure to cloud platforms. Cloud-based network traffic analyzer offers simple management, better scalability, and faster deployment in comparison to on-premises. According to the December 2024 Ministry of Information and Broadcasting report, almost 300 government departments in India have used cloud services to improve data performance, security, and storage. This transformation makes an organization with agility capable of securing dynamic and distributed digital environments effectively.

Our in-depth analysis of the network traffic analyzer market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Deployment |

|

|

Organization Size |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Network Traffic Analyzer Market - Regional Analysis

North America Market Insights

North America is the dominating region in the network traffic analyzer market and is expected to hold the market share of 38.5% by the end of 2035. The market is driven due to the high concentration of enterprise data centers, stringent regulatory compliance demands, and sophisticated cyber threats. The Next Gen Annual Report in 2022 documents that a huge investment of USD 8.5 billion is used to modernize U.S. air traffic management using advanced digital communications, network surveillance such as satellite-enabled and automated broadcast, and centralized automation management solutions. These efforts enable controllers and government agencies to monitor, analyze, and securely exchange high-volume network data, representing a major government-backed use of network traffic analysis.

U.S. is dominating the network traffic analyzer market in the North America region and is mainly driven by the cybersecurity threats and complexity of hybrid cloud infrastructures. The Cloud Security Alliance report in June 2022 states that nearly 95% companies' digital workload is expected to be deployed in the cloud naïve platforms by the end of 2025, which is a rise of 30% from 2021. Further, the Cybersecurity and Infrastructure Security Agency, the Continuous Diagnostics and Mitigation program requires advanced network monitoring for all federal networks. A key trend is the integration of AI for automated threat detection and response is moving beyond traditional monitoring to proactive security.

Canada's network traffic analyzer market is expanding significantly and is driven based on the heightened national cybersecurity priorities and increased digital transformation across the public and private sectors. The Canadian Centre for Cyber Security actively informs critical infrastructure operators to put a strong network monitoring as part of a defense-in-depth approach. According to the Government of Canada report in October 2024, USD 917.4 million is allocated for intelligence and cyber operations programs in Canada to counter national security threats. Furthermore, the government has increased focus on protecting critical infrastructure by creating sustained demand for advanced network traffic analysis solutions from key industries like energy and finance.

Loss Due to Cyber Crime in Canada in CAD

|

Year |

Amount |

|

2021 |

$383 million |

|

2022 |

$530 million |

|

2023 |

$567 million |

Source: Government of Canada, October 2024

APAC Market Insights

The Asia Pacific is the fastest-growing region in the network traffic analyzer market and is expected to grow at a CAGR of 10.2% by 2035. The region is driven by the rapid digitalization, massive investments in 5G infrastructure, and escalating cyber threats. Due to the rising cyber threats, governments are actively integrating national cybersecurity policies, including China's Cybersecurity Law and India's National Cyber Security Strategy, which compel rigorous network monitoring for important infrastructure. A primary driver is the expansive growth of data centers and the adoption of cloud services in the region for advanced performance and security management tools.

China is set to lead and increase at a high pace during the forecast year. A report by the Global Times in July 2021 depicts that a draft plan was released by the Ministry of Industry and Information Technology, reporting that the cybersecurity industry is projected to exceed USD 38.62 billion by 2023 with a 15% annual growth rate. This strong government backing, combined with the proliferation of AI-powered network monitoring and industrial IoT, continues to drive the demand for sophisticated network traffic analyzers throughout China.

India is also dominating the market with the Digital India and Smart Cities campaigns, and the growth of IoT and 5G networks. According to the Ministry of Electronics and Information Technology report of 2025-2026, Rs. 782 crores have been spent on cybersecurity projects for the period from 2025 to 2026. This investment also supports the deployment of AI-based network monitoring, threat detection solutions and traffic analysis, which enhances the enterprise and government sectors throughout the country to make the digital infrastructure more resilient.

Europe Market Insights

The network traffic analyzer market in Europe is defined by strong data protection laws, a mature digital economy, and growing investment in cybersecurity. The key driver is the implementation of the EU General Data Protection Regulation (GDPR) and the NIS2 Directive, which require high-strength network security and incident reporting, forcing organizations to implement sophisticated monitoring solutions. Furthermore, the vital trend is the convergence of Artificial Intelligence and Machine Learning for threat prediction and automated response, transcending compliance to proactive security.

UK is the highest shareholder in the network traffic analyzer market in Europe and is fueled by the strong financial services sector and adherence to high cybersecurity standards post-Brexit. On the other hand, the National Cyber Security Centre also actively promotes network monitoring as a core defense. As per the Tech UK report in December 2021, the UK government has funded £2.6 billion on the National Cyber Force to bolster cyber resilience. Further, this strategy has made progress in the UK cyber security sector by generating £8.9 billion last year.

Germany is the largest market in Europe and is driven by its vast manufacturing sector and crucial infrastructure. The Federal Office for Information Security (BSI) reports a continuous high level of cyber threats, particularly ransomware. As per the Federal Office for Information Security report in 2023, Germany companies have lost nearly 203 billion euros in 2022 due to cyber attacks, and hence require a robust network traffic analyzer tool, with an emphasis on securing government and critical infrastructure networks by means of advanced monitoring capabilities.

Key Network Traffic Analyzer Market Players:

- Cisco Systems

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Palo Alto Networks

- VMware (Broadcom)

- SolarWinds

- Fortinet

- Juniper Networks

- Kentik

- ExtraHop

- Darktrace

- ManageEngine

- IBM

- Netscout

- Progress Software

- Paessler AG

- Micro Focus

- Nagios Enterprises

- Splunk

- Nokia

- NIKSUN

- InMon

The network traffic analyzer market is very competitive and defined by the presence of top giants and well-experienced cybersecurity companies. Many leading players are pursuing strategic initiatives to consolidate their position in the market. These strategies include investment in Artificial Intelligence and Machine Learning, and cloud native platforms to give predictive analytics and automate threat detection. Moreover, the strong trend on the convergence of broader security information and event management and Network Detection and Response solutions is providing a unified security posture to the customers. As networks nowadays are becoming complex with the adoption of IoT and hybrid cloud, the demand for advanced, intelligent, and scalable traffic analysis solutions is expected to drive the market further.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In July 2025, Darktrace has announced the acquisition of Mira Security, a leading provider of network traffic visibility solutions. This will improve the company’s network security leadership by aiding more insight from encrypted network traffic, and help drive the next generation of Darktrace technology.

- In July 2025, Lansweeper has announced the acquisition of Redjack, which is a pioneer in asset discovery by using network traffic analysis. Integrating Redjack’s passive, traffic-based discovery and application dependency mapping, Lansweeper improves its platform to provide security teams with complete visibility of every asset that touches the network.

- In November 2024, CableLabs released NetLLM which is a handy automated network assistance used to collect metrics from the network and pass them as text to an out-of-the-box LLM trained on natural language for analysis.

- Report ID: 8187

- Published Date: Oct 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Network Traffic Analyzer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.