Self-Organizing Network Market Outlook:

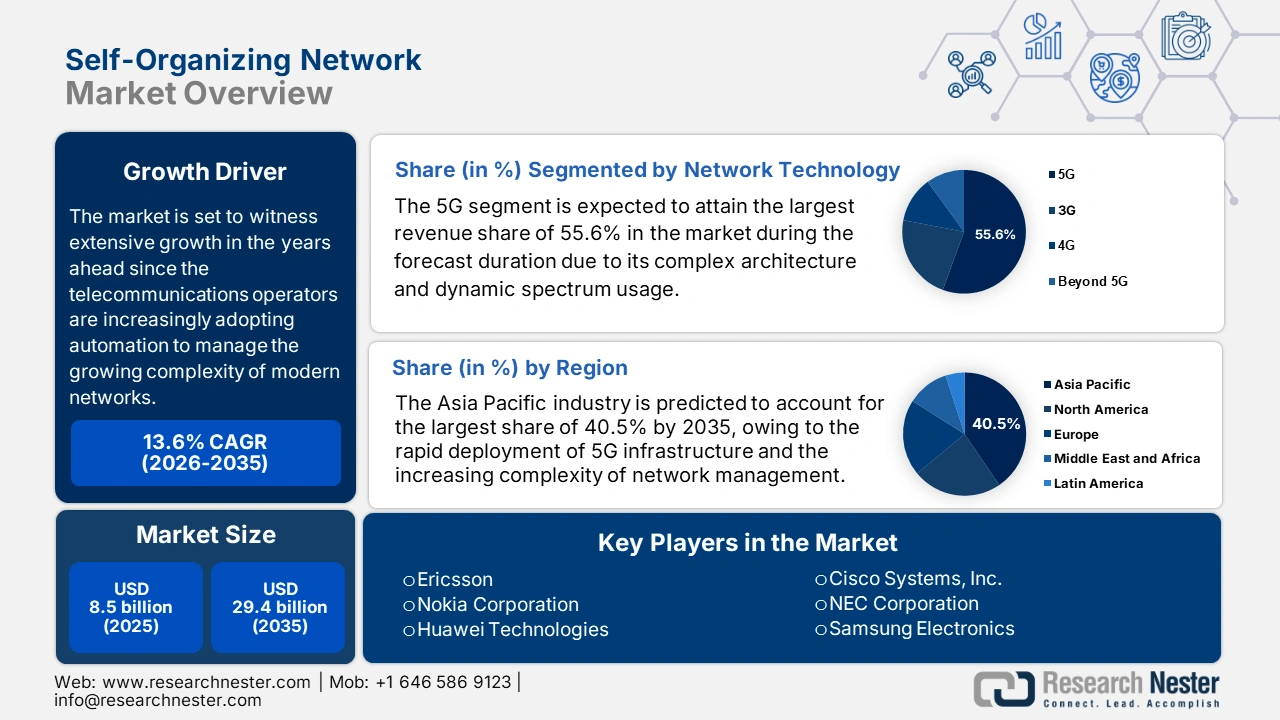

Self-Organizing Network Market size was valued at USD 8.5 billion in 2025 and is projected to reach USD 29.4 billion by the end of 2035, rising at a CAGR of 13.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of self-organizing network is evaluated at USD 9.6 billion.

The market is set to witness extensive growth in the years ahead since the telecommunications operators are increasingly adopting automation to manage the growing complexity of modern networks. This can be testified from the article from the Department of Telecommunications in February 2025, which states that AI is rapidly transforming India’s telecom sector by enhancing network optimization, automating customer support, and improving security. It also stated that the leading operators, such as Jio, Airtel, and Vi, are leveraging AI for predictive maintenance, fraud detection, and personalized services.

Furthermore, the market benefits from the reduced operational costs, wherein the advancements in AI and machine learning are accelerating the capabilities of these systems. Technological Forecasting and Social Change in June 2023 analyzed 102 studies on how automation technologies impact employment across multiple levels of analysis, which found that industrial robots and AI have the complete potential to both displace and create jobs.

Key Self-Organizing Network Market Insights Summary:

Regional Highlights:

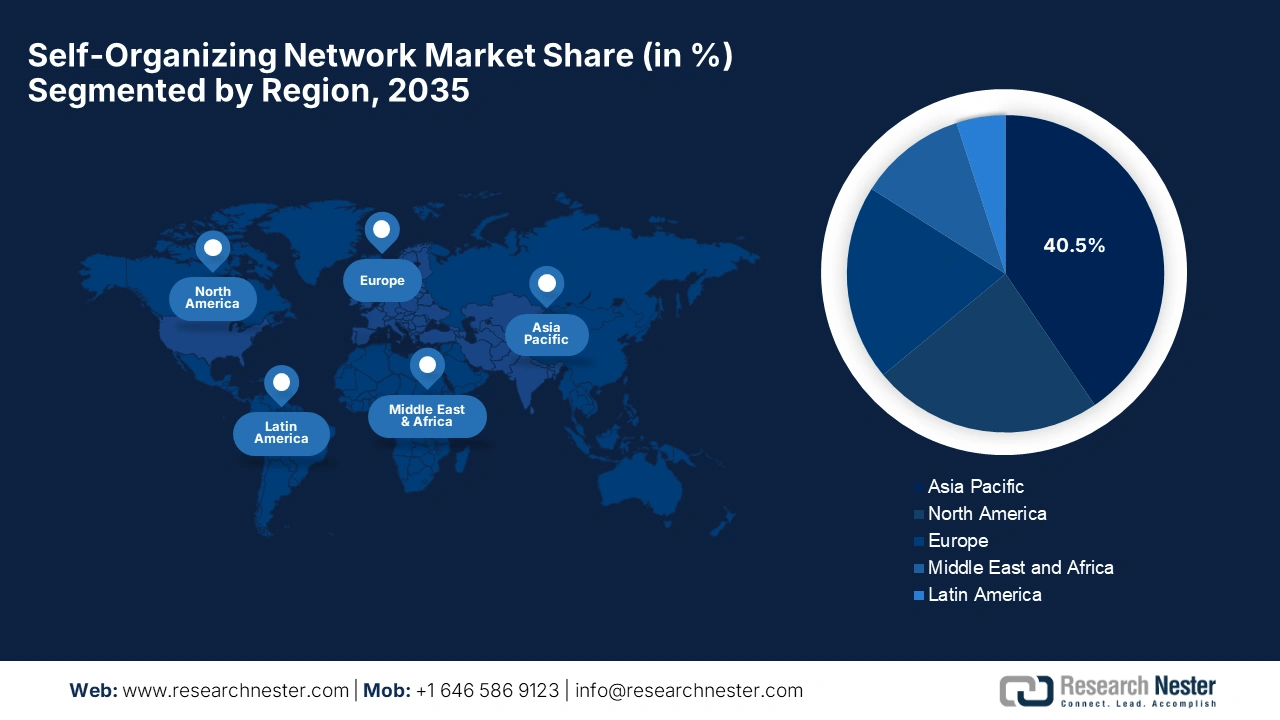

- The Asia Pacific region is anticipated to command a 40.5% share of the Self-Organizing Network Market by 2035, stimulated by the rapid expansion of 5G infrastructure and the growing intricacy of network management.

- North America is projected to exhibit robust growth through 2026–2035, impelled by rising adoption of advanced wireless technologies and substantial investments in SON solutions to automate and optimize network operations.

Segment Insights:

- The 5G segment in the Self-Organizing Network Market is projected to hold a 55.6% revenue share during the forecast period 2026–2035, propelled by its complex architecture, dynamic spectrum utilization, and stringent latency demands enabling efficient radio access network management.

- The Hybrid SON segment is anticipated to secure a 42.4% share by 2035, owing to its blend of centralized and distributed automation that facilitates real-time decision-making and enhances global network optimization.

Key Growth Trends:

- Explosion in mobile data traffic

- 5G deployment & advanced generation networks

Major Challenges:

- Complexity of network environments:

- Data Privacy & security concerns

Key Players:Ericsson, Nokia Corporation, Huawei Technologies, Cisco Systems, Inc., NEC Corporation, Samsung Electronics, ZTE Corporation, Comarch S.A., Amdocs, Vodafone Group Plc, Airspan Networks, Parallel Wireless, Cellwize, Rohde & Schwarz, Accuver Americas Inc., Keysight Technologies, Bharti Airtel Limited, Telstra Corporation Limited, Telekom Malaysia Berhad.

Global Self-Organizing Network Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.5 billion

- 2026 Market Size: USD 9.6 billion

- Projected Market Size: USD 29.4 billion by 2035

- Growth Forecasts: 13.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.5% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: India, Indonesia, Brazil, Mexico, United Kingdom

Last updated on : 9 October, 2025

Self-Organizing Network Market - Growth Drivers and Challenges

Growth Drivers

- Explosion in mobile data traffic: This is the primary driver for the market since there has been a rapid increase in smartphone usage, video streaming, cloud services, and IoT devices, all generate much more traffic in this field. The PEW Research Center revealed that as of 2024, 98% of U.S. adults own a cellphone, and 91% own a smartphone, which marks a significant increase of 35% in 2011. Therefore, this shift highlights growing mobile connectivity, hence providing an optimistic opportunity for players in this field.

- 5G deployment & advanced generation networks: The rollout of 5G and beyond‑5G in the upcoming years increases network complexity in multiple spectrum bands, denser cells, network slicing, and ultra-low latency requirements, wherein SON helps manage self-configuration, self-healing, self‑optimization in these complex architectures. In September 2024, Nokia announced that it had entered into a major three-year partnership with Vodafone Idea to deploy 4G and 5G networks across key cities in India. Besides, under this alliance, Nokia will also supply its MantaRay SON solution to optimize and automate network performance, enhancing service quality for over 200 million VIL subscribers, hence denoting a positive market outlook.

- Network virtualization: The modern architectures, such as NFV, SDN, cloud, and edge, create a flexible, virtual infrastructure that is extremely susceptible to automation, and dynamic optimization is one of the important drivers in this field. In April 2025, ETSI reported that it released a White Paper and Group Report underscoring the emergence of NFV towards a platform-oriented Telco Cloud architecture designed to support future networks such as 6G. Besides, this emphasizes cloud-native principles, automation, and AI integration, thereby enhancing scalability and sustainability in telecom networks.

Evolution of Mobile Network Usage and Its Implications for SON Adoption

|

Year |

Event |

Details |

|

2022 |

Total mobile subscriptions reach 8.58 billion |

Compared to 7.95 billion global population (ITU data). |

|

2023 |

50th anniversary of the first mobile call |

Celebrated globally as a milestone in telecommunications history. |

|

2023 |

Mobile subscribers exceed 5.4 billion people. |

According to GSMA, over two-thirds of the global population has at least one mobile subscription. |

Source: WEF

Key Advances in Self-Organizing Network Deployments and Innovations

|

Company(s) |

Location |

Key News/Development |

Year |

|

Huawei |

ASEAN (Malaysia) |

Launched One Network, One Cloud, Three Platforms AI architecture for the intelligent steel industry |

2025 |

|

Airbus & Ericsson |

Hamburg & Toulouse |

Deployed private 5G networks for factory digitalization; expansion planned across Europe and beyond |

2025 |

|

Nokia & stc Group |

Saudi Arabia |

Deployed AI-powered MantaRay Cognitive SON for autonomous RAN, boosting network efficiency and energy savings |

2024 |

|

Deutsche Telekom, Nokia, Fujitsu, Mavenir |

Germany (Neubrandenburg) |

First commercial multi-vendor Open RAN deployment using Nokia, Fujitsu, and Mavenir to support 2G/4G/5G |

2023 |

Source: Company Official Press Releases

Challenges

- Complexity of network environments: This is one of the primary challenges in the self-organizing market wherein modern telecom networks come with extremely complex integrations, where technologies such as 4G, 5G, and soon 6G, and different hardware and software components. Therefore, managing this complexity and ensuring optimization in terms of SON algorithms across vendor equipment poses a major challenge necessitating advanced AI and machine learning capabilities.

- Data Privacy & security concerns: This is yet another restraint, causing an obstacle to the firms involved in the market, since SON solutions rely on collecting and analyzing large amounts of network data to optimize performance. Moreover, this creates concerns about data privacy and cybersecurity risks, creating hesitation among consumers and manufacturers to make investments in this field, thereby complicating SON deployment and acceptance.

Self-Organizing Network Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.6% |

|

Base Year Market Size (2025) |

USD 8.5 billion |

|

Forecast Year Market Size (2035) |

USD 29.4 billion |

|

Regional Scope |

|

Self-Organizing Network Market Segmentation:

Network Technology Segment Analysis

Based on network technology 5G segment is expected to attain the largest revenue share of 55.6% during the forecast duration. Its complex architecture, dynamic spectrum usage, and stringent latency requirements enable SON for managing radio access networks is the key factor behind this leadership. In June 2021, Nokia reported that its self-organizing network software is being deployed by BT’s mobile division, EE, to enhance network reliability and reduce operational costs across its 4G and 5G networks. Besides, the solution automates complex network management tasks, improves handover performance, and supports a multi-vendor environment, hence denoting a wider segment scope.

Type Segment Analysis

In terms of type hybrid SON segment is anticipated to capture a share of 42.4% by the end of 2035. The subtype combines centralized and distributed automation advantages, thereby enabling faster real-time decisions with coordinated global network optimization. Furthermore, this flexibility suits the complexity of future networks, which includes 5G and more, coupled with increased demand from operators demanding agility and cost efficiency.

Application Segment Analysis

Based on the application network optimization segment is projected to garner a significant share of 38.8% during the analyzed timeframe. The efficient resource allocation, load balancing, and interference mitigation are the key factors fueling leadership in this segment. Besides the surge of connected devices and traffic heterogeneity in 5H or 6G networks necessitates continuous optimization to meet KPIs and improve QoE, thereby reducing manual operational costs.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Network Technology |

|

|

Type |

|

|

Application |

|

|

Deployment |

|

|

End user |

|

|

Offering |

|

|

Network Infrastructure |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Self-Organizing Network Market - Regional Analysis

APAC Market Insights

Asia Pacific is anticipated to hold the largest share of 40.5% in the self-organizing network market by the end of 2035. The leadership of the region is effectively driven by the rapid deployment of 5G infrastructure and the increasing complexity of network management. In July 2025, Ericsson reported that it had expanded its partnership with SoftBank Corp. to supply advanced 4G and 5G network equipment across Hokkaido, Tohoku, Kanto, Hokuriku, and Tokai regions, and parts of the Kansai region, including low, mid, and high-frequency bands. The company also stated that it will provide energy-efficient radio access network products such as Massive MIMO AIR 3255 and AIR 6476, along with AI-optimized RAN Compute hardware and software.

China is augmenting its leadership in the regional market owing to its pivotal role in 5G deployment and network infrastructure development. Besides, telecom operators are also integrating the technologies to manage the growing complexity of their networks. As evidence, China Telecom in August 2025 reported that it received Asia’s Best CSR award, supporting the company’s broader efforts to deploy advanced network technologies such as self-organizing networks that enhance operational efficiency and promote greener telecom infrastructure.

India is showcasing tremendous upliftment in the self-organizing network market, productively led by the surge in mobile data consumption, the expansion of 5G networks, and the rise of digital services. In September 2025, Vodafone Idea notified that it had launched 5G services in Kolkata, which marks its second 5G city in West Bengal, offering unlimited data plans, thereby enhancing its network. Vi partnered with Nokia to deploy AI-powered self-organizing networks and energy-efficient infrastructure, hence making it suitable for standard market growth.

Selected Telecommunications Statistics for India and Jio Platforms

|

Category |

Statistic |

Value / Detail |

|

5G Rollout (India) |

Total 5G Sites Deployed (as of July 30, 2023) |

308,466 |

|

|

Formal 5G Launch Date |

October 1, 2022 |

|

Jio 5G Coverage |

Cities/Towns with LIVE 5G |

6,258 |

|

|

States/UTs with LIVE 5G |

34 |

|

Market Forecast |

5G Subscriptions in India Region (Forecast for 2028) |

690 million |

|

|

Share of Total Mobile Subscriptions (2028) |

53% |

|

Economic Impact |

5G's Projected Contribution to India's GDP by 2030 |

~2% |

|

|

Projected 5G Sector Revenue by 2030 |

~USD 180 billion |

|

Jio Network Scale |

4G Cells |

4.35 million |

|

|

Optical Fiber Network |

730,000 km |

|

|

Global Share of Mobile Data |

8% |

|

Jio User Consumption |

Avg. Monthly Data per User |

22 GB |

|

|

5G vs. 4G Data Consumption Multiplier |

2.6x |

|

Jio Spectrum |

Total 5G Spectrum Acquired |

24,740 GHz |

|

Jio 5G Core |

Operational 5G Core Locations |

40+ |

Source: NCCS

North America Market Insights

North America is expected to witness strong growth in the self-organizing network market owing to the increasing adoption of advanced wireless technologies and the increasing complexity of mobile networks. Besides, telecom operators across this region are making heavy investments in SON solutions to automate network management, enhance performance, and reduce operational costs. Furthermore, there has been a focus on 5G rollout and push towards network automation, which has accelerated the demand in this field.

The U.S. is the key contributor to growth in the regional self-organizing network market, wherein the major carriers deploy automated network solutions to support the expanding 5G infrastructure. In September 2025, Verizon announced the launch of AI-powered innovations to transform customer experience across its stores, support, and digital services. This move highlights Verizon’s commitment to leveraging advanced technologies such as AI and software-defined networking principles to deliver personalized, efficient, and secure services to its users.

Canada is also portraying notable progress in the self-organizing network market due to a strong focus on network optimization and operational efficiency, since operators are readily opting for SON solutions to automate network planning, configuration, and maintenance. In this regard, Bell Canada in February 2025 reported that it has expanded its partnership with Nokia to accelerate 5G innovation through the deployment of Cloud RAN and future-ready Open RAN infrastructure. Besides, the company aims to make the network more agile and responsible by using Nokia’s AirScale portfolio, AI-driven MantaRay network management, and Red Hat OpenShift running on Dell infrastructure.

Europe Market Insights

Europe is recognized as one of the prominent players in the self-organizing network market, facilitated by a strong impetus from digital transformation initiatives and the drive for cross-border connectivity. In February 2025, Innovile reported that it had successfully deployed its INNTELLIGENT self-organizing network management and INNSPIRE configuration management solutions with Türk Telekom to enhance network efficiency, automation, and sustainability. Therefore, the integration of 19 SON modules and over 60 CM modules, including energy saving and load balancing, has streamlined operations and improved network performance.

Germany is maintaining a strong position in the self-organizing network market since the telecom operators in the country are integrating SON as a key enabler for supporting Gigabit Society goals and bridging the urban–rural connectivity divide. In July 2024, Deutsche Telekom reported that it is advancing its Open RAN strategy with initial commercial deployments in the country by partnering with Nokia, Fujitsu, and Mavenir to deliver 2G, 4G, and 5G services in the Neubrandenburg area. Therefore, this multi-vendor approach leverages open fronthaul technology to enable interoperability and hardware/software decoupling, promoting greater vendor diversity and innovation.

The U.K. is gaining traction in the self-organizing network market due to the intensifying competitive pressure among operators and consumer demand for ultra-reliable, low-latency services such as gaming, AR/VR. Besides, the providers in the country are focusing on investments in enhancing user experience, especially in hotspots and dense urban zones. Furthermore, partnerships with vendors and integration with cloud native RAN and edge computing are helping the country’s operators turn SON into a differentiator in network quality.

Key Self-Organizing Network Market Players:

- Ericsson

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nokia Corporation

- Huawei Technologies

- Cisco Systems, Inc.

- NEC Corporation

- Samsung Electronics

- ZTE Corporation

- Comarch S.A.

- Amdocs

- Vodafone Group Plc

- Airspan Networks

- Parallel Wireless

- Cellwize

- Rohde & Schwarz

- Accuver Americas Inc.

- Keysight Technologies

- Bharti Airtel Limited

- Telstra Corporation Limited

- Telekom Malaysia Berhad

The worldwide market is extremely oligopolistic in nature, dominated by the network infrastructure vendors such as Ericsson, Nokia, and Huawei, who are leveraging deep integration with proprietary RAN hardware. Also, there has been a strategic shift from traditional rule-based automation to AI-based, predictive SON platforms, which is rearranging the competitive dynamics in this landscape. Furthermore, the prominent players are readily making R&D investments to incorporate machine learning for proactive network healing and optimization.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In July 2025, Ericsson reported that it had expanded its partnership with Japan’s SoftBank Corp. to supply advanced 4G and 5G network equipment across multiple regions, including low, mid, and high-frequency bands.

- In March 2025, Samsung Electronics announced a collaboration with NVIDIA to advance AI-driven Radio Access Network (AI-RAN) technologies, aiming to unlock the full potential of software-based mobile networks.

- Report ID: 8182

- Published Date: Oct 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Self-Organizing Network Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.