Active Electronic Components Market Outlook:

Active Electronic Components Market size was valued at USD 482.9 billion in 2025 and is projected to reach USD 742.7 billion by the end of 2035, rising at a CAGR of 4.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of active electronic components is evaluated at USD 506.5 billion.

The active electronic components market is poised for exceptional growth owing to the heightened demand for smart devices, expansion of 5G networks, the semiconductor industry, and a surge in automotive (especially electric vehicles and industrial automation sectors. In March 2024, NIST reported that the CHIPS and Science Act of 2022 allocates around USD 52.7 billion over five years to strengthen U.S. semiconductor manufacturing, research, and workforce development, which will be administered through the CHIPS Program Office (USD 39 billion) for facility and equipment investments and the CHIPS R&D Office (USD 11 billion) for advancing technology and competitiveness. It also mentioned the key R&D programs, which include the National Semiconductor Technology Center (USD 5 billion), National Advanced Packaging Manufacturing Program (USD 3 billion), CHIPS Metrology Program USD 519 million), and the CHIPS Manufacturing USA Institute (USD 200 million), collectively enhancing the domestic R&D ecosystem.

In addition, the federal funding opportunities under CHIPS are supporting the construction, expansion, and modernization of semiconductor fabrication, materials, and equipment facilities, ensuring the consistent growth of a resilient supply chain and fostering innovation across sectors reliant on semiconductors. Besides, this strengthened infrastructure will enable faster active electronic components market debut for new electronic components and improve supply chain reliability for manufacturers as well as OEMs. Also, the strong emphasis on workforce development will cultivate a skilled talent pool, addressing labor shortages in advanced electronics production. Moreover, increased domestic production is expected to reduce dependence on imports, thereby enhancing national supply security. Hence, it boosts the active electronic components market by increasing domestic manufacturing capacity, advancing R&D in the upcoming years.

Key Active Electronic Components Market Insights Summary:

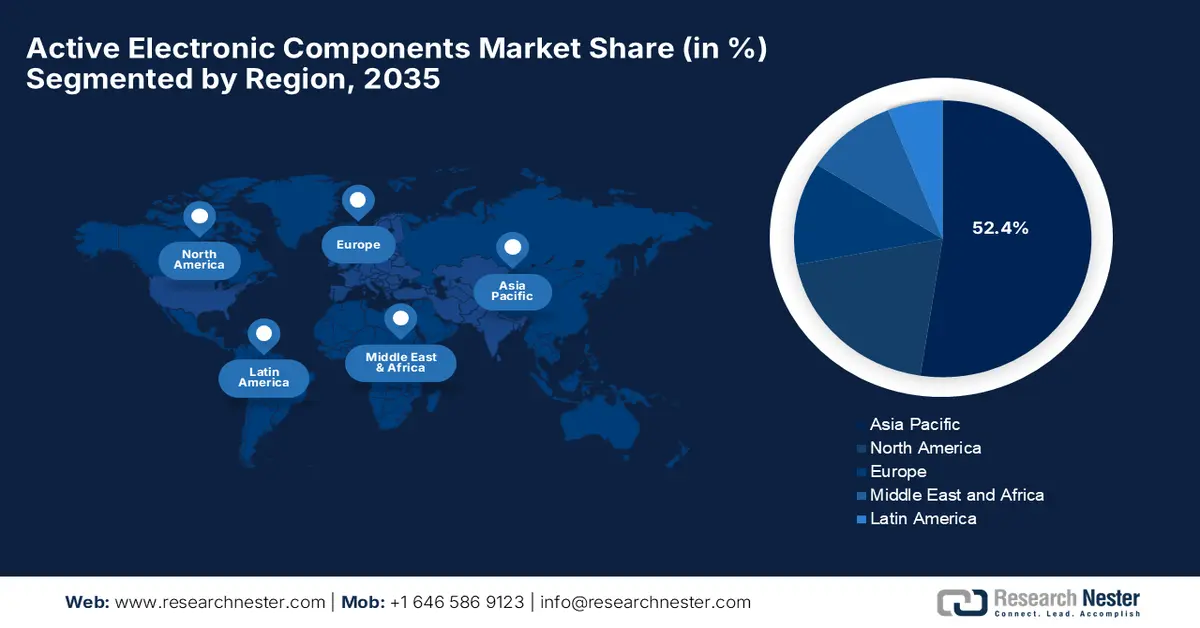

Regional Insights:

- Asia Pacific is anticipated to command a 52.4% revenue share by 2035 in the active electronic components market, underpinned by its strong manufacturing ecosystem, rising foreign investments, and sustained government-backed production initiatives

- North America is projected to retain a notable market position through 2035, supported by extensive federal investments in smart city infrastructure and accelerating 5G network deployments

Segment Insights:

- Semiconductor devices are projected to account for a dominant 58.6% revenue share by 2035 in the active electronic components market, strengthened by rising demand for energy-efficient technologies and continuous product innovation

- The consumer electronics segment is expected to secure a significant revenue contribution over the forecast period, fueled by surging adoption of microelectronic appliances, gaming devices, and advanced networking hardware

Key Growth Trends:

- Booming consumer electronics sector

- Expansion of 5G networks

Major Challenges:

- Technological complexity

- Regulatory compliance

Key Players: Analog Devices (U.S.), Infineon Technologies (Germany), NXP Semiconductors (Netherlands), STMicroelectronics (Switzerland), ON Semiconductor (U.S.), Renesas Electronics (Japan), Broadcom Inc. (U.S.), Qualcomm (U.S.), Microchip Technology (U.S.), Toshiba Electronic Devices & Storage (Japan), Maxim Integrated (U.S.), ROHM Semiconductor (Japan), Skyworks Solutions (U.S.), GigaDevice Semiconductor (China).

Global Active Electronic Components Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 482.9 billion

- 2026 Market Size: USD 506.5 billion

- Projected Market Size: USD 742.7 billion by 2035

- Growth Forecasts: 4.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (52.4% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Brazil, Indonesia, Vietnam, Mexico

Last updated on : 16 December, 2025

Active Electronic Components Market - Growth Drivers and Challenges

Growth Drivers

- Booming consumer electronics sector: The rising adoption of smartphones, tablets, wearables, and IoT devices drives continued demand for microcontrollers, power ICs, and discrete semiconductors, which in turn prompts a profitable business environment for the active electronic components market. As per the article published by the government of India in October 2025, the country’s electronics component manufacturing scheme is efficiently driving growth, wherein the first seven approved projects worth ₹5,532 crore (USD 670 million) are expected to generate around ₹44,406 crore (USD 5.4 billion) in output and create over 5,000 jobs. It covers high-value components such as camera module sub-assemblies, multi-layer and HDI PCBs, copper clad laminates, and polypropylene film. Furthermore, the scheme strengthens India’s domestic electronics ecosystem by boosting international competitiveness and integrating the country into international value chains.

India Exports of Active Electronic Components (Parts of Integrated Circuits and MIC) by Country - 2023

|

Export Partner |

Export Value (USD 1,000) |

Quantity |

|

World |

95,845.13 |

– |

|

U.S. |

10,968.38 |

– |

|

Nigeria |

9,990.79 |

– |

|

France |

7,821.05 |

– |

|

Germany |

7,556.45 |

– |

|

South Africa |

7,299.33 |

– |

|

Egypt, Arab Rep. |

2,908.14 |

29,440,500 |

|

Turkey |

2,476.71 |

14,586,000 |

Source: WITS

- Expansion of 5G networks: The rollout of 5G networks across the globe necessitates high-speed, high-frequency semiconductors for base stations, routers, and mobile devices is an important growth driver for the active electronic components market. Active components such as RF ICs and amplifiers are highly essential for low-latency, high-bandwidth communication. As per the April 2025 article published by 5G Americas, the 2025 5G landscape shows strong global momentum with more than 2.25 billion connections and North America leading in performance, which in turn drives sustained demand for advanced semiconductor and active electronic components. Also, the expanding standalone 5G, FWA adoption, enterprise pilots, and the transition toward 5 G are accelerating requirements for RF chips, power electronics, processors, and network hardware, hence supporting maintenance growth across the electronics and semiconductor ecosystem.

- Automotive electrification and industrial automation: The rise in terms of electric vehicles, ADAS systems, and industrial automation consistently increases demand for power management ICs, microcontrollers, and sensors. Besides these, the active electronic components market plays a highly essential role in EV power systems and robotics. In January 2024, the U.S. Department of Commerce reported that its 2024 preliminary investment of USD 162 million under the CHIPS and Science Act to expand Microchip Technology’s U.S. production of microcontroller units, thereby providing a direct boost to automotive electrification. Since MCUs are central to EV power systems, battery management, and ADAS controls, the planned tripling of output across Microchip’s Colorado and Oregon fabs strengthens domestic availability of these critical active electronic components. Hence, this move reduces reliance on foreign foundries and supports a more stable supply chain for EVs and industrial automation systems.

Active Electronic Components Key Market Opportunities & Innovations

|

Year |

Company |

Product / Collaboration |

Market Opportunity |

Notes |

|

2025 |

onsemi & NVIDIA |

800 VDC power solutions for AI data centers |

High–power ICs, SiC devices, high-efficiency converters |

Focus on data center power distribution and high-voltage systems |

|

2024 |

Texas Instruments (TI) |

AWR2544 radar sensor & DRV3946-Q1 / DRV3901-Q1 driver chips |

High -automotive MCUs, radar ICs, driver ICs for BMS & EV |

Supports ADAS, battery management, and powertrain safety |

Source: Company Official Press Releases

Challenges

- Technological complexity: The products from the active electronic components market need to evolve to meet the high-performance miniaturization and energy-efficiency demands. Also, the rapid innovation cycles are posing major challenges for manufacturers in maintaining competitive product lines while controlling costs. On the other hand, the development of next-generation semiconductors or advanced packaging solutions necessitates substantial R&D investment, specialized equipment. In this context, companies face challenges in integrating new components into existing assembly lines without compromising yield or reliability. Hence constant pressure to adopt technologies such as system-in-package solutions or heterogeneous integration, which in turn can strain smaller firms, negatively impacting active electronic components market growth.

- Regulatory compliance: The active electronic components market faces continued challenges from the regulatory bodies since they impose stricter environmental standards and international trade restrictions. Semiconductor exports are subject to U.S. Commerce Department controls, whereas environmental regulations govern chemical handling and waste management during production. Therefore, companies that are producing active electronic components must navigate through these tariff schedules, trade licenses, and evolving compliance requirements, which can increase operational costs and delay shipments. Also, trade tensions with major suppliers can exacerbate risks in obtaining critical materials and equipment, whereas non-compliance with regulatory standards to anticipate policy shifts may lead to fines, supply chain interruptions, thereby complicating planning and capital allocation in this field.

Active Electronic Components Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 482.9 billion |

|

Forecast Year Market Size (2035) |

USD 742.7 billion |

|

Regional Scope |

|

Active Electronic Components Market Segmentation:

Product Segment Analysis

In the active electronic components market, the semiconductor devices are likely to garner the largest revenue share of 58.6% over the discussed timeframe. The dominance of the segment is highly attributable to the heightened demand for energy-efficient devices and continued product innovations. Simultaneously, the heightened demand for integrated circuits in alignment with vehicle automation systems and network devices is fostering the adoption of semiconductor devices. In December 2025, the Semiconductor Industry Association revealed that the global semiconductor sales reached USD 72.7 billion in October 2025, which marks a rise of 4.7% month-to-month and 27.2% year-over-year, reflecting strong momentum across the Americas and Asia-Pacific. It also mentioned that the WSTS autumn 2025 forecast projects global sales to grow 22.5% in 2025 to USD 772.2 billion, thus indicating sustained acceleration in chip demand. This growth trend reinforces robust upstream demand for active electronic components, particularly integrated circuits, sensors, and power devices.

Application Segment Analysis

In the application segment consumer electronics segment is expected to attain a significant revenue share in the active electronic components market. The demand for microelectronic appliances and other gaming gadgets is the key factor positioning the subtype at the forefront of revenue generation in this field. Simultaneously, the networking hardware products, such as gateways, routers, and modems, are surging, propelling the continued growth of the segment. Sony, in October 2024, announced that it showcased its latest image sensor technologies at CEATEC 2024 by highlighting innovations in resolution, speed, and light perception that are widely utilized in smartphones, cameras, and gaming devices. Besides these, semiconductors are also known as electronic eyes, have become highly integral to everyday consumer electronics, thereby supporting new entertainment and practical applications. Furthermore, the firm’s image sensors held a 53% global active electronic components market share in 2023, underscoring their ongoing demand in the market.

Technology Segment Analysis

By the end of 2035, digital components based on technology will grow at a lucrative rate in the active electronic components market. The growth of the segment is highly subject to its highly essential role in modern devices such as smartphones and most consumer electronics. Also, the subtype has a higher capability for communication and data processing, increasing the uptake in this field. In addition, this trend is further supported by the rise of IoT devices, wearable technology, and connected home appliances, which rely heavily on advanced digital components for seamless functionality. The ongoing advancements in semiconductor miniaturization and energy-efficient processing are readily driving higher adoption across consumer and industrial electronics. Hence, the presence of all of these factors responsibly positions digital components as a key revenue driver through 2035.

Our in-depth analysis of the active electronic components market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

Application |

|

|

Technology |

|

|

Business Model |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Active Electronic Components Market - Regional Analysis

APAC Market Insights

Asia Pacific is predicted to hold the largest revenue share of 52.4% in the international active electronic components market by the end of 2035. The region’s dominance is effectively attributed to its strong manufacturing base, international investments, and continued government initiatives that are supporting the production process. In October 2024, PANJIT announced that it had entered into a strategic partnership with Chip One Stop to strengthen its presence in Japan and across Asia. Besides, the collaboration leverages Chip One Stop’s extensive e-commerce distribution network to provide a much faster delivery and enhanced customer experience for PANJIT’s semiconductor products. Furthermore, this partnership supports PANJIT’s expansion in automotive, industrial, consumer, and communication applications by reinforcing its commitment to quality, sustainability, and regional growth.

China is efficiently progressing in the regional active electronic components market due to rapid industrialization, extensive electronics manufacturing, and strong domestic demand for consumer electronics, automotive electronics, and telecommunications equipment. In the country, being a global hub for smartphones, computing, and automotive production, the adoption of semiconductors, microcontrollers, power management ICs, and sensors is also rapidly accelerating. In November 2025, the article published by USSC, the country’s Made in China 2025 (MIC2025) initiative, has significantly boosted the domestic semiconductor industry, wherein the foundational chip production capacity has more than doubled over the last decade. The report also underscored that the country still lags in advanced chipmaking and localizing high-end equipment. State-led investments and the expansion of companies such as SMIC have strengthened production of integrated circuits for consumer electronics, automotive, and industrial applications.

India continues to maintain its strong position in the active electronic components market, primarily fueled by increasing smartphone penetration, growth in consumer electronics, and rising adoption of electric vehicles and industrial automation. Simultaneously, the government’s initiatives, such as Make in India and production-linked incentive schemes for electronics manufacturing, are attracting global semiconductor players and boosting local production capabilities. In August 2025, the country’s government announced that it had approved four new semiconductor manufacturing projects under the India Semiconductor Mission, with a total investment of ₹4,600 crore (≈ USD 554.2 million), to be set up in Odisha, Punjab, and Andhra Pradesh. Besides, these projects include the country’s first commercial Silicon Carbide compound fab, an advanced glass-based packaging unit, and facilities producing high-power discrete semiconductors, targeting applications in EVs, defense, consumer electronics, and industrial systems, hence strengthening India’s semiconductor ecosystem.

North America Market Insights

North America has captured a prominent position in the active electronic components market due to the substantial investments by the federal government for smart cities and the ever-increasing adoption of micro-electromechanical systems and renewable energy resources. The region’s leadership is also propelled by telecom operators owing to the continued growth in 5G deployments. For instance, the Smart Cities and Communities Act of 2025 in the U.S. aims to advance the adoption of innovative and secure smart technologies across communities with a prime focus on improving efficiency, mobility, and energy productivity. It also establishes an Interagency Council on smart cities to coordinate all types of federal activities, funding, standards, and workforce development by ensuring cybersecurity, privacy, as well as equitable benefits. Furthermore, the Act efficiently promotes technology demonstration grants, technical assistance, and international cooperation to accelerate high-performance smart city solutions.

The U.S. is augmenting its leadership over the regional active electronic components market on account of technological improvements in sectors such as industrial, electric vehicles, and consumer electronics. Simultaneously, there has been an increased demand for microprocessors, semiconductors, and integrated circuits. In October 2024, MIT reported that its researchers had demonstrated a major advance toward fully 3D-printed active electronics by creating semiconductor-free logic gates using a copper-doped polymer, thereby enabling switches and resettable fuses without any traditional clean-room fabrication. Besides, the matching silicon transistors are not yet in performance; these devices can perform basic control operations, are biodegradable, energy-efficient, and durable over thousands of cycles. Furthermore, the team aims to expand this approach to fully functional electronics, thus enabling on-demand 3D-printed mechatronics for applications ranging from everyday devices to spacecraft.

Canada has a strong scope to capitalize on the regional active electronic components market, backed by the expansion of electric vehicles and strong government support for renewable energy projects and clean technology fuels. The country’s market also benefits from increasing focus on digitalization and 5G infrastructure development. In March 2025, the Government of Canada announced a USD 8 million contribution from the Strategic Innovation Fund to support Teledyne’s USD 42 million project to upgrade its Bromont, Quebec, semiconductor facility. It also underscored that the investment will help Teledyne develop next-generation image sensors, expand semiconductor capabilities, and convert its CCD production line from 150 mm to 200 mm wafers, increasing productivity by 40%. Hence, the upgrade reinforces the country’s position in specialized, high-value semiconductor products and growth in strategic technology sectors.

Europe Market Insights

Europe is yet another dominant force in the active electronic components market, propelled by strict regulatory frameworks that necessitate both energy efficiency and sustainability. The central countries in the region, such as Germany, France, and the UK, are focusing on R&D and collaboration among industry players, thereby positioning Europe as a key player in the global market. In December 2025, EFECS 2025, held on 3 to 4 December in St Julian’s, Malta, brought together the region’s electronic components and systems community to discuss strategic priorities across the semiconductor value chain under the theme called Accelerate Innovation: Building European Competitiveness. Besides, during the forum, the Chips Joint Undertaking announced the Work Programme, outlining EUR 179 million (USD 193.32 million) in EU funding and national contributions to support research, innovation, and capacity-building in microelectronics, hence making it suitable for standard active electronic components market growth.

Germany is growing exponentially in the regional active electronic components market owing to its advanced industrial base, strong automotive sector, and precision manufacturing ecosystem. Also, the country’s extensive network of OEMs and Tier‑1 suppliers integrates active components into electric vehicles, robotics, smart factory solutions, and instrumentation, making it highly essential for both analog and digital component technologies. In November 2024, Infineon Technologies announced the launch of the AURIX TC4Dx microcontroller, which is the first in its TC4x family, with a 28nm multi-core architecture with six 500MHz TriCore cores, designed for next-generation software-defined vehicles. Besides, the MCU supports advanced AI-based use cases, high-speed connectivity with 5 Gbit/s Ethernet, PCIe, CAN-XL, and meets top functional safety and cybersecurity standards, which include ISO26262 ASIL-D and post-quantum cryptography.

The U.K. is readily progressing in Europe’s active electronic components market owing to the strong demand from telecommunications, consumer electronics, defense systems, and emerging mobility technologies. The country is supported by academic research institutions and innovation clusters, the country is strengthening its position in both foundational and niche active component technologies, which are highly essential for electrified transport ecosystems. In December 2025, Sumitomo Electric Industries announced that it had secured a contract with National Grid Electricity Transmission to supply and install a 140 km, 525 kV HVDC submarine cable for the Sea Link project between Kent and Suffolk, UK. It also mentioned that the cable will be manufactured at Sumitomo’s Port of Nigg facility in Scotland, supporting the country’s Clean Power 2030 and Net Zero 2050 initiatives. Furthermore, collaborating with Siemens Energy and VanOord, the project aims to strengthen the local supply chain, enhance energy transmission capacity goals.

Key Active Electronic Components Market Players:

- Texas Instruments (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Analog Devices (U.S.)

- Infineon Technologies (Germany)

- NXP Semiconductors (Netherlands)

- STMicroelectronics (Switzerland)

- ON Semiconductor (U.S.)

- Renesas Electronics (Japan)

- Broadcom Inc. (U.S.)

- Qualcomm (U.S.)

- Microchip Technology (U.S.)

- Toshiba Electronic Devices & Storage (Japan)

- Maxim Integrated (U.S.)

- ROHM Semiconductor (Japan)

- Skyworks Solutions (U.S.)

- GigaDevice Semiconductor (China)

- Texas Instruments is identified as a global leader in analog and embedded processing solutions, which is serving the automotive, industrial, and consumer electronics sectors. The firm’s product portfolio includes power management ICs, analog signal processors, and microcontrollers. Besides, TI emphasizes innovative analog design, high-volume manufacturing, and energy-efficient solutions and makes continued investments in R&D to address trends such as electric vehicles, industrial automation, and AI-enabled systems.

- Analog Devices specialized player in this field, which leverages high-performance analog, mixed-signal, and digital signal processing technologies, including amplifiers, converters, sensors, and power management ICs. The firm is primarily focused on innovation in precision analog and power electronics, with acquisitions and collaborations to expand its product portfolio. Furthermore, Analog enables energy-efficient systems, data acquisition, and signal integrity for industrial automation, IoT, and AI applications.

- Infineon Technologies, a firm from Germany and is best known for its power semiconductors, microcontrollers, and sensors, targeting automotive, industrial, and security applications. Simultaneously, the company emphasizes energy efficiency, electrification, and safety solutions, making strong investments in SiC and GaN technologies to enhance power density and reduce system losses. In addition, Infineon leverages its global manufacturing footprint and innovation-driven approach, positioning Infineon as a key competitor in the active electronic components market.

- NXP Semiconductors focuses on automotive, industrial, and connectivity solutions, and it is offering microcontrollers, power management ICs, and RF devices. The company deliberately prioritizes connected and energy-efficient technologies for smart vehicles, industrial IoT, and communication systems. Further, with a great expertise in innovation in mixed-signal and embedded processing, along with strategic collaborations, NXP drives continued growth in the global market.

- STMicroelectronics is the central player in this field that provides power management ICs, microcontrollers, and MEMS sensors for various applications. The firm is focused on smart automation and connected solutions, thereby expanding its footprint in EVs, industrial drives, and AI-enabled systems. In addition, STM’s strategic R&D investments and collaborations help it to maintain its leadership in the active electronic components sector.

Below is the list of some prominent players operating in the global active electronic components market:

The active electronic components market is witnessing intense competition among both established semiconductor companies and emerging players. The key manufacturers in this field are strongly focused on technological innovation, product diversification, and strategic acquisitions to secure their market positions. In this context, GigaDevice, in November 2025, showcased its latest innovations in AI, power management, and consumer electronics at Embedded World North America, thereby highlighting its GD32 MCU family, flash memory, sensors, and analog products. The firm also mentions the key demonstrations, which include edge AI facial and voice recognition, a 12kW high-efficiency AI server power solution using SiC MOSFETs, and interactive consumer device control. Hence, such advancements reinforce GigaDevice's role as one of the prominent players in the market, providing high-end technologies for industrial, automotive, computing, IoT, and AI-based applications.

Corporate Landscape of the Active Electronic Components Market:

Recent Developments

- In December 2025, Marvell announced that its Alaska P PCIe 6 retimers are being adopted by leading AI and data center infrastructure providers to enable high-speed, low-latency connectivity between GPUs, XPUs, CPUs, SSDs, and other components since they ensure signal integrity across servers and clusters.

- In April 2025, Cybord launched ShieldScan, which is an advanced AI-powered solution for full PCB assembly inspection, offering real-time anomaly detection, component verification, and supply chain security, making it highly suitable for electronics manufacturing, aerospace, automotive, and data center industries.

- In April 2025, DigiKey added 104 new suppliers and nearly 100,000 NPIs, enhancing its global distribution of electronic components and automation products, which include advanced solutions for IoT, industrial, medical, and smart building applications, from Infineon, NXP, TDK, and Murata.

- In January 2025, onsemi announced that it had completed its acquisition of Qorvo’s Silicon Carbide JFET technology business, which includes the United Silicon Carbide, for USD 115 million in cash to enhance the EliteSiC power portfolio, enabling higher energy efficiency and power density in various sectors.

- Report ID: 8323

- Published Date: Dec 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Active Electronic Components Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.