Electronic Components Distribution Market Outlook:

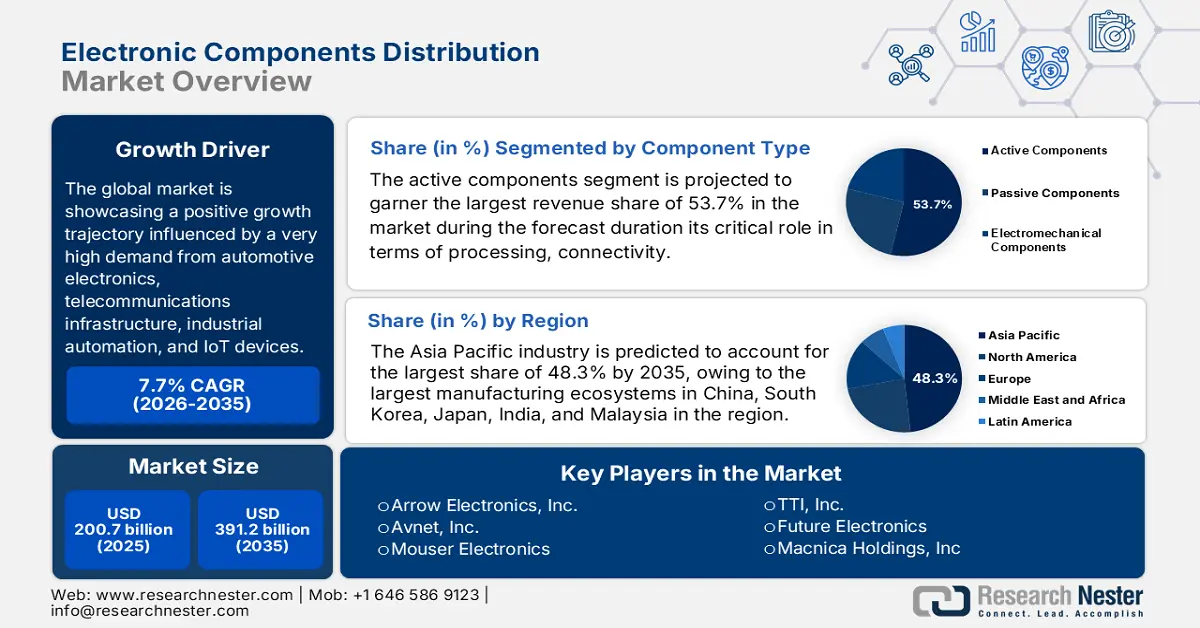

Electronic Components Distribution Market size was valued at USD 200.7 billion in 2025 and is projected to reach USD 391.2 billion by the end of 2035, rising at a CAGR of 7.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of electronic components distribution is estimated at USD 216.1 billion.

The global market of electronic components distribution is showcasing a positive growth trajectory influenced by a very high demand from automotive electronics, telecommunications infrastructure, industrial automation, and IoT devices. The supply chain dynamics in this field are creating opportunities for various channels, which include raw‑material extraction such as silicon, speciality metals, chemicals, proceeds through semiconductor and passive‑component manufacturing, assembly and testing, and distribution to OEMs, EMS providers, and system integrators. In this regard, the WITS reported that in 2023, the U.S. imported parts of electronic integrated circuits and microassemblies, which were valued at USD 1.15 billion, primarily from Mexico (USD 249.1 million), China (USD 129.8 million), and Japan (USD 109.9 million), wherein notable inflows from Malaysia and other Asian economies were also reported. Simultaneously, exports of these components were directed mainly to Mexico, Canada, and Singapore, reflecting the integrated nature of North America and Asia-Pacific semiconductor supply chains.

U.S. Imports of Parts of Electronic Integrated Circuits and Micro assemblies by Country, 2023

|

Rank |

Partner Country |

Trade Value (USD ‘000) |

Notes |

|

1 |

World (Total) |

1,146,541.91 |

Total U.S. imports of HS 854290 |

|

2 |

Mexico |

249,090.75 |

Largest import partner |

|

3 |

China |

129,796.36 |

Major supplier from Asia |

|

4 |

Japan |

109,923.52 |

Key source for semiconductors |

|

5 |

Other Asia, nes |

84,362.46 |

Regional component hub |

|

6 |

Malaysia |

84,206.68 |

Major Southeast Asian supplier |

|

7 |

Singapore |

73,674.50 |

Key regional logistics hub |

|

8 |

Thailand |

69,901.80 |

Growing electronics exporter |

|

9 |

Korea, Rep. |

48,455.03 |

Active in chip and part supply |

|

10 |

Germany |

39,355.06 |

Leading European source |

|

11 |

France |

38,392.72 |

EU supplier of microcomponents |

|

12 |

Colombia |

32,947.58 |

Includes 49.47 million items |

|

13 |

India |

26,470.85 |

Expanding electronics base |

|

14 |

Canada |

19,832.28 |

North American trade partner |

|

15 |

Israel |

18,266.31 |

Specialized semiconductor components |

|

16 |

Austria |

17,827.20 |

EU source for industrial parts |

|

17 |

Hong Kong, China |

13,105.25 |

Regional re-export hub |

|

18 |

U.K. |

11,844.03 |

Key European trading partner |

|

19 |

Brazil |

9,709.92 |

Latin American exporter |

|

20 |

Italy |

9,605.90 |

European supplier of components |

Source: WITS

Furthermore, the U.S. government’s initiatives under the CHIPS and Science Act of 2022 are reshaping the foundation of the market by rapidly enhancing domestic semiconductor production and supply chain capacity. The report from OIG stated that a total of USD 39 billion was allocated for fabrication, assembly, and packaging facilities, and USD 11 billion toward regional technology hubs. Therefore, this Act supports distributors by expanding domestic sourcing and reducing reliance on East Asian imports, which currently account for 75% of worldwide chip output. In addition, the aspect of USD 10 billion in NIST funding strengthens small manufacturers and R&D partnerships, encouraging innovation and production efficiency. Hence, collectively, all of these factors are expected to enhance supply stability, reduce lead times positively impact market growth.

Key Electronic Components Distribution Market Insights Summary:

Regional Highlights:

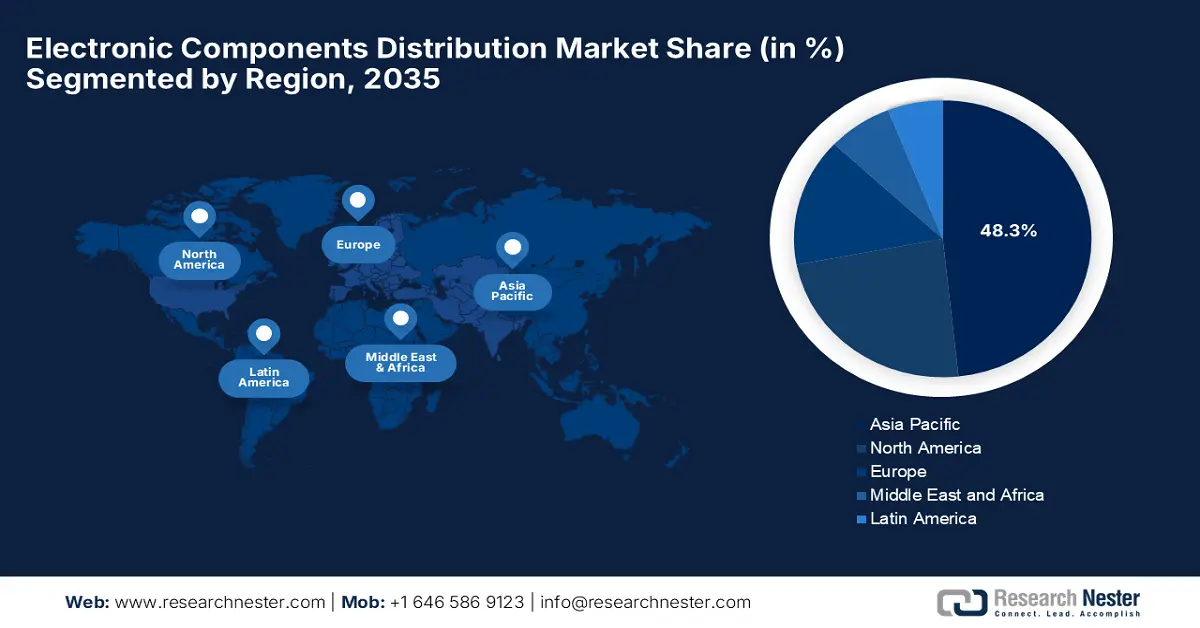

- Asia Pacific is expected to secure a 48.3% share by 2035 in the electronic components distribution market, impelled by its extensive manufacturing ecosystems and growing demand for consumer, automotive, and industrial electronics.

- North America is projected to hold a significant share by 2035, driven by a resilient supply chain environment shaped by reshoring, semiconductor incentives, and inventory optimization.

Segment Insights:

- Active components segment is projected to account for 53.7% share during the forecast period 2026-2035 in the electronic components distribution market, propelled by its critical role in processing, connectivity, and sensing in modern electronics.

- Traditional & online distributors segment is expected to hold a 40.5% share by 2035, owing to their ability to consolidate supply, provide inventory buffering, and deliver value-added services.

Key Growth Trends:

- Expansion of semiconductor and IoT applications

- Government initiatives and manufacturing incentives

Major Challenges:

- Supply chain disruptions and component shortages

- Raw material price volatility and cost pressures

Key Players: Arrow Electronics, Inc. - U.S., Avnet, Inc. - U.S., Mouser Electronics, Inc. - U.S., TTI, Inc. - U.S., Future Electronics - Canada, Macnica Holdings, Inc. - Japan, RS Components / RS Group plc - UK, Digi‑Key Electronics - U.S., NXP Semiconductors N.V. - Netherlands/U.S., STMicroelectronics NV - France/Italy, Texas Instruments Incorporated - U.S., Infineon Technologies AG - Germany, TE Connectivity Ltd. - Switzerland, Renesas Electronics Corporation - Japan, Avio Components - South Korea.

Global Electronic Components Distribution Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 200.7 billion

- 2026 Market Size: USD 216.1 billion

- Projected Market Size: USD 391.2 billion by 2035

- Growth Forecasts: 7.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.3% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: India, Malaysia, Mexico, Brazil, Vietnam

Last updated on : 13 November, 2025

Electronic Components Distribution Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of semiconductor and IoT applications: The increased adoption of connected technologies across various applications, such as automotive, industrial, and consumer sectors, is fueling a heightened demand for semiconductors, sensors, and integrated circuits. Also, the growth in terms of electric vehicles, factory automation, and IoT-enabled devices continues to elevate distribution volumes. As per an article published by SEMI in July 2025, worldwide semiconductor manufacturing equipment sales are forecast to reach USD 125.5 billion by the end of 2025, marking a 7.4% year-on-year increase. The report also highlighted that these sales are efficiently driven by AI, leading-edge logic, and memory transitions, hence denoting a positive market demand in the upcoming years.

- Government initiatives and manufacturing incentives: This is the primary growth driver for the market since the public sector investments, such as the U.S. CHIPS and Science Act and the EU Chips Act, are boosting domestic semiconductor production and the component supply chain. As evidence European Commission reported that the European Chips Act, which was effective from September 2023, aims to strengthen the region’s semiconductor sovereignty by doubling its global market share to 20% by the end of 2030. It also stated that more than €31.5 billion (USD 34 billion) was received in a combination of public and private investments, which supports major projects by STMicroelectronics, GlobalFoundries, Infineon, and ESMC to enhance manufacturing, packaging, and R&D. Hence, this initiative anchors Europe’s ambition to build a robust, self-reliant semiconductor ecosystem.

- Rising demand for advanced electronics: Developing regions, including Southeast Asia and India, are witnessing a sustained growth in electronics manufacturing and assembly, creating optimistic opportunities for new distribution networks. In March 2024 Ministry of Electronics & IT reported that India’s Make in India initiative has helped the country into the second-largest mobile phone producer worldwide, with domestic manufacturing rising from 26% in 2014 to 2015 99.2% by 2024. It also stated that more than 300 manufacturing units are now operational, driving electronics production. In addition, major semiconductor investments totalling ₹1.52 lakh crore (USD 18.3 billion) are encouraging India to rapidly emerge as a hub for electronics innovation and manufacturing.

Challenges

- Supply chain disruptions and component shortages: The market is extremely sensitive to factors such as supply chain interruptions caused by global tensions, natural disasters, and geopolitical issues. Also, the long lead times for advanced components are making it challenging for distributors to meet this heightened demand. On the other hand, delays in manufacturing and transportation can, in turn, result in backlogs and subsequent lost sales. Therefore, these fluctuations in terms of supply are creating huge uncertainty for both distributors and clients, hence posing a major hurdle for market expansion.

- Raw material price volatility and cost pressures: This is yet another factor that has skewed growth in the market. The prices of raw materials such as metals, silicon, and rare earth elements are extremely high, creating hesitation among investors from price-sensitive regions. Therefore, this unpredictability directly affects the cost of components and skews up distributor profit margins as well. In addition, sudden spikes in material costs can disrupt pricing strategies and inventory planning, which compels distributors to balance between competitive pricing with sustained profitability.

Electronic Components Distribution Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.7% |

|

Base Year Market Size (2025) |

USD 200.7 billion |

|

Forecast Year Market Size (2035) |

USD 391.2 billion |

|

Regional Scope |

|

Electronic Components Distribution Market Segmentation:

Component Type Segment Analysis

Based on component type active components segment is projected to garner the largest revenue share of 53.7% during the forecast duration. The dominance of the segment is effectively attributable to its critical role in terms of processing, connectivity, and sensing in modern electronics. Also, these are associated with the source of energy, such as transistors and diodes, enhancing demand at the highest rate. In April 2025 Government of India announced that the Union Minister for Electronics and IT had launched the guidelines and portal for the electronics component manufacturing scheme, marking a significant step toward strengthening the country’s electronics manufacturing ecosystem. The article also underscored that the scheme aims to support the entire supply chain, including components, subassemblies, and capital equipment, while promoting domestic production of active components such as transistors and ICs.

Distribution Channel Segment Analysis

In terms of distribution channel, the traditional & online distributors segment is expected to capture a significant revenue share of 40.5% by the end of 2035. Their ability to consolidate supply from multiple manufacturers, provide inventory buffering, and offer value-added services is the key factor driving this leadership. Also, the distributors play a prominent role in streamlining procurement for OEMs, EMS providers, and smaller companies. In addition, efficient logistics, credit facilities, and technical support are making this channel extremely preferable. Furthermore, the increasing digitalization and supply chain integration are encouraging the segment to grow at a rapid pace, influencing it even further in the upcoming decade.

Application Segment Analysis

Based on the application, the consumer electronics segment is likely to attain a lucrative share of 30.3% during the forecasted timeline. The growth in the segment is subject to the heightened demand for personal devices, wearables, smart home systems, and entertainment electronics. Also, the aspect of rapid refresh cycles and a broader global user base is readily driving this demand. In this regard, the government of India announced that its electronics industry displayed a six times expansion in terms of production over the past decade, which reached ₹11.3 lakh crore (USD 128 billion) in 2024 -2025. It also stated that mobile exports rose by a significant 127 times to ₹2 lakh crore (USD 24.1 billion), positioning the country as the world’s second-largest mobile manufacturer. Furthermore, the sector consists of consumer electronics, automotive, medical devices, and electronic components, hence denoting a wider segment scope.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Component Type |

|

|

Distribution Channel |

|

|

Application |

|

|

Material Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electronic Components Distribution Market - Regional Analysis

APAC Market Insights

Asia Pacific in the electronic components distribution market is expected to capture the largest revenue share of 48.3% during the forecast duration. The dominance of the region in this field is attributable to the largest manufacturing ecosystems in China, South Korea, Japan, India, and Malaysia. The region also benefits from value chains, increasing demand for consumer electronics, automotive electronics, and industrial automation intensifies. L-com, in April 2025, reported that it has added a variety of Bulgin circular connectors, which include power, data, and RF connectors specifically designed for harsh environments, marking an expansion of its connectivity solutions. It further stated that these new products consist of high ingress protection ratings, IP66, IP68, IP69K, secure locking mechanisms, and mounting and pin options, ensuring proper operation in sectors such as industrial automation, transportation, and healthcare.

China is likely to hold the dominant position in the regional electronic components distribution market owing to the presence of domestic distributors who are constantly putting efforts to handle both the traditional role of parts supply and value-added services such as design‑in support, pre-testing, and logistics for domestic OEMs. The country is witnessing heightened demand for smartphones, telecom hardware, which is encouraging for mass production and high-volume standard parts. In this regard, ZF Group in December 2022 announced a crucial investment in China to build a highly automated plant for electronics and advanced driver assistance products, including autonomous driving systems, cameras, sensors, and brake electronics. The new facility, which spans around 12,000 square meters, will employ around 700 people, feature four product lines, and encourage the firm to advance future mobility technologies and establish the region as a hub for innovation in networked vehicles.

India has a stronger potential to capitalize on the electronic components distribution market due to its strong capacity in domestic manufacturing and export‑push initiatives. Government schemes in the country target building domestic sourcing of components and promoting manufacturing clusters, thereby increasing demand for distributors who can deliver components to OEMs and EMS companies locally. For instance, in September 2025 Government of India announced that SEMICON India 2025, which is the country’s largest semiconductor and electronics show, showcases a semiconductor hub, highlighting design, fabrication, and packaging advancements under the India Semiconductor Mission and the ₹76,000 crore (USD 912 million) PLI scheme. Furthermore, special programs focus on workforce development, STEM engagement, and professional training to support India’s growing semiconductor ecosystem.

North America Market Insights

North America is predicted to hold a significant share in the global electronic components distribution market throughout the discussed tenure. The leadership of the region in this sector is primarily driven by the supply chain environment, which is shaped by reshoring, supply chain security, and semiconductor incentives. Distributors in the region are aligning with manufacturers' needs for shorter lead times, inventory management, as well as resilience in terms of volatile trade instances. The U.S. and Canada are witnessing an increased emphasis on components such as aerospace defense computing and services, more than pure parts supply. Furthermore, distributors have the complete capability to co-loate inventory and provide fulfillment across manufacturing sites, thereby gaining a competitive advantage. Therefore, all of these factors together will position the region as the predominant leader in this landscape.

The U.S. is augmenting its strong position in the regional electronic components distribution market, efficiently driven by technological transitions such as AI-based data centers, 5G, 6G infrastructure, and the heightened demand for advanced products. The country’s market also benefits from sectors such as automotive electronics, industrial automation, and telecom infrastructure that require reliable distributor ecosystems. Arrow Electronics in April 2025 announced that it had entered into a strategic distribution agreement with Ohmite, which enables it to offer Ohmite’s power resistor solutions to its vast customer base. In this context, the partnership expands Arrow’s electronic component offerings, allowing customers to access both Ohmite’s legacy and new products, hence denoting a positive market outlook.

There is a huge opportunity for Canada in the electronic components distribution market, primarily propelled by its strengths in embedded systems, sensors, and specialty components supporting sectors such as clean tech, telecommunications, and aerospace. The country is witnessing an increased interest in regional manufacturing capabilities and government support for high‑technology industries; therefore, distributors are adapting by enhancing local service capabilities. In July 2023, Future Electronics underscored its significant role in providing exclusive electronic component solutions for the numerous sectors, such as vehicle automation, smart city infrastructure, asset tracking, and mass transit or rail technologies. The company also noted that its expertise lies in global presence to address the evolving instances of transportation, offering innovative and reliable solutions to consumers.

Europe Market Insights

Europe is predicted to acquire a prominent position in the electronic components distribution market over the forecasted years. The region’s upliftment in this field effectively caters to the presence of distributors who are adapting by diversifying their portfolios toward industrial sensors, automation modules, and power‐control components, investing in regional warehousing and supply‐chain transparency. In October 2025, Mouser Electronics announced that it entered into a distribution agreement with Northern Technologies, which is a division of the EDAC Group, expanding its portfolio to include Northern’s high-performance shielding products and a wide range of connectors, including D-subminiature, SCSI, V.35, and modular-style connectors. Besides, the agreement ensures that Mouser customers can access certified, genuine Northern products, supported by detailed technical resources and design tools to streamline development.

Germany is gaining momentum in the regional electronic components distribution market, facilitated by its strong manufacturing base in terms of automotive and industrial automation. Distributors in the country are deeply embedded in terms of OEM supply chains, enabling their support for high complexity orders and system-level component needs. In November 2025, FBDi reported that in the third quarter of 2025, the country’s distribution market showcased recovery after three years of contraction, wherein sales increased 1.2% year-on-year. Also, the book-to-bill ratio was 1.0, with bookings up 33.1% when compared to the third quarter of 2024. It also stated that semiconductors recorded €477.5 million (USD 553 million) in sales, with strong bookings in MOS micro logic, memory, and discrete components, while interconnects, passive, and electromechanical products held steady at €268.7 million (USD 311.5 million) in sales.

The U.K. is growing exponentially in the regional electronic components distribution market, positively influenced by the adoption of post-Brexit trade conditions, supply chain logistics, and domestic manufacturing. Distributors in this field are emerging to meet demand from various sectors such as telecom infrastructure, data centers, and defence electronics, aligning. In June 2025, CMS Distribution announced a partnership with Lexar to expand its product portfolio across the UK, Ireland, and Nordic markets. Therefore, this collaboration will encourage the company to provide resellers and retailers with Lexar’s high-performance products, including memory cards, USB drives, SSDs, and DRAM, catering to creative professionals, gamers, and enterprise IT sectors. Also, the move is expected to drive growth in high-demand data storage segments.

Key Electronic Components Distribution Market Players:

- Arrow Electronics, Inc. - U.S.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Avnet, Inc. - U.S.

- Mouser Electronics, Inc. - U.S.

- TTI, Inc. - U.S.

- Future Electronics - Canada

- Macnica Holdings, Inc. - Japan

- RS Components / RS Group plc - UK

- Digi‑Key Electronics - U.S.

- NXP Semiconductors N.V. - Netherlands/U.S.

- STMicroelectronics NV - France/Italy

- Texas Instruments Incorporated - U.S.

- Infineon Technologies AG - Germany

- TE Connectivity Ltd. - Switzerland

- Renesas Electronics Corporation - Japan

- Avio Components - South Korea

- Arrow Electronics, Inc. is leading in terms of distributing both electronic components and computing solutions. The company provides reliable supply chain services and lifecycle management across various sectors such as automotive, industrial, and ICT. In addition, Arrow has strengthened its global footprint through strategic acquisitions and partnerships with pioneering manufacturers. Furthermore, the firm’s focus on digital platforms, services, and e-commerce solutions enables it to meet the growing demands and enhance supply chain efficiency.

- Avnet, Inc. is also emerging as the prominent distributor of electronic components, embedded solutions, and interconnect products. The company is deeply emphasizing design-in support, technical assistance, as well as supply chain optimization for OEMs, industrial, and technology sectors. The company is making huge investments in terms of AI-driven supply chain analytics and customer-centric services, which are strengthening its competitiveness, making it a key player in high-growth areas such as IoT, automotive, and 5G infrastructure.

- Digi-Key Electronics is headquartered in the U.S. and helps distribute to engineers, manufacturers, and hobbyists across most nations. The company is best known for its exclusive product portfolio, real-time inventory availability, and fast delivery. Digi-Key leverages digital tools, e-commerce platforms, and design support to enhance customer satisfaction. Therefore, its global reach, strong relationships with semiconductor and component manufacturers, and focus on high-mix, low-volume distribution have enabled it to capture a strong consumer base in both industrial and consumer electronics segments.

- Future Electronics is one of the central distributors specializing in semiconductors, passive and electromechanical components, and power solutions. The key focus of the company is to provide design support, technical guidance, and logistics to serve numerous sectors, including automotive, industrial, and consumer electronics. The firm is deliberately committed to innovation, rapid delivery, and strong partnerships with leading component manufacturers allow it to maintain a competitive advantage.

- Marubeni Corporation, through its subsidiary Marubeni Ele-Next, is a key player in electronic components distribution in Japan as well as ASEAN. The company supplies power semiconductors, analog devices, and industrial components along with electronic circuit design support. Marubeni is extensively focusing on regional expansion, enhancement of product offerings, and strengthening design capabilities, positively contributing towards market expansion.

Below is the list of some prominent players operating in the global market:

The global electronic components distribution market is extremely competitive, influenced by a variety of factors such as innovation, scale, and service differentiation. Major pioneers in this field, such as Arrow Electronics, Avnet, and Digi‑Key, are focusing on value-added services, which include logistics, design support, and lifecycle management. In addition, expansion into high-growth areas such as IoT, 5G/6G infrastructure, and automotive electronics is one a the strategies implemented by these players to strengthen their market positions. In April 2025, Marubeni Corporation announced that it acquired a 100% stake in OS Electronics Co., Ltd, which is a Japan-based distributor of electronic components and semiconductors with a strong expertise in circuit design. OSE supplies power and analog semiconductors for industrial machinery, automotive, and consumer electronics, supporting the heightened demand influenced by EVs, factory automation, and 5G. Therefore, this acquisition strengthens Marubeni’s regional presence, expands its product portfolio, and enhances circuit design capabilities.

Corporate Landscape of the Electronic Components Distribution Market:

Recent Developments

- In September 2025, Quectel Wireless Solutions announced that it had partnered with Future Electronics to distribute its full IoT portfolio across North America and the Asia Pacific. Leveraging Future Electronics’ extensive infrastructure and design-in capabilities to accelerate the adoption of its modules, antennas, and ODM services across various sectors.

- In June 2025, Mouser Electronics was recognized with over 25 awards from leading manufacturers, including multiple Distributor of the Year honors, for its exceptional performance since it offers the widest selection of semiconductors and electronic components.

- Report ID: 8235

- Published Date: Nov 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electronic Components Distribution Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.