Wearable Electronics Market Outlook:

Wearable Electronics Market size was valued at USD 193.7 billion in 2025 and is projected to reach USD 789.7 billion by the end of 2035, rising at an estimated CAGR of 16.9% during the forecast period, i.e., 2026‑2035. In 2026, the industry size of wearable electronics is estimated at USD 226.4 billion.

The worldwide market of wearable electronics is showcasing tremendous growth on account of advancements in smart sensors, microLED displays, energy-efficient batteries, and health-focused operating systems. It also operates through an extremely complex supply chain that comprises raw material extraction, component manufacturing, assembly, final testing, and logistics. As per an article published by the U.S. BLS in October 2025 U.S. computer and electronic product manufacturing sector employed roughly 1,003.5k workers across 26,317 private establishments. It also stated that average hourly earnings for all employees reached USD 47.61, with production and nonsupervisory staff earning USD 36.99 per hour. The Producer Price Index for the sector rose to 106.876 in August 2025, marking a 1.3 % month-over-month increase. Therefore, this stable employment and rising productivity in electronics manufacturing support scalable production and innovation, thereby driving overall market growth.

Furthermore, the aspect of export price trends for the U.S. computer and electronic product manufacturing reflects the sector’s pricing stability regardless of the presence of worldwide traditional fluctuations. Therefore, BLS notes that in the U.S., the export price index for computer and electronic product manufacturing showed minor fluctuations between May 2024 and May 2025, starting at 100.0 in May 2024 and slightly decreasing to 98.9 by August 2024. In comparison, the broader all manufacturing export index generally rose over the same period, thereby indicating relatively slower export price growth in the electronics subsector. Thus, this steady recovery in export prices supports market growth by enhancing competitiveness and signaling consistent demand.

U.S. Export Price Index - Computer & Electronic Product Manufacturing (May 2024 = 100)

|

Month |

Computer & Electronic Product Manufacturing |

All Manufacturing |

|

May 2024 |

100.0 |

100.0 |

|

Jun 2024 |

99.8 |

99.8 |

|

Jul 2024 |

99.5 |

100.5 |

|

Aug 2024 |

98.9 |

100.1 |

|

Sep 2024 |

99.0 |

99.9 |

|

Oct 2024 |

99.3 |

100.6 |

|

Nov 2024 |

99.4 |

100.6 |

|

Dec 2024 |

99.5 |

100.4 |

|

Jan 2025 |

99.6 |

101.1 |

|

Feb 2025 |

99.5 |

101.6 |

|

Mar 2025 |

99.9 |

102.1 |

|

Apr 2025 |

100.4 |

102.4 |

|

May 2025 |

100.2 |

102.5 |

Source: BLS

Key Wearable Electronics Market Insights Summary:

Regional Highlights:

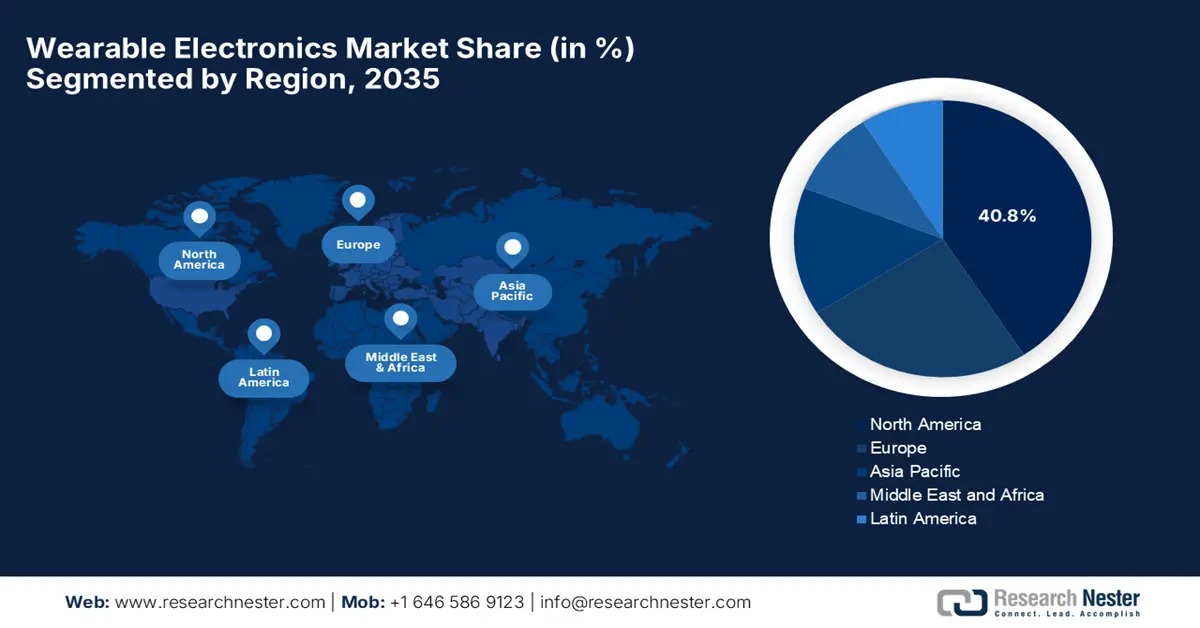

- North America is projected to hold a 40.8% share in the wearable electronics market by 2035, impelled by rising consumer adoption and spending coupled with a strong digital health ecosystem.

- Asia Pacific is expected to witness rapid growth over the forecast period 2026-2035, fueled by rising smartphone penetration, smart device adoption, and expanding technological infrastructure.

Segment Insights:

- Smartwatches segment is projected to account for 46.5% share in the wearable electronics market by 2035, propelled by their multifunctionality and growing consumer awareness of health and wellness.

- Online retail segment is anticipated to hold a 45.3% share by 2035, owing to its extensive reach, convenience, and cost-effectiveness.

Key Growth Trends:

- Health and wellness monitoring

- Technological advancements in sensors and connectivity

Major Challenges:

- Battery life and power consumption limitations

- Data security, privacy, and trust issues

Key Players: Apple Inc. - U.S., Garmin Ltd. - U.S., Fitbit (Google) – U.S., Samsung Electronics Co., Ltd. - South Korea, Sony Group Corporation - Japan, LG Electronics Inc. - South Korea, Xiaomi Corporation - China, boAt Lifestyle - India, Withings (formerly) - France, Zepp Health (Amazfit) - China, Lenovo Group Ltd. - China, Huawei Technologies Co., Ltd. - China, OPPO (BBK Electronics) - China, Garmin (again) - U.S., Meta Platforms, Inc. - U.S., Snap Inc. - U.S., Polar Electro Oy - Finland, Vuzix Corporation - U.S., Suunto Oy (Amer Sports) - Finland, Titan Company (Fastrack) - India.

Global Wearable Electronics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 193.7 billion

- 2026 Market Size: USD 226.4 billion

- Projected Market Size: USD 789.7 billion by 2035

- Growth Forecasts: 16.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Indonesia

Last updated on : 10 November, 2025

Wearable Electronics Market - Growth Drivers and Challenges

Growth Drivers

- Health and wellness monitoring: This is the primary fueling factor for the wearable electronics market since the increasing worldwide focus is driving adoption. These devices are capable of monitoring heart rate, blood oxygen levels, sleep patterns, and chronic conditions, attracting the health-conscious consumers. In July 2023, Henkel announced that it had expanded its portfolio for medical wearables, leveraging its complete expertise in adhesives and electronic materials to support devices such as smart health patches, continuous glucose monitors, and smart glasses. The firm deliberately opted for industrial molding technologies for medical applications by offering single-step, skin-safe over-mold designs that reduce assembly complexity and production costs, hence making it suitable for overall market growth.

- Technological advancements in sensors and connectivity: The miniaturization of sensors, advances in low-power electronics, and improvements in wireless connectivity are fostering an extremely profitable environment for the pioneers involved in this field. Enhanced processing capabilities allow wearables to deliver real-time analytics and AI-driven insights. In October 2025, Wearable Devices Ltd. announced that it had entered an exclusive distribution agreement with Sky Commerce to market and sell its AI-powered Mudra Band and Mudra Link neural input wristbands. The partnership includes meeting annual minimum purchase targets and completing KC certification procedures before sales. Hence, this strategic move supports wearable devices’ expansion, thereby drawing the interest of global leaders in this field.

- Enterprise and industrial applications: This aspect is identified as one of the important growth drivers for the wearable electronics market since these are being utilized in enterprise and industrial settings. In September 2025, Saphlux, Inc. and Vuzix Corporation announced that they had entered into a strategic alliance to develop high-performance AR display solutions for next-generation AI/AR smart glasses. Saphlux will provide its T1-0.13 mono-green micro LED microdisplay, whereas Vuzix will integrate it with proprietary waveguides and system design expertise. Furthermore, by combining display technology with optical design expertise, the collaboration aims to accelerate mass-market adoption of AR glasses and expand real-world applications.

Challenges

- Battery life and power consumption limitations: One of the most significant challenges in the market is the reduced battery life and limitations in terms of power consumption. The wearable devices mostly struggle to deliver longer spans of utilization in a single time charging, influenced by a variety of factors such as energy demands from displays, sensors, and wireless connectivity. On the other hand, compact and lightweight designs are limiting the space for larger batteries, making frequent recharging a huge necessity. Therefore, this can reduce convenience, thereby negatively impacting user adoption in this field. On the other hand, advanced wearables such as AR glasses and smart textiles face even higher energy demand, hence causing a hindrance to the worldwide market expansion.

- Data security, privacy, and trust issues: The concerns regarding data security also cause obstacles to the wearable electronics market from achieving the desired success. These devices collect personal and biometric data, including health metrics and location information, which in turn raises concerns over data misuse, breaches, and unauthorized access. Therefore, strict regulations such as GDPR and HIPAA add compliance complexity for companies, adding to burgeoning expenses. Therefore, users may hesitate to adopt devices if trust is lacking in data handling practices, thus remaining one of the most significant obstacles for market growth. As a result, this aspect compels companies must invest heavily in robust encryption, secure cloud platforms, and to gain consumer trust.

Wearable Electronics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

16.9% |

|

Base Year Market Size (2025) |

USD 193.7 billion |

|

Forecast Year Market Size (2035) |

USD 789.7 billion |

|

Regional Scope |

|

Wearable Electronics Market Segmentation:

Product Type Segment Analysis

Based on product type smartwatches segment is projected to garner the largest revenue share of 46.5% in the wearable electronics market during the forecast duration. The dominance of the segment is effectively attributable to the multifunctionality and consumer appeal. These devices are a combination of fitness and health tracking, which also come with integration to smartphones and other devices. In addition, the growing consumer awareness of health and wellness is readily driving adoption in this field. In September 2025, AUO and Garmin announced the launch of the world’s first micro-LED smartwatch, the Garmin fēnix 8 Pro, which features a 1.4-inch ultra-high-density 326 PPI display that delivers brightness, vivid color, and high dynamic contrast. Therefore, the firm’s ongoing investment in micro LED commercialization across industries undercuts its expansion into consumer wearables.

Distribution Channel Segment Analysis

In terms of the distribution channel online retail segment is anticipated to garner a considerable revenue share of 45.3% in the market by the end of 2035. The extensive reach, convenience, and cost-effectiveness are the key factors driving the leadership of this subtype. Consumers can access the latest wearable devices globally through these channels, compare features and prices, with faster delivery without visiting the stores physically. Moreover, the emergence of COVID-19 readily accelerated the shift towards e-commerce, wherein the trend continues, especially in terms of emerging markets where online shopping penetration is extremely high. Furthermore, the flexibility, transparency, and scalability of online retail denote a wider segment scope.

Application Segment Analysis

Based on the application consumer electronics segment is predicted to capture a lucrative share of 40.6% in the wearable electronics market over the analyzed timeframe. The growth in the segment is highly subject to its increasing utilization in daily life for both practical and recreational purposes. This also includes personal fitness tracking, mobile notifications, and entertainment applications. On the other hand, fashion trends and brand-driven designs also contribute to adoption, drawing the interest of more players to make investments in this field. The government of India announced that its electronics industry has experienced a six-fold increase in production over the past decade, surpassing ₹11.3 lakh crore (USD 128 billion) in 2024 -2025, with mobile exports rising 127 times to ₹2 lakh crore (USD 24.1 billion), making India the world’s second-largest mobile manufacturer. The sector consists of consumer electronics, automotive, medical devices, and electronic components, thereby driving digital transformation.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Application |

|

|

Distribution Channel |

|

|

Connectivity Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wearable Electronics Market - Regional Analysis

North America Market Insights

North America is predicted to hold the highest share of 40.8% in the wearable electronics market throughout the discussed tenure. The leadership of this region in this field is primarily driven by the ever-increasing consumer adoption and rising spending. The region also benefits from a favorable ecosystem of digital health and high device connectivity, wherein the presence of key market players is also identified as a major driver. For instance, in September 2025, Apple announced the launch of the Apple Watch Series 11, which includes advanced health features, including hypertension notifications and a sleep score, along with up to 24 hours of battery life, 5G connectivity, and a display that is twice as scratch-resistant. Hence, the presence of these features in the Apple Watch Series 11 will drive market growth by increasing consumer adoption and demand for smart health monitoring devices.

The U.S. is readily rapid growth in the regional wearable electronics market owing to the growing focus on fitness tracking, along with the adoption of smartwatches, fitness bands, and AR/VR devices. The country’s market also benefits from the integration of AI and IoT technologies into wearable devices is readily driving demand. On the other hand, the presence of major tech companies, significant trade activities, and continuous product innovation is also fueling market progress, enabling consumers to access features such as real-time health monitoring and smartphone integration. An article published by JMIR in July 2024 revealed that a survey study of 23,974 participants in the country in a span of two years found that 44.5% owned wearable devices, where higher ownership was identified among younger, urban, and higher-income individuals.

U.S. Trade and Price Trends for Electronic Products (Including Wearable Electronics)

|

Parameter |

Value |

|

U.S. Exports of Electronic Products (2021) |

USD 161.5 billion (↑10.3%) |

|

U.S. Imports of Electronic Products (2021) |

USD 572.0 billion (↑18.3%) |

|

Export Price Index (NAICS 334 – Electronics) |

83.8 (Dec 2005 = 100, August 2025) |

|

Import Price Index (NAICS 334 – Electronics) |

71.3 (August 2025) |

Source: USITC, FRED

Canada market is gaining enhanced momentum due to the heightened demand for connected devices, which include smart clothing, fitness trackers, and medical wearables. The country also benefits from government initiatives, which are promoting telehealth and smart healthcare infrastructure, whereas both domestic and international players contribute to both product diversity and market competitiveness. March Networks, in June 2025, announced that it had partnered with IONODES to integrate the PERCEPT body camera into its video management platform, thereby enhancing wearable IoT surveillance for both retail and financial sectors. It further stated that this compact, high-performance body camera provides highly secure wireless connectivity and real-time monitoring, hence improving employee safety, thereby creating an optimistic market opportunity.

APAC Market Insights

Asia Pacific is considered to be the fastest-growing region in the wearable electronics market over the analyzed timeframe. The region’s upliftment in this field is effectively catered to rising smartphone penetration, increased adoption of smart devices, and the expansion of technological infrastructure. Consumers in the region are increasingly embracing wearables for connectivity, entertainment, and fitness tracking, whereas tech firms are innovating with lightweight designs, enhanced displays, and advanced sensors, thereby attracting consumers. On the other hand, integration with mobile apps, cloud services, and IoT ecosystems further strengthens the market, creating optimistic opportunities for smartwatches, wireless earbuds, and AR/VR devices. Furthermore, government initiatives promoting digitalization and smart cities also propel growth in this region.

China is solidifying its position in the wearable electronics market owing to the presence of extremely strong domestic manufacturing, technology innovation, and a tech-savvy population. Consumers in the country are adopting smart wearables not only for fitness and lifestyle but also for digital payments, communication, and entertainment applications, encouraging more players to make investments in this field. Huawei in August 2024 introduced its Huawei TruSense system, which is a platform designed to enhance accuracy in health and fitness monitoring for wearable devices. It also stated that the system integrates sensors and algorithms to track over 60 health indicators, which also include heart rate, SpO2, blood pressure, and emotional well-being. Therefore, such activities will enhance wearable device capabilities, attracting more users, and prompting a favorable business environment.

India is recognized as the central player in the market, positively influenced by growing smartphone usage, increasing internet penetration, and rising interest in connected devices. The introduction of affordable wearables and supportive developmental infrastructure, including emerging 5G networks, is readily driving increased adoption in this field. In January 2023, Titan, India, announced the launch of Titan Talk S, which is a smartwatch designed for the technologically advanced millennial generation. The firm highlighted that the watch features a 1.78 AMOLED display, BT calling, more than 100 sports modes, an AI voice assistant, and health monitoring for SpO2, blood pressure, sleep, and women’s health. Hence, this move will elevate market growth by appealing to fashion-conscious and fitness-savvy consumers and driving the adoption of premium smartwatches.

Europe Market Insights

Europe is expected to retain its position as the second-largest revenue booster in the international wearable electronics market from 2025 to 2035. The region’s progress in this field is bolstered by rising interest in wrist‑worn devices like smartwatches and fitness trackers. The country’s presence on the west side of this region leads in terms of adoption, whereas enterprise and industrial applications, such as worker monitoring and augmented reality, are also contributing to market growth. In May 2025, Warner Bros. Discovery Sports Europe announced that it had extended its partnership with GoPro, making it the official wearable camera supplier for the WHOOP UCI mountain bike world series for the third year. In this regard, GoPro’s helmet-mounted cameras will provide immersive rider POV footage across disciplines such as short track, cross-country, downhill, and enduro, hence making it suitable for overall market growth.

Germany is augmenting its dominant position in the regional wearable electronics market, efficiently backed by its strong engineering base, high consumer purchasing power, and well‑established tech infrastructure. The country’s leadership in standards and industrial IoT also extends its support towards highly advanced wearables in professional use cases, wherein its mature ecosystem makes it a key hub for both consumer and industrial wearable devices. In November 2025, Blackline Safety Corp. announced that it had inaugurated two new international offices in Cologne, Germany, and Abu Dhabi, UAE, to strengthen its presence across both regions. The Cologne office will support regional sales, service, and customer engagement, wherein the move also places the company closer to these regional ecosystems, enabling quicker service, stronger partnerships, and easier deployment of wearable technology solutions in enterprise & industrial settings.

The U.K. is one of the most influential landscapes for the wearable electronics market, which is effectively influenced by the heightened demand for smartwatches, hearables, and wearable accessories among urban consumers who value connectivity, style, and convenience. On the other hand, integration with mobile ecosystems, e-commerce channels, and smart lifestyle platforms is also an asset for this landscape, signalling a strong potential for both domestic and international players. In addition, the country benefits from an extremely vibrant startup activity and partnerships between technology firms and fashion brands, enhancing both product diversity and appearance. Furthermore, wearables are increasingly becoming part of everyday tech stacks for consumers the thereby attracting more players to make investments in this field.

Key Wearable Electronics Market Players:

- Apple Inc. - U.S.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Garmin Ltd. - U.S.

- Fitbit (Google) – U.S.

- Samsung Electronics Co., Ltd. - South Korea

- Sony Group Corporation - Japan

- LG Electronics Inc. - South Korea

- Xiaomi Corporation - China

- boAt Lifestyle - India

- Withings (formerly) - France

- Zepp Health (Amazfit) - China

- Lenovo Group Ltd. - China

- Huawei Technologies Co., Ltd. - China

- OPPO (BBK Electronics) - China

- Garmin (again) - U.S.

- Meta Platforms, Inc. - U.S.

- Snap Inc. - U.S.

- Polar Electro Oy - Finland

- Vuzix Corporation - U.S.

- Suunto Oy (Amer Sports) - Finland

- Titan Company (Fastrack) - India

- Apple Inc. is the most popular brand name in the worldwide wearable electronics sector, which is leveraging the Apple Watch lineup and the AirPods ecosystem. The company has a strong integration across hardware, software, and health ecosystems, with Apple Health, Fitness+, and iOS connectivity is creating a highly enhanced user experience. On the other hand, Apple is setting new industry standards in digital health and lifestyle technology with heavy investments in microLED displays and AI-driven health analytics.

- Samsung Electronics Co., Ltd. stands out as one of the most prominent and influential players in this sector which is, emphasizing the Galaxy Watch and Galaxy Buds series. The firm’s wearables integrate with the broader Galaxy ecosystem, enabling consumers to have advanced fitness tracking, sleep monitoring, and stress management capabilities as well. It also has a strong focus on AI-enhanced health tracking, extended battery life, and design materials such as titanium and sapphire glass, which have bolstered its position among consumers.

- Huawei Technologies Co., Ltd. leverages exclusive products such as the Huawei Watch GT series and FreeBuds, appreciably enhancing its presence in this field. The company combines advanced health-tracking sensors, long battery life, and independent operating systems called HarmonyOS to create highly reliable products. Also, its prime focus of the firm lies in AI-based health tracking, sports performance analytics, and affordable premium design, from Asia to Europe.

- Garmin Ltd. is a specialized firm that specializes in terms of performance -oriented wearables, especially designed for athletes, adventurers, as well as fitness enthusiasts. The firm is best known for its precision GPS technology, whereas its fēnix, Forerunner, and Venu lines deliver professional-grade fitness tracking and navigation features. Moreover, its recent partnership with AUO to introduce the world’s first-ever Micro LED smartwatch showcases the commitment to display innovation and endurance technology.

- Fitbit is a part of Google LLC in the U.S and remains the most popular name in wearable electronics, which is best known for pioneering affordable fitness trackers and health wearables as well. Following the acquisition by Google, Fitbit has gained increased access to AI-driven health algorithms, Wear OS integration, and cloud-based health analytics. Its products, such as the Fitbit Charge, Versa, and Inspire series, offer robust health tracking features, including heart rate, sleep, and stress monitoring, hence benefiting overall market growth.

Below is the list of some prominent players operating in the global market:

There has been an intensifying competition between the major firms involved in the market. Pioneers in this field, such as Apple, Samsung, and Garmin, are dominating through premium segments by offering hardware-software integration and a very strong service ecosystem. Simultaneously, regional players such as boAt in India are focusing on cost-competitiveness and domestic adaptation to capture maximum revenue share. For instance, in February 2025, OPPO announced the launch of its OPPO Watch X2smartwatch, which has a premium design, advanced health tracking, and exceptional endurance. The watch comprises ECG analysis, blood oxygen monitoring, and a 60-second health check as well. Therefore, this launch readily contributes to the growth of the wearable electronics industry by setting new benchmarks in performance, design, and battery innovation.

Corporate Landscape of the Wearable Electronics Market:

Recent Developments

- In October 2025, Samsung Electronics announced a major milestone in wearable health technology with the world’s first smartwatch capable of detecting left ventricular systolic dysfunction using advanced AI algorithms, which was developed in collaboration with Medical AI.

- In June 2025, Apple announced the launch of watchOS 26, which marks a major update that enhances personalization, health, and connectivity on the Apple Watch with a stunning Liquid Glass design. It offers a more expressive interface across apps and notifications.

- In December 2024, MicroEJ introduced VEE Wear 2, which is a next-generation wearable operating system designed to revolutionize smartwatch performance with ultra-low power consumption, advanced health tracking, and seamless customization.

- Report ID: 8232

- Published Date: Nov 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wearable Electronics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.