Waterproof Portable Speakers Market Outlook:

Waterproof Portable Speakers Market size was valued at USD 7.9 billion in 2025 and is projected to reach USD 18.5 billion by the end of 2035, rising at a CAGR of approximately 10.6% during the forecast period, i.e., 2026 to 2035. In 2026, the industry size of waterproof portable speakers is estimated at USD 8.7 billion.

The waterproof portable speakers market is set to witness extensive growth in the forecasted years, owing to the rising consumer demand for high-quality, durable audio devices that can accompany outdoor and on-the-go lifestyles. On the supply chain and trade dynamics, the electronic components, such as audio modules, driver units, Bluetooth/WiFi chips, batteries, and waterproof casings, are integrated into worldwide manufacturing networks. In this regard, the article published by USITC in September 2023 revealed that the U.S. domestic exports of consumer electronics increased by a substantial USD 166 million (5%) to USD 3.5 billion in 2022. Therefore, this underscores a steady growth, prompting a significant trend of audio equipment such as speakers. On the other hand, in the U.S., the general imports of telecommunication equipment reflected a rise by USD 15.5 billion (14%) to USD 126.7 billion.

Moreover, the same report from USITC (U.S. International Trade Commission) notes that the growth in this sector is influenced by factors such as the expansion of 5G networks and the progress in the Internet of Things, which includes a vast ecosystem of connected devices such as smart and portable speakers. Meanwhile, the import data for consumer electronics displayed an increase of USD 535 million (1%) to USD 52.6 billion in 2022. The leading sources for these imports, such as China and Vietnam, are also the primary global manufacturing hubs for consumer electronics, indicating that the supply chains for products like portable speakers are deeply integrated with these trading partners. Therefore, the existence of all of these factors will readily accelerate the growth of the worldwide waterproof portable speakers market.

Import and Export Statistics for Portable Speaker Equipment

|

Region |

Category |

Import/Export Value & Partner |

|

European Union |

Loudspeakers |

Imports into the region in 2023: approximately USD 574,754.59 from various partners (China ~USD 303.8 million, Vietnam ~USD 154.9 million) |

|

European Union |

Parts of microphones, loudspeakers, and headphones |

Imports into the region in 2023: approximately USD 336.99 million; from China, ~USD 201.36 million |

|

European Union |

Same parts category |

Exports from the region in 2023: approximately USD 165.21 million; to the U.S. ~USD 32.32 million |

Source: WITS

Key Waterproof Portable Speakers Market Insights Summary:

Regional Highlights:

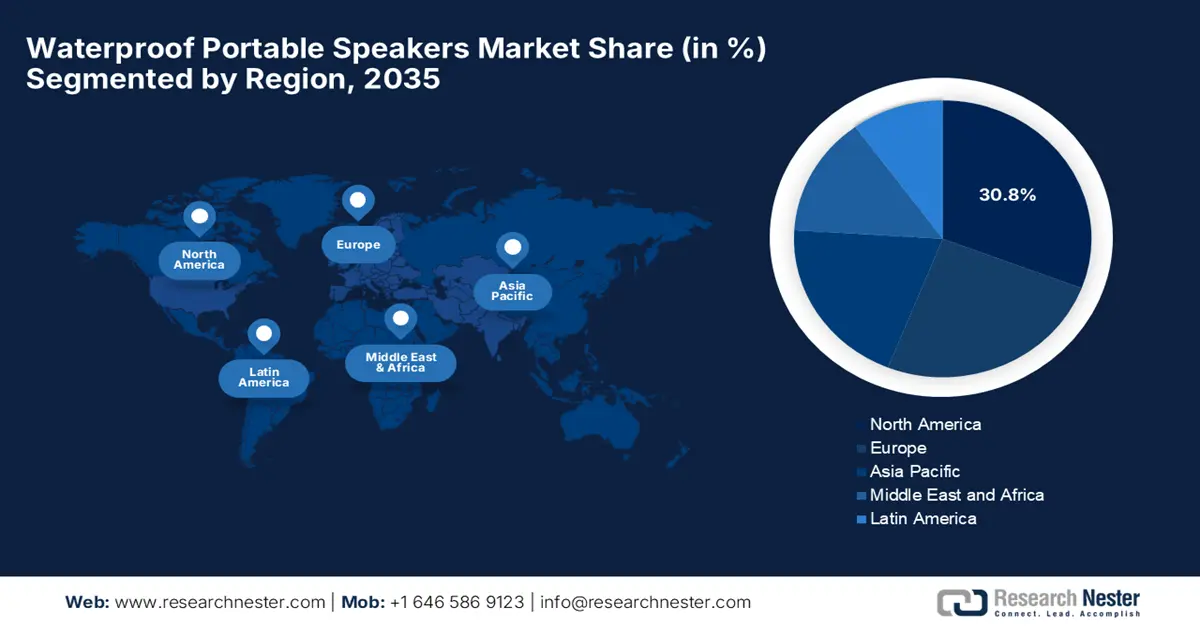

- North America is predicted to secure a 30.8% share of the waterproof portable speakers market by 2035, stemming from the widespread adoption of outdoor and recreational lifestyles.

- Asia Pacific is anticipated to expand at the fastest pace throughout 2026-2035 as the region undergoes a strong lifestyle shift toward outdoor activities, travel, and beach-centric leisure.

Segment Insights:

- The personal use segment is projected to command a 75.5% share by 2035 in the waterproof portable speakers market, propelled by the ever-increasing consumer focus on outdoor recreation, wellness, and social gatherings.

- The bluetooth speaker segment is expected to capture a 68.4% share by 2035, owing to the universal adoption of Bluetooth technology in smartphones, its ease of use, and continuous improvements in codec quality and battery life.

Key Growth Trends:

- Rising disposable incomes

- Integration of smart and connected features

Major Challenges:

- Technological limitations

- Battery and power constraints

Key Players: Bose Corporation- U.S., JBL (Harman International)- U.S., Sony Corporation- Japan, Ultimate Ears (Logitech International)- Switzerland, LG Electronics- South Korea, Samsung Electronics- South Korea, Panasonic Corporation- Japan, Anker Innovations- China, Altec Lansing- U.S., Bang & Olufsen- Denmark (Europe), Philips (Koninklijke Philips N.V.)- Netherlands (Europe), Skullcandy, Inc.- U.S., Braven (ZAGG Inc.)- U.S., Denon (Sound United LLC)- Japan, Cambridge Soundworks- U.S., Marshall (Zound Industries)- Sweden/UK (Europe), boAt Lifestyle- India, Portronics Digital Private Limited- India, KEF- UK (Europe), Tribit Audio- Malaysia.

Global Waterproof Portable Speakers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.9 billion

- 2026 Market Size: USD 8.7 billion

- Projected Market Size: USD 18.5 billion by 2035

- Growth Forecasts: 10.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 6 November, 2025

Waterproof Portable Speakers Market - Growth Drivers and Challenges

Growth Drivers

- Rising disposable incomes: This, coupled with the expanding middle class in emerging nations, is the primary growth driver for the waterproof portable speakers market. The electronic sector has represented consistent progress over the past few years, creating a heightened demand for consumer electronics, including audio devices. Therefore, this provides an encouraging opportunity for the pioneers involved in the portable speakers sector. In this regard, the report from IBEF in January 2025 states that India is set to become the world’s third-largest consumer market after the US and China. It also noted that the number of affluent individuals with annual incomes above USD 10,000 is expected to rise from 40 million in 2023 to 88 million by the end of 2028. Disposable per capita income increased from USD 2.11 thousand in 2019 to USD 2.54 thousand in 2023, and is projected to reach USD 4.34 thousand by 2029. This income growth, coupled is fueling higher spending on devices such as waterproof portable speakers.

- Integration of smart and connected features: The global market for waterproof portable speakers has heavily benefited from this factor, as connected devices, voice-enabled assistants, and multi-room/portable interoperability consistently drive business in this sector. In this regard, manufacturers and B2B buyers recognized that waterproof portable speakers increasingly serve as part of a connected audio ecosystem for outdoor use, travel, rather than standalone passive devices. For instance, in August 2022, Sony India reported that it had expanded its X-series wireless speaker lineup, with three new models called the SRS-XG300, SRS-XE300, and SRS-XE200, which are especially designed for powerful, immersive sound and portability. The products feature Sony’s x-balanced speaker unit; these models deliver enhanced bass and sound clarity with Live Sound Mode for a 3D experience. Further, the product comes with an IP67 rating, which is resistant to water and dust, ideal for outdoor use, hence positively impacting market growth.

- Stable pricing: The aspect of stable pricing in the consumer electronics sector, especially in terms of audio and related devices, represents an extremely balanced waterproof portable speakers market environment wherein both the supply and demand remain constant. Therefore, this steady nature underscores that manufacturers have effectively managed production, supply chain coordination, and cost-control strategies to absorb raw material and logistics changes without any price volatility imposed on buyers. This can be testified from the report published by the U.S. Bureau of Labor Statistics, which states that in the U.S. CPI release for December 2024 shows that for the category video and audio products, the year-over-year change was 0.0%, whereas for audio equipment was up about 2.0% hence fostering a profitable business environment.

Challenges

- Technological limitations: This is the major challenge associated with the waterproof portable speakers market since creating these speakers necessitates extremely skilled professionals. Also, the development of a waterproof speaker that delivers premium audio quality while remaining compact and portable is a significant engineering challenge, creating hesitation among investors. Also, achieving high IP ratings, such as IP67 or IP68, requires advanced sealing, specialized materials, and rigorous testing. In addition, the aspect of over-engineering for durability can sometimes compromise acoustic performance or increase the product’s weight, affecting the portability of these advanced speakers. Therefore, manufacturers must continuously innovate in speaker driver design, water-resistant coatings, and structural design to maintain sound quality and usability.

- Battery and power constraints: This is yet another factor that has skewed growth in the waterproof portable speakers market since it hinders widespread adoption. Extended playtime is one of the key factors driving consumer preference, but integrating high-capacity batteries into small designs is technically complex, making it challenging for manufacturers to satisfy user preferences. On the other hand, features such as Bluetooth connectivity, LED ambient lighting, and enhanced audio output significantly increase power consumption. Therefore, designers must carefully balance battery size, weight, and charging efficiency to ensure portability and reliability, where failure can negatively affect market expansion.

Waterproof Portable Speakers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.6% |

|

Base Year Market Size (2025) |

USD 7.9 billion |

|

Forecast Year Market Size (2035) |

USD 18.5 billion |

|

Regional Scope |

|

Waterproof Portable Speakers Market Segmentation:

Application Segment Analysis

Based on the application personal use segment is projected to garner the largest revenue share of 75.5% in the waterproof portable speakers market during the projected timeframe. The dominance of the segment is effectively attributable to the ever-increasing consumer focus on outdoor recreation, wellness, and social gatherings. Also, government agencies across different nations are proactively promoting physical activities, which often involves portfolio fueling the demand of this sector. In addition, government initiatives in several countries actively promote physical activity, sports, and community events, indirectly boosting the adoption of personal-use audio devices. Furthermore, the convergence of lifestyle trends, health awareness, and supportive public policies is also playing a critical role in reinforcing the segment’s strong market performance, hence denoting a wider segment scope.

Type Segment Analysis

In terms of type Bluetooth speaker segment is expected to capture a significant revenue share of 68.4% in the waterproof portable speakers market by the end of 2035. The universal adoption of Bluetooth technology in smartphones, its ease of use, and continuous improvements in codec quality and battery life are the key factors behind this leadership. Also, the convenient options such as seamless, wire-free connection for personal audio are continuously increasing consumer demand. For instance, in September 2025, JBL introduced the JBL Grip, which is an ultra-portable Bluetooth speaker featuring JBL Pro Sound, AI sound boost, and IP68 water, dust, and drop protection, especially designed for on-the-go adventures. Also, this compact, upright speaker includes 12 hours of playtime, Auracast for multi-speaker pairing, and customizable ambient lighting via the JBL Portable app, hence denoting a positive market outlook.

Distribution Channel Segment Analysis

Based on the distribution channel online segment is anticipated to grab a lucrative share of 55.3% in the waterproof portable speakers market during the analyzed timeframe. The shift towards e-commerce, owing to the better product comparison, customer reviews, and direct-to-consumer brand strategies, along with discounting options, is propelling the growth of this sub-segment. Besides the trust towards online transactions, the strong support from cybersecurity frameworks makes it a highly preferred purchasing channel. The segment also allows global companies to reach geographically diverse markets with much lower operational costs when compared to traditional brick-and-mortar outlets, thereby enabling rapid expansion. Therefore, this combination of convenience, competitive pricing, enhanced transparency, and secure digital infrastructure makes the online channel a rapidly expanding source for purchasing waterproof portable speakers.

Our in-depth analysis of the waterproof portable speakers market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Type |

|

|

Distribution Channel |

|

|

Price Range |

|

|

Waterproof Rating |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Waterproof Portable Speakers Market - Regional Analysis

North America Market Insights

North America is predicted to hold the highest share of 30.8% in the global waterproof portable speakers market throughout the discussed tenure. The leadership of this region in this field is primarily driven by the widespread adoption of outdoor and recreational lifestyles. The region also benefits from a mature consumer electronics ecosystem, high disposable incomes, and a culture that effectively leverages outdoor recreation, which together drive demand for these water‑proof audio devices. In this regard, the JBL Flip 6 Martin Garrix edition expands the brand’s presence in the portable speaker sector, wherein in October 2023, JBL, along with Martin Garrix, introduced the special edition JBL Flip 6 portable speaker, marking a highly anticipated collaboration which features a distinctive + x pattern delivering the firm’s signature sound quality, is IP67 waterproof, hence making it suitable for standard market growth.

The U.S. is solidifying its dominance over the regional waterproof portable speakers market, backed by the presence of intense brand competition, rapid product refresh cycles, and a strong focus on premium features and experiences. Besides, the country’s market also benefits from continued innovations in this field, better performance and durability standards, allowing a steady cash influx. In 2024, Sonos reported that it continued its streak of innovation with the launch of the Sonos Roam 2 and Sonos Ace, which comprises features such as TV audio swap for seamless private listening. Moreover, Sonos Arc Ultra and Sub Gen 4 enhanced home audio with advanced drivers delivering deeper bass and clarity. Furthermore, in 2025, the Sonos Era 100 Pro with PoE was released, which offers an extremely simplified installation for homes and businesses with Ethernet infrastructure.

There is a huge opportunity for Canada in the waterproof portable speakers market, wherein the geography and climate play a critical role in product utilization, since there is a heightened demand for speakers that are resistant to cold, snow, or lakeside environments. Also, the expanding consumer demand for durability and reliability often leans towards models that cater to mixed indoor‑outdoor lifestyles. On the distribution network, the channels include both national chains and specialty electronic stores, wherein the expansion of e-commerce is readily fueling growth in this sector. In addition, the collaborations with popular music artists and tech influencers are emerging as a key strategy to attract younger consumers. The trends represent a highly significant segment for manufacturers and distributors in the entire North America, hence denoting a positive market outlook.

APAC Market Insights

The Asia Pacific region is identified as the fastest-growing region in the regional waterproof portable speakers market from 2026 to 2035. The region’s progress in this field is efficiently driven by a strong lifestyle shift toward outdoor activities, travel, and beach-centric leisure. The region’s market extremely benefits from the rising influence of social media and music streaming trends, heating demand for high-quality, portable sound devices. Sony in April 2025 reported that it successfully expanded its ULT POWER SOUND series in collaboration with Post Malone, introducing the ULT Tower 9, ULT Tower 9ac, ULT Field 5, ULT Field 3, and ULTIMATE 1 wireless microphones. The field models provide portable, high-quality sound with which are waterproof and dustproof protection, and detachable shoulder straps for on-the-go use, hence fostering a favorable business environment.

China is the major contributor to upliftment in the regional waterproof portable speakers market, fueled by tech-savvy consumers and a heightened demand for innovative gadgets. Both domestic and international brands in the country are extensively focusing on exclusive designs, high-quality audio, and smart connectivity to attract urban and younger demographics. In this regard, B&C Speakers introduced its Eminence Pro range at Prolight + Sound Guangzhou 2025, showcasing high-performance products after the acquisition of the Eminence Speaker brand expanded its product portfolio for live events and installations. Hence, the eminence pro range will readily accelerate waterproof portable speakers market growth by attracting professional users who are seeking reliable audio solutions, expanding the firm’s presence in the premium speaker segment.

India is gaining momentum in the waterproof portable speakers market, due to the rising disposable incomes and increased exposure to digital entertainment. The offline electronics chains and expanding online retail platforms, making premium and mid-range offerings accessible. According to an article published by the government of India in August 2025 the country is experiencing easing inflation, wherein CPI is reported to be 2.10%, boosting purchasing power. Also, there has been a strong export growth, particularly in services and electronics, which is narrowing the trade deficit and strengthening the economy. In addition, government initiatives such as PLI schemes, logistics improvements, and export facilitation for MSMEs are enhancing competitiveness. Therefore, all of these factors will position the country to become the world’s third-largest economy by the end of 2030, deliberately boosting market expansion.

Europe Market Insights

Europe is predicted to gain the second-largest stakeholder position in the worldwide waterproof portable speakers market over the discussed tenure. The region’s growth in this field is propelled by environmental consciousness is driving demand for durable and energy-efficient devices, whereas smart connectivity and integration with home ecosystems are increasingly influencing purchasing decisions. In June 2024, Ultimate Ears, a Logitech brand, announced the launch of everboom, which is a durable portable speaker delivering 360° crystal-clear sound, with an IP67 rating making it waterproof, dustproof, and floatable. The company also stated that this speaker offers up to 20 hours of playtime, a 55-meter Bluetooth range, and an outdoor boost feature for enhanced bass outdoors, hence suitable for the overall expansion of the waterproof portable speaker industry.

Germany is growing exponentially in the regional waterproof portable speakers market, owing to the popularity of outdoor events and recreational sports, where water-resistant audio solutions are extremely essential. The country also leverages local distribution networks, including both specialty electronics stores and e-commerce platforms, which are enabling enhanced access to these premium audio devices, ensuring these premium audio devices reach a wider audience efficiently. Furthermore, the ever-increasing consumer preference for waterproof devices, coupled with the presence of key market players in the country, is allowing a steady cash inflow in the waterproof portable speakers market, encouraging more players to establish their footprint in Germany.

The U.K. is also maintaining a strong position in Europe’s waterproof portable speakers market, owing to the huge interest in portable, weather-resistant audio with premium sound quality, often seeking features like Bluetooth connectivity and extended battery life. In this regard, Bose in May 2024 announced that it has launched the SoundLink Max, which is a rugged and portable Bluetooth speaker which has an IP67 rating for water, dust, and shock resistance. The product possesses a Bose articulated array, passive radiators, and adjustable EQ via the Bose app, prompting enhanced usage. It also offers immersive audio with deep bass and distortion-free clarity by supporting Bluetooth 5.3, Snapdragon Sound, and Google Fast Pair, the Soundlink Max. Therefore move will drive market growth by attracting consumers who are seeking high-quality, durable, and waterproof portable speakers for outdoor and on-the-go use.

Key Waterproof Portable Speakers Market Players:

- Bose Corporation- U.S.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- JBL (Harman International)- U.S.

- Sony Corporation- Japan

- Ultimate Ears (Logitech International)- Switzerland

- LG Electronics- South Korea

- Samsung Electronics- South Korea

- Panasonic Corporation- Japan

- Anker Innovations- China

- Altec Lansing- U.S.

- Bang & Olufsen- Denmark (Europe)

- Philips (Koninklijke Philips N.V.)- Netherlands (Europe)

- Skullcandy, Inc.- U.S.

- Braven (ZAGG Inc.)- U.S.

- Denon (Sound United LLC)- Japan

- Cambridge Soundworks- U.S.

- Marshall (Zound Industries)- Sweden/UK (Europe)

- boAt Lifestyle- India

- Portronics Digital Private Limited- India

- KEF- UK (Europe)

- Tribit Audio- Malaysia

- Harman International Industries, Inc., globally popular as JBL, is based in the U.S, a subsidiary of Samsung Electronics Co., Ltd., and is considered to be the predominant leader in terms of portable audio. The company successfully reached a milestone of 100 million portable speakers shipped, solidifying its dominating position in this field. On the other hand, its most recent launches, such as the Flip 7 and Charge 6, feature IP68 waterproofing, AI Sound Boost, and Bluetooth 5.4 connectivity, encouraging it for further investments in rugged design, outdoor use orientation, and large distribution channels.

- Sony Corporation is one of the most prominent players in the waterproof portable speakers market, which has readily expanded its ULT POWER SOUND range with models such as ULT FIELD 5 and FIELD 3 that carry IP66/IP67 waterproof and dustproof ratings and saltwater resistance. The firm positions itself as more premium, immersive audio, linking product launches with lifestyle‐marketing (and emphasizing high fidelity, durability, and brand heritage.

- Bose Corporation stands out as the third most critical player in the waterproof speakers industry, wherein it leverages SoundLink Plus and SoundLink Micro with inclusions such as IP67-rated waterproof, dustproof, and rustproof features, a floating design, and 20-hour battery life in the Plus. Gizmochina Bose continues to leverage its premium brand in portable audio.

- Anker Innovations Co., Ltd. (Soundcore). It has ongoing operations all over the world and, under its Soundcore audio brand, Anker offers highly advanced and waterproof portable speakers market catering to outdoor and budget-conscious segments. The company Anker emphasizes value, features such as party lights, bass boost, floating design, and direct-to-consumer channels to challenge premium brands.

- LG Electronics Inc. is based in South Korea and is best known for its home electronics. LG offers portable audio devices, including waterproof Bluetooth speakers, in its lineup, particularly targeting the outdoor lifestyle and mobile device accessory segments. Besides, the company has its prime focus on smart integration, design aesthetics, and leveraging its broader brand presence in both South Korea and Asia.

Below is the list of some prominent players operating in the global waterproof portable speakers market:

The global waterproof portable speakers market is witnessing strong brand differentiation and technology innovations. Premium players in these fields, such as Bose, Sony, and JBL, are dominating in terms of audio fidelity, design, and durability, whereas the value-oriented brands are competing in terms of affordability and battery longevity. The key firms are extensively leveraging mergers & acquisitions to strengthen global distribution networks, allowing a steady cash influx in this sector. Bose Corporation, in November 2024, announced that it had acquired McIntosh Group, which is the parent company of high-performance audio brands including McIntosh and Sonus faber. The acquisition expands Bose’s exclusive product portfolio across headphones, speakers, soundbars, and automotive audio, thereby allowing McIntosh to continue focusing on luxury amplifiers, loudspeakers, and turntables.

Corporate Landscape of the Waterproof Portable Speakers Market:

Recent Developments

- In June 2025, Bose announced the launch of SoundLink Plus and next-gen SoundLink Micro, which is a combination of rugged portability with high-quality audio. The SoundLink Plus delivers booming bass, 20-hour battery life, IP67 water and dust resistance, and can double as a power bank.

- In March 2025, JBL introduced the Flip 7 and Charge 6, possessing AI Sound Boost technology for powerful, distortion-free audio. The company also stated that both of these models are IP68-certified, offering water, dust, and drop resistance, with extended playtime.

- Report ID: 8227

- Published Date: Nov 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Waterproof Portable Speakers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.