Portable Data Storage Market Outlook:

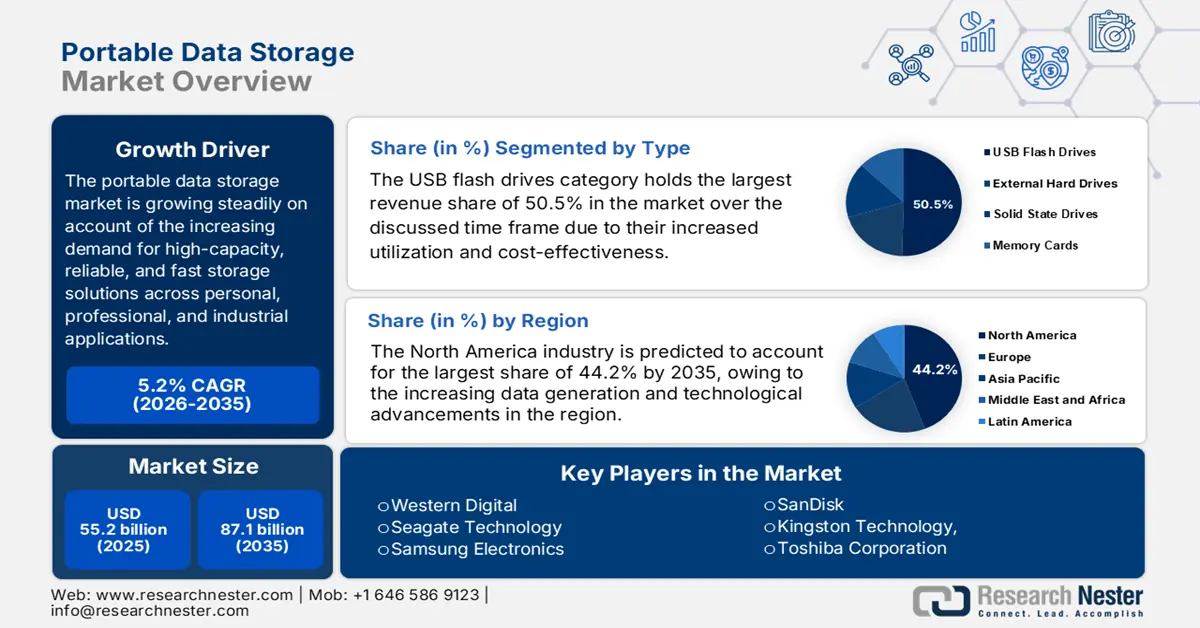

Portable Data Storage Market size was valued at USD 55.2 billion in 2025 and is projected to reach USD 87.1 billion by the end of 2035, rising at a CAGR of 5.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of portable data storage is estimated at USD 58 billion.

The portable data storage market is growing steadily on account of the increasing demand for high-capacity, reliable, and fast storage solutions across personal, professional, and industrial applications. Pure Storage, in December 2025, announced a substantial USD 400 million incremental share repurchase authorization, which reflects its strong financial position and strategic focus on delivering shareholder value while continuing to invest in technological innovation. The repurchase program was funded from available cash, allows flexibility through open market transactions or negotiated deals, and has no expiration date. Hence, such instances underscore Pure Storage’s commitment to disciplined capital allocation along with the advancements in data storage platform, which supports energy-efficient solutions across on-premises, cloud, and hosted environments.

Furthermore, the portable data storage market is also influenced by cloud adoption, data security concerns, and the need for proper data transfer, fostering continued innovations from the leading manufacturers. In this regard, researchers at the Centre for Nano and Soft Matter Sciences (CeNS) have developed a novel photonic memory using tin oxide slanted nanorod arrays that can be controlled by both electrical and optical stimuli, enabling multilevel data storage. As of the May 2023 findings, this memory demonstrates low operating voltages, high ON/OFF ratios, and long retention, with unusual negative photoresponse under UV and visible light. CeNS also mentioned that its operation relies on the formation and dissolution of oxygen-vacancy filaments, allowing electrical SET and optical RESET of resistance states.

Key Portable Data Storage Market Insights Summary:

Regional Highlights:

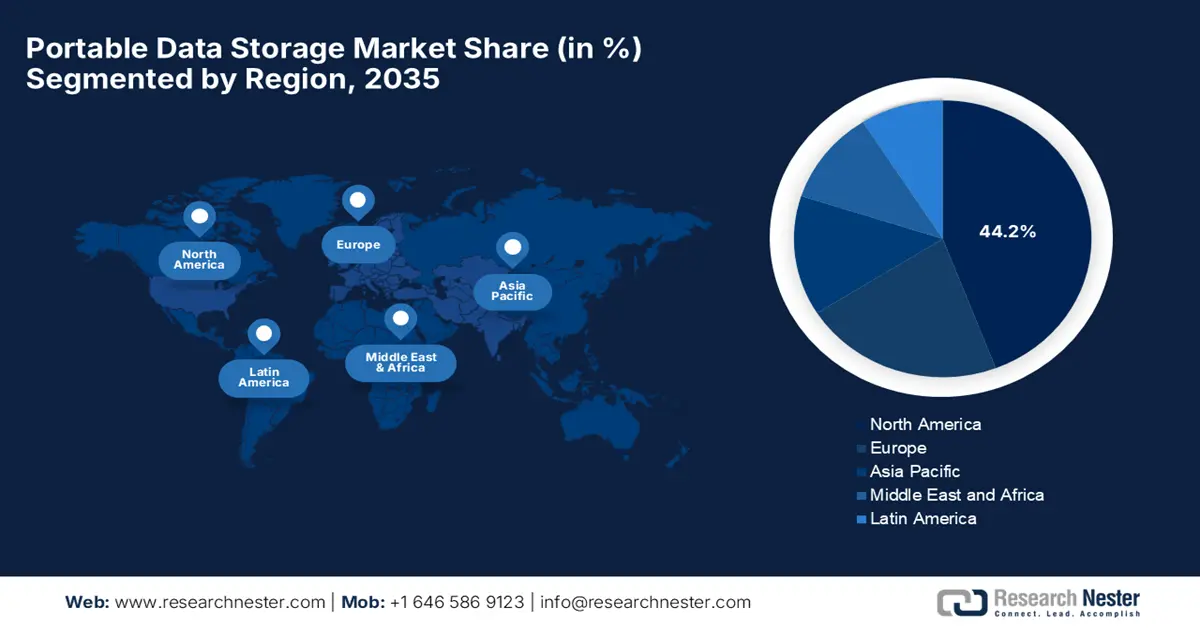

- North America in the portable data storage market is forecast to capture a dominant 44.2% share by 2035, supported by accelerating data generation volumes and continuous technological progress across consumer and enterprise environments.

- Asia Pacific is projected to record the fastest expansion by 2035, stimulated by rising smartphone penetration and expanding internet connectivity across emerging digital economies.

Segment Insights:

- The USB flash drives segment in the portable data storage market is expected to account for a leading 50.5% revenue share by 2035, strengthened by widespread adoption and affordability advantages enhancing routine data transfer needs.

- By 2035, the individual user segment is anticipated to expand at a notable pace as personal data creation accelerates through digital lifestyles and high-resolution content usage.

Key Growth Trends:

- Demand for high-capacity storage devices

- Advancements in memory technologies

Major Challenges:

- Data security & private concerns

- High cost of storage technologies

Key Players: Western Digital (U.S.), Seagate Technology (U.S.), Samsung Electronics (South Korea), SanDisk (U.S.), Kingston Technology (U.S.), Toshiba Corporation (Japan), Transcend Information (Taiwan), ADATA Technology (Taiwan), Sony Corporation (Japan), LaCie (U.S./France; Seagate subsidiary), Buffalo Technology (U.S./Japan), Corsair (U.S.), PNY Technologies (U.S.), Silicon Power (Taiwan).

Global Portable Data Storage Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 55.2 billion

- 2026 Market Size: USD 58 billion

- Projected Market Size: USD 87.1 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Brazil, Mexico

Last updated on : 16 December, 2025

Portable Data Storage Market - Growth Drivers and Challenges

Growth Drivers

- Demand for high-capacity storage devices: The ever-increasing utilization of smartphones, laptops, cameras, and IoT devices is efficiently driving business in the portable data storage market, influenced by the need for devices with larger storage capacities. In September 2023, Apple launched its iPhone 15 Pro and iPhone 15 Pro Max, which have advanced camera upgrades with a 48MP main camera and a 5x telephoto lens. These are powered by the A17 Pro chip, which delivers next-level gaming and professional performance, while the new USB-C connector with USB 3 speeds enables faster data transfer and pro workflows. In addition, it the high performance and expanded storage capabilities for creative and demanding users, and it has up to 1TB of internal storage, reflecting growing consumer demand for higher storage capacities to support high-resolution videos, gaming, and AR applications.

- Advancements in memory technologies: Emerging technologies such as SSDs, flash drives, and photonic or multilevel memories enable much faster, more reliable, and energy-efficient storage solutions. In May 2025, Micron Technology unveiled two high-performance SSDs at Computex 2025 which are the Crucial T710 PCIe Gen5 NVMe SSD and the Crucial X10 portable SSD. Besides, the T710 delivers blazing Gen5 speeds, which are suitable for pro gamers and creators, thereby enhancing gaming and AI applications with cutting-edge NVMe technology. In addition, the X10 combines proper design, durability, and storage capacities up to 8TB, making it highly ideal for massive backups and portable use, reflecting Micron’s commitment to meeting evolving consumer storage needs. Also, as per the Research Nester analysis, the portable SSD market is also expected to grow at a considerable rate over the forecasted years, positively impacting the portable data storage market.

- Growing Data Generation: There has been an exponential growth of digital data in sectors such as media, healthcare, and enterprise IT, which is efficiently fueling demand for portable and easily transportable storage options. As per the article published by the National Institute of Health, its 2025-2030 strategic plan for data science outlines a vision to advance biomedical and behavioral research by leveraging the rapid growth and diversity of data. It focuses on improving data management, enhancing human-derived datasets, developing AI and computational tools, and supporting a federated biomedical research infrastructure. It also mentioned that the plan aims to build sustainable capabilities and a skilled workforce to accelerate discoveries. Also, biomedical research is producing petabytes of data, thereby driving the need in the portable data storage market and management solutions to support research and clinical data sharing.

Challenges

- Data security & private concerns: This is a major obstacle for the upliftment of the portable data storage market. The devices, such as external hard drives and USB drives, are vulnerable to theft, unauthorized access due to their small, easily transportable form. If the security measures, such as encryption or passwords, are not properly employed, the sensitive data can be compromised, restricting widespread adoption in this field. Also, the governing bodies have imposed strict requirements on data protection, thereby creating compliance challenges for businesses that are using portable storage. In addition, the malware or ransomware attacks can infect devices, risking data integrity. Furthermore, the data breaches have also become more costly and damaging; therefore, both manufacturers and users must invest in advanced security features.

- High cost of storage technologies: Emerging storage improvements such as NVMe SSDs, PCIe Gen5 drives, and experimental photonic memories offer significant speed, reliability, and energy-efficiency improvements when compared to traditional HDDs and standard flash drives. But these high-performance devices come with substantial costs, which in turn can limit adoption in the portable data storage market, especially among budget-conscious consumers and small enterprises from price-sensitive regions. Also, the mainstream SSDs are more expensive per gigabyte than traditional hard drives, in which the price challenge is complemented by rapidly evolving technologies. As a result, high-capacity, high-speed portable storage solutions are in demand, but their affordability remains a barrier for portable data storage market penetration.

Portable Data Storage Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 55.2 billion |

|

Forecast Year Market Size (2035) |

USD 87.1 billion |

|

Regional Scope |

|

Portable Data Storage Market Segmentation:

Type Segment Analysis

The USB flash drives category holds the largest revenue share of 50.5% in the portable data storage market over the discussed time frame. The dominance of the segment is propelled by the increased utilization and cost-effectiveness. Consumers are preferring these drives owing to their familiarity with data transfer and storage. In May 2025, AlphaTheta announced that it had teamed up with SanDisk to launch the high-performance SanDisk DJ flash drive, which is designed specifically for DJs who need fast, reliable, and durable storage for professional workflows. This drive offers up to 1,000MB/s read and 900MB/s write speeds, dual USB-C/USB-A connectors, and capacities up to 1TB, and it is also optimized for Pioneer DJ and rekordbox systems. Furthermore, the device includes a 3-month Rekordbox Creative Plan, which makes it a dependable solution for creating, storing, and transferring DJ sets, hence denoting a wider segment scope.

End user Segment Analysis

By the end of 2035, the individual user segment is expected to grow at a considerable rate in the portable data storage market. The rising digital lifestyle and the advent of personal devices are the key factors behind this leadership. Simultaneously, there has been a rise in multimedia content, which in turn has heightened demand for these portable data storage solutions. The small and medium-scale enterprises are opting for digital solutions, which is also increasing their demand for data storage. In addition, consumers are expanding the use of high-resolution formats, which include 8K video and RAW photography, thereby necessitating larger storage capacities. Growth in personal gaming libraries and portable game consoles is also accelerating demand for high-speed, high-endurance flash drives and SSDs. Furthermore, SMEs are increasingly adopting hybrid cloud-local storage setups, driving purchases of secure portable storage for off-site backups and fast data transfer.

Application Segment Analysis

Based on application data, the backup segment is likely to hold a significant share in the portable data storage market, owing to increased demand across both business and personal use. Also, the rise in data generation, coupled with stricter regulations for data privacy are major driver for the sub-type. In March 2025, Western Digital reported that 87% of consumers now back up their data, owing to the fears of losing important files, rising cyber threats, and the need to free up device space. Besides, with cloud storage limits frequently maxing out at 60% running out of space in the prior six months, most of the users are shifting to a hybrid backup model, thereby relying on external HDDs, SSDs, and NAS devices. The firm also mentioned that this trend is reinforced by Western Digital’s expanded high-capacity portfolio, which includes 26TB external drives and 6TB portable HDDs, hence directly supporting the growing demand for dependable backup solutions.

Our in-depth analysis of the portable data storage market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

End user |

|

|

Application |

|

|

Technology |

|

|

Form Factor |

|

|

Memory Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Portable Data Storage Market - Regional Analysis

North America Market Insights

North America is predicted to account for the largest share of 44.2% in the portable data storage market by the end of 2035, owing to the increasing data generation and technological advancements in the region. The region’s leadership is also propelled by the rise of remote work and the presence of key market players. In October 2025, Integral introduced its new USSD line, which is a portable solid-state drive built in a compact USB form factor that delivers SSD-level performance without any cables or connectivity requirements. The product is especially designed for modern workflows, and it offers speeds of up to 2000MB/s, capacities up to 2TB, and broad compatibility across laptops, desktops, smartphones, and even cameras. In addition, the Turbo-C model targets power users with USB-C 20Gbps performance for tasks like 4K editing, while the SlimXpress Dual USB-C provides both USB-A and USB-C connectors for use across legacy and modern devices, hence positively influencing overall portable data storage market growth.

The U.S. is continuously growing in the portable data storage market on account of regulatory support for data protection and privacy, and the presence of advanced manufacturing facilities. The country is home to a strong distribution network, and the need for data storage has allowed firms in the country to capture encouraging opportunities. In August 2024, Samsung Electronics America introduced new 512GB BAR Plus, FIT Plus, and USB Type-C flash drives, thereby expanding their lineup with higher-capacity options for users who need fast, reliable portable storage. It notes that these drives offer up to 400 MB/s read and 110 MB/s write speeds, enabling quick transfers such as moving a 3GB 4K UHD file in just 10 seconds. Furthermore, these solutions work across Windows, macOS, Linux, and any device with a USB 3.1 port, while remaining backward compatible with older standards. Hence, such instances encourage more players to establish their footprint in the country to meet the evolving consumer needs.

In Canada, the portable data storage market is unfolding remarkable growth opportunities due to the ever-increasing data generation, heightened demand for data mobility, and the increasing need for data backup solutions among both businesses and consumers. The country is witnessing a major shift towards durable and high-capacity solutions as SSDs and cloud-based storage, due to which the government has enforced strict data privacy regulations. As of May 2022, data from the country’s government outlined strict requirements for portable data storage devices, broadly defining them to include USB drives, external disks, mobile devices, and optical media. It also states that these devices should be physically secured, encrypted using approved cryptographic standards, and used only for temporary storage unless formally authorized. Furthermore, departments are completely responsible for managing issuance, monitoring, sanitization, disposal, and mandatory reporting of loss or theft, thereby ensuring the protection of sensitive government information.

APAC Market Insights

Asia Pacific is likely to register the fastest growth in the international portable data storage market, owing to the proliferation of smartphones, internet penetration, and the emerging e-commerce industry. The region benefits from the presence of prominent countries and their unique developmental tendency. Also, the presence of both established and emerging entities is prompting a favourable ecosystem for continued innovations. For instance, in April 2025, Kioxia, AIO Core, and Kyocera together announced the development of a PCIe 5.0-compatible broadband optical SSD by combining high-speed optical transceivers and optoelectronic integration for advanced data transfer applications such as generative AI. Besides, this technology allows greater physical separation between compute and storage in next-generation green data centers by maintaining energy efficiency and high signal quality. Furthermore, it is supported by Japan’s NEDO Green Innovation Fund Project, and it aims to reduce data center energy consumption by more than 40% when compared to current systems.

The portable data storage market in China is witnessing progress due to increasing digitalization across industries, strong R&D, rising adoption of smartphones, PCs, and gaming devices, and the proliferation of content such as 4K and 8K media. Besides, businesses in the country are also prioritizing backup and rapid data access due to stricter data protection regulations. In April 2025, Fudan University reported that its researchers at developed a picosecond-level flash memory device, PoX, which achieved a program speed of 400 picoseconds that is equivalent to 25 billion operations per second, and surpassing previous speed records. Hence, this breakthrough makes it the fastest known semiconductor charge storage device, which also has potential applications in ultra-fast AI model operations. Furthermore, it dramatically increases non-volatile memory access speed, and the technology addresses critical demands for high computational power and energy efficiency in next-generation computing.

In India, the portable data storage market is efficiently growing on account of the surge in digital content creation, e-learning, and mobile device usage. The country’s market also benefits from the rise of small and medium enterprises adopting digital workflows, and growing awareness of data security, which in turn is boosting demand for external storage solutions such as SSDs, USB drives, and memory cards. In September 2023, DigiBoxx announced the launch of Megh3, which is a digital storage and backup solution in the country that is, offering fast, flexible, and scalable storage compatible with S3 infrastructure. Besides, this launch is targeted at both corporate and individual users; the product strongly emphasizes security, performance, and simple access to data. Furthermore, it is powered by Hitachi Systems in India, and it represents a homegrown solution addressing the growing demand for reliable cloud-based storage in the country’s portable data storage market.

Europe Market Insights

Europe is predicted to account for a lucrative growth rate in the portable data storage market from 2026 to 2035. This growth is efficiently propelled by the data protection regulations and the increasing preference among businesses to manage their sensitive data. The regional portable data storage market is also fueled by a strong focus on sustainability and continued innovations. According to the article published by the European Union, its EU Data Act, which came into force from September 2025, establishes harmonized rules for fair access and use of data generated by connected devices, thereby making it suitable for both consumers and businesses. It also mentioned that this act enables data portability, cost-effective repairs, and access to performance data, thereby fostering innovation and efficiency across sectors such as manufacturing, agriculture, and IoT-driven services. Furthermore, by balancing the interests of data holders and users, the Act aims to strengthen the regional data economy by supporting sustainability along with digital transformation objectives.

Germany in the portable data storage market is augmenting its leadership over the regional landscape, owing to the increasing adoption of digital technologies across both personal and business sectors. Simultaneously, the regulatory emphasis on cybersecurity, coupled with the need for mobility of critical information, is also encouraging consumers and enterprises to make investments in external storage devices such as SSDs, USB drives, and hybrid solutions. In October 2024, KIOXIA Europe announced the launch of the EXCERIA PLUS G2 portable SSD series, which offers a compact and elegant external storage solution for on-the-go users and content creators. The company also underscored that this SSD features BiCS FLASH 3D memory, USB 3.2 Gen2 interface, and speeds up to 1050MB/s read and 1000MB/s write, and it supports capacities from 500GB to 2TB and broad device compatibility, hence positively impacting market growth.

In the U.K., the portable data storage market is readily blistering growth on account of rising digital data volumes. The country’s market is also supported by trends such as remote work, the rise of IoT devices, and increasing reliance on multimedia content for both professional and personal use. In April 2022, Samsung announced the launch of the T7 Shield Portable SSD, which is a durable, credit-card-sized external drive designed for creative professionals and on-the-go users. It features IP65-rated water and dust resistance, shock protection from drops up to three meters, and ensures a very reliable performance in any environment. Furthermore, the SSD is offering USB 3.2 Gen2 speeds up to 1,050 MB/s read and 1,000 MB/s write, wide device compatibility, hardware-based 256-bit AES encryption, and eco-friendly packaging, hence delivering fast and sustainable portable storage.

Key Portable Data Storage Market Players:

- Western Digital (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Seagate Technology (U.S.)

- Samsung Electronics (South Korea)

- SanDisk (U.S.)

- Kingston Technology (U.S.)

- Toshiba Corporation (Japan)

- Transcend Information (Taiwan)

- ADATA Technology (Taiwan)

- Sony Corporation (Japan)

- LaCie (U.S./France; Seagate subsidiary)

- Buffalo Technology (U.S./Japan)

- Corsair (U.S.)

- PNY Technologies (U.S.)

- Silicon Power (Taiwan)

- Western Digital is a leading global provider of data storage solutions, which is offering a wide range of portable SSDs, HDDs, and flash drives for both consumers and enterprises. The company is primarily focused on high-capacity, high-performance, and reliable storage solutions. In addition, Western Digital is continuously making investments in innovations around NVMe SSD technology and portable drives, and it also emphasizes integration with cloud and enterprise storage services to strengthen its market presence in the years ahead.

- Seagate Technology is a major dominant force in performance-oriented storage solutions, particularly in portable hard drives and SSDs. The company is targeting both consumer and professional users by expanding into enterprise and cloud storage. Meanwhile, durability, high-speed data transfer, and innovation, including multi-terabyte portable drives and hybrid storage solutions, are enabling Seagate to maintain the competitive edge in the global landscape.

- Samsung Electronics is leveraging a very strong semiconductor expertise to produce high-speed, compact portable SSDs and memory products. The firm’s extensive product portfolio includes NVMe and SATA SSDs, which are optimized for performance, portability, and reliability. Samsung is also focused on integrating technologies such as PCIe Gen 4 and advanced flash memory designs, hence solidifying its position as a premium portable storage brand.

- SanDisk is a subsidiary of Western Digital and is renowned for its flash memory and portable storage devices. The firm emphasizes durability, fast data transfer speeds, and reliability across USB drives, memory cards, and portable SSDs. In addition, SanDisk targets everyday consumers and professionals, who are leveraging brand recognition and global distribution networks to maintain a strong foothold in this field.

- Kingston Technology is recognized as a major manufacturer of memory and storage solutions, which include portable SSDs, USB drives, and industrial-grade storage products. The company is focused on affordability, reliability, and high-performance storage solutions. Furthermore, Kingston maintains a very strong international presence and emphasizes long-term customer relationships to reinforce its reputation in the portable data storage market.

Below is the list of some prominent players operating in the global portable data storage market:

The competitive landscape of the portable data storage market is efficiently shaped by both established technology firms and specialized storage manufacturers. The pioneers are intensely competing in terms of performance, capacity, and connectivity features. Simultaneously, the market leaders such as Western Digital, Seagate, Samsung, and SanDisk are leveraging their extensive R&D and vertically integrated supply chains with a collective goal of offering high-performance storage devices for both consumers and enterprises. In May 2024, Western Digital announced that it had expanded its portable HDD lineup with the world’s first-ever 2.5 6TB drives across its WD, WD_BLACK, and SanDisk professional brands, thereby addressing the growing demand for high-capacity, portable storage solutions. Hence, these innovations reinforce the firm’s focus on performance and versatility for diverse consumer and professional requirements.

Corporate Landscape of the Portable Data Storage Market:

Recent Developments

- In December 2025, Lenovo launched a wide range of modern data storage, virtualization, and AI-ready solutions, which include the ThinkSystem DS series and ThinkAgile FX/MX/HX series, especially designed to optimize enterprise performance, security, and efficiency.

- In December 2025, Apacer Technology notified that it had launched the ECO series, made from fully recycled plastics, along with the AS714 Portable SSD, which offers IP65-rated protection and high-speed performance for mobile users.

- In November 2025, Kingston Digital announced the launch of its first cable-free dual portable SSD, offering USB Type-A and USB-C connectivity with USB 3.2 Gen 2 speeds up to 1,050MB/s read and 950MB/s write, and storage capacities up to 2TB.

- Report ID: 8324

- Published Date: Dec 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Portable Data Storage Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.