Acetyl Serine Market Outlook:

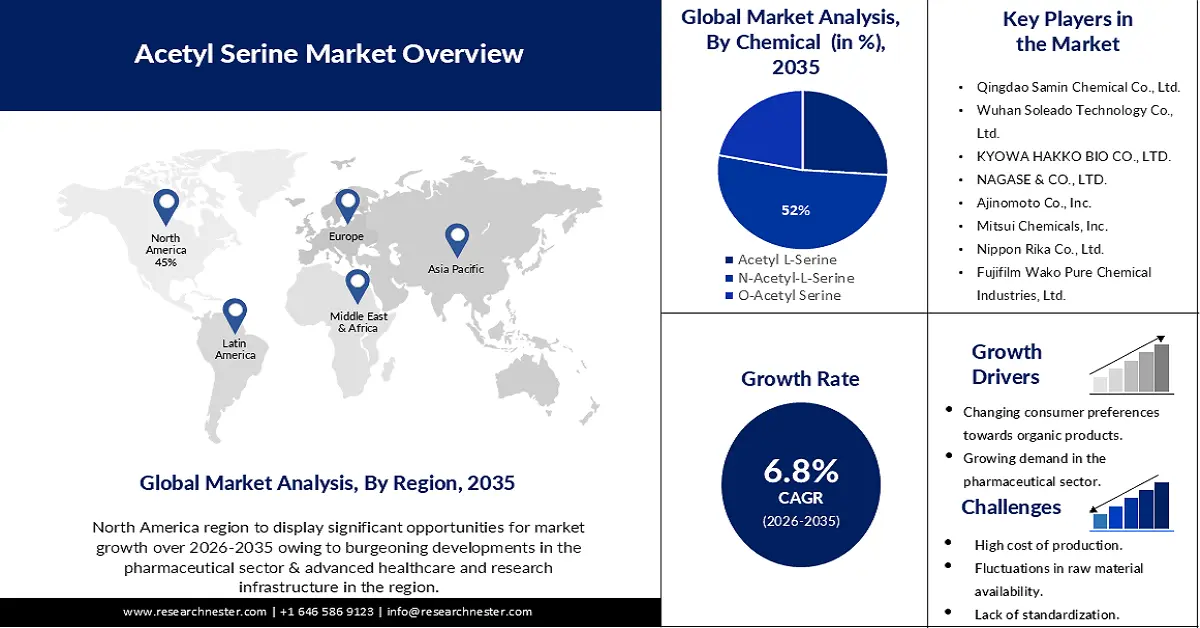

Acetyl Serine Market size was over USD 61.16 million in 2025 and is projected to reach USD 118.08 million by 2035, witnessing around 6.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of acetyl serine is evaluated at USD 64.9 million.

The demand for acetyl serine is calculated to grow in the coming years due to the increasing consumption of meat worldwide.

As analyzed by Research Nester analysts, in 2021, around 132 million tons of poultry meat was consumed globally. Also, the consumption of meat worldwide is expected to reach between 450 and 560 million tons by 2050. As the demand for meat production rises, so does the need for additives, which is predicted to drive the growth of the acetyl serine market.

In addition, due to shifting consumer preferences towards a healthy diet and the growing urban population, there is an increase in demand for dietary supplementary such as vitamins, Minerals, dietary fibers, Amino Acids, Enzymes, Probiotics, etc. As observed by Research Nester analysts, Dietary supplement sales in the United States increased by 5% to around USD 35o million in 2019 before the pandemic.

Key Acetyl Serine Market Insights Summary:

Regional Highlights:

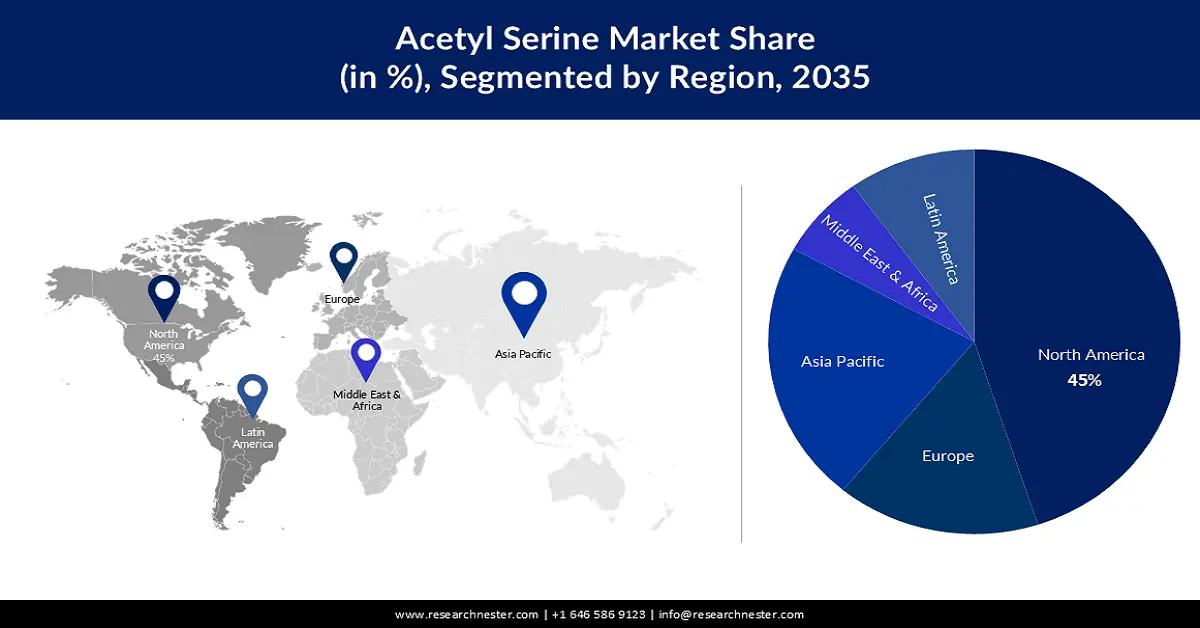

- North America acetyl serine market will dominate more than 45% share by 2035, driven by the pharmaceutical sector's use of Acetyl Serine in antibiotic and peptide synthesis, alongside demand from nutraceutical, agricultural, and cosmetics industries.

- Asia Pacific market will register significant growth during the forecast timeline, driven by the pharmaceutical sector's demand for Acetyl Serine in antibiotic and peptide synthesis, alongside growth in nutraceutical and agricultural applications.

Segment Insights:

- The pharmaceuticals segment in the acetyl serine market is forecasted to capture a 53% share by 2035, fueled by higher demand for prescription and OTC medications versus other end uses.

- The n-acetyl-l-serine segment in the acetyl serine market is expected to attain a 52% share by 2035, driven by its versatile applications in pharmaceuticals, particularly drug development.

Key Growth Trends:

- Cosmetics and personal care

- Demand in pharmaceuticals

Major Challenges:

- Possible side effects of acetyl serine in the human body

Key Players: Guangzhou LES biological Technology Co., Ltd., Thermo Fisher Scientific Inc. Hanhong Scientific, Shanghai Bide Pharmaceutical Technology Co., Ltd., Tianjin Pharmaceutical Co. Ltd., Wuxi Jinghai Amino Acid Co., Ltd., WUHAN DONG KANG YUAN TECHNOLOGY CO., LTD., Qingdao Samin Chemical Co., Ltd., Wuhan Soleado Technology Co., Ltd., KYOWA HAKKO BIO CO., LTD., NAGASE & CO., LTD..

Global Acetyl Serine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 61.16 million

- 2026 Market Size: USD 64.9 million

- Projected Market Size: USD 118.08 million by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 16 September, 2025

Acetyl Serine Market Growth Drivers and Challenges:

Growth Drivers

-

Cosmetics and personal care - Without question, chemistry has produced a plethora of goods that have enhanced people's lives in practically every way. Unfortunately, some of these goods are poisonous, non-biodegradable, or proving to be difficult to dispose of. Consequently, there is a growing focus on minimizing the quantity of synthetic products or additives and substituting them with natural alternatives.

Serine is a naturally occurring amino acid that is necessary for the body to synthesize proteins but is not essential, meaning the body can make it. Moreover, studies indicate that cysteine is particularly significant in regulating the diameter of hair fibers. A crucial part of keratin, the protein that makes up a hair strand, is cysteine. Furthermore, it has been demonstrated that thinning and slowed hair development might result from a reduced cysteine supply. -

Agricultural applications - The limiting process in the production of cysteine in plants and microbes is catalyzed by serine acetyltransferase (SAT). Apart from its enzymatic role, SAT joins forces with O-acetyl serine sulfhydrylase to produce a macromolecular complex. One important biochemical regulating mechanism in plant sulfur metabolism is the formation of the cysteine regulatory complex (CRC).

Compounds containing sulfur are strongly linked to the flavor and nutritional value of agricultural products and are necessary for plant growth and environmental adaption. The majority of these active ingredients originate from cysteine, the first organic sulfur-containing molecule produced in plants. -

Demand in pharmaceuticals - A wide range of cellular processes, including neurotransmission, sphingolipid, phospholipid, and sulfur-containing amino acid production, as well as the cycles of methionine and folate, depend on acetyl serine.

In fact, L-serine needs have increased, according to recent research, and it may be useful as a treatment for certain illnesses. A lack of L-serine is linked to decreased nervous system function, mostly because of aberrant phospholipid and sphingolipid metabolism, especially increased synthesis of deoxysphingolipids.

Challenges

-

Possible side effects of acetyl serine in the human body - L-serine is often ingested through food. An average diet offers roughly 3.5-8 grams per day. Higher dosages of serine may be safe for use as medication. There have been safe uses of L-serine in dosages of up to 25 grams per day for up to a year and D-serine in doses of 2-4 grams per day for up to 4 weeks. Bleeding and upset stomach are possible side effects.

When eaten at very large levels, such as 25 grams or more of L-serine or 8 grams or more of D-serine daily, serine may be dangerous. Elevated dosages may cause more adverse effects in the stomach and convulsions. Although this can temporarily impede the acetyl serine market expansion of acetyl serine however the huge implementation will help the acetyl serine industry to regain its gains. -

Regulatory requirements and compliance standards in different regions can pose challenges for Acetyl serine manufacturers.

-

Fluctuations in the availability or prices of these raw materials can affect production costs and subsequently impact the overall acetyl serine market dynamics.

Acetyl Serine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 61.16 million |

|

Forecast Year Market Size (2035) |

USD 118.08 million |

|

Regional Scope |

|

Acetyl Serine Market Segmentation:

Chemical Segment Analysis

In acetyl serine market, N-Acetyl-L-serine segment is poised to dominate over 52% share by 2035. The segment’s growth is dependent on its versatile applications in pharmaceuticals, particularly in drug development and research. N-acetyl-L-serine serves as a crucial precursor in the synthesis of various pharmaceutical compounds, contributing to its increasing demand within the pharmaceutical industry.

There is growing interest in the mechanism of action of N-acetyl-l-leucine because of its potential as a medication for treating a wide range of illness indications. Currently, the working theory suggests that N-acetyl-l-leucine enters metabolic pathways and that its effects are mediated through its metabolic products to reconcile the pharmacokinetic and pharmacodynamic findings. In addition, N-acetyl-l-serine is a component of the dietary proteins and minor components of food as free amino acids. This variant’s potential for synthesis pathways and its role in creating valuable pharmaceutical products are key factors propelling its growth within the acetyl serine market.

End-User Segment Analysis

In acetyl serine market, pharmaceutical segment is estimated to account for around 53% revenue share by 2035. Pharmaceuticals encompass a wide range of products used for medicinal purposes, addressing various health conditions. Antibacterial adjuvants play a crucial role in reducing the emergence of antibacterial resistance and lowering the therapeutic dose of conventional antibiotics. O-acetyl serine sulfhydrylase (OASS) inhibitors may be utilized as adjuvants to colistin in the treatment of infections brought on by Salmonella enterica serovar Typhimurium, Escherichia coli, and Klebsiella pneumonia, three important pathogens that are spreading around the world.

The demand for prescription and over-the-counter medications is generally higher compared to feed additives, nutraceuticals, or dietary supplements, contributing to its larger acetyl serine market size. Moreover, the pharmaceutical sector often involves extensive research, development, and regulatory processes, leading to a robust market presence.

Our in-depth analysis of the global acetyl serine market includes the following segments:

|

Chemical |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Acetyl Serine Market Regional Analysis:

North American Market Insights

North America industry is likely to account for largest revenue share of 45% by 2035. The pharmaceutical sector anchors the market, utilizing Acetyl Serine in antibiotic and peptide synthesis, aligning with the region’s advanced healthcare and research infrastructure. Furthermore, the burgeoning nutraceutical industry in North America elevates the demand for acetyl serine in dietary supplements due to its antioxidant properties and health benefits, catering to a health-conscious consumer base.

In a survey conducted, it was observed that about 75% of Americans are users of dietary or nutritional supplements. The agricultural sector also contributes significantly, leveraging acetyl serine to enhance crop resilience and productivity amid changing climatic conditions. Additionally, the cosmetics industry integrates this compound into skincare formulations, capitalizing on its skin-enhancing attributes. Innovation, research initiatives, and technological advancements continue to fuel the growth of the North American acetyl serine market across pharmaceuticals, agriculture, nutraceuticals, and cosmetics, indicating a promising trajectory amidst evolving market dynamics.

APAC Market Insights

Asia Pacific acetyl serine market demonstrates significant growth propelled by various industries. The pharmaceutical sector, particularly in countries like China and India, propels demand as acetyl serine is a pivotal element in antibiotic and peptide synthesis, aligning with the region’s expanding healthcare needs and pharmaceutical manufacturing capabilities.

Moreover, the burgeoning nutraceutical industry across the Asia Pacific elevates the demand for acetyl serine due to its antioxidant properties and health-promoting benefits, appealing to a health-conscious populace. Agricultural applications also contribute substantially, leveraging acetyl serine to enhance crop resilience and yield in countries prioritizing agricultural innovation.

Acetyl Serine Market Players:

- Merck KGaA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Guangzhou LES Biological Technology Co., Ltd.

- Thermo Fisher Scientific Inc.

- Hanhong Scientific

- Shanghai Bide Pharmaceutical Technology Co., Ltd.

- Tianjin Pharmaceutical Co. Ltd.

- Wuxi Jinghai Amino Acid Co., Ltd.

- WUHAN DONG KANG YUAN TECHNOLOGY CO., LTD.

- Qingdao Samin Chemical Co., Ltd.

- Wuhan Soleado Technology Co., Ltd.

Recent Developments

- Merck KGaA and XtalPi jointly published a study highlighting the advantages of integrating computational workflows with wet lab experiments to advance drug development.

- Thermo Fisher Scientific Inc., a global leader in providing services to the scientific community, announced that it has successfully paid $17.4 billion to acquire PPD, Inc., a prominent global provider of clinical research services to the biopharma and biotech industries.

- Report ID: 5538

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Acetyl Serine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.