Dietary Fibers Market Outlook:

Dietary Fibers Market size was valued at USD 9.68 billion in 2025 and is set to exceed USD 23.77 billion by 2035, registering over 9.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dietary fibers is estimated at USD 10.5 billion.

The market’s growth can be attributed to the increasing popularity of dietary supplements. Dietary fibers are highly used in dietary supplements such as fiber drinks, supplement tablets, and others. Over 63% and 67% of people in Lithuania took nutritional supplements to strengthen their bodies and immune systems, respectively. Also, during a pandemic, consumption greatly soared.

In addition to these, factors that are believed to fuel the market growth of dietary fibers include the rising use of beta-glucan owing to its rising benefits. Beta-glucans are soluble fibers found in the cell walls of various bacteria, plants, yeasts, and fungi. Taking 2.5-3.5 grams of beta-glucan daily for 3 to 8 weeks can lower fasting blood sugar levels and enhance long-term blood sugar management in persons with type 2 diabetes. On the other hand, the rising collaboration of major players is also expected to ring lucrative opportunities for the market. For instance, AGT Food and Ingredients Inc. (AGT), one of the largest suppliers of value-added plant-based food products, collaborated with Equinom, the food technology company. Both companies aim to boost the development, certification, and commercialization of co-branded functional ingredients made from Equinox ultra-high protein yellow pea varieties.

Key Dietary Fibers Market Insights Summary:

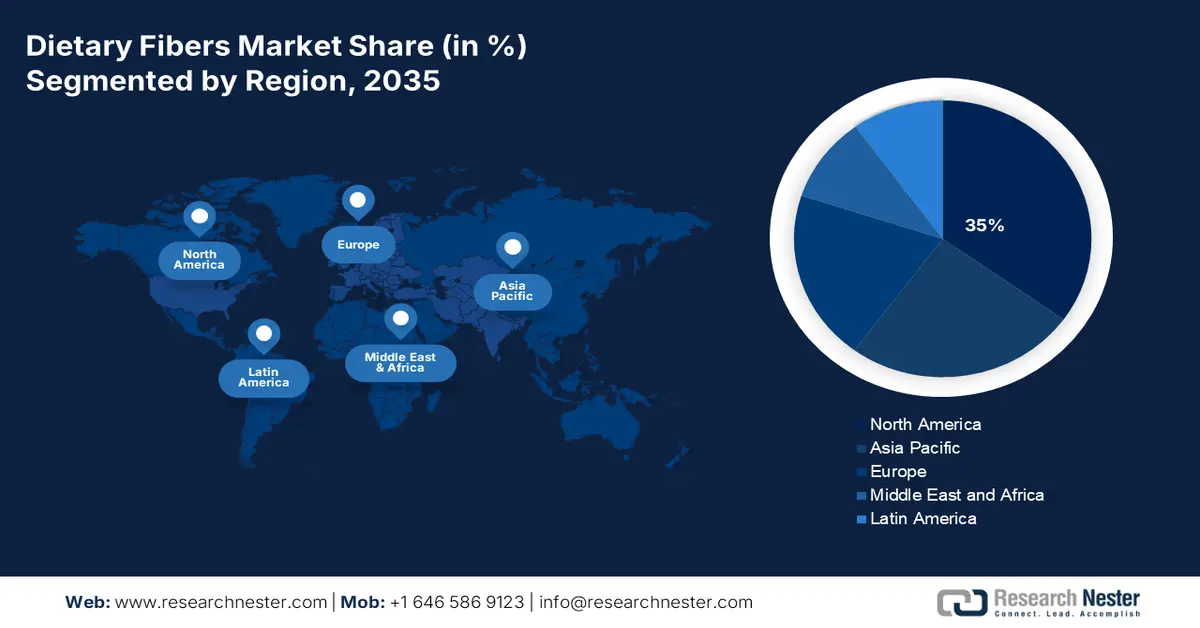

Regional Highlights:

- North America dietary fibers market will hold over 35% share by 2035, driven by rising awareness about health and chronic illnesses.

- Asia Pacific market will secure the second largest share by 2035, attributed to rising digestive issues and fiber consumption.

Segment Insights:

- The insoluble segment in the dietary fibers market is expected to achieve the largest share by 2035, driven by the increasing problems of constipation and hemorrhoids.

- The cereals & grains segment in the dietary fibers market is expected to hold a significant share by 2035, fueled by higher fiber intake from cereals and grains and rising cereal production.

Key Growth Trends:

- Growing Prevalence of Chronic Diseases

- Increasing Awareness of Health Maintenance

Major Challenges:

- Rise in the number of people allergic to gluten

- Harmful effects of excessive consumption of dietary supplements

Key Players: AGT Food and Ingredients Inc., Emsland Food Group, Cargill, Incorporated, Kerry Group plc., The Green Labs LLC, Nexira, Farbest Brands, J. RETTENMAIER & SOHNE GmbH + Co KG, Taiyo International, Beneo GmbH.

Global Dietary Fibers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.68 billion

- 2026 Market Size: USD 10.5 billion

- Projected Market Size: USD 23.77 billion by 2035

- Growth Forecasts: 9.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Dietary Fibers Market Growth Drivers and Challenges:

Growth Drivers

- Growing Prevalence of Chronic Diseases – High dietary fiber intakes seem to dramatically reduce the risk of chronic diseases. According to the World Health Organization, noncommunicable diseases (NCDs) account for 41 million annual fatalities, or 74% of all fatalities worldwide. Before the age of 70, 17 million individuals per year pass away from an NCD.

- Increasing Awareness of Health Maintenance– Growing concern about health has increased the consumption of dietary fibers. Almost 60% of consumers believe that the pandemic has made them more conscious of the need to maintain a healthy lifestyle in order to prevent health issues; this is expected to be a long-lasting change.

- Growing Use of Sports Nutrition & Nutraceutical – Nutraceutical foods fall under the category of dietary fiber which is expected to boost the market growth. Over 150 million people in India alone have made the conscious decision to include the use of nutraceuticals in their everyday lives.

- Rising Importance of Beta-Glucan– A particular type of soluble dietary fiber is beta-glucan. It is available in supplements as well. Around 8 weeks of daily intake of 3 grams of beta-glucan reduced total cholesterol by almost 9% and LDL cholesterol by 15%.

- Rising Consumption of Dietary Supplements– dietary fibers are used in dietary supplements and especially fiber-based supplements, such as psyllium, Metamucil, Citrucel, and others. There is 77 percent of people say they take dietary supplements. Also, out of all the age categories, adults between the ages of 35 and 54 use dietary supplements the most.

Challenges

- Rise in the number of people allergic to gluten – Gluten can be found in very common dietary fibers, such as brown rice, bread, wheat bran, cereals, and others. Owing to rising cases of gluten allergy the popularity of gluten-free products is soaring. Moreover, gluten is also associated with various diseases, including celiac and neurological disorders and infertility. It is expected to hamper the market growth of dietary supplements.

- Harmful effects of excessive consumption of dietary supplements

- Strict government guidelines for dietary fibers

Dietary Fibers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.4% |

|

Base Year Market Size (2025) |

USD 9.68 billion |

|

Forecast Year Market Size (2035) |

USD 23.77 billion |

|

Regional Scope |

|

Dietary Fibers Market Segmentation:

Type Segment Analysis

The global dietary fibers market is segmented and analyzed for demand and supply by type into soluble, and insoluble. Out of the two types of dietary fibers, the insoluble segment is estimated to gain the largest market share in the year 2035. The growth of the segment can be attributed to the increasing problems of constipation and hemorrhoids. Insoluble fibers are beneficial in preventing constipation by speeding up waste processing and reducing blockage. Moreover, it prevents the development of small folds and hemorrhoids in the colon. Approximately 16 out of 100 people in the US experience constipation problems. Moreover, around 33 out of 100 persons 60 and older have constipation-related symptoms. Furthermore, roughly three out of every four adults can get hemorrhoids occasionally.

Raw Material Segment Analysis

The global dietary fibers market is also segmented and analyzed for demand and supply by raw material into fruits & vegetables, nuts & seeds, and cereals & grains. Amongst these three segments, the cereals & grains segment is expected to garner a significant share in the year 2035. The growth of the segment is expected on the account of higher consumption of fiber from cereals and grains, followed by rising production of cereals. Intake of fiber from cereal foods is the highest in the globe, supplying around 32 to 49% of the total in the United States and Europe, respectively. Moreover, around 89% of all cereal production globally is made up of wheat, rice, and maize.

Our in-depth analysis of the global market includes the following segments:

|

By Raw Material |

|

|

By Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dietary Fibers Market Regional Analysis:

North American Market Insights

The North American dietary fibers market, amongst the market in all the other regions, is projected to hold the largest market share of about 35% by the end of 2035. The growth of the market can be attributed majorly to the increasing awareness about health and rising cases of chronic diseases which in turn is expected to boost the demand for dietary fibers. Dietary fibers are beneficial in chronic disease management. Every sixth adult in America, according to the Centers for Disease Control and Prevention, has a chronic illness. In addition, 4 out of 10 adults have two or more chronic conditions. Furthermore, since the pandemic started, about 7 in 10 people are more conscious of how they treat their bodies. Furthermore, roughly 6 in 10 people are now aware of the benefits of leading a healthy lifestyle and eating well.

APAC Market Insights

The Asia Pacific dietary fibers market, amongst the market in all the other regions, is projected to hold the second largest share during the forecast period. The growth of the market can be attributed majorly to the rising digestive issues in the region. Around 13% of adult Indians report having severe constipation, which affects about 22% of the population overall. Moreover, roughly 6% of Indians experience constipation linked to specific comorbidities. Furthermore, the growth of the market in the region is also expected on the account of high consumption of grain-based fibers. China's consumption of important grain crops has increased during the previous 20 years, going from less than 400 million metric tonnes annually to somewhere around 750 million tonnes.

Europe Market Insights

Further, the market in Europe, amongst the market in all the other regions, is projected to hold a notable share by the end of 2035. The market growth of the segment is expected on the back of major dietary fiber manufacturers in the region. For instance, in July 2021, Cargill, Incorporated, a major player in the sugar-reduction market, entered the market of soluble fiber in Poland with an investment of USD 45 million. Moreover, rising health awareness among people and growing consumption of fruits and vegetables are also expected to boost the market growth.

Dietary Fibers Market Players:

- AGT Food and Ingredients Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Emsland Food Group

- Cargill, Incorporated

- Kerry Group plc.

- The Green Labs LLC

- Nexira

- Farbest Brands

- J. RETTENMAIER & SOHNE GmbH + Co KG

- Taiyo International

- Beneo GmbH

Recent Developments

-

Beneo GmbH expands its portfolio of animal nutrition with the introduction of faba bean ingredients. The faba bean is a non-GMO pulse that is a sustainable source of protein, carbohydrates, and fiber that helps feed producers raise the nutritional value of their goods.

-

Kerry Group plc announced the launch of Emulgold Fibre into the white bread market. It is a naturally sourced, soluble type of dietary fiber ingredient. Emulgold increases the number of fibers in white bread by over 300% in comparison to normal white bread.

- Report ID: 4736

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dietary Fibers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.