Chronic Disease Management Market Outlook:

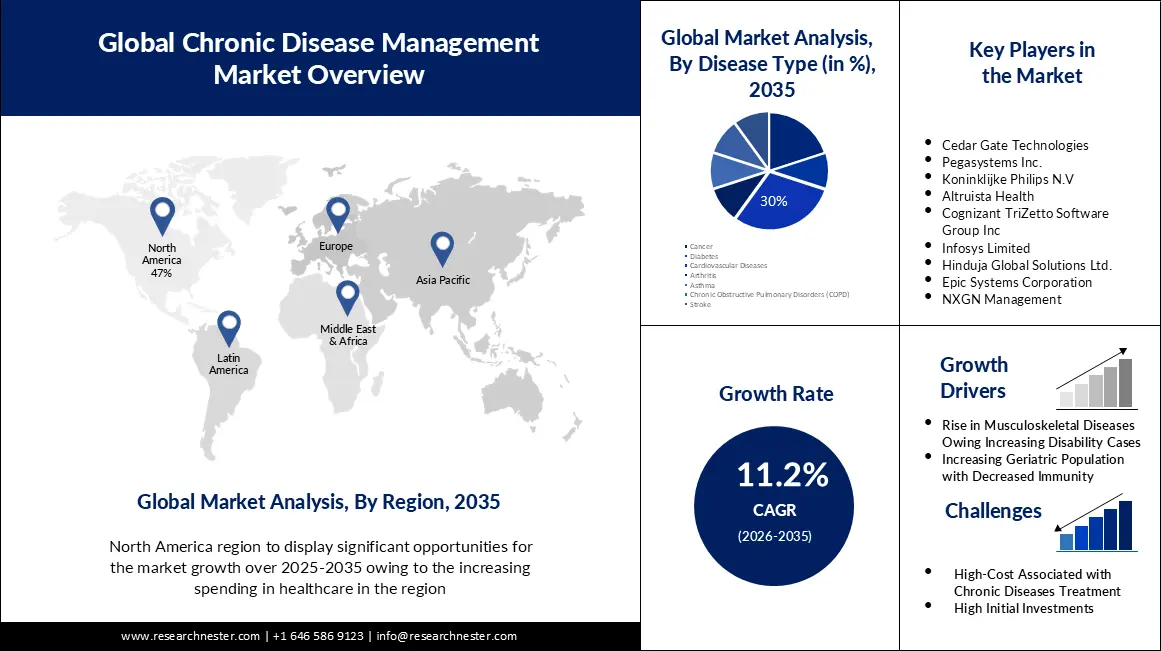

Chronic Disease Management Market size was over USD 6.54 billion in 2025 and is poised to exceed USD 18.91 billion by 2035, witnessing over 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of chronic disease management is estimated at USD 7.2 billion.

The growth in the chronic disease management market is impelled by the increase in the prevalence of various types of related ailments, which is inflating the need for long-term intensive care. There is a worldwide upsurge in chronic obstructive pulmonary disease (COPD), cardiovascular disease (CVD), chronic kidney disorder (CKD), and cancer, fostering a large consumer base for this sector. In 2021, the number of diabetic people aged between 20 and 79 was 536.6 million in the world, which is projected to reach 783.2 million by 2045 (NLM). Simultaneously, the expected annual new and death cases of cancer around the globe are 26.0 million and 17.0 million by 2030: NLM. On the other hand, globally, the age-standardized rate of mortality for CKD is poised to be 21.26 per 100,000 by 2032: Frontiers.

This demography also comes with a huge economic burden, demanding more accessible and long-acting solutions, which can be achieved by using the commodities from the chronic disease management market. According to the NLM estimations, the net global expense on these health conditions is to be USD 47.0 trillion by 2030. This is pushing medical service providers and MedTech pioneers to cultivate solutions with affordable payers’ pricing. On this note, NLM published a study in June 2020 demonstrating the benefits of implementing an integrated chronic disease management (ICDM) model in primary healthcare clinics in South Africa. The results revealed the implementation cost per clinic and cost per patient per visit to be USD 1,48,446.0 and USD 6.0, respectively.

Key Chronic Disease Management Market Insights Summary:

Regional Highlights:

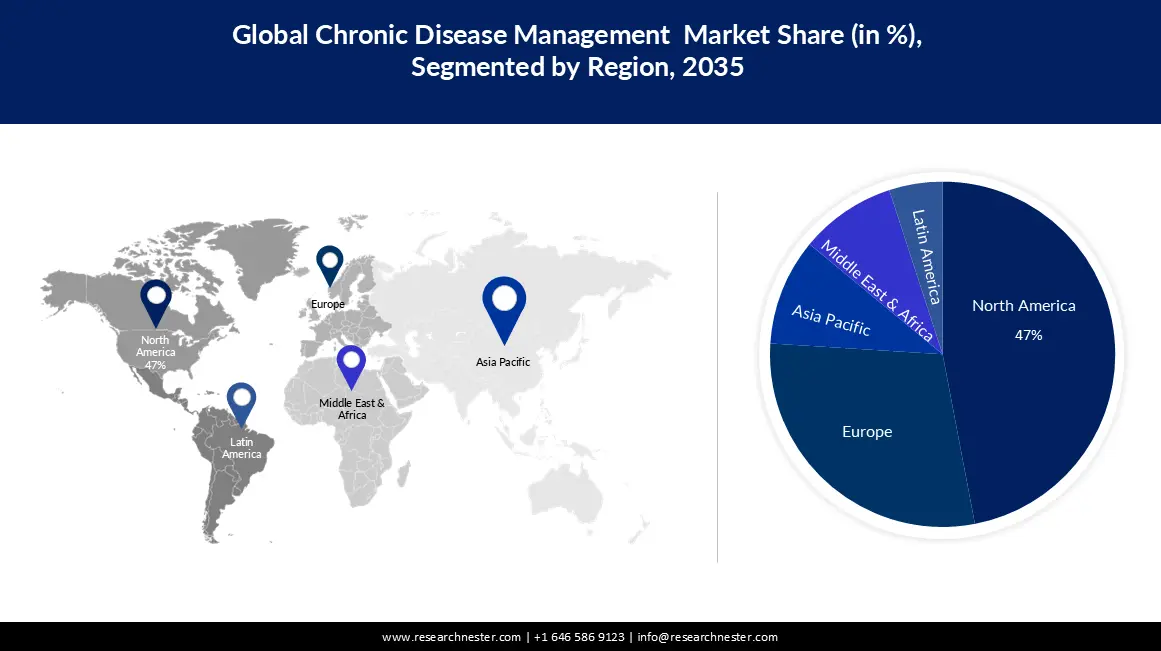

- North America’s chronic disease management market will secure around 47% share by 2035, driven by increasing healthcare spending in developed countries such as the U.S. and Canada.

- Asia Pacific market will register remarkable growth during the forecast timeline, fueled by the increased mortality from chronic illnesses pushing authorities to improve patient care systems.

Segment Insights:

- The cardiovascular diseases segment in the chronic disease management market is expected to hold a 30% share by 2035, driven by rising CVD prevalence and lifestyle-related risks.

- The solutions segment in the chronic disease management market is anticipated to achieve a substantial share by 2035, attributed to the adoption of cloud-based infrastructure in healthcare.

Key Growth Trends:

- Benefits of tech-based solutions in medical care

- Growing acceptance toward data-driven solutions

Major Challenges:

- High initial and additional cost of implementation

- Lack of workforce with cross-functional skills

Key Players: WellSky Corporation, Cedar Gate Technologies, Pegasystems Inc., Koninklijke Philips N.V, Altruista Health, Cognizant TriZetto Software Group Inc, Infosys Limited, Hinduja Global Solutions Ltd., Epic Systems Corporation, NXGN Management.

Global Chronic Disease Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.54 billion

- 2026 Market Size: USD 7.2 billion

- Projected Market Size: USD 18.91 billion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 9 September, 2025

Chronic Disease Management Market Growth Drivers and Challenges:

Growth Drivers

- Benefits of tech-based solutions in medical care: The rapid penetration of AI and cloud in healthcare is fostering a pre-established trading atmosphere for the chronic disease management market. Remote patient monitoring, AI-powered diagnosis, and mobile health apps are evolving the approach to managing associated ailments and improving outcomes, creating a surge in this sector. For instance, in June 2024, Verily shared its vision of commercializing its AI-driven personalized chronic care solution, Lightpath, in early 2026. It is intended to support interchange between allocated modular programs, such as Metabolic Intensive, Weight Loss Intensive, Metabolic Improvement, and Metabolic Achievement, as per user's needs.

- Growing acceptance toward data-driven solutions: As consumers seek more value-based healthcare, the chronic disease management market witnesses a strong push toward wide adoption. Particularly, after the pandemic struck, the importance and economic significance of data-driven remote care have magnified. This also created an adaptive consumer base for this sector by streamlining virtual assistance and telemedicine as essential clinical assets.

Challenges

- High initial and additional cost of implementation: Chronic diseases, such as cancer, are long-term illnesses that need treatment for lifetime treatment in most cases. Thus, the existing financial burden of primary medications and surgical procedures may create a barrier between service providers and consumers in the chronic disease management market. In addition, a lack of resources in underserved regions limits worldwide expansion in this sector due to the issues in availability and accessibility.

- Lack of workforce with cross-functional skills: In both remote and on-premises healthcare settings across the globe, the shortage of trained caregivers is becoming a prominent issue. According to an OECD report, the required supply of care workers for older people in the world is poised to demand 13.5 million new recruits by 2040. This signifies the possible future deficiency in an efficient workforce, which is necessary to implement solutions from the chronic disease management market.

Chronic Disease Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 6.54 billion |

|

Forecast Year Market Size (2035) |

USD 18.91 billion |

|

Regional Scope |

|

Chronic Disease Management Market Segmentation:

Disease Type Segment Analysis

The cardiovascular diseases segment is estimated to hold the largest share of 30% in the chronic disease management market throughout the discussed years. The growing prevalence of heart failure, coronary artery disease, stroke, and other related illnesses that impact the blood vessels and the heart is positioning this segment as a major revenue generator in this field. According to the World Heart Federation, CVD took away over 20.5 million lives in 2021, making it the leading cause of death globally. In addition, the heightening global population with hypertension, high blood cholesterol, smoking, inactivity, a poor diet, and obesity are highly prone to CVD events and mortality. On this note, a 2022 article revealed that dietary risks alone accounted for 6.5 million CVD deaths in the same year (American College of Cardiology).

Type Segment Analysis

The solutions segment in the chronic disease management market is anticipated to capture a substantial revenue share by 2035. The increased awareness regarding the use and benefits of cloud-based infrastructure in healthcare settings is inflating adoption in this segment. Being a highly desired option to enable patients to share health information for advancing the treatment of chronic diseases, both standalone and hybrid cloud solutions are remarkably contributing to this field’s augmentation. Furthermore, their efficiency in remote monitoring, operational effectiveness, and reduced costs are making them a prior choice for both patients and service providers. For instance, in March 2023, Royal Philips launched Philips Virtual Care Management, offering a cost-effective and comprehensive solution for patient engagement.

Our in-depth analysis of the global chronic disease management market includes the following segments:

|

Type |

|

|

Deployment Mode |

|

|

Disease Type |

|

|

Service Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Chronic Disease Management Market Regional Analysis:

North American Market Insights

North America is predicted to account for the highest chronic disease management market share of 47% over the assessed timeline. The region’s proprietorship is significantly impelled by increasing spending in healthcare in developed countries such as the U.S. and Canada. As per the American Medical Association, healthcare expenditure in the U.S. rose by 4.1% in 2022, reaching USD 4.5 trillion. This has led to an increase in access to quality medical treatments for people with chronic diseases residing across the region. Besides, the enlarging patient pool, the increasing availability of sufficient resources, and the presence of specialized training facilities are fostering a good capital influx in this landscape.

According to the CDC statistics, the number of citizens in the U.S. with a minimum of 1 chronic illness surpassed 129.0 million in 2024. Additionally, the country consists of a large obese adult population, which reached 100.0 million in 2023 (NORC at the University of Chicago). This indicates a continuously emphasizing patient pool, creating new business opportunities. This demography is further attracting global pioneers to invest and participate in the chronic disease management market. For instance, in March 2024, UTMHealthcare, in partnership with the Somml Health platform, introduced NuLink Health in the U.S., enhancing chronic disease care and cost efficiencies for medical practices.

APAC Market Insights

Asia Pacific is expected to register a remarkable CAGR in the chronic disease management market throughout the analysed timeframe. The increased rate of mortality from chronic illnesses across this region is pushing authorities in developing countries, such as Japan, Australia, China, and India, to establish a standardized and efficient system of patient care. This is garnering a great scope of doing profitable business for global leaders. Furthermore, the improving reimbursement policies are escalating accessibility in this field. For instance, in July 2025, the Government of Australia upgraded its Medicare Benefits Schedule (MBS) items, enabling multidisciplinary team care for habitats suffering from chronic conditions.

India is becoming one of the largest contributors and revenue generators in the market, owing to its large patient population, increased disposable income, and enhanced MedTech development. Additionally, the home healthcare industry in this country is gaining traction, which is poised to be valued at USD 19.9 billion by 2025, up from USD 5.4 billion in 2022 (Healthcare Federation of India). Thus, this augmenting landscape is attracting more investors and participants. On this note, in June 2023, TatvaCare launched a cutting-edge digital therapeutic application, MyTatva, for the treatment and management of chronic conditions, such as COPD and Asthma, in India.

Chronic Disease Management Market Players:

- WellSky Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cedar Gate Technologies

- Pegasystems Inc.

- Koninklijke Philips N.V

- Altruista Health

- Cognizant TriZetto Software Group Inc

- Infosys Limited

- Hinduja Global Solutions Ltd.

- Epic Systems Corporation

- NXGN Management

- Validic

- Owens & Minor

The current dynamics of the chronic disease management market are shifting toward automation with the integration of artificial intelligence and machine learning (ML). Key players in this field are supporting this cohort by incorporating their expertise and capabilities in this category in their product pipelines. For instance, in June 2024, Ushur launched a new line of AI-powered digital self-service commodities, Prebuilt Care Navigation Solutions, for two key members, including health plans and third-party administrators for chronic illness management. This dedicated portfolio is designed to cater to members with appropriate resources, improving outcomes and cost savings. Such utilization of advanced technologies is fostering a broader scope of business. These key players are:

Recent Developments

- In February 2025, Validic announced the commercial launch of its full suite of Intelligent Digital Care Solutions and Services in AWS Marketplace. The new pipeline includes: Validic Health IoT platform, a Remote Patient Management solution, logistics & device purchasing, and a patient service desk.

- In February 2025, Owens & Minor introduced a personalized digital health program, ByramConnect, to help optimize outcomes for people with type 1 or type 2 diabetes and associated chronic conditions. It is backed by Welldoc App’s AI capabilities, providing actionable insights and reports to prevent hypertension, obesity, and cardiovascular risks.

- Report ID: 4242

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Chronic Disease Management Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.