Wood Plastic Composites Market Outlook:

Wood Plastic Composites Market size was valued at USD 8.9 billion in 2025 and is projected to reach USD 27.6 billion by the end of 2035, rising at a CAGR of 12% during the forecast period, i.e., 2026-2035. In 2026, the industry size of wood plastic composites is expected to reach USD 9.9 billion.

The global wood plastic composites market is witnessing stable expansion, fueled by growing demand for long-term, sustainable building materials. The trend leans towards higher product performance, appearance, and flexibility of application, and manufacturers are making positive innovations to meet evolving consumer and industry needs for sustainable alternatives to wood. For instance, Fiberon LLC, in February 2025, introduced a digitally color-matched railing system for its U.S. WPC decking lines, employing AI-based sensors to ensure accurate color consistency and improve appearance, a reflection of the industry's shift towards sophisticated product integration and design.

Market growth is backed by favorable government regulations and changing building codes that promote the adoption of WPC products. Officials increasingly are linking the advantages of WPC, recyclability, and reduced maintenance to long-term environmental and circular economy objectives. An example is the U.S. Environmental Protection Agency (EPA), which in July 2024 released new guidelines requesting the adoption of WPC products in federal landscaping projects, citing WPC recyclability, durability, and reduced maintenance, a trend set to considerably increase public sector orders for these new materials.

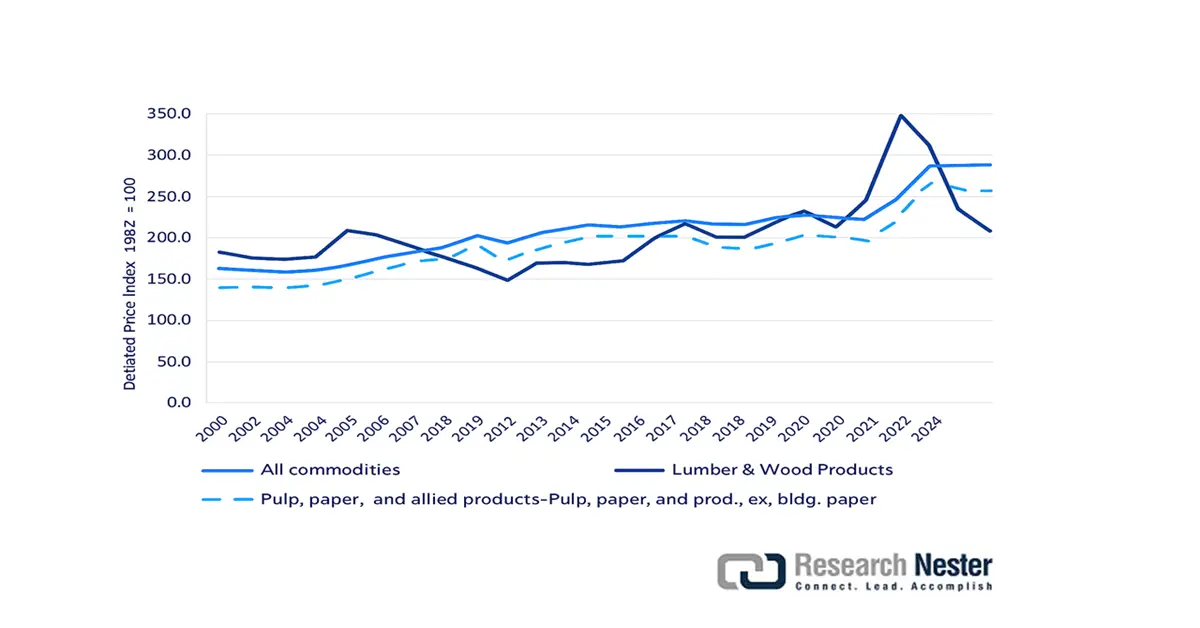

Lumber and wood products (LWP) outpaced the producer price index for all commodities in 2020, through 2022. The LWP PPI declined between 2000 to 2007 by 36.1%. The primary contributor to the decline was the Great Recession’s adverse impact on housing and construction, remodeling, and furniture manufacturing. The LWP index has fluctuated during this period until it stabilized at 347.0 in 2021 from 172.5 in 2012. However, the paper, unadjusted pulp, and allied products, except building paper (PPA), PPI remained consistent over the last few years. The PPA index stood at 286.8 in 2023 from 224.7.4 in 2020, according to 2024 Bureau of Labor Statistics (BLS) data.

Producer Price Index: All commodities, lumber and wood products, and pulp, paper, and allied products (ex. building paper), 2000 to the first half of 2024.

Source: UNECE, BLS 2024

In terms of raw materials, the hemicelluloses relevant wood yields include glucomannans (GM) and xylans, containing arabinose (Ara), galacturonic acids (GalA), and glucuronic acids (GlcA) substituents in mannans. Hemicellulose macromolecular composition comprises 30–32 wt % of softwood and 15-35 wt % of hardwood. Softwoods such as white spruce (Picea glauca) and Norway spruce (Picea abies) are popular raw material choices as these are rich in galactoglucomannan (GGM) and arabinoglucuronoxylan (AGX) (16-17% and 8-10% of dry wood weight). Paper birch (Betula papyrifera), a widely used hardwood, is rich in glucuronoxylan (GX) (15–30%) and has traces of GM (1–2%). Furthermore, Xyloglucans (XG) make up approximately 25% dicotyledonous angiosperms, 10% in softwoods, and 2–5% in grasses. Owing to their lower concentration in wood, XGs are usually not considered as hemicellulose sources.

Capacity Utilization of Wood Products

|

Capacity Utilization (in %, seasonally adjusted) |

2024 Proportion |

2024 Q4 |

2025 Q1 |

2025 Q2 |

2025 Feb. |

2025 Mar |

2025 Apr |

2025 May |

2025 June |

2025 July |

|

Wood Products |

1.65 |

77.4 |

77.1 |

76.1 |

78.0 |

77.0 |

76.1 |

76.7 |

75.5 |

75.9 |

Source: Federal Reserve

The rising emphasis on a circular economy has led to efficient usage of wood biomass instead of disposing in landfills. Forest trees are harvested less often than crops, thus making crops a key source of raw materials. Biomass is currently used for cellulose, hemicellulose, and lignin production. Implementing large-scale adoption of wood hemicellulose feedstocks is anticipated to provide incentives for new harvesting strategy developments and aid in the preservation of forests and optimal usage of biomass, also supporting the overall trade scenario. The global cellulose trade in 2023 was USD 6.8 billion, as mentioned by the OEC. The category has expanded at a 3.2% growth over the last five years. It ranked 460 in worldwide trade value, among 1217 products and accounted for 0.03% of global trade. The leading exporters were the U.S. (USD 1.43 billion), China (USD 1.15 billion), and Germany (USD 1.08 billion), whereas the key importers included India (USD 590 million), China (USD 551 million), and the U.S. (USD 446 million), as of 2023.

|

Polyethylene having a specific gravity of <0.94, Exports 2023 |

|

|

Saudi Arabia |

3,170,580,000 Kg |

|

U.S. |

3,341,890,000 Kg |

|

European Union |

1,021,060,000 Kg |

|

Netherlands |

839,022,000 Kg |

|

Belgium |

826,946,000 Kg |

Source: World Trade Integrated Solution (WITS)

Key Wood Plastic Composites Market Insights Summary:

Regional Highlights:

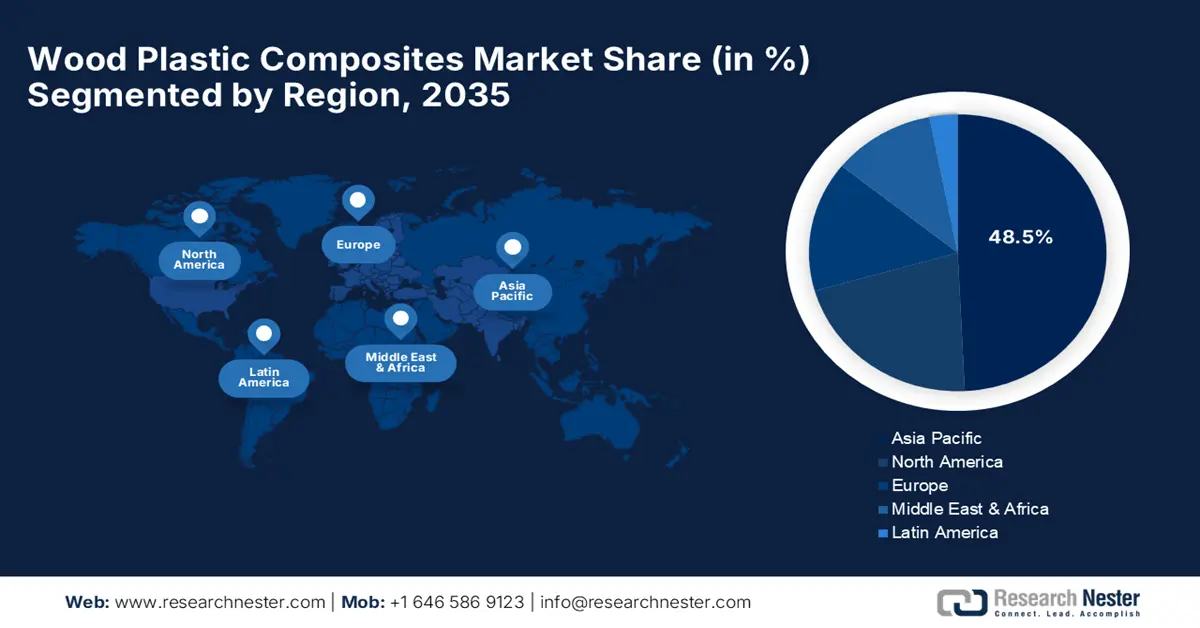

- The Asia Pacific region is projected to dominate the Wood Plastic Composites Market with a 48.5% share between 2026 and 2035, attributed to rapid urbanization, surging construction activities, and government initiatives promoting green building materials.

- North America is anticipated to register a CAGR of 4.5% through 2037, supported by the strong demand for durable, low-maintenance WPC products in residential and commercial construction applications.

Segment Insights:

- The Polyvinylchloride (PVC)-based WPCs segment is projected to hold around 51% share of the Wood Plastic Composites Market by 2035, propelled by PVC’s inherent durability, superior moisture resistance, and low maintenance suitability for outdoor applications.

- The automotive component segment is estimated to account for a commanding 62% share by 2037, fueled by the rising preference for lightweight, eco-friendly, and recyclable materials enhancing vehicle efficiency and aesthetics.

Key Growth Trends:

- Government support and eco-friendly practices drive expansion

- Favorable pricing scenario

Major Challenges:

- Scaling recycling infrastructure for circularity and standardized testing and performance data requirements

Key Players: Trex Company, Inc., The AZEK Company Inc. (TimberTech), UFP Industries, Inc., Fiberon LLC, MoistureShield (Oldcastle APG, CRH), CertainTeed (Saint-Gobain), TAMKO Building Products LLC, Beologic N.V., FKuR Kunststoff GmbH, JELU-WERK J. Ehrler GmbH & Co. KG, PolyPlank AB, Axion Structural Innovations LLC, Guangzhou Kindwood Co. Ltd., Resysta International, Green Dot Bioplastics, Inc., Fukuvi Chemical Industry Co., Ltd., Einwood, WPC Corporation, JJWOOD, Resysta Japan.

Global Wood Plastic Composites Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.9 billion

- 2026 Market Size: USD 9.9 billion

- Projected Market Size: USD 27.6 billion by 2035

- Growth Forecasts: 12% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.5% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Germany, China, Japan, India

- Emerging Countries: Brazil, Mexico, South Korea, Indonesia, Turkey

Last updated on : 7 October, 2025

Wood Plastic Composites Market - Growth Drivers and Challenges

Growth Drivers

- Government support and eco-friendly practices drive expansion: One of the main drivers of the growth in the WPC market is the growing worldwide focus on green building practices and government incentives to use green materials. Recycling content and landfill waste reduction policies benefit wood plastic composites directly since they commonly use recycled plastic and wood fibers. For instance, in December 2024, the Canadian government revised its Green Building Standard to include incentives for builders who use wood plastic composite products with certified recycled content. This landfill waste reduction policy and circular economy practice have already resulted in various provincial housing authorities mandating the use of wood plastic composites in public housing projects.

- Favorable pricing scenario: From 2019 to 2024, wood plastic composite prices fluctuated moderately with substantial spikes in North America and Europe prompted by raw material price increases and ongoing supply chain rationing. According to the U.S. Bureau of Labor Statistics, the Producer Price Index (PPI) of plastic building materials (construction polystyrene foam products) was 199.237 in July 2025, illustrating the sector's responsiveness to input costs. Price volatility was most acute during periods of geopolitical tensions like the Russia-Ukraine war and extreme U.S. South weather events, which caused supply shortfalls and price spikes. Environmental regulations, especially in the U.S. and EU, have also raised costs of production by requiring more recycled content. Global demand for WPCs is strong, with the construction, automotive, and consumer goods industries driving demand, even with such challenges.

Challenges

- Scaling recycling infrastructure for circularity and standardized testing and performance data requirements: One of the challenges of the WPC industry, beyond the initial material cost, is maximizing and scaling up recycling facilities to properly deal with post-consumer WPC items and continue to increase the percentage of recycled content in new material. While wood plastic composites are capable of using recycled material, it is not possible to develop closed-loop systems for composites. Another challenge is the need for more comprehensive long-term performance data and standardized test protocols, especially for more recent wood plastic composite formulations and applications exposed to harsh environmental conditions. Quality, consistency, and assured prediction of service life under diverse climates and stress conditions are critical to specifier confidence and broader market acceptance.

Wood Plastic Composites Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12% |

|

Base Year Market Size (2025) |

USD 8.9 billion |

|

Forecast Year Market Size (2035) |

USD 27.6 billion |

|

Regional Scope |

|

Wood Plastic Composites Market Segmentation:

Product Type Segment Analysis

Polyvinylchloride (PVC)-based WPCs segment is poised to capture around 51% of the market share during the forecast period due to the natural longevity of PVC, better rot and moisture resistance, and low maintenance, which make it highly appropriate for outdoor applications like decking, fencing, and cladding. PVC also possesses favorable fire resistance and can be easily processed into various profiles and textures, making it highly sought after. The emergence of proprietary WPC systems, such as the introduction by Fiberon LLC of a digitally color-matched railing system that might include PVC materials, is indicative of the trend towards aesthetics and integration in favor of this segment.

Application Segment Analysis

The automotive component market is anticipated to lead the WPC market with a dominant 62% share by 2037, driven by the automotive sector's increasing focus on lightweight materials for fuel efficiency and the trend toward more eco-friendly and recyclable components in interior automotive trim. WPCs offer an attractive value proposition of lower weight than traditional materials, positive mechanical properties, and the potential to incorporate natural fiber and recycled plastic content. The application of wood plastic composites in the automotive sector is also enabled by their design freedom, i.e., complex geometries and embedded functions, and their capacity to help deliver enhanced cabin beauty and lower noise.

Our in-depth analysis of the wood plastic composites market includes the following segments:

|

Segment |

Subsegment |

|

Product Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wood Plastic Composites Market - Regional Analysis

APAC Market Insights

Asia Pacific is projected to lead the wood plastic composites market with a 48.5% share between 2026 and 2035. This growth is driven by rapid urbanization, rising construction activity, and rising government interest in green building materials in some regionally large economies. Rising disposable incomes and a rising preference for low-maintenance, aesthetically pleasing construction choices also contribute significantly. The region has dynamic product innovation, with businesses such as Reliance Industries in India launched RelWood, a new series of termite-resistant WPC boards for both domestic use and export.

China WPC market is the force behind the APAC, driven by huge government patronage for green building construction and enormous infrastructure projects that increasingly call for composite materials. Domestic producers are launching innovative products at a whirlwind rate, making specialty WPC products for varied applications, ranging from building facades to mass transit. For example, the Green Building Evaluation Standard provides credits for the use of wood plastic composites in façade and balcony applications, is further stimulating developers in key cities such as Shanghai and Beijing to replace traditional wood with these new-generation composites. China is the fastest growing export market for U.S. cellulose and held a value of USD 34.4 million, registering a CAGR of 12.3% during 2022-2023.

India wood plastic composites market is expanding at a considerable rate, largely attributed to the government efforts to encourage sustainable and affordable housing, with greater consciousness of the benefits of wood plastic composites over conventional materials in tropical economies like resistance to termites and moisture. The Make in India initiative is also encouraging domestic manufacturing and innovation. In addition to this, India's Ministry of Housing and Urban Affairs revamped guidelines in September 2024 for the use of WPC in affordable housing schemes owing to its durability and low maintenance, with pilot schemes launched in Maharashtra and Tamil Nadu states.

North America Market Insights

North America wood plastic composites market is expected to record a CAGR of 4.5% through 2037, owing to robust residential and commercial construction demand, particularly for decking, railing, and fencing applications. The region is fueled by high consumer recognition of wood plastic composites value proposition through low maintenance and durability, robust manufacturing base, and established distribution channels. Canada wood plastic composites market is experiencing robust growth fueled by stringent building codes that emphasize durability and sustainability, coupled with government incentives for green building. Wood plastic composites demand is experienced in applications that must endure harsh climatic conditions, including extreme cold and moisture.

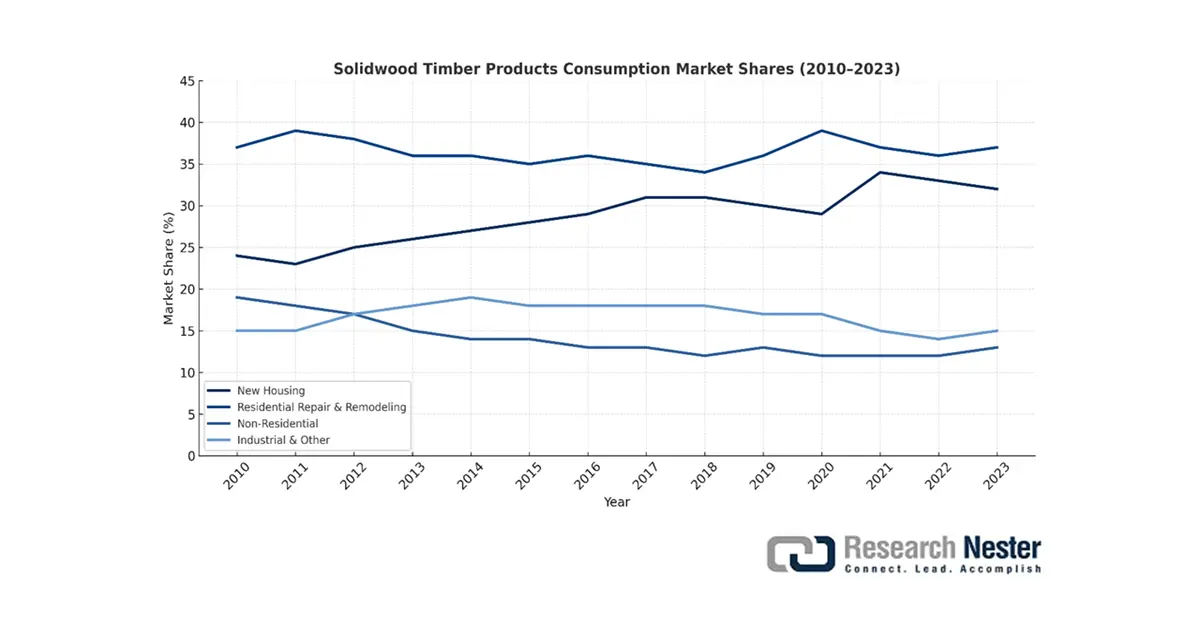

The U.S. wood plastic composites market is characterized by fierce innovation and sharp focus on sustainability, as builders and consumers alike increasingly demand green and high-performance building materials. Government initiatives promoting green buildings and recycled content are also fueling market expansion. Factors affecting the U.S. economy and demand for wood products in 2022 and 2023 included the efforts to control inflation by the Federal Reserve Board of Governors, the Russia-Ukraine war, international trade tensions, housing affordability, and the Israeli-Palestinian conflict. Hardwood lumber manufacturing and usage were significantly lower in 2023 as compared to the previous year (22.4% and 23.4%, respectively).

The U.S. forest products industry forms the key raw material supplier for wood plastic composites. It comprises of sectors 321-wood products and 322-paper and paperboard products, as classified by the National Industrial Classification System (NAICS) and contributed USD 161.4 billion (including 337 (furniture)) to the U.S. real GDP in 2023 (0.63% of the overall GDP) and USD 162.5 billion in 2022, according to the UNECE October 2024 report. The country is a leading producer of wood-based parts and components owing to the availability of plentiful forest resources and high manufacturing capacity.

Source: UNECE

The U.S. plays a pivotal role in the worldwide forest products industry and is a key consumer of pulp for paper and roundwood; the second largest end user of sawnwood, paper and paperboard, and recovered paper; the largest supplier of wood pellets, industrial roundwood, and pulp for paper. In 2024, cellulose was the most exported item out of 1,227 and held an export value of USD 1.54 billion. China (USD 330 million), Belgium (USD 233 million), India (USD 133 million), Brazil (USD 129 million), and Japan (USD 103 million) emerged as the main destinations. In June 2025, the U.S. exported USD 132 million and imported USD 54.8 million worth of cellulose. This led to a USD 77 million positive trade balance. The U.S. cellulose exports surged by USD 10.7 million (8.84%), from USD 121 million to USD 132 million. On the other hand, imports declined by USD 4.24 million (-7.18%), from USD 59.1 million to USD 54.8 million between May 2025 and June 2025, as stated by the OEC.

Key Wood Plastic Composites Market Players:

- Trex Company, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The AZEK Company Inc. (TimberTech)

- UFP Industries, Inc.

- Fiberon LLC

- MoistureShield (Oldcastle APG, CRH)

- CertainTeed (Saint-Gobain)

- TAMKO Building Products LLC

- Beologic N.V.

- FKuR Kunststoff GmbH

- JELU-WERK J. Ehrler GmbH & Co. KG

- PolyPlank AB

- Axion Structural Innovations LLC

- Guangzhou Kindwood Co. Ltd.

- Resysta International

- Green Dot Bioplastics, Inc.

- Fukuvi Chemical Industry Co., Ltd.

- Einwood

- WPC Corporation

- JJWOOD

- Resysta Japan

The global wood plastic composite market is highly competitive with a mix of large multinationals and niche regional players, competing on market share through innovation in product, strategic growth, and efficient distribution networks. Some of the prominent industry players include Trex Company, Inc., The AZEK Company Inc. (TimberTech), UFP Industries, Inc., Fiberon LLC, and MoistureShield (Oldcastle APG, CRH). Some of the other prominent major players that are shaping the market include CertainTeed (Saint-Gobain), TAMKO Building Products LLC, Beologic N.V., FKuR Kunststoff GmbH, JELU-WERK J. Ehrler GmbH & Co. KG, and PolyPlank AB, which are shaping WPC technology and application developments worldwide.

Strategic partnerships, mergers and acquisitions, and international market expansion are major strategies employed by these companies to enhance their relative positions and leverage growing global demand. Most are focused on building their businesses in emerging markets and designing products with enhanced sustainability profiles and targeted performance characteristics. For instance, UFP Industries, Inc., in December 2023, launched a collaboration with a Japan trading firm to distribute U.S.-made WPC decking in Japan, focusing on the high-end residential and hospitality sectors and providing technical support to establish a foothold in Asia market.

Here are some leading companies in the wood plastic composites market:

Recent Developments

- In February 2025, ACS Publications rolled out a study on a new ecologically viable wood plastic composite using high-density polyethylene (HDPE)-loaded sawdust (St)- 0–40%, w/w and fiberglass (FG)- 0–40% w/w quantity without compatibilizers. for compressive strength with a Simplex Lattice mixture design. The results suggest a 37% cost reduction as compared to product counterparts

- In January 2022, College of Biotechnology and Pharmaceutical Engineering, Nanjing Tech University, Nanjing, China, College of Food Science and Light Industry, Nanjing Tech University, Nanjing, China, and School of Chemical Engineering, Zhengzhou University, Zhengzhou, China published the research report on the development of WPC using environmentally friendly source materials such as low-value biomass and corn stalk (CS). An alkaline-EtOH stewing process and acid stewing method for selective removal of hemicellulose were adopted.

- Report ID: 5159

- Published Date: Oct 07, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wood Plastic Composites Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.