GFRP Composites Market Outlook:

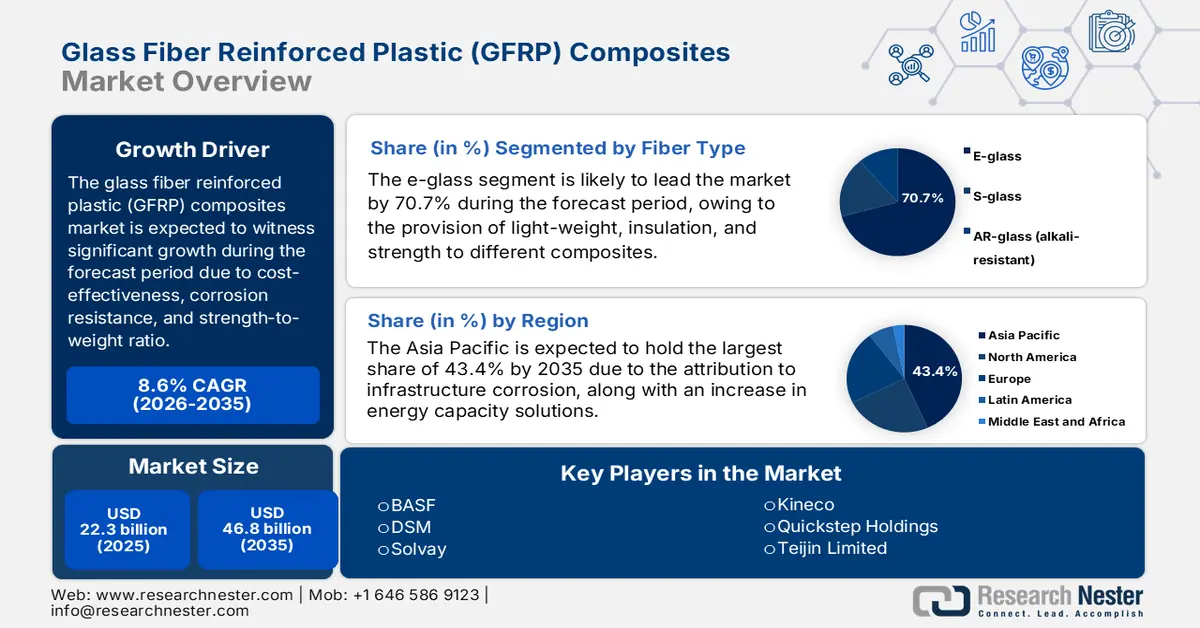

GFRP Composites Market size was over USD 22.3 billion in 2025 and is estimated to reach USD 46.8 billion by the end of 2035, expanding at a CAGR of 8.6% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of glass fiber reinforced plastic (GFRP) composites is assessed at USD 24.2 billion.

The international GFRP composites market is increasingly being adopted across different industries, owing to the aspects of cost efficiency, corrosion resistance, and increased strength-to-weight ratio. As per an article published by Defence Technology in June 2023, the A-10 Warthog offers suitable protection for the pilot and readily weighs 1,200 lbs. Besides, according to an article published by the U.S. Department of Energy in 2025, a 10% reduction in vehicle weight effectively leads to a 6% to 8% in fuel economy optimization. Therefore, replacing conventional steel and cast-iron components with lightweight materials, including polymer composites, carbon fiber, aluminum alloys, magnesium alloys, and high-strength steel, can diminish vehicles’ weight by almost 50%, and thus reduce vehicle fuel consumption.

Light-Weight Materials Ensuring Mass Reduction (2025)

|

Material Type |

Reduction (%) |

|

Magnesium |

30 to 70 |

|

Carbon Fiber Composites |

50 to 70 |

|

Aluminum and AI Matrix Composites |

30 to 60 |

|

Titanium |

40 to 55 |

|

Glass Fiber Composites |

25 to 35 |

|

Advanced High-Strength Steel |

15 to 25 |

|

High Strength Steel |

10 to 28 |

Source: U.S. Department of Energy

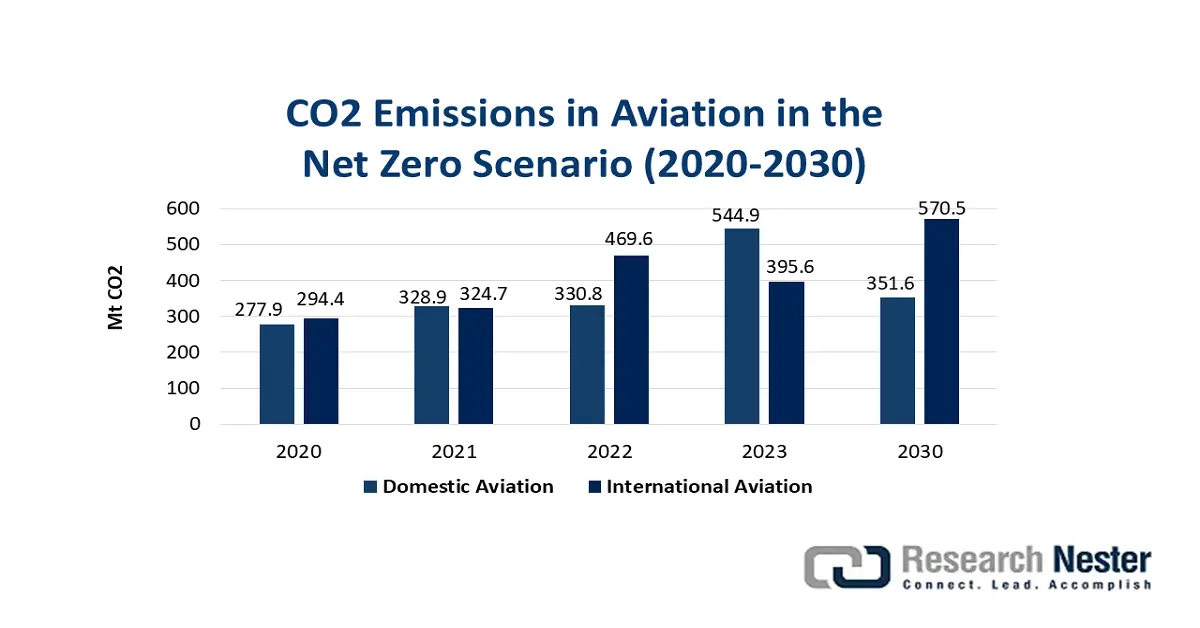

Furthermore, circular economy, sustainability, light-weighting in transportation, infrastructure resilience, and process innovation are current trends that are significantly fueling the glass fiber reinforced plastic (GFRD) composites market globally. As stated in a data report published by the Europe Commission in 2024, France’s President announced the 5-year €1.8 billion plan, with the intention of financing research in quantum computing, sensing, and communications, which is propelling the market’s exposure across different nations. Besides, as per an article published by the IEA Organization in 2025, aviation accounted for 2.5% of the international energy-driven carbon dioxide emissions as of 2023. However, to combat this, the U.S. granted almost USD 1.7 per gallon of SAF produced under the IRA, which is to be achieved between 2030 and 2050. Moreover, the aspect of carbon dioxide emissions in aviation for achieving a net-zero scenario is also uplifting the glass fiber reinforced plastic (GFRP) composites market’s demand internationally.

Source: IEA Organization

Key Glass Fiber Reinforced Plastic (GFRP) Composites Market Insights Summary:

Regional Insights:

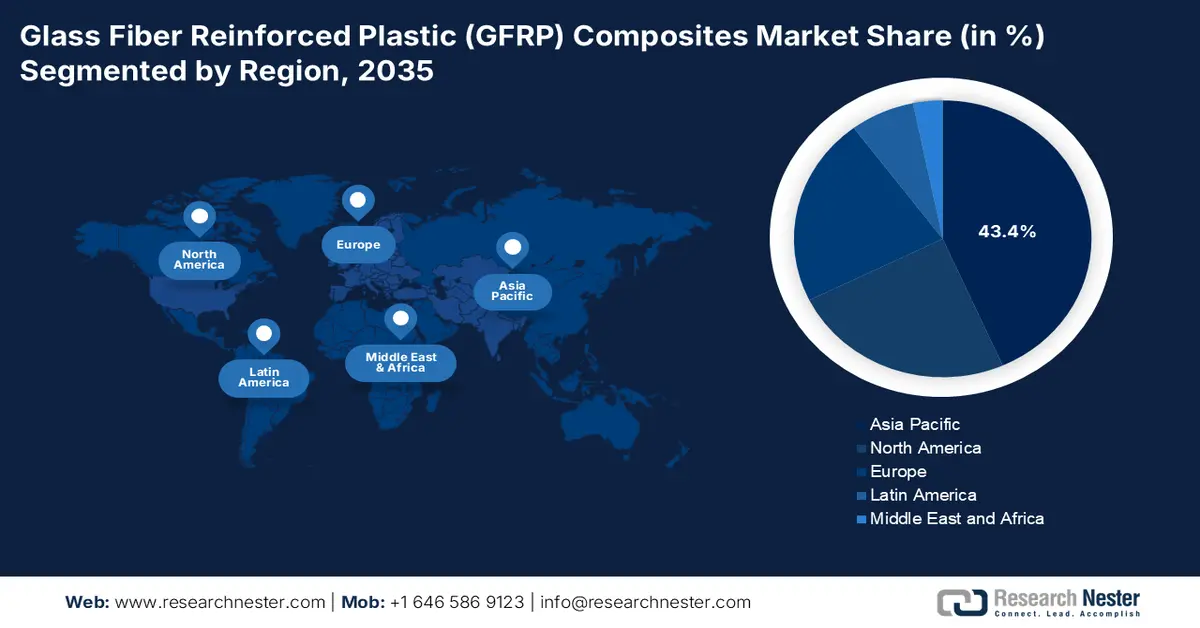

- Asia Pacific is projected to command a 43.4% share by 2035 in the glass fiber reinforced plastic (GFRP) composites market, supported by accelerated wind energy capacity additions, automotive lightweighting initiatives, and corrosion-mitigation demand across infrastructure applications.

- Europe is expected to register the fastest growth by 2035, strengthened by corrosion-resilient infrastructure modernization, transport lightweighting trends, and stringent regional sustainability policies.

Segment Insights:

- The e-glass segment is anticipated to account for a dominant 70.7% share by 2035 in the glass fiber reinforced plastic (GFRP) composites market, underpinned by its lightweight characteristics, insulation capability, mechanical strength, and versatility across renewable energy, automotive, and construction uses.

- The polyester resin sub-segment is projected to secure the second-largest share by 2035, benefiting from its cost efficiency, broad availability, and suitability for high-volume manufacturing across construction, automotive, marine, and industrial applications.

Key Growth Trends:

- Integrating digital twins and automation

- Expansion in renewable energy

Major Challenges:

- Increased production expenses and capital intensity

- Recycling and end-of-life disposal issues

Key Players: Johns Manville (U.S.), AGY Holding (U.S.), Jushi Group (China), Taishan Fiberglass (China), Chongqing Polycomp International (China), Nippon Electric Glass (Japan), Nittobo (Japan), Saint-Gobain Vetrotex (France), 3B Fibreglass (Belgium), Lanxess (Germany), BASF (Germany), DSM (Netherlands), Solvay (Belgium), SABIC (Saudi Arabia), KCC Corporation (South Korea), Kineco (India), Quickstep Holdings (Australia), Teijin Limited (Japan), Toray Industries (Japan).

Global Glass Fiber Reinforced Plastic (GFRP) Composites Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 22.3 billion

- 2026 Market Size: USD 24.2 billion

- Projected Market Size: USD 46.8 billion by 2035

- Growth Forecasts: 8.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.4% share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Vietnam, Indonesia, Mexico

Last updated on : 19 December, 2025

GFRP Composites Market - Growth Drivers and Challenges

Growth Drivers

- Integrating digital twins and automation: These particular technologies are being readily integrated into composite manufacturing, which, in turn, is uplifting the GFRP composites market globally. According to an article published by NLM in March 2023, 85% of Internet of Things (IoT)-based devices utilize digital twins to safeguard information security. Therefore, digital twin-specific smart city construction has emerged as one of the research hotspots. Besides, as per the September 2025 ITA article, with over USD 165 billion investment as of 2024, along with the latest U.S.-India tactical technological partnerships, there is a growing demand for exports in industrial automation, which is also driving the market’s growth and expansion across different countries.

- Expansion in renewable energy: The aspect of wind energy projects requiring GFRP for turbine blades and structural supports is gradually proliferating the GFRP composites market globally. As per a data report published by the IEA Organization in 2025, the international renewable source capacity is predicted to double by the end of 2030, thereby increasing by 4,600 GW. Based on this expansion, solar photovoltaic (PV) caters to nearly 80% of the increase, which is followed by geothermal, bioenergy, hydropower, and wind. Besides, in over 80% of countries, the renewable power capacity is expected to grow rapidly between 2025 and 2030. Therefore, with this continuous surge in the renewable source capacity, the glass fiber reinforced plastic (GFRP) composites market is poised to witness increasing growth and demand.

- Focus on advanced molding techniques: The presence of techniques, such as filament winding, pultrusion, and RTM, is gradually optimizing throughput and diminishing expenses, which in turn, is fueling the GFRP composites market. As stated in an article published by NLM in May 2022, the automotive industry in Germany consumes 19 kt of natural fiber composites every year, along with 64% flax, 11% jute or kenaf, 10% hemp, and 7% sisal. Meanwhile, different textile processes are readily compatible with natural fibers, but remaining textiles require adaptations to manage the material characteristics of natural fiber products. Therefore, with the presence of innovative molding technologies, there is a huge growth opportunity for the glass fiber reinforced plastic composites market to gain importance globally.

Challenges

- Increased production expenses and capital intensity: This is one of the most significant challenges for the GFRP composites market, which is associated with advanced manufacturing processes. Techniques such as resin transfer molding (RTM), pultrusion, and filament winding require specialized equipment, skilled labor, and strict quality control. The raw materials, particularly high-performance resins and specialty glass fibers, are expensive compared to traditional construction materials like steel or aluminum. This cost disparity often limits adoption in price-sensitive markets such as developing economies, where upfront capital expenditure is prioritized over lifecycle savings. Additionally, scaling production to meet large infrastructure or automotive demands requires substantial investment in plant capacity, automation, and testing facilities.

- Recycling and end-of-life disposal issues: While the GFRP composites market provides durability and corrosion resistance, their end-of-life disposal and recycling present a major challenge. Unlike metals, which can be easily melted and reused, GFRP materials are thermoset-based and difficult to recycle due to cross-linked polymer structures. Current recycling methods, such as mechanical grinding or thermal processes, are energy-intensive, costly, and often degrade material properties, limiting reuse in high-performance applications. This creates environmental concerns, particularly in Europe and North America, where stringent regulations on waste management and circular economy principles are enforced, thereby causing a hindrance in the market’s growth.

GFRP Composites Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.6% |

|

Base Year Market Size (2025) |

USD 22.3 billion |

|

Forecast Year Market Size (2035) |

USD 46.8 billion |

|

Regional Scope |

|

GFRP Composites Market Segmentation:

Fiber Type Segment Analysis

The e-glass segment, which is part of the fiber type, is anticipated to hold the largest share of 70.7% in the GFRP composites market by the end of 2035. The segment’s upliftment is extremely propelled by its importance for offering insulation, light weight, and strength in composites, along with its versatility. In addition, it readily strengthens car parts and wind turbines and lowers energy bills, along with protecting interiors, thus making them indispensable for modernized renewable energy, automotive, and construction industries. According to an article published by NLM in February 2022, the mechanical property of glass fibers, with a tensile strength ranging between 2,415 MPa to 4,890 MPa, is significantly associated with a relatively low density, which is from 2.1 g/cm3 to 2.7 g/cm3. Additionally, this is combined with a low tensile strength, ranging from 27 MPa to 137 MPa, along with low density from 0.9 g/cm3 to 1.2 g/cm3, thereby bolstering the segment’s exposure.

Resin Type Segment Analysis

Based on the resin type segment, the polyester sub-segment in the GFRP composites market is expected to cater to the second-largest share during the forecast period. The sub-segment’s growth is highly driven by its cost-effectiveness, versatility, and widespread availability. In addition, polyester is extensively utilized in construction, automotive, marine, and industrial applications. Its popularity stems from a favorable balance of mechanical strength, corrosion resistance, and affordability compared to epoxy or vinyl ester resins. Polyester-based resins are particularly effective in open-mold processes such as hand lay-up and spray-up, making them suitable for high-volume production of panels, pipes, tanks, and reinforcement structures. The resin’s adaptability to various curing agents and fillers enhances design flexibility, while its chemical resistance supports applications in harsh environments like water treatment plants and chemical storage. Growth in polyester-based GFRP is further supported by infrastructure expansion in Asia-Pacific and Latin America, where cost-sensitive markets prioritize durable yet economical materials.

End use Industry Segment Analysis

By the end of the stipulated timeline, the construction and infrastructure segment, under the end use industry, is predicted to account for the third-largest share in the GFRP composites market. The segment’s development is effectively fueled by GFRP’s corrosion resistance, lightweight properties, and long lifecycle performance, making it an ideal substitute for steel in bridges, tunnels, water systems, and coastal structures. Reinforcement bars, also known as rebar, panels, pipes, and tanks, are widely deployed in infrastructure projects where durability and reduced maintenance costs are critical. Governments across North America, Europe, and the Asia-Pacific are increasingly specifying GFRP materials in public procurement contracts to enhance resilience against corrosion, particularly in aggressive environments such as marine and chemical exposure.

Our in-depth analysis of the GFRP composites market includes the following segments:

|

Segment |

Subsegments |

|

Fiber Type |

|

|

Resin Type |

|

|

End use Industry |

|

|

Product Form |

|

|

Application |

|

|

Manufacturing Process |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

GFRP Composites Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the GFRP composites market is anticipated to hold the highest share of 43.4% by the end of 2035. The market’s upliftment in the region is highly attributed to wind energy capacity additions, automotive light-weighting, and infrastructure corrosion mitigation for panels, pipes, and rebar. According to an article published by Carbon Brief Organization in January 2024, wind and solar capacity in the Association of Southeast Asian Nations (ASEAN) region has significantly increased by 20% as of 2023. This has resulted in bringing the overall total to over 28 GW. Besides, technologies currently make up to 9% of the electricity generating capacity, which is also fueling the market’s demand in the overall region. Moreover, combined with a massive hydropower base, the growth in solar and wind has led to the achievement of the renewable energy capacity target of 35% as of 2025.

Total Operating Wind and Solar Capacity (2023)

|

Countries |

Wind and Solar (GW) |

|

Vietnam |

19.5 |

|

Thailand |

3.1 |

|

Philippines |

3.0 |

|

Malaysia |

1.6 |

|

Cambodia |

0.4 |

|

Myanmar |

0.2 |

|

Singapore |

0.2 |

|

Indonesia |

0.2 |

Source: Carbon Brief Organization

China in the GFRP composites market is significantly growing due to an increase in wind energy installations, automotive light-weighting, and the presence of large-scale infrastructure renewal for industrial, water, and bridge piping. As per an article published by the Global Energy Monitor Organization in July 2024, the country has readily cemented its position as one of the international leaders in renewables development, with 159 GW of wind power and 180 GW of utility-scale solar under construction. Besides, 339 GW of wind and utility-scale solar have successfully reached the construction stage, accounting for 1/3rd of the overall proposed solar and wind capacity in the country. In addition, this has significantly surpassed the international construction rate of only 7%, which is positively impacting the market’s growth and expansion.

India in the GFRP composites market is also growing, owing to increased priority over lifecycle savings and corrosion resistance, along with the existence of strong infrastructure modernization, particularly for coastal works, bridges, metros, and water systems. As stated in an article published by the ITA in April 2023, the solid waste management industry in the country is projected to grow at 7.5%, which is readily driven by a surge in investments, a rise in waste management awareness, and increased urbanization. Besides, the country generates more than 62 million tons of waste every year, of which 43 million tons are collected, and 12 million tons are treated before disposal, while the remaining 31 million tons are simply discarded. Additionally, this waste comprises 0.1 million tons of biomedical waste, followed by 1.5 million tons of e-waste, 5.6 million tons of plastic waste, and 7.9 million tons of hazardous waste, all of which cater to the upliftment of the glass fiber reinforced plastic composites market.

Europe Market Insights

Europe in the GFRP composites market is expected to emerge as the fastest-growing region by the end of the forecast period. The market’s development in the region is highly propelled by corrosion-resilient infrastructure upgradation, light weighting in transport, as well as regional sustainability policies. According to an article published by the Transport Environment Organization in July 2025, almost 1.8 million battery electric vehicles (BEVs) have been produced in the region as of 2024. Based on this production, Germany is leading with 1.2 million (BEVs), which is followed by France with 330,000. However, as per the present regional regulation of car carbon dioxide policies, the compliance is projected to require 9.6 million by the end of 2030. Besides, standard electric car production plans in the region are also fueling the glass fiber reinforced plastic composites market’s demand.

Electric Vehicle Production Plans in Europe (2025)

|

Company and City Name |

Announced Investment (EUR) |

Capacity Planned |

|

Nissan: Sunderland (UK) |

1,170,000,000 |

100,000 |

|

Jaguar Land Rover: Halewood (UK) |

292,500,000 |

150,000 |

|

BMW Mini: Oxford (UK) |

702,000,000 |

- |

|

Volvo Cars: Torslanda, Gothenburg (Sweden) |

910,000,000 |

250,000 |

|

ElectroMobility Poland: Jaworzno (Poland) |

1,380,000,000 |

200,000 |

|

BYD: Szeged (Hungary) |

4,000,000,000 |

200,000 |

Source: Transport Environment Organization

Germany in the glass fiber reinforced plastic (GFRP) composites market is gaining increased traction, owing to robust research and development ecosystems, industrial infrastructure upgrades, industrial modernization reforms, and safety frameworks. Besides, as stated in an article published by Clean Energy Wire Organization in December 2025, renewable energy sources readily cover almost 56% of the country’s gross electricity consumption as of 2025. Additionally, there has been an increase in the solar power output by 18.7%, along with onshore turbines with a capacity of 5.2 GW added to the country’s grid, which further marked a surge from 3.3 GW in the previous year. Besides, as per the February 2025 Clean Energy Wire Organization article, the country has set an objective to reduce emissions by nearly 65% by the end of 2030, as well as 88% by the end of 2040, which is also positively impacting the market’s upliftment.

Poland in the glass fiber reinforced plastic (GFRP) composites market is also developing due to the upscaling of localized manufacturing for utilities and construction, regional structural fund provisions, and infrastructure modernization. According to the 2025 PAIH Government report, there has been a significant step towards strengthening the country’s semiconductor industry through the National Framework for Supporting Strategic Semiconductor Investments project, which is proposed by the Ministry of Digital Affairs, providing a USD 1.5 billion budget. This particular project has outlined policies for investors to commence the production of semiconductor facilities, and to achieve suitable assistance, investors are recommended to invest almost PLN 850 million within a maximum of 20 years. In this regard, there is a huge opportunity for ensuring at least 100 new employment opportunities throughout the overall project duration, thereby denoting a huge growth opportunity for the market.

North America Market Insights

North America in the glass fiber reinforced plastic (GFRP) composites market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly driven by utility-scale energy projects, light-weighting in transportation, and corrosion-resistant infrastructure upgradation. According to a data report published by the IEA Organization in 2024, the U.S. has initiated an investment of USD 1.4 in clean energy as of 2023, with investors directing USD 1 for fossil fuels. Besides, there has been a recent clean energy investment, wherein the Bipartisan Infrastructure Investment and Jobs Act significantly allocated USD 550 billion for clean infrastructure and energy. In addition, the US Inflation Reduction Act (IRA) of 2022 offered approximately USD 370 billion for promoting energy security and overcoming climate change. Therefore, with this increased focus on clean energy, the market is poised to grow in the region.

The glass fiber reinforced plastic (GFRP) composites market in the U.S. is gaining increased exposure due to infrastructure resilience, energy transition, upscaling the chemical industry, and budget attribution. Additionally, as stated in a data report published by the CISA Government in 2023, the chemical sector in the U.S. accounts for approximately USD 486 billion, which is more than 25% of the country’s overall gross domestic product (GDP). Moreover, 96% of goods in the country are manufactured utilizing chemical sector products, and it is the second-largest chemical producer, denoting that 13% of the world’s chemicals are derived from the country. Besides, as per an article published by ACMANET Organization in October 2023, the composites sector is continuously growing since there has been an increase in the GDP, from USD 27.6 trillion as of August 2023 to USD 27.6 trillion in September, thus creating an optimistic outlook for the market’s growth.

The GFRP composites market in Canada is also growing, owing to infrastructure modernization, environmental and sustainability regulations, automotive light-weighting, innovation in defense and aerospace, and expansion in renewable energy. As per an article published by the Government of Canada in December 2024, the country successfully added 1,006 MW of installed capacity for wind energy as of 2022, for an overall 15,132 MW. In the same year, wind energy generated 35 TWh of electricity in the country. This readily accounted for 5.7% of total electricity generation, providing suitable electricity to power almost 3 million people. Therefore, there is a surge in the utilization of GFRP, particularly in structural supports and turbine blades, which is gradually uplifting the overall market in the country.

Key GFRP Composites Market Players:

- Owens Corning (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johns Manville (U.S.)

- AGY Holding (U.S.)

- Jushi Group (China)

- Taishan Fiberglass (China)

- Chongqing Polycomp International (China)

- Nippon Electric Glass (Japan)

- Nittobo (Japan)

- Saint-Gobain Vetrotex (France)

- 3B Fibreglass (Belgium)

- Lanxess (Germany)

- BASF (Germany)

- DSM (Netherlands)

- Solvay (Belgium)

- SABIC (Saudi Arabia)

- KCC Corporation (South Korea)

- Kineco (India)

- Quickstep Holdings (Australia)

- Teijin Limited (Japan)

- Toray Industries (Japan)

- Owens Corning is one of the largest international producers of glass fiber composites, with a strong presence in construction, automotive, and wind energy applications. The company continues to expand its product portfolio through innovations in lightweight and corrosion-resistant GFRP solutions.

- Johns Manville, which is considered a Berkshire Hathaway organization, readily manufactures advanced fiberglass reinforcements and composite materials. Its focus on sustainability and insulation technologies has positioned it as a key supplier to infrastructure and industrial markets.

- AGY Holding specializes in high-performance glass fibers, including S-glass and E-glass, widely used in aerospace, defense, and electronics. The company’s niche expertise in specialty fibers gives it a competitive edge in high-strength GFRP applications.

- Jushi Group is regarded as one of the world’s largest fiberglass manufacturers, supplying a broad range of reinforcements for GFRP composites. With extensive production capacity and global distribution, it plays a critical role in meeting rising demand across the Asia-Pacific and beyond.

- Taishan Fiberglass, which is part of the CNBM Group, is a major China-based producer of fiberglass reinforcements. The company emphasizes large-scale production and cost efficiency, serving construction, automotive, and industrial sectors with GFRP materials.

Here is a list of key players operating in the global glass fiber reinforced plastic (GFRP) composites market:

The competitive landscape of the glass fiber reinforced plastic (CFRP) composite market is moderately consolidated, with the top four players jointly garnering a generous share, thus indicating that vertical integrators and regional specialists are readily competing on proximity, quality, and cost. The market’s growth has underscored continuous demand from the wind, automotive, and construction industries. Additionally, tactical approaches, such as localization to diminish lead times, pultrusion throughout gains, innovation in resin systems, and upscaling e-glass capacity, are also responsible for the market’s growth. Besides, in December 2024, NEOM successfully signed a joint venture deal with Samsung C&T Corporation for unlocking an initial investment of over SAR 1.3 billion in construction robotics. This agreement accelerated the deployment and development of cutting-edge rebar construction automation technology, especially in Saudi Arabia, thereby making it suitable for boosting the GFRP composites market.

Corporate Landscape of the GFRP Composites Market :

Recent Developments

- In April 2025, LANXESS has effectively accomplished the sale of its very own Urethane Systems business to the Japan-based UBE Corporation, and achieved an estimated €500 million gross cash proceeds, with €460 million enterprise valuation.

- In November 2024, Dow, JLR, and Adient significantly developed industry industry-first breakthrough for circularity in automotive seating by integrating closed-loop recycled materials into the newest seat foam.

- In October 2024, ExxonMobil declared that it has acquired the exclusive overseas licensing rights for Neuvokas Corporation’s proprietary composite rebar manufacturing process, especially outside North America.

- Report ID: 3829

- Published Date: Dec 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Glass Fiber Reinforced Plastic (GFRP) Composites Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.