Bioplastic Composites Market Outlook:

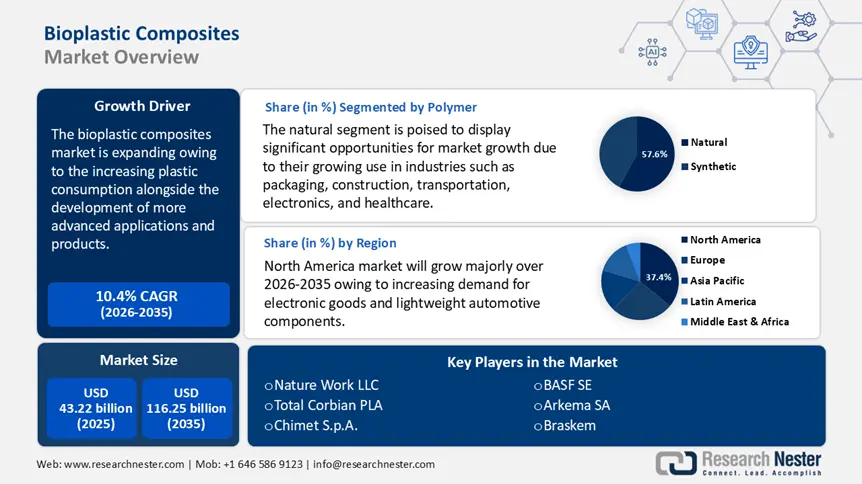

Bioplastic Composites Market size was valued at USD 43.22 billion in 2025 and is likely to cross USD 116.25 billion by 2035, expanding at more than 10.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bioplastic composites is assessed at USD 47.27 billion.

The global bioplastic composites market is projected to experience significant growth, driven by increasing plastic consumption alongside the development of more advanced applications and products. Key factors influencing consumer adoption of bio-based and biodegradable plastic materials include heightened environmental awareness and a growing familiarity with sustainable alternatives. Biodegradable and bio-based polymers serve as the primary materials utilized in the production of injection-molded bioplastics. Biodegradable polymers are derived from plant or animal lipids, while bio-based polymers originate from natural sources such as cellulose and starch. Various industries, including food and beverage, cosmetics, chemicals, and household cleaning, stand to benefit from the utilization of these materials.

Bioplastics present a viable investment opportunity to lessen dependency on fossil fuels and the environmental impact of plastic production as businesses place a greater emphasis on sustainability. As a result, the production of bioplastic components has expanded globally. The European Bioplastics e.V. revealed that bioplastics represent just 1% of the 335 million tons of plastic that are produced each year. However, as demand increases and more advanced biopolymers become available, new products and uses are developed, and the market is expanding steadily.

Key Bioplastic Composites Market Insights Summary:

Regional Highlights:

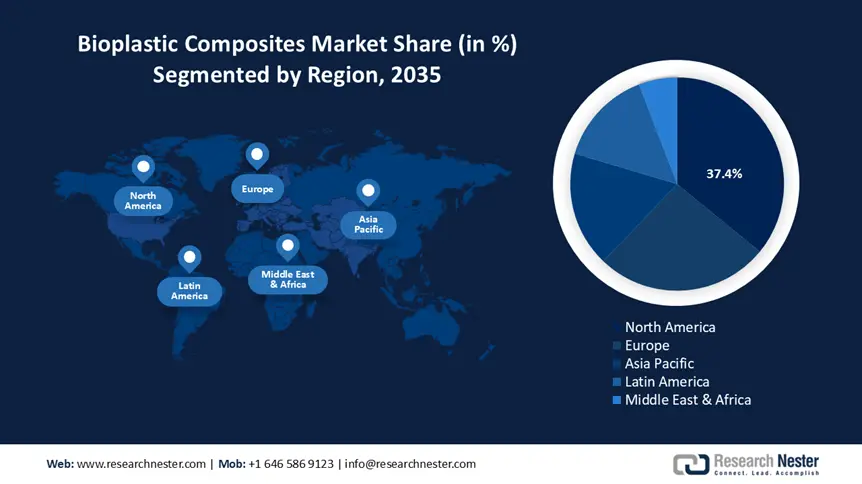

- North America dominates the Bioplastic Composites Market with a 37.4% share, driven by increasing demand for electronics and lightweight automotive components, ensuring leadership in sustainable materials through 2026–2035.

- Europe's Bioplastic Composites Market is set for significant growth by 2035, propelled by high product consumption and growing R&D in bioplastics.

Segment Insights:

- The Natural Polymer segment is projected to hold 57.6% market share by 2035, driven by increasing use in packaging, transportation, and healthcare due to sustainability trends and demand for bio-based materials.

- The Wood fiber segment is poised for significant growth from 2026-2035, driven by its lightweight nature, reducing carbon footprints and improving fuel economy in consumer products, automotive, and construction.

Key Growth Trends:

- Growing utilization of petroleum-based plastics

- Increasing government investments

Major Challenges:

- High costs

- Environmental concerns

- Key Players: Nature Work LLC, Total Corbian PLA, Chimet S.p.A., Braskem, Owens Corning, Arkema SA, BASF SE, The Dow Chemical Company, Green Dot Bioplastics, Inc., CSIRO.

Global Bioplastic Composites Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 43.22 billion

- 2026 Market Size: USD 47.27 billion

- Projected Market Size: USD 116.25 billion by 2035

- Growth Forecasts: 10.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Bioplastic Composites Market Growth Drivers and Challenges:

Growth Drivers

- Growing utilization of petroleum-based plastics: The increasing demand for petroleum-based plastics is expected to heighten the necessity for bioplastic composites. Given that petroleum-based plastic products are derived from fossil fuels, they present multiple environmental challenges. Additionally, the production of these plastics is a costly process that is heavily dependent on the extraction and refinement of fossil fuels. Bioplastic composites serve as a viable alternative to address these issues, as they contribute to a reduction in the reliance on non-renewable biofuel components in plastic manufacturing. Starch is one type of composite material employed in the production of bioplastic products. Furthermore, the utilization of starch-based composite materials has been shown to eliminate up to 64% of the demand for petroleum-derived feedstock.

- Increasing government investments: By enacting laws that encourage the development and use of bioplastics, governments are playing a significant role in promoting these materials. Mandatory quotas for the amount of bioplastic in specific products, for instance, increased market demand and prompted producers to seek bio-based substitutes. Also, major companies are establishing plants and expanding their production capacities significantly, driving the bioplastic composites market growth.

Furthermore, tax exemptions or incentives for the manufacture of bioplastics can reduce expenses and increase the materials' competitiveness with conventional plastics. For instance, in July 2024, in India, Nagaland, Ecostarch, an MSME based in Nagaland, has established a facility to produce bioplastic bags from cassava plants. The company is encouraging farmers within a 30 to 40-kilometer radius of the production site to start growing cassava. The planting of materials has already begun, and they will be ready for harvest in roughly a year.

Challenges

- High costs: Due to the intricate process of turning corn or sugarcane into the building blocks for PLA (polylactic acid), bioplastics are now more costly than conventional plastics. Additionally, the cost of biodegradable plastics is higher than that of their petroleum-based, non-biodegradable equivalents due to their restricted supply and higher raw material costs. Consequently, bioplastic composites market expansion is constrained by the high cost of bioplastics.

- Environmental concerns: Ocean pollution by microplastics is a major issue worldwide. One way to address this issue is by using bioplastics, which are constructed from materials that form biofilms and break down naturally. DNA is one of the most crucial components in the genetic process, even if bioplastics contain proteins, polysaccharides, polylactic acids, and other substances. Furthermore, a lot of DNA-containing products, including salmon milk, are thrown away as industrial waste worldwide, even though they might be used to create bioplastics.

Bioplastic Composites Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.4% |

|

Base Year Market Size (2025) |

USD 43.22 billion |

|

Forecast Year Market Size (2035) |

USD 116.25 billion |

|

Regional Scope |

|

Bioplastic Composites Market Segmentation:

Polymer (Natural, Synthetic)

The natural segment is anticipated to hold bioplastic composites market share of more than 57.6% by 2035. A non-biodegradable material created from renewable resources is known as synthetic polymer. Because they are used in many different industries, such as packaging, construction, transportation, electronics, and healthcare, petrochemical-based polymers are beneficial to society. Commercially accessible bio-polyamides include PA10, PA11, PA6, PA66, and PA12. There are numerous commercial applications for them. Nordic walking poles, eyeglasses, and other products are made from these polyamides, which have a partially bio-based content. For the past 60 years, PA11, a totally bio-based polyamide, has been available on the market and is mostly used in a range of automotive applications.

Fiber (Wood, Non-wood)

The wood segment is anticipated to garner a significant bioplastic composites market share during the assessed period. Wood fiber composites are primarily used in the consumer products, automotive, construction, and packaging sectors. The lightweight nature of wood fiber composites reduces the carbon footprint and improves vehicle fuel economy. Furthermore, Ravensburger, a German company that sells jigsaw puzzles throughout Europe, uses injection molding and entirely bio-based materials, such as wood fiber and bioplastics, to create its toys. The use of wood fiber composites has grown significantly in the building industry in North America in recent years. However, due to its light weight, wood fiber composite is mostly used in the automotive industry in the European region.

Our in-depth analysis of the global bioplastic composites market includes the following segments:

|

Type |

|

|

Fiber Type |

|

|

Polymer |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bioplastic Composites Market Regional Analysis:

North America Market Statistics

North America bioplastic composites market is likely to capture revenue share of around 37.4% by the end of 2035. The North American market is anticipated to experience steady growth due to the increasing demand for electronic goods and lightweight automotive components within the region. Additionally, the consumer goods sector is poised to contribute to market expansion, driven by elevated living standards and a consumer preference for premium products over substandard alternatives. Furthermore, a significant factor influencing market trends globally is the rising demand for bioplastics in horticulture and agriculture. The growth of the food manufacturing industry will also play a crucial role in the region's development as producers actively seek environmentally friendly packaging solutions in response to the global initiative to minimize reliance on conventional plastics.

Europe Market Analysis

Europe bioplastic composites market is expected to grow at a significant rate during the projected period. As the leading region for product consumption and research and development, Europe is an important hub. Approximately 25% of manufacturing is currently based in Europe, according to data from the European Bioplastics Association. bioplastic composites market demand is also expected to be supported by a robust automotive industry and the growing demand for bioplastic packaging from many local firms.

Key Bioplastic Composites Market Players:

- Nature Work LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent developments

- Regional Presence

- SWOT Analysis

- Total Corbian PLA

- Chimet S.p.A.

- Braskem

- Owens Corning

- Arkema SA

- BASF SE

- The Dow Chemical Company

- Green Dot Bioplastics, Inc.

- CSIRO

The bioplastic composites market is defined by the existence of well-established competitors who compete based on technological breakthroughs, product quality, and innovation. Key market players frequently use strategic moves like mergers, acquisitions, and expansions to increase bioplastic composites market presence and effectively fulfill the growing demand.

Recent Developments

- In September 2024, CSIRO, Australia's national science agency, and Murdoch University inaugurated The Bioplastics Innovation Hub, a USD 8 million cooperation that will collaborate with industry partners to create a new generation of 100% compostable plastic. The Bioplastics Innovation Hub intends to transform plastic packaging by creating biologically produced plastic that degrades in compost, soil, or water.

- In July 2022, Green Dot Bioplastics, a leading producer and supplier of bioplastic materials for innovative, sustainable end uses, expanded its Terratek BD line with nine new compostable grades aimed at single-use and packaging applications. The increased offering for film extrusion, thermoforming, and injection molding aligns with Green Dot Bioplastics' goal of achieving faster biodegradability rates in ambient conditions while fulfilling the expanding sustainability demands of brand owners and customers.

- Report ID: 7517

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bioplastic Composites Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.