Wide Format Printers Market Outlook:

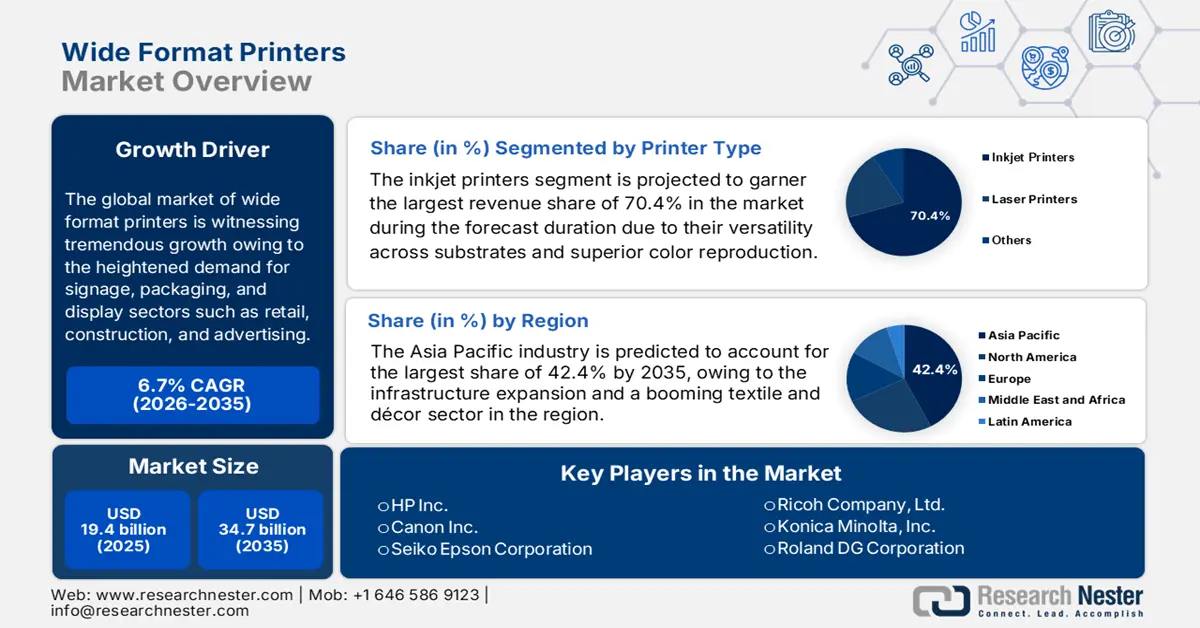

Wide Format Printers Market size was valued at USD 19.4 billion in 2025 and is projected to reach USD 34.7 billion by the end of 2035, rising at a CAGR of 6.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of wide format printers is evaluated at USD 20.7 billion.

The global market of wide format printers is witnessing tremendous growth owing to the heightened demand for signage, packaging, and display sectors such as retail, construction, and advertising. On the supply chain dynamics, it includes key raw materials such as specialty printheads, ink formulations, flexible/rigid substrates, components such as motors, bearings, electronics, assembly of the printer unit, testing, shipping, and finally installation by distributors and service providers. In this regard, WITS reported that in the U.S., the imported parts of printing machinery were valued at USD 7.12 billion, which totaled 93.3 million kg. Meanwhile, on the export side, U.S. shipments of parts of printing machinery and machines reached USD 2.37 billion, reflecting substantial international trade flows that support both domestic assembly operations and global supply chains.

Top Exporters of Printing Machinery Parts - 2023

|

Rank |

Exporter |

Trade Value (USD ‘000) |

Quantity (Kg) |

|

1 |

Japan |

6,221,105.35 |

111,147,000 |

|

2 |

China |

5,560,535.80 |

327,432,000 |

|

3 |

Germany |

4,565,041.19 |

53,218,700 |

|

4 |

European Union |

3,993,977.46 |

59,796,300 |

|

5 |

Netherlands |

3,809,374.53 |

72,363,700 |

|

6 |

Hong Kong, China |

3,232,248.74 |

81,034,400 |

|

7 |

Singapore |

2,810,939.36 |

45,330,600 |

|

8 |

U.S. |

2,371,880.22 |

28,938,300 |

|

9 |

Malaysia |

2,365,750.46 |

42,498,200 |

|

10 |

U.K. |

818,094.62 |

12,367,500 |

Source: WITS

On the pricing front, the wide format printers market is associated with industrial manufacturing and printing sectors, wherein the pricing and supply chain dynamics are heavily influenced by input costs and material availability as well. Testifying to this, the Bureau of Labor Statistics noted that as of August 2025, the U.S. producer price index for final demand reduced by 0.1% month-over-month, where services reduced by 0.2% and goods rose 0.1%. On a year-over-year basis, the PPI increased 2.6% from August 2024, and the index for final demand excluding foods, energy, and trade services rose by 2.8%, which marks the largest gain since March 2025. Therefore, these trends reflect consistent cost pressures on domestic producers and can influence pricing decisions, raw material sourcing, and production planning for wide-format printer manufacturers.

Key Wide Format Printers Market Insights Summary:

Regional Insights:

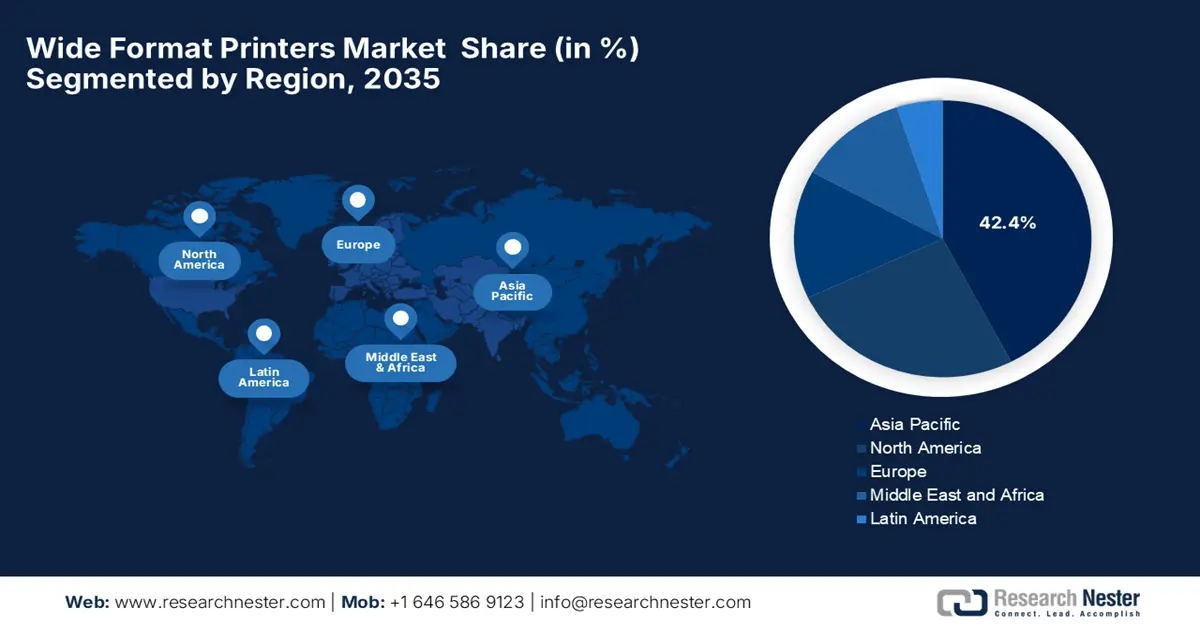

- By 2035, Asia Pacific is expected to hold a 42.4% share in the wide format printers market, supported by expanding urban infrastructure, robust textile printing adoption, and rising preference for UV-curable and eco-solvent technologies.

- North America is set to capture a substantial market share by 2035, propelled by its mature advertising ecosystem, strong uptake of UV and dye-sublimation systems, and increasing integration of automated and cloud-enabled print workflows.

Segment Insights:

- By 2035, the inkjet printers segment is projected to command a 70.4% share in the wide format printers market, bolstered by broad substrate compatibility, enhanced color performance, and ongoing advancements in operational efficiency.

- By 2035, the commercial segment is expected to achieve a 65.9% share, energized by rising demand for promotional graphics, customized short-run printing, and the expansion of experiential marketing formats.

Key Growth Trends:

- Expansion of the advertising and signage industry

- Adoption in textile, décor, and packaging applications

Major Challenges:

- High initial investment and operating costs

- Competition from digital signage & display technologies

Key Players: HP Inc. (U.S.), Canon Inc. (Japan), Seiko Epson Corporation (Epson) (Japan), Ricoh Company, Ltd. (Japan), Konica Minolta, Inc. (Japan), Roland DG Corporation (Japan), Mimaki Engineering Co., Ltd. (Japan), Agfa Gevaert Group (Belgium/Europe), Durst Phototechnik AG (Italy/Europe), Lexmark International, Inc. (U.S.), Xerox Corporation (U.S.), Kyocera Corporation (Japan), ColorJet India Ltd. (India), Mutoh Holdings Co., Ltd. (Japan), Fujifilm Holdings Corporation (Japan)

Global Wide Format Printers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 19.4 billion

- 2026 Market Size: USD 4.7 billion

- Projected Market Size: USD 20.7 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.4% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Mexico, Brazil

Last updated on : 10 November, 2025

Wide Format Printers Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of the advertising and signage industry: The expansion of the advertising and signage industry is readily driving business in the wide format printers market. There has been a heightened demand for high-visibility, large-scale graphics such as billboards, banners, in-store displays, and transit advertising is increasing across all nations. ORF in October 2022 reported that advertisement hoardings in India are considered to be visibility promotional tools, placed in areas where there is heavy traffic and footfall, helping brands to build a strong brand presence. On the other hand, municipal authorities regulate hoardings through various statutes and bye-laws, requiring permissions, verification, and traffic clearance, with guidelines for imposed or electronic displays to avoid hazards. Hence, such compliance allows brands to maintain a strong presence in both urban and retail areas with proper regulatory support.

- Adoption in textile, décor, and packaging applications: This has readily enhanced the businesses of manufacturers since they are utilizing wide-format printers for textiles, interior décor, and packaging. Their ability to print on a diverse range of substrates and flexible packaging materials enables short-run production and on-demand printing. MS Printing Solutions and JK Group, part of Dover, in September 2025, announced the launch of five innovative MP Series printers, which are designed to enhance performance in digital textile printing, offering advances in design, durability, electronics, and user interface. The company also stated that the series includes models for sublimation, sportswear, fashion, and direct-to-fabric printing, delivering speeds up to 630 square meters per hour and supporting multiple ink types, hence suitable for overall market growth.

- Technological advancements in printing systems: Continuous innovations in terms of printing technology are one of the important growth drivers for the wide format printers market. The UV-curable inks, eco-solvent inks, and hybrid printers are capable of handling both rigid and flexible media, and automation-integrated workflow solutions, which in turn are enhancing efficiency and output quality. For instance, in August 2024, Epson announced that it will showcase its latest wide-format printing solutions at PRINTING United Expo 2024, which features live demonstrations of dye-sublimation, UV flatbed, solvent, resin, DTG/DTFilm, fine art, CAD/technical, and color management printers. This highlights the firm’s commitment to innovation and delivering high-quality across multiple professional applications.

Emerging Technologies and Strategic Alloys Shaping the Print and Additive Manufacturing Landscape - 2025

|

Company |

Product / Initiative |

Details |

|

Canon |

corrPRESS iB17 Digital Press |

Industrial-scale digital printing for corrugated packaging. 8,000 m²/hr speed with water-based food-contact inks. |

|

Bosch |

Nikon SLM Solutions NXG XII 600 Metal 3D Printer |

High-speed, large-scale production of complex metal parts (e.g., engine blocks). 12-laser system for volume manufacturing. |

|

Agfa |

Distribution Partnership with Friedheim International |

Expands sales & service for Agfa's wide-format inkjet printers (hybrid, flatbed, roll-to-roll) in the UK and Nordic regions. |

Source: Company Official Press Releases

Challenges

- High initial investment and operating costs: This is the primary challenge hindering the growth of the market. The industrial and hybrid models in this sector come with extremely high upfront expenses, making it challenging for firms from price-sensitive regions. On the other hand, the cost of installation, calibration, and specialized maintenance further exacerbates these expenses. In addition, consumables such as inks, printheads, and media are even more costly, which often necessitates replacements as well. Therefore, the aspect of high initial costs coupled with recurring expenses creates hesitation among small and medium-scale firms this creating a major hurdle for market expansion.

- Competition from digital signage & display technologies: This is yet another factor negatively impacting the growth of the wide format printers market. The rise of both digital and LED signage has become a strong substitute for both printed banners as well as posters. Therefore, this has attracted businesses that prefer dynamic and easily updatable displays. This, in turn, has reduced the demand for traditional printed advertising in malls, transportation hubs, and outdoor venues. In this regard, wide format printing companies must diversify applications other than only signage to sustain growth. Most of the firms are exploring décor, textile, and industrial printing to address the decline in print-based displays.

Wide Format Printers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 19.4 billion |

|

Forecast Year Market Size (2035) |

USD 34.7 billion |

|

Regional Scope |

|

Wide Format Printers Market Segmentation:

Printer Type Segment Analysis

Inkjet printers segment is projected to garner the largest revenue share of 70.4% in the wide format printers market during the forecast duration. Their versatility across substrates, superior color reproduction, and ongoing improvements in speed and cost efficiency are the key factors driving the dominance of this subtype. Also, its adaptability to signage, décor, textiles, and architectural graphics makes it extremely preferable to a wider audience group. In July 2025, Seiko Epson Corporation announced that it had established its first high-capacity ink tank inkjet printer manufacturing facility in India, which is located within the factory of partner RIKUN Manufacturing Pvt. Ltd. in Chennai. It also stated that mass production is scheduled to begin in October 2025, which will localize production and meet growing demand. Hence, the facility will enhance cost efficiency, reduce consumables waste, and strengthen the firm’s long-term commitment to sustainable manufacturing.

Application Segment Analysis

In terms of application commercial segment is expected to attain a significant share of 65.9% in the market by the end of 2035. The growth in the segment is effectively attributable to its critical role in banners, outdoor advertising, and in-store graphics and brand promotion. In addition, the growth of retail environments, experiential marketing, and digital print demands support this segment. Increasing adoption of customized and short-run printing for promotional campaigns and the growing preference for high-quality signage are readily driving business in this field. Moreover, businesses are leveraging wide format printing for event branding, trade shows, thereby creating encouraging opportunities for the players in this market. Furthermore, the segment’s strength across multiple industries, such as hospitality, entertainment, and corporate branding, reinforces its dominance in this sector.

Ink Type Segment Analysis

Based on ink type UV curable inks segment is anticipated to gain a share of 35.3% in the wide format printers market over the analyzed timeframe. The subtype is increasingly preferred since it supports both rigid and flexible substrates, which enables faster drying and meets tougher outdoor durability. This also meets eco-compliance requirements, wherein the UV-curable and eco-solvent inks as key growth drivers in wide format printing. In July 2025, ALTANA announced that it awarded its innovation award to the ECKART division for developing a new high-performance, environmentally friendly UV-curing printing ink formulation. It also stated that the inks combine alcohol-based silver dollar pigments with ultra-thin METALURE effect pigments produced via a physical vapor deposition process, delivering smooth, non-flaking surfaces and high-gloss mirror or chrome effects. Thus, this innovation enhances both efficiency and sustainability in packaging printing, hence denoting a wider segment scope.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegment |

|

Printer Type |

|

|

Application |

|

|

Ink Type |

|

|

Print Width |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wide Format Printers Market - Regional Analysis

APAC Market Insights

Asia Pacific is expected to dominate the wide format printers market, capturing the largest revenue share of 42.4% during the forecast duration. The dominance of the region is effectively attributable to the rapid urbanization, infrastructure expansion, and a booming textile and décor sector. The region benefits from textile printing, wherein the manufacturers are adopting roll-to-roll and flat-bed large-format printers to handle fabric. Technological shifts such as increased uptake of UV‑curable and eco-solvent ink systems further enhance capabilities. Canon in March 2025 announced that it has launched the imagePROGRAF TC-21M, which is an all-in-one A1+ desktop large format printer with advanced scanning and copy capabilities, enabling users to create creative materials such as flyers, promotional posters, teaching resources, and restaurant menus.

China market is continuously growing owing to its strong manufacturing and retail industries. There has been an increased adoption of digital signage in urban centers, wherein the government infrastructural projects and commercial spaces have led to increased investments in this field. In October 2025, Shengda Printing Technology placed a follow-up order for ten additional HEIDELBERG Jetfire 50 industrial inkjet systems, thereby expanding its digital printing capacity for efficient mass production of short runs. It also stated that the investment follows successful initial operations, highlighting the product’s superior color quality, high stability, automation, and reduced personnel requirements, enabling Shengda to integrate fully automated digital production lines fed directly by web-to-print jobs, hence denoting a positive market outlook.

India also holds a strong position in the wide format printers market, efficiently backed by the rapid expansion of sectors such as retail, advertising, and educational sectors, along with a surge in digital marketing and large-scale event promotions. Therefore, businesses are preferring on-demand printing for banners, posters, and hoardings, creating an encouraging opportunity for high-speed printers. In July 2023, IBEF revealed that print media revenue in the country is expected to grow by 13% to 15% in 2024, driven by increased government and corporate advertising spending, which surpassed USD 3.63 billion (Rs. 30,000 crore). It also stated that profitability is projected to rise by 10% to 14.5%, with revenue split approximately 70:30 between subscriptions and advertisements. Furthermore, subscription revenue for physical newspapers continues to rise, wherein the moderate price increases grow by 5% to 7%, reflecting sustained customer preference for print media.

North America Market Insights

North America is predicted to hold a lucrative share in the global wide format printers market throughout the discussed tenure. The leadership is primarily driven by a highly mature advertising and printing industry with a very high adoption of technologies such as UV, solvent, and dye-sublimation printing. The region’s pace of progress in this field is also fueled by heightened demand for high-quality promotional materials, custom graphics, and architectural needs. Furthermore, the integration of these devices with cloud printing solutions and automated workflows is readily enhancing efficiency, thereby encouraging investments in terms of wide format printers across both large and small businesses. Therefore, the existence of all of these factors will position North America as a predominant leader, encouraging more players to establish their footprint in the country.

The U.S. is augmenting its leadership in the regional wide format printers market, effectively propelled by a heightened demand from advertising agencies and the construction sector for durable outdoor signage. Besides, the technological advancements, such as hybrid printers and eco-friendly ink systems, are allowing a steady cash influx in this sector. In March 2025, HP announced the launch of the HP Latex R530 printer and printos production hub to transform large format printing for businesses of all sizes. It also stated that the R530 offers an all-in-one solution for rigid and flexible media, delivering high-quality output while minimizing space, maintenance, and operational costs. Complementing this, the printos production hub provides a highly centralized platform for real-time order management and workflow optimization, hence enabling print service providers to streamline operations efficiently.

Canada is portraying notable growth in the wide format printers market, efficiently backed by the huge popularity of personalized marketing and educational materials. Growth in the country is also supported by government-backed sustainability initiatives and the need for energy-efficient, low-maintenance solutions in various businesses. The Government of Canada, in August 2023, stated that an investment of USD 1.3 million in Simpson Print, which is a leading sustainable wide-format printer in Bloomingdale, Ontario, with a prime focus on enhancing production and integrating advanced digital technologies. It further highlighted that the funding will support green innovations such as UV LED curing, reduced harmful chemical use, improved carbon footprint, and full waste recycling, allowing the firm to offer end-to-end eco-friendly printing solutions, hence positively impacting market growth.

Europe Market Insights

The wide format printers market in Europe is expected to acquire a lucrative revenue share over the discussed time frame. The region’s progress in this field is effectively attributable to the strong emphasis on design, architecture, and creative industries that rely on high-resolution and large-scale prints. It is also witnessing a rise in terms of digital textile printing and urban development projects, which are driving the adoption of wide-format printers. Ricoh in October 2024 announced that it had launched Ricoh Printing Solutions Europe Limited to strengthen its industrial inkjet printing business across the region’s vast geography. It further stated that the new firm will be involved in functions such as sales, engineering support, and product evaluation, enabling consistent support to customers. Hence, this move strengthens the region’s role in digitization, sustainability, and growth in the industrial printing market.

Germany is witnessing the highest rate of expansion in the region market due to a strong adoption of industrial-grade wide format printers for advertising, architectural, and industrial applications. The country also benefits from a strong focus on precision engineering, advanced manufacturing, and sustainability. In May 2025, Koenig & Bauer reported results after the 11th Beijing International Printing Exhibition, which had more than 221,500 international visitors and a significant number of orders. The company reinforced its market leadership in large-format and long sheetfed offset presses, thereby underscoring its growing interest in packaging production. Furthermore, sales incentives from government programs, such as Italy’s PNRR, contributed to a strong order intake exceeding €50 million (USD 54.5 million) in a span of four months.

The U.K. is projected to grow exponentially in the wide format printers market, primarily fueled by the presence of creative sectors who are necessitate customizable prints for both indoor and outdoor applications. The country also benefits from sustainability regulations, coupled with the rise of e-commerce and retail personalization, which encourage the adoption of wide-format printers. In November 2025, HEIDELBERG reported that Micropress has strengthened its digital print capabilities by investing in the country’s first-ever HEIDELBERG Jetfire 50, to address the growing demand and capacity constraints in its inkjet operations. It also stated that the Jetfire 50, integrated with the Prinect portal, delivers high-speed performance, best image quality, and workflow automation, supporting both efficiency and reliability, hence denoting a positive market outlook.

Key Wide Format Printers Market Players:

- HP Inc. - U.S.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Canon Inc. - Japan

- Seiko Epson Corporation (Epson) - Japan

- Ricoh Company, Ltd. - Japan

- Konica Minolta, Inc. - Japan

- Roland DG Corporation - Japan

- Mimaki Engineering Co., Ltd. - Japan

- Agfa Gevaert Group - Belgium (Europe)

- Durst Phototechnik AG - Italy (Europe)

- Lexmark International, Inc. - U.S.

- Xerox Corporation - U.S.

- Kyocera Corporation - Japan

- ColorJet India Ltd. - India

- Mutoh Holdings Co., Ltd. - Japan

- Fujifilm Holdings Corporation – Japan

- HP Inc. is one of the most popular brand names in the field of wide-format printing, which is supported by the extensive portfolio of products such as DesignJet, PageWide XL, and Latex for various applications for signage, CAD, and textile production. The firm focuses on automation, cloud-based workflow tools, and the sustainability initiatives that foster a profitable business environment.

- Canon Inc. is headquartered in Japan and brings deep imaging‑technology to large format printing, offering UV‑curable, aqueous, and pigment‑ink wide format systems under its imagePROGRAF and other series. The company’s strategy lies in delivering high-quality output for various applications such as graphics, CAD, fine art, advanced print‑head and ink‑system development, and a strong service and dealer network.

- Seiko Epson Corporation is emerging as one of the most prominent players in this field, which efficiently emphasizes Micro Piezo inkjet technology and heat-free printing innovations to advance its wide format portfolio, especially in terms of signage, décor, and textile applications. The firm also focuses on digitalization of printing workflows, eco-friendly ink systems, and platform expansion, such as its SureColor series for production photo and graphics.

- Mimaki Engineering Co., Ltd. is a specialist manufacturer of wide-format inkjet and cutter or plotter systems that serve graphics, textile, and industrial sectors. Meanwhile, the company’s product strategy includes ultra-wide format capability, rapid turnaround systems, and eco-certified inks for both indoor and outdoor signage. Besides, Mimaki also emphasises niche high-value segments and maintains distributor and service networks to support growth in this field.

- Roland DG Corporation is identified as the top seller in terms of durable graphics, especially those in inkjet printer cutters, combining printing and cutting functionality. The firm emphasizes innovation in user workflow and on-demand production for signage, vehicle graphics, décor, and interior applications. Furthermore, service and channel support are key strengths, positioning the firm as a predominant leader in this field.

Below is the list of some prominent players operating in the global market:

The wide-format printers market is effectively dominated by the presence of global pioneers who are emphasizing strong innovation, distribution networks with very strong service ecosystems. Leading firms such as HP, Canon, and Epson are pursuing different strategic initiatives by expanding hybrid inkjet technology, pushing UV‑curable and latex ink platforms, thereby enhancing software workflows and scaling manufacturing in emerging regions. In February 2023, Brother Industries, Ltd., notified that it had developed the WF1-L640 latex wide-format printer, which is designed for signage, posters, and interior decorations. The firm further underscored that the printer uses environmentally friendly, water-based latex ink, which enables vibrant colors and high weather resistance, suitable for both indoor and outdoor applications, hence suitable for overall market growth.

Corporate Landscape of the Market:

Recent Developments

- In April 2025, Stratasys introduced the Neo800+, which is a high-speed, large-format stereolithography 3D printer, designed for applications such as prototyping, tooling, and wind tunnel testing. The product features ScanControl+ technology, enhanced lasers, and optics; the printer delivers up to 50% faster throughput.

- In January 2025, Canon India announced the launch of its new imagePROGRAF TZ-5320 and TX Series large format printers for a wide range of professional printing needs, including CAD drawings, posters, and corporate materials.

- Report ID: 8230

- Published Date: Nov 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wide Format Printers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.