Water Treatment Chemicals Market Outlook:

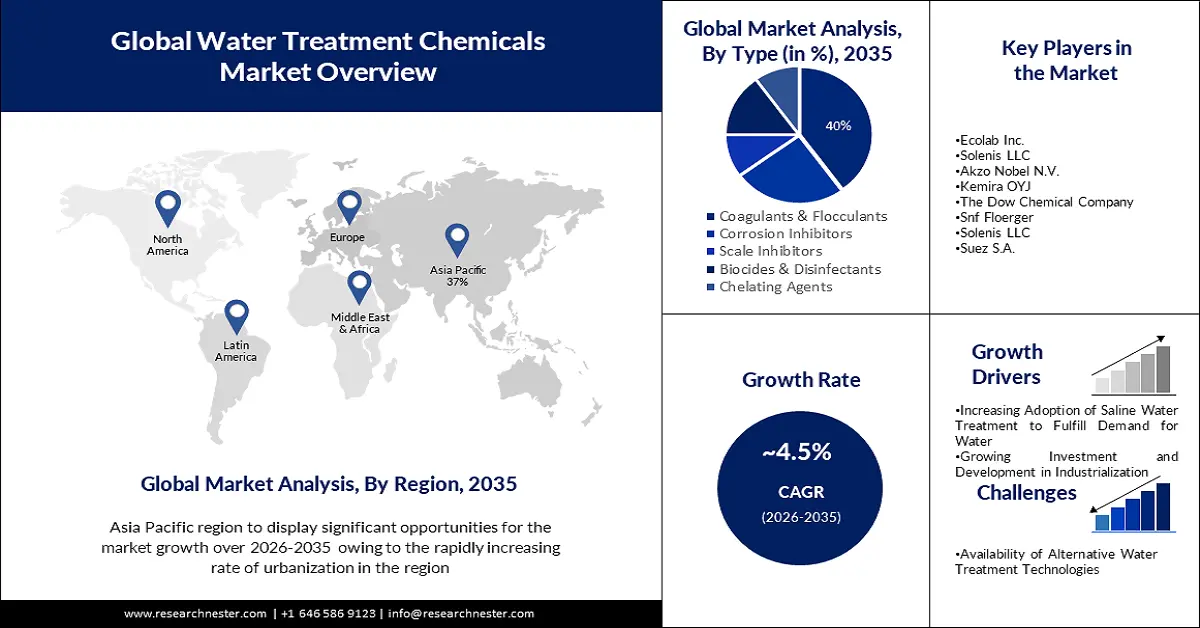

Water Treatment Chemicals Market size was over USD 38.33 billion in 2025 and is projected to reach USD 59.53 billion by 2035, witnessing around 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of water treatment chemicals is evaluated at USD 39.88 billion.

Increasing regulatory and sustainability measures put forward by various organizations all over the world on water and wastewater treatment have raised the requirement for water treatment chemicals. In developed regions such as North America and Europe, these regulations are highly strict. In Canada, the Wastewater Effluent Regulations found under the Fisheries Act consist of some minimum effluent quality standards that can be achieved with the help of water treatment chemicals.

This growth is driven by increasing demand from the sugar and ethanol, fertilizer, geothermal, petrochemical manufacturing, and refining sectors, particularly in developing markets. The market for various types of water treatment chemicals such as flocculants and coagulants, defoamers, corrosion inhibitors, and pH improvers is expected to grow exponentially owing to the rapid development and urbanization of the industrial sector.

Key Water Treatment Chemicals Market Insights Summary:

Regional Highlights:

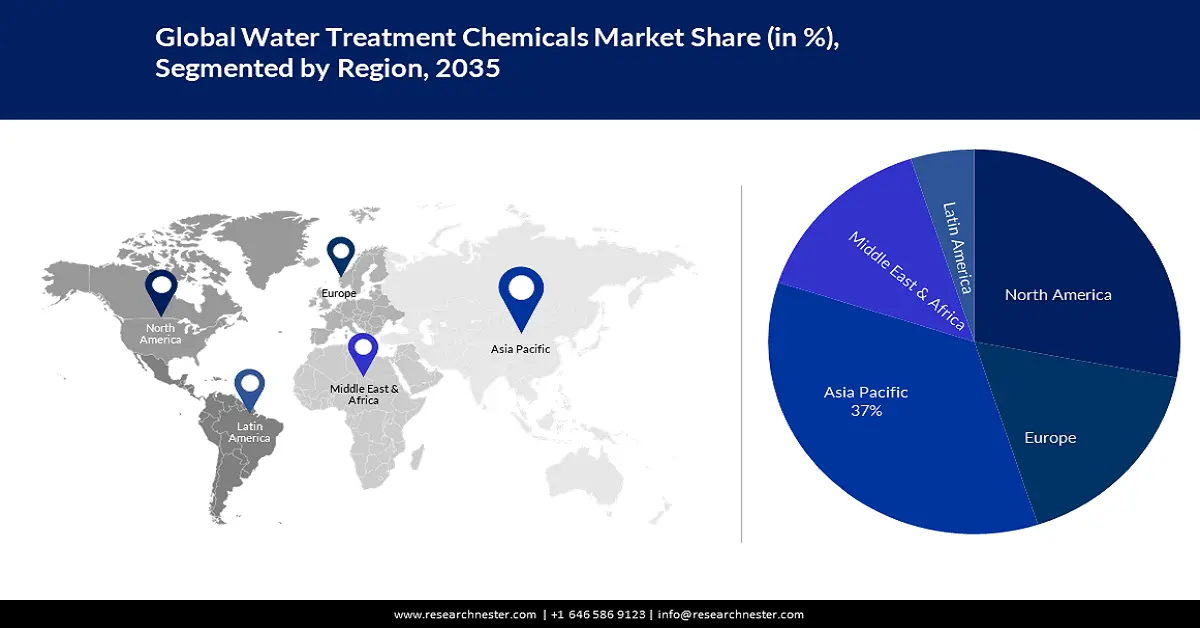

- Asia Pacific water treatment chemicals market will hold around 37% share by 2035, driven by rapid urbanization and water demand in industrial and municipal sectors.

- North America market will capture significant revenue share by 2035, attributed to rising water treatment needs in upstream oil & gas and municipal sectors.

Segment Insights:

- The coagulants & flocculants (type) segment in the water treatment chemicals market is expected to secure a 40% share by 2035, driven by the wide applicability and ease of use of coagulants and flocculants in water treatment.

- The municipal segment in the water treatment chemicals market is set to maintain a significant share from 2026-2035, driven by the widespread use of water treatment chemicals in municipal wastewater treatment to protect the environment and prevent disease spread.

Key Growth Trends:

- Surge in Adoption of Saline Water Treatment

- Growing Investment and Development in Industrialization

Major Challenges:

- Surge in Adoption of Saline Water Treatment

- Growing Investment and Development in Industrialization

Key Players: BASF SE, Ecolab Inc., Solenis LLC, Akzo Nobel N.V., Kemira OYJ, The Dow Chemical Company, Snf Floerger, Solenis LLC, Suez S.A., Lonza Group.

Global Water Treatment Chemicals Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 38.33 billion

- 2026 Market Size: USD 39.88 billion

- Projected Market Size: USD 59.53 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Indonesia

Last updated on : 9 September, 2025

Water Treatment Chemicals Market Growth Drivers and Challenges:

Growth Drivers

- Surge in Adoption of Saline Water Treatment – In recent times many countries including the Middle East have adopted the process of saline water treatment or desalination process in order to accomplish the consumption of clean water. Many regions around the world are still dependent on desalination technology for meeting their water needs. Desalination is one of the most widely used processes for obtaining clean water and it uses coagulant substances, scale-inhibiting agents, and biocides on a large scale. The global water demand is estimated to increase by 55% in 2050 as per the report of the United Nations.

- Growing Investment and Development in Industrialization - As a consequence of development in developed and developing countries crucial investment can be seen in various end-user industries such as oil & gas, paper & pulp, food & beverage, personal care, and others. For instance, China’s 40% global textile export in 2019 was attributed to private sector investment in the textile industry. The need for water treatment chemicals has increased as a consequence of development and investment in various industries.

- Increasing Scarcity of Freshwater - The scarcity of water is one of the significant and major concerns prevalent in society faced by industries and people in general. As per the UNICEF report, around 4 billion people all across the world suffer from water scarcity. Industries require large amounts of water for the production process and generate large amounts of wastewater too. Increasing industrialization is expected to rise the demand for more water resources.

- Rising Demand for Freshwater in Municipal and Industrial Sectors - Day-by-day increasing urbanization has raised the demand for municipal water treatment owing to rising demand for clean water and sanitization services. The escalating world population and economic development are boosting the demand for municipal and industrial water treatment which is further expected to propel the market growth.

Challenges

- Availability of Alternative Water Treatment Technologies – Alternative Water treatment technologies such as ultrafiltration, RO, and UV disinfection is expected to limit the market growth in the upcoming times. Technological advancement minimizes the application of water treatment chemicals. Also, owing to increasing environmental regulations and measures end user industries are looking for more sustainable choices for water treatments.

- Vulnerability Regarding Copying the Patents

- Requirement for Eco-friendly Formulation

Water Treatment Chemicals Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 38.33 billion |

|

Forecast Year Market Size (2035) |

USD 59.53 billion |

|

Regional Scope |

|

Water Treatment Chemicals Market Segmentation:

End-User Segment Analysis

In water treatment chemicals market, municipal segment is predicted to account for significant share by 2035. Water treatment chemicals are widely used in the municipal wastewater treatment procedure before it is exposed to the environment to stop any kind of damage to the environment and prevent the spread of harmful diseases. In Mexico, there are approximately 2,477 municipal wastewater treatment plants, 2,639 wastewater purification plants, 874 potable water treatment plants, and 435 desalination units.

Type Segment Analysis

Water treatment chemicals market from the coagulants & flocculants segment is expected to hold the largest share of 40% during the forecast upcoming decades in terms of type segmentation. Coagulants and flocculants are one of the most widely used water treatment chemicals highly consumed owing to their wide variety of properties and easier usage for the treatment of water.

Our in-depth analysis of the global water treatment chemicals market includes the following segments:

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Water Treatment Chemicals Market Regional Analysis:

APAC Market Insights

The Asia Pacific region is likely to capture around 37% water treatment chemicals market share by the end of 2035 and witness significant growth on the back of rapidly growing urbanization, which is expected to boost the growth of end-user industries of the product including chemical, power, and oil & gas.

Furthermore, increasing urbanization and growth in China are projected to fuel numerous industries such as municipal, industrial, food & beverage, oil & gas, and others, owing to the high need for fresh water in these sectors, which is expected to drive the growth of the market. As per International Trade Administration, China is planning to construct 80,000 km sewage collection pipeline networks and grow the sewage treatment capacity by 20 million cubic meters between 2021 and 2025.

North American Market Insights

The North America region is estimated to capture significant water treatment chemicals market share by 2035, which can be credited to the rising penetration of water treatment facilities in the upstream oil & gas sector, and soaring water scarcity.

Furthermore, In Canada and the United States, the increasing demand for water and wastewater treatment in the municipal and industrial sectors owing to the wide properties of water treatment chemicals is estimated to drive market growth.The United States Environmental Protection Agency (USEPA) places a strong focus on the improvement of water and sewage facilities, especially in the local wastewater treatment domain, and plans to invest an estimated USD 600 billion in capital improvements over the next 20 years.

Water Treatment Chemicals Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ecolab Inc.

- Solenis LLC

- Akzo Nobel N.V.

- Kemira OYJ

- The Dow Chemical Company

- Snf Floerger

- Solenis LLC

- Suez S.A.

- Lonza Group

Recent Developments

- Nalco Water, Ecolab Inc’s water and process management business, announced the launch of Global Chemical, which will be a new business unit focusing on holistic approaches to water, carbon, and energy challenges.

- BASF SE and Solenis LLC completed the transfer of BASF’s paper and water chemical business to Solenis. The combined business offers increased sales and production capabilities globally.

- Report ID: 3791

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Water Treatment Chemicals Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.