Pickling Chemicals Market Outlook:

Pickling Chemicals Market size was valued at USD 2.08 billion in 2025 and is likely to cross USD 3.42 billion by 2035, expanding at more than 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of pickling chemicals is assessed at USD 2.18 billion.

The escalating demand from industries like steel, automotive, and electronics is driving the growth of the market. As manufacturing activities expand globally, the need for effective metal surface treatment to enhance corrosion resistance and product quality becomes paramount. As observed by Research Nester analysts, the manufacturing sector contributed USD 6 trillion, or 17 %, to the global GDP of USD 39 trillion in 2019. Pickling chemicals play a vital role in preparing metal surfaces, driving their increased adoption. Additionally, the emphasis on environmentally sustainable formulations, technological advancements, and stringent quality standards further propels pickling chemicals market growth, positioning pickling chemicals as essential solutions for diverse industrial applications and contributing to the overall economic development of key sectors.

Furthermore, Industrial and manufacturing processes often involve the use of metals that require surface treatment for enhanced quality and performance. With the ongoing trend of industrialization and the establishment of new manufacturing facilities worldwide, the demand for pickling chemicals is expected to increase.

Key Pickling Chemicals Market Insights Summary:

Regional Highlights:

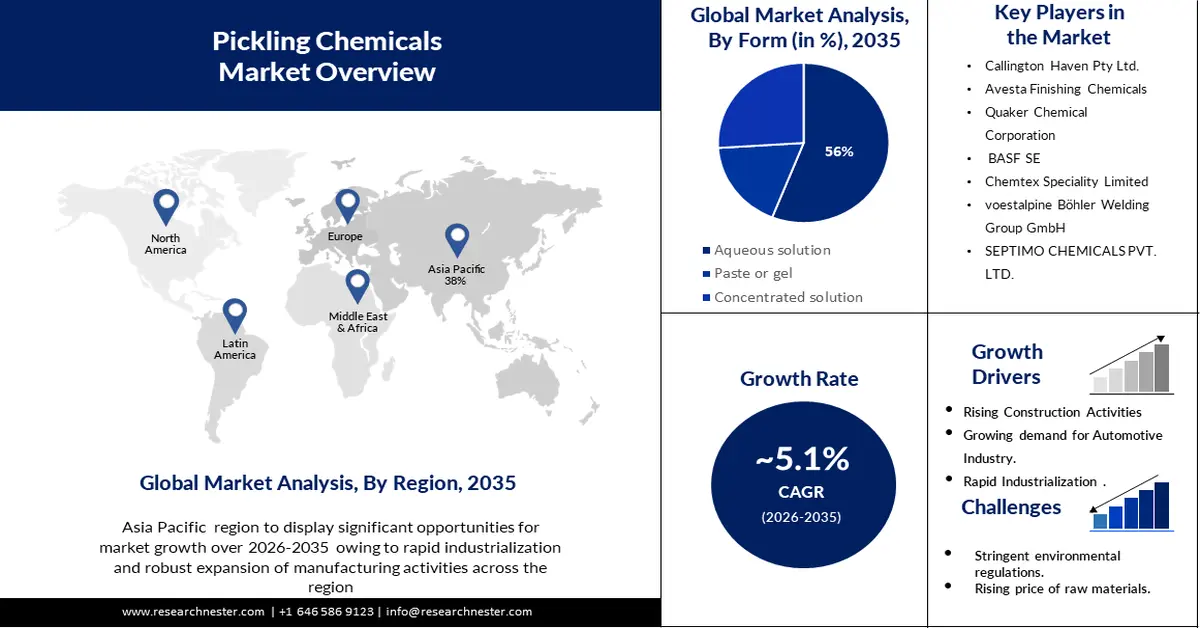

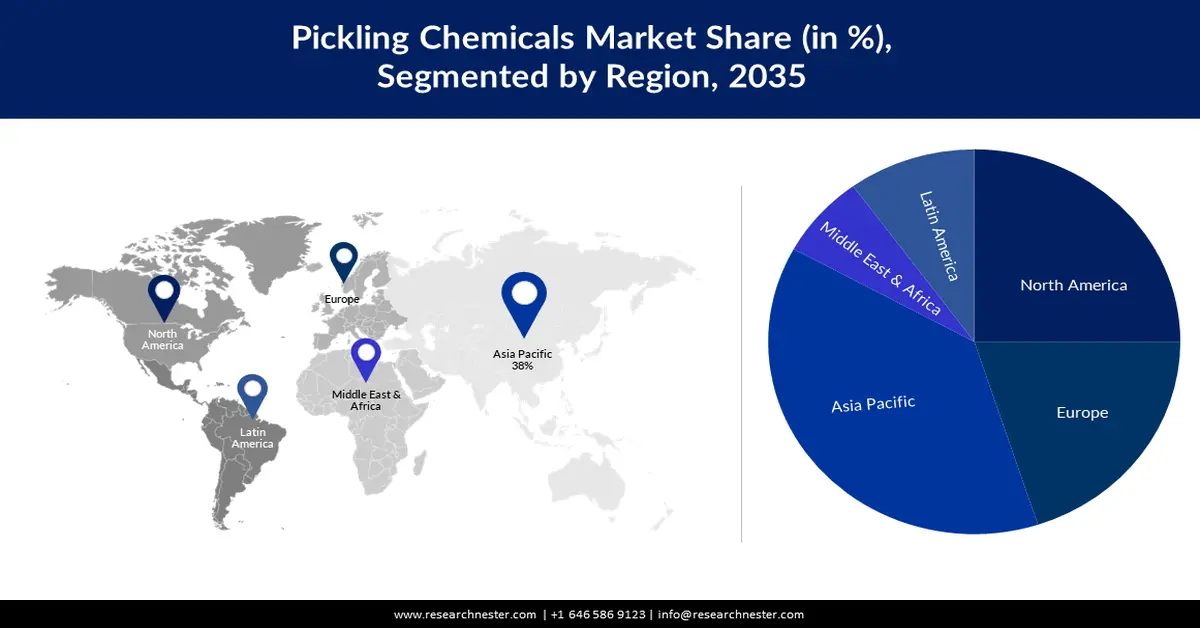

- Asia Pacific pickling chemicals market will secure over 38% share by 2035, fueled by rapid industrialization and robust manufacturing activities.

- North America market will register significant revenue share during 2026-2035, attributed to the thriving industrial and manufacturing sectors in North America.

Segment Insights:

- The aqueous solution segment in the pickling chemicals market is projected to capture a 56% share by 2035, attributed to ease of application, uniformity, and environmental compatibility in metal processing.

- The steel and metallurgy segment in the pickling chemicals market is expected to achieve major revenue growth through 2035, driven by the widespread use of pickling chemicals to enhance steel surface quality.

Key Growth Trends:

- Rising Focus on Energy Efficiency

- Growing Demand from the Automotive Industry

Major Challenges:

- Rising Raw Material Costs

- Strict environmental regulations, particularly regarding the disposal and emissions of chemical substances, pose a challenge for the pickling chemical industry.

Key Players: Callington Haven Pty Ltd., Avesta Finishing Chemicals, Quaker Chemical Corporation, BASF SE, Chemtex Speciality Limited, voestalpine Böhler Welding Group GmbH, SEPTIMO CHEMICALS PVT. LTD., Lakum-KTL YAU SANG GALVANIZING (HOT-DIP) CO., LTD.

Global Pickling Chemicals Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.08 billion

- 2026 Market Size: USD 2.18 billion

- Projected Market Size: USD 3.42 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 16 September, 2025

Pickling Chemicals Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Focus on Energy Efficiency- Energy-efficient pickling processes are gaining traction as industries seek ways to reduce energy consumption and operational costs. Pickling chemicals that contribute to energy-efficient surface treatment processes are likely to experience increased demand as companies prioritize sustainability and cost-effectiveness.

- Growing Demand from the Automotive Industry- The automotive industry extensively uses pickling chemicals for surface treatment of metal components, such as car bodies and engine parts. As the automotive sector continues to grow globally, driven by increasing vehicle production and demand, the need for pickling chemicals is expected to rise.

- Expansion of the Construction Sector- Pickling chemicals play a crucial role in preparing metal surfaces for equipment & materials like steel beams and structures. The expanding construction industry undergoing infrastructure development contributes to the increased use of pickling chemicals. The global construction industry’s output is expected to grow by an average of 3.7% per annum between 2021 and 2025. This would provide extensive opportunities for the pickling chemicals market.

- Stringent Environmental Regulations- Environmental regulations mandating the use of eco-friendly and low-emission chemicals in industrial processes have led to the development of environmentally sustainable pickling chemicals. Companies complying with these regulations are likely to see increased demand for their product, as industries seek alternatives that meet environmental standards.

Challenges

- Rising Raw Material Costs- Pickling chemicals are often derived from raw materials like acids and inhibitors. Fluctuations in the prices of these raw materials can significantly impact production costs. Rising costs may lead to increased prices for pickling chemicals, affecting the pickling chemicals market competitiveness.

- Economic uncertainties, such as recessions or financial crises, can impact the overall demand for industrial products, including those requiring pickling processes.

- Strict environmental regulations, particularly regarding the disposal and emissions of chemical substances, pose a challenge for the pickling chemical industry.

Pickling Chemicals Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 2.08 billion |

|

Forecast Year Market Size (2035) |

USD 3.42 billion |

|

Regional Scope |

|

Pickling Chemicals Market Segmentation:

Form Segment Analysis

Aqueous solution segment is estimated to hold 56% share of the global pickling chemicals market by 2035. Aqueous solutions offer advantages such as ease of application, uniform coverage, and reduced environmental impact compared to other forms. Industries, especially in metal processing, automotive, and construction, prefer aqueous pickling solutions due to their efficiency in removing impurities and scales from metal surfaces while aligning with environmental regulations. The aqueous solutions' versatility, cost-effectiveness, and compatibility with various metals contribute to its dominance in the market.

Application Segment Analysis

The steel and metallurgy segment are estimated to hold a major revenue share in the global pickling chemicals market. This dominance is attributed to the extensive use of pickling chemicals in the surface treatment of metals, particularly steel, to remove impurities and enhance corrosion resistance. As the steel industry continues to grow globally, driven by infrastructure development and manufacturing demands, the demand for pickling chemicals remains high. As analyzed by Research Nester analyts the chemical surface treatment industry garnered a revenue of around USD 10 billion. The critical role of pickling in preparing metals for various applications within the steel and metallurgy sector positions it as the leading end-user segment in the market.

Our in-depth analysis of the global pickling chemicals market includes the following segments:

|

Form |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pickling Chemicals Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to account for largest revenue share of 38% by 2035. The region witnessed remarkable growth, propelled by rapid industrialization and robust expansion of manufacturing activities across the region. With key contributors such as China, India, and Japan, the demand for pickling chemicals has surged in tandem with the flourishing automotive, construction, and electronics sectors. Nearly half of APAC manufacturers (44%) want to implement smart manufacturing in the upcoming year, with China (80%), Australia (60%) and India (59%) already utilizing some of its components. As these industries continue to scale up production, the need for efficient metal surface treatment becomes pivotal, driving the uptake of pickling chemicals. Moreover, the Asia Pacific region’s increasing focus on infrastructure development and urbanization further bolsters the demand for pickling chemicals in construction applications. While the market benefits from these growth factors, challenges include navigating environmental regulations and fostering sustainable practices. As the Asia Pacific region remains a global manufacturing hub, the market is poised for sustained expansion, supported by ongoing technological advancements and the continual pursuit of high-quality metal products.

North American Market Insights

North American pickling chemicals market is set to exhibit significant revenue share, propelled by the thriving industrial and manufacturing sectors in the region. The automotive and construction industries, in particular, have been significant contributors to the escalating demand for pickling chemicals, which are essential for the surface treatment of metal components. The market has seen a surge in innovation, with a focus on eco-friendly formulations and advanced pickling technologies to align with stringent environmental regulations. Additionally, the increased emphasis on corrosion prevention and maintenance of metal quality has further driven the adoption of pickling chemicals. Despite these conditions, challenges such as fluctuating raw material costs and the need for continual advancements in safety standards persist. Overall, the North American Market remains dynamic, and poised for sustained growth as industries prioritize quality surface treatments to meet evolving consumer demands and regulatory standards.

Pickling Chemicals Market Players:

- Wilh. Wilhelmsen Holding ASA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Callington Haven Pty Ltd.

- Avesta Finishing Chemicals

- Quaker Chemical Corporation

- BASF SE

- Chemtex Speciality Limited

- voestalpine Böhler Welding Group GmbH

- SEPTIMO CHEMICALS PVT. LTD.

- Lakum-KTL

- YAU SANG GALVANIZING (HOT-DIP) CO., LTD.

Recent Developments

- Quaker Chemical Corporation and Houghton International Inc., companies with a combined 250 years of experience as providers of process fluids, chemical specialties, or technical expertise to the global primary metals and metalworking industry announced that they have entered into definitive merger agreements. The headquarters of both Quaker Chemical and Houghton International are located in Philadelphia.

- In China, BASF has opened an Innovation and Technology Centre of Chemetall on surface treatment solutions

- Report ID: 5587

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pickling Chemicals Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.