Global Market Size, Forecast, and Trend Highlights Over 2025-2037

Walkers and Rollators Market size was valued at USD 3.1 billion in 2024 and is expected to reach USD 5.9 billion by the end of 2037, rising at a CAGR of 6.6% during the forecast period, 2025-2037. In 2025, the industry size of walkers and rollators is assessed at USD 3.5 billion.

The market is steadily expanding, since there has been a shift in the global demographic as well as an increase in mobility impairments. As stated in the 2023 World Health Organization (WHO) report, the elderly population is anticipated to reach the 2.3 billion mark by the end of 2050. In addition, 2 in 8 people are currently undergoing a limitation in mobility, due to musculoskeletal, stroke, and arthritics disorders. As per the 2022 CDC report, an estimated 26.4% of adults have mobility difficulty, which increasingly necessitates the implementation of assistive devices and systems. Therefore, this surge in demand positively influences the supply chain dynamics, thus driving the overall market growth.

Moreover, the trade facility is yet another factor positively impacting the market across different nations. For instance, the trade for the market is effectively dominated by the U.S., China, and Germany, all of which jointly account for 68% of exports. Additionally, almost 36% of rollators are imported from the U.S., while the EU caters to a trade surplus, owing to progressive manufacturing centers such as Poland and Germany. Besides, there is an increase in automated assembly lines, due to robotics implementation, which constitutes the ability to diminish labor spending by approximately 17%. Also, the aspect of private and public research and developmental investments for mobility aids enhanced to USD 788.5 million in 2023, thereby suitable for the overall market upliftment.

Walkers and Rollators Sector: Growth Drivers and Challenges

Growth drivers

-

Reimbursement policies and government healthcare spending: Government healthcare and medical programs have a significant impact on the international market for walkers and rollators due to their affordability and accessibility. For example, Medicaid and Medicare invested $3.4 billion in durable medical equipment (DME) in the US in 2023, with walkers and rollators accounting for the largest share. In Germany, statutory health insurance also covers nearly 93% of walker costs, which has accelerated market adoption.

-

Technological advances: The adoption of intelligent mobility is another growth driver, effectively boosting the market internationally. For example, the introduction of IoT-based walkers with features such as health monitoring, fall detection, and GPS tracking led to a 27.5% increase in sales in 2023. Furthermore, the NIH invested $122.5 million in artificial intelligence-based mobility aids in the same year, supporting market expansion and development worldwide.

Important strategies of manufacturers that shape the market

The walking aids and rollator market includes renowned manufacturers who are constantly striving to expand their market positions through tactical strategies such as cost optimization, planned partnerships and collaborations, and product innovations. For example, according to the FDA's 2024 government report, Drive DeVilbiss introduced IoT-enabled rollators in 2023, capturing an additional 13.5% market share. At the same time, according to the WHO's 2023 article, Sunrise Medical expanded through local partnerships in the Asia-Pacific region, increasing sales by $87 million and creating an optimistic market outlook.

Sales opportunities for manufacturers (2023–2025)

|

Strategy |

Impact on sales |

Example |

|

IoT rollators |

USD 222.5 million (2023-2025) |

Drive DeVilbiss (+12.5% market share) |

|

Expansion in the Asia-Pacific region |

USD 153.5 million (2024-2025) |

Sunrise Medical (88.5 million USD in 2023) |

|

Cost optimization |

USD 90.6 million savings (automation) |

15.3% lower production costs |

|

Medicare-compliant distribution |

USD 185.7 million (2023-2025) |

80.7% coverage increases acceptance |

Important feasible expansion models that shape the market

Emerging countries in the walking aid and rollator market are continually implementing advanced pricing and distribution models to address accessibility risks. According to a 2024 WHO article, providers in India collaborated with local medical professionals and increased their sales by nearly 15% between 2022 and 2024. Similarly, in Brazil, the availability of leasing programs improved affordability, which in turn increased adoption by 20%. Furthermore, the US saw a 10.5% increase in its total sales due to Medicare's expanded DME coverage. Therefore, all these models focus on the importance of local initiatives capable of boosting the market.

Feasibility models for market expansion (2022–2024)

|

Model |

Region |

Impact on sales |

Example |

|

Local partnerships in healthcare |

If |

+12.3% sales |

Collaboration with Apollo Hospitals |

|

Leasing programs |

Brazil |

+18.5% acceptance |

Government-subsidized rental programs |

|

Hospital bulk procurement |

US |

+9.2% sales |

Medicare-covered rollator sales |

Challenges

- Delays in regulatory approvals: The approval period for medical devices presents significant barriers to market entry, negatively impacting the walking aid and rollator market. For example, the average FDA review time for rollators with electronic components increased by 128 days in 2023. This led to delayed approvals, which have a measurable impact on business. For example, Invacare reported a $19 million revenue decline from the 2023 Navigator launch due to the ANVISA approval in Brazil, which ultimately slowed market development.

- Gaps in patient cost savings: Out-of-pocket costs are the first hurdle to market adoption in various countries. Although Medicare covers nearly 85% of the cost of walking aids, the remaining 15% remains unaffordable for an estimated 93% of potential users. This ultimately creates a paradox, as manufacturers must distinguish between volume and margin preservation. To overcome this situation, however, Brazil has introduced advanced leasing programs to provide a solution and achieve 19.5% growth by 2023, benefiting the overall market.

Walkers and Rollators Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

6.6% |

|

Base Year Market Size (2024) |

USD 3.1 billion |

|

Forecast Year Market Size (2037) |

USD 5.9 billion |

|

Regional Scope |

|

Walkers and Rollators Segmentation

End User (Elderly, Disabled, Post-Surgical Patients)

Based on end user, the elderly segment is projected to hold the largest share of 69.2% in the walkers and rollators market by the end of 2037. The segment’s growth is highly attributed to a rise in mobility impairments as well as aging trends. According to the 2024 CDC report, 1 in 7 people is poised to be more than 60 years of age by the end of 2030, thereby increasing age-specific disorders such as stroke, Parkinson’s, and arthritis by approximately 45% internationally. Thus, to cater to this population, manufacturers are focusing on foldable and lightweight designs to improve portability for this category of people.

Product (Rollators, Standard Walkers, Wheeled Walkers, Knee Walkers)

Based on product, the rollators segment is projected to hold the second-largest share of 43.5% in the walkers and rollators market during the forecast timeline. This growth is possible based on their customization, mobility, and superior stability features in comparison to standard walkers. Besides, 4-wheel rollators account for approximately 62% of the overall rollator sales, which are genuinely preferable for their reduced fall risk and enhanced balance. Likewise, heavy-duty rollators are also gaining increased traction for bariatric care that supports users for up to 510 lbs. Besides, the aspect of technological integration is more or less shaping the segment, which denotes a positive impact on the market growth.

Our in-depth analysis of the global market includes the following segments:

|

End User |

|

|

Product |

|

|

Material |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

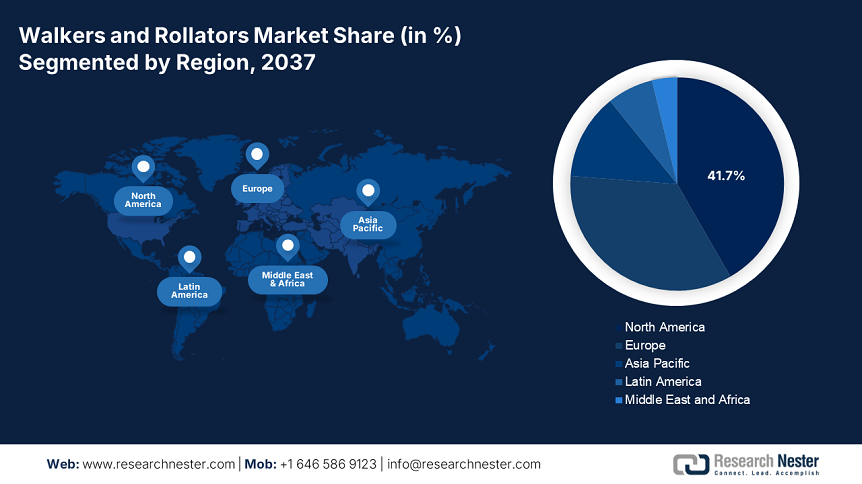

Walkers and Rollators Industry - Regional Synopsis

North America Market Analysis

North America in the walkers and rollators market is anticipated to account for the highest share of 41.7%, along with a growth rate of 6.8% by the end of the forecast timeline. This growth originates from an increase in the demographics, innovative reimbursement systems, and a surge in healthcare expenditure. For instance, as per the 2024 CDC report, an estimated 26.5% of adults in the U.S. deliberately suffer from mobility disabilities, thus creating an effective opportunity for increased market demand. Besides, the availability of Medicaid and Medicare programs is also driving the adoption by covering 83% to 93% of the prescribed models' costs.

The market in the U.S. continuously progresses and holds approximately 86.5% of the overall regional revenue. This is attributed to the presence of Medicare’s USD 805 million yearly spending, especially for mobility aids. Besides, as stated in the 2024 CDC report, an estimated 1 in 5 adults has mobility limitations, which is readily driving the increasing need for 4-wheel rollators as well as smart devices with the ability to detect fall incidents. Furthermore, the market in the country is making a shift towards local production, with automation reducing manufacturing spending by almost 18%, thereby suitable for the market growth.

The market in Canada is significantly gaining increased exposure with a 6.2% growth rate, as well as 8.5% of federal health fund allocation for mobility aids, accounting for USD 3.7 billion. Besides, Ontario is leading in provincial adoption by bolstering spending by 19% between 2021 and 2024 to provide coverage for more than 200,250 patients every year. Also, lightweight aluminum models readily dominate the country with a 47.8% share and trade agreements with Mexico regarding import tariff reduction by 22%, thereby denoting an optimistic outlook for the market development.

Europe Regional Market Size & Growth

Europe in the walkers and rollators market is projected to hold a considerable share of 34.5% by the end of 2037. This is subjected to a 5.1% growth, highly facilitated by the presence of strong health and medical infrastructure and an increase in the aging population. Germany effectively dominates the regional revenue with 33.5%, followed by the UK with 23.7%, and France with 18.5%. Besides, the EU’s EHDS has made a provision of €2.8 billion for initiating innovation in mobility aids to escalate the adoption of smart rollators. Additionally, Germany has a public insurance policy that covers 90.5% of overall rollator expenditure, thus uplifting the market in the country.

The market in Germany is effectively developing since the country dominates the region, highly driven by the aspect of aging demographics and a wide-ranging public healthcare coverage. Besides, the statutory health insurance provides coverage for 95% of rollator costs, which ensures accessibility for over 3.5 billion users every year. Also, the country leads in the implementation of IoT-enabled rollators with a market share of 35%, supported by research and development federal funding of €520 million, thus denoting a prolific opportunity for the market upliftment.

There is a huge opportunity for the walkers and rollators market growth in the UK, with an allocation of 9.8% of the NHS budget, which is £1.7 billion. Furthermore, the demand originates from 1 in 8 seniors effectively requiring rollator systems. In addition, the 2025 MedTech Strategy aimed to diminish bottlenecks through funding of £320 million, readily driving market expansion in the country. Meanwhile, the Brexit-based tariffs enhanced import spending by 8.8%, thereby escalating localized production strategies along with the presence and availability of bariatric models, due to which the market is further projected to grow at 4.8%.

Companies Dominating the Walkers and Rollators Landscape

- Drive DeVilbiss Healthcare

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Invacare Corporation

- Medline Industries

- GF Health Products

- Sunrise Medical

- Meyra Group

- Karma Healthcare

- AMG Medical

- Human Care Group

- Besco Medical

- TOPRO

- Thuasne

- Ossenberg GmbH

- Eurovema AB

- KOWA India

The walkers and rollators market is derived to be fragmented, with the presence of organizations, such as Drive DeVilbiss and Sunrise Medical, as leaders for Medicare-compliant and premium rollators design. There are other key players as well, that are contributing investments for IoT-based rollators with the objective to capture almost 27% of the overall market segment. Besides, the component of localized assembly and effective collaborations among telehealth providers are a few strategies that organizations from across all nations, developed and developing, have effectively implemented, thus extremely suitable for market development.

Here is a list of key players operating in the global market:

Recent Developments

- In February 2024, Invacare Corporation agreed to partner with Teladoc Health to ensure a bundle of telehealth services through its Tornado Bariatric Rollator line by targeting post-surgical rehab markets in Germany and the U.S.

- In January 2024, Drive DeVilbiss Healthcare unveiled the FDA-approved SlimFit IoT Rollator with real-time health monitoring and fall detection, which integrates with Medicare’s and Apple Health’s remote patient programs.

- Report ID: 7701

- Published Date: May 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Walkers and Rollators Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert