Lutein and Zeaxanthin Market Outlook:

Lutein and Zeaxanthin Market size was valued at USD 1.6 billion in 2025 and is projected to reach USD 3 billion by the end of 2035, rising at a CAGR of 6.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of lutein and zeaxanthin is evaluated at USD 1.7 billion.

The global lutein and zeaxanthin market is driven by the rising incidence of vision-based illness conditions, including age-related macular degeneration, diabetic retinopathy, and cataracts. As per the AMDF report in 2025, nearly 20 million of the U.S. population are aged above 40, and some are affected by AMD or cataracts. On the other hand, the WHO report in August 2023 states that 1 billion people have moderate to severe visual impairment. This patient volume in the aging population in Europe, Asia, and North America is broadening annually, creating a consistent downstream demand for lutein and zeaxanthin-based dietary supplements and therapeutic products.

On the supply chain side, lutein and zeaxanthin APIs are isolated from marigold flowers by large-scale farming, with extraction taking place in Mexico, China, and India. Manufacturing is based on batch processing and spray-drying technologies, usually outsourced to Southeast Asian facilities. NIH in 2023 has spent USD 2.2 billion on R&D for health-related nutrition research for aging populations. The market is also fueled by regional manufacturing and R&D financing. Moreover, growing government backing for healthy aging programs is fueling the incorporation of lutein and zeaxanthin into pharmaceutical and nutraceutical supply chains.

Key Lutein and Zeaxanthin Market Insights Summary:

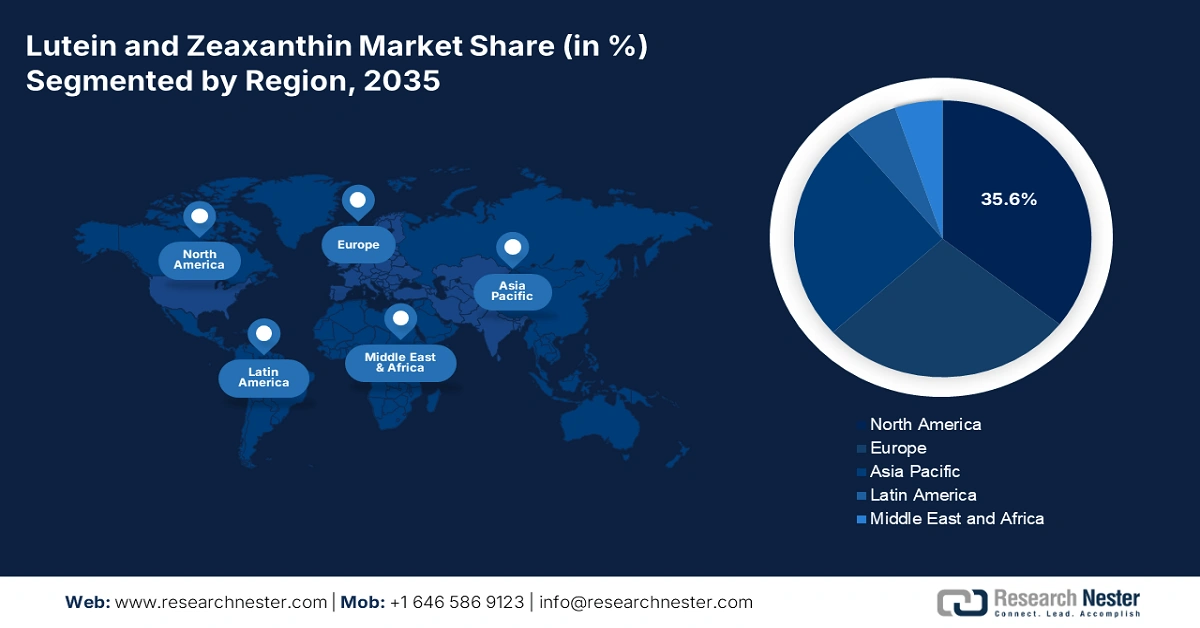

Regional Insights:

- North America is projected to hold a 35.6% share by 2035 in the Lutein and Zeaxanthin Market, impelled by the rising incidence of age-related macular degeneration, growing geriatric population, and strong government reimbursements.

- Asia-Pacific is expected to witness rapid growth by 2035, fueled by increasing health awareness, expansion of geriatric population, and a surge in eye-related disorders.

Segment Insights:

- The Naturals segment in the Lutein and Zeaxanthin Market is projected to account for 62.5% share by 2035, propelled by the increasing demand for plant-based, non-synthetic health ingredients aligned with FDA’s GRAS standards.

- The Nutraceuticals segment is anticipated to secure a substantial share by 2035, fueled by the surging supplement intake among older adults aiming to prevent age-related vision decline.

Key Growth Trends:

- Rising patient pool and disease prevalence

- Out-of-pocket healthcare spending and preventive trends

Major Challenges:

- Lack of affordability in emerging nations

Key Players: DSM Nutritional Products, BASF SE, Kemin Industries, Allied Biotech Corporation, OmniActive Health Technologies, Zhejiang Medicine Co., Ltd., Chr. Hansen Holding A/S, Divi’s Laboratories Ltd., Lycored Corp., Bio-gen Extracts Pvt. Ltd., Fenchem Biotek Ltd., Synthite Industries Ltd., Shaanxi Xinheng-Long Co., Ltd., Sabinsa Corporation, Nature’s Bounty (Nestlé Health), Koyo Chemical Co., Ltd., Daiichi Sankyo Healthcare, Eisai Co., Ltd., Mitsubishi Chemical Group, Nihon Kolmar Co., Ltd.

Global Lutein and Zeaxanthin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.6 billion

- 2026 Market Size: USD 1.7 billion

- Projected Market Size: USD 3 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.6% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, Germany, Japan, France, Canada

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 12 September, 2025

Lutein and Zeaxanthin Market - Growth Drivers and Challenges

Growth Drivers

- Rising patient pool and disease prevalence: Nearly 200 million people in the world are suffering from age related macular degeneration, based on the Eye Health Central report in 2025 and this number is expected to grow further. These trends are creating a sustained demand among the aging population for preventive and therapeutic ocular nutrition solutions. This rise is further helping to surge the investment in clinical-grade lutein and zeaxanthin formulations by the firms in Europe. Furthermore, the reimbursements in Germany are under discussion to support preventive supplementation for elderly people at high risk.

- Out-of-pocket healthcare spending and preventive trends: The CMS report in June 2025 depicts that the personal healthcare spending accounted to USD 4.9 trillion in the U.S. for vision care and supplements, and the per person spending reached USD 14,579. Consumer purchases of lutein and zeaxanthin supplements for preventive eye health is increased over the past decade, mainly among adults. The rise is related to the public educational campaigns under NEI’s National Eye Health Education Programs promoting preventive supplementation as vital for healthy aging strategies.

- Manufacturers' strategies and innovation: Various companies are investing in lutein and zeaxanthin formulations R&D to lead the market. OmniActive Health Technologies in 2024 joined with international healthcare systems to supply Lutemax 2020, which is a microencapsulated lutein zeaxanthin complex, to the North America and Europe markets. Collaborations among the multinational distributors and CDMOs are aiding expanded access to cost-effective and clinically backed eye supplements.

Prevalence and Burden of Age-related Macular Degeneration (AMD)

|

Region/Population |

Prevalence / Burden |

|

Asia |

6.8% prevalence, 113 million cases projected by 2040 |

|

Europe |

8.8% prevalence |

|

Africa |

7.53% prevalence |

|

Germany |

23% rise in early AMD and 36% rise in late AMD |

|

U.S. |

Early-stage: 18.34 million (11.64%) Late-stage: 1.49 million (0.94%) |

|

Caucasian ethnicity (U.S.) |

54.4% of visual impairment, 22.9% of blindness burden due to AMD |

|

Global |

Late AMD blindness: 11 million 4th cause of blindness (5.8%) & 3rd cause of moderate-to-severe vision impairment (3.9%) |

Source: NLM May 2023

Challenges

- Lack of affordability in emerging nations: Apart from the rising AMD prevalence, India’s public health schemes, such as Ayushman Bharat, do not include non-essential supplements, and hence limiting lutein and zeaxanthin access for the elderly population in the rural regions. As per the 2023 affordability report by WHO, the supplements exceed the monthly out-of-pocket costs affordability thresholds for the elderly population in India. Further, domestic producers also lower the ingredient quality to meet the pricing standards, resulting in reduced therapeutic effectiveness.

Lutein and Zeaxanthin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 1.6 billion |

|

Forecast Year Market Size (2035) |

USD 3 billion |

|

Regional Scope |

|

Lutein and Zeaxanthin Market Segmentation:

Source Segment Analysis

The naturals lead the segment and are expected to hold the share value of 62.5% by 2035. The segment is driven by the rising demand for plant based non-synthetic health ingredients in based on the FDA-recognized Generally Recognized as Safe standard. As per the U.S. Department of Agriculture report, the marigold cultivation volumes in Asia and Latin America are effective due to the climatic conditions enabling scalable extraction operations. Further the National Center for Biotechnology Information has reported that the natural lutein from the marigold has higher antioxidant activity and greater consumer preference based on the clean label appeal.

End use Industry Segment Analysis

Nutraceuticals lead the segment and is poised to hold a considerable share by 2035. The segment is driven by the rising supplement consumption among the elderly people aged 55 and above seeking preventive solutions for vision deterioration. As per the NIH Office of Dietary Supplements reports, lutein and zeaxanthin are the top researched non-vitamin dietary ingredients for eye health. Further, patients who took the AREDS2 formulation with lutein and zeaxanthin had about an 18% to 25% lower risk of developing advanced AMD. The rise of clinically backed supplement brands and clean label formulations is expanding the demand from private manufacturers, health-based retail chains, and formulation labs.

Distribution Channel Segment Analysis

Direct sales sub-segment leads the distribution channel segment by 2035. The raw lutein and zeaxanthin are mainly sold directly to the pharmaceutical and nutraceutical companies via long-term procurement contracts. As per the NLM report in April 2024, the global marigold oleoresin market volume is 10,000 tons, were 80% is used as feed and the remaining 20% for health foods and pharmaceutical materials. The trend highlights the strong B2B consolidation and vertical integration among the manufacturers including manufacturing organizations and strategic tie ups to manage encapsulation, formulation and packaging processes effectively.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Source |

|

|

Form |

|

|

Application |

|

|

End use Industry |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lutein and Zeaxanthin Market - Regional Analysis

North America Market Insights

North America is the dominating region in the lutein and zeaxanthin market and is expected to hold the market share of 35.6% by 2035. The market is driven by increasing age-related macular degeneration (AMD) incidence, rising geriatric population, and robust government reimbursements. NIH and AHRQ depict that lutein and zeaxanthin are becoming more commonly associated with visual preservation among older populations. As per the Statistics Canada report in April 2022, nearly 6% of the overall population is visually impaired. Strong regulatory frameworks and tax benefits further drive the market growth.

The U.S. lutein and zeaxanthin market is expanding rapidly and is driven by federal investments, an aging population, and favorable reimbursement structures. As per the CDC report in May 2024, more than 19.8 million U.S. population are suffering from AMD, which is likely to double by the year 2050, leading to greater clinical adoption of carotenoids. As per CMS and KFF data, Medicare and Medicaid have expanded their access, with combined outlays in 2024. The market has been driven further by the inclusion of lutein and zeaxanthin in visual function-improving interventions by the AHRQ. Innovation in nutraceuticals is on the rise, with U.S. firms investing in microencapsulation technology and sustainable marigold extract sourcing.

Population with Age-Related Macular Degeneration, by Stage and Age Group

|

Age |

AMD, Any Stage |

AMD, Vision Threatening Stage |

|

40-44 |

2.02% |

0.02% |

|

45-49 |

5.38% |

0.07% |

|

50-54 |

7.84% |

0.12% |

|

55-59 |

9.65% |

0.20% |

|

60-64 |

11.57% |

0.28% |

|

65-69 |

13.31% |

0.36% |

|

70-74 |

17.96% |

0.81% |

|

75-79 |

23.99% |

1.51% |

|

80-84 |

32.35% |

4.60% |

|

85-89 |

42.22% |

9.21% |

|

90-94 |

51.30% |

13.86% |

|

95-99 |

60.35% |

18.09% |

Source: CDC, May 2024

APAC Market Insights

The Asia-Pacific is the fastest growing region in the lutein and zeaxanthin market and is expected to have a strong market share by 2035. It is driven by health awareness, growth in the geriatric population, and an upsurge in eye diseases. According to the Frontiers report in August 2025, higher intake of lutein reduced biological aging considerably, especially in cardiovascular and organ systems. Further, based on the dosage levels the anti-aging and anti-inflammatory effects vary, but not with the additional benefit of excessive intake. Advances in technology in developing nutraceuticals' formulation and expansion of distribution channels are also fueling growth. Support by regional policies, particularly in South Korea and Japan, involves tax relief and reimbursement for lutein-enriched supplements.

India is the largest shareholder in the lutein and zeaxanthin market. As per the NLM report in March 2024, the average dietary intake of lutein and zeaxanthin is estimated at 1.8 mg per day, and the dietary intake of 6 mg/day or more has been associated with decreased risk of age-related macular degeneration. Further, with the rise of age-related ocular disorders and the rise in screen time among all age groups, the government launched subsidy programs and widened community-based supplementation and screening programs. The main aim of this program is preventive care under India's National Program for Control of Blindness.

Europe Market Insights

The lutein and zeaxanthin market in Europe is expected to be the second largest region by 2035. The region is experiencing strong growth due to the increasing incidence of age-related macular degeneration (AMD), cataracts, and diabetic retinopathy, particularly among aging populations. The market size is poised to expand, fueled by rising adoption of preventive eye care, nutritional supplementation, and public health policy aimed at vision protection. The European Medicines Agency (EMA) and the Directorate-General for Health and Food Safety of the European Commission have prioritized ocular health at the top of their Vision 2030 program, aiding clinical studies and subsidy schemes for nutraceuticals like lutein and zeaxanthin.

The lutein and zeaxanthin market in Germany is the largest shareholder in 2035. As per the Frontiers report in October 2024, supplementation with lutein and zeaxanthin complexes has been shown to increase macular pigment optical density (MPOD) and improve visual functions in these groups. The report also states that lutein ester is 61.6% more bioavailable comparing with unesterified lutein formulation with a higher maximum serum concentration. This growing clinical evidence is expected to further boost demand for advanced lutein and zeaxanthin formulations in Germany’s nutraceutical and pharmaceutical sectors.

Lutein Supplementation Details

|

Tablet |

Capsule |

|

3 mg of lutein ester and 1 mg of β-carotene |

Placebo 1 (soybean oil) |

|

6 mg of lutein |

Placebo 1 (soybean oil) |

|

6 mg of lutein and 1.2 mg of zeaxanthin |

Placebo 1 (soybean oil) |

|

12 mg of lutein ester and 1.2 mg of zeaxanthin |

Placebo 1 (soybean oil) |

|

6 mg of lutein and 1.2 mg of zeaxanthin |

130 mg of DHA and 325 mg of EPA |

|

Placebo 2 (microcrystalline cellulose) |

Placebo 1 (soybean oil) |

Source: Frontiers October 2024

Key Lutein and Zeaxanthin Market Players:

- DSM Nutritional Products

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Kemin Industries

- Allied Biotech Corporation

- OmniActive Health Technologies

- Zhejiang Medicine Co., Ltd.

- Chr. Hansen Holding A/S

- Divi’s Laboratories Ltd.

- Lycored Corp.

- Bio-gen Extracts Pvt. Ltd.

- Fenchem Biotek Ltd.

- Synthite Industries Ltd.

- Shaanxi Xinheng-Long Co., Ltd.

- Sabinsa Corporation

- Nature’s Bounty (Nestlé Health)

- Koyo Chemical Co., Ltd.

- Daiichi Sankyo Healthcare

- Eisai Co., Ltd.

- Mitsubishi Chemical Group

- Nihon Kolmar Co., Ltd.

The global lutein and zeaxanthin market is very competitive and driven by multinational and regional players. Some key players such as DSM, BASF, and Kemin are dominating by clinically tested ingredient and patented technologies. Further, M&A, product innovation and joint ventures, these strategic initiatives also lead to the players to dominate the market. For example, OmniActive’s Lutemax 2020 gained EU Novel Food approval which improved its expansion in Europe market. Further, companies in Asia are broadening the supply chain and making a distribution alliance to surge the ophthalmic and nutraceuticals markets. Japan companies focus on the aging population targeting their eye health. As the regulatory approvals are ease and demand of the supplement rises the market competition is expanding globally.

Here is a list of key players operating in the market:

Recent Developments

- In April 2025, Focus Vitamins launched Focus Lutein, which is a daily eye health supplement containing a mixture of a triple-carotenoid blend of lutein, zeaxanthin, and meso-zeaxanthin.

- In May 2024, Kemin introduced Macu-LZ, a lutein and zeaxanthin isomer for comprehensive nutraceutical solutions. It is a carotenoid formulation and is used to target the intricate connections between eye, brain, and skin health.

- Report ID: 8099

- Published Date: Sep 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lutein and Zeaxanthin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.