Visual Collaboration Platform Software Market Outlook:

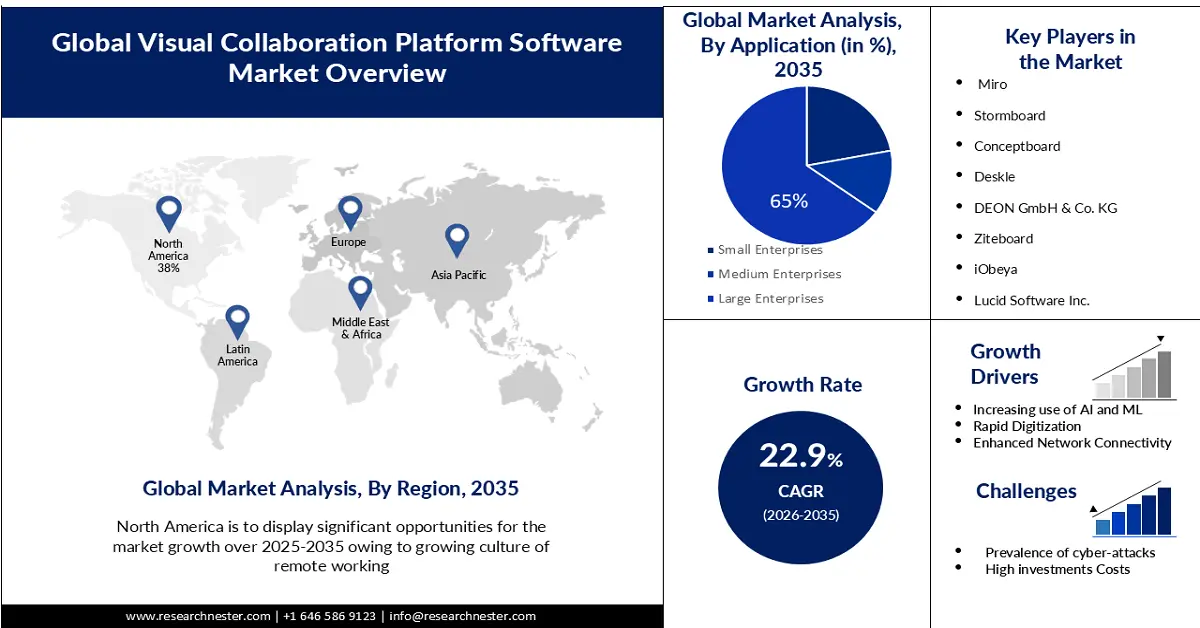

Visual Collaboration Platform Software Market size was valued at USD 17.58 billion in 2025 and is set to exceed USD 138.21 billion by 2035, expanding at over 22.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of visual collaboration platform software is evaluated at USD 21.2 billion.

The main driver in this market is the growing culture of remote working. The global number of workers working remotely has increased at an exponential rate since the COVID-19 outbreak accounting for 16% of global companies, increasing usage of visual communication and collaboration tools without compromising productivity.

The key to solving enduring issues is visual collaboration. Regardless of location, experience level, or personality, teams may discuss, cooperate, and solve problems both in real-time and asynchronously thanks to the flexibility and cloud-based settings offered by the digital solutions associated with visual collaboration. Applications for visual collaboration will dominate 30% of meeting encounters by 2024. This has provided a major boost to the market.

Key Visual Collaboration Platform Software Market Insights Summary:

Regional Insights:

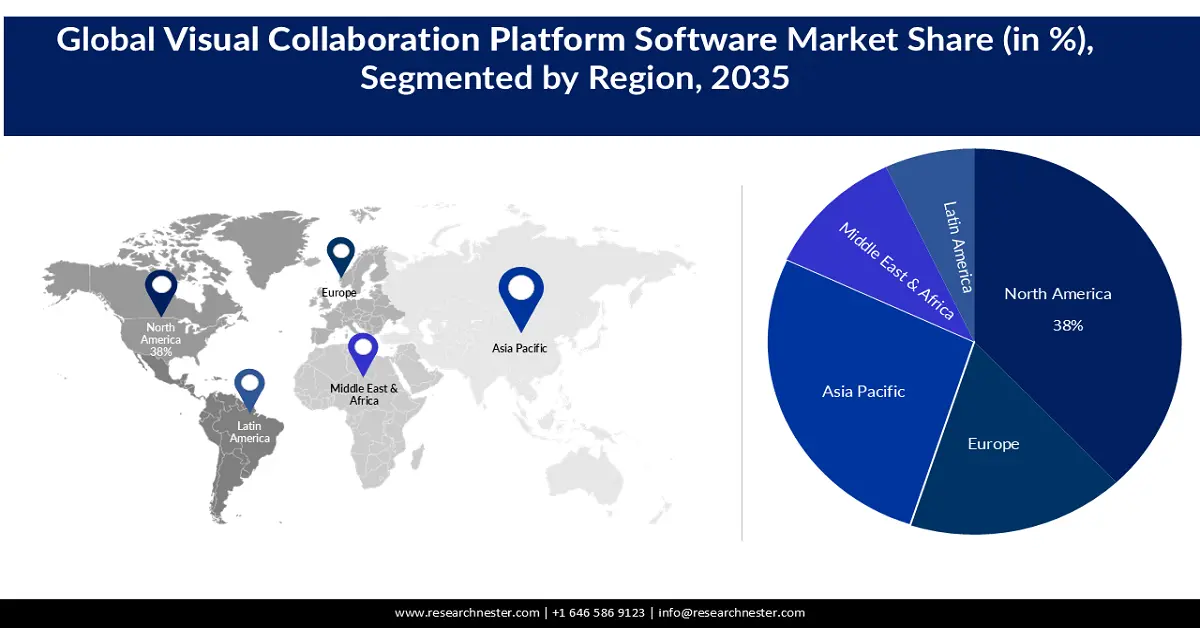

- North America is projected to hold a 38% share of the Visual Collaboration Platform Software Market by 2035, spurred by sustained technological progress and rising IT solution expenditures

- The European market is anticipated to secure a significant share by 2035, underpinned by escalating mobile usage and rapid adoption of advanced digital tools

Segment Insights:

- The Cloud-based segment is projected to command a substantial share of the Visual Collaboration Platform Software Market by 2035, propelled by the expanding shift toward remote operational models

- The Large enterprises segment is expected to capture a remarkable share by 2035, owing to the growing need to streamline complex workflows

Key Growth Trends:

- Increasing use of AI and ML

- Increased Network Connectivity

Major Challenges:

- Issues related to network connectivity and infrastructure

- To protect the valuable collaboration channels from cyber attacks.

Key Players: Deskle, DEON GmbH & Co. KG, Ziteboard, beya, Lucid Software Inc., Prysm Systems, Inc., Conceptboard, Stormboard.

Global Visual Collaboration Platform Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.58 billion

- 2026 Market Size: USD 21.2 billion

- Projected Market Size: USD 138.21 billion by 2035

- Growth Forecasts: 22.9%

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: India, South Korea, Brazil, Singapore, UAE

Last updated on : 19 November, 2025

Visual Collaboration Platform Software Market - Growth Drivers and Challenges

Growth Drivers

- Increasing use of AI and ML - Visual communication tools are being enhanced by the integration of cutting-edge technology like Artificial Intelligence as a service and ML. The behaviors of employees and the shared information may be tracked by AI-based visual collaboration, which is utilized to give staff predicted business insights and speed up work. Studies have shown that, periodically, 90% of the world's top businesses are investing in artificial intelligence. Businesses may benefit from video Analytics to gain more knowledge about a range of business applications, like customer behavior, staff retention, and office usage, having a positive effect on the market.

- Rapid Digitization: Increased adoption of technical innovations and integration Internet of Things by residential and industrial applications in their existing infrastructure had a major impact on the market. In recent years, digital transformation has also been taking place within several endues sectors accumulating to a value of USD 3.4 trillion by 2026, and is expected to have a positive impact on the growth of the visual collaboration platform software market.

- Increased Network Connectivity- The market is projected to increase significantly over the coming decade, thanks to the increasing adoption of 4.0 and 5.0 technologies. For example, Industry 4.0 is expected to free up between 15 and 25 % of the cost of quality and also reduce the number of machine failures by 25-50%. The global market is also projected to be driven by a surge of business model transformation, supported by an increased uptake of high-speed broadband services like 5G. Moreover, it is also estimated that the market growth over the coming years will be facilitated by an increase in shipments of 5 G-enabled smartphones which are expected to reach a share exceeding 70 % at the end of 2023.

Challenges

- Issues related to network connectivity and infrastructure: Even though outdated telecommunications technologies are unable to offer a low delay and high bandwidth connection, emerging and developing countries in the world continue to rely on them. Consequently, organizations in these countries are increasingly relying on audio collaboration to cope with the inconveniences of not having a sufficient visual or intermittent connection. The growth of the market revenue is being held back by this. In the event of Internet difficulties, collaboration could be difficult. misunderstandings and time and effort waste could occur because of poor video quality or interruptions caused by an error in connection.

- To protect the valuable collaboration channels from cyber-attacks.

- High initial investment cost

Visual Collaboration Platform Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

22.9% |

|

Base Year Market Size (2025) |

USD 17.58 billion |

|

Forecast Year Market Size (2035) |

USD 138.21 billion |

|

Regional Scope |

|

Visual Collaboration Platform Software Market Segmentation:

Type Segment Analysis

Cloud-based segment is poised to account for substantial visual collaboration platform software market share by the end of 2035. The cloud-based tool is capable of accessing software applications that use shared computing resources. Cloud-based software such as disk storage, memory, and processing power are also part of the feature set. This segment was popularised during coved, in consequence of lockdowns and large firms and institutions opting to switch to work from home.

Application Segment Analysis

Large enterprises segment is expected to account for remarkable Visual collaboration platform software market share by the end of 2035. This is about the integration of visual collaborative platform software, to maintain workflow. Large companies, with multiple stakeholders and complex procedures, also manage complicated projects. Platforms for visual collaboration software facilitate these processes by providing tools to manage tasks, share documents, and communicate in real-time. This platform increases overall output, reduces duplication of effort, and improves efficiency.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Visual Collaboration Platform Software Market - Regional Analysis

North American Market Insights

North America industry is estimated to account for largest revenue share of 38% by 2035, growth in this region is primarily attributed to technical advancements and sustainable economic growth. Institutions and firms in the region are exhibiting productive growth patterns, in the adoption of visual collaboration and communications tools for their team communications, to efficiently carry out the projects. Increasing business expenditures for IT solutions is also a major booster. additionally, better network connectivity in the region makes a major impact on the market. The pandemic promoted the adoption of such software.

European Market Insights

The European market is expected to expand by a significant share by 2035. Growth in the region is exhibited as a result of high mobile usage and technical developments adopted by the industries. Furthermore, the emergence of several virtual companies helps to boost the business in the region.

Visual Collaboration Platform Software Market Players:

- Mural.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stormboard

- Conceptboard

- Deskle

- DEON GmbH & Co. KG

- Ziteboard

- beya

- Lucid Software Inc.

- Prysm Systems, Inc.

Recent Developments

- Mural upgraded its interface to give more security and clarity. Customers of the Enterprise Plan will benefit from new features that provide more visibility, security, and control.

- Lucid Software, the leader in visual collaboration software, announced that it will be rolling out 15 new integration options with major software providers across its Visual Collaboration Suite. These partnerships are available on the newly opened Lucid marketplace.

- Report ID: 3150

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Visual Collaboration Platform Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.