E-Commerce Software and Platform Market Outlook:

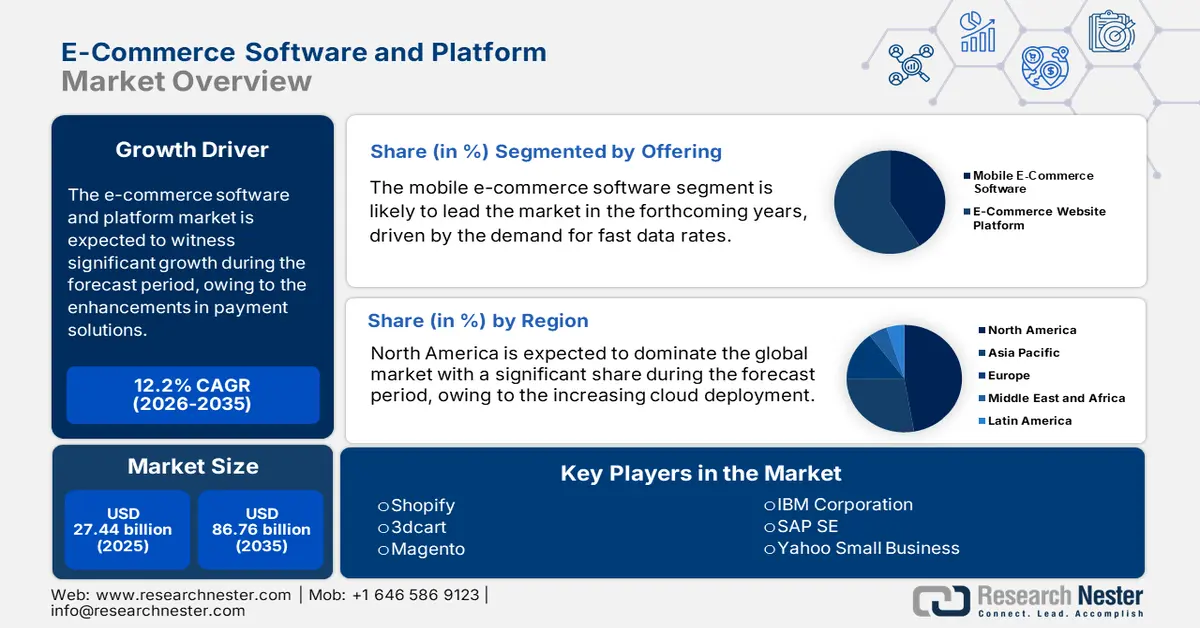

E-Commerce Software and Platform Market size was over USD 27.44 billion in 2025 and is projected to reach USD 86.76 billion by 2035, witnessing around 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of e-commerce software and platform is evaluated at USD 30.45 billion.

The e-commerce software and platforms are gaining a lot of traction from the rising adoption of cloud-based solutions, as businesses are increasingly emphasizing them for better performance owing to their flexible scaling and lower operational costs. For instance, in March 2023, Salesforce Commerce Cloud released Einstein GPT. This AI solution helps organizations streamline individual customer engagement, which improves both their support functions and marketing performance. The tool implements state-of-the-art AI technology to deliver precise promotion and tailored recommendations, resulting in increased user interaction while raising conversion rates in the expanding e-commerce cloud service domain, creating immense opportunities for the market.

Key E-commerce Software and Platform Market Insights Summary:

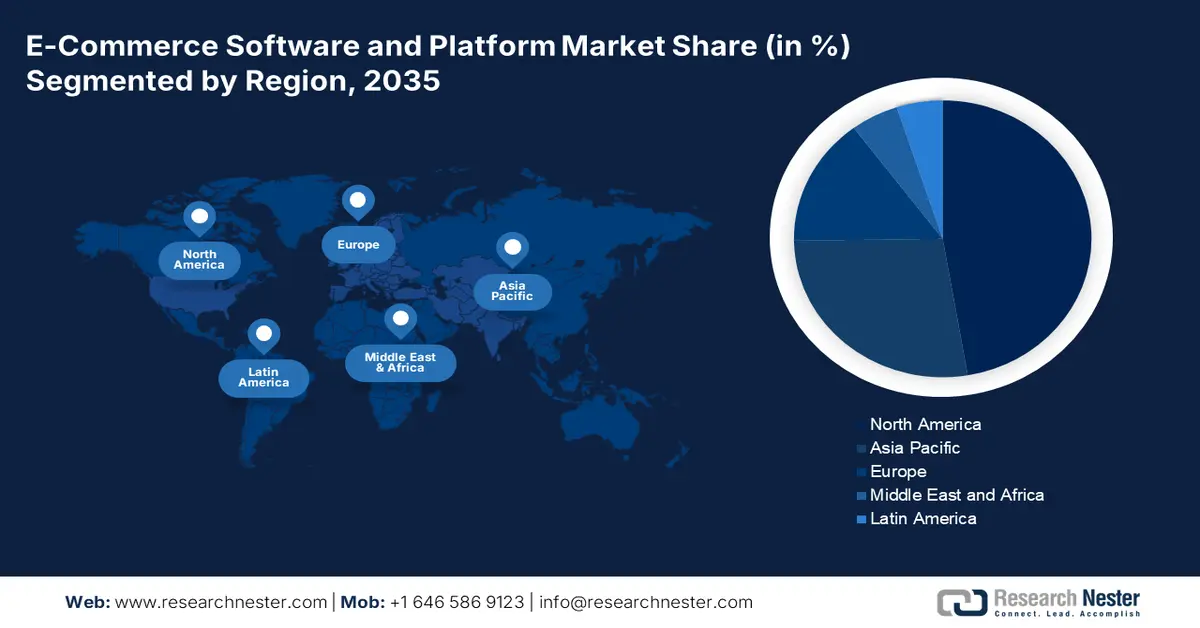

Regional Highlights:

- The Asia Pacific e-commerce software and platform market is forecasted to hold a 55% share by 2035, driven by presence of giant automobile manufacturers, rising awareness about ACC features, government encouragement, and economic growth.

- The North America market is poised for accelerating growth over the forecast period 2026–2035, driven by the rapid implementation of cloud-based solutions by technology players.

Segment Insights:

- The mobile (e-commerce software) segment in the e-commerce software and platform market is expected to hold the largest share over the forecast period 2026-2035, driven by 5G technology enabling faster data rates and better mobile experiences.

Key Growth Trends:

- Enhanced payment solutions

- Omnichannel retailing

Major Challenges:

- Market saturation

Key Players: Shopify; 3dcart; WooCommerce; Magento; IBM Corporation; SAP SE; Intershop Communications AG; Salesforce.com, Inc.; Volusion, LLC; Web.com Group, Inc.; Yahoo Small Business.

Global E-commerce Software and Platform Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 27.44 billion

- 2026 Market Size: USD 30.45 billion

- Projected Market Size: USD 86.76 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (55% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, United Kingdom, Germany

- Emerging Countries: China, India, Indonesia, Singapore, Malaysia

Last updated on : 8 September, 2025

E-Commerce Software and Platform Market Growth Drivers and Challenges:

Growth Drivers

- Enhanced payment solutions: There is a rise in demand for innovative payment solutions as online commerce is significantly expanding, with consumers requiring secure and reliable payment options. The online shopping experience is transforming as businesses are leveraging innovative payment solutions, including cryptocurrency payments, buy-now-pay-later services, and digital wallets. The technology providers are innovating to build better and faster checkout solutions to address rising consumer demands for secure online purchases. For instance, in August 2024, PayPal introduced Fastlane as a system that enables shoppers to maintain payment and delivery information for speedy online checkouts through a single-click guest payment method.

- Omnichannel retailing: The market is directly linked to the adoption of omnichannel retailing systems. The technology providers are integrating retail methods with online services to deliver advanced shopping experiences to customers. In September 2024, Salesforce introduced the new commerce cloud platform, which connects B2C, B2B, and order management along with payments to one unified platform, providing businesses the full visibility of the customer’s account. The new consumer buying patterns highlight multiple touchpoints between different channels as shoppers engage in omnichannel purchasing, thus requiring integrated solutions to address their shopping behavior. The e-commerce platforms are developing capabilities that allow them to bridge multiple customer contacts in order to deliver one cohesive experience.

Challenges

- Market saturation: The market saturation poses a challenge to the e-commerce software and platform industry, with the continuous entrance of companies. The established e-commerce software domain is led by several major players, as these providers offer thorough solutions and extensive features. The availability of financial resources in large enterprises is resulting in difficulties for newer and smaller platforms to stand out, as they lack equivalent capability. The market is becoming restrictive for innovation as new entrants face barriers to presenting disruptive solutions while trying to capture meaningful presence.

E-Commerce Software and Platform Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 27.44 billion |

|

Forecast Year Market Size (2035) |

USD 86.76 billion |

|

Regional Scope |

|

E-Commerce Software and Platform Market Segmentation:

Offering Segment Analysis

The mobile segment is expected to account for the largest revenue share during the forecast period as 5G technology delivers lower latency and faster data rates is opening new avenues. This trend provides users with improved browsing, faster load speeds, and reliable mobile transactions. The mobile e-commerce applications optimized for 5G provide better user satisfaction and higher conversion rates, ensuring smooth and streamlined shopping experiences. Technology giants are rolling out new features for mobiles for faster connections. In March 2025, Qualcomm unleashed its X85 5G modem to offer enhanced 5G connections with better speed and efficiency. Through its performance-enhancing capabilities, this technology provides improved latency reduction and speeds to mobile app performance, specifically in e-commerce applications.

Deployment Model Segment Analysis

Companies benefit from the on-premises deployment method as it provides complete control over their data and helps address the demands of the security standard, such as the Payment Card Industry Data Security Standard for handling payments. Players who run their e-commerce platforms on private servers can have access to tailored encryption measures along with security, which in turn reduces the possibility of data breaches. The on-premises technology is needed for industries that cater to sensitive customer information, including healthcare and finance, as maintaining data integrity and regulatory compliance is crucial for them.

Our in-depth analysis of the global e-commerce software and platform market includes the following segments:

|

Software and Platform Type |

|

|

E-Commerce Business Model

|

|

|

Offering |

|

|

Solutions for Industry |

|

|

Enterprise Type |

|

|

Deployment Model |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

E-Commerce Software and Platform Market Regional Analysis:

North America Market Insights

Technology players are rapidly implementing cloud-based solutions, which is accelerating the growth of the e-commerce software and platform market in North America. Local businesses use cloud deployment to manage their data security and reduce infrastructure costs. The digital marketplace benefits mainly from cloud-based solutions, enabling flexibility and scalability to small and medium-sized enterprises for effective competition. Cloud-based solutions allow users to integrate with artificial intelligence as well as mobile commerce, so the platform delivers an enhanced experience and operational efficiency. The market is expanding as businesses recognize cloud solutions as their primary adoption strategy for e-commerce platforms.

The expansion of the U.S. e-commerce software and platform market is directly linked to the strong presence of major e-commerce software and platform providers operating in the country. The industry is driven by major e-commerce companies, including Shopify, Square, and BigCommerce, which provide flexible solutions for small to large businesses. Users benefit from their industrial platforms, making it easy for smooth online operations, payment processing, and transaction security functions. The key companies are in a stable position, attracting businesses of all sizes that require dependable e-commerce solutions.

APAC Market Insights

The APAC e-commerce software and platform market is growing at a steady pace, due to the rapid expansion of mobile commerce, with increasing access to smartphones and the internet. Modern consumer behavior highlights an increase in the usage of mobile internet, driving customers to shop online through their handheld devices. This trend is prompting e-commerce platforms to focus on unifying their operations to portable devices, which boosts user accessibility while improving services. These developments are assisting the market expansion by addressing consumer needs through the integration of mobile payments and location-based services.

The e-commerce software and platform industry in China is expected to significantly grow, with the local government's support for e-commerce infrastructure development and digital transformation. According to International Services, Shanghai, in October 2023, the State Council authorized Shanghai to establish a pioneering Silk Road e-commerce cooperation area through its approval. This initiative has set its target to ensure economic and trade standard compliance through institutional innovation while developing the e-commerce sector for international exchange. The targeted outcome according to the plan for 2025 includes exemplary institutional openness achievements along with internationally competitive e-commerce entities and distinctive regional carriers. Through this initiative, the e-commerce transactions are likely to be activated with additional international cooperation, further fueling the market growth.

E-Commerce Software and Platform Market Players:

- Shopify

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 3dcart

- WooCommerce

- Magento

- IBM Corporation

- SAP SE

- Intershop Communications AG

- Salesforce.com, Inc.

- Volusion, LLC

- Web.com Group, Inc.

- Yahoo Small Business

The e-commerce software and platform market is fueled by the availability of diverse solutions from major players. Organizations including Adobe Commerce, Shopify, and others are leading the market, providing tailored payment solutions, as well as integrated tools for companies. Niche entrants and new providers are also offering advanced features for industries and regional markets. Acquisitions and partnerships among giants are resulting in an effort to expand their capabilities and customer base, fostering market expansion. Here are some key players operating in the global market:

Recent Developments

- In May 2023, Cardinal Health launched Modern Commerce Solutions for retail independent pharmacies, powered by Square. This collaboration enables pharmacies to enhance operational efficiency by integrating flexible payment options, including in-store, online, and delivery purchases, and accessing comprehensive software tools.

- In April 2023, Square introduced its Integrated Spring Product Release, unveiling nearly 100 new features across its ecosystem to help sellers diversify revenue streams and automate operations.

- Report ID: 653

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.