Public Affairs and Advocacy Software Market Outlook:

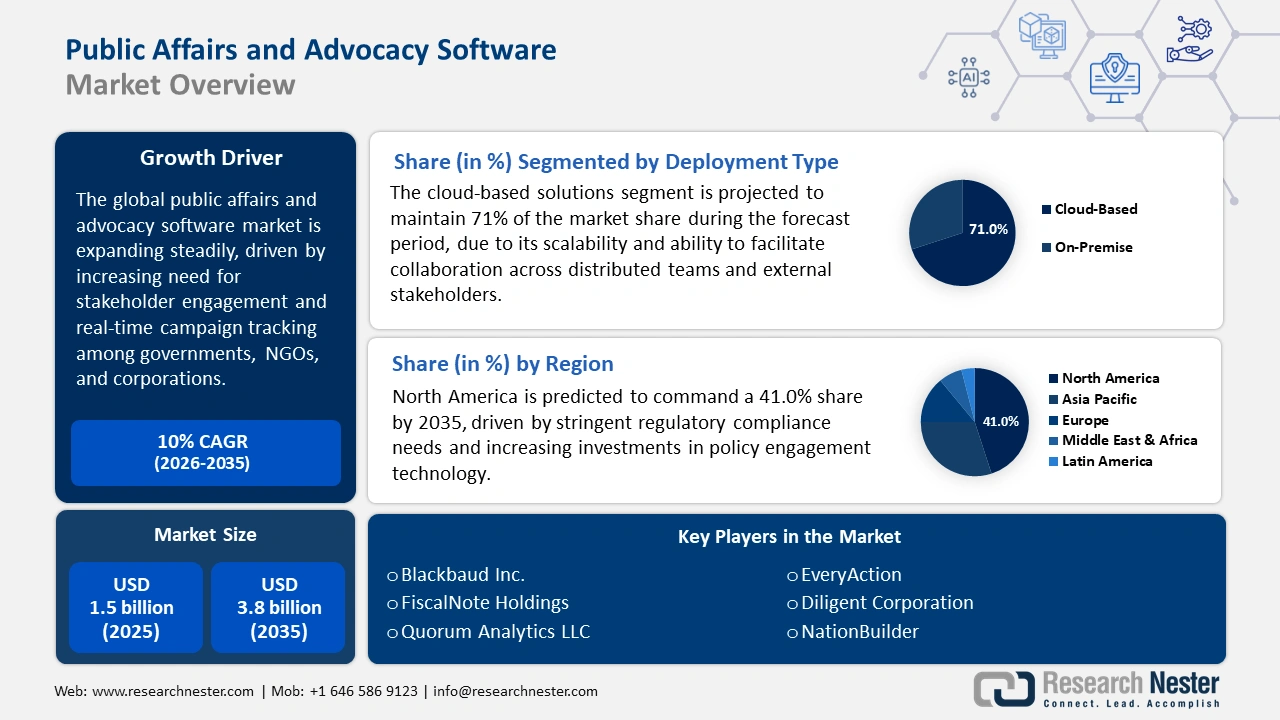

Public Affairs and Advocacy Software Market size is valued at USD 1.5 billion in 2025 and is projected to reach a valuation of USD 3.8 billion by the end of 2035, rising at a CAGR of 10.0% during the forecast period, i.e., 2026-2035. In 2026, the industry size of public affairs and advocacy software is estimated at USD 1.6 billion.

The demand for public affairs and advocacy software is set to fuel significant growth, driven by businesses needing to manage online stakeholder relationships and track dynamic legislative landscapes. The speeding global digital revolution offers a compelling value proposition to solutions that can incorporate donor and stakeholder management. Pressure to innovate is constant, compelling manufacturers to provide seamless integration and intuitive interfaces. For example, U.S. federal agencies are rapidly adopting digital transformation, focusing on AI, cloud, and cybersecurity. The Department of State's Enterprise Artificial Intelligence Strategy for 2021-2025 illustrates this commitment to responsible AI innovation. Similarly, agencies are leveraging FedRAMP-cleared cloud technologies to modernize operations and improve services.

Market expansion is driven by stringent regulatory compliance demands and huge government investment in digital networks. This landscape heavily necessitates the adoption of sophisticated software solutions by every public affairs professional. One such market innovation was in February 2024, when Charity Engine released a new product feature that introduced donation choices right into advocacy campaign action. It yielded a smooth experience, unifying engagement and fundraising into a single platform.

Key Public Affairs and Advocacy Software Market Insights Summary:

Regional Insights:

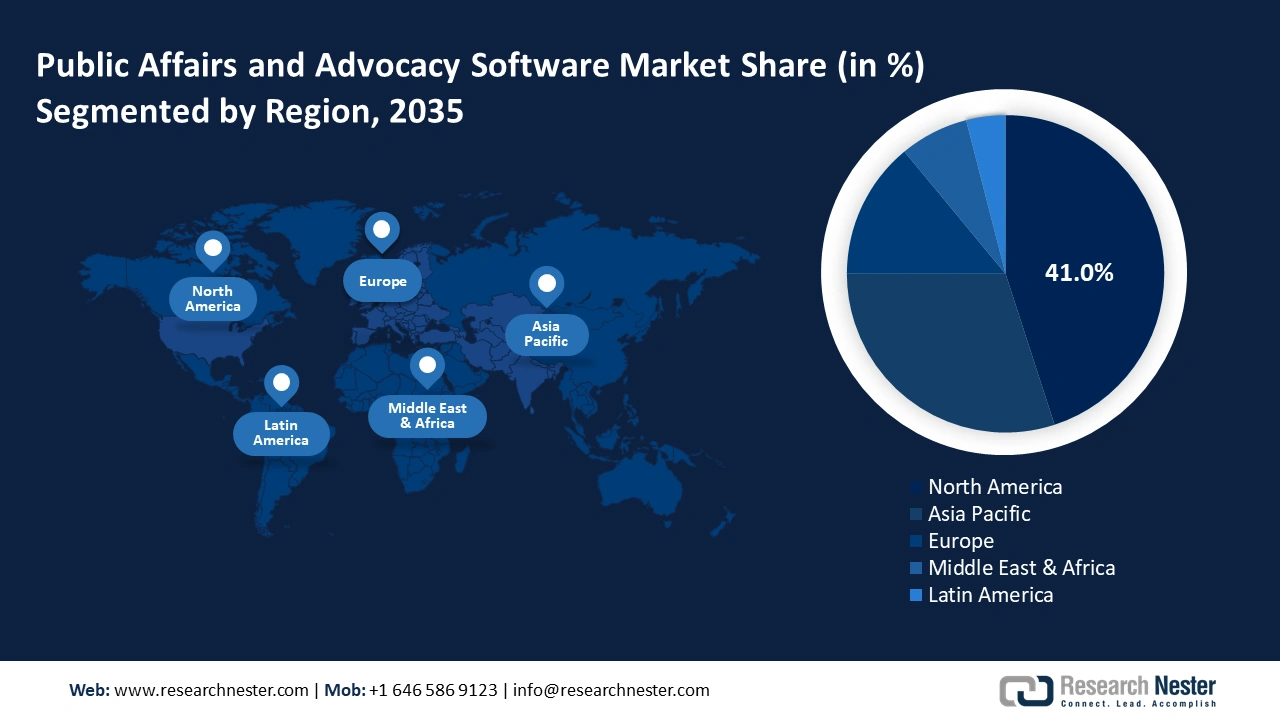

- North America is expected to maintain a 41.0% market share during the forecast period, owing to a highly institutionalized advocacy culture and persistent campaign activity.

- Asia Pacific is anticipated to grow at a CAGR of 20.0% between 2026 and 2035, impelled by rising digital literacy and government-backed digital transformation programs.

Segment Insights:

- The cloud-based solutions segment is projected to account for 71.0% of the Public Affairs and Advocacy Software Market share during the forecast period, driven by reduced capital expenditure and enhanced scalability.

- The private corporations segment is poised to hold 42.0% share by 2035, propelled by the necessity for advanced analytics and comprehensive reporting.

Key Growth Trends:

- Strategic AI and predictive analytics adoption

- Needed public sector digital transformation initiatives

Major Challenges:

- Complex and challenging regulatory compliance environments

- Persistent data interoperability and ecosystem integration loopholes

Key Players: Blackbaud Inc., FiscalNote Holdings, Quorum Analytics LLC, EveryAction, NationBuilder, Cision Ltd., Diligent Corporation, Civica Group Limited, and others.

Global Public Affairs and Advocacy Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.5 billion

- 2026 Market Size: USD 1.6 billion

- Projected Market Size: USD 3.8 billion by 2035

- Growth Forecasts: 10% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.0% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, United Kingdom, Germany, France

- Emerging Countries: India, China, Japan, Singapore, South Korea

Last updated on : 6 October, 2025

Public Affairs and Advocacy Software Market - Growth Drivers and Challenges

Growth Drivers

- Strategic AI and predictive analytics adoption: Radical embedding of advanced Artificial Intelligence (AI) capabilities is a core growth driver, radically altering the conduct of advocacy campaigns. AI-powered solutions allow teams to automate routine tasks and deliver higher individual personalization in messaging. This enables more informed, data-driven choices that significantly enhance overall campaign performance. This technology push is essential for organizations vying for maximum engagement with optimized staff resources. This convergence is vindicated by the fact that in September 2024, HubSpot introduced a series of AI-fueled product releases like Breeze Intelligence and Copilot. These tools make it possible to automate as well as offer rich, detailed reporting and analysis essential to sophisticated multichannel lead management.

- Needed public sector digital transformation initiatives: Governments globally are placing significant capital on strategic digital modernization, and this spurs the adoption of compliant public affairs software for citizen participation as well as compliance. Strategic digital service enhancement and end-to-end e-governance emphasis create big market momentum. For example, in 2024, the UK government's digital transformation agenda spurred the adoption of cloud-based communication and citizen engagement platforms in the public as well as non-profit sectors. This government drive aims to improve the effectiveness of services, substantially increase civic engagement, and ensure transparency in all public interactions.

- Increased demand for stakeholder and compliance platforms: The complexity of today's policy environment, policymaking, monitoring, and lobbying disclosure is creating strong demand for integrated stakeholder management and compliance platforms. Multi-jurisdictional organizations require centralized dashboards and deep reporting facilities to proactively manage significant legal and reputation exposures. This pivotal market demand is addressed strategically by the fact that in October 2024, Salesforce rolled out Winter '25 releases for Nonprofit Cloud, introducing personalized donor lists. The features also included targeted outreach briefings and program management enhancements, allowing public affairs teams to enjoy the benefits of streamlined stakeholder management.

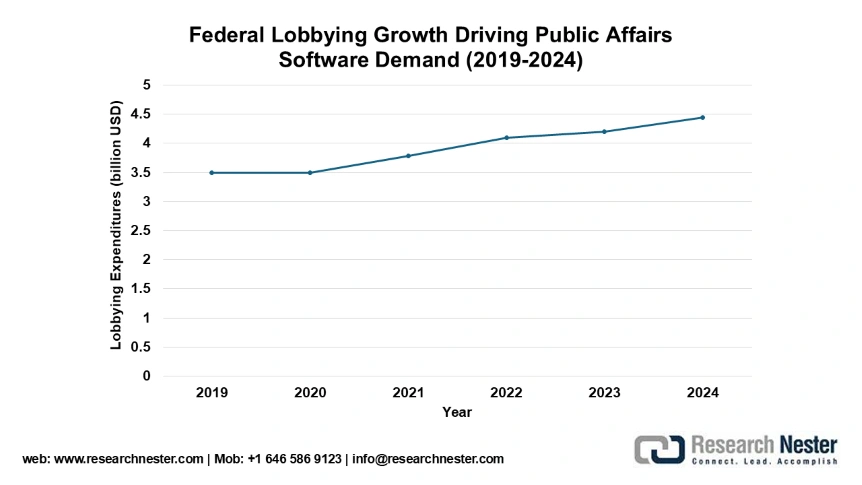

Federal Lobbying Growth Driving Public Affairs Software Demand (2019-2024)

The consistent growth in federal lobbying expenditures, reaching a record $4.44 billion in 2024, directly fuels demand for sophisticated public affairs and advocacy software solutions. This increased investment in government relations requires more efficient tools for stakeholder management, regulatory monitoring, and campaign coordination across multiple channels.

Source: Open Secrets

Federal Lobbying Trends & Public Affairs Software Market Implications

|

Trend |

Evidence |

Software Market Impact |

|

Record-High Spending |

Lobbying expenditures grew from $3.5B (2019) to $4.44B (2024) |

Increased demand for comprehensive public affairs platforms to manage larger advocacy budgets |

|

Healthcare Sector Dominance |

Pharmaceuticals/Health Products spent $387M in 2024 - leading all sectors |

Specialized healthcare policy tracking and stakeholder management features become essential |

|

Technology Sector Growth |

Electronics manufacturing lobbying grew 28% from 2021-2024 |

Rising need for tech policy monitoring and regulatory compliance tools |

|

Multi-Sector Engagement |

10+ industries spending over $100M annually on lobbying |

Demand for customizable platforms serving diverse industry regulatory needs |

|

Sustained Quarterly Activity |

Each quarter of 2023 exceeded $1B in lobbying spending |

Need for real-time monitoring and quarterly reporting capabilities |

Source: OS

Challenges

- Complex and challenging regulatory compliance environments: A dominant challenge is the constantly shifting, geographically fragmented regulatory regime, necessitating relentless, high-expenditure platform replacements to meet core legal compliance. The absence of a common standard for data privacy or lobbying disclosure leads to notoriously convoluted operations. Such regulatory recalcitrance necessitates heavy R&D emphasis on compliance features, often excluding investment in pure technological innovation. This systemic concern is highlighted by the occurrence in May 2024 when Germany's data protection bodies reasserted stringent GDPR enforcement through Federal Data Protection Act amendments and regulation of digital services. This compels organizations to conform to greater privacy, security, and consent safeguards for public affairs software use across the board.

- Persistent data interoperability and ecosystem integration loopholes: Public affairs professionals usually work with a suite of highly technical software applications that lack good communication abilities, producing disruptive data silos and inefficient operational procedures. Smooth and secure data interoperability across the heterogeneous infrastructure is yet a fundamental technical obstacle. This resistance hinders the collection of rich, real-time strategic intelligence across the complete functional spectrum of an entire campaign. This integration challenge of the critique is also explained by the fact that the Office of the Commissioner of Lobbying of Canada released updated enforcement guidelines for the Lobbying Act in April 2025. This demands robust, auditable processes of tracking and reporting of lobbying activity, demanding the exchange of high-level data between internal systems.

Public Affairs and Advocacy Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10% |

|

Base Year Market Size (2025) |

USD 1.5 billion |

|

Forecast Year Market Size (2035) |

USD 3.8 billion |

|

Regional Scope |

|

Public Affairs and Advocacy Software Segmentation

Deployment Model Segment Analysis

The cloud-based solutions segment is projected to maintain 71.0% of the market share during the forecast period, solidifying its position as the popular deployment model. This market leadership is a consequence of the intrinsic advantages of cloud technology, namely reduced initial capital expenditure and improved scalability. This market-leading trend aligns with strategic industry shifts focused on improving the overall user experience. A prime example of this is the debut of the all-new Quorum Grassroots in January 2024. This freshly updated version of the grassroots advocacy platform was launched by Quorum, a leading provider of public affairs software, and stands as a strong testament to this focus on user experience. Cloud deployment is a requirement for facilitating the real-time collaboration that geographically dispersed campaign team's demand.

Target Audience Segment Analysis

The private corporations segment is poised to lead with 42.0% market share through 2035, reflecting the rapidly increasing demand for proactive corporate reputation management and policy influence visibility. Large corporations are transforming expenditure dramatically in highly sophisticated advocacy software to monitor intricate legislation in multiple jurisdictions at once. This open monitoring critical emphasis was further solidified when, in May 2024, Borealis was listed on the UK's G-Cloud 14 marketplace, an occasion that represented some of the best stakeholder consultation and public consultation management enhancements. The growth in the segment is being fueled by the sheer necessity for advanced analytics and comprehensive reporting to properly quantify the ROI of public affairs efforts.

Industry Verticals Segment Analysis

The social advocacy groups segment is predicted to expand at a CAGR of 22.0% by 2035, dominated by the surge in global incidence of high-impact grassroots activism. These groups extensively utilize advocacy software to create large campaigns within a short period with strategic features such as text-to-call and social sharing. This allows smaller, resource-limited organizations to execute large campaigns with comparable levels of technological sophistication to much larger organizations. Key platforms are driving this growth momentum, particularly through enhanced mobilization efforts. For instance, in October 2024, Muster improved its grassroots advocacy software by integrating powerful CRM segmentation and targeted communication features. The elevated growth rate projected implies the increased accessibility and affordability of sophisticated platforms.

Our in-depth analysis of the public affairs and advocacy software market includes the following segments:

|

Segment |

Subsegments |

|

Type of Software |

|

|

Deployment Model |

|

|

Target Audience |

|

|

Industry Verticals |

|

|

Functionality Features |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Public Affairs and Advocacy Software Market - Regional Analysis

North America Market Insights

North America public affairs and advocacy software market is anticipated to maintain a commanding position with a 41.0% market share during the forecast period. This sustained demand is supported by a highly institutionalized advocacy culture of legislation and the persistently high volume of both political and non-profit campaigns. Furthermore, the market is fueled by a relentless, high-risk cycle of innovation. The expanding reservoir of professional political consultants and specialized advocacy firms also adds weight to the stability of this commanding market share.

The U.S. remains a significant market, characterized by governmental expenditure on national digital transformation and a structurally complex, highly regulated political system. The relentless, demanding cycle of election activity and congressional proceedings, coupled with mandatory compliance with newly implemented Federal Election Commission (FEC) regulations, aggressively drives the demand for sophisticated, compliance-focused software solutions. For example, in August 2025, NationBuilder announced new supporter communications features, strategically featuring advanced segmentation, tailored email/text templates, and automated journeys. This enabled more scalable and impactful data-driven relationship-building for public affairs activities in the intensely competitive U.S. market.

Canada public affairs and advocacy software market is showing consistent growth, driven by the 'Digital Ambition' program of the federal government and continued modernization efforts. The program actively encourages non-profits and associations to adopt sophisticated advocacy software to drive public involvement as well as legislative tracking. The increasing complexity of federal and provincial lobbying laws necessitates stringent compliance and reporting systems. This climate is well-suited for vendors to provide centralized data dashboard technology and sophisticated time-tracking capability. Such motivation is assisted by government effort, as April 2025 saw Canada's Office of the Commissioner of Lobbying publish updated enforcement guidance under the Lobbying Act, requiring rigorous tracking and disclosure of lobbying activity in an effort to avoid sanction.

APAC Market Insights

Asia Pacific public affairs and advocacy software market is expected to rise at a CAGR of 20.0% between 2026 and 2035. This growth is fueled by a rise in digital literacy and government-funded digital transformation programs. A major contributing factor is the increased organizational integration of crucial cloud-based functionalities for public interaction. As the locus of political activism and civil society engagement is shifting at lightning speed online throughout Asia, large-scale, localizable software packages are in large demand. The steep growth trend aligns with the region's strategic opportunity to leapfrog prior, foundational legacy infrastructure and move straight to modern, highly effective cloud-first advocacy platforms.

China market growth is driven by its pervasive and expedited national digitalization programs and the increasing operational sophistication encountered by global as well as local corporations. Strong, natively secure platforms are operationally vital to adapt to effectively handle both corporate reputation and official communication channels. In May 2025, Scrut Automation published platform releases such as new Microsoft Teams and Sophos Central integrations, improved user reviews of access, as well as additional compliance frameworks. Although public affairs focus typically tends to remain primarily with governmental affairs and corporate social responsibility (CSR) obligations, there is definitely a visible, growing demand for such software utilities that adequately manage all aspects of communications with stakeholders.

India market is undergoing rapid expansion, significantly complemented by the central government's ambitious 'Digital India' program. The initiative focuses on e-governance and mass citizen digital empowerment, presenting a market size of astronomical proportions for advocacy platforms of an advanced nature. This undertaking is compelling government agencies and non-profits to adopt platforms for delivering direct, transparent services and dealing with citizens online. This robust blend of governmental and legislative pressure is expediting the complete shift to digital platforms. This trend is reinforced by developments such as the new Corporate Social Responsibility (CSR) reporting requirements implemented by India's Ministry of Corporate Affairs in April 2024. The firm requirement for companies to comply with new, stricter Corporate Social Responsibility (CSR) reporting regulations is, at the same time, pressuring businesses to adopt analytics-capable platforms.

Europe Market Insights

Europe public affairs and advocacy software market is projected to expand steadily from 2026 to 2035, a growth spurred primarily by the continent's considerably stringent regulatory environment, along with the increased pace of digital delivery of public services across member states. The region's high emphasis on general data protection (GDPR) and institutional transparency effectively necessitates the requirement of high-compliance platforms for all types of digital messaging. For example, in March 2024, Oracle's Responsys Campaign Management platform was refreshed with the 24A update, which included deliverability status tracking and improved email performance dashboards. Furthermore, the unmistakable commitment of European governments to finish digitalization creates important new market opportunities for advocacy platforms.

Germany is a lucrative market due to its unyielding enforcement of data protection law and the recent complete operational effect of the Digital Services Act (DSA). This is relevant for more compliant governance, continuous platform monitoring, and proactive reputation management. This strong focus on regulatory compliance was emphasized in August 2023, when Germany's Digital Services Act came into full force, imposing new, stringent standards for digital communications and thus requiring widespread adoption of software across the market. For organizations engaged in strategic digital advocacy, advanced data management and highly secure, compliant digital communications are an absolute, top-level imperative.

The UK market growth is fueled by the ambitious digital transformation plan of the central government and concomitant, essential updates issued by the Charity Commission. Charitable organizations are attempting to successfully segment donor populations and realize tight conformity with new digital codes. This compliance-based demand is driven by the UK Charity Commission publishing in September 2023 new guidance on online giving and social media best practice, a rule change that specifically invited charities to use more advanced donor and critical campaign management software solutions. The continued need for government transparency as well as private sector campaigning also further drives this market growth.

Key Public Affairs and Advocacy Software Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The public affairs and advocacy software market is highly fragmented and competitive, with a structural profile that features a strategic balance of large, well-established enterprise solution vendors and a plethora of niche platforms. Key market giants, including the market leaders FiscalNote, Quorum Analytics, Inc., NationBuilder, and EveryAction (Bonterra), find themselves in a fierce battle of innovation. They continue to introduce additional AI capabilities, seamless system integrations, and increasingly sophisticated predictive analytics. The competitive differentiator of primary significance increasingly resides in the capability to supply total, genuinely all-in-one solutions that seamlessly integrate core functions.

Strategic mergers and concentrated acquisitions continue to represent an absolutely crucial operational component of the competitive environment of the market. The drive of the industry towards fully integrated solutions with full legislative monitoring and e-advocacy highlights the vast strategic value of the scale of operations and technological functional scope. This focus on the fusion of core competencies was positively demonstrated in September 2022, when Capitol Canary was purchased by Quorum, which merged its public affairs and digital advocacy technology into the acquisition to instantly provide complete solutions for legislative tracking, activism campaigns, and essential compliance reporting to its combined client base.

Here are some leading companies in the public affairs and advocacy software market:

|

Company Name |

Country |

Market Share (%) |

|

FiscalNote |

U.S. |

16.0 |

|

Quorum Analytics, Inc. |

U.S. |

14.0 |

|

NationBuilder |

U.S. |

11.0 |

|

EveryAction (Bonterra) |

U.S. |

9.0 |

|

Muster |

U.S. |

6.0 |

|

Engaging Networks |

UK |

xx |

|

Salsa Labs (Bonterra) |

U.S. |

xx |

|

CharityEngine |

U.S. |

xx |

|

Cision (Brandwatch) |

U.S. |

xx |

|

OpenGov |

U.S. |

xx |

|

Ecanvasser |

Ireland |

xx |

|

Campaign Monitor (Marigold) |

Australia |

xx |

|

Trend Micro Incorporated |

Japan |

xx |

|

Fujitsu Limited |

Japan |

xx |

|

NEC Corporation |

Japan |

xx |

Below are the areas covered for each company in the public affairs and advocacy software market:

Recent Developments

- In September 2025, Civix, a provider of public sector software, unveiled its Go suite of cloud-based solutions for government agencies. The new platform includes modules for grants management, ethics compliance, and business services. This provides government clients with modern tools to improve transparency and efficiency in their public affairs operations.

- In May 2025, Quorum announced the expansion of its AI-powered assistant, Copilot, to provide comprehensive support across its entire suite of government affairs tools. The update helps professionals in non-profit organizations, government agencies, and private corporations to draft communications, summarize legislation, and analyze policy documents more efficiently.

- In May 2024, MetricStream, a GRC platform leader, announced its 12th annual GRC Summit, with a focus on AI-Powered Connected GRC Strategies. The summit highlighted the company's general enhancements in its platform with AI capabilities. This focus on AI demonstrates the growing importance of artificial intelligence in governance, risk, and compliance.

- Report ID: 3716

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Public Affairs and Advocacy Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.