Sales Platform Software Market Outlook:

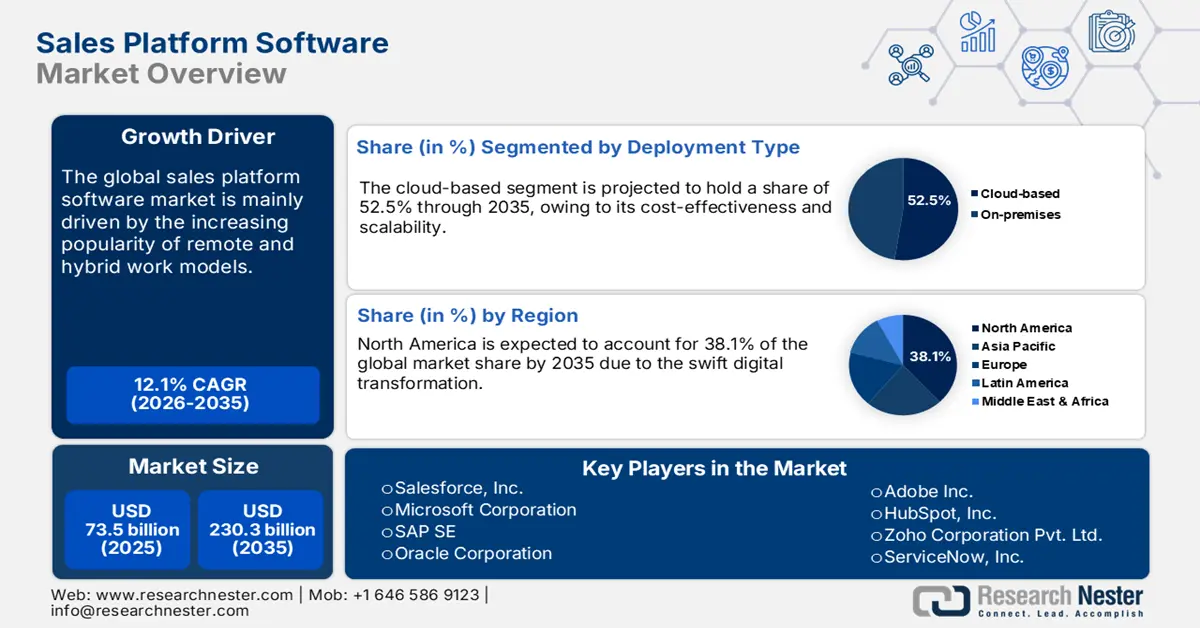

Sales Platform Software Market size was USD 73.5 billion in 2025 and is estimated to reach USD 230.3 billion by the end of 2035, expanding at a CAGR of 12.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of sales platform software is assessed at USD 82.3 billion.

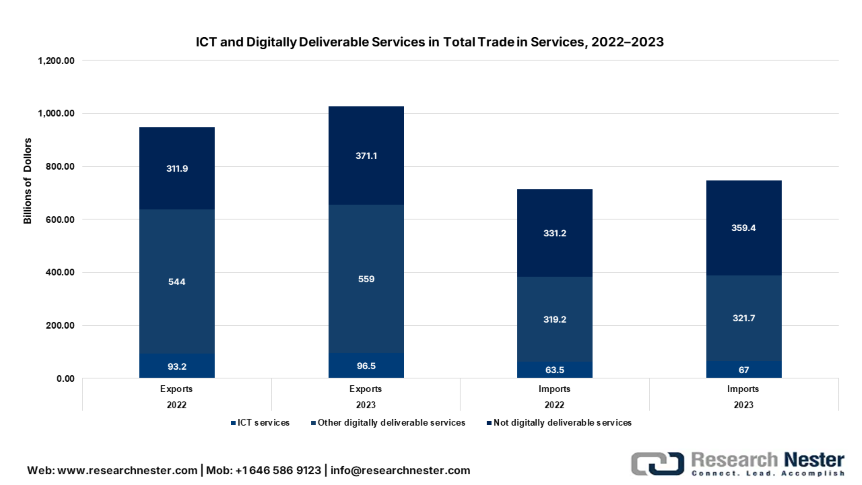

The global supply chain powering the sales platform software trade relies on a robust infrastructure of data centers, cloud platforms, server hardware, and integrated software delivery networks. The software being digital, its manufacturing depends on physical assets such as semiconductors, network equipment, and storage systems. According to the Observatory of Economic Complexity (OEC), the global trade of semiconductor devices was calculated at USD 155 billion in 2023. This underscores a strong demand for digital software across several sectors. Furthermore, the Bureau of Economic Analysis (BEA) discloses that in 2023, the U.S. ICT service exports amounted to USD 96.5 billion. The majority of exports were of cloud-based platforms, including enterprise sales software. The increasing demand for advanced technologies is poised to fuel the adoption of AI and ML-powered sales platform software solutions.

Source: BEA

Key Sales Platform Software Market Insights Summary:

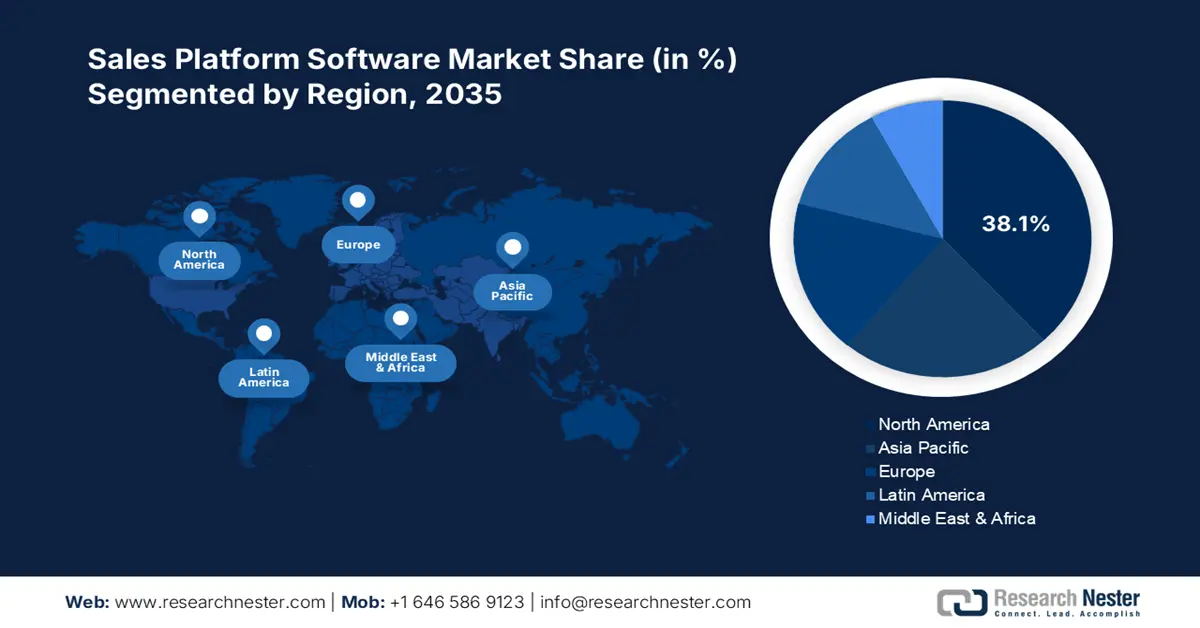

Regional Insights:

- The North America Sales Platform Software Market is projected to hold a 38.1% revenue share through 2035, supported by the increasing integration of AI-powered CRM tools and favorable regulatory frameworks.

- The Asia Pacific region is expected to grow at a 12.1% CAGR from 2026 to 2035, owing to rapid digital transformation and rising investments in cloud-based platforms.

Segment Insights:

- The cloud-based segment is projected to account for 52.5% of the global Sales Platform Software Market share by 2035, propelled by growing investments in public cloud infrastructure and government initiatives supporting secure cloud adoption.

- The large enterprises segment is anticipated to capture 57.1% share by 2035, impelled by the need to manage complex sales workflows and rising adoption of AI-enabled sales forecasting tools.

Key Growth Trends:

- Rise in remote & hybrid work models

- Digital transformation

Major Challenges:

- Stringent data protection policies

- Inadequate infrastructure

Key Players: Salesforce, Inc.,Microsoft Corporation,SAP SE,Oracle Corporation,Adobe Inc.,HubSpot, Inc.,Zoho Corporation Pvt. Ltd.,ServiceNow, Inc.,Pega Systems Inc.,Freshworks Inc.,Infor, Inc.,Atlassian Corporation Plc,IFS Applications,Epicor Software Corporation,Samsung SDS Co., Ltd.,Skubana (by EmergeTech),Sansan, Inc.,JustSystems Corporation,Money Forward, Inc.,Cybozu, Inc.,Works Applications Co., Ltd.

Global Sales Platform Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 73.5 billion

- 2026 Market Size: USD 82.3 billion

- Projected Market Size: USD 230.3 billion by 2035

- Growth Forecasts: 12.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.1% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Canada, Germany, United Kingdom, China

- Emerging Countries: India, Japan, South Korea, Australia, Singapore

Last updated on : 26 September, 2025

Sales Platform Software Market - Growth Drivers and Challenges

Growth Drivers

- Rise in remote & hybrid work models: The shift to remote and hybrid work models is increasing the demand for sales platform software solutions. End users are investing heavily in solutions integrated with Microsoft Teams or Slack. These advanced remote work software technologies accelerate sales team productivity and overall operational efficiency. North America and Europe are estimated to lead the sales of remote tools owing to robust internet infrastructure. The World Economic Forum (WEF) estimates that by 2030, digital jobs worldwide are expected to increase by about 25%, reaching over 90 million roles. This indicates that the job opportunities to work from anywhere are estimated to rise, contributing to the overall market growth.

- Digital transformation: The digitalization trend across retail, healthcare, and manufacturing sectors is increasing the demand for integrated sales platforms. The advanced sales platform software solutions' ability to streamline operations and improve data-driven decision-making is contributing to their demand. China and India are a hotspot for digital transformation and are fueling the investments in sales platform software technologies. The report by the World Bank disclosed that in 2022, more than 90% of the population living in high-income economies used the Internet. This indicates high earning opportunities for sales platform software manufacturers.

- Technological innovations: The continuous technological advancements are set to double the revenues of sales platform software manufacturers in the years ahead. The integration of AI and ML is poised to boost the productivity and effectiveness of the sales platform software. The tech-savvy end users are prime users of AI and ML-powered sales platform software systems. In May 2025, Salesloft unveiled its 15 new AI tools that work on their own to cut down on manual tasks and speed up sales processes. With a total of 26 AI tools now available or being developed, the Salesloft platform supports the entire sales cycle from start to finish. Thus, technological innovation strategies are estimated to boost the reach of key players.

Challenges

- Stringent data protection policies: The strict data protection regulations are limiting companies from cross-border transfer of customer information. These regulations also mandate data localization and breach reporting, which increases the operational costs and delays new market entries. Thus, the polices leading to trade barriers are poised to hamper the adoption of sales platform software technologies in the coming years.

- Inadequate infrastructure: The poor digital infrastructure in underdeveloped regions is hampering the adoption of sales platform software solutions. Inadequate connectivity is hindering the employment of cloud-based solutions. Many industry giants are considering this as an opportunity and are collaborating with public entities to expand digital infrastructure and their product offerings.

Sales Platform Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.1% |

|

Base Year Market Size (2025) |

USD 73.5 billion |

|

Forecast Year Market Size (2035) |

USD 230.3 billion |

|

Regional Scope |

|

Sales Platform Software Market Segmentation:

Deployment Segment Analysis

The cloud-based segment is projected to account for 52.5% of the global sales platform software market share by 2035. The cloud-based deployment solution is exhibiting high demand owing to its flexibility, scalability, and cost-efficiency. In February 2025, the World Bank revealed that high-income countries score an average of 7.5 out of 10 on the Global Cloud Ecosystem Index, which shows how well they support the use of cloud technology. The growing investments in public cloud infrastructure and widespread shifts to SaaS models are contributing to the increasing demand for cloud-based solutions. Furthermore, government initiatives, including the Federal Cloud Computing Strategy (FedRAMP), are promoting the use of secure cloud solutions. This is accelerating the demand for enterprise-oriented cloud-hosted sales platforms.

Organization Size Segment Analysis

The large enterprises are poised to hold 57.1% of the global sales platform software market share throughout the forecast period. The complex sales workflows of large enterprises necessitate them to invest in sales platform software. The U.S. Small Business Administration (SBA) states that in 2023, enterprises with fewer than 500 employees accounted for nearly 46.4% of private-sector employment and boosted the adoption of digital sales tools. The high investment capacity of the large enterprises is also fueling the demand for CRM and AI-enabled sales forecasting solutions.

Industry Vertical Segment Analysis

The retail and e-commerce segment is estimated to hold the largest market share throughout the study period. These domains expand on the high transaction volumes, omnichannel engagement, and dynamic customer expectations, which necessitate the application of sales platform software technologies. Retail and e-commerce require platforms that can process millions of interactions in real time, which directly fuel the demand for advanced sales platform software solutions. The surge in online shopping is also increasing the application of digital sales tools.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Deployment |

|

|

Organization Size |

|

|

Industry Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sales Platform Software Market - Regional Analysis

North America Market Insights

The North America sales platform software market is foreseen to capture 38.1% of the global revenue share through 2035. The growth in the AI-powered CRM and sales engagement tools by the larger enterprises is creating a profitable environment for sales platform software producers. The strong presence of end users in both the U.S. and Canada is fueling the adoption of SaaS solutions. These technologies aid in predictive analytics and streamlining sales pipelines. The supportive regulatory policies are expected to accelerate the adoption of sales platform software solutions in the years ahead.

The adoption of sales platform software solutions in the U.S. is forecast to expand at a high pace during the study period. The growing popularity of AI-enhanced CRM systems and predictive sales analytics is fueling the adoption of cloud-based enterprise solutions. The digitalization trend is increasing the use of cloud-based solutions in the public sector. The Federal Communications Commission (FCC) reveals that in 2023, more than 20.0 million U.S. households enrolled for the Affordable Connectivity Program. This boosted the adoption of the cloud-enabled digital services, including sales platforms.

The digitalization trends among SMEs and investments in rural connectivity infrastructure in Canada are poised to fuel the revenues of sales platform software companies in the years ahead. The Innovation, Science, and Economic Development’s increasing investments in digital accessibility are also estimated to fuel the trade of sales platform software during the foreseeable period. The consistent government support is set to accelerate the production and commercialization of sales platform software in the country.

APAC Market Insights

The Asia Pacific sales platform software market is anticipated to increase at a 12.1% CAGR between 2026 and 2035. The digital transformation movement across APAC countries is opening lucrative doors for sales platform software manufacturers. The strong existence of end users in China and India is fueling the demand for sales platform software solutions. The positive foreign direct investment policies and public entities' interest in cloud-based platforms are further increasing the installation of sales platform software technologies.

In China, the increasing adoption of digital tools by both SMEs and big enterprises is likely to double the revenues of key players in the coming years. The supportive government policies, such as Made in China and the Five-Year Plan, are poised to fuel the production of advanced technologies, including sales software in the country. The rise in public-private investments is set to increase the domestic production of sales platform software solutions in the years ahead.

The digital movement of India is attracting several sales platform software companies to invest in the market. Digital Bharat and Made in India programs are increasing the number of new companies in the country. The boom in public-cloud investments is anticipated to drive the adoption of sales platform software. The Press Information Bureau (PIB) disclosed that internet connections in India grew from 251.5 million in 2014 to 969.6 million in 2024. It also reveals that the digital economy is expanding quickly, making up 11.74% of the country’s income in 2022–23 and expected to reach 13.42% by 2024-25. Overall, investing in India is anticipated to double the revenues of key players.

Europe Software Market Insights

The Europe sales platform software market is estimated to increase at the fastest pace from 2026 to 2035. The region’s strong digital infrastructure and high internet penetration are prime factors boosting the adoption of sales platform software solutions. The rising shift toward omnichannel commerce is also contributing to high demand for digital sales tools. The EU’s Digital Strategy and regulations, such as GDPR, are further accelerating the adoption of sales platforms with advanced data privacy and compliance features.

The U.K. leads the demand for sales platform software solutions, owing to its advanced digital economy and robust e-commerce trade. The increasing popularity of cloud computing is also opening high-earning doors for key players. The retail, financial, and professional service enterprises are prime end users of AI-enabled sales platforms. The government’s push for digital transformation is pushing the application of sales platform software solutions.

The Germany market is estimated to be driven by industrial automation and digitalization. The strong adoption of digital solutions in both B2B and B2C sectors is propelling the trade of sales platform software. The country’s Digital Strategy 2030 initiative is further boosting sales platform software adoption across several industries.

Key Sales Platform Software Market Players:

- Salesforce, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Adobe Inc.

- HubSpot, Inc.

- Zoho Corporation Pvt. Ltd.

- ServiceNow, Inc.

- Pega Systems Inc.

- Freshworks Inc.

- Infor, Inc.

- Atlassian Corporation Plc

- IFS Applications

- Epicor Software Corporation

- Samsung SDS Co., Ltd.

- Skubana (by EmergeTech)

- Sansan, Inc.

- JustSystems Corporation

- Money Forward, Inc.

- Cybozu, Inc.

- Works Applications Co., Ltd.

The key players in the market for sales platform software are employing several organic and inorganic strategies, such as new product launches, technological innovations, mergers & acquisitions, partnerships & collaborations, and regional expansion, to earn high profits. Industry giants are collaborating with other high-tech companies to boost their product offerings. Big companies are also acquiring smaller companies or start-ups with innovative solutions to uplift their market position. They are also entering into high-potential markets to grab lucrative shares from untapped opportunities. The organic sales are anticipated to double the revenues of sales platform software companies in the coming years.

Recent Developments

- In October 2024, Salesforce launched Agentforce, a new feature on its platform that lets companies create and use AI agents. These agents can work on their own to handle tasks across different business areas.

- In January 2024, Temenos introduced Temenos LEAP, a new program to help its clients upgrade to the latest Temenos platform. This program makes it easier for them to switch to cloud and Software-as-a-Service solutions.

- Report ID: 4185

- Published Date: Sep 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sales Platform Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.