Loan Origination Software Market Outlook:

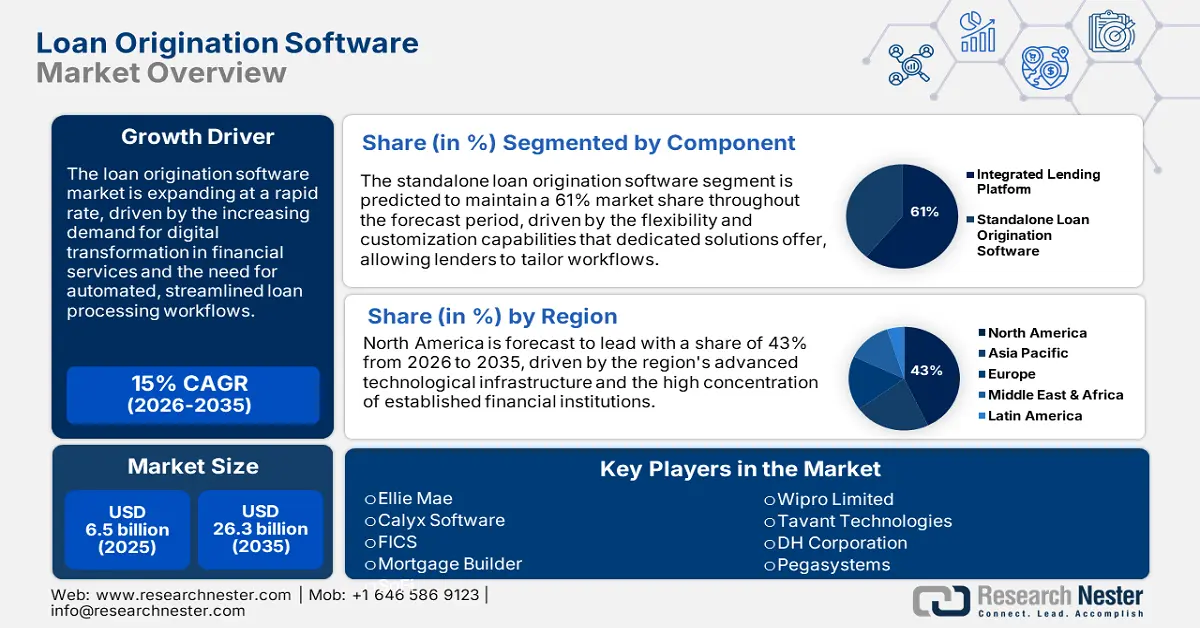

Loan Origination Software Market size is valued at USD 6.5 billion in 2025 and is projected to reach a valuation of USD 26.3 billion by the end of 2035, rising at a CAGR of 15% during the forecast period, i.e., 2026-2035. In 2026, the industry size of loan origination software is assessed at USD 7.4 billion.

The loan origination software market is expanding at a rapid rate, driven by artificial intelligence-based credit assessment, blockchain-based documentation, and the proliferation of mobile-led loan apps. Emerging platforms utilize predictive analytics, omnichannel origination strategies, and API-based ecosystem integrations to provide comprehensive end-to-end digital lending solutions. In January 2025, the U.S. Census Bureau reported that the proportion of banks using AI increased from 14% in 2017 to 43% in 2019. AI-armed banks lend significantly more to distant borrowers and experience lower default rates on such borrowers.

Federal regulators continue to monitor and research the impact of technology on lending, while establishing compliance standards for online lending platforms. Increased monitoring mechanisms and reporting requirements for data open up new opportunities for software firms to develop enterprise compliance solutions. In March 2025, the Federal Reserve's report, Consumer & Community Context, indicated that less than one-quarter (23 percent) of small companies borrowed through loans, lines of credit, and cash advances from online lenders in 2023. Such analysis by the government is critical to loan origin software development and market positioning strategy.

Key Loan Origination Software Market Insights Summary:

Regional Highlights:

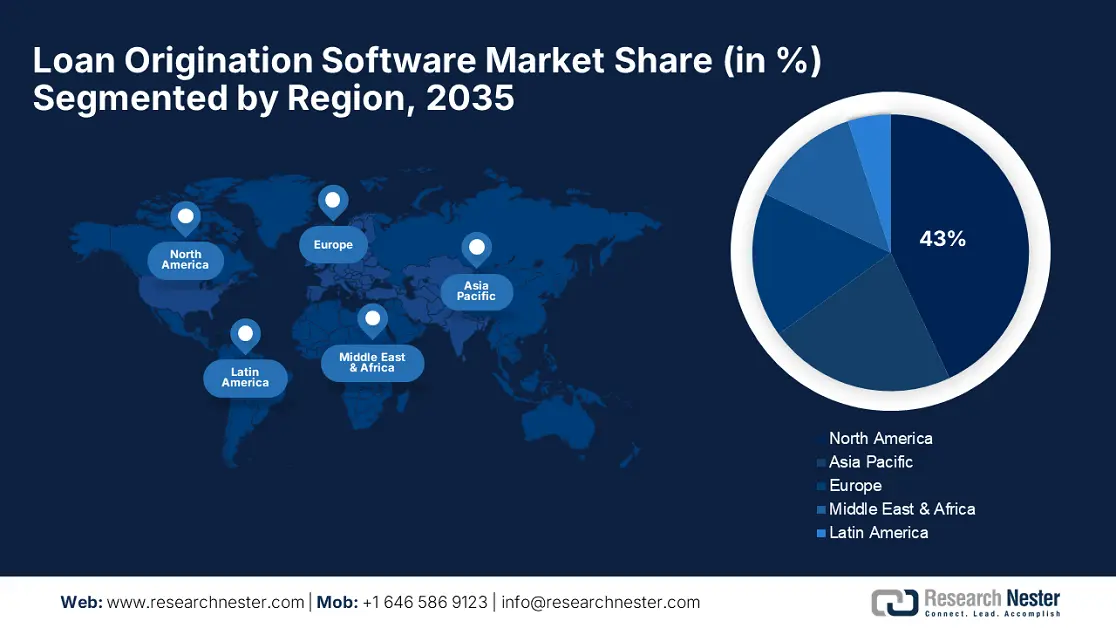

- North America is expected to command a 43% share of the Loan Origination Software Market by 2035, underpinned by its advanced financial infrastructure, robust fintech investments, and widespread adoption of AI-driven lending technologies.

- Asia Pacific is forecasted to register a 14% CAGR from 2026 to 2035, owing to rapid digital expansion, government-backed fintech initiatives, and rising financial inclusion across emerging economies.

Segment Insights:

- The standalone loan origination software segment is anticipated to maintain a 61% share of the Loan Origination Software Market by 2035, propelled by financial institutions’ preference for specialized lending platforms offering seamless end-to-end capabilities.

- The cloud segment is projected to hold a 76% share by 2035, driven by rapid digitalization in financial services and the growing need for scalable, cost-efficient infrastructure solutions.

Key Growth Trends:

- Cloud infrastructure adoption drives digital transformation

- AI and automation drive operational efficiency advantages

Major Challenges:

- Advanced regulatory compliance requirements impose development costs

- Technical and operational complexity in integrating data across legacy financial systems

Key Players: Ellie Mae, Calyx Software, FICS, Mortgage Builder, Wipro Limited, Tavant Technologies, DH Corporation, Pegasystems, Newgen Software, Nucleus Software.

Global Loan Origination Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.5 billion

- 2026 Market Size: USD 7.4 billion

- Projected Market Size: USD 26.3 billion by 2035

- Growth Forecasts: 15% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 8 September, 2025

Loan Origination Software Market - Growth Drivers and Challenges

Growth Drivers

- Cloud infrastructure adoption drives digital transformation: The sharp shift to cloud-based lending infrastructure is changing the approach of lending institutions to deploying and scaling up their loan origination capabilities. Cloud platforms are more flexible, less expensive to operate, and more reliable than on-premise in-house solutions. In December 2023, Computer Services Inc. acquired Hawthorn River LLC to enhance its loan origination capabilities and expand market penetration in the community banking sector. The acquisition enables CSI borrowers to experience a more comprehensive, end-to-end loan origination solution with sustainable growth. It is such a strategic move that showcases how companies are combining capabilities to provide cloud-native solutions that better serve the needs of community banking.

- AI and automation drive operational efficiency advantages: The integration of artificial intelligence and machine learning is transforming loan origination from lengthy, manual processes to streamlined, automated ones. Advanced AI solutions enable real-time credit decisions, automated document processing, and risk forecasting models that significantly reduce cycle times and expenses. In October 2024, Tavant Technologies launched LO.ai, an AI-enabled product designed to empower the borrower and loan officer within its Touchless Lending platform. The solution leverages generative AI to improve loan pull-throughs, reduce manufacturing costs, and automate loan officer training.

- Modernization of regulation introduces new market prospects: The new regulatory models and government policies are designing standardized data exchange protocols that enable more sophisticated loan origination software functionalities. Increased regulatory clarity on digital lending, open banking, and consumer protection of personal data is paving the way for software innovation and market expansion. In 2025, India's Reserve Bank continued to drive the Account Aggregator (AA) Framework, which facilitates the secure sharing of financially impactful data that directly affects lending origination software firms catering to the Indian market. Over 2.2 billion bank accounts now have the ability to securely share information via the AA network, with more than 23 banks adopting standard APIs for digital finance analytics. This government initiative enables loan origination software platforms to utilize extensive financial information about borrowers to conduct more comprehensive credit analysis and perform real-time risk evaluation.

Challenges

- Advanced regulatory compliance requirements impose development costs: Emerging regulatory regimes in a variety of geographies are forcing serious compliance complexity on loan origination software vendors. Software companies are burdened with higher development costs and longer implementation periods as they integrate compliance functionality into their systems, all while maintaining expected system performance and end-user experience parameters. Germany went live with the Digital Operational Resilience Act (DORA) in December 2024, mandating the use of enhanced-quality analytics in ICT risk management, incident reporting, and resilience metrics for financial services institutions. DORA oversees telemetry and testing analytics for operational resilience, compelling loan origination software providers to invest in observability and compliance dashboards.

- Technical and operational complexity in integrating data across legacy financial systems: Integrating modern loan origination software with existing legacy banking infrastructure presents critical technical and operational complexity to banks. Legacy infrastructure often lacks standardized APIs, real-time data, and higher-level security standards necessary for seamless software integration. In June 2025, the UK Government released Student Loans in England Financial Year 2024-25 statistics of higher education loan balances at £266.6 billion and undergraduate borrowing at £19.8 billion, representing a year-on-year 2.5% growth. These government figures are valuable benchmarking data for education finance market vendors of loan origination software that target financial institutions.

Loan Origination Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15% |

|

Base Year Market Size (2025) |

USD 6.5 billion |

|

Forecast Year Market Size (2035) |

USD 26.3 billion |

|

Regional Scope |

|

Loan Origination Software Market Segmentation:

Component Segment Analysis

The standalone loan origination software segment is predicted to maintain a 61% loan origination software market share throughout the forecast period, as financial institutions prefer specialist, dedicated lending platforms. These platforms offer end-to-end capabilities without the complexity and integration drawbacks inherent in more advanced financial software suites. In September 2023, National MI became embedded in Calyx Software's Point(R) loan origination system (LOS), enabling lenders and brokers to place real-time, risk-based mortgage insurance orders via National MI's Rate GPS(R) feature within the Point system. This integration eliminates the need for lenders to leave their primary workflow system, streamlining the mortgage insurance ordering process while saving valuable processing time.

Deployment Model Segment Analysis

The cloud segment is predicted to account for 76% of the loan origination software market by 2035, reflecting the rapid digitalization of the financial services industry and the need for scalable and cost-effective infrastructure solutions. Banks are leveraging cloud platforms to rapidly expand their lending business as well as utilize advanced analytics and artificial intelligence capabilities that would prove costly in on-premise deployments. In October 2024, Wipro Limited continued its digital transformation in the banking sector with a focus on cloud adoption and the introduction of AI to help financial institutions simplify and enhance their operations. These solutions focus on migrating legacy finance systems to cloud environments, offering process consistency and control, and increasing robustness against rare events.

Enterprise Size Segment Analysis

The large enterprises with 500 to 999 workers segment is expected to hold a 46% loan origination software market share through 2035, driven by the high lending volumes of these companies and their complex operational needs. Large banks require sophisticated loan origination systems that can handle a high volume of transactions, serve a wide range of loan products, and integrate with a comprehensive current technology infrastructure. These institutions have the capital to invest in end-to-end loan origination platforms and the technical expertise to leverage advanced features and customizations. For instance, nCino published insights into the intelligent automation revolution transforming mortgage lending from document-heavy, manual processes to efficient, automated ones in July 2025. The platform offers mobile-native, AI-enabled document validation capabilities, enabling borrowers to scan, upload, and process documents anywhere, anytime.

Our in-depth analysis of the loan origination software market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Deployment Model |

|

|

Enterprise Size |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Loan Origination Software Market - Regional Analysis

North America Market Insights

North America is poised to maintain a 43% loan origination software market share during the forecast period, solidifying the region's position as the industry leader in the global loan origination software market. The region boasts a well-developed financial services infrastructure, a high-tech talent base, and substantial venture capital investment in fintech innovation. North American banks and other financial institutions are leaders in adopting advanced lending technologies, leveraging cloud platforms, analytics driven by artificial intelligence, and automated underwriting systems to consolidate operations and enhance customer experience.

In the U.S., credit unions and banks are rapidly adopting advanced loan origination software that integrates artificial intelligence, machine learning, and real-time data analytics to transform their legacy lending processes. For example, Abrigo launched Abrigo Small Business Lending, a commercial loan origination software designed specifically for small business lending, in September 2024. The advanced product allows financial institutions to lend more and lend quicker to small businesses without compromising compliance with 1071 small business collection requirements.

Canada loan origination software market is embracing more sophisticated data sharing patterns and digital banking standards for supporting more sophisticated loan origination software features and cross-platform compatibility. Canadian financial institutions have good regulatory regimes with better banking sector underpinnings, and governmental initiatives towards fintech innovation and financial inclusion. In 2024, Canada's Finance Ministry initiated consumer-driven banking consultations and introduced standard, agreed-upon data access models to enable loan originator software to securely review financial data and assess budgeting, affordability, and credit risk.

Europe Market Insights

Europe is expected to witness stable loan origination software market expansion between 2026 and 2035, driven by digital finance regulations, open banking, and increasing fintech collaboration within the European Union. The emphasis on customer rights, regulatory harmonization, and data protection by the jurisdiction offers a robust platform for loan origination software development and cross-border deployment. There is significant investment in digital transformation by European banks and financial institutions centered on customer experience, operational effectiveness, and regulatory compliance through advanced lending technology platforms.

Germany based banks are leading the adoption of loan origination technology in Europe, leveraging the country's high engineering skills and digital banking expertise to implement advanced lending platforms. In July 2025, Publicis Sapient analyzed how AI is transforming the U.K. building society mortgage lending sector, showcasing how forward-thinking institutions are embracing technology to future-proof their operations. This identifies strategic collaborations that allow building societies to utilize the most modern loan origination technology without having to develop it in-house.

The UK maintains its position as a European fintech leader through visionary regulatory frameworks, strong financial services expertise, and constant innovation in digital lending technologies. Financial institutions in the UK enjoy regulatory independence, which enables them to respond rapidly to market changes while maintaining high consumer protection levels. In October 2023, Kennek raised $12.5 million in seed funding to expand its lending software platform in Europe after acquiring its first European customer. Such startups develop loan origination software for financial institutions, enabling them to automate their lending processes using automated workflows and advanced compliance capabilities.

APAC Market Insights

Asia Pacific loan originations software market is predicted to gain a CAGR of 14% during the forecast period, driven by faster digital expansion, growth in financial inclusion drives, and government support for fintech development across regional economies. The region is enabled by high smartphone penetration, growing middle-class consumer bases, and progressive regulatory regimes supporting the adoption of digital lending platforms. Regional governments are establishing favorable policies for digital financial services, along with adequate regulation and consumer protection standards.

China loan origination software market is leveraging advanced AI, blockchain, and cloud technologies to build holistic digital lending ecosystems for both consumer and business financing. China enhanced its social credit system in April 2025 to facilitate high-quality development by establishing a national financing credit service platform that integrates 74 key categories of data, including business registration, tax payment, and social security. In February 2025, Chinese financial institutions had released 37.3 trillion yuan worth of loans through this platform, with 9.4 trillion yuan comprising credit loans, which directly addressed MSME funding needs and demand for automated loan origination systems.

India is witnessing rapid growth in the loan origination software market, owing to government-driven digital finance policies, the increasing use of fintech, and strong demand for inclusive lending solutions from both urban and rural populations. The country's digital public infrastructure, including unified payment interfaces and digital identities, provides a strong foundation for innovative loan origination platforms. In June 2023, the Government of India pledged approximately INR 5 trillion towards scaling up the Emergency Credit Line Guarantee Scheme, which is expected to drive exponential growth in MSME lending and directly impact the use of loan origination software in India. The scheme coverage opens the door for banks to raise lending to small businesses through automated origination platforms.

Key Loan Origination Software Market Players:

- Ellie Mae

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Calyx Software

- FICS

- Mortgage Builder

- Wipro Limited

- Tavant Technologies

- DH Corporation

- Pegasystems

- Newgen Software

- Nucleus Software

The loan origination software market is characterized by intense competition from established tech companies and newer fintech companies that continue to upgrade their platforms with cutting-edge analytics, AI capabilities, and cloud-native architecture. Leading industry vendors like Ellie Mae, Calyx Software, FICS, Mortgage Builder, Wipro Limited, Tavant Technologies, DH Corporation, Pegasystems, Newgen Software, Nucleus Software, NTT Data Corporation, Fujitsu Limited, Hitachi Solutions, NEC Corporation, and Toshiba Digital Solutions are providing substantial research and development investments in order to maintain a competitive advantage.

Companies are actively pursuing strategic acquisitions, alliances, and new product launches to establish market presence and increase technological sophistication, thereby continuously changing the competitive landscape. Market leaders are forging strategic alliances to tap into complementary strengths and accelerate innovation, while new entrants are focusing on niche markets and disruptive technologies. In June 2024, Fuse brought banks and credit unions together to design custom workflows and integrations with their next-generation loan origination software. The platform provides financial institutions with flexible tools to tailor their lending processes to meet compliance and security needs.

Here are some leading companies in the loan origination software market:

Recent Developments

- In May 2025, FICS (Financial Industry Computer Systems) hosted its 38th Annual Users' Conference in Dallas, showcasing innovation and resilience in the mortgage industry with over 270 participants attending the April 9-11 conference. The event featured live demonstrations of new product features and enhancements for Loan Producer, Commercial Servicer, and Mortgage Servicer systems.

- In February 2024, Axe Finance was positioned as a technology leader in the Quadrant Knowledge Solutions SPARK Matrix for Commercial Loan Origination System and Retail Loan Origination System. The company's Axe Credit Portal (ACP) features AI-driven automation, multilingual interfaces, enhanced credit risk scoring, and seamless third-party integrations.

- Report ID: 8072

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Loan Origination Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.