Credit Management Software Market Outlook:

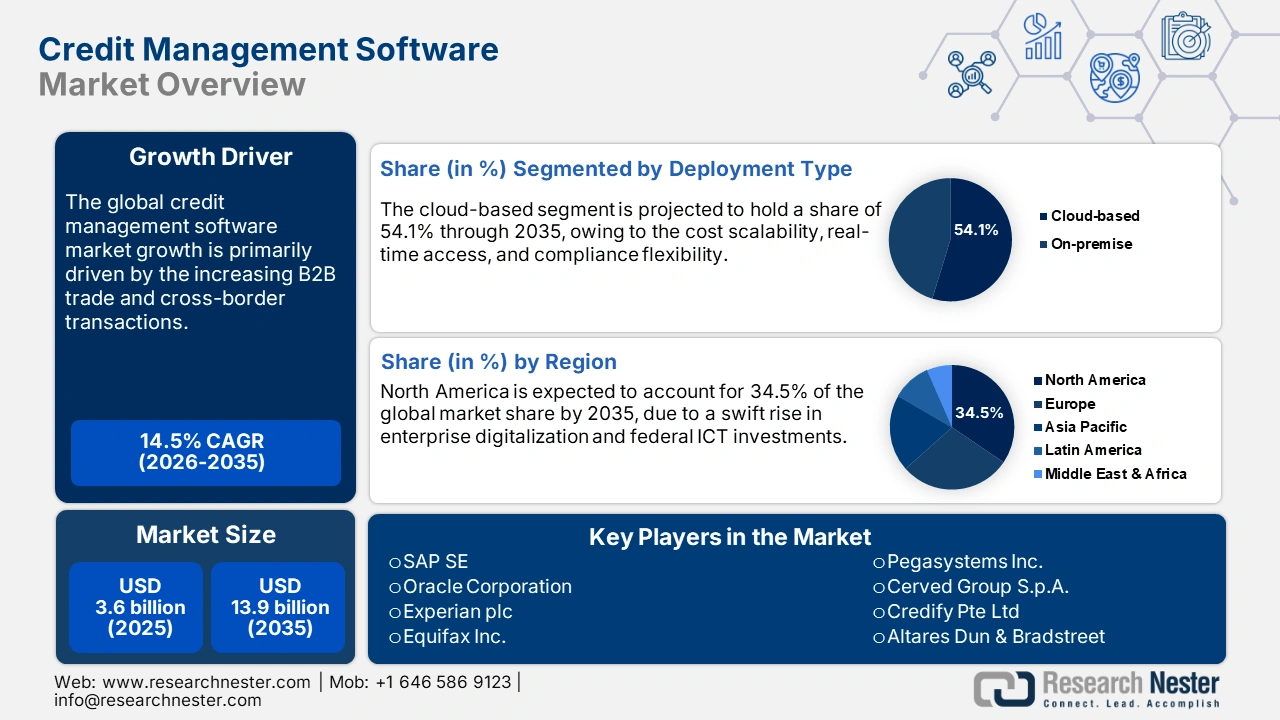

Credit Management Software Market size was USD 3.6 billion in 2025 and is estimated to reach USD 13.9 billion by the end of 2035, expanding at a CAGR of 14.5% during the forecast period, i.e., 2025-2035. In 2026, the industry size of credit management software is assessed at USD 4.1 billion.

The trade of credit management technologies is estimated to be driven by the stable supply chain of specialized hardware and software components. The expansion of broader digital services, such as software development, cloud infrastructure provisioning, and enterprise financial operations, also contributes to the overall market growth. Additionally, regulatory pressures, namely Basel IV, IFRS 9, GDPR, and rising non-performing assets (NPAs), are encouraging financial institutions toward compliant and fault-resistant credit systems. These regulations demand precise credit risk modeling, provisioning, data governance, and timely disclosures.

In September 2025, India's Reserve Bank (RBI) penalized the Surat People's Co-operative Bank INR 18.3 lakh for failing to submit mandatory data on large credit exposures to the Central Repository of Information on Large Credits (CRILC) within the set timeline. This case highlights why financial institutions are turning to strong credit management platforms and how regulatory compliance failures directly translate into financial and reputational costs.

Key Credit Management Software Market Insights Summary:

Regional Insights:

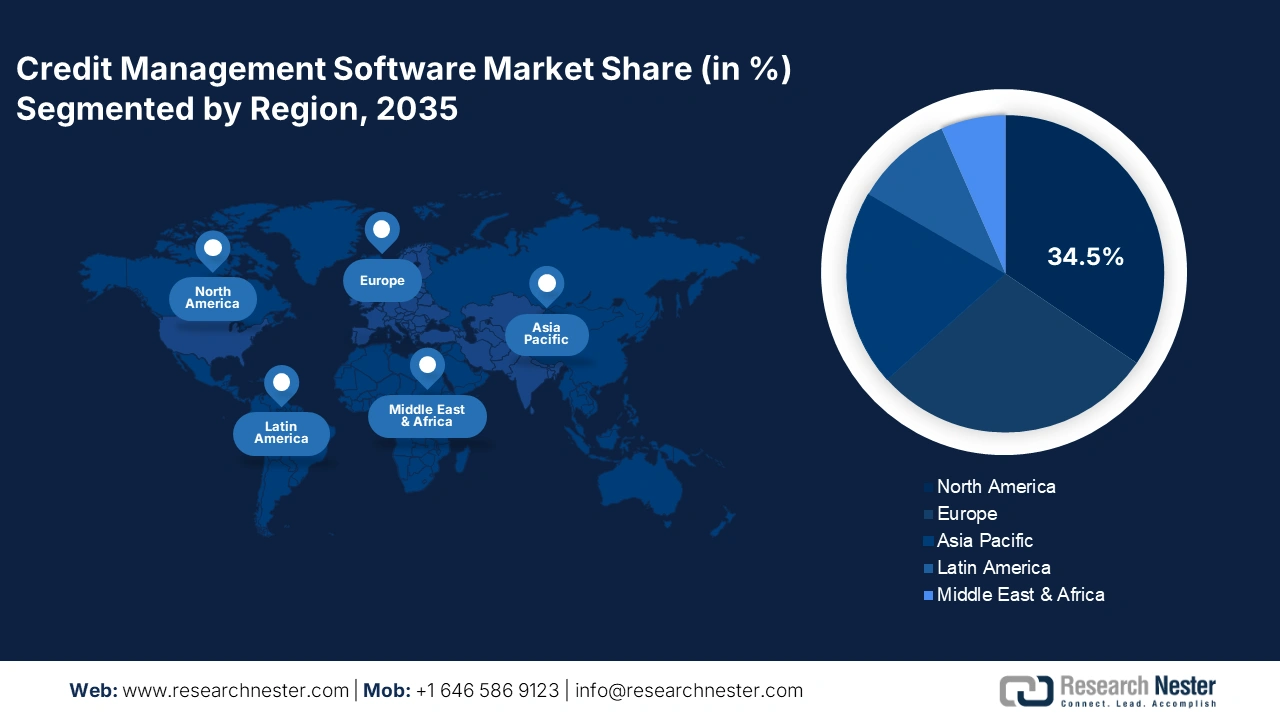

- The North America Credit Management Software Market is projected to secure a 34.5% revenue share by 2035, owing to swift enterprise digitalization and federal ICT investments.

- The Europe region is anticipated to account for 28.9% of the market share through 2035, supported by enterprise digitization and EU-backed cybersecurity compliance mandates.

Segment Insights:

- The BFSI segment is projected to hold a 41.5% share of the Credit Management Software Market by 2035, propelled by increasing global credit demand and evolving regulatory requirements.

- The cloud-based segment is anticipated to capture 54.1% share during 2026–2035, owing to cost scalability, real-time access, and compliance flexibility.

Key Growth Trends:

- Increasing B2B trade and cross-border transactions

- Shift toward API-First ecosystems and ERP integration

Major Challenges:

- Data protection and localization laws

- Pricing model misalignment with developing markets

Key Players: SAP SE, Oracle Corporation, Experian plc, Equifax Inc., FICO (Fair Isaac Corporation), Pegasystems Inc., Cerved Group S.p.A., Credify Pte Ltd, Altares Dun & Bradstreet, Finastra, Software AG, Provenir Inc., CreditorWatch Pty Ltd, Crif S.p.A., Perfios Software Solutions Pvt. Ltd., NTT Data Corporation, OBIC Business Consultants Co., Ltd., Rist Inc., Fujitsu Limited, NEC Corporation.

Global Credit Management Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.6 billion

- 2026 Market Size: USD 4.1 billion

- Projected Market Size: USD 13.9 billion by 2035

- Growth Forecasts: 14.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, China, Japan

- Emerging Countries: India, South Korea, Australia, Canada, France

Last updated on : 3 October, 2025

Credit Management Software Market - Growth Drivers and Challenges

Growth Drivers

- Increasing B2B trade and cross-border transactions: The boom in global business-to-business (B2B) trade is fueling the demand for credit management solutions that align with local regulations. Further, in Asia, China’s Regional Comprehensive Economic Partnership (RCEP) is boosting the trade of tools that manage diverse credit data within the region. Thus, the rising cross-border trade is creating a profitable environment for credit management technologies.

- Shift toward API-First ecosystems and ERP integration: Modern finance enterprises are increasingly investing in credit systems that easily connect with software such as SAP, Oracle, and Salesforce. For instance, HighRadius offers a Credit Cloud solution that integrates out of the box with major ERPs, including SAP, Oracle NetSuite, Microsoft Dynamics, and Sage Intacct via real-time APIs and plug-and-play modules. The evolving consumer demand for instant data sharing and automation systems is opening lucrative doors for key players. Considering this trend, many companies in the U.S. and Europe are offering credit management technologies with easy-to-use, plug-and-play features.

- Growing demand for real-time credit monitoring: The shift from checking credit occasionally to monitoring it in real time, due to fast-paced trading, on-demand supply chains, and finance tools built into everyday systems, is boosting the adoption of credit management solutions among enterprises. The customers using real-time dashboards are reporting a fall in their days sales outstanding (DSO) by 18% to 20%. Such positive outcomes are accelerating the adoption of advanced creative monitoring solutions, especially in North America and Western Europe. Also, to earn hefty gains, many companies are focusing on the production of AI-powered alerts and customizable credit management software solutions.

Challenges

- Data protection and localization laws: The varied and inconsistent data protection regulations across the world are estimated to restrain the sales of credit management software solutions in the years ahead. The EU's General Data Protection Regulation (GDPR) and India's Digital Personal Data Protection (DPDP) Act are the prime hindering factors for the global adoption of credit management software technologies. The cross-border trade of these technologies is nearly delayed by 6 to 9 months, which significantly hampers the profits of key players.

- Pricing model misalignment with developing markets: The advanced software technologies are often commercialized through monthly subscriptions in the developed regions, but users in low-income countries prefer to pay a one-time fee for the software for better budget management. Thus, the sales of subscription-based credit management software solutions are expected to expand at a slower pace in the budget-constrained markets.

Credit Management Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14.5% |

|

Base Year Market Size (2025) |

USD 3.6 billion |

|

Forecast Year Market Size (2035) |

USD 13.9 billion |

|

Regional Scope |

|

Credit Management Software Market Segmentation:

End user Segment Analysis

The BFSI segment is projected to account for 41.5% of the credit management software market share by 2035. The increasing global credit demand and evolving regulatory requirements are boosting the adoption of credit management software solutions. The BFSI companies' increasing need for predictive credit scoring systems is expected to double the revenues of key players. Government rules, including those from the Consumer Financial Protection Bureau (CFPB) on digital credit access and SEC reporting requirements, are also driving the sales of credit management software among banks and financial companies.

Deployment Type Segment Analysis

The cloud-based segment is estimated to capture 54.1% of the market share throughout the forecast period, due to cost scalability, real-time access, and compliance flexibility. The U.S. Government Accountability Office (GAO) and the Cybersecurity and Infrastructure Security Agency (CISA) are directing government agencies and financial organizations to move important tasks to FedRAMP-approved cloud systems, which support modern cloud-based credit platforms. This reflects that the adoption of cloud-based platforms is set to exhibit a boom in the years ahead.

Enterprise Size Segment Analysis

The large enterprises segment is expected to register robust growth during the forecast period owing to high credit risks, increasing traction volumes, and growing need for optimized cash flow and customer relations. large enterprises operate across multiple geographies, where customer default risks vary. These companies often rely on advanced credit management software to mitigate financial risk, maintain customer relationships, and ensure healthy cash flow through automation of credit assessments, streamlined collections processes, and efficient monitoring of accounts.

Our in-depth analysis of the global credit management software market includes the following segments:

|

Segments |

Subsegments |

|

Deployment Type |

|

|

Enterprise Size |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Credit Management Software Market - Regional Analysis

North America Market Insights

The North America market is anticipated to hold 34.5% of the revenue share through 2035, owing to the swift enterprise digitalization and federal ICT investments. The robust adoption of online transaction systems is also driving the adoption of credit management software solutions. The data privacy regulations, such as the U.S.’s Consumer Data Protection Act and Canada's Digital Charter, are expected to increase the demand for credit management software systems in the years ahead. Rising cross-border trade between the U.S. and Canada, under the USMCA agreement, has also increased the need for reliable credit risk systems. Moreover, fintech adoption and embedded finance solutions is creating chances for real-time credit monitoring tools. In 2024, HighRadius recorded notable adoption of its AI-powered credit cloud solutions among Fortune 500 companies across North America.

The sales of credit management software solutions in the U.S. are estimated to be driven by the digital infrastructure upgrades and the strong presence of large enterprises. The Infrastructure Investment and Jobs Act (IIJA), which supports funding for tech adoption across state and local governments, is expected to indirectly boost credit management solution adoption among public and private sector institutions. Additionally, U.S. enterprises are using ERP-integrated credit systems to lower Days Sales Outstanding (DSO) and improve cash flows. For instance, in February 2024, JAS Worldwide, an Atlanta-based logistics business, utilized Creditsafe’s real-time credit risk platform, recording a 33% cut in DSO. The cloud shift, AI integration, and automation in credit workflows are also contributing to the overall market growth.

The Canada market is projected to increase at a high pace during the forecast period. The public sector support, SME digital adoption, and regulatory modernization are key factors boosting the sales of credit management software solutions. The government of Canada's drive for fintech innovation and open banking initiatives is driving software adoption in financial companies. In October 2024, Equifax Canada launched an upgraded credit risk management platform, providing real-time SME credit monitoring to help lenders and businesses. Moreover, the public-private investment strategies are poised to propel the sales of advanced credit management solutions in the years ahead.

Europe Market Insights

The Europe credit management software market is anticipated to account for 28.9% of the global revenue share throughout the study period, due to the expanding enterprise digitization. The banking sector modernization and EU-backed cybersecurity compliance mandates are also propelling the sales of credit management software solutions. The Digital Europe Programme allocation of more than €7.6 billion for digital transformation across member countries is accelerating the adoption of enterprise-grade software, including credit management tools. Germany, France, and the U.K. are leading credit management software adoption due to updated financial risk frameworks, integration of AI in lending operations, and cloud-native deployments.

Germany market is experiencing steady growth, driven by its strong manufacturing and export-oriented economy. German enterprises are combining ERP-connected credit management systems, particularly within SAP environments, to optimize receivables and ensure compliance with EU financial directives. Rising cross-border trade with the EU and Asia has further strengthened the need for automated credit risk solutions. The focus on lowering non-performing exposures in the banking sector is also accelerating adoption.

The France market for credit management software is projected to expand at a robust pace owing to the regulatory modernization efforts. The SME digitization and strategic fintech partnerships are emerging as key factors promoting the trade of credit management solutions. The government’s France 2030 digital transformation strategy and Bpifrance's tech adoption grants are further contributing to the market growth. The country’s fintech ecosystem, centered in Paris and Lyon, also drives the sales of credit management software technologies.

APAC Market Insights

The Asia Pacific market is expected to increase at a CAGR of 13.7% from 2026 to 2035. The rapid digitalization, public-private collaboration, and rising credit volumes are pushing the sales of credit management software solutions. China, Japan, India, South Korea, and Australia are leading the adoption of these technologies owing to their national digital economy strategies. The expansion of B2B lending platforms, cross-border financing, and tighter credit compliance laws are also some of the key factors contributing to this growth. The increasing emergence of high-tech start-ups is also representing the profitability of the region.

The market in China is projected to be driven by the strong state-sponsored digitization through the Ministry of Industry and Information Technology (MIIT), and integration mandates for financial risk management platforms. The banking, healthcare, and government sectors are prime end users of credit management software solutions in China. The government is also investing in cloud-native and blockchain-integrated credit systems to enhance its operations. The Digital China Plan is also expected to contribute to the increasing sales of credit management software solutions.

The India credit management software market is predicted to capture the fastest CAGR during the forecast period due to a rise in digital lending, rising NPAs, and increased regulatory compliance requirements from the Reserve Bank of India (RBI). Banks and NBFCs are adopting advanced credit monitoring tools to strengthen underwriting and manage risks effectively. The government’s drive for digital transformation in finance, alongside the rising SME sector in India, is promoting adoption. Real-time dashboards and AI-driven alerts are becoming popular in decreasing Days Sales Outstanding (DSO).

Key Credit Management Software Market Players:

- SAP SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Oracle Corporation

- Experian plc

- Equifax Inc.

- FICO (Fair Isaac Corporation)

- Pegasystems Inc.

- Cerved Group S.p.A.

- Credify Pte Ltd

- Altares Dun & Bradstreet

- Finastra

- Software AG

- Provenir Inc.

- CreditorWatch Pty Ltd

- Crif S.p.A.

- Perfios Software Solutions Pvt. Ltd.

- NTT Data Corporation

- OBIC Business Consultants Co., Ltd.

- Rist Inc.

- Fujitsu Limited

- NEC Corporation

The credit management software market is characterized by the strong dominance of Western companies, owing to their robust cloud-native platforms and integrated AI analytics, and the increasing emergence of start-ups. The leading companies are entering into strategic partnerships with other companies to expand their market reach and product offerings. Mergers and acquisitions strategies are also boosting their position in the competitive space. Key players are entering emerging markets to earn high gains from untapped opportunities. Organic sales are projected to double the revenues of key players in the years ahead.

Here is a list of key players operating in the market:

Recent Developments

- In February 2025, Valley Bank partnered with Finley Technologies to launch a post-origination loan platform, Credit Management System, specially designed to help mid-sized banks automate, expand, and monitor their portfolio operations.

- In June 2023, Experian announced the launch of its Ascend Ops+ platform. It is an AI-powered credit lifecycle optimization tool that automates credit decisions and enhances risk management.

- Report ID: 8165

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Credit Management Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.