Utility Communication Market Outlook:

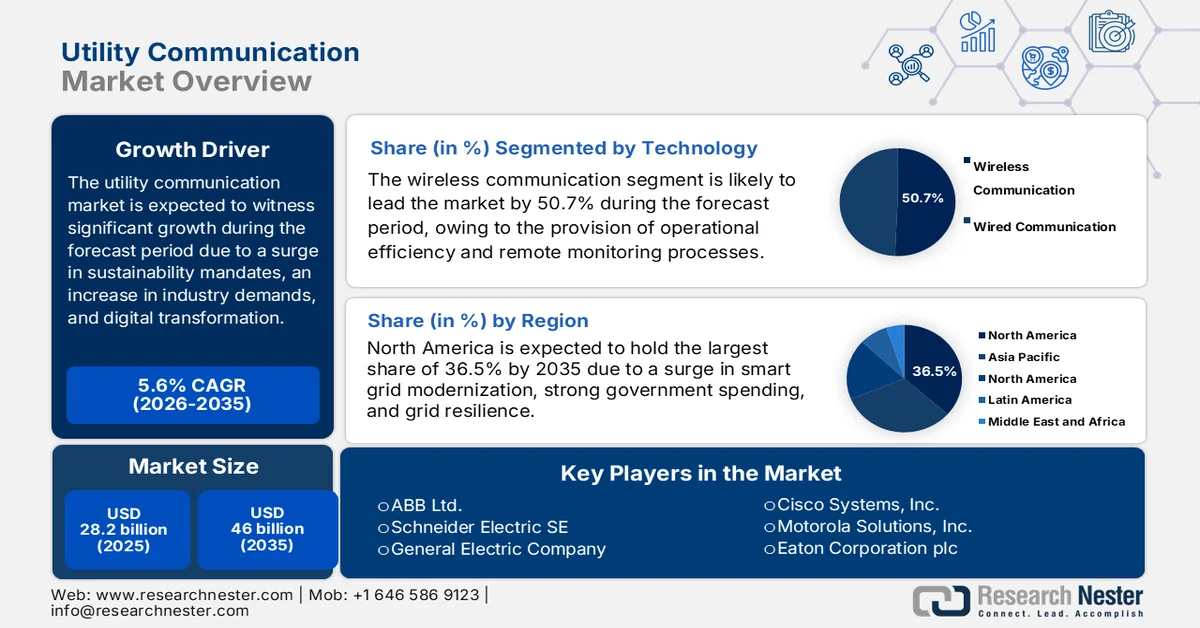

Utility Communication Market size was over USD 28.2 billion in 2025 and is estimated to reach USD 46 billion by the end of 2035, expanding at a CAGR of 5.6% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of utility communication is evaluated at USD 29.7 billion.

The worldwide utility communication market is rapidly evolving since utilities across every nation have adapted to digitalized transformation, newest industrial requirements, and sustainability mandates. According to official statistics published by the OECD Organization in 2025, the utilization of generative artificial intelligence (AI) has become an integral part of regular activities, accounting for 53.6% points. Additionally, the AI difference by income level and educational attainment is also effectively significant, both at nearly 21% points. Moreover, this technological adoption is also comprehensive among the labor industry, which includes 441.1% in employment as well as 36.7% in unemployment. Therefore, with this increased utilization, there is a huge growth opportunity for the market across different regions.

Furthermore, the integration of edge computing, blockchain for utility transactions, the presence of hybrid communication models, and AI-based predictive maintenance are certain trends that are fueling the market globally. As per an article published by the Space Foundation Organization in July 2025, the international space economy has hit a record USD 613 billion as of 2024, with the commercial industry readily constituted 78% of overall growth. In addition, government budgets significantly accounted for the remaining 22%, which is positively creating an impact in the market’s demand globally. Besides, there has been a rise in government-based space expenditure by 6.7% to USD 132 billion, with the U.S. generously investing USD 77 billion in civil space and national security programs, thereby denoting an optimistic outlook for the market’s expansion.

Key Utility Communication Market Insights Summary:

Regional Insights:

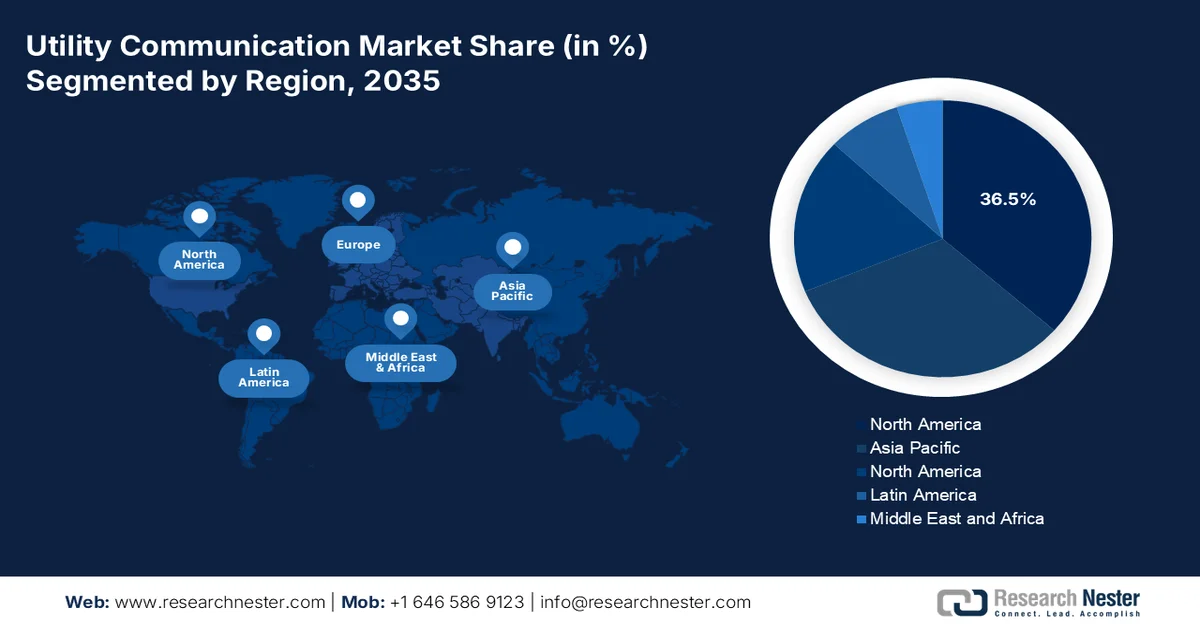

- North America is forecast to command a 36.5% share by 2035 in the utility communication market, underpinned by accelerated smart grid modernization, strong government spending, and grid resilience upgrades.

- Europe is poised to emerge as the fastest-growing region through 2035, stimulated by renewable energy integration, industrial modernization, and expansive smart grid deployment.

Segment Insights:

- The wireless communication sub-segment within the technology segment is projected to account for a 50.7% share by 2035 in the utility communication market, strengthened by improved operational efficiency, real-time remote monitoring, and smart grid advancements.

- The electric utilities segment is expected to register the second-highest share by 2035, supported by the urgency to modernize power distribution networks, integrate renewable energy, and enhance grid reliability.

Key Growth Trends:

- Growth in decentralized energy systems

- Increase in industrial electrification

Major Challenges:

- Cybersecurity risks and data privacy

- High capital expenses and infrastructure investment

Key Players:Siemens AG, ABB Ltd., Schneider Electric SE, General Electric Company, Cisco Systems Inc., Motorola Solutions Inc., Eaton Corporation plc, Honeywell International Inc., Mitsubishi Electric Corporation, Hitachi Ltd., NEC Corporation, Toshiba Corporation, Huawei Technologies Co. Ltd., Samsung Electronics Co. Ltd., LG Electronics Inc., Infosys Limited, Tech Mahindra Limited, Telstra Corporation Limited, Telekom Malaysia Berhad, BT Group plc

Global Utility Communication Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 28.2 billion

- 2026 Market Size: USD 29.7 billion

- Projected Market Size: USD 46 billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Australia, Canada

Last updated on : 10 February, 2026

Utility Communication Market - Growth Drivers and Challenges

Growth Drivers

- Growth in decentralized energy systems: The rise in distributed generation and microgrids is significantly fueling the demand for the utility communication market to coordinate different energy sources efficiently. According to official statistics published by the IEA Organization in 2025, there has been a continuous increase in worldwide energy demand by 2.2% as of 2024, denoting a notably faster rate than the yearly average of 1.3% as was observed in 2023. This upliftment has been partially owing to the effect of severe weather conditions, which has been estimated to account for 0.3% points. Besides, there has also been a surge in the electricity demand by 4.3% as of 2024, both for energy demand and GDP, thereby making it suitable for boosting the market’s exposure across different regions.

- Increase in industrial electrification: The presence of heavy industries, especially chemicals, is readily electrifying processing and requiring strong communication systems to monitor energy-based operations safely, which is positively impacting the market. As stated in an article published by the IEA Organization in February 2026, the electricity demand is on the verge to bolster rapidly by almost 2.5 times. Besides, the momentum behind low-emission sources of generation is projected to continue by the end of 2030, by which time both nuclear and time renewables are expected to generate 50% of international electricity, denoting a rise from 42%, thus creating an optimistic outlook for the market.

- Resilience against climate change: The existence of severe weather incidents is significantly pressuring utilities to generously invest in communication systems that tend to enhance emergency response capabilities, disaster recovery, and grid resilience, which is proliferating the market internationally. As stated in an article published by the IEA Organization in 2026, the consumption and production of energy are effectively responsible for 75% of greenhouse gas emissions, thus making it the ultimate driver of climate change. Besides, there has been the development of a pathway for the global energy industry to reach net-zero emissions by mid-century, thus restricting global warming to 1.5 degrees Celsius, as part of the Paris Agreement, thus boosting the market’s exposure.

Challenges

- Cybersecurity risks and data privacy: Systems in the utility communication market are increasingly digital, relying on IoT devices, cloud platforms, and wireless networks. This connectivity exposes utilities to cyberattacks, data breaches, and ransomware threats. A single breach can disrupt power grids, water supply, or chemical plant operations, leading to massive economic and safety consequences. Besides, based on the U.S. Department of Energy, cyber incidents in energy infrastructure have risen steadily, with utilities among the most targeted sectors. The challenge lies in balancing innovation with robust cybersecurity frameworks. Utilities often operate legacy systems that lack modern security protocols, making integration with advanced communication technologies complex.

- High capital expenses and infrastructure investment: Deploying utility communication systems, such as fiber optics, RF mesh networks, and IoT-enabled modules, requires significant upfront investment. For many regions, especially in Latin America and Africa, the cost of modernizing grids and communication infrastructure is prohibitive. Even in developed markets, utilities face budget constraints and competing priorities, such as renewable energy integration and decarbonization. Moreover, administrative agencies are estimating an increase in the global investment by the end of 2030, particularly in smart grids to meet sustainability goals, yet current funding lags. Governments provide subsidies and grants, but these are often insufficient to cover the scale of transformation needed, thus negatively impacting the market.

Utility Communication Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 28.2 billion |

|

Forecast Year Market Size (2035) |

USD 46 billion |

|

Regional Scope |

|

Utility Communication Market Segmentation:

Technology Segment Analysis

The wireless communication sub-segment, which is part of the technology segment, is anticipated to garner the highest share of 50.7% in the utility communication market by the end of 2035. The sub-segment’s upliftment is primarily attributed to fueling increased operational efficiency, real-time remote monitoring, and ensuring smart grid advancements. According to official statistics published by the IIP Series Organization in 2024, Bluetooth is regarded as a short-range wireless technology that effectively functions within a frequency range of 2.4 GHz. Besides, as per an article published by iScience in May 2025, there has been a surge in wireless data traffic, with the International Telecommunication Union (ITU) projecting an increase in the demand for 5G and 6G technology by a factor of 100 by the end of 2030 in comparison to present levels, thereby deliberately bolstering the sub-segment’s exposure globally.

End user Segment Analysis

Based on end user, the electric utilities segment is projected to hold the second-highest share in the market during the forecast period. The segment’s growth is highly driven by the critical need to modernize power distribution networks, integrate renewable energy, and enhance grid reliability. Electric utilities rely heavily on advanced communication systems, such as fiber optics, RF mesh, and IoT-enabled modules, to monitor grid performance, detect faults, and optimize energy flows in real time. Government initiatives play a pivotal role in driving adoption. In the U.S., the Department of Energy (DOE) has invested billions in smart grid modernization programs, while Canada has allocated the majority of its funds in 2023 toward clean energy and power production. Therefore, these investments directly support utility communication infrastructure across different nations.

Application Segment Analysis

By the end of the stipulated timeline, the smart grid sub-segment, part of the application segment, is expected to hold the third-highest share in the market. The sub-segment’s development is highly propelled by the aspect of transforming conventional electricity networks into intelligent, adaptive systems capable of integrating renewable energy, managing demand response, and ensuring resilience against outages. Utility communication technologies, including wireless RF mesh, fiber optics, and IoT-enabled sensors, are essential for smart grid operations. They enable real-time monitoring of grid assets, predictive maintenance, and automated fault detection. According to the DOE’s Grid Modernization Initiative, smart grids reduce outage durations, thereby optimizing reliability and lowering operational expenses.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

End user Industry |

|

|

Application |

|

|

Component |

|

|

Network Type |

|

|

Communication Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Utility Communication Market - Regional Analysis

North America Market Insights

North America in the utility communication market is anticipated to grab the highest share of 36.5% by the end of 2035. The market’s upliftment in the region is highly attributed to an increase in prioritizing smart grid modernization, robust government expenditure, and grid resilience enhancements. Based on government estimates published by the Department of Energy in July 2025, permitting 104 GW of firm generation by the end of 2030, without suitable replacement, tends to result in severe outages. In addition, modelling demonstrates that yearly outage hours can enhance from single digits to more than 800 hours every year. Besides, this particular plant's requirements are significantly replaced by 209 GW of latest generation by the same year, of which 22 GW derives from firm baseload generation sources, thereby making it suitable for boosting the market in the region.

The aspects of DOE funding, smart grid modernization, sustainability programs, EPA green chemistry, NIST-based interoperability and standards, along with the industrial demand from the chemical industry, are fueling the market in the U.S. For instance, in October 2023, the U.S. DOE declared almost USD 3.4 billion in Grid Resilience and Innovation Partnerships Program as an investment for 58 projects in 44 states. The purpose is to effectively strengthen electric grid reliability and resilience across the overall region and deliberately include 16 projects under the Grid Resilience Utility and Industry Grants. Besides, in October 2024, the DOE declared nearly USD 4.2 billion in federal investments for 46 projects across 47 states. The objective is to protect against increased threats of critical weather, thus boosting the market in the country.

Grid Resilience and Innovation Partnership Program Selection in the U.S. (2024)

|

Components |

Amount/Number |

|

Total federal investment |

USD 7.6 billion |

|

Total projects selected |

105 |

|

Miles of transmission affected |

Approximately 2,500 |

|

Jobs supported or developed |

More than 15,000 |

|

Estimated number of customers impacted |

85 million |

Source: Department of Energy

The utility communication market in Canada is growing significantly, owing to the provision of government clean energy investments, renewable and smart city integration programs, safety and environmental regulations, as well as cross-border energy collaboration. As per an article published by the Canada Energy Regulator in May 2024, USD 22.6 billion has been readily spent on in-house research and development by industries in the country, of which 7.5% of USD 1.7 billion has been energy-based. Besides, fossil fuels made up the highest energy share at 32%, despite a decrease in research and development spending. Meanwhile, the Government of Canada is readily focused on achieving net-zero greenhouse gas emissions by the end of 2050. This objective requires a generous investment of USD 520 billion as capital spending, thus making it suitable for bolstering the market.

Europe Market Insights

Europe utility communication market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by modernization in the chemical sector, renewable integration, and smart grid deployment. According to official statistics published by the Europe Environment Agency in November 2025, as of 2024, 25.4% of overall final energy consumed in the region has been obtained from renewable sources, which is almost 1% points more than in 2023. Besides, the renewables share in the region is projected to grow rapidly by catering to the latest minimum regional target for renewable sources of 42.5% by the end of 2030. Moreover, the revised Renewable Energy Directive has increased the binding target for 2030 from 32% to 42.5%, with an aim of gaining 45%, thus creating a huge growth opportunity for the market in the region.

Progress Towards Renewable Energy Source Targets in Europe (2020-2030)

|

Year |

Renewable Energy Share |

|

2020 |

22.0% |

|

2021 |

21.9% |

|

2022 |

23.1% |

|

2023 |

24.6% |

|

2024 |

25.4% |

|

2025 |

28.3% |

|

2026 |

31.1% |

|

2027 |

34.0% |

|

2028 |

36.8% |

|

2029 |

39.7% |

|

2030 |

42.5% |

Source: Europe Environment Agency

The aspect of leadership in energy innovation, an increase in government funding, robust industrial demand, and the generous investment allocation for renewable integration and communication infrastructure are responsible for uplifting the market in Germany. As per an article published by the Clean Energy Wire Organization in December 2025, the country’s estimated 900 energy suppliers are poised to require an additional EUR 68 billion in energy capital for upgrading heating and electricity grids by the end of 2035. Besides, the infrastructure for a climate-neutral energy supply is expected to cost about EUR 627 billion. Moreover, as per the January 2025 EIB Organization article, the Federal Network Agency has noted that €327.7 billion in investment is essential for electricity grid installations across the country by the end of 2045, thereby making it suitable for the market’s expansion.

The utility communication market in the UK is gaining increased exposure due to the presence of strong sustainability policies, the government’s funding contribution for communication technologies and clean energy, and an increase in the Internet of Things (IoT) adoption. As per an article published by Renewables Now in 2024, as of 2023, the government in the country proposed a consultation with energy suppliers and successfully set the latest targets to install smart meters in almost 74.5% households and nearly 69% of small-scale businesses, which has been successfully achieved by the end of 2025. Besides, the domestic virtual power plant (VPP) asset portfolio has grown to over 1 GW, thereby significantly making the country’s largest flexible energy system. Therefore, with such portfolio development, there is a huge growth opportunity for the market in the country.

APAC Market Insights

The Asia Pacific utility communication market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly driven by modernization in the energy industry, an increase in renewable integration, and a surge in smart city projects. According to official statistics published by the IEEFA Organization in June 2024, the potential for solar photovoltaic as well as offshore wind supply as renewable investments in the region represents a USD 1.1 trillion opportunity, of which 75% can be spent among countries readily undertaking these projects. In addition, solar PV power projects demonstrate a huge opportunity to capitalize on the supply chain, with USD 346 billion of localized inputs out of USD 395 billion of investment by the end of 2050, thereby creating a huge growth opportunity for the market in the region.

The aspect of prioritizing smart grid expansion, funding allocations for communication infrastructure, enforcing stringent sustainability mandates, and an effective push to domestic firms in adopting communication technologies are uplifting the market in China. As per an article published by the IEA Organization in 2025, there has been a significant push for smart, storage, and grid infrastructure, as has been observed from USD 88 billion in distribution and transmission investment as of 2025. Meanwhile, the ongoing extension of coal, with exceeded investment, amounting to USD 54 billion in the same year, is also proliferating the market’s exposure in the country. Therefore, to continuously support energy expansion, the government in the country has readily facilitated private participation in over 8,000 suggested projects since 2024.

The utility communication market in India is also gaining increased exposure, owing to an increase in the renewable energy adoption, modernization in the power industry, and the presence of strong government investment opportunities. As stated in an article published by the IBEF Organization in November 2025, the electricity demand in the country has been rising rapidly, with 1,694 billion units of consumed power as of 2025. In addition, this denotes a 33% upsurge than 2021, further demonstrating a 5-year growth rate of 7.4%. Besides, the peak power demand is projected to reach 277 GW as of 2026, and the overall energy demand is anticipated to grow at 6% to 6.5% yearly for the upcoming 5 years, deliberately underscoring the scale of risks and opportunities for the industry, thereby enhancing the market’s growth opportunity in the overall nation.

Key Utility Communication Market Players:

- Siemens AG (Germany)

- ABB Ltd. (Switzerland)

- Schneider Electric SE (France)

- General Electric Company (U.S.)

- Cisco Systems, Inc. (U.S.)

- Motorola Solutions, Inc. (U.S.)

- Eaton Corporation plc (Ireland)

- Honeywell International Inc. (U.S.)

- Mitsubishi Electric Corporation (Japan)

- Hitachi, Ltd. (Japan)

- NEC Corporation (Japan)

- Toshiba Corporation (Japan)

- Huawei Technologies Co., Ltd. (China)

- Samsung Electronics Co., Ltd. (South Korea)

- LG Electronics Inc. (South Korea)

- Infosys Limited (India)

- Tech Mahindra Limited (India)

- Telstra Corporation Limited (Australia)

- Telekom Malaysia Berhad (Malaysia)

- BT Group plc (UK)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- Siemens AG is a leading player in utility communication, offering advanced smart grid and digital communication solutions. The company invests heavily in IoT-enabled platforms and grid automation technologies, positioning itself as a key driver of Europe’s utility modernization initiatives.

- ABB Ltd. focuses on integrated communication systems for power distribution and renewable integration. Its strong presence in automation and grid connectivity solutions makes it a critical partner for utilities seeking efficiency and sustainability in communication infrastructure.

- Schneider Electric SE emphasizes sustainable utility communication through smart metering, demand response, and energy management systems. The company’s EcoStruxure platform enhances interoperability, enabling utilities to optimize communication networks across diverse energy systems.

- General Electric Company provides robust utility communication technologies, particularly in grid monitoring and industrial communication modules. GE’s investments in AI-driven predictive analytics and renewable integration strengthen its role in North America’s utility communication landscape.

- Cisco Systems, Inc. leverages its expertise in networking and cybersecurity to deliver secure utility communication solutions. Its focus on IoT-enabled communication modules and cloud-based platforms supports utilities in achieving resilience and efficiency in digital grid ecosystems.

Here is a list of key players operating in the global market:

The international utility communication market is highly competitive, dominated by multinational corporations leveraging scale, innovation, and government partnerships. Notable players such as Siemens, ABB, and Schneider Electric focus on digital utility ecosystems, while U.S. firms, such as Cisco and GE, invest in IoT-enabled communication modules. Meanwhile, Asia-specific manufacturers, including Mitsubishi, Samsung, and Infosys, are expanding rapidly through smart grid projects and renewable integration. Strategic initiatives include mergers, R&D investments in power technologies, and collaborations with governments under sustainability programs. Besides, in September 2025, Vision Ridge Partners announced its acquisition of FortisTCI Ltd., along with rebranding as Pelican Energy TCI. This readily reflects its renewed focus on developing a resilient and sustainable energy future, thus suitable for uplifting the utility communication industry globally.

Corporate Landscape of the Utility Communication Market:

Recent Developments

- In December 2025, MacLean Power Systems and Power Grid Components declared the signing of a suitable agreement to recapitalize and merge MPS, based on the current financial sponsor and funds affiliated with Blackstone Energy Transition Partners, as well as its flagship private equity strategy.

- In October 2025, ALLETE, Inc. notified that it has obtained the regulatory acceptance from Minnesota Public Utilities Commission for partnering with CPP investments and international infrastructure partners.

- In February 2025, VertiGIS announced the launch of VertiGIS ConnectMaster for ArcGIS, which is a cutting-edge platform designed to transform the management process of telecommunications network operators and utilities for handling their network inventory and operations.

- Report ID: 8390

- Published Date: Feb 10, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Utility Communication Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.