Smart Gas Market Outlook:

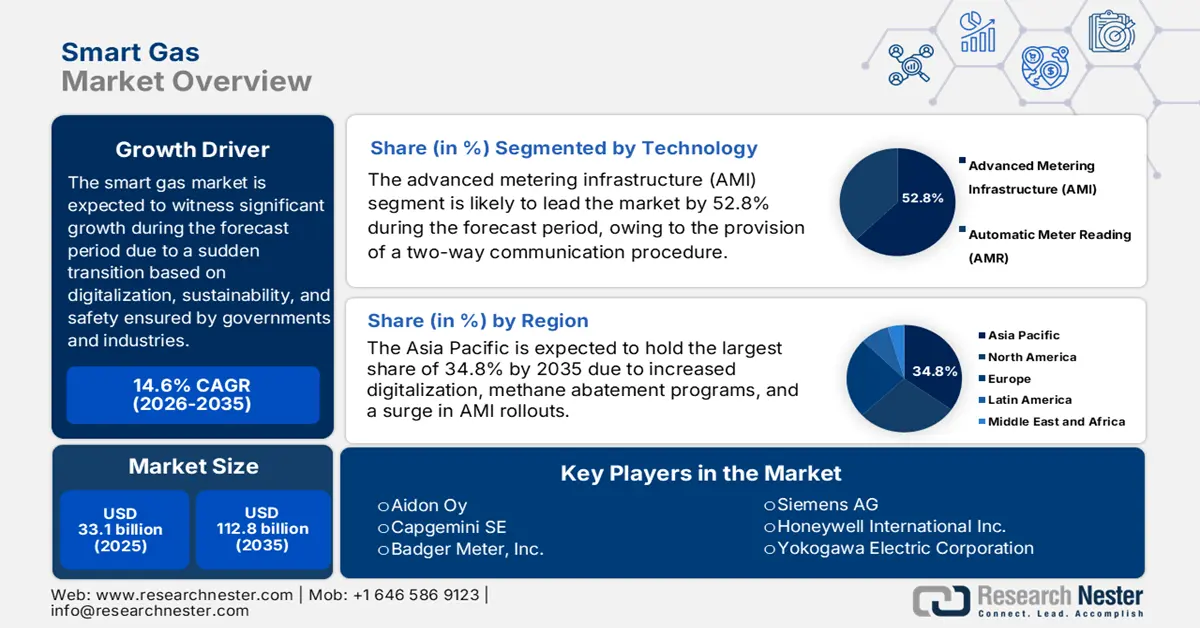

Smart Gas Market size was over USD 33.1 billion in 2025 and is estimated to reach USD 112.8 billion by the end of 2035, expanding at a CAGR of 14.6% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of smart gas is estimated at USD 37.9 billion.

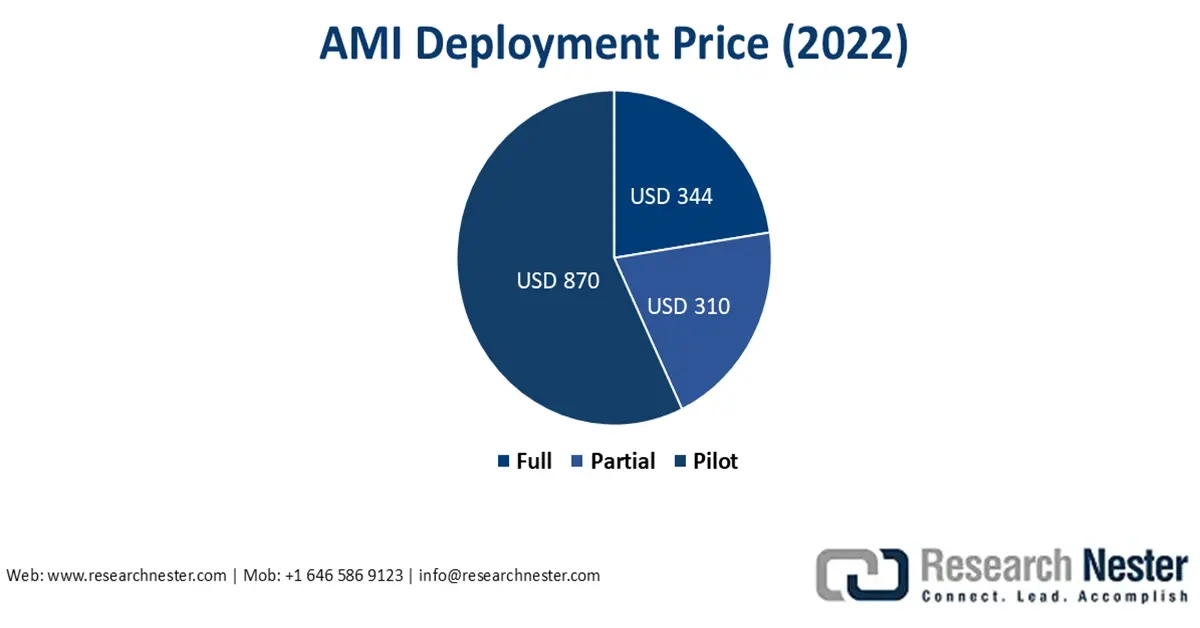

The international smart gas market is readily undergoing a standard shift, since industries, governments, and utilities are embracing safety, sustainability, and digitalization. Besides, smart gas solutions, including cloud-based analytics, IoT-enabled leak detection, and advanced metering infrastructure (AMI), are extremely essential for consumer empowerment, regulatory compliance, and energy efficiency. According to a data report published by the Grid Works Organization in March 2022, 16 states in the U.S. comprise smart meter penetrations, which are gradually exceeding 50%. In addition, the AMI penetration has been continuously growing by 4% to 5% year, with 115 million smart meters significantly deployed, and 75% of households having s smart meter. Besides, the overall price of AMI deployment globally varies from utility to utility based on meter device, communications, data management, and others, thus making it suitable for boosting the market internationally.

Source: Grid Works Organization

Furthermore, Internet of Things (IoT) integration, cloud-based analytics, consumer empowerment, increased focus on cybersecurity, and hybrid deployment models are other factors driving the smart gas market globally. As per an article published by the IMC Organization in March 2024, internationally, IoT connections are projected to reach 40 billion by the end of 2033. In addition, by the end of 2023, there has been 16.1 billion active IoT devices, which is eventually predicted to increase to 39.9 billion, along with a 10% growth rate in 2033. Besides, the yearly device sales are expected to grow from 4.1 billion in 2023 to 8.7 billion, based on an 8% growth rate. Moreover, short-range-based technologies are projected to dominate connections, constituting 73% by the end of 2033, thereby denoting a huge growth opportunity for the smart gas market across different nations.

Yearly International IoT Connections Growth Internationally (2023-2033)

|

Year |

Growth Rate |

|

2023 |

16.1% |

|

2024 |

18.2% |

|

2025 |

20.4% |

|

2026 |

22.7% |

|

2027 |

25.0% |

|

2028 |

27.5% |

|

2029 |

30.0% |

|

2030 |

32.5% |

|

2031 |

35.0% |

|

2032 |

37.5% |

|

2033 |

39.9% |

Source: IMC Organization

Key Smart Gas Market Insights Summary:

Regional Highlights:

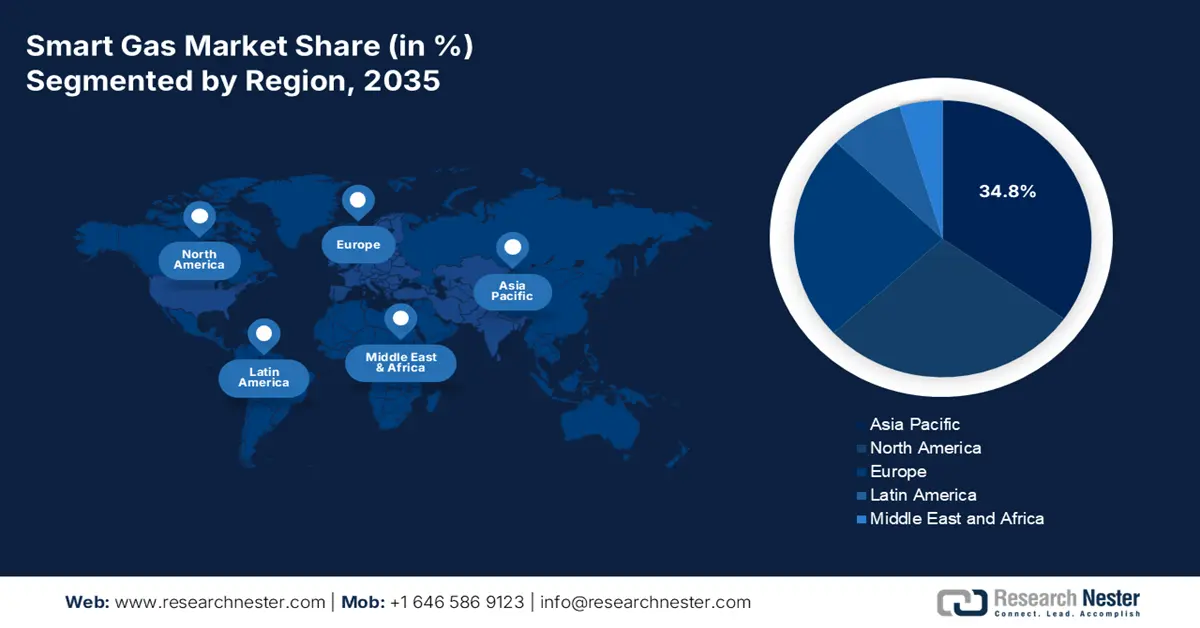

- Asia Pacific is expected to capture a commanding 34.8% share by 2035 in the smart gas market, supported by widespread industrial digitalization, methane abatement initiatives, and expanding AMI deployments driven by stricter emission-reduction imperatives in the oil and gas sector.

- Europe is projected to be the fastest-growing region by 2035, benefitting from interoperable utility data platforms, advanced leak-detection systems, and sustainability-led AMI adoption stimulated by the region’s climate-neutral 2050 agenda.

Segment Insights:

- Advanced Metering Infrastructure (AMI) under the technology segment is anticipated to account for a substantial 52.8% share by 2035 in the smart gas market, reflecting its effectiveness in enabling two-way communication, real-time monitoring, and network efficiency accelerated by mandatory smart utility infrastructure policies.

- Radio Frequency within the communication segment is forecast to represent the second-largest share by 2035, highlighting its role in wireless data transmission, remote monitoring, and automated billing strengthened by growing adoption of flexible and durable sensor technologies.

Key Growth Trends:

- Focus on energy efficiency objectives

- Increase in smart cities and urbanization

Major Challenges:

- Increase in cybersecurity risks

- Surge in regulatory fragmentation

Key Players: Aidon Oy, Capgemini SE, Badger Meter, Inc., Siemens AG, Honeywell International Inc.

Global Smart Gas Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 33.1 billion

- 2026 Market Size: USD 37.9 billion

- Projected Market Size: USD 112.8 billion by 2035

- Growth Forecasts: 14.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.8% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Australia, Canada, France

Last updated on : 23 December, 2025

Smart Gas Market - Growth Drivers and Challenges

Growth Drivers

- Focus on energy efficiency objectives: The presence of emission reduction targets and national climate policies is readily driving the adoption of leak detection and demand-based systems, which is fueling the smart gas market’s growth internationally. According to an article published by the IEA Organization in November 2025, the international primary energy intensity, which is the ultimate metric for tracking efficiency, depends on a 1.8% improvement, denoting a rise from only 1% as of 2024. Besides, China has issued the 2024-2025 Energy Conservation and Carbon Reduction Action Plan for optimizing national energy intensity by 2.5%, with an increased goal of 3.5%, particularly in large-scale industries. Further, there has been an escalation in the energy intensity from 0.8% per year to almost 1.8% by 2022, thereby denoting a growth opportunity for the market.

- Increase in smart cities and urbanization: An increase in urban growth, particularly in APAC, has accelerated the need for integrated smart utility infrastructure, denoting a positive outlook for the smart gas market internationally. As per a data report published by the UN-Habitat Organization in September 2024, urban locations hosted 57% of the world’s population as of 2023. This, however, is expected to increase to 68% by the end of 2030. Besides, cities are readily contributing to uplifting the international expenditure on digitalized transformation, which successfully reached USD 1.8 trillion back in 2022. Moreover, the smart city technologies market is forecasted to grow rapidly from USD 121 billion to USD 301 billion by the end of 2032, thereby making it suitable for bolstering the market’s exposure.

- Surge in industrial modernization: The existence of manufacturing and chemical sectors is generating significant investment in smart gas systems to cater to compliance and safety standards. As per an article published by the IEA Organization in June 2025, international energy investment is projected to increase by the end of 2025, amounting to a record USD 3.3 trillion. In addition, investment in clean technologies, such as electrification, efficiency, low-emissions fuels, storage, grids, nuclear, and renewables, is projected to hit USD 2.2 trillion by the end of the same year. Simultaneously, investment in coal, natural gas, and oil is also set to amount to USD 1.1 trillion. Therefore, with all these investments, the smart gas market is poised to experience continuous growth across different nations.

Challenges

- Increase in cybersecurity risks: Systems in the smart gas market depend on interconnected IoT devices, cloud platforms, and two-way communication networks, making them vulnerable to cyberattacks. Hackers targeting metering infrastructure can manipulate consumption data, disrupt billing, or even compromise safety by disabling leak detection systems. Utilities face increasing pressure to secure data flows, especially as consumer privacy regulations tighten. The challenge is compounded by legacy infrastructure that was not designed for digital integration, creating weak points in the network. Cybersecurity investments, such as encryption, intrusion detection, and secure communication protocols, add high costs and complexity, thus negatively impacting the market’s growth.

- Surge in regulatory fragmentation: The smart gas market operates across diverse regulatory environments, with varying mandates for metering, data privacy, and emissions monitoring. In Europe, regional mandates smart meter rollouts, but implementation differs by member state, creating inconsistencies in adoption timelines and technical standards. In North America, federal and state-level policies diverge, complicating utility compliance. APAC markets face similar fragmentation, with countries like China enforcing strict efficiency targets while others lag in regulatory enforcement. This patchwork of rules increases costs for manufacturers and utilities, who must customize solutions for each jurisdiction. Regulatory uncertainty also discourages investment, as utilities hesitate to commit capital without clear long-term mandates, thereby causing a hindrance in the market’s expansion.

Smart Gas Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14.6% |

|

Base Year Market Size (2025) |

USD 33.1 billion |

|

Forecast Year Market Size (2035) |

USD 112.8 billion |

|

Regional Scope |

|

Smart Gas Market Segmentation:

Technology Segment Analysis

The advanced metering infrastructure (AMI) segment, which is part of technology, is anticipated to garner the largest share of 52.8% in the smart gas market by the end of 2035. The segment’s growth is highly fueled by its ability to enable a two-way communication between utilities and consumers, allowing real-time monitoring, leak detection, and demand-response capabilities. This functionality is critical for modern gas distribution networks, where efficiency, safety, and sustainability are paramount. Furthermore, the growth of AMI is driven by government mandates for smart utility infrastructure, particularly in North America, Europe, and Asia-Pacific. In addition, regulators in these regions deliberately require utilities to adopt advanced metering systems to improve transparency and reduce emissions. Therefore, with these capabilities, there is a huge growth opportunity for the segment, which is uplifting the market’s exposure internationally.

Communication Segment Analysis

By the end of the forecast period, the radio frequency sub-segment, part of the communication segment, is projected to cater to the second-largest share in the smart gas market. The sub-segment’s growth is highly uplifted by its importance to enable wireless data transmission, facilitate remote monitoring, and eliminate manual readings. This, in turn, leads to rapid billing, lowered utility losses, and optimized consumer service through real-time consumption insights. According to an article published by Environment International in May 2024, the technological applications of radiofrequency electromagnetic fields usually range between 100 kHz to 300 GHz. Based on this, and as stated in the November 2024 NLM article, flexible sensors are readily able to withstand mechanical deformation, with more than 10 m−1 bending curvature or over 1% strain, without device failure.

Deployment Segment Analysis

Based on the deployment segment, the cloud-based sub-segment in the smart gas market is expected to account for the third-largest share during the stipulated duration. The sub-segment’s development is extremely fueled by its provision of essential accessibility, computational power, and scalability. These are necessary for managing massive datasets that are generated by smart devices, enabling operational efficiency, enhancing safety, and real-time analytics. As per an article published by the IBEF Organization in June 2023, the data center sector in India is worth USD 4.4 billion, which is projected to rise by USD 8.0 billion in the upcoming years. Besides, the domestic public cloud services industry is projected to reach USD 13.5 billion, along with a 24% growth rate. Therefore, this has resulted in a huge focus on implementing big data and IoT for data collection and storage thus denoting an optimistic outlook for the segment.

Our in-depth analysis of the global smart gas market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Communication |

|

|

Deployment |

|

|

Application |

|

|

Type |

|

|

Meter Data |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Gas Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the smart gas market is anticipated to garner the largest share of 34.8% by the end of 2035. The market’s upliftment in the region is extremely driven by industrial digitalization at scale, methane abatement programs, and increased AMI rollouts. According to an article published by the Climate and Clean Air Coalition in 2025, the energy demand in the Association of Southeast Asia Nations (ASEAN) is expected to reach an estimated 1,282 Mtoe, with gas and oil catering to 47% of the mix. In addition, it has also been predicted that energy-based GHG emissions are expected to reach 4,503 Mt CO2-eq by the end of 2050. Likewise, within this particular emissions mix, methane accounts for 15.2%, thereby making it the second largest pollutant in ASEAN. Besides, of these, the oil and gas industry has been regarded as the largest contributor, accounting for 53.2%, thereby bolstering the market’s growth in the region.

China in the smart gas market is growing significantly, owing to the presence of dual-control and efficiency regimes, increased AMI deployments, and massive utility networks. As per an article published by the Journal of Power Sources in February 2025, the country’s solar and wind power generation readily accounted for 37% and 40% of the international total. Besides, the country is considered the world’s largest carbon emitter, accounting for an estimated 29% of the world’s total. For instance, China’s installed wind power capacity has reached 330 GW, along with the solar power capacity reaching 310 GW. In this regard, both these power generation across 30 provinces of the country increased from 02.8 billion kWh and 3.5 billion kWh to 655.8 billion kWh and 325.4 billion kWh, respectively. Therefore, with increased focus on energy efficiency, there is a huge growth opportunity for the market in the country.

India in the smart gas market is also growing due to green hydrogen investment, CCUS research and development upscaling, and industrial decarbonization. The Department of Science & Technology has also launched the national research and developmental program in 2025 for coordinating infrastructure, industrial pilots, and research that demand precision metering. As stated in an article published by the Ministry of New and Renewable Energy in December 2025, two crucial financial incentive mechanisms have been proposed with ₹ 17,490 crore by the end of 2030, with a focus on the intensive manufacturing of electrolysers and producing green hydrogen. Moreover, an outlay of ₹455 crore for low-carbon steel projects, along with ₹496 crore for mobility pilot projects, and ₹115 crore for shipping pilot projects, has been allocated, thus boosting the smart gas market in the country.

Europe Market Insights

Europe in the smart gas market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly fueled by interoperable data platforms across industrial and utilities sites, leak detection, digitalized mandates driving AMI deployment, chemical sustainability, and the regional climate-neutral 2050 objective. According to an article published by Fraunhofer ICT in 2025, the PLANETS project in the region received EUR 14.5 million for demonstrating the applicability of the SSbD Draft Framework. The ultimate purpose is to develop technical alternatives for 3 essential molecule classes in the chemical industry, including surfactants, flame retardants, and plasticizers. Moreover, as per the May 2022 NLM article, public inventories estimated approximately 355,000 chemicals that have been registered for utilization and production, with an estimated 69,000 chemicals in commerce, thereby making it suitable for uplifting the market in the region.

Germany in the smart gas market is gaining increased traction due to sustained digitalization, the energy-intensive chemical and pharma industry, and a massive industrial base under the regional market and climate frameworks. As per an article published by ITA in August 2025, the country has a target for 80% of its overall electricity supply to originate from renewables by the end of 2030, and also gained 59% as of 2024. In addition, the country has planned to lower its greenhouse gas emissions by 65% within the same year, with its ultimate objective to achieve carbon neutrality by 2045. Besides, the country’s government has revealed plans to set aside USD 11.3 billion by 2030 to readily subsidize electricity prices for energy-based sectors to shield businesses from increased electricity prices, particularly for energy-based organizations, thus catering to the market’s growth.

Poland in the smart gas market is also developing, owing to the policy clarity on energy transition, grid modernization, and substantial gas system throughput. Additionally, national energy transformation approaches have set a long-lasting path for facility investment, offering support for AMI analytics, interoperability, and rollouts across industrial and transmission facilities. As per an article published by the Energy Transition Organization in April 2023, the installed photovoltaic capacity has reached 11 GW by the end of August 2022 in the country, denoting an over 84% enhancement from the previous year. Moreover, the solar production in the country is projected to increase by almost 20 GW by the end of 2030, especially in the newest solar sources, along with the production potential of 21 TWh every year, and more than 14 GW in the latest onshore wind farms, with a 37 TWh production potential per year.

North America Market Insights

North America's smart gas market is projected to witness considerable growth by the end of the stipulated period. The market’s growth in the region is highly propelled by the chemical value chain, safety modernization across utilities, digitalized metering rollouts, and the presence of methane reduction mandates. According to an article published by the EPA Government in December 2024, the U.S. Environmental Protection Agency and the U.S. Department of Energy declared an estimated USD 850 million for 43 selected projects to assist small oil and gas operators, tribes, and other entities across the nation to monitor, measure, diminish, and quantify methane emissions from the oil and gas industry. Moreover, there has been the allocation of USD 350 million in grant funding by the EPA and DOE to support industrial efforts for reducing emissions at low-producing wells, conduct environmental restoration, and ensure monitor emissions, and conduct environmental restoration.

The smart gas market in the U.S. is gaining increased exposure, owing to methane abatement, programmatic support, industrial alignment, federal budget provision, and the presence of governmental programs. As per a report published by the U.S. Department of Energy in March 2023, the DOE has readily proposed USD 51.9 billion in budget authority as of 2024, denoting USD 6.2 billion or a 13.6% increase from the 2023 Enacted Level. Besides, the Budget has provided a generous investment of USD 8.8 billion for the Office of Science for making advancements towards the authorized level in the CHIPS and Science Act for supporting next-generation research. Furthermore, with the funding for Science, the Budget offers more than USD 1 billion to support the objective of gaining fusion on the decadal timescale. Besides, the Budget also invested nearly USD 2 billion to support the clean energy workforce as well as infrastructure projects across the country, thus suitable for boosting the market.

DOE Budget Provision by Program in the U.S. (2024)

|

Program Type |

Funding Amount and Rate |

|

Fossil Energy and Carbon Management |

USD 0.9 billion and 2% |

|

Nuclear Energy |

USD 1.5 billion and 3% |

|

Energy Efficiency and Renewable Energy |

USD 3.8 billion and 7% |

|

Environmental Management |

USD 8.7 billion and 17% |

|

Office of Science |

USD 8.8 billion and 17% |

|

National Nuclear Security Administration |

USD 23.8 billion and 46% |

|

Cybersecurity, Energy Security, and Emergency Response |

USD 0.5 billion and 1% |

|

All other programs |

USD 3.2 billion and 6% |

Source: U.S. DOE

The smart gas market in Canada is also growing due to the presence of emissions reduction and federal clean energy programs, utility modernization and smart city strategies, industrial and chemical demand, along with safety and environmental regulations. As stated in an article published by the Government of Canada in March 2023, the country’s government declared suitable support, comprising almost USD 100 million, to reduce the carbon footprint and optimize worker safety at BHP’s USD 7.5 billion. Additionally, in Ontario, Umicore notified its plan to invest USD 1.5 billion in a net-zero infrastructure for producing crucial electric vehicle battery components. Besides, in Quebec, Rio Tinto Fer et Titane declared its plans to bolster the production of critical minerals, reduce emissions, and assist in building clean technology supply chains through USD 222 million in federal funding.

Key Smart Gas Market Players:

- ABB Ltd. (Switzerland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Elster Group GmbH (Germany)

- General Electric Company (U.S.)

- Itron, Inc. (U.S.)

- Schneider Electric SE (France)

- Oracle Corporation (U.S.)

- Sensus, a Xylem brand (U.S.)

- CGI Inc. (Canada)

- Aclara Technologies LLC (U.S.)

- Aidon Oy (Finland)

- Capgemini SE (France)

- Badger Meter, Inc. (U.S.)

- Siemens AG (Germany)

- Honeywell International Inc. (U.S.)

- Yokogawa Electric Corporation (Japan)

- Hitachi, Ltd. (Japan)

- Samsung Engineering Co., Ltd. (South Korea)

- Larsen & Toubro Limited (India)

- Schneider Electric Malaysia Sdn. Bhd. (Malaysia)

- Schneider Electric Australia Pty Ltd. (Australia)

- ABB Ltd. offers advanced automation and SCADA solutions for gas distribution networks, enabling real-time monitoring, leak detection, and operational efficiency. Recent partnerships, such as with THINK Gas in India, have demonstrated ABB’s ability to reduce operational costs by up to 60% through digitalization.

- Elster Group GmbH, currently part of Honeywell, is one of the international leaders in gas metering, regulation, and flow measurement systems. Its smart gas solutions deliver operational efficiencies and improved customer service, making it a key player in utility modernization.

- General Electric Company is recognized as a major player in the smart gas market, offering integrated solutions that combine metering, grid management, and industrial IoT. Its presence in global smart gas market reports highlights GE’s role in advancing smart infrastructure and energy efficiency.

- Itron, Inc. specializes in AMR and AMI smart gas meters, with its Intelis ultrasonic meters leading the industry in safety and leak detection. The company partners with utilities worldwide to support decarbonization and improve visibility across gas distribution networks.

- Schneider Electric SE is focused on digital transformation in the energy and chemical industries, integrating smart automation, AI, and data-driven insights. Its solutions reduce energy usage by up to 10% and unplanned downtime by 15%, strengthening resilience in smart gas operations.

Here is a list of key players operating in the global market:

The international smart gas market is extremely competitive, with notable players from the U.S., Europe, and Asia-Pacific, readily driving innovation through advanced metering infrastructure (AMI), IoT integration, and cloud-based analytics. Companies such as ABB, Siemens, and Itron are expanding their portfolios via strategic partnerships, mergers, and acquisitions, while Asian firms like Hitachi and Samsung Engineering focus on regional expansion and government-backed sustainability programs. U.S. players, including Honeywell and Oracle, leverage digital platforms and cybersecurity frameworks to strengthen market positioning. Besides, in January 2024, Samsung Electronics declared that it has teamed up with British Gas for enabling consumers to effectively manage energy utilization in homes, particularly in Britain. This specific strategy denotes the expansion of SmartThings Energy for integrating British Gas’ PeakSave incentive program, thereby boosting the smart gas market’s growth globally.

Corporate Landscape of the Smart Gas Market:

Recent Developments

- In December 2025, Vi Business made an expansion of its Advanced Metering Infrastructure (AMI) portfolio with Smart Gas Metering solutions for the City Gas Distributions (CGDs) for strengthening its commitment to support the Government’s approach for modernizing utility infrastructure.

- In February 2025, Polaris Smart Metering Pvt. Ltd targeted its leadership in India by capturing almost 50% share of the smart gas metering market, with the ultimate objective of exporting its products.

- In March 2023, Indraprastha Gas Limited (ICL) and Genesis Gas Solutions Private Limited notified their joint venture agreement to build India’s first-ever Integrated Smart Meter Manufacturing Plant, with a capital spending of Rs. 1100 million.

- Report ID: 3391

- Published Date: Dec 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Gas Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.