Smart Inverter Market Outlook:

Smart Inverter Market size was over USD 13.9 billion in 2025 and is estimated to reach USD 47.7 billion by the end of 2035, expanding at a CAGR of 14.7% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of smart inverter is estimated at USD 15.9 billion.

The international smart inverter market is gradually entering a transformative phase, which is shaped by distinct market drivers, including sustainability and digitalization, along with factors such as industrial demand and policy incentives. According to official statistics published by Energy Strategy Reviews in May 2023, power effectively constituted 18% of worldwide energy demand, thus making it pivotal to nations’ economic competitiveness and social well-being. Besides, developing countries constitute a 3% electricity demand expansion rate, highly attributed to service rendering, industrial output, and income levels. Simultaneously, developed countries account for a modest electricity demand increase rate of 0.7%, which is fueled by electrification and digitalization, with an eventual migration towards a carbon-free electricity supply mix, thus boosting the market’s exposure.

Furthermore, the IoT connectivity and digital integration, decentralized energy systems, ESG and sustainability alignment, hybridization with storage, along with increased focus on cybersecurity, are other trends that are responsible for uplifting the market globally. As stated in an article published by the IEA Organization in 2026, there has been an increase in grid-based investment in digitalized technologies by more than 50%, and this further reached 19% of overall grid investment as of 2023. In addition, there has also been a significant upswing in investments for the electric vehicle charging facilities, which doubled in 2022. Besides, digital technologies are directly responsible for nearly 2% of energy-based greenhouse gas emissions. Moreover, connected devices, data transmission networks, and data centers significantly underpinning digitalization, accounted for nearly 330 million tons, thus boosting the market’s exposure globally.

International Digitally-Enabled Automated Devices Stock Analysis (2012-2022)

|

Years |

Sensors and Other IoT (Billion) |

Smart Meters (Billion) |

Lighting (Billion) |

Audio (Billion) |

Appliances (Billion) |

Other (Billion) |

|

2012 |

0.24 |

0.32 |

- |

- |

- |

- |

|

2013 |

0.46 |

0.42 |

- |

- |

- |

- |

|

2014 |

0.81 |

0.54 |

0.01 |

- |

- |

- |

|

2015 |

1.31 |

0.60 |

0.02 |

- |

- |

- |

|

2016 |

1.92 |

0.69 |

0.06 |

- |

- |

0.01 |

|

2017 |

2.59 |

0.77 |

0.13 |

0.02 |

- |

0.01 |

|

2018 |

3.35 |

0.86 |

0.23 |

0.06 |

0.01 |

0.03 |

|

2019 |

4.21 |

0.94 |

0.39 |

0.11 |

0.03 |

0.06 |

|

2020 |

5.21 |

1.02 |

0.60 |

0.16 |

0.06 |

0.10 |

|

2021 |

6.44 |

1.07 |

0.85 |

0.20 |

0.13 |

0.16 |

|

2022 |

7.98 |

1.12 |

1.14 |

0.25 |

0.26 |

0.25 |

Source: IEA Organization

Key Smart Inverter Market Insights Summary:

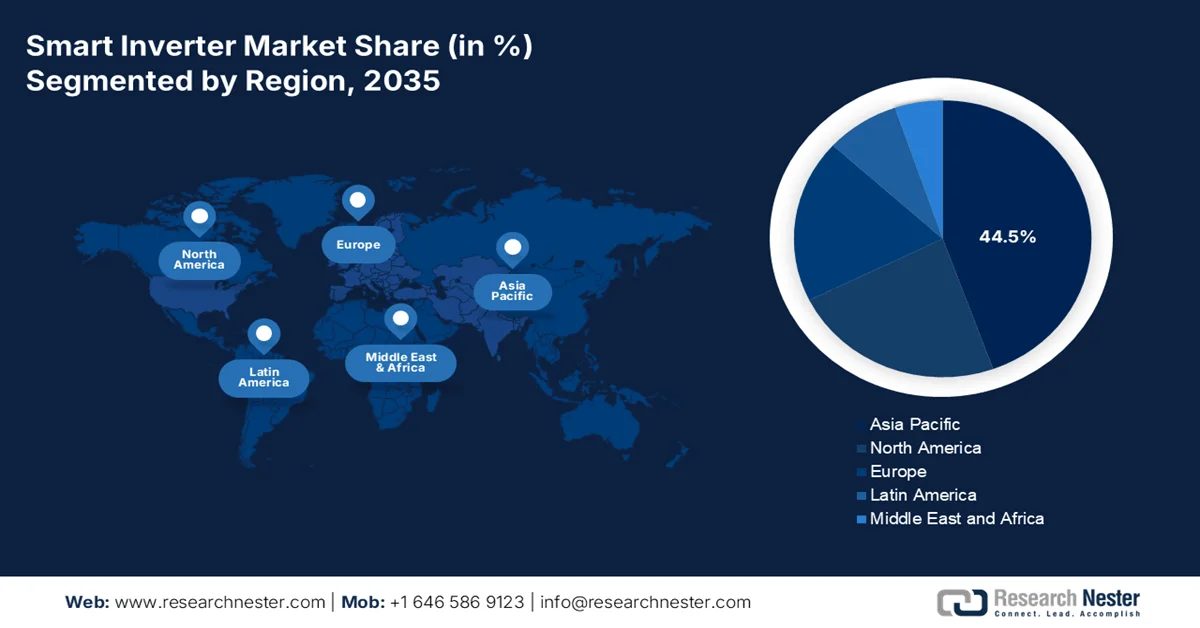

Regional Highlights:

- Asia Pacific is projected to hold a 44.5% share by 2035 in the smart inverter market, strengthened by government-funded sustainability initiatives, semiconductor innovation, and ambitious renewable energy targets.

- Europe is expected to emerge as the fastest-growing region over the forecast period 2026–2035, accelerated by rising investments in advanced clean energy technologies and stringent regional sustainability programs.

Segment Insights:

- The string inverters segment is estimated to account for a 40.4% share by 2035 in the smart inverter market, supported by its affordability and suitability as a centralized power conversion solution in modern solar systems.

- The utility-scale solar projects sub-segment is anticipated to secure the second-largest share by the end of 2035, fueled by the growing deployment of large grid-connected solar farms requiring advanced inverter functionalities.

Key Growth Trends:

- Rise in energy demand

- Increase in electrification

Major Challenges:

- Grid compatibility and regulatory complexity

- Cybersecurity risks and data privacy concerns

Key Players: Huawei Technologies Co., Ltd., Sungrow Power Supply Co., Ltd., Delta Electronics, Inc., SMA Solar Technology AG, ABB Ltd., Schneider Electric SE, General Electric Company, Emerson Electric Co., Eaton Corporation plc., Toshiba Corporation, Panasonic Corporation, Mitsubishi Electric Corporation, Hitachi Energy Ltd., Hyundai Electric & Energy Systems Co., Ltd., LG Electronics Inc., TMEIC Corporation.

Global Smart Inverter Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13.9 billion

- 2026 Market Size: USD 15.9 billion

- Projected Market Size: USD 47.7 billion by 2035

- Growth Forecasts: 14.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: Vietnam, Thailand, Indonesia, Brazil, Mexico

Last updated on : 5 February, 2026

Smart Inverter Market - Growth Drivers and Challenges

Growth Drivers

- Rise in energy demand: The aspect of rapid industrialization in Africa and the Asia Pacific is readily fueling the need for reliable power solutions, thus making the market extremely crucial for grid stability. According to official statistics published by the IEA Organization in 2025, the international energy demand grew by 2.2% as of 2024, denoting a notably faster rate than the yearly average of 1.3% as of 2023. This growth is owing to the effect of severe weather, which has been estimated to add 0.3% points. Despite this, there has been an increase in the energy requirement, which gradually extended by 3.2% as of 2024, close to its long-lasting average. Therefore, with this continuous growth in the energy requirement, there is a huge growth opportunity for the market internationally.

- Increase in electrification: The presence of chemical and manufacturing industries is readily integrating smart inverters to meet sustainability and efficiency objectives, supported by investments in innovative semiconductor materials. Based on government estimates published by the Department of Energy in December 2024, data centers in the U.S. significantly consumed nearly 4.4% of the overall electricity as of 2023 and are projected to consume roughly 6.7% to 12.0% of the overall domestic electricity by the end of 2028. In addition, there has been an ongoing surge in the overall data center electricity utilization from 58 TWh to 176 TWh as of 2023, and it is further anticipated to increase between 325 TWh and 580 TWh by the end of 2028, thus proliferating the market’s growth and development.

- Surge in utility-based renewable projects: The existence of large-scale wind and solar farms requires innovative inverter technologies for grid integration, driving the market’s demand across regions, such as the Middle East, India, and China. As stated in an article published by the IEA Organization in 2026, the international capacity is projected to more than double by the end of 2030, increasing by 4,600 GW. Besides, solar PV readily accounts for nearly 80% of the worldwide increase, which is followed by geothermal, bioenergy, hydropower, and wind. Additionally, across over 80% of nations globally, the renewable power capacity is expected to increase rapidly between 2025 and 2030, thereby making it suitable for bolstering the market’s expansion across different nations.

Challenges:

- Grid compatibility and regulatory complexity: The smart inverter market is designed to provide advanced grid-support functionalities, but its deployment often faces challenges due to varying regulatory frameworks and grid compatibility issues. Different countries and regions have unique grid codes, safety standards, and compliance requirements, making it difficult for manufacturers to design universally compatible products. For instance, while Europe emphasizes strict grid integration standards under the Green Deal, emerging markets may lack clear regulatory frameworks, leading to delays in deployment. This regulatory fragmentation increases expenses for manufacturers, who must customize products for different markets. Moreover, grid operators are often cautious about integrating new technologies, fearing instability or cybersecurity risks.

- Cybersecurity risks and data privacy concerns: As the smart inverter market becomes increasingly connected through IoT and cloud platforms, cybersecurity risks emerge as a critical challenge. These devices collect and transmit real-time data on energy usage, grid performance, and system health, making them potential targets for cyberattacks. A breach could disrupt grid stability, compromise consumer data, or even cause widespread outages. Utilities and regulators are particularly concerned about vulnerabilities in large-scale deployments, where a single attack could affect thousands of households or industrial facilities. Data privacy is another concern, as smart inverters often integrate with smart home systems, exposing sensitive consumer information.

Smart Inverter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14.7% |

|

Base Year Market Size (2025) |

USD 13.9 billion |

|

Forecast Year Market Size (2035) |

USD 47.7 billion |

|

Regional Scope |

|

Smart Inverter Market Segmentation:

Product Type Segment Analysis

The string inverters segment, which is part of the product type, is anticipated to hold the largest share of 40.4% in the smart inverter market by the end of 2035. The segment’s upliftment is highly attributed to its ability to act as the highly affordable component in modernized solar energy systems, further acting as the centralized facility that tends to convert direct current electricity produced by solar panels. For instance, in October 2025, GoodWe significantly unveiled its latest 50 kW industrial and commercial string inverter, regarded as the newest addition to its SDT series. This particular inverter has been designed for small-scale applications, deliberately catering to the international demand for easy-to-install, high-performance, and quiet solutions. Therefore, based on organizational contributions, there is a huge growth opportunity for the segment across different nations.

Application Segment Analysis

By the end of the forecast duration, the utility-scale solar projects sub-segment, part of the application segment, is projected to garner the second-largest share in the smart inverter market. The sub-segment’s growth is highly driven by the aspect of these projects comprising large-scale solar farms connected directly to national or regional grids, requiring advanced inverter technologies to ensure stability, efficiency, and compliance with grid codes. Smart inverters in this segment provide critical functionalities such as reactive power support, voltage regulation, and frequency response, which are essential for integrating intermittent renewable energy into existing infrastructure. Besides, governments worldwide are prioritizing utility-scale solar as part of their decarbonization strategies, thus boosting the sub-segment’s exposure.

Communication Technology Segment Analysis

The cloud or IoT-enabled inverters segment in the smart inverter market is expected to account for the third-largest share during the stipulated timeline. The segment’s development is primarily attributed to leveraging cloud platforms and IoT connectivity to enable real-time monitoring, predictive maintenance, and AI-driven optimization. This connectivity allows utilities, industrial operators, and residential users to remotely track performance, detect faults, and optimize energy flows, significantly improving efficiency and reducing operational costs. Moreover, the rise of smart grids and digital energy ecosystems is fueling adoption, thus denoting a positive outlook for the segment’s growth.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Application |

|

|

Communication Technology |

|

|

Phase |

|

|

End user |

|

|

Power Rating |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Inverter Market - Regional Analysis

APAC Market Insights

The Asia Pacific smart inverter market is anticipated to grab the highest share of 44.5% by the end of 2035. The market’s upliftment in the region is highly driven by the existence of government-funded sustainability programs, innovation in semiconductor, and robust renewable energy objectives. According to official statistics published by the UNDP Organization in March 2025, the transport industry in Thailand is significantly responsible for 30% of the nation’s overall greenhouse gas emissions. Besides, Vietnam has witnessed rapid climate modifications that usually cost the country USD 10 billion every year, which is 3.2% of its gross domestic product (GDP). Additionally, the Just Energy Transition Partnership has aimed to revolutionize the country’s energy landscape and diminishing carbon dioxide emissions from 240 megatons by the end of 2035 to 170 megatons by the end of 2030, thus fueling the market’s demand in the overall region.

The expansion in wind and solar capacity, an increase in prioritizing renewable integration, and the aspect of organizations adopting sustainable energy processes are responsible for enhancing the market in China. As stated in an article published by the IEA Organization in 2025, as of 2024, the country’s clean energy investment amounted to over USD 625 billion. In addition, the country successfully gained its 2030 solar and wind capacity target in the same year. While the nation has effectively met its 5% GDP growth, the economy observed mounting pressures from domestic consumption. This led to a significant push for smart, storage, and grid infrastructure, as has been witnessed from USD 88 billion in distribution and transmission investment as of 2025, thereby denoting an optimistic outlook for the market’s growth and expansion.

The smart inverter market in India is growing significantly, owing to energy and power industrial modernization, strong renewable energy targets, and an upsurge in demand, particularly in hybrid and utility-scale solar farm energy projects. According to official statistics published by the Invest UP Government in October 2024, almost 100% FDI is permitted under the automatic route for renewable energy generation and distribution projects, subject to provisions of the Electricity Act. Based on this, the country’s installed non-fossil fuel capacity has surged by 396% in the last 8 years and further stands at over 201.7 GW, which is 45.3% of the nation’s overall capacity. In addition, the country also witnessed the highest year-on-year uplift in renewable energy additions of 9.8% as of 2022, thereby positively impacting the market’s requirement.

Europe Market Insights

Europe smart investor market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by a surge in investments for advanced energy technologies, regional sustainability programs, and strong renewable energy targets. According to official statistics published by the EIB Organization in October 2024, countries in the region initiated an investment of nearly €110 billion in renewable energy projects as of 2023, while, in South Estonia, the establishment of 38 wind turbines is increasing over land. Besides, the Sopi-Tootsi facility, which has been constructed by Enefit Green, provides generous green energy to power 197,000 residents every year, covering an estimated 10% of Estonia’s electricity demands. Therefore, with this increase in clean energy projects and investments, the market is gradually growing in the overall region.

Clean Energy Investment Analysis in Europe (2015-2025)

|

Source Type |

2015 (EUR Billion) |

2016 (EUR Billion) |

2017 (EUR Billion) |

2018 (EUR Billion) |

2019 (EUR Billion) |

2020 (EUR Billion) |

2021 (EUR Billion) |

2022 (EUR Billion |

2023 (EUR Billion) |

2024 (EUR Billion) |

2025 (EUR Billion) |

|

Renewables Power |

99.5 |

92.7 |

90.8 |

93.1 |

89.1 |

90.8 |

110.3 |

134.3 |

146.5 |

149.4 |

162.1 |

|

Energy Efficiency |

65.4 |

70.5 |

76.3 |

80.5 |

82.4 |

83.5 |

90.7 |

97.3 |

103.1 |

102.6 |

102.4 |

|

Electricity Networks |

58.5 |

57.3 |

57.6 |

59.4 |

59.5 |

61.4 |

66.0 |

66.2 |

80.9 |

90.4 |

96.4 |

|

Other End use |

35.8 |

40.3 |

48.9 |

52.5 |

57.2 |

72.7 |

86.1 |

102.0 |

114.2 |

115.3 |

120.6 |

|

Nuclear Power |

6.9 |

6.7 |

5.6 |

6.7 |

10.5 |

16.8 |

25.7 |

28.1 |

21.4 |

17.5 |

18.7 |

|

Oil Fuel |

59.5 |

45.0 |

43.5 |

42.9 |

40.5 |

31.1 |

32.8 |

30.7 |

30.1 |

30.9 |

28.7 |

|

Gas Fuel |

48.4 |

38.5 |

36.6 |

36.1 |

36.6 |

32.8 |

35.6 |

34.0 |

38.4 |

40.9 |

47.1 |

|

Coal Fuel |

3.0 |

2.1 |

4.2 |

3.9 |

3.9 |

2.7 |

2.9 |

3.0 |

3.2 |

3.0 |

5.6 |

|

Oil and Gas Power |

12.8 |

12.5 |

11.2 |

9.9 |

9.2 |

8.6 |

9.7 |

10.7 |

11.9 |

12.9 |

6.7 |

Source: Europe Environment Agency

The support provision by the Federal Ministry for Economic Affairs and Climate Action, transition to renewable energy, sustainable energy and power, as well as an increase in funding for inverter technologies and solar PV, are responsible for proliferating the market’s growth in Germany. As per an article published by the PV Tech Organization in January 2026, the country installed 16.2 GW of solar PV as of 2025. In addition, the cumulative installed solar PV capacity readily stood at 116.8 GW by the end of 2025, further surpassing the 108 GW target that has been set by the country’s government. Besides, with a surge in this installation, the electricity generation by solar PV power facilities reached 87 TWh in the same year, denoting a 21% rise from the previous year. Therefore, with this continuous rise in the energy source capacities, there is a huge growth opportunity for the market in the country.

The smart inverter market in the UK is gaining increased traction due to generous investments in semiconductors, strong clean energy policies, significant fund allocations to renewable integration, and effective commitment to innovative materials. As stated in a data report published by the UK Renewable Organization in January 2023, a 100% renewable energy scenario is poised to save more than EUR 120 billion for achieving net zero by the end of 2050. Besides, in terms of the Inter-Annual Storage scenario, the primary energy requirement accounts for 1,717 TWh every year, with the government’s CPS being 1,829 TWh, with an increase in shares from nuclear energy and fossil fuels. Therefore, with these objectives, the market is gradually expanding in the overall country.

North America Market Insights

North America smart inverter market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly fueled by federal investments in clean energy, an increase in grid modernization, and strong renewable energy policies. According to official statistics published by the Department of Energy (DOE) in 2026, renewable energy effectively generates more than 20% of overall U.S.-based electricity, and it is expected to continuously grow. Besides, as of 2022, the yearly U.S. renewable energy generated exceeded coal for the very first time, while the regional solar energy generation is projected to increase by 75% and wind by 11% by the end of 2025. Besides, the U.S. is considered a resource-rich nation with suitable renewable energy resources to generate over 100 times the electricity amount, thereby making it suitable for bolstering the market’s growth.

Electricity Production Analysis in North America (2022)

|

Source Type |

Electricity Share |

|

Wind |

10.3% |

|

Hydropower |

6.0% |

|

Solar |

3.4% |

|

Biomass |

1.2% |

|

Geothermal |

0.4% |

Source: Department of Energy

The aspects of federal clean energy spending, grid modernization, utility-scale solar, and advanced semiconductor and manufacturing support are significantly responsible for uplifting the market in the U.S. As per a data report published by the Semiconductors Organization in July 2025, more than 100 projects across 28 states in the country have been declared, totally over half-a-trillion dollars in private investments. Additionally, these particular projects are projected to develop and effectively support over 500,000 employment opportunities in the country and also assist in tripling the domestic chipmaking capacity by the end of 2032. Moreover, these employment opportunities include 68,000 facility jobs in the semiconductor system, 1,22,000 construction jobs, and more than 320,000 additional jobs, thus boosting the market’s demand in the country.

The smart inverter market in Canada is growing significantly, owing to the generous provision of federal clean energy investments, expansion in ESG commitments and renewable energy, along with safety and partnership programs. Based on government estimates published by the Government of Canada in November 2025, the country generated 620 TWh of electricity as of 2023. Of this, 411 TWh derived from renewable sources, deliberately making up to 66% of overall generation. Besides, hydroelectricity remained dominant, accounting for 58% of domestic generation, which is followed by 6% of wind, 1% of solar, and other renewable sources, such as a combined 1% of geothermal and biomass. Moreover, the overall electricity generation in the country increased by 6.6% from 581 TWh to 620 TWh, while the renewable generation surged by 12.6% from 365 TWh to 411 TWh, thus bolstering the market’s growth in the nation.

Key Smart Inverter Market Players:

- Huawei Technologies Co., Ltd. (China)

- Sungrow Power Supply Co., Ltd. (China)

- Delta Electronics, Inc. (Taiwan)

- SMA Solar Technology AG (Germany)

- ABB Ltd. (Switzerland)

- Schneider Electric SE (France)

- General Electric Company (U.S.)

- Emerson Electric Co. (U.S.)

- Eaton Corporation plc (Ireland)

- Toshiba Corporation (Japan)

- Panasonic Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- Hitachi Energy Ltd. (Japan)

- Hyundai Electric & Energy Systems Co., Ltd. (South Korea)

- LG Electronics Inc. (South Korea)

- TMEIC Corporation (Japan)

- Fimer S.p.A. (Italy)

- Solaredge Technologies Inc. (Israel)

- Sterling and Wilson Pvt. Ltd. (India)

- GoodWe Power Supply Technology Co., Ltd. (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- Huawei Technologies Co., Ltd. is one of the largest suppliers of smart inverters globally, leveraging its expertise in ICT and AI-driven monitoring systems. The company’s focus on IoT-enabled solutions and grid modernization has positioned it as a leader in utility-scale and residential solar projects.

- Sungrow Power Supply Co., Ltd. is a dominant player in renewable energy inverters, with strong penetration in the Asia Pacific and Europe. Its emphasis on high-efficiency string and central inverters has made it a preferred choice for large-scale solar farms.

- Delta Electronics, Inc. integrates smart inverter technology with energy management systems, offering solutions for both commercial and industrial applications. The company’s research and development investments in power electronics and sustainability initiatives strengthen its competitive edge.

- SMA Solar Technology AG is a pioneer in solar inverter technology, known for its advanced grid integration and monitoring solutions. Its strong presence in Europe and partnerships with utilities support its leadership in smart inverter adoption.

- ABB Ltd. combines smart inverter technology with automation and grid solutions, focusing on industrial and utility-scale applications. Its global reach and innovation in digital energy systems make it a key player in supporting renewable integration worldwide.

Here is a list of key players operating in the global market:

The international smart inverter market is highly competitive, with leading players from Asia Pacific, Europe, and North America driving innovation and market expansion. Companies such as Huawei, SMA Solar Technology, and Schneider Electric are investing heavily in research and development, focusing on IoT-enabled solutions and grid modernization. Strategic initiatives include mergers, acquisitions, and partnerships with utilities to strengthen market presence. Governments’ renewable energy mandates and sustainability programs further accelerate adoption. Besides, in December 2024, Samsung Electronics declared the unveiling of newest refrigerators with AI Hybrid Cooling technology, suitable for expanding into international markets. This particular AI-based inverter compressor readily contributes to the efficient utilization of energy, which denotes an optimistic outlook for the smart invert industry’s growth globally.

Corporate Landscape of the Smart Inverter Market:

Recent Developments

- In December 2025, Eastman Auto & Power Ltd. declared its acceleration in its international energy portfolio with the newest telecom battery and hybrid inverter range, deliberately featuring innovative lithium battery and highly efficient inverters that are designed to support the evolutionary demands of global telecom infrastructure.

- In November 2025, GoodWe introduced its latest GT 150 kW inverter, with the purpose-built to effectively deliver intelligent, reliable, and powerful energy solutions to industrial and commercial solar applications.

- In May 2025, Solis successfully launched 125 kW hybrid inverted and AI-based energy assistant, known as Solis AI for optimizing and automating solar energy utilization for both businesses and homes.

- Report ID: 8383

- Published Date: Feb 05, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Inverter Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.