High Frequency Solar Inverter Market Outlook:

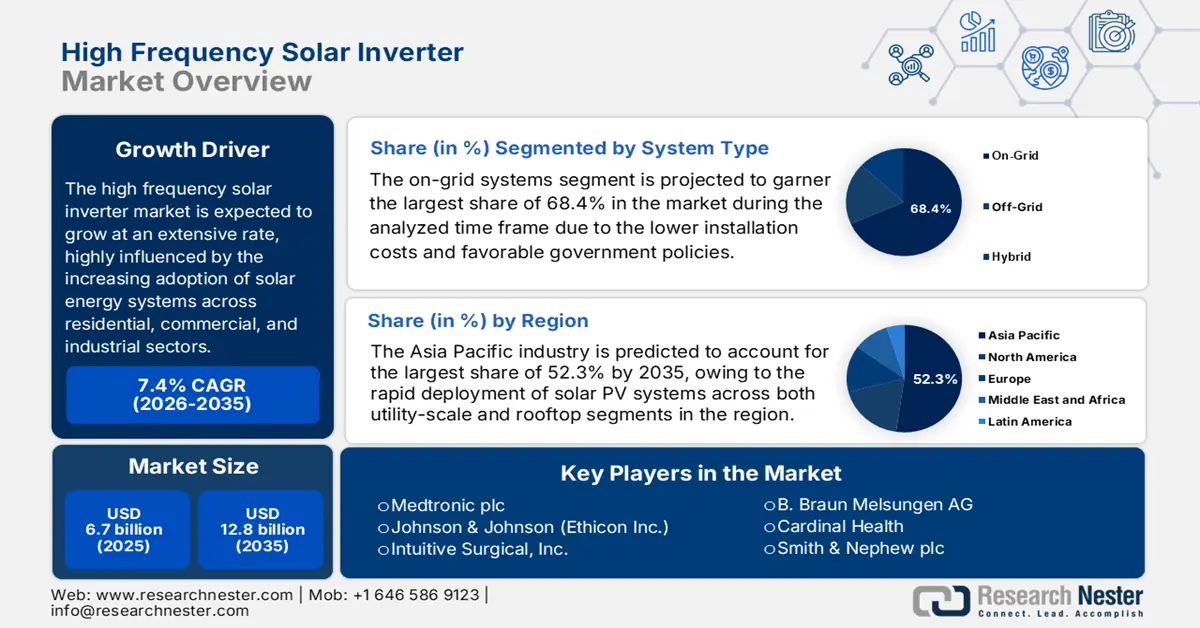

High Frequency Solar Inverter Market size was valued at USD 6.7 billion in 2025 and is projected to reach USD 12.8 billion by the end of 2035, rising at a CAGR of approximately 7.4% during the forecast period 2026 to 2035. In 2026, the industry size of high frequency solar inverter is estimated at USD 7 billion.

The high frequency solar inverter market is expected to grow at an extensive rate, highly influenced by the increasing adoption of solar energy systems across residential, commercial, and industrial sectors. As per an article published by WEF in May 2023, renewables will supply 35% of the world’s electricity by the end of 2025, which marks a 29% from 2022. It also stated that electricity demand is set to grow by 3% on an annual basis through 2026, where in the U.S, solar is projected to account for 54% of new electricity capacity in 2023.

In addition, the worldwide shift towards renewable energy and supportive government policies is providing an encouraging opportunity for the pioneers to capitalize on this field. As evidence, the U.S. Department of Energy reported that two major tax credits are supporting domestic clean energy manufacturing, which are the 45X advanced manufacturing production tax credit and the 48C advanced energy project investment tax credit. It also stated that manufacturers can claim one, based on eligibility, for producing solar components or investing in manufacturing facilities, hence positively influencing market growth.

Key High Frequency Solar Inverter Market Insights Summary:

Regional Insights:

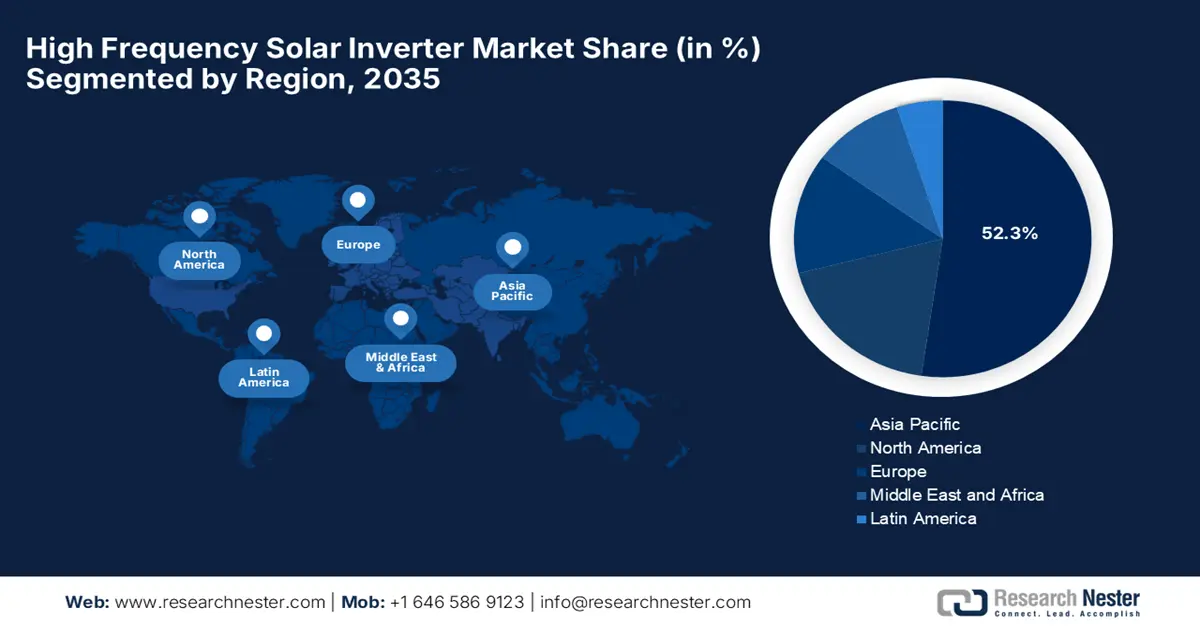

- By 2035, Asia Pacific is projected to command a 52.3% share in the high frequency solar inverter market, underpinned by accelerating solar PV deployment and supportive renewable-energy initiatives.

- North America is anticipated to expand significantly by 2035 with rising adoption of rooftop and utility-scale solar installations, bolstered by advancements in high-capacity inverter technologies.

Segment Insights:

- By 2035, the on-grid systems segment is projected to secure a 68.4% share in the high frequency solar inverter market, supported by lower installation expenses and favorable policy frameworks.

- The residential segment is expected to hold a 45.8% share by 2035, sustained by rising electricity costs, increasing demand for energy independence, and enhanced government incentives.

Key Growth Trends:

- Cutting-edge technical breakthroughs

- Growth in PV installations

Major Challenges:

- Technical complexity & reliability issues

- High upfront costs and price sensitivity

Key Players: SMA Solar Technology AG (Germany), Huawei Technologies Co., Ltd. (China), Sungrow Power Supply Co., Ltd. (China), Ginlong Technologies Co., Ltd. (Solis) (China), Fronius International GmbH (Austria), Power Electronics S.L. (Spain), Delta Electronics, Inc. (Taiwan), SolarEdge Technologies, Inc. (Israel), Enphase Energy, Inc. (U.S.), GoodWe Technologies Co., Ltd. (China), TMEIC (Japan), Yaskawa Electric Corporation (Japan), Growatt New Energy Co., Ltd. (China), FIMER S.p.A. (Italy), ABB Ltd. (Switzerland), Darfon Electronics Corp. (Taiwan), LG Electronics (South Korea), Fimer Group (Italy).

Global High Frequency Solar Inverter Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.7 billion

- 2026 Market Size: USD 7 billion

- Projected Market Size: USD 12.8 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (52.3% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: Vietnam, Brazil, United Arab Emirates, South Korea, Mexico

Last updated on : 27 October, 2025

High Frequency Solar Inverter Market - Growth Drivers and Challenges

Growth Drivers

- Cutting-edge technical breakthroughs: The utilization of materials such as silicon‑carbide and gallium‑nitride, along with improvements in MPPT algorithms and thermal/EMI management, is appreciably boosting inverter performance, thereby enhancing uptake. For instance, in April 2025, Navitas Semiconductor introduced its latest SiCPAK power modules, which comprise silicon carbide MOSFET technology with epoxy-resin potting, achieving 5× lower thermal resistance shift under thermal stress, ensuring extended system life and superior high-temperature performance. Besides, these modules target demanding applications such as solar inverters and power optimizers.

- Growth in PV installations: There has been an increased deployment across areas such as residential, commercial, and utility sectors, which is rearranging the growth dynamics in this market. According to an article published by Ember in September 2025, solar installations surged 64% in the first half of 2025, across all nations, reaching 380 GW, which is well ahead of the 232 GW added in the same period of 2024. It also observed that China led this growth, accounting for 67% of global capacity additions, more than doubling its installations when compared to last year.

- Declining costs of solar panels: The lower upstream costs of solar panels and balance of systems make solar installations extremely visible, which in turn is increasing the demand for inverters and other components as well. This can be testified from the article published by the U.S. Department of Energy, which found that the cost of solar energy has significantly reduced, wherein the worldwide weighted average levelized cost of energy for concentrating solar power has dropped by 70% from USD 0.39/kWh in 2010 to under USD 0.12/kWh in 2023.

48C Advanced Energy Project Investment Tax Credit (ITC) Effective from 2023

|

Project Type |

Credit Amount |

|

Qualified energy projects (meeting labor rules) |

30% of the investment cost |

|

If labor rules are not met |

6% of the investment cost |

Source: U.S. Department of Energy

Global Solar Capacity Additions in First Half of Each Year (GW)

|

Year |

China |

Rest of World (Total) |

|

2022 |

37 |

53 |

|

2023 |

98 |

83 |

|

2024 |

125 |

107 |

|

2025 |

256 |

124 |

Source: Ember

Challenges

- Technical complexity & reliability issues: This has skewed growth in the high frequency solar inverter market. These inverters utilize advanced switching technologies and operate at a much higher switching speed when compared to conventional inverters. Therefore, this complexity increases their vulnerabilities, such as thermal stress, electromagnetic interference, and faster component wear. In harsh climates such as high temperatures, dust, or humidity, these inverters witness reliability issues, requiring highly advanced thermal management.

- High upfront costs and price sensitivity: The production in this market is typically higher due to the use of advanced components and design technologies. This also results in a very steep purchase price, which is a major barrier, especially in price-sensitive markets. Furthermore, consumers and installers often opt for lower-cost alternatives, thereby restricting widespread adoption in the high frequency solar inverter market.

High Frequency Solar Inverter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 6.7 billion |

|

Forecast Year Market Size (2035) |

USD 12.8 billion |

|

Regional Scope |

|

High Frequency Solar Inverter Market Segmentation:

System Type Segment Analysis

Based on system type, the on-grid systems segment is projected to garner the largest share of 68.4% in the high frequency solar inverter market during the analyzed time frame. The lower installation costs and favorable government policies, such as net metering, are the key factors behind this leadership. Testifying, the government of India reported that the PM Surya Ghar: Muft Bijli Yojana, which was launched in February 2024 with a substantial amount of ₹75,021 crore (USD 9.02 billion), aims to boost the adoption of solar rooftop among residential households. Further, it offers subsidies up to ₹78,000 (USD 939.7) for systems up to 3 kW, thereby strengthening on-grid solar systems.

End user Segment Analysis

Based on the end user residential segment is expected to attain a significant share of 45.8% in the high frequency solar inverter market throughout the analyzed tenure. The rising electricity prices, increasing consumer demand for energy independence, and strong government incentives are the key factors behind the segment’s leadership. Besides tax credits, rebates, and subsidies, lowering the upfront cost of residential solar plus storage systems thereby accelerate adoption in this field.

Type Segment Analysis

In terms of type single-phase inverters segment is predicted to capture a considerable revenue share of 42.6% in the high frequency solar inverter market by the end of 2035. The growth in the segment is highly subject to the global expansion of the residential solar sector, wherein these are standard for most home electrical systems. In September 2024, SolarEdge introduced its next-generation all-in-one home solar + storage solution, which comprises a modular, scalable design supporting up to 211.2 kWh for whole-home backup. The product is designed to cut installation time by 50%, and it integrates with SolarEdge ONE software for enhanced energy management and efficiency.

Our in-depth analysis of the high frequency solar inverter market includes the following segments:

|

Segment |

Subsegments |

|

System Type |

|

|

End user |

|

|

Type |

|

|

Power Rating |

|

|

Distribution Channel |

|

|

Phase |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High Frequency Solar Inverter Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is expected to capture the largest revenue share of 52.3% in the global high frequency solar inverter market by the end of 2035. The dominance of this region in this field effectively caters to the rapid deployment of solar PV systems across both utility-scale and rooftop segments. Also, governments across the region are proactively promoting renewable energy and energy‑storage integration, which in turn boosts demand for inverters. In May 2025, Sungrow reported that it had been officially named Australia's No.1 inverter and residential battery manufacturer for 2024 by SunWiz, due to its dominant position in the country's competitive renewable energy sector.

China holds a dominating position in the high frequency solar inverter market since it is the largest solar installer and is the hub of worldwide inverter manufacturing and innovation. The domestic firms in the country have captured large global shares of inverter shipments and are ramping up production of advanced inverters, prompting a greater market expansion. In August 2025, Ember revealed that in H1 2025, the country exported 208 GW of solar products, wherein solar cells and wafers made up over 40% of this total, reflecting a major shift in China’s solar export strategy.

India in the high frequency solar inverter market is growing exponentially deliberately driven by its extensive solar targets, growth in rooftop and decentralized systems, along with a surge in the adoption of hybrid and smart inverter solutions. According to Ember reports published in August 2025, the country’s solar manufacturing capacity reached 68 GW for panels and 25 GW for cells, after adding 36 GW and 16 GW in 2024 as of March. While the target is for 120 GW of panel capacity by the end of 2030, the country accounted for 52% of the global growth in China’s solar cell exports in H1 2025, thereby doubling its imports from 11 GW to 21 GW.

North America Market Insights

North America is poised for extensive growth in the high frequency solar inverter market in the upcoming years, strongly benefiting from a push towards renewable energy. Moreover, the region has witnessed more rooftop solar in residential and commercial settings and larger utility-scale solar farms. In September 2024, GE Vernova reported that it has launched its new 6 MVA, 2000 Vdc utility-scale solar inverter, which is aiming to cut costs and enhance scalability in solar installations. It also stated that the inverter will be piloted in a multi-megawatt solar park in North America, in collaboration with Shoals Technologies and a PV module supplier.

The U.S. is solidifying its dominance in the regional high frequency solar inverter market, effectively attributable to the state-level renewable mandates, federal tax credits, and strong solar adoption in high‑irradiance states all contribute. Besides the heightened demand for inverters that can integrate with smart grid infrastructure and support hybrid storage or grid-interactive applications, there is also a propelling growth in the country. Furthermore, government initiatives and net metering policies are also an asset of this landscape, hence making it suitable for standard market growth.

Canada is unfolding remarkable growth opportunities in the high frequency solar inverter market, highly influenced by its clean energy transition plans. For instance, in September 2025, Canadian Solar reported that it had launched its next-generation low carbon modules featuring advanced HJT cell technology, which is one of the lowest carbon footprints in the industry at 285 kg CO₂eq/kW. The module is especially designed for utility-scale and C&I applications, wherein the modules offer up to 660 Wp output and 24.4% efficiency, hence denoting a positive market outlook.

Europe Market Insights

Europe is expected to retain its position as the strongest stakeholder in the high frequency solar inverter market throughout the discussed timeframe. The upliftment in this region is effectively propelled by its strong commitment to renewable energy targets and grid modernization efforts. In June 2024 the Solar Power Europe reported that the European solar industry has formally launched its initiative to secure an important project of common European interest, which is focused on solar inverters, hence strengthening the region’s inverter manufacturing ecosystem.

Germany is maintaining a strong position in the high frequency solar inverter market owing to the presence of strong policy backing for renewables and the presence of domestic manufacturers innovating in inverter technology. In September 2025, SMA Solar Technology AG reported that it had signed an MOU to create a manufacturing next-generation string inverters and PowerSkids. Therefore, this partnership boosts the country’s solar industry presence in the international landscape, thereby strengthening its global competitiveness and fostering export-led growth.

The U.K. remains one of the powerful players in the high frequency solar inverter market, efficiently supported by growth in residential rooftop and smaller commercial solar installations, along with incentives for self-consumption and grid-compatible generation. On the other hand, the rising electricity prices, smart meter roll‑out and the demand for high-efficiency inverter systems are also pushing towards increased adoption. Further, the micro inverter technologies are becoming extremely common in the country, hence presenting an optimistic market opportunity.

Key High Frequency Solar Inverter Market Players:

- SMA Solar Technology AG (Germany)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Huawei Technologies Co., Ltd. (China)

- Sungrow Power Supply Co., Ltd. (China)

- Ginlong Technologies Co., Ltd. (Solis) (China)

- Fronius International GmbH (Austria)

- Power Electronics S.L. (Spain)

- Delta Electronics, Inc. (Taiwan)

- SolarEdge Technologies, Inc. (Israel)

- Enphase Energy, Inc. (U.S.)

- GoodWe Technologies Co., Ltd. (China)

- TMEIC (Japan)

- Yaskawa Electric Corporation (Japan)

- Growatt New Energy Co., Ltd. (China)

- FIMER S.p.A. (Italy)

- ABB Ltd. (Switzerland)

- Darfon Electronics Corp. (Taiwan)

- Fimer Group (Italy)

- Fimer Group (Italy)

- LG Electronics (South Korea)

- Fimer Group (Italy)

- Huawei Technologies Co., Ltd. is based in China and has revolutionized this market by integrating its core expertise in telecommunications and digital technology into its solar investments. The company is well known for its string inverters that feature built-in smart features and grid support functions as well. Further, the considerable R&D investments and a vast supply chain enable it to offer technologically advanced products.

- Sungrow Power Supply Co., Ltd. has established itself as one of the dominant forces in this field owing to its extensive product portfolios covering residential, commercial, and utility-scale areas. Its strong vertical integration and relentless focus on technological innovation, especially in hybrid and energy storage solutions, remain its strengths, thereby leveraging massive manufacturing scale.

- SMA Solar Technology AG is headquartered in Germany and provides high-quality products comprising engineering excellence, particularly in terms of large-scale utility and commercial segments. On the other hand, the company is set to focus on high-margin segments and energy management and storage integration solutions for the evolving digital and decentralized energy grid.

- SolarEdge Technologies, Inc. has successfully reshaped the market with its pioneering DC optimized inverter system that maximizes energy harvest at the individual panel level. Besides, this technology also provided a compelling alternative to microinverters and established its leadership in the residential as well as commercial markets.

- Enphase Energy, Inc. is based in the U.S. and emerging as the central leader in the microinverter segment. The company has developed a complete modular system where each solar panel operates independently. Moreover, this approach is extremely valued for its safety, design flexibility, and strong performance in shaded conditions.

Below is the list of some prominent players operating in the global market:

The global market for high frequency solar inverters is extremely competitive and fragmented, wherein the key players in the market, such as Huawei, Sungrow, and SMA Solar, dominate through technological innovation, extensive global supply chains. Also, integration of inverters with smart energy management systems and battery storage solutions has become the primary focus of these pioneers to create value-added products. In August 2025, ILJIN Electronics India, which is a subsidiary of Amber Enterprises, acquired a majority stake in Power-One Micro Systems, marking its entry into the country. Besides, this move brings together Power-One’s solar inverters, BESS, and EV chargers with Amber’s manufacturing and R&D strength.

Corporate Landscape of the High Frequency Solar Inverter Market:

Recent Developments

- In October 2024, Livguard (under SAR Group) introduced its High-Frequency Solar Inverters at the 17th Renewable Energy India Expo 2024, which comprises transformer-less, compact, and hybrid/off-grid models supporting both Lead Acid and Lithium batteries.

- In January 2024, Polycab India announced the launch of a 350 kW three-phase string inverter (UT Series) for utility-scale solar projects, featuring high efficiency, robust safety, and support for bifacial modules.

- Report ID: 8192

- Published Date: Oct 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.