Solar Micro Inverter Market Outlook:

Solar Micro Inverter Market size was valued at USD 3.9 billion in 2025 and is projected to reach USD 18.9 billion by the end of 2035, rising at a CAGR of 19.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of solar micro inverter is assessed at USD 4.6 billion.

The principal driver for expansion in the solar micro inverter market is the acceleration of distributed and rooftop PV installations backed by government-manufactured incentives and manufacturing mandates. As per an article published by the U.S. Department of Energy, its solar photovoltaics supply chain review report 2022 states that to meet the 100% clean electricity goal by the end of 2035, solar power must increase from 4% to 40% of the national electricity supply, thereby driving massive demand for solar modules, inverters, and related components. It also underscored that the global supply chain remains concentrated in China; strategic federal incentives, manufacturing investments, and workforce initiatives could restore U.S. production capacity, enabling domestic competitiveness and energy security. Hence, these factors encourage improving the uptake of PV systems micro inverters rather than centralized approaches.

Furthermore, the accelerating worldwide deployment of solar energy is creating a strong foundation for the expansion of the market. In May 2024, the article published by NREL stated that in 2023, PV installations across the world reached between 407 to 446 GWdc, bringing total capacity to around 1.6 TWdc, with China contributing nearly 60% of new capacity and the U.S. emerging as the second-largest market. In addition, solar accounted for 54% of new U.S. power generation, which was supported by over 26 GWac of new PV installations and rapidly growing energy storage capacity. The report further underscored that the module prices have reduced and technology has advanced toward high-efficiency mono and N-type cells; the need for module-level optimization, grid resilience, and energy monitoring continues to rise, thereby boosting the global Solar Micro Inverter Market.

Key Solar Micro Inverter Market Insights Summary:

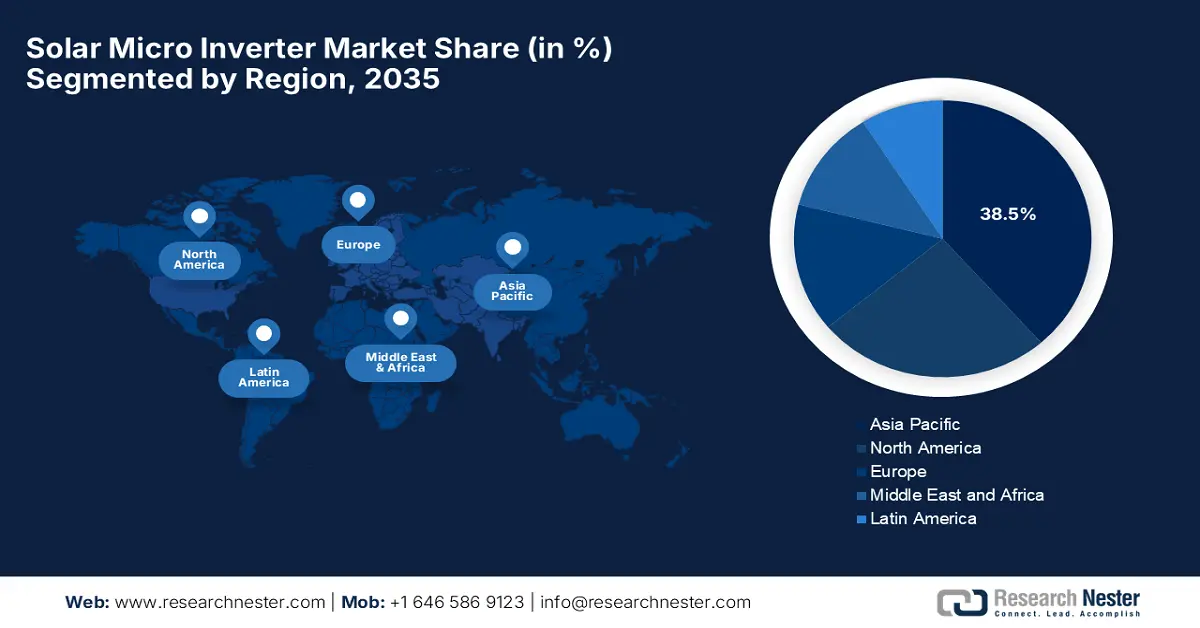

Regional Insights:

- By 2035, the Asia Pacific region in the solar micro inverter market is expected to command a 38.5% revenue share, propelled by its strong emphasis on decentralized energy solutions and rooftop solar expansion.

- North America is set to strengthen its market position through heightened solar adoption and supportive net-metering structures, impelled by progressive energy policies.

Segment Insights:

- By 2035, the single-phase segment in the solar micro inverter markett is projected to capture a 55.6% share, underpinned by the widespread penetration of residential rooftop PV systems.

- The residential segment is anticipated to account for a 40.3% share by 2035, supported by accelerating PV deployment and incentive-driven adoption.

Key Growth Trends:

- Rapid residential solar adoption

- Technological advancements in module-level power electronics

Major Challenges:

- Supply chain concentration

- Technical complexity and reliability

Key Players: Enphase Energy, Inc., APsystems, AEconversion GmbH & Co., SMA Solar Technology AG, ABB Ltd., Darfon Electronics Corporation, and others.

Global Solar Micro Inverter Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.9 billion

- 2026 Market Size: USD 4.6 billion

- Projected Market Size: USD 18.9 billion by 2035

- Growth Forecasts: 19.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Australia, Brazil, Netherlands, United Kingdom

Last updated on : 20 November, 2025

Solar Micro Inverter Market - Growth Drivers and Challenges

Growth Drivers:

- Rapid residential solar adoption: This is one of the primary growth drivers for the solar micro inverter market since the deployment of rooftop PV systems, especially in the developed economies, is prompting an extremely favorable business environment in this field. According to the report published by Research Nester, the rooftop solar PV market, which is the primary application for microinverters, is projected to grow at a notable pace by the end of 2035, since a rising tide lifts all boats. As more rooftop installations are built, the demand for all components, including inverters, increases, where the report also mentioned that the on-grid segment is poised for significant growth. Microinverters are particularly well-suited for on-grid residential and commercial rooftop systems, making them suitable for overall market growth.

Sungrow’s Global Product Launches and Market Milestones at Intersolar 2024 Events

|

Event |

Details |

Product Focus |

Market Impact |

|

Intersolar Europe 2024 |

Sungrow showcased ~50 renewable products; launched SG350HX-20 string inverter with intelligent I-V curve diagnosis and enhanced grid adaptability |

Utility-scale string inverter (SG350HX-20) |

Boosts plant efficiency and grid stability; supports sustainable power generation |

|

Intersolar South America 2024 |

Reached 20 GW cumulative contracted inverter orders in Latin America; introduced residential microinverter S2000S-SA; unveiled new C&I inverters and storage systems |

Residential microinverter (S2000S-SA), C&I and utility inverters, energy storage, EV chargers |

Strengthens presence in Latin America; supports solar, storage, and EV expansion |

Source: Sungrow

- Technological advancements in module-level power electronics: These microinverters offer individual panel optimization and improved system reliability, which is readily increasing adoption rates in the market. In this regard, Apex Energy Australia in September 2024 reported that it had completed an off-grid solar installation for a 100% electric home in South Australia, which features a 19.92 kW free-standing solar array. It also stated that the system integrates FIMER UNO-DM 6kW inverters, Jinko Tiger NEO panels, selectronic SP PRO battery inverter/charger, and PowerPlus Energy LFP batteries, designed to meet the home’s 40 kWh daily energy demand with minimal generator backup. Also, the installation uses multiple solar orientations, dual MPPT inverters, and communication for optimized energy production, ensuring reliable, uninterrupted power in an off-grid setting.

- Government incentives and supportive policies: The existence of policies such as the U.S. Investment Tax Credit, feed-in tariffs, and net metering programs is providing incentives for solar adoption, creating strong demand for microinverter-based systems, especially in regions with high electricity costs and renewable energy mandates. Energy & Environment in August 2025 disclosed that India has emerged as a predominant leader in the renewable energy sector, which ranked 4th in overall renewable capacity, 4th position in wind, and 3rd in solar power. It also underscored that the country’s solar capacity surpassed 119.02 GW, wherein renewables contributed 50.07% of total power capacity, achieving its COP26 targets five years early. Also, the government initiatives such as PM Surya Ghar, PM-KUSUM, Solar Parks, and green hydrogen projects are driving clean energy adoption and domestic manufacturing, thus benefiting the solar micro inverter market.

Challenges

- Supply chain concentration: The solar micro inverter market faces severe challenges in terms of the supply chain aspect since it relies on critical components such as semiconductors, capacitors, and power electronics, most of which are manufactured in a small number of countries, particularly in Asia. The existence of vulnerability to trade restrictions, tariffs, and geopolitical disruptions, coupled with a limited diversification of suppliers, increases lead times and exposes manufacturers to sudden price spikes. Therefore, these disruptions in upstream raw materials such as silicon, copper, and electronic components can result in production delays, ultimately causing a major obstacle for market expansion. Furthermore, this concentration complicates deployment and affects reliability for international projects as well.

- Technical complexity and reliability: The micro inverters require one unit per solar module, which increases the installation complexity relative to centralized inverters, diminishing the growth dynamics of the solar micro inverter market. Also, each inverter represents a potential point of failure, raising concerns about long-term reliability and maintenance costs. On the other hand, the technical challenges, such as efficient thermal management, voltage regulation, and protection against environmental stressors, are also creating hesitation among pioneers to make investments in this field. Similarly, the module-level monitoring provides performance benefits; installers must be trained to handle the higher number of devices per system. Hence, maintenance or replacement in large arrays can be logistically challenging for developers and end-users.

Solar Micro Inverter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

19.2% |

|

Base Year Market Size (2025) |

USD 3.9 billion |

|

Forecast Year Market Size (2035) |

USD 18.9 billion |

|

Regional Scope |

|

Solar Micro Inverter Market Segmentation:

Phase Segment Analysis

The solar micro inverter market is expected to be dominated by the single-phase segment, capturing the largest revenue share of 55.6% by the end of 2035. The dominance of the subtype is effectively fueled by the extensive penetration of residential rooftop PV systems in established markets, where standard household service is single-phase. Also, these inverters map naturally into the single-phase systems, which makes it advantageous for module-level electronics, thereby prompting enhanced revenue share. In addition, these are well-suited for module-level power electronics, which allow for individual optimization of each solar panel. Therefore, this capability enhances energy harvest and efficiency, particularly in installations where shading, orientation, or panel mismatch could otherwise reduce overall system performance, hence denoting a wider segment scope.

Application Segment Analysis

The residential segment is expected to garner a considerable share of 40.3% in the market during the discussed time period. The growth in the segment is largely supported by the PV adoption since it has a high unit count and is policy-driven. As per the NREL report published in May 2024, since the passage of the Investment Tax Credit, the U.S. residential solar market has experienced explosive growth, with the number of annually installed PV systems increasing by roughly 36% per year, which is over 250 times the initial figure. By the end of 2023, SEIA estimated around 4.7 million residential PV systems nationwide, in which 3.3% of all households (or 5.3% of single-family detached homes) had adopted solar. Therefore, these incentives and grid-tie policy structures support residential systems, also favouring the selection of micro inverters.

Communication Technology Segment Analysis

By the end of the forecast duration wired segment based on communication technology is predicted to gain a share of 35.3% in the solar micro inverter market. The module-level conversion systems feature advanced monitoring and communications links, which are easier to integrate via wired networks, especially in residential and small‑commercial installations where cabling cost is marginal. The utilities are demanding more granular monitoring along with fault detection, in which the wired communications embedded in micro inverter systems become a differentiator and revenue driver, contributing towards a higher adoption in this sub-segment. Moreover, both utilities and system operators are increasingly demanding granular monitoring and rapid fault detection to ensure increased reliability and efficiency. Hence, this enhanced functionality not only improves operational efficiency but also acts as a key differentiator in the market, propelling extremely high adoption rates.

Our in-depth analysis of the solar micro inverter market includes the following segments:

|

Segment |

Subsegments |

|

Phase |

|

|

Application |

|

|

Power Rating |

|

|

Grid Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Solar Micro Inverter Market - Regional Analysis

APAC Market Insights

Asia Pacific has acquired a dominant position in the international market, capturing the largest revenue share of 38.5% by the end of the forecast duration. This dominance is actively propelled by the strong focus on decentralized energy solutions and rooftop solar installations. Prominent countries in the region, such as Japan, South Korea, and Australia, are actively promoting residential and commercial solar adoption owing to the regional energy policies emphasizing grid stability and energy storage integration. In February 2025, ITOCHU Corporation announced that it had formed a strategic partnership with Enphase Energy Inc., increasing the adoption of Enphase’s microinverters for residential solar systems in Japan, starting with Tokyo and aiming for nationwide expansion. Hence, this collaboration addresses challenges of limited rooftop space and uneven sunlight, thereby enabling more efficient solar power generation.

The solar micro inverter market in China has gained immense exposure in recent years, with large-scale adoption in residential and small commercial installations. Simultaneously the domestic manufacturers focus on developing smart and grid-compatible solutions to meet consumer requirements. In this regard, AP Systems has demonstrated a clear and consistent commitment to innovation and leadership in the microinverter sector, wherein in 2021, it solidified its technological segment by releasing the world's first fourth-generation, high-current microinverters and a compatible rapid shutdown device, while also expanding its business vertically into the residential energy storage sector. Further, this trajectory of innovation continued into 2023 with the launch of new microinverters featuring advanced dual communication modes for improved installation flexibility. Also, the company's repeated recognition with the Top PV Brand award across multiple regions from 2021 to 2023 underscores its successful penetration and established brand reputation.

India has become most influential and strong landscapes for the market owing to rising electricity costs, frequent grid disruptions, and residential and commercial installations. Innovative financing models and subsidy programs encourage households and small businesses to adopt micro-inverter-based solar systems. In this context, IBEF in September 2025 reported that the country’s government is expanding the approved list of models and manufacturers' initiatives to cover solar cells, with plans to include ingots and polysilicon, aiming to boost domestic manufacturing. The Rs. 24,000 crore (USD 2.72 billion) production-linked incentive scheme for solar modules has attracted Rs. 50,000 crore (USD 5.66 billion) in investments, which is readily driving India’s solar capacity growth from 2.4 GW in 2013 to 130 GW today, along with significant expansion in wind and rooftop solar. The government targets 500 GW of non-fossil fuel-based power within five years, hence indicating a positive market outlook.

North America Market Insights

North America is expected to be the frontrunner in the market, largely owing to strong adoption, particularly in areas where there exists high solar irradiance and progressive energy policies. Also, the aspect of net metering programs is encouraging homeowners to integrate rooftop solar with microinverters, with enhanced efficiency. The region also benefits from IoT integration and system monitoring, which provides an encouraging opportunity for pioneers in this field. Besides these, Inverters are increasingly paired with battery storage systems to support grid independence. Furthermore, regional awareness about renewable energy, combined with corporate sustainability initiatives, is accelerating micro inverter adoption across both residential and commercial sectors. Hence, the presence of all of these factors is increasing the market uptake in North America.

The U.S. has established its position as the key growth contributor in the regional solar micro inverter market over the discussed timeframe. This progress is successfully backed by strong federal incentives, solar policies, and rising electricity costs. Strategic partnerships and domestic manufacturing are also readily bolstering market expansion. In July 2024, Enphase Energy reported that it had begun shipping its IQ8 commercial microinverters from its Texas manufacturing facility, marking a major shift from overseas production supported by the Inflation Reduction Act. These inverters are designed for small- and medium-sized commercial installations, which offer enhanced energy harvest, and industry-leading safety, and are compatible with solar panels up to 640 W. It also stated that U.S. distributors can now order these microinverters, which are supported by the IQ gateway commercial 2 and Enphase monitoring platform, providing businesses with renewable energy solutions.

Canada in the solar micro inverter market is projected to represent notable expansion, supported by both provincial and federal grants. Harsh climate conditions in the country necessitate these inverters, whereas the awareness campaigns and sustainable energy targets in provinces such as Ontario and British Columbia are boosting widespread adoption. In September 2025, Canadian Solar announced the launch of its next-generation low-carbon modules, combining advanced wafer innovations with heterojunction cell technology to achieve a low-carbon footprint of 285 kg CO₂eq/kW. They are especially designed for utility-scale and commercial applications, the modules deliver up to 660 Wp output with 24.4% efficiency, whereas manufacturing innovations reduce energy consumption and shorten carbon payback time by around 11%. These are fully compatible with the country’s solar inverter portfolio, hence denoting a positive market outlook.

Europe Market Insights

Europe is growing exponentially in the worldwide market, effectively attributable to decarbonization policies and the proliferation of residential rooftop solar systems. Countries focus on increasing energy efficiency, integrating smart grids, and corporate ESG initiatives, and community solar programs contribute to demand. In May 2025, SMA Group reported a sales value of a substantial €1,530 million (USD 1,652.4 million). The Large Scale & Project Solutions segment performed strongly, achieving €1,175.8 million (USD 1,269.3 million) in sales and €227 million (USD 245.2 million) EBIT. It also stated that for 2025, the company is expecting sales of €1,500 to 1,650 million (USD 1,620 to 1,782 million), supported by the merger of Home and C&I segments into the new Home & Business Solutions division and ongoing cost reduction measures. Hence, this presence of strong demand creates an extremely profitable business environment for the market.

SMA Group Key Financial Metrics for 2023 (EUR and USD)

|

Metric |

2023 (EUR Million) |

2023 (USD Million) |

|

Sales |

1,904.1 |

2,056.4 |

|

EBITDA |

311.0 |

335.9 |

|

EBIT |

269.5 |

290.7 |

|

Net Income |

225.7 |

243.6 |

|

Inverter Output |

20.5 GW |

20.5 GW |

|

Net Cash |

283.3 |

305.9 |

Source: SMA

Germany is leading the entire regional market, strongly propelled by a solar pv penetration, supportive feed-in tariffs, and the presence of energy transition policies. The country’s market also benefits from integration with energy storage solutions, which address the grid stability concerns. There has been a push toward distributed energy generation and decentralized solar installations. In November 2025, Infineon Technologies AG announced that its CoolGaN bi-directional switch technology powers Enphase Energy’s next-generation IQ9 series microinverters, thereby enhancing power output, efficiency, and reliability while reducing system costs. It further highlighted that the GaN-based BDS allows single-stage power conversion, cutting power loss by up to 68% when compared to silicon switches, and supports a huge range of applications from solar PV and energy storage to EVs and AI servers.

The U.K. holds a strong position in the solar micro inverter market due to enhanced solar adoption as well as the governing support, which promotes low-carbon energy. Both national and international players operating in the country are focusing on high-efficiency devices, grid integration, and real-time monitoring, enhancing the consumer uptake. In addition, the country hosts several urban solar projects, community energy programs, and off-grid hybrid systems, which are contributing towards greater market expansion. Furthermore, the increasing energy costs, sustainability goals, and growing awareness about renewable solutions are recognized to be the key drivers in this field. The UK market emphasizes reliability, safety, and ease of installation, positioning micro inverters as a preferred choice for residential and small-scale commercial solar applications.

Key Solar Micro Inverter Market Players:

- Enphase Energy, Inc. - U.S.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- APsystems - China / U.S.

- AEconversion GmbH & Co. - Germany

- SMA Solar Technology AG - Germany

- ABB Ltd. - Switzerland

- Darfon Electronics Corporation - Taiwan

- Hoymiles Power Electronics - China

- Chilicon Power LLC - U.S.

- Northern Electric Power Co., Ltd. - China

- Tigo Energy, Inc. - U.S.

- Envertech Corporation - China

- SunPower Corporation - U.S.

- Sensata Technologies Inc. - U.S.

- Tata Power Solar Systems Ltd. - India

- Enphase Energy, Inc. has established itself as one of the most prominent players in residential micro‑inverters across the globe. The company’s strategy lies in expanding manufacturing capacity through contract manufacturing and targeting high‑powered solar modules. Furthermore, the company has also announced workforce restructuring to align operational costs with market realities, potentially capturing expansion in the long run.

- APsystems has grown rapidly since its founding and now claims to serve customers in over 150 countries with cumulative MLPE (module‑level power electronics) shipments exceeding 6 GW by the end‑of 2024. The company emphasises high‑volume, multi-module microinverters (e.g., dual‑module and three-phase versions), backed by strong R&D investment (over 89 invention patents), and is widely recognised for its financial health in inverter manufacturing.

- SMA Solar Technology AG is a broad-based inverter supplier covering a wide range of PV applications, including residential, commercial, and utility. Also, the company represented its recorded sales of €1.90 billion and EBITDA of €311 million, which also has 4,377 employees globally. Along with micro‑inverters, SMA also focuses on scale and integrated energy‑management solutions, placing it in a strong competitive position in module-level inverter penetration across Europe and other markets.

- AEconversion GmbH & Co. KG is a specialist in micro‑inverters and power‑electronics for smaller installations (for example, rooftop, balcony systems) based in Bad Sassendorf, Germany. The company emphasizes modular design, ease of installation, and high‐quality local R&D and production; this positions it for niche growth in the decentralized PV segment in Europe.

- Darfon Electronics Corporation Originally a larger electronics component manufacturer, Darfon entered the solar/inverter business and now offers micro‑inverter and hybrid inverter products globally. With full in-house design and control of cost/quality for its micro‑inverter products, Darfon leverages its component manufacturing background to compete on both reliability and cost.

Below is the list of some prominent players operating in the global market:

The specialized players involved in the solar micro inverter market are readily driving module-level optimization, whereas the larger power‑electronics firms are expanding into that. Leading companies such as Enphase Energy, APsystems, and AEconversion are emphasizing proprietary micro‑inverter architectures, software monitoring capabilities, as well as installation networks. In June 2025, Amber Group’s electronic division, IL JIN Electronics, announced that it had entered into definitive agreements to acquire a majority stake in Power-One Micro Systems Pvt. Ltd., a leading provider of solar inverters, battery energy storage systems, EV chargers, UPS, and solar power solutions. It also stated that the partnership aims to leverage IL JIN’s manufacturing R&D capabilities to accelerate product innovation and strengthen Power-One’s position in the renewable energy and industrial segments.

Corporate Landscape of the market:

Recent Developments

- In January 2025, Enphase Energy announced that it had expanded its Southeast Asia presence by entering the Vietnam and Malaysia solar markets, shipping its high-powered IQ8P Microinverters for residential and commercial applications.

- In October 2024, Servotech Power Systems Ltd. announced the launch of a new series of solar solutions, which includes microinverters (800 W-1600 W), on-grid inverters, hybrid inverters, battery energy storage systems, and solar pump controllers.

- Report ID: 8256

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Solar Micro Inverter Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.