Gas Turbine Services Market Outlook:

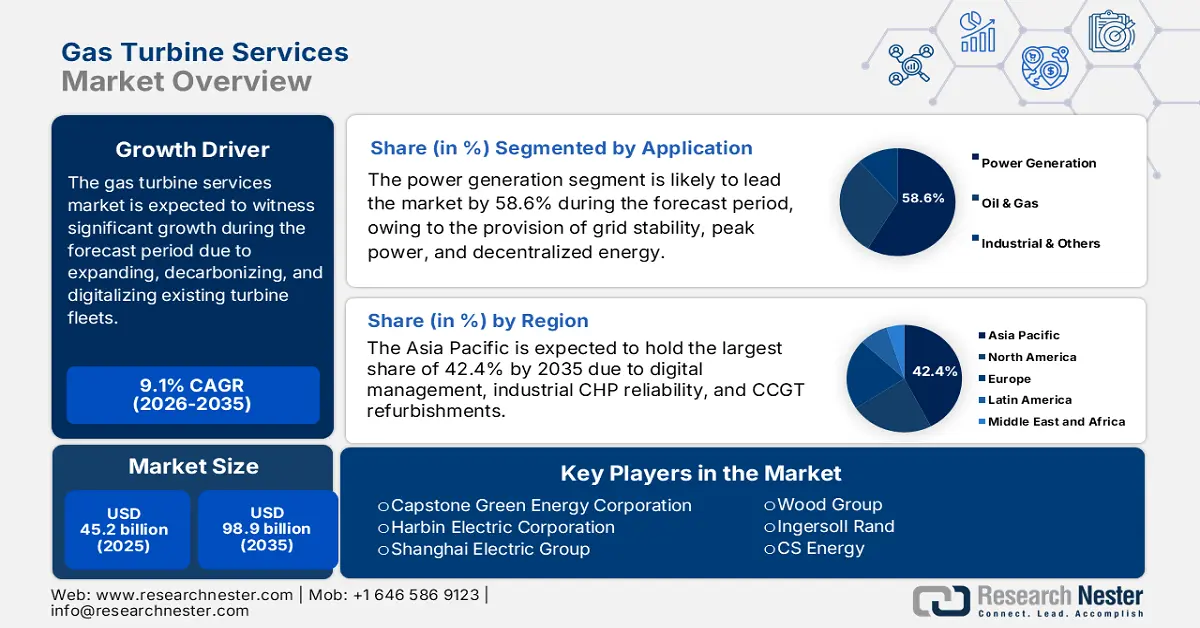

Gas Turbine Services Market size was over USD 45.2 billion in 2025 and is estimated to reach USD 98.9 billion by the end of 2035, expanding at a CAGR of 9.1% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of gas turbine services is evaluated at USD 49.3 billion.

The international market is currently witnessing steady growth, which is fueled by lifecycle expansion, digitalization, and decarbonization of present turbine fleets. According to official statistics published by the Global Energy Monitor Organization in August 2024, Mitsubishi Power, Siemens Energy, and GE Vernova are regarded as the top three leading manufacturers of gas turbines, significantly dominating with 2/3rd of the market. Besides, GE Vernova is explicitly leading the international market with nearly 55 GW of turbines under construction. Additionally, this organization offers 39% of gas turbines for in-construction gas facilities in China. Meanwhile, Mitsubishi’s joint venture, Dongfang Electric Corporation, caters to almost 25% of gas turbines in construction. Therefore, with an increase in organizational contributions globally, there is a huge growth opportunity for the gas turbine services market.

Furthermore, hydrogen and decarbonization integration, predictive and digitalization maintenance, fleet modernization, lifecycle expansion, and continuous regional growth are other drivers uplifting the market globally. As per official statistics published by the United Nations Organization in 2025, almost 80% of the worldwide population resides in nations that are suitable importers of fossil fuels, which is nearly 6 billion people depending on fossil fuels. Besides, more than 90% of the latest renewable projects are cheaper in comparison to fossil fuel alternatives. Simultaneously, offshore wind and solar, respectively, account for 53% and 41% of the renewable energy than fossil fuels. Besides, renewable energy caters to the electricity demand, especially for data centers and artificial intelligence (AI). For instance, a typical AI data center consumes electricity as 100,000 homes, and each major technological firm needs to switch 100% renewables to power data facilities by the end of 2030.

Key Gas Turbine Services Market Insights Summary:

Regional Highlights:

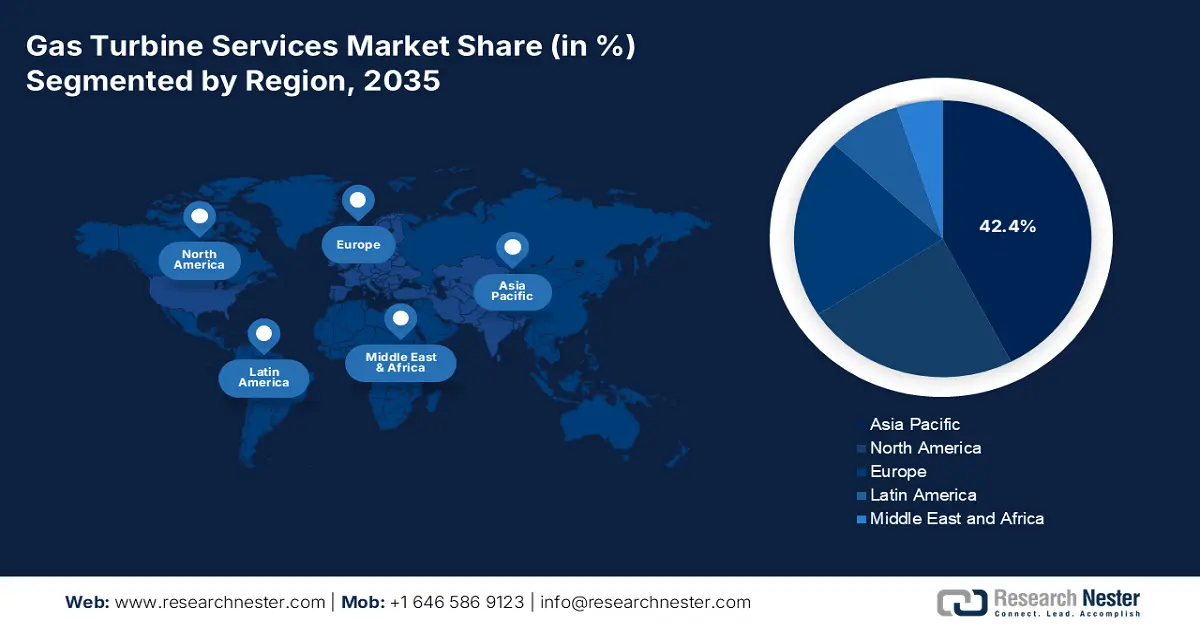

- Asia Pacific is projected to command a leading 42.4% share by 2035 in the gas turbine services market, reinforced by rising CCGT refurbishments, expanding digitalized operations, and strong industrial CHP reliance across key economies.

- Europe is anticipated to register the fastest growth over the 2026-2035 period, accelerated by stringent climate alignment, emissions compliance requirements, and sustained lifecycle servicing of an extensive installed turbine base.

Segment Insights:

- The power generation sub-segment is expected to capture a dominant 58.6% share by 2035 in the gas turbine services market, supported by its role in decentralized energy delivery, peak-load balancing, and grid stability while advancing clean-fuel integration that necessitates intensive maintenance.

- The OEM services sub-segment is projected to secure the second-largest share by 2035, strengthened by proprietary design expertise, certified spare-part access, and integrated service offerings that sustain high-efficiency and compliant turbine operations.

Key Growth Trends:

- Increase in clean energy transition

- Surge in grid modernization

Major Challenges:

- Increase in operational and maintenance expenses

- Integrating hydrogen and alternative fuels

Key Players: General Electric (U.S.), Siemens Energy AG (Germany), Mitsubishi Power (Japan), Kawasaki Heavy Industries (Japan), Solar Turbines Incorporated (U.S.), Ansaldo Energia (Italy), Rolls-Royce Holdings plc (UK), MAN Energy Solutions (Germany), Bharat Heavy Electricals Limited (India), Doosan Heavy Industries & Construction (South Korea), Hyundai Heavy Industries (South Korea), Alstom (France), Capstone Green Energy Corporation (U.S.), Harbin Electric Corporation (China), Shanghai Electric Group (China), Toshiba Energy Systems & Solutions Corporation (Japan), Wood Group (UK), Ingersoll Rand (U.S.), CS Energy (Australia), Sime Darby Berhad (Malaysia).

Global Gas Turbine Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 45.2 billion

- 2026 Market Size: USD 49.3 billion

- Projected Market Size: USD 98.9 billion by 2035

- Growth Forecasts: 9.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.4% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Japan, Germany, India

- Emerging Countries: South Korea, Saudi Arabia, United Arab Emirates, Brazil, Indonesia

Last updated on : 13 January, 2026

Gas Turbine Services Market - Growth Drivers and Challenges

Growth Drivers

- Increase in clean energy transition: The gas turbine services market is increasingly gaining importance, since it is utilized as a bridge technology to readily balance renewable intermittency. Additionally, suitable services ensure turbines remain compliant and efficient with emissions standards. According to official statistics published by the World Resources Institute in February 2025, solar storage has successfully surpassed 2023’s record installations as of 2024, adding approximately 39.6 GW of capacity in comparison to 27.4 GW in 2023. Likewise, battery storage has almost doubled in 2024, with the overall installed capacity reaching nearly 29 GW, and further grew by 47% by the end of 2025. Meanwhile, there has been a growth in onshore wind capacity, with 5.3 GW of latest generation addition as of 2024, thus positively catering to the clean energy aspect.

Global Solar, Battery Storage, and Wind Capacity Yearly Capacity Additions (2021-2025)

|

Year |

Solar (GW) |

Battery Storage (GW) |

Wind Capacity (GW) |

|

2021 |

19 |

3.4 |

15 |

|

2022 |

17.9 |

4.1 |

9.2 |

|

2023 |

27.4 |

6.4 |

6.6 |

|

2024 |

39.4 |

13.1 |

5.3 |

|

2025 |

37.5 |

16.2 |

8.9 |

Sources: World Resources Institute

- Surge in grid modernization: The rise in renewable penetration increasingly demands fast-ramping and flexible turbines, along with services focusing on operational agility, which positively impacts the market globally. As per official production figures indicated by the IEA Organization in 2026, electricity grids are expected to reach national objectives by refurbishing more than 80 kilometers by the end of 2040. Besides, according to the Net Zero Emissions by 2050 Scenario, solar and wind cater to nearly 90% of the increase. Therefore, the escalation of renewable energy deployment focuses on modernizing grid distribution and establishing standard transmissions for connecting renewable sources, which in turn denotes an optimistic outlook for the gas turbine services market.

- Focus on industrial demand: Industries, such as manufacturing, petrochemicals, and oil and gas, readily depend on turbine services for reliability and cogeneration. According to an article published by Cleaner Waste Systems in March 2025, nearly 2.47 × 106 kJ of energy is significantly consumed per 1 metric ton of product in a usual petrochemical sector. In addition, the 1,066 GW renewable power capacity contributes to ensuring a reduction in greenhouse gas emissions by 14.7%, which is equivalent to almost 129 MtCO2. Besides, the aspect of steam cracking comprises feeding hydrocarbons, effectively mixed with steam, into the radiant furnace coils that operate at extreme temperatures, ranging between 750 to 950 degrees Celsius. Moreover, the energy intensity in this case frequently accounts for a substantial portion, surpassing 50% of a facility’s overall thermal energy demand, thus suitable for uplifting the market globally.

Challenges

- Increase in operational and maintenance expenses: The gas turbine services market is capital-intensive, requiring specialized equipment, skilled labor, and advanced diagnostic tools. The cost of spare parts, particularly for large industrial turbines, can be prohibitive, with OEMs often controlling pricing and availability. Smaller operators and independent service providers struggle to compete with OEMs due to economies of scale and proprietary technologies. Additionally, unplanned outages can lead to significant financial losses, making preventive maintenance critical but costly. The complexity of modern turbines, especially those designed for combined-cycle operations, demands advanced monitoring systems and digital twins, further increasing service costs, thereby negatively impacting the gas turbine services market expansion.

- Integrating hydrogen and alternative fuels: The push toward decarbonization is driving demand for hydrogen-ready turbines, but integrating hydrogen into existing fleets presents significant challenges. Hydrogen combustion requires modifications to turbine components, including burners and cooling systems, to handle higher flame temperatures and prevent NOx emissions. Service providers must develop new expertise and invest in research and development to retrofit turbines safely and efficiently. However, hydrogen supply chains remain underdeveloped, with limited infrastructure for production, storage, and distribution. This creates uncertainty for operators considering hydrogen retrofits, as the economic viability depends on fuel availability and cost. Moreover, regulatory frameworks for hydrogen adoption vary across regions, complicating the standardization of service practices in the gas turbine services market.

Gas Turbine Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.1% |

|

Base Year Market Size (2025) |

USD 45.2 billion |

|

Forecast Year Market Size (2035) |

USD 98.9 billion |

|

Regional Scope |

|

Gas Turbine Services Market Segmentation:

Application Segment Analysis

The power generation sub-segment, which is part of the application segment, is anticipated to garner the largest share of 58.6% in the gas turbine services market by the end of 2035. The sub-segment’s upliftment is primarily attributed to the provision of decentralized energy, peak power, and grid stability for marine propulsion, industries, and homes. Additionally, it can bridge the gap in the energy transition by implementing clean fuels, such as hydrogen, which demand strong maintenance for reliability and efficiency. According to official statistics published by the IEA Organization in 2025, there has been a surge in the electricity demand by 4.3% as of 2024, denoting an increase from 2.5% in 2023. Besides, the average electricity pace was 2.7% in 2023, significantly doubling the rate of overall energy demand growth within the same timeline. Internationally, the electricity consumption increased by 1,080 TWh, which is almost twice the yearly average.

Service Provider Segment Analysis

By the end of the forecast period, the OEM services sub-segment, part of the service provider, is projected to hold the second-largest share in the gas turbine services market. The sub-segment’s growth is highly driven by its proprietary knowledge, access to original designs, and ability to provide certified spare parts. OEM services typically include long-term service agreements (LTSAs), predictive maintenance, performance upgrades, and digital monitoring solutions. Their competitive advantage lies in offering integrated packages that combine hardware, software, and technical expertise, ensuring turbines operate at peak efficiency and comply with emissions standards. OEMs such as General Electric, Siemens Energy, and Mitsubishi Power leverage global service networks, enabling rapid response and standardized quality across regions. The increasing complexity of modern turbines, especially those designed for combined-cycle and hydrogen-ready operations, further strengthens OEM dominance, as independent providers often lack the technical depth to manage advanced retrofits.

Turbine Type Segment Analysis

Based on the turbine type, the heavy duty segment in the gas turbine services market is expected to account for the third-largest share during the stipulated timeline. The segment’s development is extremely propelled by its utilization in utility-scale power generation and large industrial applications. These turbines are designed for high output, durability, and continuous operation, making them critical assets in national grids and industrial clusters. Service demand for heavy-duty turbines is substantial, as they require regular maintenance, overhaul, and performance optimization to ensure reliability under demanding operating conditions. The segment benefits from the global push toward cleaner energy, with heavy-duty turbines increasingly retrofitted for hydrogen blending and low-NOx combustion systems, thereby making it suitable for boosting the market’s exposure.

Our in-depth analysis of the gas turbine services market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Service Provider |

|

|

Turbine Type |

|

|

Service Type |

|

|

Turbine Capacity |

|

|

Contract Model |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gas Turbine Services Market - Regional Analysis

APAC Market Insights

Asia Pacific gas turbine services market is expected to account for the largest share, 42.4%, by the end of 2035. The market’s upliftment in the region is highly attributed to a rise in CCGT refurbishments, digitalized operations and management, along with industrial CHP dependency, particularly in Southeast Asia, South Korea, Japan, India, and China. According to official statistics published by the IEA Organization in 2026, 11.1% is the overall gas in the energy supply as of 2023. In addition, the total natural gas supply in the region accounts for 32,594,334 TJ, along with more than 201% in trend, and 23% of the international share in the same year. Besides, the share of regional gas production caters to 75.3% of the overall gas supply, with 24,553,764 TJ, over 143% of trend, and 17% of the worldwide share. However, the natural gas supply across different countries is positively driving the market’s demand in the region.

Country-Specific Total Natural Gas Supply in Asia Pacific (2023)

|

Countries |

Natural Gas Supply (TJ) |

|

China |

13,349,463 |

|

Japan |

3,341,205 |

|

India |

2,438,346 |

|

Korea |

2,137,336 |

|

Malaysia |

1,849,400 |

|

Indonesia |

1,806,381 |

|

Australia |

1,518,992 |

|

Thailand |

1,469,852 |

Source: IEA Organization

The gas turbine services market in China is growing significantly due to continuous decarbonization reforms that readily favor high-efficiency gas assets, industrial CHP, and the presence of a massive installed CCGT base. Based on official statistics published by the State Council in November 2025, by the end of 2025, the usual installed hydropower capacity in the country stood at nearly 380 GW, along with pumped-storage hydropower stations at nearly 62.3 GW. Besides, within the same duration, the country comprised 112 nuclear power units in operation, both under construction and accepted for construction, with a combined installed capacity of 125 GW. Moreover, the country was leading with an yearly production capacity of green hydrogen energy, with more than 150,000 tons in 2024, thereby denoting a positive outlook for the market’s growth.

The gas turbine services market in Malaysia is also growing, owing to the existence of robust policy support for cleaner generation, utility fleet modernization, and an increase in industrialization. According to the January 2025 ITA article, the country has readily pledged to diminish its greenhouse gas emission intensity by almost 45% by the end of 2030. In addition, the country has made a suitable commitment to enhance the renewable energy composition to 70% of the overall generation capacity by 2050. Therefore, as part of this entire procedure, the country is projected to extend its renewable capacity from 6 GW to 14 GW. Besides, the government in Sarawak has significantly integrated climate strategies among domestic states and has declared targets to gain more than 70% renewable energy utilization by the end of 2030, thus readily supporting the market’s growth.

Europe Market Insights

Europe gas turbine services market is expected to emerge as the fastest-growing region during the forecast period. The market’s development is highly propelled by alignment with regional climate policy, emissions compliance, and lifecycle maintenance of a large-scale installed base. Industry-validated analysis proposed by CEFIC Organization in 2024, the chemical industry landscape in France constitutes a turnover of €108.5 billion, along with €2 billion for research and development and €8 billion in capital spending. In addition, the chemical sector continues to remain the probable exporting industrial sector with €80 billion in exports. Besides, the Europe Commission’s research and innovation aspect for advanced materials and chemicals under the Europe Green Deal and Horizon Europe also supports sustainable and safe inputs, thus suitable for boosting the gas turbine services market.

Germany is gaining increased traction due to industrial cogeneration, the presence of a base for combined-cycle technology, sectoral emission budgets, and strict climate targets. According to official statistics put forth by Carbon Brief Organization in February 2025, the country’s target is to achieve net-zero for all greenhouse gases by the end of 2045, with interim targets of a 65% emission reduction by 2030 as well as 88% by 2040. Additionally, the country is also regarded as the first-ever economy to provide a net-negative objective beyond its net-zero date. Moreover, the present objective has been set for the country to reach 80% of renewable power by the end of 2030. In addition, this particular target is also supported by 30 GW of offshore wind, along with 115 GW of onshore wind, thus catering to the market’s upliftment in the country.

The gas turbine services market in the UK is also developing, owing to flexible generation demands, including rapid renewable integration that is escalating the need for high-availability CCGT services, capabilities, and digitalized performance optimization. Based on government data proposed by Wind Europe Organization in August 2024, the country’s government allocated budget for the upcoming contract to a record of £1.5 billion. Out of this, £1.1 billion is projected to be available for bottom-based offshore wind. In addition, this denotes 38% higher than the £800 billion onshore wind budget readily proposed under the UK government. Besides, wind energy is considered the cornerstone on which the government’s objective is to completely decarbonize electricity consumption by the end of 2030. This even comprises a commitment to double onshore wind, along with quadrupling offshore wind capacity by the same year, thus suitable for boosting the market.

North America Market Insights

North America gas turbine services market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly fueled by digitalization in operations and management, emissions compliance, along with lifestyle upgradation and maintenance for the large-scale installed base in combined-cycle facilities. According to official statistics published by the ITA in 2025, the chemical sector is one of the most essential exporting industries of the U.S. manufacturing, exporting more than USD 494 billion of chemicals. In addition, as the most eminent leader in chemical production, more than 13% of the world’s chemicals are derived from the country, thereby assisting the market for dependable heat and power generation. Moreover, the sector comprises 14,000 establishments for more than 70,000 products, and in the middle of 2024, the chemical manufacturing sector employed over 902,300 employees, thus creating an optimistic outlook for the overall market.

The gas turbine services market in the U.S. is gaining exposure due to decarbonization of power generation, predictive and digitalization maintenance, as well as EPA-based green chemistry strategies. Based on government data put forth by the Department of Energy in August 2024, the Office of Fossil Energy and Carbon Management (FECM) declared USD 8.8 million for 11 university-specific research and development projects for improving the performance of hydrogen-based turbines. These selected projects are expected to create innovative components and materials that tend to withstand and manage extreme environmental conditions that are generated during hydrogen combustion to utilize 100% of clean hydrogen in gas turbines, especially for low-carbon power generation. This assists in advancing the Biden-Harris Administration's objectives of 100% carbon-free electricity by the end of 2035.

The gas turbine services market in Canada is also growing due to gas backup, hydropower integration, federal clean energy funding, cross-border electricity trade, circular waste and economy reduction. According to Government-reported estimates as per the December 2024 Government of Canada article, the country is the third-largest producer of hydroelectricity internationally, and hydroelectric stations generated an overall 393,789 GWh, readily accounting for 61.7% of the country’s overall electricity generation. In addition, the country also generated 595 hydroelectricity stations, along with 82,322 megawatts of installed capacity. Furthermore, as per the November 2023 Government of Canada article, hydro caters to nearly 60% of the country’s overall generation, and by the end of 2040, the country is predicted to generate 8.5% of the global hydro power, thus making it suitable for the market’s upliftment.

Key Gas Turbine Services Market Players:

- General Electric (U.S.)

- Siemens Energy AG (Germany)

- Mitsubishi Power (Japan)

- Kawasaki Heavy Industries (Japan)

- Solar Turbines Incorporated (U.S.)

- Ansaldo Energia (Italy)

- Rolls-Royce Holdings plc (UK)

- MAN Energy Solutions (Germany)

- Bharat Heavy Electricals Limited (India)

- Doosan Heavy Industries & Construction (South Korea)

- Hyundai Heavy Industries (South Korea)

- Alstom (France)

- Capstone Green Energy Corporation (U.S.)

- Harbin Electric Corporation (China)

- Shanghai Electric Group (China)

- Toshiba Energy Systems & Solutions Corporation (Japan)

- Wood Group (UK)

- Ingersoll Rand (U.S.)

- CS Energy (Australia)

- Sime Darby Berhad (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- General Electric remains one of the largest players in the global gas turbine services market, with a strong presence in power generation and industrial sectors. Its service portfolio emphasizes digital monitoring, predictive maintenance, and lifecycle management, helping utilities extend turbine efficiency and reliability.

- Siemens Energy AG is a leading European provider of gas turbine services, focusing on modernization, hydrogen-ready retrofits, and emissions reduction. The company’s global service network and partnerships with utilities position it as a key driver of sustainable turbine operations.

- Mitsubishi Power delivers advanced turbine services across Asia and globally, with strong expertise in combined-cycle plants. Its initiatives include hydrogen blending pilots and long-term service agreements, supporting Japan’s and Asia’s decarbonization goals.

- Kawasaki Heavy Industries specializes in industrial gas turbines and service solutions for distributed generation and cogeneration. The company emphasizes reliability upgrades and efficiency improvements, particularly in industrial clusters and localized energy systems.

- Solar Turbines Incorporated, a Caterpillar subsidiary, focuses on small to mid-sized industrial gas turbines and aftermarket services. Its service offerings are widely adopted in oil & gas and industrial cogeneration, with strong emphasis on uptime and operational flexibility.

Here is a list of key players operating in the global market:

The worldwide gas turbine services market is highly competitive, dominated by established players from the U.S., Europe, and Asia. Companies such as General Electric, Siemens Energy, and Mitsubishi Power leverage digitalization, predictive maintenance, and hydrogen-ready retrofits to strengthen their market positions. Strategic initiatives include alliances with utilities, investments in research and development for low-emission technologies, and expansion into emerging markets like India and Southeast Asia. Regional firms such as BHEL, Doosan, and Sime Darby are increasingly collaborating with global OEMs to enhance service capabilities. Besides, in November 2025, Toshiba Energy Systems & Solutions Corporation and GE Vernova significantly signed a memorandum of understanding (MoU). The purpose of this is to operate together and integrate the Gas Turbine Combined Cycle (GTCC) CCS solution for reducing power plant carbon dioxide emissions, thereby making it suitable for bolstering the gas turbine services market globally.

Corporate Landscape of the Market:

Recent Developments

- In December 2025, FTAI Aviation Ltd. notified the introduction of FTAI Power, which is the newest platform, readily focused on converting CFM56 engines to power turbines that are developed for offering the most cost-efficient, scalable, and flexible solution to deliver reliable energy across data centers internationally.

- In October 2025, GE Vernova Inc. unveiled the latest Repair Service Center in the Parque industrial Centenario in Argentina, marking its first-ever repair facility for its Aeroderivative business in Latin America, predicted to uplift repair capabilities for aero derivatives gas turbines fleet.

- In February 2025, Mitsubishi Power declared that it has received a huge order in Morocco for supplying 2 M701JAC gas turbines, along with auxiliary equipment for the Al Wahda Open Cycle Gas Turbine Power Plant that is operated and owned by The National Office of Electricity and Drinking Water (ONEE).

- Report ID: 8336

- Published Date: Jan 13, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gas Turbine Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.