Aeroderivative Gas Turbine Market Outlook:

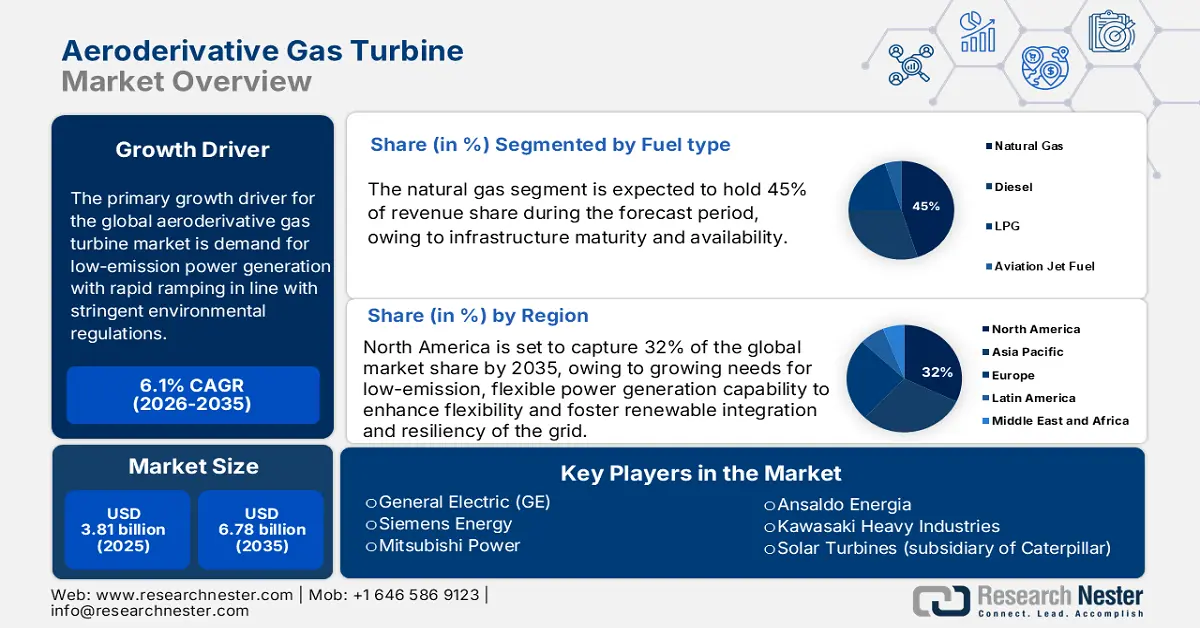

Aeroderivative Gas Turbine Market size was valued at USD 3.81 billion in 2025 and is projected to reach USD 6.78 billion by the end of 2035, growing at a CAGR of 6.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of aeroderivative gas turbine is estimated at USD 4.04 billion.

The dominant demand for oil and gas is foreseen to fuel the installation of aeroderivative gas turbines in the exploration facilities. The onshore exploration is leading the production of hydrocarbons. However, several oil and gas companies are focusing on offshore discoveries to earn lucrative gains. The U.S. Energy Information Administration (EIA) estimates that by the end of 2025 and the first quarter of 2026, the average amount of oil in the world's inventory will be above 2 million barrels per day (b/d), which is 0.8 million b/d more than it was last month. Furthermore, the study by the International Energy Agency highlights that global oil consumption in 2024 increased by 1.3% over 2019 levels, mostly as a result of a 12% increase in demand for petrochemical feedstocks over the preceding five years.

The U.S., Saudi Arabia, Russia, Canada, Iraq, and China are leading the oil production in the global landscape. The strong existence of onshore oil reserves in these areas is directly boosting the trade of aeroderivative gas turbines. The current investments in the exploration of offshore oil and gas farms are set to increase the applications of aeroderivative gas turbines during the foreseeable period. The IEA study projects that, by December 2025, the U.S. will produce a record-breaking 13.6 million barrels of crude oil per day. By the last quarter of 2026, the United States will produce 13.1 million barrels of crude oil per day. The production of crude oil is expected to average 13.4 million barrels per day in 2025 and 13.3 million barrels per day in 2026.

Key Aeroderivative Gas Turbine Market Insights Summary:

Regional Insights:

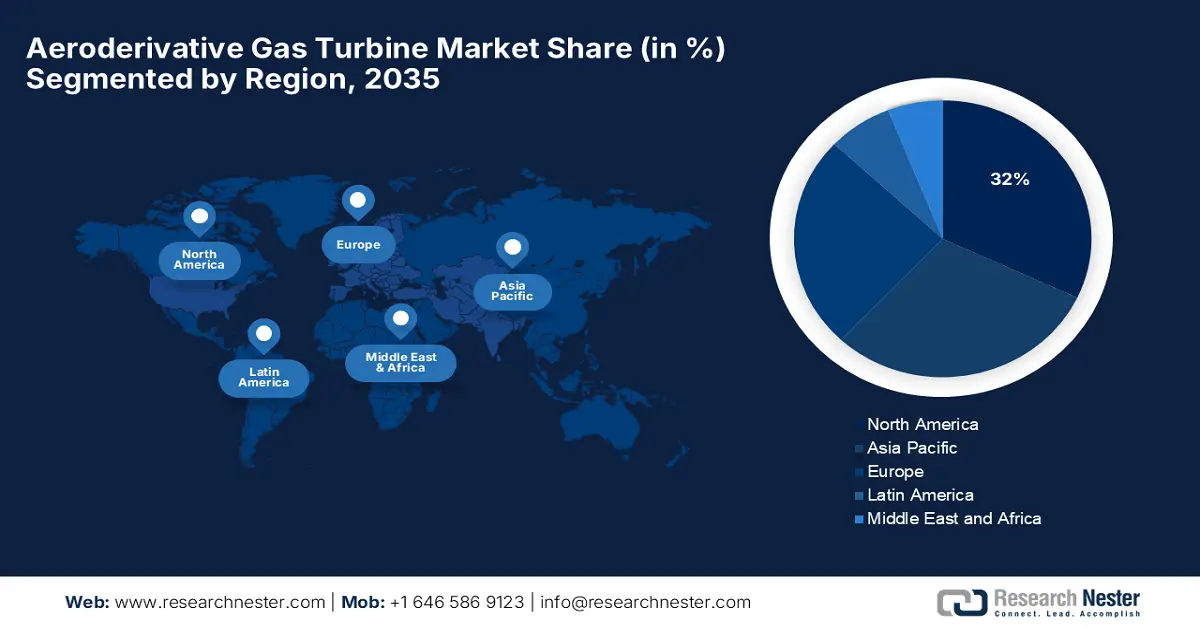

- North America is predicted to hold around 32% market share by 2035, impelled by growing demand for low-emission and flexible power generation solutions.

- Asia Pacific is expected to account for approximately 30% share by 2035, driven by industrialization, rising power demand, and renewable energy initiatives.

Segment Insights:

- Natural Gas segment is projected to account for 45% market share by 2035, propelled by infrastructure maturity and fuel availability.

- 10–20 MW Capacity Power sub-sector is expected to hold 42% market share by 2035, owing to scalability, efficiency, and suitability for industrial and distributed energy applications.

Key Growth Trends:

- Military and aviation revenue boosters

- Greener fuels & chemical recycling innovation

Major Challenges:

- High initial capital requirement

- Competition from decarbonization trend

Key Players: General Electric (GE), Siemens Energy, Mitsubishi Power, Ansaldo Energia, Kawasaki Heavy Industries, Solar Turbines (subsidiary of Caterpillar), MAN Energy Solutions, Hyundai Heavy Industries, Bharat Heavy Electricals Limited (BHEL), John Cockerill, Wood Group, Woodward, Inc., Australian Gas Turbines Pty Ltd, MHI Machinery Corporation, Mitsubishi Heavy Industries (MHI).

Global Aeroderivative Gas Turbine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.81 billion

- 2026 Market Size: USD 4.04 billion

- Projected Market Size: USD 6.78 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, United Kingdom, Japan

- Emerging Countries: India, China, South Korea, Brazil, Australia

Last updated on : 24 September, 2025

Aeroderivative Gas Turbine Market - Growth Drivers and Challenges

Growth drivers

- Military and aviation revenue boosters: The military and aerospace fields are a growing opportunity for aeroderivative gas turbine companies. The versatility of aeroderivative gas turbines in these sectors, such as energy generation, propulsion, and auxiliary solutions, is contributing to the overall market growth. The increasing innovation and export activities in the aerospace and military space are increasing the installation of aeroderivative gas turbines. The International Trade Administration (ITA) states that the U.S. aerospace companies have a presence in over 200 global cities. The developments in new business partnerships and growing global presence are likely to offer growth opportunities for aeroderivative gas turbine manufacturers in the U.S.

- Greener fuels & chemical recycling innovation: The goal of the 2022 REPowerEU Strategy was to produce 10 million tons and import 10 million tons by 2030. About 10% of the EU's energy demands are expected to be met by renewable hydrogen by 2050, significantly lowering the carbon footprint of energy-intensive industrial operations and the transportation sector. The EU's energy transition, net-zero, and sustainable development strategies all heavily rely on hydrogen. These are the very innovations that comply with the EPA low-carbon fuel provisions and CO₂ limits. Low-emission fuel turbines, along with hydrogen co-firing, act as a real competitive advantage to be applied in wider industrial and grid-steering applications.

- Increasing applications in LNG plants: The rise in investments in the LNG infrastructure expansion is poised to open new avenues in the market for aeroderivative gas turbines. The clean energy trend is augmenting the consumption of natural gas and renewable fuels. This aspect is creating a profitable space for aeroderivative gas turbine manufacturers. For instance, the Institute for Energy Economics and Financial Analysis (IEEFA) projects that the global capacity for nameplate liquefaction may reach 666.5 MTPA by the end of 2028. According to the International Energy Agency's (IEA) stated policy scenario, the global LNG trade is expected to reach 482 MTPA in 2050. Asia Pacific and North America are anticipated to lead the LNG production and supply. According to IEEFA, 193 million metric tons per year (MTPA) of new supply capacity could be added by nameplate LNG liquefaction capacity from projects that have already started construction or that have been approved by financially viable backers between 2024 and 2028, representing a 40% increase in just five years.

1.Emerging LNG Supply Trade

Global LNG Supply Facilities in Operation,2020-2023

|

Country |

Project / Train |

Start Year |

Capacity (MTPA) |

|

USA |

Elba Island T4-T10 |

2020 |

1.8 |

|

USA |

Cameron T2 |

2020 |

4.5 |

|

USA |

Cameron T3 |

2020 |

4.5 |

|

USA |

Freeport T2 |

2020 |

5.5 |

|

USA |

Freeport T3 |

2020 |

5.5 |

|

USA |

Corpus Christi T3 |

2020 |

5.1 |

|

Russia |

Yamal T4 |

2021 |

0.9 |

|

USA |

Sabine Pass T6 |

2021 |

5.1 |

|

Malaysia |

PFLNG Dua |

2021 |

1.5 |

|

Russia |

Portovaya LNG |

2022 |

1.5 |

|

USA |

Calcasieu Pass |

2022 |

10.5 |

|

Mozambique |

Coral South |

2022 |

3.4 |

|

Indonesia |

Tangguh LNG T3 |

2023 |

3.8 |

Source: IEEFA

2.Emerging Trade Dynamics of Aeroderivative Gas Turbine Market

Leading Exporters and Importers of Aeroderivative Gas Turbine Market in 2023

|

Leading Exporters |

Value (USD Billion) |

Leading Importers |

Value (USD Billion) |

|

United States |

69.3 |

United States |

29.8 |

|

United Kingdom |

29.1 |

Hong Kong |

16.5 |

|

France |

19.2 |

Germany |

14.4 |

Source: OEC

Challenges

- High initial capital requirement: The upfront investment required for the production and installation of aeroderivative gas turbines is challenging their sales growth. The small scale and new companies often find it difficult to compete with leading giants due to limited budgets. This factor often limits the new product launches and hinders small players from accessing the latest opportunities. The high installation and maintenance costs also deter end users from investing in aeroderivative gas turbines. This competitive scenario is often observed in price-sensitive markets.

- Competition from decarbonization trend: The decreasing costs of renewables such as solar, wind, and battery storage are likely to challenge the sales of aeroderivative gas turbines. The decarbonization trend is estimated to register a clean energy shift globally. However, the innovations focused on the use of aeroderivative gas turbines in renewable sources are anticipated to increase the revenues of key market players. Also, the dominance of fossil fuels is projected to offer high revenue-earning opportunities to the manufacturers.

Aeroderivative Gas Turbine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 3.81 billion |

|

Forecast Year Market Size (2035) |

USD 6.78 billion |

|

Regional Scope |

|

Aeroderivative Gas Turbine Market Segmentation:

Fuel Type Segment Analysis

Natural gas takes the lead with an estimated 45% market share of revenues by 2035 due to infrastructure maturity and availability, states the U.S. DOE. Nearly 2,400 billion cubic feet (Bcf) of natural gas in the form of LNG were exported by the United States in 2020 in the form of huge LNG tanker ships. A smaller amount was transported by truck or container. As of August 2021, the United States had shipped LNG to 40 nations across five continents. Its lower CO₂ emissions than coal or oil are consistent with stricter EPA regulations towards 2030 CO₂ reduction. Fuel preference supports operational dependability and competitiveness to drive big-power and industrial customers.

Power Output Segment Analysis

The 10-20 MW capacity power sub-sector is expected to retain 42% market share in 2035, reflecting the balance of capability and modularity appropriate for industrial and distributed energy applications. Distributed generation capacity is expected to increase according to the U.S. Energy Information Administration's prediction. The turbines are highly efficient and have a fast response, addressing onsite power and cogeneration markets. Their ability to scale and use low-carbon fuels places them at the top of the list in grids focusing on resiliency and emissions reductions. The increasing expansion of renewable energy generation plants is foreseen to double the revenue of advanced aeroderivative gas turbine producers.

Application Segment Analysis

The power generation sub-segment is expected to capture 37% of market revenue in 2035. The aeroderivative gas turbine is the most sought-after component in the power generation facilities. The constant rise in the consumption of energy is likely to register a stable demand for aeroderivative gas turbines. From 2.5% in 2023 to a 4.3% year-over-year increase in 2024, electricity consumption is predicted to expand at a strong 3.9% rate during 2025-2027. China accounted for 54% of the increase in worldwide power demand in 2024, with emerging economies seeing the majority of this growth. Developing nations will continue to be the main drivers of growth through 2027, contributing over half of the increases and around 85% of the increased global demand for energy. All these trends position aeroderivative turbines at the forefront of utility assets to address variable load management and decarbonization goals.

Our in-depth analysis of the global aeroderivative gas turbine market includes the following segments:

|

Segments |

Subsegments |

|

Power Output |

|

|

Fuel Type |

|

|

Application |

|

|

Service Type |

|

|

Technology |

|

|

Deployment type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aeroderivative Gas Turbine Market - Regional Analysis

North America Market Insights

North America's aeroderivative gas turbine market is expected to account for around 32% of the overall market share by 2035 and grow at a CAGR of 5.8% during the forecast period of 2026-2035. The demand is driven by growing needs for low-emission, flexible power generation capability to enhance flexibility and foster renewable integration and resiliency of the grid. Infrastructure upgrades and tough environmental regulations continue driving the installation of rapid-ramping, hydrogen-compatible turbines into utility and industrial applications. The growth of the aerospace sector is set to push the sales of aeroderivative gas turbines in the years ahead. The overall business output of the A&D sector in 2023 was $955 billion. The industry produced $533 billion in direct output, and the domestic A&D supply chain created an additional $422 billion in indirect activity. The A&D sector produced $425 billion in economic value, or 1.6% of the nominal GDP of the United States in 2023. The U.S. A&D sector supports jobs that account for 1.4% of all jobs in the country.

The U.S. aeroderivative gas turbine market is expected to lead the regional demand with nearly 85% of North America by 2035. Six hydrogen research and development projects, mostly centered on gas turbine technology, have received $24.9 million from the U.S. Department of Energy, with more than $11 million coming from private funding. Raytheon was awarded $3 million to create a low-NOx ammonia-fired turbine combustor and $4.5 million to test hydrogen-natural gas mixtures. General Electric received approximately $7 million for additional turbine research and $5.9 million to test hydrogen blends up to 100% in turbine components. 8 Rivers Capital was awarded $1.4 million for a design study of a hydrogen production and carbon capture plant, and the Gas Technology Institute was awarded $3 million to investigate ammonia-hydrogen fuel mixtures. Increments of utility-scale installations, distributed generation, and CHP installations fuel the turbine buys. Besides, energy resilience and security as a priority by the United States government is driving the updating of turbines in strategic facilities and defense bases.

Canada supplies about 15% of the home market, with growing industrial cogeneration and gas-fired generators. Provincial regulation in Alberta and Ontario stimulates lower emissions through combined cycle retrofits and renewable fuel blending. Canada's huge natural gas reserves and export operations are perfect cases of the unabated relevance of aero derivative turbines to balancing environmental issues with the requirement for energy. By 2025 or 2026, Canada's first large-scale LNG project is expected to begin operations. The pipeline expenses for the 14-MTPA LNG Canada project, which is led by Shell, PetroChina, Mitsubishi Corporation, and KOGAS, more than doubled. The price of Woodfibre LNG, a smaller project, has increased from CAD1.6 billion to CAD6.8 billion.

Asia Pacific Market Insights

The Asia Pacific aeroderivative gas turbine market is expected to account for around 30% of the global share by 2035 and expand at an estimated CAGR of 6.2% from 2026 to 2035. Industrialization, rising power requirements, and ambitious renewable energy proposals are the prime growth drivers. Focus of regional governments on grid stability has prompted investment in rapid-start, compact turbines that enable co-firing to facilitate hydrogen. Energy infrastructure upgrades and capacity expansion are the growth drivers for long-term markets.

China leads the aeroderivative gas turbine market, with more than 48% Asia Pacific revenue market share by 2035. China's 14th Five-Year Plan is focused on energy transformation, with targets for hydrogen and renewables integration set high. Provincial manufacturing centers like Jiangsu and Guangdong increased the capacity of turbine manufacturing. In 2023, China regained its position as the world's biggest importer of LNG. Imports reached 72.1 MTPA, a 12.4% rise. However, LNG purchases are still 10% below 2021 imports and have not fully recovered to levels prior to the Russian invasion of Ukraine. Government subsidies back R&D for future-generation gas turbine technology, driving domestic innovation. Mass-scale utility development is leading to a need for efficient and flexible power solutions that comply with emissions targets.

India is the Asia Pacific's second-largest market and accounted for nearly 20% of demand by 2035. The National Infrastructure Pipeline (NIP) was introduced by the Indian government for the fiscal years 2020-2025 to expedite the execution of outstanding infrastructure projects. NIP was introduced with a 2020-2025 infrastructure investment budget of Rs. 111 lakh crore ($1.5 trillion). Sectors with a significant participation in the NIP include energy, roads, urban infrastructure, and railroads. India's aviation industry is among the fastest-growing globally. From about 61 million in FY14 to approximately 137 million in FY20, India's domestic traffic has more than doubled, representing an annual growth of more than 14%. Growing penetration of combined heat and power (CHP) units, facilitated by government incentives, is driving the adoption of aeroderivative turbines in industrial and commercial applications.

Europe Market Insights

The aeroderivative gas turbine market of Europe is expected to have a market share of approximately 25.3% by 2035, growing at a CAGR of 4.8% from 2026 to 2035. The growth is supported by rigorous emission regulations by the EU and its green commitment to renewable-energy integration under the European Green Deal. Demand for this also comes from investments into hydrogen-capable turbines and combined heat and power systems in Germany, France, and the UK. These capacity enhancement and grid balancing projects have been vital to keep the regional market resilient through the ongoing energy transition.

Germany is driven by the National Hydrogen Strategy and the establishment of partnerships with industries. Russia supplied 55% of Germany's natural gas in 2020. Denmark, Norway, Belgium, and the Netherlands supplied 40% of Germany's residual natural gas consumption. The expected daily exports of 7.1 billion cubic feet of US LNG to EU nations in 2023 were worth more than $14.6 billion. About 48% of imports into the EU came from exports.

Key Aeroderivative Gas Turbine Market Players:

- General Electric (GE)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens Energy

- Mitsubishi Power

- Ansaldo Energia

- Kawasaki Heavy Industries

- Solar Turbines (subsidiary of Caterpillar)

- MAN Energy Solutions

- Hyundai Heavy Industries

- Bharat Heavy Electricals Limited (BHEL)

- John Cockerill

- Wood Group

- Woodward, Inc.

- Australian Gas Turbines Pty Ltd

- MHI Machinery Corporation

- Mitsubishi Heavy Industries (MHI)

The aeroderivative gas turbine market is highly competitive, dominated by established multinational corporations leveraging advanced R&D capabilities. GE and Siemens Energy collectively hold about 40% of the market, focusing on innovation in hydrogen-ready turbines and digital solutions for operational efficiency. Mitsubishi Power and Kawasaki Heavy Industries, leading Japanese players, are expanding capacity through strategic collaborations and pilot projects in hydrogen co-firing. Emerging players from India and South Korea invest in localization and cost optimization to capture regional demand. Industry leaders prioritize sustainability, targeting emissions reduction via integrated carbon capture and flexible hybrid systems, driving competitive differentiation and market expansion.

Top 15 Global Aeroderivative Gas Turbine Manufacturers by Market Share:

Recent Developments

- In March 2025, GE Vernova Inc. announced the launch of its next-generation of mobile aeroderivative gas turbines, power plants on wheels. This innovation delivers reliable and efficient energy anywhere, irrespective of the grid.

- In May 2020, Siemens Energy unveiled a pilot project in Norway deploying hybrid aeroderivative gas turbines that co-fire green hydrogen and natural gas. The initiative, supported by the Norwegian government’s green energy fund, targets a 50% reduction in carbon emissions from gas-fired power plants by 2030, setting a new benchmark for sustainable grid support technologies.

- Report ID: 5229

- Published Date: Sep 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aeroderivative Gas Turbine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.