Gas Turbine Market Outlook:

Gas Turbine Market size was valued at USD 12.89 billion in 2025 and is set to exceed USD 18.9 billion by 2035, registering over 3.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gas turbine is evaluated at USD 13.34 billion.

The market growth is driven by growing demand for natural gas and fuel efficient power plants, increasing investments in the power sector, and growing demand for electricity, especially in emerging economies. Additionally, government plans to boost the power sector and reduce carbon emissions have further contributed to the market revenue. There was a total inflow of USD 17 billion into the Indian power sector between April 2000 and June 2022. A total of 167 GW of renewable energy was installed in India as of October 31, 2022, representing 41% of the country's overall power capacity. Gas turbines produce fewer emissions than traditional coal-fired power plants and have become an increasingly popular option for governments to meet their emissions targets. This increased demand for gas turbines is expected to have a positive impact on the power sector, thereby driving the market growth.

In addition, increasing demand for energy efficient, cost-effective, and reliable power generation solutions, along with increasing investments in research and development of more efficient and clean gas turbines will boost the market size. Moreover, a growing population, increased urbanization, and increased economic activity contribute to the increase in power consumption in rural and urban areas. According to the International Energy Agency, world total electricity consumption reached 22 848 TWh in 2019, an increase of 1.7% over 2018. As of 2019, OECD final electricity consumption stood at 9 672 TWh. Gas turbines are an efficient way to generate electricity, as they can convert a large amount of fuel into energy quickly.

Key Gas Turbine Market Insights Summary:

Regional Highlights:

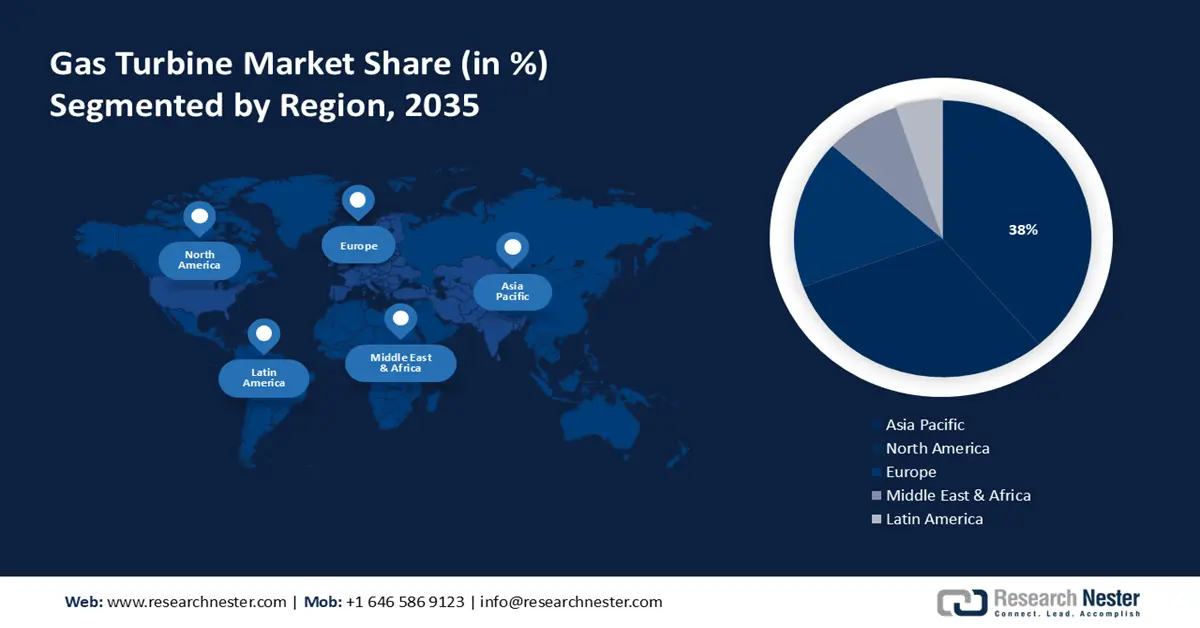

- Asia Pacific gas turbine market will dominate over 38% share by 2035, driven by rapid industrial growth requiring high power output and increasing demand for natural gas-fired turbines in the region.

- North America market will capture a 31% share by 2035, driven by the increasing adoption of natural gas for electricity generation, backed by the availability of natural gas resources in the region.

Segment Insights:

- The open cycle segment in the gas turbine market is forecasted to achieve a 64% share by 2035, driven by lower capital costs and faster start-up time in industrial and power sectors.

- The above 200 mw segment in the gas turbine market is projected to achieve a 37% share by 2035, attributed to the demand for efficient and cost-effective power generation in large-scale applications.

Key Growth Trends:

- Increasing Demand and Supply of Gas

- Surging Natural Gas-Based Electricity Generation

Major Challenges:

- Increasing Demand and Supply of Gas

- Surging Natural Gas-Based Electricity Generation

Key Players: General Electric Company, Siemens AG, Kawasaki Heavy Industries, Ltd., Ansaldo Energia, Mitsubishi Power, Ltd., MAN Energy Solutions, Solar Turbines Incorporated, Centrax Gas Turbines, Técnicas Reunidas S.A., Wärtsilä.

Global Gas Turbine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.89 billion

- 2026 Market Size: USD 13.34 billion

- Projected Market Size: USD 18.9 billion by 2035

- Growth Forecasts: 3.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 8 September, 2025

Gas Turbine Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Demand and Supply of Gas- There was a 4 % increase in inland demand of natural gas in the EU in 2021 compared with 2020. Additionally, the EU's dependency on natural gas imports reached 82% in 2021. As demand for gas increases, more gas turbines are needed to generate the necessary electricity. At the same time, an increased supply of gas makes it more affordable, leading to more people using gas turbines for their energy needs.

-

Surging Natural Gas-Based Electricity Generation- According to the United States Energy Information Administration, natural gas was the source of 38.3% of utility-scale electricity in 2021. The increasing availability of natural gas, combined with its affordability, has encouraged many countries to switch to natural gas-based electricity generation. This has caused an increase in demand for gas turbines, which are used in natural gas-based power generation.

-

Increasing Preference for Gas-Fired Power Plants Over Nuclear-Based Power Plants- Nuclear plants require a large upfront investment and have associated operational risks, such as the potential for a nuclear meltdown which can cause significant environmental damage. Additionally, nuclear plants generate a high amount of carbon emissions which has increased the demand for gas-fired power plants as an alternative. Approximately 36.3 billion tonnes of carbon dioxide were emitted in 2021 due to energy-related activities, up 6% from 2021.

-

An Increase in The Number of Power Plants Worldwide - The number of power plants reported worldwide is approximately 30,000 as of 2021, spread across 164 countries. As demand for electricity is increasing, more and more power plants are being built to meet the demand. The result is an increase in the need for gas turbines, which are the main source of power for these plants.

-

Growing Aviation Industry - According to estimates, as of 2022, 745 million Americans were traveling by air. A total of USD 204 billion was generated by US airlines during the first three quarters of 2022. There were 140 million more passengers flying in 2022 than in 2021, an increase of 123%. With the growing demand for air travel, airlines are looking for more efficient ways to power their aircrafts. Gas turbines are becoming increasingly popular as they are lightweight and fuel efficient, making them a cost-effective solution for the aviation industry.

Challenges

- Rising environmental concerns regarding gas turbine usage - Gas turbines are a major source of air pollution, and governments are increasingly taking steps to reduce emissions from gas turbines. This is giving rise to stricter regulations and higher costs, which limit the growth of the gas turbine market.

- High initial investments

- Short life of gas turbines

Gas Turbine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.9% |

|

Base Year Market Size (2025) |

USD 12.89 billion |

|

Forecast Year Market Size (2035) |

USD 18.9 billion |

|

Regional Scope |

|

Gas Turbine Market Segmentation:

Capacity Segment Analysis

The above 200 MW segment is estimated to hold about 37% market share by 2035. The segment growth can be attributed to growing demand for efficient, reliable and cost-effective power generation solutions in large-scale applications. For instance, 6 GE LM2500XPRESS gas turbines will generate approximately 200 megawatts (MW) of power at the temporary gas-fired power plant in Dublin, allowing Ireland to meet its electricity demand and ensure the stability of its electricity supply. Additionally, higher fuel efficiency and lower maintenance costs associated with gas turbines are expected to drive the segment growth. Moreover, above 200 MW turbines are more efficient than smaller turbines and can generate more power with less fuel. This makes them a more cost-effective option for power generation companies.

Type Segment Analysis

The open cycle segment share is estimated to surpass 64% by 2035, led by increasing installation of open cycle gas turbines in industrial, power and oil & gas industries owing to its lower capital costs and faster start-up time. It is also beneficial for providing base load and peak load power in an efficient and reliable manner. It is analyzed that gas turbines with open cycles are observed to have high thermal efficiency of up to 44%. A gas turbine with an open cycle (OCGT) is the simplest way to generate electricity or power from gas combustion. An OCGT consists only of a gas turbine, with no waste heat recovered.

Our in-depth analysis of the global market includes the following segments:

|

By Capacity |

|

|

By Type |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gas Turbine Market Regional Analysis:

APAC Market Insights

The Asia Pacific gas turbine market share is set to exceed 38% by 2035, propelled by rapid growth of the industrial sector that requires high power output, and the increasing demand for natural gas-fired gas turbines. It was observed that as of April 2021, India's industrial production reached an all-time high of 134%, an increase of 6% from 1994 to 2023. The total industrial production of China reached a record high of 35% in January of 2021, with an average growth rate of 11% between 1990 and 2023.

Gas turbines are considered to be the most efficient and cost-effective type of power generation. As the industrial sector expands, businesses are compelled to invest in power generation to meet the increased demand for energy. These turbines are a viable option as they provide a consistent level of energy with low emissions. Additionally, the increasing focus on renewable energy sources, such as wind and solar, will boost the market growth in the region. Governments in the region are making huge investments in the development of renewable energy technology, and this is expected to contribute to an increase in the adoption of natural gas turbines as a source of energy.

North American Market Forecast

The North America gas turbine market is estimated to account for 31% share by the end of 2035. The market growth is led by increasing adoption of natural gas as a source of electricity, backed by presence of oil wells in the countries, such as, Canada, and United States. Energy Information Administration figures show that in 2020, the power sector consumed about 38% of total U.S. natural gas consumption, totaling 30.48 trillion cubic feet.

Natural gas is a relatively clean burning fuel and can be used to generate electricity more efficiently than other sources of energy. As such, it has become increasingly popular in region as a way to generate electricity, which in turn is driving the demand for gas turbines. Moreover, rising demand for efficient and cost-effective gas turbine systems from the power generation sector, as well as the increasing demand for natural gas-based power generation as well as the abundance of natural gas supply is anticipated to fuel regional market growth.

Europe Market Insights

The gas turbine market in the Europe is anticipated to witness moderate growth rate till 2035. The increasing demand for efficient and reliable electricity supply, rising investments in the power sector, and the growing need for sustainable sources of energy are some of the major factors driving the market in Europe. As the demand for electricity increases, governments and businesses are investing more in power infrastructure, such as gas turbines. This increased investment in the power sector has driven the demand for gas turbines as they are necessary to generate electricity. Additionally, the increasing adoption of advanced technologies such as combined cycle plants, heat recovery steam generators, and advanced combustors will drive the market revenue.

Gas Turbine Market Players:

- General Electric Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens AG

- Kawasaki Heavy Industries, Ltd.

- Ansaldo Energia

- Mitsubishi Power, Ltd.

- MAN Energy Solutions

- Solar Turbines Incorporated

- Centrax Gas Turbines

- Técnicas Reunidas S. A.

- Wartsila

Recent Developments

-

The Shanghai Electric Company and Ansaldo Energia have been awarded a USD 350 million contract for the construction of an 800MW combined cycle power plant in Bangladesh. The project is part of the Bangladeshi government's plan to increase the country's energy generation capacity.

-

The Mexican government awarded a contract to a consortium formed by Técnicas Reunidas and TSK to design and construct combined cycle plants at Valladolid and Mérida. Approximately 1,000 MW and 500 MW of power is expected from these plants.

- Report ID: 3354

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gas Turbine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.